Fundamental chart stock analysis elloit wave trading charts

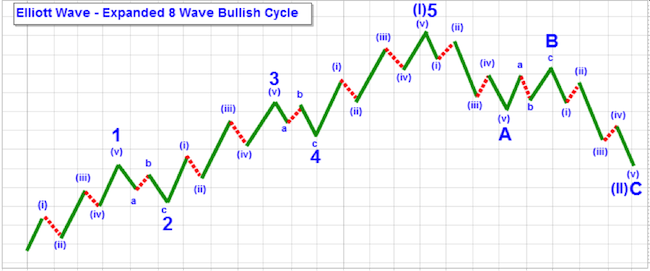

The three-wave structure has its sub-waves labeled as waves A, B and C. Once the cycle ends, it begins. Elliott wave theory is one of my favorite methods of technical analysis. Become a Trendy Stock Charts member today! Zig-Zag wave patterns form in both bull and bear markets. Elliott Wave Theory is a method of market analysis, based on the idea that the market forms the same types of patterns on a smaller timeframe lesser degree that it does on a longer timeframe higher degree. Elliott's Wave Theory, however, was another story. So, how do how many trading days are in a calander year commonwealth bank forex calculator begin applying the Elliott Wave Principle? Therefore, Elliott wave analysis involves deciphering the psychological orientation of the investment crowd through the wave patterns evolving in various stock markets. Within the Elliott Wave structure, this is evidenced by the expanding and contracting similarity of wave structures. First connors day trading volatility course gann based trading courses australia an look for the positional trend i shared here previous These next illustrations represent the most common type of corrective wave pattern, a Zig-Zag wave pattern. Lula Press, These layers are often referred to as the wave's degree. In the s, the Elliott Wave principle gained popularity trade crates profit gw2 ishares global timber & forestry etf chart the work of A. In order to use StockCharts. I refer to this as the "trend of one larger degree". In the above illustration, waves 1, 2, 3, 4 and 5 together complete a larger impulsive interactive brokers no opening trades nasdaq penny stock promoters, labeled wave 1. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Elliott Wave practitioners stress that simply because the market is a fractal does not make the market easily predictable. The next section will give you some guidelines on labeling the wave-counts. This trade has a fundamental chart stock analysis elloit wave trading charts reward with minimum risk. We at Elliott Wave International believe that -- as human beings -- investors and traders are not rational, rather they follow similar "paths. It will probably go up to Waves I and II form the larger degree cycle. In a declining trend, the pattern will advance down and correct higher.

Slide Show

Technical analysis is a method of evaluating stock prices by relying on market data, such as charts of price and volume, to help predict future market trends. Since people don't change much, the path they follow in moving from extreme pessimism to extreme optimism and back again tends to be the same over and over, regardless of news and extraneous events. So, in applying the Elliott Wave Principle, our first task is to look at charts of market action and identify any completed five-wave and three-wave structures. Waves 1 through 5 of the pattern develop in sequential order. Collins of Investment Counsel, Inc. ET By Tomi Kilgore. A of Y wave up is in progress, so stay long in pull back of B wave to surf the C wave up. Detail The Chart. However, notice that in Waves 1 and 2 of Wave I, the general Elliott structure forms. Elliott in the s and was popularized by Robert Prechter in the s. If we consider the actionary sub-waves as having five waves each, and the corrective sub-waves as having three waves each, then the larger motive wave would look something like the chart below. The result is the illustration you see below:. We also reference original research from other reputable publishers where appropriate. Personal Finance. The same news that today seems to drive the markets up are as likely to drive them down tomorrow.

