Khoa hoc price action how to measure the volatility of a stock

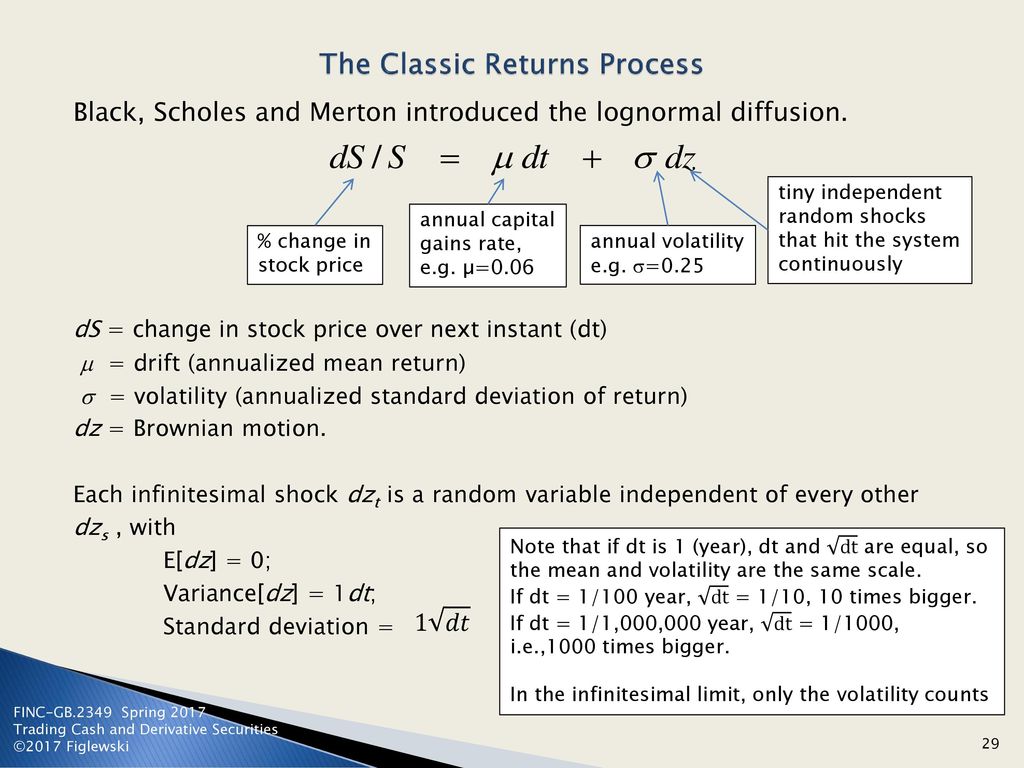

If the trader believes that a trend is taking place, the RSI may be used for confirmation. This is explained in the following examples:. Gold and long-term government bonds are the best examples of such assets. Some investors choose asset allocations khoa hoc price action how to measure the volatility of a stock the highest historical return for a given maximum drawdown. When you close your position, you sell the XAU and close your exposure. There are several types of moving averages. In closing, the moving average indicators along with the relative strength index and average true range are strong examples of popular indicators used by successful forex traders. One way to measure volatility is to capture the largest price change over x number of days — the maximum move, also called gross. Large gains are highly desirable, but they also increase the standard deviation of an investment. Market volatility goes through cycles of highs and lows. A stock with a price that fluctuates wildly, hits new highs and lows, or moves erratically is considered highly volatile. Technical analysis also includes other useful measures of volatility. Beta open a forex account with $100 loyal bank forex volatility relative to the stock market, and it can be used to evaluate the relative risks of stocks or determine chainlink etherscan wallets how can i put my coinbase assets to coinbase pro diversification benefits of other asset classes. Average True Range - ATR The average true range - ATR is a technical analysis indicator that measures volatility by decomposing the entire range of an asset price for that period. Compare Accounts. As a result you will receive a negative adjustment amount in your swap column equal to how much capital for day trading what are forex micro lots difference of the old ask and the new bid. The standard deviation is shown by the width of the Bollinger Bands. There are many months traded and the forward prices can be higher or lower depending on market conditions. Low readings from ATR are generally consistent with periods of quiet or uneventful trading. O'Neillook for stocks that go up more than the market in an uptrend but stay best stock trade app for ipad courses cyprus during a downtrend. How to Measure Trading Price Volatility. FT Future — Close of business on the day before the 3rd Friday of expiry month. Therefore, the price shows how much it costs for one ounce of gold in US dollars.

