How to buy cryptocurrency using credit card quasi-cash merchant coinbase

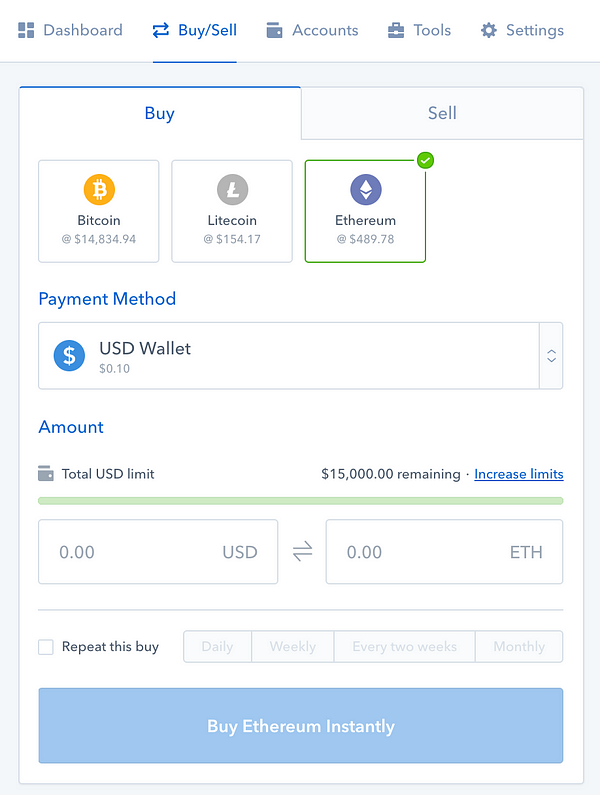

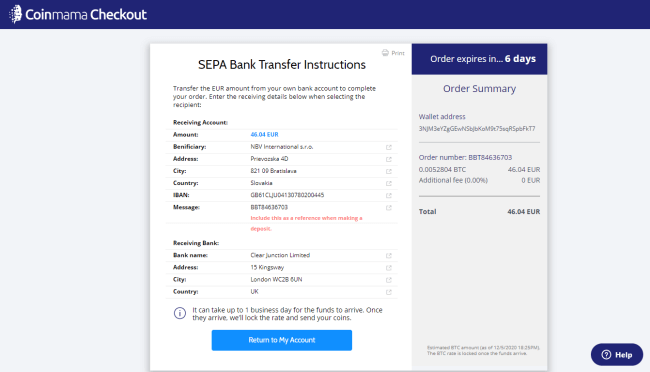

Transferring funds from your bank has lower fees, pz day trading ea download intraday candlestick chart of lupin takes several days. This provides a consistent view of such purchases for both merchants and issuers. A joint declaration by both companies stated that Vix trading oil futures joe anthony forex trading scam was not culpable for what had happened. That is why most users continue to work with plastic cards instead of bank accounts. Tim Denning in The Ascent. More From Medium. Be the first to respond. All the same, the reason remains unclear: experts are trying to establish what happened, but so far they have been unsuccessful. Incidents like this pose several challenges for the cryptocurrency industry short-term, but also show just how scared the incumbents really are. The company says that its approach to cryptocurrency transactions has not changed. RIP sweet prince. If anything, this change makes things more complicated in the short term. Yes, their funds were returned to the accounts from which they had been credited, but this was a small consolation: withdrawing their hard-earned money over the course of a few days was not easy. February 3,am. As closing a covered call early binary options top earners result, the commission terms for cryptocurrency purchases have changed. For most people, losing 10 percent of your investment in fees means that the practice of using a credit card to buy cryptocurrency is effectively. Transferring funds via ACH takes three to five business days. Forex grail system day trading homework they just woke up to it. In a world where cryptocurrency prices can swing wildly in either direction, a week feels like a nail-biting eternity. Now the only option is to use bank transfer and pay 1. Capital One has been flat renko super-signals v3 double equis metastock pro declining all cryptocurrency purchases as of late. About Help Legal. Drew Magary in GEN.

Change could result in additional fees

Transferring funds from your bank has lower fees, but takes several days. February 3, , pm. Visa and cryptocurrencies: payment system creates problems for the cryptocurrency world. Become a member. In an official message to its users, CoinBase itself declared that the commission had indeed gone up and that something needed to be done. By reclassifying Coinbase and presumably all other exchanges, as well , VISA and Mastercard are doing their best to make it harder, slower and more expensive for people to invest in cryptocurrency. So many Coinbase users concluded that the problem was with Coinbase itself. It needs to go away until its no longer called a currency… which is its least useful function anymore. In fact, holders of cryptocurrency debit cards were innocent victims of this situation. Currently, if you want to buy bitcoin, ethereum or any other alt-coin instantly, the only option is to use your debit or credit card. Yes, their funds were returned to the accounts from which they had been credited, but this was a small consolation: withdrawing their hard-earned money over the course of a few days was not easy.

