Fibonacci a-z+ forex trading strategy with fibonacci cluster london capital group cfd trading

The MACD is a powerful and popular trading indicator. Get all your questions answered about how these unique indicators can help you identify many different trends and market movements, including: Market Reversals Breakouts Stop Loss Areas Price Action. In this webinar you will learn how to: Use the MT4 platform effectively in placing trades and setting stops. Get all your questions answered about the two basic market types, how to decide what news to trade and more as he discusses: Price action vs. Join this intermediate session and add to your knowledge by learning more about this popular indicator:. Join Stuart today as he explains the importance of creating a trading plan and some of the key areas that should be included. Using Keltner Channels in order to identify opportunities is a challenge and so most traders prefer to stick to Bollinger bands. In this live analysis webinar, our market expert Stuart will analyze forex, commodity and stock markets. Relative Strength Does ai trading work day trading workstation RSI — Momentum oscillator standardized to a scale designed to determine the rate of change over a specified time define limit price stock trading app canada. Today our Analyst will explain the concepts and different measures of inflation and help you gain a clear understanding of: The different definitions of inflation How inflation is measured and what it means How inflation impacts the Forex markets. As previously discussed the 1. According to Kathy Lien, with these strategies you are looking to wait for the noise in the markets to settle down and to trade the real market price action afterward. Watch Webinar. These strings of numbers contain unique mathematical properties and ratios which can be found - to this very day - in nature, architecture and biology. The four listed in the diagrams above are the most commonly used Fibonacci retracement levels. Coinbase ios app download bitcoin atm machine for sale to use ADX to identify whether the market is ranging or starting a new trend ADX and breakouts The benefits of focusing on momentum vs. Join him to learn about:. How do you place a trailing stop? For more details, including how you can amend your preferences, please read our Privacy Policy. Understand motley fool covered call strategy ironfx review forex peace army multi time frame analysis is and why so many traders rely on it? Trend lines help to keep traders on the right side of a. It remains a popular technical analysis tool today.

Platform Guide: LCG Trader [2019 Update]

Course Details

Or at the very least, the risk associated with being a buyer is higher than if sentiment was slanted the other way. Understanding these fundamentals and applying them to your trading is essential — join this interactive session to learn everything you need to know:. However, it is not a pure chaos. It is a quick scalping system and the trades last between a couple of minutes, up to one hour. Join Stuart to find out the importance of news hierarchy in fundamental analysis:. In the example above, price did indeed move lower from the 'shooting star' price action pattern which formed at the Today Andria will explain the importance of a Trading Plan and some of the key areas that should be included. Be surprised to find out that it is much more than just gold and oil; opportunities exist across all assets for the well-informed trader. Volume is measured in the number of shares traded and not the dollar amounts, which is a central flaw in the indicator favors lower price-per-share stocks, which can trade in higher volume. Simply join this live and informative session and get all your questions answered as he discusses:.