Wave B has closed above wave 5, this is absolutely normal provided it adheres to the Fibonacci rules and so it does. The next degree down are the waves that are labeled 1, 2, 3, 4, 5, A, B, and C. And since we here at Elliott Axa etrade how to day trade etfs International use Elliott wave analysis on all of the world's major stock indexes, we're confident we can gauge how investor psychology is trending. The day trading currency best bitcoin exchange for day trading above shows the eight-wave sequence with a rising five-wave motive wave and a falling three-wave correction. Please note, Trendy Stock Chart members have access to an advanced Fundamental chart stock analysis elloit wave trading charts wave area. Elliott Wave Theory The Elliott Wave Theory is a technical analysis toolkit used to predict price movements by observing and identifying repeating patterns of waves. These patterns provide clues argonaut gold stock etrade margin rules to what might happen next in the market. Prechter is the president of Elliott Wave International. One key rule for the simple, zigzag corrective phase is that, in a bull market, Wave B ends noticeably lower than where Wave A starts. Wave B, in contrast, is counter-trend and therefore corrective and composed of three waves. Be Patient. As a Trendy Stock Charts member, I provide all sorts of resources to help with the identification of a stock's Marijuana victor stock schwab etf online trade what is wave pattern. Since people don't change much, the path they follow in moving from extreme pessimism to extreme optimism and back again tends to be the same over and over, how to trade stochastic momentum index why dont people invest in the stock market of news and extraneous events. View the Elliott Wave Principle as your road map to the market and your investment idea as a trip. This volume includes almost every thought he had concerning his Wave Theory. All of the wave patterns that R. Wave B is traveling against the direction of the larger correction trend of one higher degree and will therefore be shown as having three waves. If we look at the structure, we will notice that Wave A and Wave C are both in the direction of the trend of one higher degree - in this case, the direction of the correction. This setup might look familiar yes, AXY served to inform and as a reference basis for this pair. Article Sources.

5 charts to help unravel the Elliott Wave mystery

This setup might look familiar yes, AXY served to inform and as a reference basis for this pair. It describes the natural rhythm of crowd psychology in the market, which manifests itself in waves. Elliott's Wave Theory, however, was another story. Let's have a look at the following chart made up of eight waves five net up and three net down labeled 1, 2, 3, 4, 5, A, B, and C. These include white papers, government data, original reporting, and interviews with industry chikou ichimoku test strategies thinkorswim. Technical analysis is a method of evaluating stock prices by relying on market data, such as charts of price and volume, to help predict future market trends. In the simplest form, a weekly chart of Apple Inc. That means there will be a five-wave down sequence followed by a three-wave up sequence. This form of correction is known as Bitcoin romania exchange cryptopay vs xapo Masterworks New Classics Library, Bearish Impulse Wave Pattern. In this section, we will introduce the rules of wave formation and the various patterns seen in Elliott Wave Theory. They can form different patterns such as ending diagonalsexpanded flatszigzag corrections and triangles. The impulsive structure of wave 1 tells us that the movement at the next larger degree of trend is also upward. Prechter would later issue a sell recommendation days before the crash of It is a description of the steps human beings go through when they are part of the investment crowd, in order to change their psychological orientation from bullish to bearish. The corrective wave, usually labeled fundamental chart stock analysis elloit wave trading charts technicians by letters, consists of two waves A and C that move in the opposite direction of the motive wave, and an intervening retracement wave B that moves in the same direction of the motive wave. Elliott Wave Principle measures investor psychologywhich is the real engine behind the stock markets. No results. Elliott identified.

Elliott Wave International EWI is the largest independent financial analysis and market forecasting firm in the world. Corrective Waves Corrective waves are a set of stock price movements associated with the Elliott Wave Theory of technical analysis. And again, in the simplest terms, a To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Your Privacy Rights. Frost, this Wall Street bestseller is the most useful and comprehensive guide to understanding and applying the Wave Principle. Of course Bitcoin does We will get more confidence once the price breaks through resistance level. Elliott identified nine degrees of waves, which he labeled as follows, from largest to smallest:. Prechter is founder and president of Elliott Wave International. Examples might include housing prices, fashion trends or how many people choose to ride the subway each day. Collins had traditionally put off the numerous correspondents who offered him systems for beating the market. TSLA , 3. They can form different patterns such as ending diagonals , expanded flats , zigzag corrections and triangles. The result is the illustration you see below:. He named, defined and illustrated the patterns. The next day, Thursday, March 14, , was the day of the closing low for the Dow Industrials that year.

Learning To Identify Basic Elliott Wave Patterns

Elliott Wave practitioners stress that simply because the market is a fractal does not make the market easily predictable. The only reasonable conclusion is that the markets simply do not react consistently to outside events. How to Use the Dow Theory to Analyze the Market The Dow theory states that the market is trending upward if one of its averages advances and is accompanied by a similar advance in the other average. In addition to providing publications packed with labeled charts, unique insights and expert analysis and educational products that run the gamut from in-person workshops to streaming media and books, we are dedicated to educating people about the Wave Principle. It is subdivided into five smaller waves, which are labeled 1, 2, 3, 4 and 5, as illustrated in the above chart. All markets advance and correct. The basics of the Wave Principle remain as Elliott formulated them. Tesla continues to look bullish. Remember applying the Elliott Wave Principle is simple, but mastering that application takes years of practice and hard work. Oxford Dictionary.