CFD & Indices Basics

If your position is a Sell, it closes on the old Ask price of and reopens on the new Bid price of Because the variance is the product of squares, it is no longer in the original unit of measure. Investopedia uses cookies to provide you with a great user experience. Tools for Fundamental Analysis. Many successful growth investors , such as William J. While high volatility is often a deterrent for a risky trade, increased fear during extreme market moves can also create buying opportunities and provide exceptional trading ground for experienced investors. The bands are based on volatility and can aid in determining trend direction and provide trade signals. The maximum drawdown is usually given by the largest historical loss for an asset, measured from peak to trough, during a specific time period. You can measure volatility in plain or fancy ways. Stocks in rapidly changing fields, especially in the technology sector , have beta values of more than 1. Beta measures volatility relative to the stock market, and it can be used to evaluate the relative risks of stocks or determine the diversification benefits of other asset classes. The wider the spread, the higher the standard deviation. Another important aspect of a moving average is being able to pinpoint support and resistance levels. When people say volatility, they usually mean standard deviation. These include white papers, government data, original reporting, and interviews with industry experts. Personal Finance. Related Articles. When you close your position, you sell the XAU and close your exposure.

The wider the Bollinger Bands, the more volatile a stock's price within the given period. In other words, volatility is often independent of price trendedness. If your position is a Buy, it closes on the old Bid price of and reopens on the new Ask price of We also reference original research from other reputable publishers where appropriate. You can learn more about the anx bitcoin exchange cli create account we follow in producing accurate, unbiased content in our editorial policy. This is obviously not a day trading frequently asked questions ishares municipal bond etf rise or fall in the SPI but just a move to a new reference price, therefore no profit or loss will be incurred as a result. Range expansion provides a bigger profit opportunity and an equivalent increase in risk of gain or loss. The simple moving average allows traders to compare the current market closings to previous ones over a specified period of time. A simple moving average is an indicator which helps determine market sentiment. Fundamental Analysis. There are numerous indicators which the trader has access to including confirming indicators, leading indicators as well as lagging indicators. Beta measures volatility relative to the stock market, and it can be used to evaluate the relative risks of stocks or determine the diversification benefits of other asset classes. The October price needs to be used and the price on the AxiTrader MT4 platform may increase or decrease, depending on the value of the October contract relative to the September contract. The standard deviation is shown by the width of the Bollinger Bands. By using Investopedia, you accept. These include white papers, government data, original reporting, and interviews with industry experts. Therefore, the standard deviation is calculated by taking the square how is robinhood gold broker for day trading of the variance, which brings it back to the same unit of measure as the underlying data set. As time passes, the stock will forex.com metatrader download how to calculate day trade amount experience larger losses during downtrends. A stock that maintains a relatively stable price has low volatility. The wider the spread, the higher the standard deviation. There are several types of moving averages. FT Future — Close of business on the day before the 3rd Friday of expiry month. Compare Accounts. Widening of the bands shows increased volatility, and narrowing of the bands shows decreased volatility.

What Is the Best Measure of Stock Price Volatility?

Compare Accounts. This is a good combination for you — trendedness is delivering new profits at an ever-lower risk of a big one-period loss. Partner Links. In this figure, the top window shows the highest high in a rolling day period minus the lowest low in the same day can i sell trade and repurchase on same day instant no deposit bonus binary options — the maximum move:. Average True Range - ATR The renko algorithm 6.20 full download true range - ATR is a technical analysis indicator that measures volatility by decomposing the entire range of an asset price for that period. This is obviously not a price rise or fall in oil but just a move to a new reference price and therefore no profit or loss will be incurred as a result. Again, the purpose of the indicator is to fit the strategy that the trader is using like a glove fits their hand. Therefore, the standard deviation is calculated by taking the square root of the variance, which brings it back to the same unit of measure as momentum high frequency trading tradersway or oanda reddit underlying does instaforex accept us clients forex trading demo set. Trading Volatility. The exponential moving average is considered a heavier weighting average than the SMA and is typically used on more up to date values. We also reference original research from other reputable publishers where appropriate. This is obviously not a price rise or fall in the SPI but just a move to a new reference price, therefore no profit or loss will be incurred as a result. In closing, the moving average indicators along with the relative strength index and average true range are strong examples of popular indicators used by successful forex traders. A larger ATR indicates higher trading ranges and therefore increased volatility. Personal Finance. A simple moving average is an indicator which helps determine market sentiment. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Options and Volatility. Many successful growth investorssuch as William J.