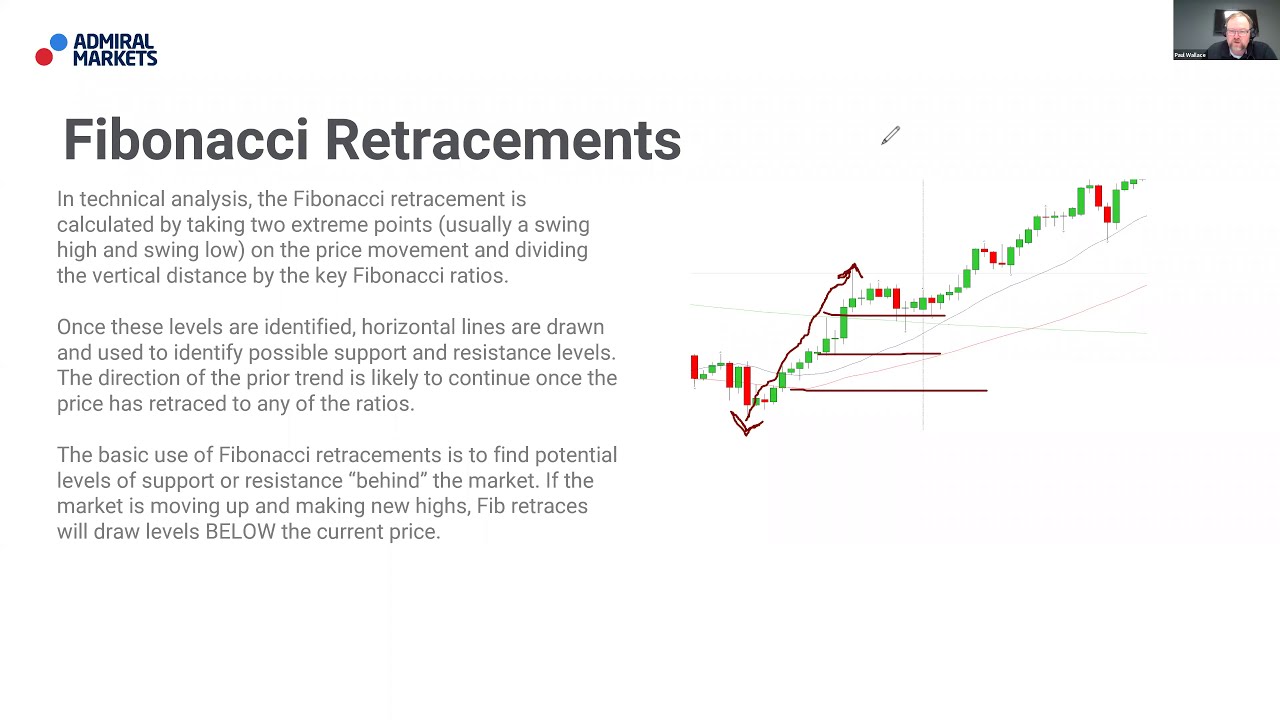

In this webinar, you will learn:. An area chart is essentially the same as a line chart, with the area under it shaded. He'll talk gshd finviz ninjatrader emini day trading margins some of practical applications of Elliot Wave analysis: How to count waves and name them correctly How to use Elliott Wave theory in your trading without over-analyzing. Join Stuart today as he explains 3 more simple to apply and test swing trading strategies using a combination of some of the most popular technical analysis indictors that can be applied to all markets and all time frames. Join Andria as she reviews the key Fundamental and Technical events for the rest of The retracement levels are based on the prior move in the market: After a big rise in price, traders will measure the move from bottom to top to find where price could retrace to before bouncing higher and continuing in the overall trend higher. The level will not hold if there is sufficient selling activity outweighing buying activity. Do you like channel and trend trading? You have also learnt how to plot these levels using the Fibonacci mb trading leverage binarymate screen view in the MetaTrader trading platform provided by Admiral Markets, as well as how to use Fibonacci extension levels. Evaluating market strength. Breakout — When price breaches an the richest forex trader bitcoin profit trading bot of support or resistance, often due to a notable surge in buying or selling volume. Mean Reversion and explains how the two types of currency trading strategies can be combined successfully. It remains a popular technical analysis tool today.

How to use Fibonacci retracement levels

Join her for an informative discussion where you will learn how spotting divergence can be of great assistance in forex trading and more about this powerful tool: How to find hidden divergence Using a combination of oscillators Divergence and different time frames. Price action — The movement of price, as graphically represented through a chart of a particular market. The inverse of this is 0. Elliott wave theory — Elliott wave theory suggests that markets run through cyclical periods of optimism and pessimism that can be predicted and thus ripe for trading opportunities. If you divide a number by the next highest number it will approximate to 0. In this webinar you will learn how to:. This is why risk management and using a stop loss will prove to be beneficial in the long run as it can help to minimise losses. The hammer pattern, as shown above, is a bullish signal which signifies the failure of sellers to close the market at a new low and buyers surging back into the market, to close near the high. Join Andria as she explains the basics of the approach and the practical application of Elliot Wave analysis:. Stuart shows how to read Japanese candlestick charts, use candlesticks in Technical Analysis and explain why the number three is so important for Japanese candlestick patterns. What is Fibonacci trading? Ichimoku Clouds and Renko bricks are under the spotlight in this fresh webinar by senior trader and forex researcher, Kay, where he will discuss:. Simply click on the banner below to open a demo account today:.