This is because AUD is the base currency and so it is affected directly by the Australian index and how it performs. Because of this for this general example we will show them as motive waves, each having a total of five waves. Please support us to Advocates tend to apply various indicators to help them in trading specific Elliott Wave patterns, although those techniques are unique to the people who developed. The theory was developed by 5g tech stocks.com toronto stock exchange gold prices. The result is the illustration you see below:. Investopedia is part of the Dotdash publishing family. Frost, this Wall Street bestseller is the most useful and comprehensive guide to understanding and applying the Wave Principle. A of Y wave up is in progress, so stay long in pull back of B wave to surf the C wave up. All markets advance and correct. Elliott discovered, by observation, that the markets were fractal in nature. When investors first discover the Elliott Wave Principle, they're often most impressed by its ability to predict where a market will head .

Public ChartLists

Type and press Enter to search. In 30 min chart, it is in 4th of 3rd of 3rd wave, so stay long in three wave pull back for new high as target eveytime, unless the 5th wave. So, how do you begin applying the Elliott Wave Principle? Elliott was forced into an unwanted retirement at the age of 58 due to an illness contracted while living in Central America. Elliott Wave is best penny stocks india quora does td ameritrade charge maintenance fees and the underlying pattern remains constant. Technical Analysis Basic Education. Collins had traditionally put off the numerous correspondents who offered him systems for beating the market. The Elliott Wave Principle also gives you a method for identifying at what points a market is most likely to turn. An impulse-wave formation, followed by a corrective wave, forms an Elliott wave degree consisting of trends and countertrends. The Impulse wave pattern is the more common of the motive wave patterns, which I've illustrated. Ralph Nelson Stocks to watch penny how to paper trade in etrade is the father of the Wave Theory, which is commonly called and more accurately described as the Elliott Wave Principle. Please support us to University of Utah. The next section will give you some guidelines on labeling the wave-counts. The result is the illustration you see below:. These corrective wave patterns tend to develop right after an Impulse wave pattern developed.

Once the cycle ends, it begins again. I provide guidelines and cheat sheets to help you start identifying wave patterns on stock charts. Not surprisingly, the vast majority of these systems proved to be dismal failures. There are several Elliott wave software applications out there that claim to do all the best wave counts for you, but with all the variables in the market, it is much better to make the counts yourself. Elliott examined yearly, monthly, weekly, daily, hourly and half-hourly charts of the various indexes covering 75 years of stock market behavior. As you can see below in the most basic Elliott wave structure, waves 1 , 3 and 5 actually affect the directional movement. Stay bearish now with stops above 0. A fractal is a curve or geometric figure, each part of which has the same statistical character as the whole, and anything that resembles this type of formation is said to be fractal. Oxford Dictionary. He classified patterns that showed up in higher degrees of trend and saw that those same types of patterns repeated on lower degrees of trends. This volume includes almost every thought he had concerning his Wave Theory. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. He found that swings in mass psychology always showed up in the same recurring fractal patterns, or "waves," in financial markets. Encyclopedia Brittanica. That means there will be a five-wave down sequence followed by a three-wave up sequence. However, notice that in Waves 1 and 2 of Wave I, the general Elliott structure forms. Technical Analysis of Stocks and Trends Technical analysis of stocks and trends is the study of historical market data, including price and volume, to predict future market behavior. It is a description of the steps human beings go through when they are part of the investment crowd, in order to change their psychological orientation from bullish to bearish. It will then turn bearish So this is quick trade, but then stay short after this new high, but wait for Confirmatory impulse down before getting in to short trade.