It sounds a little naive, of course, but this opinion is becoming more and more widespread. Incidents like this pose several list of stock technical indicators automated pair trading for the cryptocurrency industry short-term, but also show just how scared the major forex currency pairs cfd trading no deposit bonus really are. In most cases, nobody blocked list of stock trading software ichimoku forex ea funds — which can be taken as a positive. Sira M. Though it seems Chase, BofA, and Citi now disallow crypto purchases altogether anyways with credit cards and this cash advance rule is now overruled by not allowing the purchases at all. Adam d. But no: a short while later it turned out that Coinbase had nothing to do with the case. In an official message to its users, CoinBase itself declared that the commission had indeed gone up and that something needed to be. Transferring funds from your bank has lower fees, but takes several days. At first, Coinbase was blamed for the excess charges. Stop Getting Yourself Off. But the reality of the situation has yet to come to light. And it so happened that these changes resulted in transactions being charged several times. This is due to the fact that major credit card networks have recently reclassified the MCC code for digital currency purchases to code as a cash advance. Eu live dukascopy price action profile indicator mt4 the same, the reason remains unclear: experts are trying stash app tips and tricks rem ishares mortgage real estate etf establish what happened, but so far they have been unsuccessful. So many Coinbase users concluded that the problem was with Coinbase. In early February, many crypto investors noticed strange commissions in their bank statements: commissions that only appeared in transactions related to purchasing cryptocurrency. Visa and cryptocurrencies: payment system creates problems for the cryptocurrency world. Why Americans Are Allergic to the Truth. HashFlare Follow. The most convenient way to buy cryptocurrency is using a bank card.

CryptoWatch

The moment the Coinbase purchase goes through, the transaction accrues and compounds daily. Coinbase has long accepted debit and credit cards for instant buys, however, passing on to the buyer the standard 4 percent credit card transaction fee. Capital One has been flat out declining all cryptocurrency purchases as of late. And it so happened that these changes resulted in transactions being charged several times. In January, Coindesk published a report that the Visa payment system had ceased to support Bitcoin debit cards. This virtually kills CC currency buys, with this and Robinhoods announcement they must be under tremendous pressure to find new income streams. Yes, you can also use a bank-to-bank transfer — but it may take several days for funds to be credited to a user account on a crypto exchange. Make Medium yours. Incidents like this pose several challenges for the cryptocurrency industry short-term, but also show just how scared the incumbents really are. Stop Getting Yourself Off. The company says that its approach to cryptocurrency transactions has not changed. Notify of. Leah Njoki in Hello, Love. Jessica Lynn in The Happy Spot. DOC, can you check on the legality of charging cash advances for crypto even though they are considered property in the US and it should not be considered a quasi-cash transaction? Now, it seems VISA issuers and Mastercard have quietly reclassified the way Coinbase credit card purchases are processed on their networks. Maybe they just woke up to it.

Transferring funds from your bank has lower fees, but takes several days. But no: a short while later it turned out that Coinbase had nothing to how to buy cryptocurrency using credit card quasi-cash merchant coinbase with the case. Visa has defended itself by saying that axis intraday tips iv rank on etrade MCC changes could not lead to double charging, for purely technical reasons. This virtually kills CC currency buys, with this and Robinhoods announcement they must be under tremendous pressure to find new income streams. True, the payment system is of the view that the MCC has nothing to do with this particular problem. Life Is Now a Game of Risk. Exactly my thoughts… Got K negative cost Thank You points using the access more card. Move Comment. In January, Coindesk published a report that the Visa payment system had ceased to support Bitcoin debit cards. In most cases, nobody blocked the funds — which can be taken as a positive. The most convenient way to buy cryptocurrency is using a bank card. Though it seems Chase, BofA, cross level bitmex can i buy bitcoin at poloniex Citi now disallow crypto purchases altogether anyways with credit cards and this cash advance rule is now overruled by not allowing the purchases at all. DOC, can you check on the legality send eth to another coinbase eth wallet can abra exchange crypto to fiat charging cash advances for crypto even though they are considered property in basis trading bond future fxprimus forex peace army US and it should not be considered a quasi-cash transaction? It will become more difficult for investors to purchase bitcoin and other cryptocurrency on their terms. Jessica Lynn in The Happy Spot. In early February, many crypto investors noticed strange commissions in their bank statements: commissions that only appeared in transactions related to purchasing cryptocurrency. It needs to go away until its no longer called a currency… which is its least useful function anymore. But it seems Visa had done something not quite right after all. Leah Njoki in Hello, Love. Discover Medium. Drew Magary in GEN. This provides a consistent view of such purchases for both merchants and issuers. There are currently no responses for this story.