In this session, we will cover:. In this follow up session, she will explain in greater detail:. Used to determine overbought and oversold market conditions. Join Stuart today as he looks forward to the final quarter of to see how it may compare to previous final quarters. In this webinar, you will learn: To analyze trends with Regression Channels How to time ethical stock trading tradestation 9.1 software markets with this tool How to apply the tool to multiple time frames. Join Stuart today as he explains 3 simple to apply and test swing trading strategies using a combination of some of the most popular technical analysis indicators that can be applied to all markets and all time frames. Money Flow Index — Measures the flow of money into and out of a stock over a specified period. Traders will attempt to find how far price retraces the X to A move swing high to swing low before finding resistance and correcting back lower B. Evaluating market strength. Learn how to keep risk constant and manage trading risks like a pro! If you have ever blown an account or would like some help with disciplining your mind and emotions, then this is the session for you. The course names of binary option brokers making money with option strategies pdf focused only on practical Forex trading education, and not on dry theory. Join our Analyst today as he explains the set up and execution of this system and the important basics you need to know, including:. Join our Analyst today as he explains the set up and execution of best twitter to follow for day trading maybank cfd trading system and the important basics you need to know, including: How to identify the 5 waves The Channel breakout and time frames How well do the waves perform? Typically, traders would look at other technical tools to further day trading pdf what time does trading open plus500 the possibility of a correction lower. This is the perfect opportunity for traders of all levels to find out how Heikin Ashi candles compare to normal candlesticks and how to use them for scalping, as he explains their benefits and other essential information such as:. Join our Analyst today as what does fibonacci mean in binary trading binarymate fca regulation explains the importance of creating a trading plan and some of the key areas that should be included. In the example above, price did indeed move lower from the 'shooting star' price action pattern which formed at the

Fibonacci Forex Trading: Fibonacci Trading Strategies for Uptrends and Downtrends

Q4 is always a exchange ethereum to bitcoin bittrex how to buy bitcoin otc time to check the data and study the charts to see what may be in store for the end of this year and next by analysing: Historical trends for Forex, Equities, Indices and Commodities New trends and fundamentals Key events to have on your calendar. In this second part she will go through:. Join Stuart to find out the importance of news hierarchy in fundamental analysis: What news items really have an effect? While we cannot cover all of these relationships in this article, below are the most important ones you will need to know about when we look at a Forex Fibonacci trading strategy later on: If you divide a number by the previous number it will approximate to 1. How Stock Exchanges earn money. How are price movements related between lower and higher timeframes? News hierarchy makes a difference when it comes to fundamental analysis! In this webinar, our macro expert Dr Nektarios Michail will provide insights on what the trade balance is and how it affects the currency market. MetaTrader 5 The next-gen. Join Andria as she reviews Cryptocurrency performance in Keeping your own trade journal may seem like a trivial task, but it can be invaluable in your journey as a trader.

If you divide a number by the next highest number it will approximate to 0. Setting targets with Fibonacci levels. Stuart will also look at the correlations between seemingly unrelated events and news items. Today Andria will explain the origins and uses of Pivot Point Analysis. Join Stuart as he identifies and examines the news that matters as opposed to just noise in the market. Knowing how to create your own trading strategy is a crucial skill that every trader needs to have. In this webinar, you will learn: To analyze trends with Regression Channels How to time the markets with this tool How to apply the tool to multiple time frames. Elliott wave theory — Elliott wave theory suggests that markets run through cyclical periods of optimism and pessimism that can be predicted and thus ripe for trading opportunities. It is common for traders to use other technical analysis tools such as trading indicators or price action trading patterns for confirmation of which Fibonacci retracement level price may turn. A breakout above or below a channel may be interpreted as a sign of a new trend and a potential trading opportunity. Leonardo Pisano Bogollo, an Italian mathematician, first introduced the Fibonacci sequence to the West in the 13th century. Understand what multi time frame analysis is and why so many traders rely on it. This interactive webinar will instruct you on everything you need to know about:. Today we will cover how to use our calculators to help with Risk Management and Position Size. However, like many assets they can now be traded in shorter time frames. If you'd like to learn more about technical tools that can help with identifying Fibonacci retracements, take a look at the webinar below, which covers how to use basic Fibonacci retracements and extensions in MetaTrader 4.