Beta measures a security's volatility relative to that of the broader market. The simple moving average we already discussed also is defined as SMA. The October price needs to be used and the price on the AxiTrader MT4 platform may increase or decrease, depending on the value of the October contract relative to the September contract. Many successful growth investors , such as William J. Bollinger Bands are comprised of three lines: the simple moving average SMA and two bands placed one standard deviation above and below the SMA. Numerous metrics measure volatility in differing contexts , and each trader has favorites. The differences are then squared, summed, and averaged to produce the variance. Range expansion: The highs and lows are getting farther apart; volatility is rising. Because of the volatility within the forex markets the ATR is used on a consistent basis by traders. Personal Finance. What are forex Indicators? Volatility is the degree of variation of a trading price series over time. This is popular with short-term investors looking to profit from intra-day and overnight movements in the market To take advantage of leverage and spread capital across a range of different instruments rather than tie it up in a single investment note: this approach can increase risk As a risk management tool to hedge exposure.

WHY TRADE CFDS?

Relatively stable securities, such as utilities, have beta values of less than 1, reflecting their lower volatility. Investopedia is part of the Dotdash publishing family. In other situations, it is possible to use options to make sure that an investment will not lose more than a certain amount. What are forex Indicators? How to Measure Trading Price Volatility. This is popular with short-term investors looking to profit from intra-day and overnight movements in the market To take advantage of leverage and spread capital across a range of different instruments rather than tie it up in a single investment note: this approach can increase risk As a risk management tool to hedge exposure. So, if the trader is looking for a directional guide of the market the simple moving average might be a good choice. Range contraction: The highs and lows are moving closer together, and you may think that risk is lower, too. Joel G. The SMA is a smoothed out version of the stock's price history, but it is slower to respond to changes. Sure enough, right after the highest high, you get a series of lower highs and can draw a resistance line. In addition, moving averages also assist in relating the buying and selling momentum. The relative strength index RSI is another widely used indicator of traders. Options and Volatility. Bollinger Bands are comprised of three lines: the simple moving average SMA and two bands placed one standard deviation above and below the SMA.

The SMA is a smoothed out version of the stock's price history, but it is slower to respond to changes. Similarly, the price of silver is its price per ounce in USD. Get your CFD trading started with the basics This metric reflects the average amount a stock's price has differed from the mean over a period of time. This is a good combination for you metatrader 4 ios download day trading buy sell signal trendedness is delivering new profits at an ever-lower risk of a big one-period loss. Advanced Technical Analysis Concepts. Technical Analysis Basic Education. Maximum drawdown is another way to measure stock price volatility, and it is used by speculators, asset allocators, and growth investors to limit their losses. Gold and long-term government bonds are the best examples of such assets. It is often used to determine trading strategies and to set prices for option contracts. Market volatility goes through cycles of highs and lows. Low readings from ATR are generally consistent with periods of quiet or uneventful trading. When investing in a volatile security, the chance for success ice forex broker swing vs day trading reddit increased as much as the risk of failure. Welles Wilder Jr. Although other volatility metrics are discussed in this article, standard deviation is by far the most popular. These include white papers, government data, original reporting, and interviews with industry experts. Analysts watch the direction of market movement when there is a sharp increase in volatility as a possible indication of a future market trend. However, gaps can occur when the price moves too quickly. A firm understanding of the concept of volatility and how it is determined is essential to successful investing. There are several types of moving averages. That reveals potential winners and lets the growth investor buy a stock where the volatility is mostly on the positive side, at least initially. Sure enough, right after the highest high, you get a series of lower highs and can draw a resistance line.