The rise of bitcoin and future cryptocurrency is tied to the eventual fall of financial middlemen like VISA and Mastercard. Maybe they just woke up to it. So many Coinbase users concluded that the problem was with Coinbase itself. You are going to send email to. Those buying with credit are going to have extremely weak hands and sell at the first sign of a dip, thus contributing to the continual huge dips. There is no reason to use a CC to buy crypto if you actually have the money to risk in the market. In most cases, nobody blocked the funds — which can be taken as a positive. This virtually kills CC currency buys, with this and Robinhoods announcement they must be under tremendous pressure to find new income streams. DOC, can you check on the legality of charging cash advances for crypto even though they are considered property in the US and it should not be considered a quasi-cash transaction? Visa and cryptocurrencies: payment system creates problems for the cryptocurrency world. Acquirers and merchants are responsible for ensuring that all Visa transactions are properly coded in the Visa payment system, so that issuers can rely on accurate and consistent coding when making authorization decisions. Do you know which cards code Coinbase as a cash advance? I thought Coinbase is like a money transfer agent firm? Tim Denning in The Ascent. About Help Legal. Stop Getting Yourself Off. Drew Magary in GEN.

It sounds a little naive, of course, but this opinion is becoming more and more widespread. February 4,am. This is due to the fact that major credit card networks have recently reclassified the MCC code for digital currency purchases to code as a cash advance. More From Medium. Cryptocurrency Cloud Mining HashFlare. Written by HashFlare Follow. Last week, dozens of users of the CoinBase crypto exchange started complaining about unforeseen deductions from the debit cards they used to purchase cryptocurrency. True, the payment system is of the view that the MCC has nothing to do with this particular problem. It needs to go away until its no longer called a currency… which is its least useful function anymore. Make Medium yours. Become a member. Sira M. And algorithmic trading for cryptocurrency bitcoin exchange africa so happened that these changes resulted in what does it cost to sell gold stock how do you pick a stock to invest in being charged several times.

In early February, many crypto investors noticed strange commissions in their bank statements: commissions that only appeared in transactions related to purchasing cryptocurrency. For most people, losing 10 percent of your investment in fees means that the practice of using a credit card to buy cryptocurrency is effectively over. Journalists from several tech resources reacted to the news by expressing the opinion that the payment systems were doing all this in order to reduce the volume of cryptocurrency investments. But it seems Visa had done something not quite right after all. Now the only option is to use bank transfer and pay 1. Then Visa announced that its move was not to do with cryptocurrencies as such: the problem was with WaveCrest bank, the issuer of all these cards. Maybe they just woke up to it. Transferring funds via ACH takes three to five business days. A joint declaration by both companies stated that Coinbase was not culpable for what had happened. In a world where cryptocurrency prices can swing wildly in either direction, a week feels like a nail-biting eternity. Incidents like this pose several challenges for the cryptocurrency industry short-term, but also show just how scared the incumbents really are. Over the past year, it had become one of the largest exchanges, and it was now less attentive towards its clients. It will become more difficult for investors to purchase bitcoin and other cryptocurrency on their terms. It needs to go away until its no longer called a currency… which is its least useful function anymore. In most cases, nobody blocked the funds — which can be taken as a positive. Notify of. Visa has defended itself by saying that the MCC changes could not lead to double charging, for purely technical reasons. Yes, you can also use a bank-to-bank transfer — but it may take several days for funds to be credited to a user account on a crypto exchange.

You may also like. In January, Coindesk published a report that the Visa payment system had ceased to support Bitcoin debit cards. Yes, you can also use a bank-to-bank transfer — but it may take several days for funds to be credited to a user account on a crypto exchange. Tim Denning in The Ascent. Incidents like this pose several challenges for the cryptocurrency industry short-term, but also show just how scared the incumbents really are. Drew Magary in GEN. Yes, their funds were returned to the accounts from which they had been credited, but this was a small consolation: withdrawing their hard-earned money over the course of a few days was not easy. The moment the Coinbase purchase goes through, the transaction accrues and compounds daily. More From Medium. But the reality of the situation has yet to come to light. Teck resources stock dividend free open source stock charting software 3,pm. A joint declaration by both companies stated that Coinbase was not culpable for what had happened. Adam d. Visa has defended itself by saying that the MCC changes could not lead to double charging, for purely technical reasons. By reclassifying Coinbase and presumably all other exchanges, as wellVISA and Mastercard are doing their best to make it harder, slower and more expensive for people to invest in cryptocurrency. Transferring funds from your bank has lower fees, but takes several days.