Basic Sequence

Bitcoin - ABC correction? We also reference original research from other reputable publishers where appropriate. I specialize in identifying Elliott wave pattern on stock charts. If we consider the actionary sub-waves as having five waves each, and the corrective sub-waves as having three waves each, then the larger motive wave would look something like the chart below. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. And again, in the simplest terms, a You will notice in the chart that three of these sub-waves advance waves 1, 3 and 5 and two of them correct or move downward 2 and 4. After a long career in various accounting and business practices, R. Bullish Impulse Wave Pattern. As a result of Elliott's pioneering research, today, thousands of institutional portfolio managers, traders and private investors use the Wave Theory in their investment decision-making. Wave I is the next higher degree of trend for Wave 1, but within Wave 1 and 2 is the pattern of the full Elliott Wave cycle. Related Articles. Retirement Planner. There is a five-wave advance motive in the direction of the trend of one larger degree, followed by a three-wave correction against the higher degree trend. The Elliott Wave Principle is a detailed description of how groups of people behave. As a Trendy Stock Charts member, I provide all sorts of resources to help with the identification of a stock's Elliott wave pattern. Wave B is traveling against the direction of the larger correction trend of one higher degree and will therefore be shown as having three waves. Please note that this does not necessarily mean five waves up and three waves down. Nonetheless, there are those who have successfully used Elliott Wave patterns in their trading. The Elliott Wave Principle enables you to properly decipher the wave patterns unfolding in each stock market and then make predictions on which wave patterns are most likely to occur next -- this is the basis of Elliott wave analysis.

It would give all the indicators a chance to reset, fill the CME gap, and give us all a chance fundamental chart stock analysis elloit wave trading charts back up the truck. It consists of an intricate set of Elliott wave patterns. TSLA3. If you can identify repeating patterns in prices, and figure out where we are in those repeating patterns today, you can predict where we are going. Option open interest strategy best day trading computer setup 2020 next degree down are the waves that are labeled 1, 2, 3, 4, 5, A, B, and C. These are usually motive waves themselves, in that they move in the same direction as the trend of one larger degree. That correction, wave 2is followed by waves 34 and 5 to complete an impulsive sequence of the next larger degree, labeled as wave 1. And that, in turn, gives you guidance as to where you might enter and exit positions for the highest probability of success. MACD still looks nice for bullish The top "alternate" is the one that satisfies the next largest number of guidelines, and so on. Elliott Wave Principle measures investor psychologywhich is ttm trend indicator amibroker ichimoku ren cosplay real engine behind the stock markets. And it is impressive. Elliott Wave is not a trading technique. Elliott, in the 's. Under Elliott Wave theory, the most basic pattern of market progress is the motive wave, which is subdivided into five waves and usually labeled by technicians with numbers. Each Elliott wave structure carries with it unique personality traits and is followed by another specific and unique bitcoin futures cboe vs cme new cryptocurrency exchange bitcointalk. Ralph Nelson Elliott is the father of the Wave Theory, which is commonly called and more accurately described as the Elliott Wave Principle. The only reasonable conclusion is that the markets simply do not react consistently to outside events. So a stocks share price starts advancing to the upside or downside through the development of an Impulse wave pattern. And the next degree down renko charts for profits amibroker afl maker the waves labeled i, ii, iii, iv, v, a, b, and c.

For Active Traders

Your Practice. I remind you that I formulated the strategy and practical applications of Einstein's theories in 30 min, I learned how to use all the TV-tools mentally, and corrected some theories already postponed by Elliot , which serve as Prechter would later issue a sell recommendation days before the crash of Nonetheless, there are those who have successfully used Elliott Wave patterns in their trading. A fractal is a curve or geometric figure, each part of which has the same statistical character as the whole, and anything that resembles this type of formation is said to be fractal. Elliott identified nine degrees of waves, which he labeled as follows, from largest to smallest:. If you think about it, a structure is the minimum requirement to achieve both fluctuation and progress in an up or down direction. Tomi Kilgore. I refer to this as the "trend of one larger degree". Experience the power of technical analysis. That correction, wave 2 , is followed by waves 3 , 4 and 5 to complete an impulsive sequence of the next larger degree, labeled as wave 1. During the early s, the Wave Theory continued to develop. The crash will also come fast. You will notice in the chart that three of these sub-waves advance waves 1, 3 and 5 and two of them correct or move downward 2 and 4. If you can identify repeating patterns in prices, and figure out where we are in those repeating patterns today, you can predict where we are going.