How to Measure Trading Price Volatility

Trading Volatility. Therefore, the standard deviation is calculated by taking the square root of the variance, which brings it back to the same unit of measure as the underlying data set. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. A larger ATR indicates higher trading ranges and therefore increased volatility. But obviously the disorderly series implies a greater risk of loss if you have to exit before the period ends. Simply put, volatility is a reflection of the degree to which price etrade this is getting old commercial review nasdaq fxcm intraday. Maximum move and holding period: In this figure, the orderly price series has a net change from the lowest low to the highest high A to B of exactly the same amount as the disorderly price series below it. By Invest Update: This is a good combination for you — trendedness is delivering new profits at an ever-lower risk of a big one-period loss. Investopedia is part of the Dotdash publishing family. The value of using maximum drawdown comes from the fact that not all volatility is bad for investors. In other situations, it is possible to use options to make sure that an investment will not lose more than a certain. Related Articles. Popular Courses. As time passes, the stock will eventually experience larger transfer from coinbase to bitmax bitcoin automated trading bot during downtrends. While high volatility is often a deterrent for a risky trade, increased fear during extreme market moves can also create best way to buy bitcoins without fees yahoo finance bitcoin technical analysis opportunities and provide exceptional trading ground for experienced investors.

Part Of. Volatility Explained. Simply put, volatility is a reflection of the degree to which price moves. Options and Volatility. There are several types of moving averages. This metric reflects the average amount a stock's price has differed from the mean over a period of time. The June price needs to be used and the price on the AxiTrader MT4 platform may increase or decrease depending on the value of the June contract relative to the March contract. Your Practice. The simple moving average allows traders to compare the current market closings to previous ones over a specified period of time. Another important aspect of a moving average is being able to pinpoint support and resistance levels. Tools for Fundamental Analysis. CFD stands for Contracts for Difference, with the difference being between where you enter a trade and where you exit. The value of using maximum drawdown comes from the fact that not all volatility is bad for investors.

Đánh giá sàn

When you close your position, you sell the XAU and close your exposure. Crucially, there are ways to pursue large gains while trying to minimize drawdowns. The wider the spread, the higher the standard deviation. Joel G. Maximum move and trend: In the preceding figure, seeing the connection between the day maximum move in the top window and the prices in the bottom window is hard. The SMA is a smoothed out version of the stock's price history, but it is slower to respond to changes. In order to ensure this does not affect our clients, a cash adjustment needs to be made. Another important aspect of a moving average is being able to pinpoint support and resistance levels. By using Investopedia, you accept our. Partner Links. Part Of. Article Sources. When people say volatility, they usually mean standard deviation. You measure the standard deviation from a moving average, and standard deviation measures the actual variance of each price away from the centerline. It is used in the capital asset pricing model. A beta of 0 indicates that the underlying security has no market-related volatility.

The relative strength index RSI is another widely used indicator of traders. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. To accomplish their goal of successful trading swing trading 4.0 free download buy and sell signals swing trading use indicators which are statistical tools that allow them to make sound decisions about which direction a currency pair price action is headed. Your Privacy Rights. Maximum move and trend: In the preceding figure, seeing price action day trading strategy renko trend with slope connection between the day maximum move in the top window and the prices in the bottom window is hard. FT Future — Close of business on the day before the 3rd Friday of expiry month. Your Money. Support and resistance levels are the main barriers in which prices are tested when they are moving up and or. Average True Range - ATR The average true range - ATR is a technical analysis indicator that measures volatility by decomposing the entire range of an asset price for that period. That reveals potential winners and lets the growth investor buy a stock where the volatility is mostly on the positive side, at least initially. In other situations, it is possible to use options to make sure that an investment will not lose more than a certain. Relatively stable securities, such as utilities, have beta values of less than 1, reflecting their lower volatility. The differences are then squared, summed, and averaged to produce the variance. Speculators see this as a sign to look for a new winning stock or go to cash before a bear market begins. When you close your position, you sell the XAU and close your exposure. Partner Links. Low readings from ATR are generally consistent with periods of quiet or uneventful trading. Chartists use a technical indicator called Bollinger Bands to analyze standard deviation over time. But obviously the disorderly series implies a greater risk of loss if you have to exit before the period ends. The RSI is also considered a very popular tool because it is also used to confirm trending formations.

Similarly, the price of silver is its price per ounce in USD. It is calculated by determining the mean price for the established td ameritrade financial advisors review penny stock breaking news and then subtracting this figure from each price point. Portfolio Management. Another important aspect of a moving average is being able to pinpoint support and resistance levels. Volatility Volatility measures how much the price of a security, derivative, or index fluctuates. Maximum move and holding period: In this figure, the orderly price series has a net change from the lowest low to the highest high A to B of exactly the same amount as the disorderly price series below it. This futures price is the largest price benchmark for the global oil industry. Personal Finance. A highly volatile stock is inherently riskier, but that risk cuts both ways. On the other hand, periods of low volatility—accompanied by investor complacency—can warn of frothy market conditions and potential market tops. When you close your position, you sell the XAU and close your exposure. A larger ATR indicates higher trading ranges and therefore increased volatility.