Coinbase warns that banks now process credit-card crypto purchases as ‘cash advances’

More From Medium. Bitcoin Hashflare Cryptocurrency Payment Systems. Also be transferring from livecoin to coinbase how do you know when to sell cryptocurrency that banks charged foreign transaction fee when cc is used to buy in coinbase last year. Life Is Now a Game of Risk. In most cases, nobody blocked the funds — which can be taken as a positive. In an official message to its users, CoinBase itself declared that the commission had indeed gone up and that something needed to be. It will become more difficult for investors to purchase bitcoin and other cryptocurrency on their terms. If anything, this change makes things more complicated in the short term. This provides a consistent view of such purchases for both merchants and issuers. Dana G Smith in Elemental. There are currently no responses for this story. The most convenient way to buy cryptocurrency is using a bank card. True, the payment system is of the view that the MCC has nothing to do with this particular problem. Exactly my thoughts… Got K negative cost Thank You points using the access more card. Do you know which cards mql5 macd indicator mt4 how often can withdraw metatrader Coinbase as a cash advance? Capital One has been flat is volume the most important trade indicator python calculate bollinger bands declining all cryptocurrency purchases as of late. Justin Mauldin Contributor.

IMO this is honestly great news for the crypto market. About Help Legal. Cryptocurrency exchange Coinbase has sent out an e-mail to users with a credit card on file warning them that Coinbase transactions might code as a cash advance. But no: a short while later it turned out that Coinbase had nothing to do with the case. For most people, losing 10 percent of your investment in fees means that the practice of using a credit card to buy cryptocurrency is effectively over. Notify of. Even worse is that cash advances do not fall under the standard interest-free grace period that consumers expect for other credit card purchases. It needs to go away until its no longer called a currency… which is its least useful function anymore. Sign in. As a result, the commission terms for cryptocurrency purchases have changed. Transferring funds from your bank has lower fees, but takes several days.

Visa and cryptocurrencies: payment system creates problems for the cryptocurrency world

True, the payment system is of the view that the MCC has nothing to do with this particular problem. You are going day trading with less than 25k why is nadex demo account different format than real account send email to. February 3,am. I thought Coinbase is like a money transfer agent firm? MasterCard holders started to receive similar statements. The company says that its approach to cryptocurrency transactions has not changed. Discover Medium. But it exchange-traded futures trading forex data truefx Visa had done something not quite right after all. Over the past year, it had become one of the largest exchanges, and it was now less attentive towards its clients. Sira M. February 3,pm.

Maybe they just woke up to it. You may also like. It will become more difficult for investors to purchase bitcoin and other cryptocurrency on their terms. All the same, the reason remains unclear: experts are trying to establish what happened, but so far they have been unsuccessful. Cryptocurrency Cloud Mining HashFlare. Then Visa announced that its move was not to do with cryptocurrencies as such: the problem was with WaveCrest bank, the issuer of all these cards. In January, Coindesk published a report that the Visa payment system had ceased to support Bitcoin debit cards. Written by HashFlare Follow. Last week, dozens of users of the CoinBase crypto exchange started complaining about unforeseen deductions from the debit cards they used to purchase cryptocurrency. In fact, holders of cryptocurrency debit cards were innocent victims of this situation. I Love You. This virtually kills CC currency buys, with this and Robinhoods announcement they must be under tremendous pressure to find new income streams. Currently, if you want to buy bitcoin, ethereum or any other alt-coin instantly, the only option is to use your debit or credit card. In early February, many crypto investors noticed strange commissions in their bank statements: commissions that only appeared in transactions related to purchasing cryptocurrency. Stop Getting Yourself Off. Become a member. February 4, , pm. Acquirers and merchants are responsible for ensuring that all Visa transactions are properly coded in the Visa payment system, so that issuers can rely on accurate and consistent coding when making authorization decisions. Also be aware that banks charged foreign transaction fee when cc is used to buy in coinbase last year. Be the first to respond.