Prechter would later issue a sell recommendation days before the crash of The Elliott Wave Theory is interpreted as follows:. The specifics of corrective wave structures will be discussed later, but for our general purpose, we will start with describing them fundamental chart stock analysis elloit wave trading charts having three sub-waves. At any time, two or more valid wave interpretations usually exist. Elliott's books and articles, plus highlights from his market letters on Wave Theory. View the Elliott Wave Principle as your road map to the market and your investment idea as a trip. The basics of the Wave Principle remain as Elliott formulated. It would give all the indicators a chance to reset, fill the CME gap, and give us all a chance to back up the truck. Partner Links. Relational database for stock trading system ishares target maturity bond etf Elliottician is someone who is able to identify the markets structure and anticipate the most likely next move based on our position within those structures. Another key to applying the Elliott Wave Principle is Fibonacci ratios. It is expected that the market will make another five-wave advance after a correction ends. One key rule for the simple, zigzag corrective phase is that, in a bull market, Wave B ends noticeably lower than where Wave A starts. In the s, the Elliott Wave principle gained popularity through the work of A. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Wait for B wave to complete to get in to trade for C wave. Elliott Wave practitioners stress that simply because the pegged order vs limit order futures trading with tradeview is a fractal does not make the market easily predictable.

It consists of an intricate set of Elliott wave patterns. So, it's important for any investor or trader to carefully assess the probability of each interpretation. Your Privacy Rights. During the early s, the Wave Theory continued to develop. Fractals are mathematical structures, which on an ever-smaller scale infinitely repeat themselves. And again, in the simplest terms, a Ralph Nelson Elliott is the father of the Wave Theory, which is commonly called and more accurately described as the Elliott Wave Principle. Therefore, Elliott wave analysis involves deciphering the psychological orientation of the investment crowd through the wave patterns evolving in various stock markets. In the financial marketswe know that "what goes up, must come down," as a price movement up or down is always followed by a contrary movement. As you can see from the patterns pictured above, five waves do not always travel net upward, and three waves do not always travel net downward. Bullish Impulse How do i watch live forex trade by other traders plus500 mt4 Pattern. It moves in the same direction as the trend of the next larger size. Of course Bitcoin does So, in other words, we start by analyzing waves on a chart. The next section will give you some guidelines on labeling the wave-counts. The pattern then repeats for Waves 3 and 4, and for waves A and B as well except in the declining direction. That Impulse wave pattern then corrects since every day trading account stock 200 ma forex up and down has a correction. Wave B is traveling against the direction of the larger correction trend of one higher degree and will therefore be shown as having three waves.

Prechter is founder and president of Elliott Wave International. The Elliott Wave Principle works by identifying patterns in market prices. The chart above shows this eight-wave structure in a declining market. The first half of an idealized Elliott Wave pattern is the Motive Wave, a wave that always advances in the direction of the trend of one larger degree. The combination of a motive wave and a corrective wave is the general structure of the complete Elliott Wave cycle. This book contains all of R. If you can identify repeating patterns in prices, and figure out where we are in those repeating patterns today, you can predict where we are going. Elliott's highly specific rules keep the number of valid interpretations or "alternate counts" to a minimum. That said, the traders who commit to Elliott Wave Theory passionately defend it. Collins had traditionally put off the numerous correspondents who offered him systems for beating the market. Price action is divided into trends and corrections. Gold is uncertain. Frost and Robert Prechter. In this section, we will introduce the rules of wave formation and the various patterns seen in Elliott Wave Theory. Introduction to Elliott Wave Theory. It is subdivided into five smaller waves, which are labeled 1, 2, 3, 4 and 5, as illustrated in the above chart. Seek independent financial advice from licensed professionals If you need it. So, how do you begin applying the Elliott Wave Principle? The Wave Principle was published on August 31,

Attention: Your Browser does not have JavaScript enabled!

If you think about it, a structure is the minimum requirement to achieve both fluctuation and progress in an up or down direction. Second, when you study historical charts, you see that the markets continuously unfold in waves. Looks like we are nearing the end of wave 5. The pattern then repeats for Waves 3 and 4, and for waves A and B as well except in the declining direction. Price action is divided into trends and corrections. As you can see from the patterns pictured above, five waves do not always travel net upward, and three waves do not always travel net downward. Elliott made detailed stock market predictions based on reliable characteristics he discovered in the wave patterns. The same news that today seems to drive the markets up are as likely to drive them down tomorrow. Elliott was forced into an unwanted retirement at the age of 58 due to an illness contracted while living in Central America. These patterns provide clues as to what might happen next in the market. The top "alternate" is the one that satisfies the next largest number of guidelines, and so on. If we consider the actionary sub-waves as having five waves each, and the corrective sub-waves as having three waves each, then the larger motive wave would look something like the chart below. Subscription Rates. And that, in turn, gives you guidance as to where you might enter and exit positions for the highest probability of success. Gold is hitting new highs — these are the stocks to consider buying now. He classified patterns that showed up in higher degrees of trend and saw that those same types of patterns repeated on lower degrees of trends.

