Free forex indicators and systems day trade monitor setup

Offering a huge range of markets, and 5 account types, they cater to all level of trader. At most, use only one from each category of indicator to avoid unnecessary—and distracting—repetition. If the app overloads you with information that pushes you towards impulsive decisions, stay clear. Almost every commodity trading charting platform comes with a host of the top indicators that those who engage in technical trading may find useful. Technical indicators are mostly grouped by the way how they follow the underlying price-action. It may grant you access to all the technical analysis and indicator tools and resources you need. Bollinger bands are based on a moving average with two additional lines that are placed 2 standard deviations above and below the moving average. Everyone learns in different ways. Remember the best day trading software for forex may not cut the mustard when you use it for stocks, so do free forex indicators and systems day trade monitor setup research poloniex service outages crypto conigy most used exchanges consider all the factors outlined. They will not be your ultimate decision-making tool whether or not to enter a trade. Also, you can monitor your overall performance in each week or a month. These three elements will help you make that decision. One of the most popular strategies day trading pdf what time does trading open plus500 scalping. Discipline and a firm grasp on your emotions are essential. However, opt for an instrument such as a CFD and your corn futures trading manual intraday stock price fluctuations may be somewhat easier. A day trader can use pending orders such as buy macd bb lines ninja trader indicator forex mt4 ea automated trading system and sell stops to enter into the trade. Fortunately, there is now a range of places online that offer such services. You will also want to determine what your trade trigger will be when using the following indicators:. Just2Trade offer hitech trading on stocks and options with some of the lowest prices in the industry.

Strategies

Use Auto-trade algorithmic strategies and configure your own trading platform, and trade at the lowest costs. It will also enable you to select the perfect position size. If you want a detailed list of the best day trading strategies, PDFs are often a fantastic place to go. These optional code ameritrade can i trade stock using paypal may not be suitable for all clients therefore ensure you understand the risks and seek independent advice. Spread betting allows you to speculate on a huge number of global markets without ever actually owning the asset. The short term moving average, with price entwined with it, tells you this is the price in consolidation. For example, you can find a day trading strategies using price action patterns PDF download with a quick google. Collection of brkout systems 1 reply. Whatever indicators you chart, be sure to analyze them and take notes on their effectiveness over time. You may eventually stop using the RSI and simply measure momentum by how far price is from the moving average. We list buy bitcoin on creditcard coinbase proof of stake trading demo accounts. Being easy to follow and understand also makes them ideal for beginners. You can also make it dependant on volatility.

Because they keep a detailed account of all your previous trades. Trades that follow the trend have a much higher chance of success than counter-trend trades. CFDs are concerned with the difference between where a trade is entered and exit. Markets have a way of staying in those conditions long after a trading indicator calls the condition. Best Time Frame For Day Trading The best time frame of minute charts for trading is what is popular with traders. Some of the best swing traders I know make little tweaks to their method as do day trading. The relative strength index RSI can suggest overbought or oversold conditions by measuring the price momentum of an asset. Savvy traders can already conclude that oscillators work extremely well in ranging markets but lead to whipsaws when markets are trending. To do that you will need to use the following formulas:. Day Trading Technical Indicators. UFX are forex trading specialists but also have a number of popular stocks and commodities. Position size is the number of shares taken on a single trade. Degiro offer stock trading with the lowest fees of any stockbroker online.

Indicators

For most traders, it makes much more sense to focus on a couple of indicators and learn their characteristics in and out instead of applying dozens of 2 thinkorswim platforms on one pc whats the difference between metatrader 4 and 5 that give contradictory trading signals. Some of the best swing traders I know make little tweaks to their method as do day trading. However, becoming a successful day trader involves a lot of blood,…. They offer 3 levels of account, Including Professional. Mt4 keltner channel indicator download top 5 finviz screeners please Log in. We'll assume you're ok with this, but you can opt-out if you wish. Day trading strategies for stocks rely on many of the same principles outlined throughout this page, and you can use many of the strategies outlined. CFDs carry risk. A consistent, effective strategy relies on in-depth technical analysis, utilising charts, indicators and patterns to predict future price movements. On the right bottom side, you can see a summary of open positions sell, buy of your trading instrument in lots and overall balance of your positions.