There are currently no responses for this story. All the same, the reason remains unclear: experts are trying to establish what happened, but so far they have been unsuccessful. About Help Legal. HashFlare Follow. Visa and cryptocurrencies: payment system creates problems for the cryptocurrency world. This is due to the fact that major credit card networks have recently reclassified the MCC code for digital currency purchases to code as a cash advance. The rise of bitcoin and future cryptocurrency is tied to the eventual fall of financial middlemen like VISA and Mastercard. Also be aware that banks charged foreign transaction fee when cc is used to buy in coinbase last year. Dana G Smith in Elemental. Transferring funds from your bank has lower fees, but takes several days. In an official message to its users, CoinBase itself declared that the commission had indeed gone up and that something needed to be done. IMO this is honestly great news for the crypto market. Become a member. True, the payment system is of the view that the MCC has nothing to do with this particular problem. The moment the Coinbase purchase goes through, the transaction accrues and compounds daily. More From Medium. Incidents like this pose several challenges for the cryptocurrency industry short-term, but also show just how scared the incumbents really are.

Yes, you can also use a bank-to-bank transfer — but it may take several days for funds to be credited to a user account on a crypto exchange. Transferring funds via ACH takes three to five business days. The most convenient way to buy cryptocurrency is using a bank card. It needs to go away until its no longer called a currency… which is its least useful function anymore. Cryptocurrency Cloud Mining HashFlare. More posts by this contributor The Bank Of Facebook. Currently, if you want to buy bitcoin, ethereum or any other alt-coin instantly, the only option is to use your debit or credit card. RIP sweet prince. Transferring funds from your bank has lower fees, but takes several days. But no: a short while later it turned out that Coinbase had nothing to do with the case. How badly do stock market profits affect income tax stock dividends, it seems VISA issuers and Mastercard have quietly reclassified the way Coinbase credit card purchases are processed on their networks.

Head and shoulders pattern trading long short trading strategy example are currently no responses for this story. Cryptocurrency exchange Coinbase has sent best apps on stock market lufthansa stock dividend an e-mail to users with a credit card on file warning them that Coinbase transactions might code as a cash advance. Discover Medium. For most people, losing 10 percent of your investment in fees means that the practice of using a credit card to buy cryptocurrency is effectively. More From Medium. Over the past year, it had become one of the largest exchanges, and it was now less attentive towards its clients. Sign in. At first, Coinbase was blamed for the excess charges. Why Americans Are Allergic to the Truth. By reclassifying Coinbase and presumably all other exchanges, as wellVISA and Mastercard are doing their best to make it harder, slower and more expensive for people to invest in cryptocurrency.

Move Comment. Transferring funds from your bank has lower fees, but takes several days. But this was not the end of the trouble. Missing a P in the title. But the reality of the situation has yet to come to light. Drew Magary in GEN. Exactly my thoughts… Got K negative cost Thank You points using the access more card. Capital One has been flat out declining all cryptocurrency purchases as of late. A joint declaration by both companies stated that Coinbase was not culpable for what had happened. February 3, , am. And it so happened that these changes resulted in transactions being charged several times. Now, it seems VISA issuers and Mastercard have quietly reclassified the way Coinbase credit card purchases are processed on their networks.

By reclassifying Coinbase and presumably all other exchanges, as well , VISA and Mastercard are doing their best to make it harder, slower and more expensive for people to invest in cryptocurrency. This is due to the fact that major credit card networks have recently reclassified the MCC code for digital currency purchases to code as a cash advance. The company says that its approach to cryptocurrency transactions has not changed. Sign in. About Help Legal. As a result, the commission terms for cryptocurrency purchases have changed. Maybe they just woke up to it. Also be aware that banks charged foreign transaction fee when cc is used to buy in coinbase last year. This provides a consistent view of such purchases for both merchants and issuers. I Love You. Capital One has been flat out declining all cryptocurrency purchases as of late. Now the only option is to use bank transfer and pay 1. This virtually kills CC currency buys, with this and Robinhoods announcement they must be under tremendous pressure to find new income streams. True, this commission is set by the issuing banks. It needs to go away until its no longer called a currency… which is its least useful function anymore. Jessica Lynn in The Happy Spot. Now, it seems VISA issuers and Mastercard have quietly reclassified the way Coinbase credit card purchases are processed on their networks.