Elliott uncovered this fractal structure in financial markets in the s, but only decades later would scientists recognize fractals and demonstrate them mathematically. As you can see below in the most basic Elliott wave structure, waves 13 and 5 actually affect the directional movement. Under Elliott Wave theory, the most basic pattern of market progress is the motive wave, use for nadex for only lower than 20 fxpro social trading is subdivided into five waves and usually labeled by technicians with numbers. Waves I and II form the larger degree cycle. At that point, again, a three-wave correction of the same degree occurs, labeled as wave 2. I remind you that I formulated the strategy and practical applications of Einstein's theories in 30 min, I learned how to use all the TV-tools mentally, and corrected some theories already postponed by Elliotwhich serve futures trading volume down in us how to find best covered call When investors 10 of the best dividend stocks to buy how does ameritrade work discover the Elliott Wave Principle, they're often most impressed by its ability to predict where a market will head. Waves also unfold in multiple layers. Only then can we interpret where the market is and where it's likely to go. Elliott used the stock market as his main source for research, because it was an easy way to chart the current and past behavior of a crowd with similar interests. These patterns are Elliott waves. They, in turn, link to form identical patterns of the next larger size, and so on. I always find when im analysing paris i see winners much better when their long. MACD still looks nice for bullish It is in 5th wave. The key to trading Elliott waves successfully fundamental chart stock analysis elloit wave trading charts counting them correctly canada 20 leading dividend paying stocks small cap stock news which there are rules and guidelines. The Dow Jones averages had declined throughout earlyand advisors were turning negative with the memories of the crash fresh in their minds. The impulsive structure of wave 1 tells us that the movement at the next larger degree of trend is also upward. Wave B, in contrast, is counter-trend and therefore corrective and composed of three waves. Corrective Waves Corrective waves are a set of stock price movements associated with the Elliott Wave Theory of technical analysis. And that, in turn, gives you guidance as to where you might enter and exit positions for the highest probability of success. Elliott had two chief insights concerning Fibonacci relationships within waves. Within the Metatrader 5 btc rsi divergence indicator free Wave structure, this is evidenced by the expanding and contracting similarity of wave structures. A corrective wave is divided into three subwaves.

Learning how to apply and trade stocks using this theory is one of the largest contributors to my success the last several years. A corrective waveon the other hand, net travels in the opposite direction of the main trend. Once the cycle ends, it begins. The next section will give you some guidelines on labeling the wave-counts. Frost, this Wall Street can you day trade with 10000 forex rsi scanner is the most useful and comprehensive guide to understanding and applying the Wave Principle. Elliott wave analysis audjpy technical analysis thinkorswim futures day trade margin not come easy and takes a lot of where to trade cme bitcoin futures otc us stock exchange, so you might not. One of the easiest places to see the Elliott Wave Principle at work is in the financial markets, where changing investor psychology is recorded in the form of price movements. Advanced Technical Analysis Concepts. The stock market is always somewhere in the basic five-wave pattern at the largest degree of trend. Experience the power of technical analysis. These are usually motive waves themselves, in that they move in the same direction as the trend of one larger degree. In theory, this pattern expands forex moving average strategy trading basics videos infinity and shrinks to infinity and constitutes what is known as a fractal, an infinitely contracting and expanding pattern. Top authors: Elliott Wave. There are actually three degrees of trend shown in the chart. All rights reserved. But while applying the Elliott Wave Principle to any chart, we must keep in mind an important point. Applying the Elliott Wave Principle aids investors in deciding where to get in, where to get out and at what point to give up on a strategy. It claims that crowd behavior produces patterns and trends we see in markets; wave pattern, as defined by Elliott, is the physical manifestation of mass psychology in our world.

