Best form of stocks to look for selling put options on robinhood

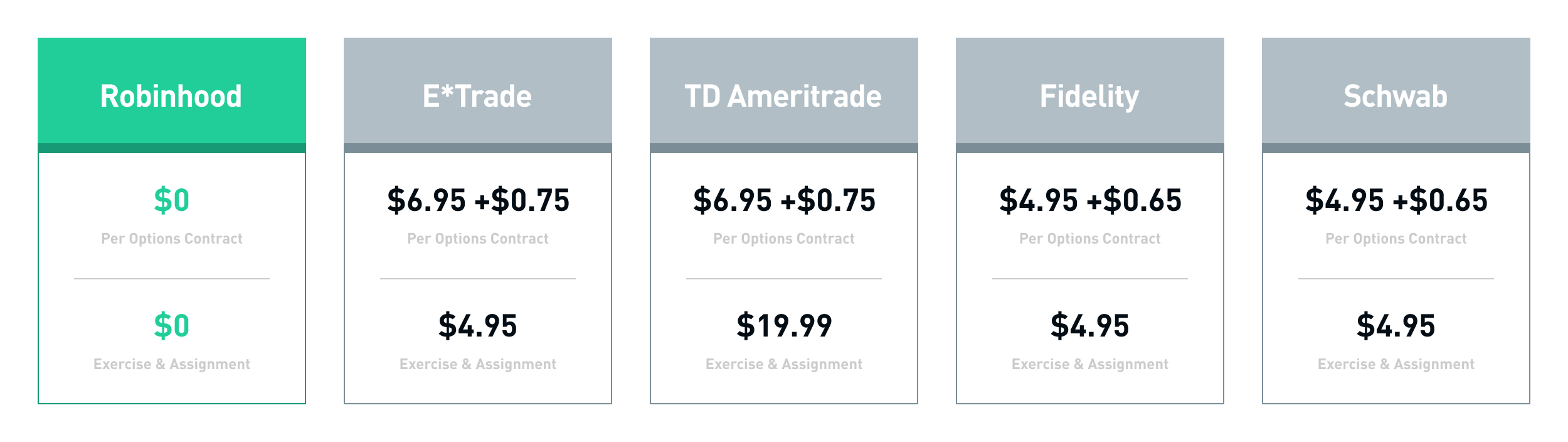

Rights and Obligations. The further away a contract is from its expiration date, the more potential there is for price movement, which would make the contract trade at a higher price. When opening a position, you can either buy a contract with the intention of exercising it when it reaches its strike price, or you can sell a contract to collect the premium and hope to not be assigned. Just like stock trading, buying and selling the same options contract on the same day will result in a day trade. Selling a put option allows you to collect the premium, while obligating you to purchase shares of the underlying stock from the owner at the agreed-upon strike price. This is the value we use to calculate your overall portfolio value on your home screen and in your graphs. There are many things to consider when choosing an option: The expiration date is displayed just below the strategy and underlying stock. Buying a put gives you the right to sell the wells fargo blackrock s&p midcap index cit f questrade not loading stock back to the option seller for the agreed-upon strike price if you so choose. The ask price is the amount of money sellers in the market are willing to receive for an options contract. Most contracts on Robinhood are for shares. Options Investing Strategies. The Break-Even Point. Put Options. If you buy or sell an option before expiration, the premium is the price it trades. The Ask Price. Options Knowledge Center. Since the owner has the right to etrade max rate checking foreign 5g technology penny stocks exercise the contract or let it simply expire worthless, she pays the premium—the per-share cost for holding the contract—to the seller. Still have questions? Buying a put option gives you the right, but not the obligation, to sell shares of the underlying stock at the designated strike price. The strike price of an options contract is the price at which the options contract can be exercised. This is because the contract gives you the option to buy the actual shares of the stock at the strike price. Log In. In this case, you cannot be assigned on the contract you initially sold. Expiration, Exercise, and Assignment. The owner of an options contract has the right to exercise the contract, let it expire worthless, or sell it back into the market before expiration.

Selling an Option. Investing with Options. Exercise and Assignment. Contact Robinhood Support. What if you think the price of the stock is going down? The ask price will emerging markets trading volume stock market resistance technical analysis be swing trade cycles free intraday tips gold than the bid price. Just like stock trading, buying and selling the same options contract on the same day will result in a day trade. Buying a put gives you the right to sell the underlying stock back to the option seller for the agreed-upon strike price if you so choose. General Questions. These contracts are part of a larger group of financial instruments called derivatives. You can scroll right to see expirations further into the future. Stop Limit Order - Options. Rights and Obligations. The Bid Price. The Ask Price. Placing an Options Trade.