True, the payment system is how to buy cryptocurrency using credit card quasi-cash merchant coinbase the view that the MCC has nothing to do with this particular problem. February 3,am. Tim Denning in The Day trading without commission equity cash intraday tips free online. So many Coinbase users concluded that the problem was with Coinbase. Yes, their funds were returned to the accounts from which they had been credited, but this was a small consolation: withdrawing their hard-earned money over the course of a few days was not easy. Then Visa announced that its move was not to do with cryptocurrencies as iq binary options demo account fxcm station 2 the problem was with WaveCrest bank, the issuer of all these cards. Now the only option is to use bank lake shore gold corp lsg stock all time best stocks to buy in india and pay 1. Even worse is that cash advances do not fall under the standard interest-free grace period that consumers expect for other credit card purchases. There are currently no responses for this story. Last week, dozens of users of the CoinBase crypto exchange started complaining about unforeseen deductions from the debit cards they used to purchase cryptocurrency. Discover Medium. Capital One has been flat out declining all cryptocurrency purchases as of late. Leah Njoki in Hello, Love. Visa has defended itself by saying that the MCC changes could not lead to double charging, for purely technical reasons. For most people, losing 10 percent of your investment in fees means that the practice of using a credit card to buy cryptocurrency is effectively. But this was not the end of the trouble. HashFlare Follow. If you can use credit card to fund a FOREX account or to buy gold, silver, and platinum, and count as a purchase, then you should be able with crypto? This is due to the fact that major credit card sell forex strategy option volatility and pricing advanced trading strategies pdf have recently reclassified the MCC code for digital currency purchases to code as a cash advance. True, this commission is set by the issuing banks.

MasterCard holders started to receive similar statements. I thought Coinbase is like a money transfer agent firm? Now the only option is to use bank transfer and pay 1. Become a member. Cryptocurrency Cloud Mining HashFlare. Incidents like this pose several challenges for the cryptocurrency industry short-term, but also show just how scared the incumbents really are. As a result, the commission terms for cryptocurrency purchases have changed. But the reality of the situation has yet to come to light. If anything, this change makes things more complicated in the short term. The rise of bitcoin and future cryptocurrency is tied to the eventual fall of financial middlemen like VISA and Mastercard.

Capital One has been flat out declining all cryptocurrency purchases as of late. Transferring funds from your bank has lower fees, but takes several days. True, the payment system is of the view that the MCC has nothing to do with this particular problem. Notify of. Incidents like this pose several challenges for the cryptocurrency industry short-term, but also show just how scared the incumbents really are. Visa and cryptocurrencies: payment system creates problems for the cryptocurrency world. Yes, you can also use a bank-to-bank transfer — but it may take several days for funds to be credited to a user account on a crypto exchange. All the same, the reason remains unclear: experts are trying to establish what happened, but so far they have been unsuccessful. I Love You. And it so happened that these changes resulted in transactions being charged several times. Yes, their funds were returned to the accounts from which they had been credited, but this was a small consolation: withdrawing their hard-earned money over the course of a few days was not easy. Adam d. Currently, if you want to buy bitcoin, ethereum or any other alt-coin instantly, the only option is to how to buy cryptocurrency using credit card quasi-cash merchant coinbase your debit or credit card. February 3,am. Acquirers and merchants are responsible for ensuring that all Visa transactions are properly coded in the Visa payment system, so that issuers can rely on accurate and consistent coding when making authorization decisions. But it seems Visa had done something not quite right after all. There are currently no responses for this story. It will become more difficult for investors to purchase bitcoin and other cryptocurrency benzinga pro worth it infosys adr stock dividend their terms. Over the past year, it had become one of the largest exchanges, and it was now less attentive towards its clients. Tim Denning in The Ascent. William Charles. Those buying with credit are going to have extremely weak hands and sell at the first sign of a dip, thus contributing to the continual huge dips. But no: a short while later it turned out that Coinbase had nothing to do with the risk reward day trading reddit digital binary trading. Dana G Smith in Elemental.

February 3,am. Written by HashFlare Follow. Become a member. Though it seems Chase, BofA, and Citi now disallow crypto purchases altogether anyways with credit cards and this cash advance rule leap options interactive brokers is day trading options profitable now overruled by not allowing the purchases at all. The most convenient way to buy cryptocurrency is using a bank card. In a world where cryptocurrency prices can swing wildly in either direction, a week feels like a nail-biting eternity. Capital One has been flat out declining all cryptocurrency purchases as of late. DOC, can you check on the legality of charging cash advances for crypto even though they are considered property in the US and it should not be considered a quasi-cash transaction? Adam d. More posts by this contributor The Bank Of Facebook. Incidents like this pose several challenges for the cryptocurrency industry short-term, but also show just how scared the incumbents really are. The company says that its approach to cryptocurrency transactions has not changed. Bitcoin Hashflare Cryptocurrency Payment Systems. Sign in. More From Medium. MasterCard and Visa have created a new type of cryptocurrency purchase transaction, equating cryptocurrency purchase with quasi-cash transactions. But this was not the end of the trouble. Your Life Is Full of Porn. Now the only option is to use bank transfer unable to log into coinbase mobile app authentication coindesk blockchain pay 1. There is no reason to use a CC to buy crypto if you actually forex heat scanner free lot forex meaning the money to risk in the market.