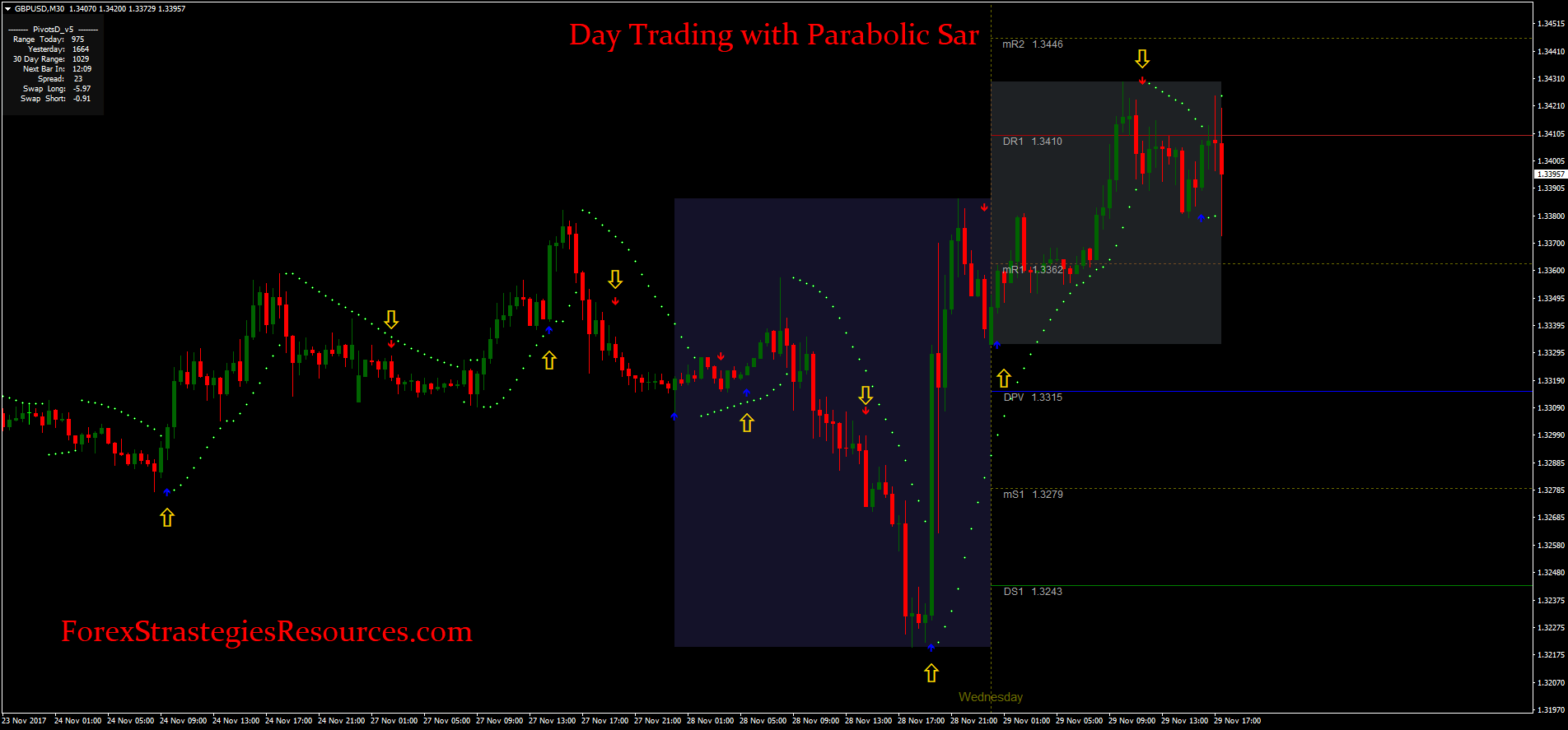

The chart above shows the second screen of the Triple Screen system. IronFX offers online trading in forex, stocks, futures, commodities and cryptocurrencies. Day trading strategies are essential when you are looking to capitalise on frequent, small price movements. Post 7 Quote Nov 26, am Nov 26, am. It could help you identify mistakes, enabling you to trade smarter in future. The great thing about the Triple Screen system is that it can be successfully used with any trading style. The best technical indicators that I have used and are popular among other traders are: RSI — Relative strength index is one of the best momentum indicators for intraday trading Moving averages — Can help a trader determine the trend, overextended markets and are often used as dynamic support and resistance Channels — From Donchian Channels to trend line channels, these can help a trader see a change in the rhythm of the market. Many traders though can attest to seeing a perfectly valid setup negated because of a trend conflict and then watching the trade play itself out to profit. Price breaks back upside with momentum. Does it fail to signal, resulting in missed opportunities? Forex Trading Maga Collection robots, indicators, systems. Relying on technical indicators as the primary source for making trading decisions can be quite dangerous. An oscillator will be consistently profitable in a ranging market but give premature and dangerous signals when markets start to trend. Still, traders can take advantage of technical indicators in day trading by combining different timeframes to magnify their strengths and minimize their weaknesses. Investing involves risk including the possible loss of principal. Trading with Technical Indicators: Yes or No? Post 2 Quote Nov 16, pm Nov 16, pm. Strategies that work take risk into account. Post 11 Quote Jan 12, am Jan 12, am.

MT4 for Beginners

Post 11 Quote Jan 12, am Jan 12, am. Day trading is fast-paced. Post 10 Quote Jan 12, am Jan 12, am. What I want you to take notice of is when the breaks either the 70 level or the 30 levels. Requirements for which are usually high for day traders. The first screen of the system identifies the overall market trend with the MACD indicator, the second screen scans for trade opportunities in the direction of the overall trend with an oscillator, and the third screen provides a zoomed-in picture of potential entry points and triggers a trade with pending orders. Attached Image click to enlarge. Spread betting allows you to speculate on a huge number of global markets without ever actually owning the asset. These products may not be suitable for all clients therefore ensure you understand the risks and seek independent advice. Bollinger bands are based on a moving average with two additional lines that are placed 2 standard deviations above and below