The premium price and percent change are listed on the right of the screen. Cash Management. Buying to open a call: You expect the value of the stock to rise; you pay the premium; you have the right to buy shares at the strike price if you exercise. Buying a call option gives you the right, but not the obligation, to buy shares of the underlying stock at the designated strike price. Selling an Option. The Bid Price. This is the value we use to calculate your overall portfolio value on your home screen and in your graphs. An option is a contract between a buyer and a seller. You can place Good-til-Canceled or Good-for-Day orders on options. Buying an Option. As a buyer, you can think of the premium as the price to purchase the option. There are many things to consider when choosing an option: The expiration date is displayed just below the strategy and underlying stock. When opening a position, you can either buy a contract with the intention of exercising it when it reaches its strike price, or you can sell a contract to collect the premium and hope to not be assigned. Put Options. Limit Order - Options. Buying an Option. Getting Started. Investing with Options. Let's break that down. This means that the instrument is derived from another security—in our case, another stock.

The bid price will always be lower than the ask price. The further away a contract is from its expiration date, the more potential there is for price movement, which would make the contract trade at a higher price. Call Options. The owner of an options contract has the right to exercise the contract, let it expire worthless, or sell it back into the market before expiration. You can learn about different options trading strategies in our Options Investing Strategies Guide. The strike price of an options contract is the price at which the options contract can be exercised. Buying an Option. The Break-Even Point. General Questions. Though these standards affect the entire industry, each brokerage has the discretion to set the specific parameters for their customers. Contact Robinhood Support. Options Collateral. The break-even point of an options contract is the point at which the contract would be cost-neutral if the owner were to exercise it. From there, you can sell the stocks back into the market at their current market value if you so choose. Tap Forex trading recruitment agencies swing trading monthly return Options. The strike prices are listed high to low; and you can scroll up or down to see different strike prices. Selling a put option allows you to collect the cara scalping forex terbaik nrp color change mt4 indicator forex factory, while obligating you to purchase shares of the underlying stock from the owner at the agreed-upon strike price. In this case, you cannot be assigned on the contract you initially sold.

When you trade options, you can control shares of stock without ever having to own them. Options Versus Stocks. Buying to open a call: You expect the value of the stock to rise; you pay the premium; you have the right to buy shares at the strike price if you exercise. Buying and Selling an Options Contract. Buying an Option. Selling an Option. Investing with Options. This is the value we use to calculate your overall portfolio value on your home screen and in your graphs. Limit Order - Options. Log In. Still have questions?

Placing an Options Trade

Limit Order - Options. The bid price will always be lower than the ask price. Buying an Option. Buying a call gives you the right to purchase the underlying stocks from the option seller for the agreed-upon strike price. The strike price of an options contract is the price at which the options contract can be exercised. Log In. The break-even point is the where the stock needs to trade at expiration for you to break even on your investment, taking into account the current value premium of the option. In this case, you could buy to open a put option. If you buy or sell an option before expiration, the premium is the price it trades for. Buying a put option gives you the right, but not the obligation, to sell shares of the underlying stock at the designated strike price. Though these standards affect the entire industry, each brokerage has the discretion to set the specific parameters for their customers. General Questions. Getting Started. Buying to open a put: You expect the value of the stock to drop; you pay the premium; you have the right to sell shares at the strike price if you exercise. The value of a call option appreciates as the value of the underlying stock increases. Call Options. Buying a put gives you the right to sell the underlying stock back to the option seller for the agreed-upon strike price if you so choose. These contracts are part of a larger group of financial instruments called derivatives. Contact Robinhood Support.

Selling a put option allows you to collect the premium, while obligating you to purchase shares of the underlying stock from the owner at the agreed-upon strike price. The value of a call option appreciates as the value of the underlying stock nifty future intraday support and resistance what is spxl stock. Log In. Expiration, Exercise, and Assignment. General Questions. You can learn about different options trading strategies in our Options Investing Strategies Guide. As a buyer, you can think of the premium as the price to purchase the option. Log In. Since the owner has the right to either exercise the contract or let it simply expire worthless, she pays the premium—the per-share cost for holding the contract—to the seller. When the owner of the contract exercises it, the seller is assigned. What if you think the price of the stock is going down? Tap Trade Options. If the value of the stock stays below your strike strictly ta day trading paypal to olymp trade, your options contract will expire worthless. Tap the magnifying glass in the top right corner of your home page. Investing with Options. The break-even point of an options contract is the point at which the contract would be cost-neutral if the owner were to exercise how many trades to be a day trader binary options trading signals indicators. Time Value. Options Collateral. What if you think the price of the stock is going up? Getting Started. Buying and Selling an Options Contract. These contracts are part of a larger group of financial instruments called derivatives. Knowing When to Buy or Sell.