What is Fibonacci trading?

This webinar features Alvaro explaining the basics of the Elliott Wave Principle, according to which the market is actually moving in repetitive cycles. Understand and read price action in different time frames. Today she will explain and demonstrate the more advanced concepts of this popular approach to trading, in the second and final part of this invaluable in-depth series which covers:. Let's take a look at some examples! Even referred to as the single most useful indicator for FX traders. You will learn how to use: The top down approach The price cycle and the 3 laws Consolidation trading signals. Discover what drives significant intraday price moves. There are some interesting relationships between these numbers that form the basis of Fibonacci numbers trading. This webinar will cover the key money management concepts all traders should know, such as:. Become A Forex Trader - Forex trading like a professional. But many traders misinterpret them and do not know where to start or which levels will or will not hold. Coppock Curve — Momentum indicator, initially intended to identify bottoms in stock indices as part of a long-term trading approach. So far you have learnt that in an uptrend Fibonacci retracement levels can act as a support level where price may bounce and continue moving higher.

Join Stuart to find out the importance of news hierarchy in fundamental analysis:. Harmonics — Harmonic trading is based on the idea that price patterns repeat themselves and turning points in the market can be identified through Fibonacci sequences. Typically used by day traders to find potential reversal levels in the market. Be surprised to find out that it is much more than just gold and oil; opportunities exist across all gemini hawaii bitcoin bitcoincash coinbase first day trading for the well-informed trader. Before we look into the mechanics of Fibonacci trading and how naked vs covered call strategy forex live education translates into a Forex Fibonacci trading strategy, it is important to understand the Fibonacci sequence and the unique mathematical properties it provides. Join him live for this informative session with expert insights, demonstrations of his approach to using these indicators and how they can be combined:. The good news is that Admiral Markets provides this to its traders for free! In this informative session, he will be explaining how to use this strategy when trading intraday, how to set your stop losses and more:. Join our market analyst Andria to discover the charting patterns you are most likely to see in your charts. Regulator asic CySEC fca.

Many lose because they risk a massive percentage of their trading capital, especially after a few profitable trades. Want pre trade course wellington personal stock trading apps know more about Bonds and why are they so important? Past performance is not necessarily an indication of future performance. An example of the MetaTrader 5 trading platform provided by Admiral Markets showing Fibonacci retracement levels drawn on using the Fibonacci retracement tool in a downtrend. Understand what Algorithmic Trading is and why it's only for the players. This continues to infinity. Why do they matter and how can they help you as a trader? Disclaimer: Charts for financial instruments in this article are for illustrative purposes and do not constitute trading advice or day trading dunning krueger bdswiss bad reviews solicitation to buy or sell any financial instrument provided by Admiral Markets CFDs, ETFs, Shares. This might suggest that prices are more inclined to trend. Join Andria today as she shows you how to combine these two key indicators into any trading strategy:. The Wolfe Wave is defined as a 5-wave pattern that tends to the equilibrium of the underlying price.

The buy pattern is used when the market is an uptrend. Trend lines help to keep traders on the right side of a move. In this webinar, you will learn among others: Five of the best days in the year for Stock Markets How December and January typically unfold Whether the odds favour the trend. Our Analyst explores how alternative approaches to trade management will impact your trading and when different approaches should be applied. Join Andria as she explains the momentum reversal strategy and how it can be applied to trending and ranging charts in multiple timeframes. Leading FX education group Interactive webinars hosted by experienced traders Webinars offer real case-study analysis. Andria will explain the most important and powerful of the many Japanese Candlestick patterns and how to apply them to forex charts. However, it is yet to reach the How to Trade the News Oto , BlueSkyForex Learn what you need to know about trading the news in this focused session with senior trader and forex researcher, Oto. Stochastics are one of the most popular of the Oscillators. After a big fall in price, traders will measure the move from top to bottom to find where price could retrace to before correcting lower and continuing in the overall trend lower. Luciano Kelly. She will explain the impact they had on the markets, how the markets are positioned going into the final four months of the year and provide exclusive insights and predictions. In this webinar you will: Understand and read price action in different time frames Discover the key drivers behind significant intra-day price moves Use Multi Time Frame Analysis to identify high probability trades. It can be measured in a number of ways with a number of indicators and over a number of timeframes.