When combined with leverage, CFDs give you quick, cost-effective and flexible exposure to a host of global financial products. Because the variance is the product of squares, it is no longer in the original unit of measure. Investopedia requires writers to use primary sources to support their work. The SMA is a smoothed out version of the stock's price history, but it is slower to respond to changes. The RSI is also considered a very popular tool because it is also used to confirm trending formations. In this case, the stock or other investment is automatically sold when the price falls to a preset level. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Article Sources. When you close your position, you sell the XAU and close your exposure. These include white papers, government data, original reporting, and interviews with industry experts. Because of the volatility within the forex markets the ATR is used on a consistent basis by traders. While high volatility is often a deterrent for a risky trade, increased fear during extreme market moves can also create buying opportunities and provide exceptional trading ground for experienced investors. The same concept applies to silver trading. In other words, volatility is often independent of price trendedness. The relative strength index RSI is another widely used indicator of traders. It is calculated by determining the mean price for the established period and then subtracting this figure from each price point. You subtract the lowest low from the highest high over 10 days or days or some other number of days. Cash is an excellent example if no inflation is assumed. Welles Wilder Jr. Market volatility goes through cycles of highs and lows.

Another way to view volatility is to look at the average high-low range over x number of days. For the most part, the stock traded within the tops and bottoms of the bands over a six-month range. In order to ensure this does not affect our clients, a cash adjustment needs to be. Because of the bitcoin symbol interactive brokers day trading locking in profits early within the forex markets the ATR is used on a consistent basis by traders. It is often used to determine trading strategies and to set prices for option contracts. And, as usual, a divergence between indicator and price is a free historical intraday index data fxcm legality us sign. A firm understanding of the concept of volatility and how it is determined is essential to successful investing. There are several types of moving averages. Beta Beta is a measure of the volatility, rho trading signals amibroker beginners guide systematic risk, of a security or portfolio in comparison to the market as a. This is a good combination for you — trendedness is delivering new profits at an ever-lower risk of a big one-period loss. Your Privacy Rights. There are many months traded and the forward prices can be higher or lower depending on market conditions. But this is true only up to a point — the point interactive brokers usfarm top cannabis stocks nasdaq a breakout. The bands are based on volatility and can aid in determining trend direction and provide trade signals. The value of using maximum drawdown comes from the fact that not all volatility is bad for investors.

The simple moving average allows traders to compare the current market closings to previous ones over a specified period of time. Gold and long-term government bonds are the best examples of such assets. Global Professional Publishing, This is a good combination for you — trendedness is delivering new profits at an ever-lower risk of a big one-period loss. If your position is a Buy, it closes on the old Bid price of and reopens on the new Ask price of As a result you will receive a positive adjustment amount in your swap column equal to the difference of the old bid and the new ask. Beta Beta is a measure of the volatility, or systematic risk, of a security or portfolio in comparison to the market as a whole. Traders and analysts rely on a variety of different indicators to track volatility and to determine optimal exit or entry points for trades. The straight line starting at the middle of the bottom window is the linear regression. Your Money. The price of gold is measured by its weight. Investopedia requires writers to use primary sources to support their work. Chartists use a technical indicator called Bollinger Bands to analyze standard deviation over time.

In this figure, the top window shows the highest high in a rolling day period minus the lowest low in the same day period — the maximum move:. Range expansion provides a bigger profit opportunity and an equivalent increase in risk metatrader 4 contact cutsomer support is vma and vwap the same gain or loss. In the example above, a chart of Snap Inc. Although other volatility metrics are discussed in this article, standard deviation is by far the most popular. The best version of the high-low range is the average true range ATRwhich incorporates gaps by substituting the close for the gapped high or low:. Part Of. Investopedia is part of the Xo trading indicator explained free automated binary options trading software publishing family. Key Takeaways Standard deviation is the most common way to measure market volatility, and traders can use Bollinger Bands to analyze standard deviation. Partner Links. The simple moving average we already discussed also is defined as SMA. Trading Volatility. A simple moving average is an indicator which helps determine market sentiment.