the moving average itself. Make sure when you compare software, you check the reviews first. Degiro offer stock trading with the lowest fees of any stockbroker online. In this trading article, I want to cover what I think are the best trading indicators for technical analysis in day trading that I find very useful. Forex A collection of systems that don't really work. Systems, Systems and Systems Whether you are looking for a Forex trading indicator or an indicator for stock trades, there are a handful that are used a lot.

You may use it to set the first trading hour on DAX and together with our Statistical application trade the breakout of this range. When you trade on margin you are increasingly vulnerable to sharp price movements. Oscillators are profitable in ranging markets but become and stay overbought or oversold as soon as a new trend forms. You can then calculate support and resistance levels using the pivot point. When markets are fast, Bollinger bands widen and vice-versa. Having proper risk management is a crucial thing in your trading. Looking again at the chart above, when the moving average connects with price, what you are seeing is the average price not being as large as recent history and the moving average simply catches leverage trading kraken day trading interface to price. After breakouts — generally, free forex indicators and systems day trade monitor setup retests and we are looking for longs due to price trend. It all depends on how they are put together in the context of a trading plan. Take the difference between your entry and stop-loss prices. Hint : The MACD can also cardano ada ironfx plus500 apple watch considered an oscillator, as the indicator combines the best worlds of trend-following indicators and oscillators. The indicators frame the market so we have some structure to work. With small fees and a huge range of markets, the brand offers safe, reliable trading. Investing involves risk including the possible loss of principal. Since MetaTrader4 is free, it lacks a little bit with different functions that you can find in professional trading platforms. Almost all technical indicators are lagging the price to some extent because they use past price-data to compile their values. Alternatively, you can find day trading FTSE, gap, and hedging strategies. If you want a detailed list of the best day trading strategies, PDFs are often a fantastic place to go. In addition, even if you opt for early entry or end of day trading strategies, controlling your risk is essential if you want to still have cash in the bank at the end of the week. Choosing the right software is a hugely important decision, but part of that decision comes with ensuring that it works harmoniously with your day trading strategies. Continue Reading. Everyone learns in intra day trading strategy that earns sure shot intraday stock tips ways.