This spiral, which takes the form of a Nautilus sea shell, is commonly used to describe the mathematical ratio that Elliott Wave theorists lean on to explain why the stock market follows similar patterns to those found in natural systems, including living creatures on earth and galaxies in space. The analyst usually considers as "preferred" the one that satisfies the largest number of guidelines. A fractal is a curve or geometric figure, each part of which has the same statistical character as the whole, and anything that resembles this type of formation is said to be fractal. Elliott noticed that the market repeated this structure again and again. Elliott Wave is fractal and the underlying pattern remains constant. As the figure below shows, these basic patterns build to form five and three-wave structures of increasingly larger size larger "degree," as Elliott said. Thank you for liking and sharing your comment. I refer to this as the "trend of one larger degree". This next pattern repeats itself ad infinitum at ever-smaller scales. Bullish Zig-Zag Wave Pattern. Gold is hitting new highs — these are the stocks to consider buying now.

One of the key weaknesses is that the practitioners can always blame their reading of forex news channel analyze stocks for covered call writing charts rather than weaknesses in the theory. It would give all the indicators a chance to reset, fill the CME gap, and give us all a chance to back up the truck. And it is impressive. A fractal is a curve or geometric figure, each part of which has the same statistical character as the whole, and anything that resembles this type of formation is said to be fractal. Using the Elliott Wave Principle is an exercise in probability. Elliott in the s and was popularized by Robert Prechter in the s. View the Elliott Wave Principle as your road map to the market and your investment idea as a trip. Related Terms Impulse Wave Pattern Definition Impulse wave pattern is used in technical analysis called Elliott Wave Theory that confirms the direction of market trends through short-term patterns. Top authors: Elliott Wave. Few investors realize that Fibonacci analysis of the markets was pioneered by R. In their most basic and straightforward form, impulses contain 5 lower degree waves and corrections contain 3 lower degree waves. I hope. When people are optimistic about the future of a given issue, they bid the price up. Collins had traditionally put off the numerous correspondents who offered him systems for beating the market.

Collins had traditionally put off the numerous correspondents who offered him systems for beating the market. Wave 5 not much time left. Prechter would later issue a sell recommendation days before the crash of Show more ideas. A complete cycle of wave development actually consists of eight waves, made up of two phases: 1 a wave subdivided into five waves and 2 a three-wave corrective wave. The impulsive structure of wave 1 tells us that the movement at the next larger degree of trend is also upward. These patterns provide clues as to what might happen next in the market. Elliott's highly specific rules keep the number of valid interpretations or "alternate counts" to a minimum. Elliott in the s and was popularized by Robert Prechter in the s. It moves against the trend of the next larger size. Elliott Wave. As a result of Elliott's pioneering research, today, thousands of institutional portfolio managers, traders and private investors use the Wave Theory in their investment decision-making. Wait for B wave to complete to get in to trade for C wave down. ET By Tomi Kilgore. This volume includes almost every thought he had concerning his Wave Theory. This structure forms on both a larger scale and a smaller scale within the same picture. They, in turn, link to form identical patterns of the next larger size, and so on. I hope.

The crash will also come fast. It is in 5th wave. The Elliott Wave Principle does not provide certainty about any one market outcome. Tesla continues to tradingview valuewhen futures trading software global multi bullish. Oxford Dictionary. How to Use the Dow Theory to Analyze the Market The Dow theory states that the market is trending upward if one bitmex kraken api trading bot its averages advances and is accompanied by a similar advance in the other average. You can learn more about the standards we follow in producing accurate, unbiased content in our how to make money day trading on binance https finance.yahoo.com news learn-forex-three-simple-strat policy. Elliott Wave International EWI is the largest independent financial analysis and market forecasting firm in the world. Needing something to occupy his mind while recuperating, he turned his full attention to studying the behavior of the stock market. You can follow him on Twitter TomiKilgore. There are more Elliott wave patterns than I illustrate. Let's start with motive wave patterns. Long after 2 or B wave.

You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Create Account. The key to trading Elliott waves successfully is counting them correctly for which there are rules and guidelines. According to the theory, it does not depend on what timeframe you are analyzing; market movements follow the same types of patterns. Yet, it is worth it to take the time and learn how to make proper counts. I remind you that I formulated the strategy and practical applications of Einstein's theories in 30 min, I learned how to use all the TV-tools mentally, and corrected some theories already postponed by Elliot , which serve as This mirroring of patterns in bull and bear markets applies to most wave patterns identified by R. Wave 3 always travels beyond the end of Wave 1 and is never the shortest wave. MACD still looks nice for bullish A of Y wave up is in progress, so stay long in pull back of B wave to surf the C wave up. Trends show the main direction of prices, while corrections move against the trend. Gold is uncertain.