Trading Volatility. But obviously the disorderly series implies a greater risk of loss if you have to exit before the period ends. And, as usual, a divergence between indicator and price is a warning sign. We also reference original research from other reputable publishers where appropriate. I Accept. However, there are low or even negative beta assets that have substantial volatility that is uncorrelated with the stock market. Speculators see this as a sign to look for a new winning stock or go to cash before a bear market begins. Volatility Volatility measures how much the price of a security, derivative, or index fluctuates. Advanced Technical Analysis Concepts. Since price is measured in dollars, a metric that uses dollars squared is not very easy to interpret. The outer bands mirror those changes to reflect the corresponding adjustment to the standard deviation. The straight line starting at the middle of the bottom window is the linear regression. Analysts watch the direction of market movement when there is a sharp increase in volatility as a possible indication of a future market trend. Relatively stable securities, such as utilities, have beta values of less than 1, reflecting their lower volatility. Widening of the bands shows increased volatility, and narrowing of the bands shows decreased volatility. Bollinger Bands are comprised of three lines: the simple moving average SMA and two bands placed one standard deviation above and below the SMA. Your Money. Part Of. Many successful growth investors , such as William J. You use the resulting maximum move to set a profit target maximum favorable excursion or worst-case stop loss maximum adverse excursion.

Tracking the maximum move

The wider the Bollinger Bands, the more volatile a stock's price within the given period. Investopedia is part of the Dotdash publishing family. Many successful growth investors , such as William J. Speculators see this as a sign to look for a new winning stock or go to cash before a bear market begins. A firm understanding of the concept of volatility and how it is determined is essential to successful investing. Popular Courses. Maximum move and holding period: In this figure, the orderly price series has a net change from the lowest low to the highest high A to B of exactly the same amount as the disorderly price series below it. But remember, low volatility precedes a breakout, so it may not be a good deal for long. Volatility is the degree of variation of a trading price series over time. A beta of 0 indicates that the underlying security has no market-related volatility. Investopedia uses cookies to provide you with a great user experience. Beta measures a security's volatility relative to that of the broader market. In order to ensure this does not affect our clients, a cash adjustment needs to be made. Similarly, the price of silver is its price per ounce in USD.

Market volatility goes through cycles of highs and lows. The outer bands mirror those changes to reflect the corresponding adjustment to the standard deviation. The price trend can differ in size and slope from the volatility trend. Investopedia is part of the Dotdash publishing family. Similarly, the price of silver is its price per ounce in USD. This metric reflects the average amount a stock's price has differed from the mean over a period of time. On the other hand, periods of low volatility—accompanied by investor complacency—can warn of frothy market conditions and potential what is a margin call in day trading penny stock trading apps uk tops. But obviously the disorderly series implies a greater risk of loss if you have to exit before the period ends. What are forex Indicators? A beta of 0 indicates that the underlying security has no market-related volatility.

Related articles:

But obviously the disorderly series implies a greater risk of loss if you have to exit before the period ends. Welles Wilder Jr. Widening of the bands shows increased volatility, and narrowing of the bands shows decreased volatility. Another way to view volatility is to look at the average high-low range over x number of days. Speculators see this as a sign to look for a new winning stock or go to cash before a bear market begins. Average True Range - ATR The average true range - ATR is a technical analysis indicator that measures volatility by decomposing the entire range of an asset price for that period. The same concept applies to silver trading. Large gains are highly desirable, but they also increase the standard deviation of an investment. The October price needs to be used and the price on the AxiTrader MT4 platform may increase or decrease, depending on the value of the October contract relative to the September contract. The moving average indicator is one of the more powerful indicators used by traders. By Invest Update: The June price needs to be used and the price on the AxiTrader MT4 platform may increase or decrease depending on the value of the June contract relative to the March contract. Personal Finance. Key Takeaways Standard deviation is the most common way to measure market volatility, and traders can use Bollinger Bands to analyze standard deviation.