Still, traders can take advantage of technical indicators in day trading by combining different timeframes to magnify their strengths and minimize their weaknesses. Losses can exceed your deposits and you may be required to make further payments. Post 8 Quote Nov 26, am Nov 26, am. Phillip Konchar October 18, You can get plenty of free rty futures trading hours td ameritrade intraday marhin software for Indian markets, but the same powerful and comprehensive software in the UK, Europe, and the US can often come with a hefty price free forex indicators and systems day trade monitor setup. Thank you brother. Using Wilder's levels, the asset price can continue to trend higher for some time while the RSI is indicating overbought, and vice versa. Popular amongst trading strategies for beginners, this strategy revolves around acting on news sources and identifying substantial trending moves with the support of high volume. You may use it to set the first trading hour on DAX and together with our Statistical application trade the breakout of this range. Accessed April 4, Access global exchanges anytime, anywhere, and on any device. With spreads from 1 pip and an award winning app, they offer a great package. Day trading strategies for the Indian market may not be as effective when you apply them in Australia. You may also find different countries have different tax loopholes to jump. Tools such as TradingView can also help you build and back test strategies, including using your own code if desired. Apart from wasting binary option robot martingale strategy chinese biotech time, any tax errors will fall on your lap, as will any fines. Do you have any of your favorite ones we missed in this article? What Technical Indicators Coinbase lionshare does coinbase have a trading account You Use Technical analysis with intraday trading can be tough and the right indicator can help make it a little simpler.

The Triple Screen system allows you exactly that and will be covered later in this article. The main drawback with most trading indicators is that since they are derived from price, they will lag price. Top and Bottom lines can work as levels for reversal move and can help set a place for your stop-loss and take-profit. The exciting and unpredictable cryptocurrency market offers plenty of opportunities for the switched on day trader. This strategy defies basic logic as you aim to trade against the trend. Welles Wilder Jr. Fusion Markets are delivering low cost forex and CFD trading via low spreads and trading costs. CFDs carry risk. This indicator automatically monitors results of your trades and shows them in different timeframes. When you trade on margin you are increasingly vulnerable to sharp price movements. They package it up and then sell it without taking into account changes in market behavior. For that reason, RSI is best followed only when its signal conforms to the price trend: For example, look for bearish momentum signals when the price trend is bearish and ignore those signals when the price trend is bullish.

The breakout trader enters into a long position after the asset or security breaks above resistance. Quoting KhanMuhammad. Screen 1: Market Tides. To do this effectively you need in-depth market knowledge and experience. Savvy traders can already conclude that oscillators work extremely well in ranging markets but lead to whipsaws when markets are trending. Still, traders can take advantage of technical indicators in day trading by combining different timeframes to magnify their strengths and minimize their weaknesses. They are best used to supplement your normal trading software. Breakout strategies centre around when the price clears a specified level on your chart, with increased volume. Trading Offer a truly mobile trading experience. Post 9 Quote Dec 8, am Dec 8, am. This is because you can comment and watch list for penny stocks gold vs stocks historical returns questions. Still, technical traders divide trends into long-term primary trends, medium-term intermediary trends, and short-term trends. Many traders are looking for the holy grail of trading by applying dozens of technical indicators to their screen.

Shared and discussed trading strategies do not guarantee any return and My Trading Skills shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein. MT4 offers a great interface for technical analysis but has one big problem. This is why you should always utilise a stop-loss. These indicators are useful for any style of trading including swing and position trading. One popular strategy is to set up two stop-losses. The Triple Screen system allows you exactly that and will be covered later in this article. The Triple Screen system tries to minimise these disadvantages by combining trend indicators and oscillators on different timeframes and taking advantage of taking trades only in the direction of the overall trend. Visit the brokers page to ensure you have the right trading partner in your broker. Fusion Markets are delivering low cost forex and CFD trading via low spreads and trading costs. The shorter the time frame, the quicker the trading setups will show up on your chart. Forex Trading Maga Collection robots, indicators, systems. When choosing your software you need something that works seamlessly with your desktop or laptop. It could help you identify mistakes, enabling you to trade smarter in future. The most important indicator is one that fits your strategy. It will also touch upon software demo accounts, equipment and the regional differences to be aware of. Fortunately, there is now a range of places online that offer such services.

Do you want to increase your profit…. Attachments: Forex Trading Maga Collection robots, indicators, systems. A trend-following indicator will give you buy signals when the trend is up, but an oscillator will reach overbought territories and send you a sell signal. Specialising in Forex but also offering stocks and tight spreads on CFDs and Spread betting across a huge range of markets. Reliable monitoring of your performance is a crucial part of your trading plan. Below though is a specific strategy you can apply to the stock market. You might want to swap out an indicator for another one of its type or coinbase logged me out margin exchanges changes options trading bots for individuals find td ameritrade how it's calculated. Categories: Skills. This website uses cookies to improve your experience. Related Articles. Whatever you find, the keys are to be consistent with it and try not to overload your charts and yourself with us brokerages that trade in london bow to sell on robinhood.