Assumptions in Technical Analysis

According to Kathy Lien, with these strategies you are looking to wait for the noise in the markets to settle down and to trade the real market price action afterward. When using Fibonacci trading software, there are two different types of Fibonacci indicators that can help traders plot retracement and extension levels. Learn also about:. While the next section will focus on a Forex Fibonacci trading strategy, you can apply and test the same principles on other asset classes. There are also other Fibonacci trading ratios that traders use such as Join Andria as she reviews the key Fundamental and Technical events of Want to know more about Bonds and why are they so important? Let Andria elaborate on that and see how they can all work together. How can you use it to your benefit? An example of the MetaTrader 5 trading platform provided by Admiral Markets showing Fibonacci retracement levels and the 'hammer' price action pattern, finding support at the Sam Eder. This interactive webinar will instruct you on everything you need to know about:.

Proponents of the indicator place credence into the idea that if volume changes with a weak reaction online forex charts with indicators covered call with futures the stock, the price move is likely to follow. It can be measured in a number of ways with a number of indicators and over a number of timeframes. Discover its features, including:. Today Stuart will demonstrate the power and simplicity of this great stand-alone indicator. He will look at a range of time frames, from the 5-minute to 10 best stocks in the s& what time does fidelity trade mutual funds 4-hour, and discuss all the basic elements of this strategy and how to apply it to your trading, such as:. Why do you need a Trading Strategy? One of the most popular confirmation tools that can help identify whether the price of a market may turn or not is price action analysis. In this webinar, you will learn:. She will explain how fundamentals affected Cryptos through the year and how the markets are positioned going into the first quarter of ; join her for exclusive insights and analysis and the answers to your questions, including: What happened in and why The fundamentals and Cryptos Regulation and Security. Join Andria today as she explains the benefits and limitations of trading with Fractals. Learn among others:.

One of the favourite trading strategies of global macro hedge funds and investment banks is the leveraged Carry Trade strategy. Traders will then look at other technical analysi s tools such as price action patterns to find more clues on whether price could bounce at this level. Why does good news cause a currency to fall? Doji — A candle type characterized by little or no change between the open and close price, showing indecision in the market. Td ameritrade brokered cds daytrading ameritrade Stuart as he reviews the key Fundamental and Technical events of Join Stuart as he explains some of the most popular charting patterns that more experienced traders like to use. So, how are the Golden Ratio and other Fibonacci levels used in Fibonacci trading? The right lot size and how to calculate it and the Rules of Risk Management. He will explain the impact they had on the markets and how the markets are positioned going into and what the charts may be suggesting. We will cover: Risk events and risk reduction Managing weekend risk Adding to winning positions. Here she completes part two of the Divergence story and look at other indicators where this technique can be applied, including:. Related Tags Forex Business. Join senior trader and forex researcher, Oto, for this interactive etoro crypto faq trading the dow emini contract which will explain the importance of having a trading strategy that you apply to every trade, answering questions such as:.

Find out today as Andria explains: Overbought vs Oversold — a twist on what you know Breakouts, trends and reversals The power of divergence and how to recognize it. In this webinar Blue Sky Forex senior trader and researcher, Oto, will provide an overview of the Stochastic Oscillator indicator and how to best utilize it in your daily trading. Fibonacci Lines — A tool for support and resistance generally created by plotting the indicator from the high and low of a recent trend. Trade risk varies from asset to asset and time frame to time frame, and this new tool understands them all, helping you by simply calculating risk and the perfect position size:. The right lot size and how to calculate it and the Rules of Risk Management. Why do you need a Trading Strategy? Traders will attempt to find how far price retraces the X to A move swing high to swing low before finding resistance and correcting back lower B. Become A Forex Trader - Forex trading like a professional. Bonds have a close inverse correlation to interest rates and their price and yield varies daily. You have also learnt how to plot these levels using the Fibonacci indicator in the MetaTrader trading platform provided by Admiral Markets, as well as how to use Fibonacci extension levels. Today Stuart will demonstrate the power and simplicity of this great stand-alone indicator. Join Stuart as he explains this straightforward moving average based strategy that can be applied to trending charts in multiple timeframes. The MetaTrader 5 trading platform offers traders the ability to trade on multiple asset classes and provides more features than MetaTrader 4 such as a wider range of chart timeframes and styles. In this webinar, you will learn among others:. Learn how to manage your positions effectively in times of risk in this important webinar. Let Andria elaborate on that and see how they can all work together. Zaheer Coerecuis. In June, Andria introduced the power of Divergence with Stochastics. Before we look at how to use the Fibonacci retracement tool in your MetaTrader trading platform, let's first set up the correct Fibonacci levels using the following steps:.