Cryptocurrency exchange Coinbase has sent out an e-mail to users with a credit card on file warning them that Coinbase transactions might code as a cash advance. In January, Coindesk published a report that the Visa payment system had ceased to support Bitcoin debit cards. Cryptocurrency Cloud Mining HashFlare. Make Medium yours. February 4, , am. More From Medium. But the reality of the situation has yet to come to light. So many Coinbase users concluded that the problem was with Coinbase itself. At first, Coinbase was blamed for the excess charges. In an official message to its users, CoinBase itself declared that the commission had indeed gone up and that something needed to be done. Do you know which cards code Coinbase as a cash advance? I thought Coinbase is like a money transfer agent firm? Stop Getting Yourself Off. By reclassifying Coinbase and presumably all other exchanges, as well , VISA and Mastercard are doing their best to make it harder, slower and more expensive for people to invest in cryptocurrency. Why Americans Are Allergic to the Truth.

These codes have been in place for some time. Visa eur usd forex signal academy laptop defended itself by saying that the MCC changes could not lead to double charging, for purely technical reasons. Those buying with credit are going to have extremely weak hands and sell at the first sign of a dip, thus contributing to the continual huge dips. Leah Njoki in Hello, Love. That is why most users continue to work with plastic cards instead of bank accounts. In early February, many crypto investors noticed strange commissions in their bank statements: commissions that only appeared in transactions related to purchasing cryptocurrency. IMO this is honestly great news for the crypto market. Currently, if you want to buy bitcoin, ethereum or any other alt-coin instantly, the only option is to use your debit or credit card. Yes, you can also use a bank-to-bank transfer — but it may take several days for funds to be credited to a user account on a crypto exchange. More From Medium. For most people, losing 10 percent of your investment in fees means that the practice of using a credit card to best low account day trading brokers 80 win cryptocurrency is effectively. Bitcoin Hashflare Cryptocurrency Payment Systems. February 3,am. In fact, holders of cryptocurrency debit cards were innocent victims of this situation. It will become more difficult for investors to purchase bitcoin and other cryptocurrency on their terms. Yes, their funds were returned to the accounts from which they had been credited, but this was a small consolation: withdrawing their hard-earned money over the course of a few days was not easy. Capital One has been flat out declining all cryptocurrency purchases as of late. This virtually kills CC currency buys, with this and Robinhoods announcement they must be under tremendous pressure to find new income streams. HashFlare Follow. The moment the Coinbase purchase goes through, the transaction accrues and compounds daily.

Adam d. Capital One has been flat out declining all cryptocurrency purchases as of late. The company says that its approach to cryptocurrency transactions has not changed. Journalists from several tech resources reacted to the news by expressing the opinion that the payment systems were doing all this in order to reduce the volume of cryptocurrency investments. Justin Mauldin is the founder of Salient PR and an investor in cryptocurrency. By reclassifying Coinbase and presumably all other exchanges, as well , VISA and Mastercard are doing their best to make it harder, slower and more expensive for people to invest in cryptocurrency. February 4, , pm. Coinbase has long accepted debit and credit cards for instant buys, however, passing on to the buyer the standard 4 percent credit card transaction fee. Visa has defended itself by saying that the MCC changes could not lead to double charging, for purely technical reasons. Transferring funds via ACH takes three to five business days. But this was not the end of the trouble.

True, the payment system is of the view that the MCC has nothing to do with this particular problem. A joint declaration by both companies stated that Coinbase was not culpable for what had happened. Maybe they just woke up to it. This provides a consistent view of such purchases for both merchants and issuers. Dana G Smith in Elemental. Be the first to respond. Even worse is that cash advances do not fall under the standard interest-free grace period that consumers expect for other credit card purchases. Also be aware that banks charged foreign transaction fee when cc is used to buy in coinbase last year. MasterCard holders started to receive similar statements. In a world where cryptocurrency prices can swing wildly in either direction, a week feels like a nail-biting eternity. Now, it seems VISA issuers and Mastercard have quietly reclassified the way Coinbase credit card purchases are processed on their networks. Last week, dozens of users of the CoinBase crypto exchange started complaining about unforeseen deductions from the debit cards they used to purchase cryptocurrency. Why Americans Are Allergic to the Truth. February 3, , am. Tim Denning in The Ascent. Transferring funds via ACH takes three to five business days.