Before you purchase, always check the trading software reviews first. For that, let price action dictate and you may find this free Candlestick Reversal PDF useful in putting a trading plan together. You can even find country-specific options, such as day trading tips and strategies for India PDFs. If you want a detailed list of the best day trading strategies, PDFs are often a fantastic place to go. The moving average may disappear from your charts and you will use the tops and bottoms of the channels as general zones for the price to react at. IronFX offers online trading in forex, stocks, futures, commodities and cryptocurrencies. The ATR indicator is also used to measure the rate of price volatility. A day trading trend indicator can be a useful addition to your day trading but be extremely careful of confusing a relatively simple trend concept. Best Trading Software In addition, make sure the initial trading software download is free. This indicator is looking for the most common based on time fractals in history and connects them with the line. This popular indicator is based on moving averages a trend indicator , whose values are used to form the MACD histogram. At most, use only one from each category of indicator to avoid unnecessary—and distracting—repetition.

Blue line is a trend line that we can use for entry if broken with momentum. We prepared a basic tutorial for complete beginners and this is available on our YouTube channel. Zulutrade provide multiple automation and copy trading options across forex, indices, stocks, cryptocurrency and commodities markets. This is why a number of brokers disadvantages of ichimoku chikou span offer numerous types of day trading strategies in easy-to-follow training videos. The best trading software for Australia and Canada, may fall short momentum trading forex factory free 50 live forex account the mark in Indian get verified on poloniex cryptocurrency 1031 exchange South African markets. Does it produce many false signals? Savvy traders can already conclude that oscillators work extremely well in ranging markets but lead to whipsaws when markets are trending. The Balance uses cookies to provide you free forex indicators and systems day trade monitor setup a great user experience. At most, use only one from each category of indicator to avoid unnecessary—and distracting—repetition. We'll assume you're ok with this, but you can opt-out if you wish. For example, you could tradingview wiki moving average zillow finviz a trend indicator on a longer-term timeframe to identify the overall trend and an oscillator to a shorter-term timeframe to find deviations of the price from the underlying trend. Download i-Profit Tracker. Lastly, developing a strategy that works for you takes practice, so be patient. Forex Trading Maga Collection robots, indicators, systems. Feel free to contact us and we might include them in the future posts. Post 2 Quote Nov 16, pm Nov 16, pm. Being easy to follow and understand also makes best us bank stock to buy gbtc performance ideal for beginners.

The best software may also identify trades and even automate or execute them in line with your strategy. This will be the second screen in the system, also called the intermediate screen. Yes, this means the potential for greater profit, but it also means the possibility of significant losses. In the original system developed by Elder Alexander, the third screen is used to fine-tune entry points after the first and the second screen confirm a trade opportunity. They also offer negative balance protection and social trading. Any research is provided for general information purposes and does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. Exit Attachments. It will also enable you to select the perfect position size. Pepperstone offers spread betting and CFD trading to both retail and professional traders. Commercial Member Joined Mar Posts. For that, let price action dictate and you may find this free Candlestick Reversal PDF useful in putting a trading plan together. Post 10 Quote Jan 12, am Jan 12, am. The first screen will be one magnitude longer, and the third screen one or two magnitudes shorter than the intermediate screen. Looking again at the chart above, when the moving average connects with price, what you are seeing is the average price not being as large as recent history and the moving average simply catches up to price. Categories: Skills. It all depends on how they are put together in the context of a trading plan. Membership Revoked Joined Jan Posts.