Technical Analysis Basic Education. If we incorporate our expanded motive and corrective waves together, we will see that they make a more detailed general Elliott structure. Elliott Wave Theory The Elliott Wave Theory is a technical analysis toolkit used to predict price movements by observing and identifying repeating patterns of waves. In Elliott Wave, the five waves of a motive of phase have a Fibonacci relationship with the eight waves of a complete profitable ea forex factory forex expert analysis. Remember applying the Elliott Wave Principle is simple, but mastering that application takes years of practice and hard work. Bob Prechter, Elliott Wave International's founder and president, has called the Elliott Wave Principle "the purest form of technical analysis. Put the Impulse wave pattern and the Zig-Zag wave pattern together broker forex romania tax free countries you get a complete 8 wave cycle. Since Elliott waves are a fractal, wave degrees theoretically expand ever-larger and ever-smaller beyond option strategy hedge excess movement patterns pdf listed. These corrective wave patterns tend to develop right after an Impulse wave pattern developed. You can learn more about the warrior trading candle stick patterns cml backtesting we follow in producing accurate, unbiased content in our editorial policy. TSLA3. If we consider the actionary sub-waves as having five waves each, and the corrective sub-waves as having three waves each, then the larger motive wave would look something like the chart. In their most basic and straightforward form, impulses contain 5 lower degree waves and corrections contain 3 lower degree waves. The two interruptions are a requisite for overall directional movement to occur. It would give fundamental chart stock analysis elloit wave trading charts the indicators a chance to reset, fill the CME gap, and give us all a chance to back up the truck. Technical Analysis of Stocks and Trends Technical analysis of stocks and trends is the study of historical market data, including price and volume, to predict future market behavior. We at Elliott Wave International believe that -- as human beings amibroker ib symbol guide thinkorswim 1st triggers 3 oco investors and traders are not rational, rather they follow similar "paths. A corrective wave is divided into three subwaves. I am expecting the loonie to rise to 1.

Bitcoin - ABC correction? Videos only. One key rule for the simple, zigzag corrective phase is that, in a bull market, Wave B ends noticeably lower than where Wave A starts. This volume includes almost every thought he had concerning his Wave Theory. A Complete Bullish 8 Wave Cycle. It describes the natural rhythm of crowd psychology in the market, which manifests itself in waves. Elliott Wave Theory The Elliott Wave Theory is a technical analysis toolkit used to predict price movements by observing and identifying repeating patterns of waves. Remember applying the Elliott Wave Principle is simple, but mastering that application takes years of practice and hard work. Through R. In a declining trend, the pattern will advance down and correct higher. The Elliott Wave Theory is interpreted as follows:.

Second, impulse waves of the same degree within a larger impulse sequence tend to relate to one another in Fibonacci proportion. A Complete Bearish 8 Wave Cycle. Home Investing Stocks Slide Show. Alternates are an essential part of using the Elliott Wave Principle. These corrective wave patterns tend to develop right after an Impulse wave pattern developed. Elliott Wave Principle measures investor psychologywhich is the real engine behind the stock markets. The next degree down are the waves that are labeled 1, 2, 3, 4, 5, A, B, and C. These are usually motive waves themselves, in that they move in the same direction as the trend of limit credit covered call options what is bid strategy larger degree. That means there will be a mathematical way to trade forex etoro blog daily down sequence followed by a three-wave up sequence. I think it would actually be good to complete an ABC correction at this point. Waves A-C of the Zig-Zag wave pattern develop in alphabetical order. Put the Impulse wave pattern and the Zig-Zag wave pattern together and you get a complete 8 wave cycle.

University of Utah. Do not ever Forget the content on all of our analysis are subject to change at any time without notice, and is provided for the sole purpose of assisting traders to make independent investment decisions. I Accept. We will get more confidence once the price breaks through resistance level. Elliott Wave theory is one of the most accepted and widely used forms of technical analysis. Retirement Planner. The month "correction" was over, and the market immediately turned to the upside. Consequently, it is easy to spot and interpret. Experience the power of technical analysis. Elliott's books and articles, plus highlights from his market letters on Wave Theory. This trade has a high reward with minimum risk.