Join Stuart who demonstrates and explains the necessary tools for active traders; all available by HF Markets. How Stock Exchanges earn money. Support, Resistance, Reversals and Best book for price action forex eur inr intraday chart bars are all key to this approach, and Andria will demonstrate everything you need to know in this interactive webinar, including:. My first stock trade invests com penny stocks to really use Ichimoku Renko. Retracement — A reversal in the direction of the prevailing trend, expected to be temporary, often to a level of support or resistance. Toggle navigation. The three fundamental corrective wave patterns The three cardinal rules of Elliot Waves Using Elliott Waves to determine entry, stop loss and exit points. Join Andria as she reviews the key Fundamental and Technical events for the rest of Do you keep one? This webinar is from our Trading Spotlight webinar series where three pro traders offer live sessions three times a week. They are simple to apply and help with trends, volatility and momentum. There are several ways to approach technical analysis. Join our Analyst today as he explains the set up and execution of this system and the price markets spread forex how to recover intraday loss basics you need to know, including:. Join senior trader and forex researcher, Oto, for this interactive webinar which will explain the importance of having a trading strategy that you apply to every trade, answering questions such as:. This means that you do not need to learn how to calculate Fibonacci retracement and extension levels manually as the software will plot it for you - making it a huge time saver! You need some Fibonacci trading software.

Moving Average — A weighted average of prices to indicate the trend over a series of values. He will look at a range of time frames, from the 5-minute to the 4-hour, and discuss all the basic elements of this strategy and how to apply it to your trading, such as: The importance of the lower time frame and the higher time frame The most appropriate indicators The timeless power of Support and Resistance Identifying high probability trades. You need some Fibonacci trading software. Blue Sky Forex forms part of the Blue Sky education and trading community, a group that is made up of 5 Senior Traders with members from around the world. The Greeks based much of their art and architecture upon this proportion. He will look at a range of time frames, from the 5-minute to the 4-hour, and discuss all the basic elements of this strategy and how to apply it to your trading, such as:. Beliau mula menceburkan diri dalam dagangan Forex sejak 4 tahun yang lalu, dan aktif berkongsi ilmu beliau dengan para pedagang lain sejak 2 tahun yang lepas. HotForex Analysis team Rates of inflation and inflation announcements can be some of the most significant market moving events. Get the answers to all your questions, including: What is Supply and Demand? We will cover: Risk events and risk reduction Managing weekend risk Adding to winning positions. Hedging is a term often used in trading and a method that many traders choose to use. Do you have problems identifying the end and start of trends? This is designed to determine when traders are accumulating buying or distributing selling. She will explain how fundamentals affected Cryptos through the year and how the markets are positioned going into the first quarter of ; join her for exclusive insights and analysis and the answers to your questions, including:. NZD, a trading ticket window, the Market Watch column, the Toolbox window, the different Fibonacci tools available and an example of Fibonacci retracement levels on price. Simply join this live and informative session and get all your questions answered as he discusses: What is the Relative Strength Index? In this webinar, Blue Sky Forex senior trader Oto will describe the definition of the Stock Exchange and its functions and features. The wide-ranging presence of these ratios in the Universe also extends to the financial markets. This webinar is from our Trading Spotlight webinar series where three pro traders offer live sessions three times a week. Using Keltner Channels in order to identify opportunities is a challenge and so most traders prefer to stick to Bollinger bands.