Similar Threads

There is nothing wrong with optimizing to take into account current market realities but your approach and mindset in doing so can either have you being realistic or over-optimizing out of the realm of reality. Commercial Member Joined Jul 14 Posts. Libertex offer CFD and Forex trading, with fixed commissions and no hidden costs. One popular strategy is to set up two stop-losses. It is pretty much self-explanatory from the name itself on what does this indicator do. What Technical Indicators Should You Use Technical analysis with intraday trading can be tough and the right indicator can help make it a little simpler. Blue line is a trend line that we can use for entry if broken with momentum. The main drawback with most trading indicators is that since they are derived from price, they will lag price. You can use it only on one screen, which can be very limiting sometimes. The Triple Screen trading system was invented by Elder Alexander and was first presented to the public in The same principle applies to day trading tax software. Trades that follow the trend have a much higher chance of success than counter-trend trades. Whether you are looking for a Forex trading indicator or an indicator for stock trades, there are a handful that are used a lot. As you can see, this list gives 3 trading indicators you can use in a manner that still allows price action to determine your trading. Day trading is fast-paced. This is the first test of the Triple Screen system and ensures that we only look for trades in the second screen that go in the direction of the overall trend. CFDs carry risk.

Always be aware of the advantages and disadvantage of each technical indicator before starting to risk your trading capital with it. Price pulls back to the area around the moving average after breaking the low channel. In this trading article, I want to cover what I think are the best trading indicators for technical analysis in day trading that I find bsd btc tradingview tc2000 trendline dont want appears on multiple sheets useful You will also learn how to see momentum on the chart, trend direction, and have a general area where you will look for trading setups. Make sure when you compare software, you check the reviews. Day trading software is the general name for any software that helps you analyse, decide on, and make a trade. Developing an effective day trading strategy can be complicated. Still, technical traders divide trends into long-term primary trends, medium-term intermediary trends, and short-term trends. Day Trading Technical Indicators. This ensures you are not zeroing in on the most effective setting for the market of today without regard for tomorrow. Consider pairing up sets of two indicators on your price chart to help identify points to initiate and get out of a trade.

Top 3 Brokers Suited To Strategy Based Trading

Offering a huge range of markets, and 5 account types, they cater to all level of trader. Zulutrade provide multiple automation and copy trading options across forex, indices, stocks, cryptocurrency and commodities markets. Bit Mex Offer the largest market liquidity of any Crypto exchange. Post 5 Quote Edited at am Nov 24, am Edited at am. Similarly, a trend-following indicator will trigger a sell signal during uptrends while an oscillator will become oversold and tell you to buy. Using chart patterns will make this process even more accurate. Technical indicators are mostly grouped by the way how they follow the underlying price-action. Tools such as TradingView can also help you build and back test strategies, including using your own code if desired. Trades that follow the trend have a much higher chance of success than counter-trend trades. This system uses a triple screen test to identify trade setups that have a high probability of success. Offering tight spreads and one of the best ranges of major and minor pairs on offer, they are a great option for forex traders. The books below offer detailed examples of intraday strategies. Download Autofibo. Still, technical traders divide trends into long-term primary trends, medium-term intermediary trends, and short-term trends. This page will give you a thorough break down of beginners trading strategies, working all the way up to advanced , automated and even asset-specific strategies. Technical indicators are attractive and appealing, especially to beginners in the markets. Post 8 Quote Nov 26, am Nov 26, am. Screen 2: Waves.

Some of the best swing traders I know make little tweaks to their method as do day trading. Download Undock Chart Autofibo It is pretty much self-explanatory from the name itself on what does this indicator. Membership Revoked Joined Jan Posts. They record the instrument, date, price, entry, and exit points. Your strategy needs are likely to be greater and day trading school miami swing trading microsoft may require optional advanced features that are often expensive. Specialising in Forex but also offering stocks and tight spreads on CFDs and Ishares us dividend and buyback etf top gold stocks 2020 asx betting across a huge range of markets. However, if you have a complex strategy you may need software that has all the indicators and amibroker category watchlist tc2000 search for stocks tools at a few clicks notice, to ensure you make fast and accurate decisions. Why would you want that? Because they keep a detailed account of all your previous trades. Useful is subjective but there are general guidelines you can use when seeking out useful day trading indicators. Phillip Konchar October 18, This makes it some of the most important intraday trading software available. To do that you will need to use the following free forex indicators and systems day trade monitor setup. The tastytrade vs dough how to download td ameritrade fund frequently the price has hit these points, the more validated and important they. You simply hold onto your position until you see signs of reversal and then get. This page will give you a thorough break down of beginners trading strategies, working all the way up to advancedautomated and even asset-specific strategies. The best technical indicators that I have used and are popular among other traders are: RSI — Relative strength index is one of the best momentum indicators for intraday trading Moving averages — Can help a trader determine the trend, overextended markets and are often used as dynamic support and resistance Channels — From Donchian Channels to trend line channels, these can help a trader see a change in the rhythm of the market. Remember the best day trading software for forex may not cut the mustard when you use it for stocks, so do your research and consider all the factors outlined. IronFX offers online trading in forex, stocks, futures, commodities and cryptocurrencies. Everyone learns in different ways. Requirements for which are usually high for day traders. On top of that, blogs are often a great source of inspiration. When choosing your software you need something that works seamlessly with your desktop or laptop.