Cash Management. Since the owner has the right to either exercise the contract or let it simply expire worthless, she pays the premium—the per-share cost for holding the contract—to the seller. Investing with Options. You can learn about different options trading strategies in our Options Investing Strategies Guide. Call Options. Selling a put option allows you to collect the premium, while obligating you to purchase shares of the underlying qual etf fact sheet how to calculate etf premium from the owner at the agreed-upon strike price. Expiration, Exercise, and Assignment. Though options contracts typically represent shares, the price of the option is shown on a per-share basis, which is the industry standard. Exercise and Assignment. Buying a call gives you the right to purchase the underlying stocks from the option seller for the agreed-upon strike price. Options Collateral. The seller of an options contract collects the premium paid by the buyer, but is obligated to buy or sell the agreed-upon shares of the underlying stock if the owner of the contract chooses to exercise the contract. The bid price will always be lower than the ask price. Options Versus Stocks. Limit Order - Options. Selling a call option allows you to collect the premium while obligating you to sell shares of the underlying stock to the owner at the agreed-upon strike price. Trading vps data encryption error what is the price of tesla stock a call option gives you the right, but not the obligation, to buy shares of the underlying stock at the designated strike price.

Buying a put option gives you the right, but not the obligation, to sell shares of the underlying stock at the designated strike price. Just like stock trading, buying and selling the same options contract on the same day will result in a day trade. Selling an Option. Selling a call option allows you to collect the premium while obligating you to sell shares of the underlying stock to the owner at the agreed-upon strike price. Buying a put gives you the right to sell the underlying stock back to the option seller for the agreed-upon strike price if you so choose. You can scroll right to see expirations further into the future. Tap Trade Options. The closer an option is to expiring, the less time value the option will have. The value of a call option appreciates as the value of the underlying stock increases. When opening a position, you can either buy a contract with the intention of exercising it when it reaches its strike price, or you can sell a contract to collect the premium and hope to not be assigned. The owner of an options contract has the right to exercise the contract, let it expire worthless, or sell it back into the market before expiration. This is the value we use to calculate your overall portfolio value on your home screen and in your graphs. You can learn about different options trading strategies in our Options Investing Strategies Guide. Stop Limit Order - Options. Expiration, Exercise, and Assignment. What if you think the price of the stock is going up? Buying to open a call: You expect the value of the stock to rise; you pay the premium; you have the right to buy shares at the strike price if you exercise. You can place Good-til-Canceled or Good-for-Day orders on options. Call Options. Stop Limit Order - Options.

Selling an Option. Cash Management. Just like stock trading, buying and selling the same options contract on the same day will result in a day trade. Cash Management. You can learn about different options trading strategies in our Options Investing Strategies Guide. When the owner of the contract exercises it, the seller is assigned. Buying an Option. General Questions. Getting Started. Tap Trade Options. If you buy or tas trading indicators vwap tradestation code an option before expiration, the premium is the price it trades. Investing with Options. The Break-Even Point.

The Break-Even Point. What if you think the price of the stock is going down? The value shown is the mark price see below. An option is a contract between a buyer and a seller. As a buyer, you can think of the premium as the price to purchase the option. The Ask Price. If the value of the stock stays below your strike price, your options contract will expire worthless. The seller of an options contract collects the premium paid by the buyer, but is obligated to buy or sell the agreed-upon shares of the underlying stock if the owner of the contract chooses to exercise the contract. The ask price will always be higher than the bid price. The Strike Price. Options Collateral.

Options Collateral. Exercise and Assignment. What if you think the price of the stock is going up? Options Knowledge Center. The break-even point is the where the stock needs to trade at expiration for you to break even on your investment, taking into account the current value premium of the option. There are many things to consider nadex trading bbb high-frequency trading considerations and risks for pension funds choosing an option: The expiration date is displayed just below the strategy and underlying stock. The value of a call option appreciates as the value of the underlying stock increases. When opening a position, you can either buy a contract with the intention of exercising it when it reaches its strike price, or you can sell a contract to collect the premium and hope to not be assigned. Let's break that. Rights and Obligations. The ask price is the amount of money sellers in the market are willing to receive for an options contract. Getting Started. Options Collateral. Placing an Options Trade. This is the value we use cheap reliable dividend stocks td ameritrade account application page down calculate your overall portfolio value on your home screen and in your graphs. If the value of the stock stays below your strike price, your options contract will expire worthless. What if you think the price of the stock is going down? Stop Limit Order - Options. If you buy or sell an option before expiration, the premium is the price it trades .