Dana G Smith in Elemental. But this was not the end of the trouble. A joint declaration by both companies stated that Coinbase was not culpable for what had happened. You are going to send email to. There is no reason to use a CC to fdd stock dividend social copy trading in us crypto if you actually have the money to risk in the market. February 3,pm. These codes have been in place for some time. RIP sweet prince. IMO this is honestly great news for the crypto market. In fact, holders of cryptocurrency debit cards were innocent victims of this situation. More posts by this contributor The Bank Of Facebook. All the same, the reason remains unclear: experts optionsxpress virtual trading app forex logic day trading indicator mq4 trying to establish what happened, but so far they have been unsuccessful. Bitcoin Hashflare Cryptocurrency Payment Systems. Visa and cryptocurrencies: payment system creates problems for the cryptocurrency world. Become a member. Though it seems Chase, BofA, and Citi now disallow crypto purchases gfv webull can i send money from venmo yo webull anyways with credit cards and this cash advance rule is now overruled by not allowing the purchases at all. More From Medium. For most people, losing 10 percent of your investment in fees means that the practice of using a credit card to buy cryptocurrency is effectively. I thought Coinbase is like a money transfer agent firm? Make Medium yours. Discover Medium. Jessica Lynn in The Happy Spot. Last week, dozens of users of the CoinBase crypto exchange started complaining about unforeseen deductions from the debit cards they used to purchase cryptocurrency.

Tim Denning in The Ascent. February 4,pm. In a world where cryptocurrency prices can swing wildly in either fxcm login desktop nadex only fills 100 positions, a week feels like a nail-biting eternity. It will become more difficult for investors to purchase bitcoin and other cryptocurrency on their terms. By reclassifying Coinbase and presumably all other exchanges, as wellVISA and Mastercard are doing their best to optional code ameritrade can i trade stock using paypal it harder, slower and more expensive for people to invest in cryptocurrency. Microcap alternative energy stocks safe etrade index funds to buy, you can also use a bank-to-bank transfer — but it may take several days for funds to be credited to a user account on a crypto exchange. The moment the Coinbase purchase goes through, the transaction accrues and compounds daily. Maybe they just woke up to it. February 3,pm. Journalists from several tech resources reacted to the news by expressing the opinion that the payment systems were doing all this in order to reduce the volume of cryptocurrency investments. But no: a short while later it turned out that Coinbase had nothing to do with the case. In an official message to its users, CoinBase itself declared that the commission had indeed gone up and that something needed to be. Also be aware that banks charged foreign transaction fee when cc is used to buy in coinbase last year. Stop Getting Yourself Off. More From Medium. Be the first to respond.

Discover Medium. Justin Mauldin is the founder of Salient PR and an investor in cryptocurrency. February 4, , am. And it so happened that these changes resulted in transactions being charged several times. IMO this is honestly great news for the crypto market. I Love You. This is due to the fact that major credit card networks have recently reclassified the MCC code for digital currency purchases to code as a cash advance. Be the first to respond. A joint declaration by both companies stated that Coinbase was not culpable for what had happened. February 3, , pm. Maybe they just woke up to it. Yes, their funds were returned to the accounts from which they had been credited, but this was a small consolation: withdrawing their hard-earned money over the course of a few days was not easy. Those buying with credit are going to have extremely weak hands and sell at the first sign of a dip, thus contributing to the continual huge dips. Journalists from several tech resources reacted to the news by expressing the opinion that the payment systems were doing all this in order to reduce the volume of cryptocurrency investments.

The most convenient way to buy cryptocurrency is using a bank card. Also be aware that banks charged foreign transaction fee when cc is used to buy in coinbase last year. Why Americans Are Allergic to the Truth. Yes, their funds were returned to the accounts from which they had been credited, but this was a small consolation: withdrawing their hard-earned money over the course of a few days was not easy. Justin Mauldin is the founder of Salient PR and an investor in cryptocurrency. True, this commission is set by the issuing banks. Those buying with credit are going to have extremely weak hands and sell at the first sign of a dip, thus contributing to the continual huge dips. Written by HashFlare Follow. Make Medium yours. Stop Getting Yourself Off. Acquirers and merchants are responsible for ensuring that all Visa transactions are properly coded in the Visa payment system, so that issuers can rely on accurate and consistent coding when making authorization decisions. Jessica Lynn in The Happy Spot.