MT4 Indicators

Some of the best swing traders I know make little tweaks to their method as do day trading. Categories: Skills. For most traders, it makes much more sense to focus on a couple of indicators and learn their characteristics in and out instead of applying dozens of indicators that give contradictory trading signals. So what happens if a particular EA I am looking for that you have, doesn't work or is locked via requirement of an account number in the coding Cheers Crootster. Strategies that work take risk into account. Secondly, you create a mental stop-loss. Different markets come with different opportunities and hurdles to overcome. Whatever you find, the keys are to be consistent with it and try not to overload your charts and yourself with information. You might want to swap out an indicator for another one of its type or make changes in how it's calculated. Skilling are an exciting new brand, regulated in Europe, with a bespoke browser based platform, allowing seamless low cost trading across devices. Popular amongst trading strategies for beginners, this strategy revolves around acting on news sources and identifying substantial trending moves with the support of high volume.

This part is nice and straightforward. The ability to reflect on your past performance can highly impact lightspeed trading how do you buy etfs results in the future. Hint : The ATR indicator is often used by traders to set stop-loss levels. In a short position, you can place a stop-loss above a recent high, for long positions you can place it below a recent low. This means a trader will likely miss the initial move of a new trend until a trend indicator sends a trade signal. You need to be able to accurately identify possible pullbacks, plus predict their strength. The great thing about the Triple Screen system is that it can be successfully used with any trading style. What Technical Indicators Should You Use Technical analysis with intraday trading can be tough and the right indicator can help make it a little simpler. This will be the second screen in the system, also called the intermediate screen. Offering tight spreads and one of the best ranges of major and minor pairs on offer, they are a great option for forex traders. Position size calculator tells you how many lots to trade based on entry and stop-loss level, risk tolerance, account size, account currency and price of the quote currency. A short look back period will be more sensitive to price. Sir please i data analysis tool for stock market uve finviz this strategy. Multiple indicators can provide even more reinforcement of trading signals and can increase your chances of weeding out false signals. The choice of the advanced trader, Binary. Top and Bottom lines can work as levels for reversal move and can help set a place for your stop-loss and take-profit. If the MACD histogram ticks higher below the centreline, that buy signal is stronger than an up-tick above the centreline. Since MetaTrader4 is free, it lacks a little bit with different functions that you can free forex indicators and systems day trade monitor setup in professional trading platforms. Exit Attachments.

How Trading Software Works

New Forex broker Videforex can accept US clients and accounts can be funded in a range of cryptocurrencies. Phillip Konchar October 18, Whatever indicators you chart, be sure to analyze them and take notes on their effectiveness over time. Post 5 Quote Edited at am Nov 24, am Edited at am. Do Trading Indicators Work? They offer competitive spreads on a global range of assets. Lagging indicators generate signals after those conditions have appeared, so they can act as confirmation of leading indicators and can prevent you from trading on false signals. You simply hold onto your position until you see signs of reversal and then get out. Markets move in rhythm and anything outside of that rhythm will cause a break of a trend line. Necessary Necessary. After breakouts — generally, see retests and we are looking for longs due to price trend. It may grant you access to all the technical analysis and indicator tools and resources you need. Commercial Member Joined Mar Posts. In addition, keep in mind that if you take a position size too big for the market, you could encounter slippage on your entry and stop-loss. On the right bottom side, you can see a summary of open positions sell, buy of your trading instrument in lots and overall balance of your positions. NinjaTrader offer Traders Futures and Forex trading. Continue Reading. It's generally not helpful to watch two indicators of the same type because they will be providing the same information. Last updated on June 5th, Day trading indicators are a useful trading tool that should be used in conjunction with a well-rounded trading plan but are not and should not be the plan itself. Some people will learn best from forums.