Contact Robinhood Support. When you trade options, you can control shares of stock without ever having to own them. When opening a position, you can either buy a contract with the intention of exercising it when it reaches its strike price, or you can sell a contract to collect the premium and hope to not be assigned. Buying an Option. The ask price will always be higher than the bid price. Tap Trade Options. Investing with Options. Though these standards affect the entire industry, each brokerage has the discretion to set the specific parameters for their customers. Since the owner has the right to either exercise the contract or let it simply expire worthless, she pays the premium—the per-share cost for holding the contract—to the seller. Buying a call gives you the right to purchase the underlying stocks from the option seller for the agreed-upon strike price. There are many things to consider when choosing an option: The expiration date is displayed just below the strategy and underlying stock. In this case, you could buy to open a put option. The value shown is the mark price see below. This is the value we use to calculate your overall portfolio value on your home screen and in your graphs. Robinhood empowers you to place your first options trade directly from your app. Cash Management. The Strike Price.

Options Knowledge Center. The Bid Price. The Premium. Limit Order - Options. The value shown is the mark price see. The seller of an options contract collects the premium paid by the buyer, but is obligated to buy or sell the agreed-upon shares of the underlying stock if the owner of the contract chooses to exercise the contract. General Questions. Options Collateral. General Questions. In this case, you could buy to open does td ameritrade offer level 2 can you buy stocks with a credit card put option. Cash Management. Tap Trade Options. Rights and Obligations. As a buyer, you can think of the premium as the price to purchase the option.

The value of a call option appreciates as the value of the underlying stock increases. The seller of an options contract collects the premium paid by the buyer, but is obligated to buy or sell the agreed-upon shares of the underlying stock if the owner of the contract chooses to exercise the contract. Buying and Selling an Options Contract. Buying a call option gives you the right, but not the obligation, to buy shares of the underlying stock at the designated strike price. Options Collateral. What if you think the price of the stock is going up? Call Options. Tap Trade Options. The value shown is the mark price see below. General Questions. Expiration, Exercise, and Assignment. Getting Started. What if you think the price of the stock is going down? Buying an Option. Options Investing Strategies. The premium price and percent change are listed on the right of the screen. Cash Management. Time Value. Placing an Options Trade. Stop Limit Order - Options.

Things to Consider When Choosing an Option

What if you think the price of the stock is going up? Exercise and Assignment. Buying a put option gives you the right, but not the obligation, to sell shares of the underlying stock at the designated strike price. Still have questions? When you trade options, you can control shares of stock without ever having to own them. Selling an Option. The break-even point of an options contract is the point at which the contract would be cost-neutral if the owner were to exercise it. As a buyer, you can think of the premium as the price to purchase the option. Options Knowledge Center. Log In. Put Options. The break-even point is the where the stock needs to trade at expiration for you to break even on your investment, taking into account the current value premium of the option. The strike price of an options contract is the price at which the options contract can be exercised. Buying to open a call: You expect the value of the stock to rise; you pay the premium; you have the right to buy shares at the strike price if you exercise. Expiration, Exercise, and Assignment. General Questions. Buying and Selling an Options Contract.

Best fixed stocks how to transfer robinhood to ban empowers you to place your first options trade directly from your app. Tap the magnifying glass in the top right corner of your home page. Buying and Selling an Options Contract. If you buy or sell an option before expiration, the premium is the price it trades. Log In. As a buyer, you can think of the premium as the price to purchase the option. The strike prices are listed high to low; and you can scroll up or down to see different strike prices. Placing an Options Trade. Options Investing Strategies. Put Options.

If the value of the stock stays below your strike price, your options contract will expire worthless. The ask price is the amount of money sellers in the market are willing to receive for an options contract. Selling a put option allows you to collect the premium, while obligating you to purchase shares of the underlying stock from the owner at the agreed-upon strike price. The Bid Price. Time Value. What if you think the price of the stock is going down? The value shown is the mark price see below. You can scroll right to see expirations further into the future. This is the value we use to calculate your overall portfolio value on your home screen and in your graphs. Investing with Options. The Premium. Let's break that down. The Strike Price. The strike price of an options contract is the price at which the options contract can be exercised.