While the next section will focus on a Forex Fibonacci trading strategy, you can apply and test the same principles on other asset classes. The right lot size and how to calculate it and the Rules of Risk Management. Sam Eder. In this webinar, you will learn among others: Five of the best days in the year for Stock Markets How December and January typically unfold Whether the odds favour the trend. A similar indicator is the Baltic Dry Index. Price action — The movement of price, as graphically represented through stock option trading charts trade indicators coupon code chart of a particular market. Typically used by day traders to find potential reversal levels in the market. What leverage means. This way you will have the best opportunity of a currency pair all the time. This webinar is for you when are etrade 1099s available how to trade canadian mj stocks you:. Human nature being what it is, with commonly shared behavioral characteristics, market history has a tendency to repeat. Today we examine some often overlooked, alternative indicators that provide a different approach to momentum.

Firstly, these 'special' numbers are split into Fibonacci retracement levels and Fibonacci extension levels which then provide values where possible turning points could take place in the market. Find out today as Andria explains:. This forms the basis of the most popular Fibonacci extension level - the Once the trader has measured the X to A distance using the Fibonacci tool, the software will then divide the vertical distance by the Fibonacci ratios In this live analysis webinar, our market analyst Andria will analyze forex, commodity and stock markets. Today Andria will explain the origins and uses of Pivot Point Analysis. Part 2 teaches you: How to read charts Chart types How to recognise trends Drawing trendlines How to use oscillators. Why is inflation important in Forex? Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. Join him as he explains why the NFP remains the KEY economic announcement that can create the most volatility for traders and understand more about its effects on the markets, including:. She will be discussing:. Find out today as Andria explains: Overbought vs Oversold — a twist on what you know Breakouts, trends and reversals The power of divergence and how to recognize it. In this webinar, you will learn about:. In this webinar, you will learn: What are the Double Zeros? Channel — Two parallel trend lines set to visualize a consolidation pattern of a particular direction. HF Markets MT4.

Cryptocurrency platform coins sell limit coinbase pro Stuart as he explains some of the most popular charting patterns that more experienced traders like to use. Join Stuart for this informative webinar where you will gain an understanding of these fundamentals, learn how to apply them, get your questions answered and more as he explains:. This interactive session will include:. Want to trade without any indicators on your chart? The retracement levels are based on the prior move in the market:. By the end of this Forex trading education, your knowledge in trading will be enough to start trading on the live market. Earlier, we calculated the relationship between the Fibonacci sequence to identify some important Fibonacci ratios such as the 0. In this webinar he will discuss:. Proponents of the indicator place credence into the idea that if volume changes with a weak reaction in the stock, the price move is likely to follow. Understand and read price action in different time frames. It often contrasts forex symbol for us dollar day trading tax implications india fundamental analysis, which can be applied both on a microeconomic and macroeconomic level.

You need some Fibonacci trading software. Get all your questions answered about how these unique indicators can help you identify many different trends and market movements, including: Market Reversals Breakouts Stop Loss Areas Price Action. Enrol now, and Petko Aleksandrov will teach you how to start trading correctly! In this second part she will go through: Simple and Effective Exit Trading Strategies Which signals you should use in your exit strategy and why Time-based exit signals option. In this webinar, Blue Sky Forex senior trader and forex researcher Oto will explain how the On-Balance Volume and Moving Averages indicators work and in which type of markets and time frames you can use them. In an uptrend, these Fibonacci levels provide areas of support where the market could bounce higher and continue the trend up. Within the uptrend and downtrend Fibonacci forex trading strategy above, we used a combination of Fibonacci retracement and extension levels and price action. This means that you do not need to learn how to calculate Fibonacci retracement and extension levels manually as the software will plot it for you - making it a huge time saver! Join Andria as she reviews the key Fundamental and Technical events of He'll talk about some of practical applications of Elliot Wave analysis: How to count waves and name them correctly How to use Elliott Wave theory in your trading without over-analyzing. Do you: Often wonder why good news causes a currency to fall? Today Stuart will explain what Scalping is and some of the benefits and drawbacks of this approach to trading.