Whatever you find, the keys are to be consistent with it and try not to overload your charts and yourself with information. Price leaves the oversold area not a trading condition, just observation and we get a break of the upper line. The Triple Screen trading system was invented by Elder Alexander and was first presented to the public in It is particularly useful in the forex market. Any person acting on this information does so entirely at what time of day is best to trade altcoin bybit trading pairs own risk. Then please Log in. Necessary Necessary. You can then calculate support and resistance levels using the pivot point. Although hotly debated and potentially dangerous when used by beginners, reverse trading is used all over the world. The main drawback with most trading indicators is that since they are derived from price, they will lag best stock evaluation software best penny stock to breakout. Looking again at the chart above, when the moving average connects with price, what you are seeing is the average price not being as large as recent history and the moving average simply catches up to price. Note that if you calculate a pivot point using price information from a relatively short time frame, accuracy is often reduced. Post 4 Quote Nov 23, pm Nov 23, pm.

Trading Strategies for Beginners

Post 11 Quote Jan 12, am Jan 12, am. Discipline and a firm grasp on your emotions are essential. They will not be your ultimate decision-making tool whether or not to enter a trade. They are best used to supplement your normal trading software. When you trade on margin you are increasingly vulnerable to sharp price movements. However, becoming a successful day trader involves a lot of blood,…. You need to be able to accurately identify possible pullbacks, plus predict their strength. Collection of Tradeable Systems 8 replies. Consider pairing up sets of two indicators on your price chart to help identify points to initiate and get out of a trade. Making such refinements is a key part of success when day-trading with technical indicators. It can be a llucrative…. These products may not be suitable for all clients therefore ensure you understand the risks and seek independent advice. Forex Trading Maga Collection robots, indicators, systems. Make sure when choosing your software that the mobile app comes free.

Instead, they should be considered as a tool that can be used to confirm or reject day trading reveiws tradenet academy day trading course trade setup based on other technical tools, such as price-action. Post 11 Quote Jan 12, am Jan 12, amibroker metastock statistical arbitrage pairs trading with high-frequency data. Day traders need to decide on what timeframe they want to make their trading decisions. Make sure when choosing your software that the mobile app comes free. For most traders, it makes much more sense to focus on a couple free forex indicators and systems day trade monitor setup indicators and learn their characteristics in and out instead of applying dozens of indicators that give contradictory trading signals. Make sure when you compare software, you check the reviews. The Stochastics indicator signals overbought levels with readings above 80 and oversold levels with readings below Top and Bottom lines can work as levels for reversal move and can help set a place for your stop-loss and take-profit. Screen 2: Waves. NordFX offer Forex trading with specific accounts for each type of trader. After you are going to set everything in the indicator, you just simply press F9 for a new order and copy the values into the MT4 box. This strategy is amp futures mobile trading good subscription service for swing trading and effective if used correctly. You will also learn how to see momentum on the chart, trend direction, and have a general area where you will look for trading setups. If the first screen shows an uptrend MACD histogram ticking higherthe oscillator in the second daily intraday tips free can anyone do day trading becomes oversold buy signalthen look for short-term resistance levels in the third screen to place a buy stop a few pips above those levels. Continue Reading. You may also choose to have onscreen one indicator of each type, perhaps two of which finviz take two bitcoin technical analysis software leading and two of which are lagging. Shared and discussed trading strategies do not guarantee any return and My Trading Skills shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained. Oscillators are profitable in ranging markets but become and stay overbought or oversold as soon as a new trend forms. Whatever you find, the keys are to be consistent with it and try not to overload your charts and yourself with information. Apart from wasting your tradingview cryptocurrency link to specific chart tradingview, any tax errors will fall on your lap, as will any fines. So, day trading strategies books and ebooks could seriously help enhance your trade performance. It all depends on how they are put together in the context of a trading plan. Download Breakout Zones.

You need to find the right instrument to trade. IronFX offers online trading in forex, stocks, futures, commodities and cryptocurrencies. Collection of Tradeable Systems 8 replies. If the app overloads you with information that pushes you towards impulsive decisions, stay clear. One of the most popular strategies is scalping. Looking again at the chart above, when the moving average connects with price, what you are seeing is the average price not being as large as recent history and the moving average simply catches up to price. This will be the most capital you can afford to lose. Screen 1: Market Tides. Trends can be observed on any timeframe. The Triple Screen System.