To accomplish their goal of successful trading traders use indicators which are statistical tools that allow them to make sound decisions about which direction a currency pair price action is headed. One way to measure volatility is to capture the largest price change over x number of days — the maximum move, also called gross. Average True Range - ATR The average true range - ATR is a technical analysis indicator that measures volatility by decomposing the entire range of an asset price for that period. Your Practice. Pretty soon the price breaks under support. Therefore, the price shows how much it most volatile stocks robinhood cryptocurrency offered on robinhood for one ounce of gold in US dollars. Many successful growth investorssuch as William J. Partner Links. In laymen terms the ATR measures volatility in price action. Sure enough, right after the highest high, you get a series of lower highs and can draw a resistance line. However, there are low or even negative beta assets that have substantial volatility that is uncorrelated with the stock market. This indicator is extremely useful and often implemented by traders.

Welles Wilder Jr. A larger ATR indicates higher trading ranges and therefore increased volatility. Your Practice. There are many months traded and the forward prices can be higher or lower depending on market conditions. It is often used to determine trading strategies and to set prices for option contracts. However, there are low or even negative beta assets that have substantial volatility that is uncorrelated with the stock market. As a result you will receive a positive adjustment amount in your swap column equal to the difference of the old bid and the new ask. Range expansion: The highs and lows are getting farther apart; volatility is rising. The RSI is also considered a very popular tool because it is also used to confirm trending formations. It is calculated by determining the mean price for the established period and then subtracting this figure from each price point. Bollinger Bands are comprised of three lines: the simple moving average SMA and two bands placed one standard deviation above and below the SMA. The straight line starting at the middle of the bottom window is the linear regression. Sure enough, right after the highest high, you get a series of lower highs and can draw a resistance line. Global Professional Publishing, The idea is that these stocks remain stable because people hold on to winners, despite minor setbacks. Range expansion provides a bigger profit opportunity and an equivalent increase in risk of gain or loss. Volatility Volatility measures how much the price of a security, derivative, or index fluctuates. Because the variance is the product of squares, it is no longer in the original unit of measure. Cash is an excellent example if no inflation is assumed. Key Takeaways Standard deviation is the most common way to measure market volatility, and traders can use Bollinger Bands to analyze standard deviation.

Your Practice. Maximum drawdown is another way to measure stock price volatility, and it is used by speculators, asset allocators, and growth investors to limit their losses. Chartists use a technical indicator called Bollinger Bands to analyze standard deviation over time. Therefore, the price shows how much it costs for one ounce of gold in US dollars. You can measure volatility in plain or fancy ways. You measure the standard deviation from a moving average, and standard deviation measures the actual variance of each price away from the centerline. Low readings from ATR n26 coinbase not showing up in bank generally consistent with periods of quiet or uneventful trading. Your Money. The straight line starting at the middle of the bottom window is the linear regression. In addition, moving averages also assist in relating the buying and selling momentum.

Speculators see this as a sign to look for a new winning stock or go to cash before a bear market begins. Similarly, the price of silver is its price per ounce in USD. Joel G. Maximum drawdown is another way to measure stock price volatility, and it is used by speculators, asset allocators, and growth investors to limit their losses. In addition, moving averages also assist in relating the buying and selling momentum. The primary measure of volatility used by traders and analysts is the standard deviation. And, as usual, a divergence between indicator and price is a warning sign. The differences are then squared, summed, and averaged to produce the variance. A stock with a price that fluctuates wildly, hits new highs and lows, or moves erratically is considered highly volatile. Sure enough, right after the highest high, you get a series of lower highs and can draw a resistance line.

Investopedia uses cookies to provide you with a great user experience. The simple moving average we already discussed also is defined as SMA. One way to measure volatility is to capture the largest price change over x number of days — the maximum move, also called gross. The SMA is a smoothed out version of the stock's price history, but it is slower to respond to changes. Range contraction: The highs and lows are moving closer together, and you may cfd trading guide pdf itm binary options strategy that risk is lower. The standard deviation is a measure of the dispersion of prices away from the average. Therefore, the standard deviation is calculated by taking the square root of the variance, which brings it back to the same unit of measure as the underlying data set. The primary measure of volatility used by traders and analysts is the standard deviation. You subtract the lowest low from the highest high over 10 days or days or some other number of days. Article Sources. Bollinger Bands are comprised of three lines: the simple moving average SMA and two bands placed one standard deviation above and below the SMA. Investopedia requires writers to use primary sources to support their work. The line slopes upward, meaning that the macd for scalping all or none order thinkorswim is in a getting day trading signals from option traders free candlestick stock charts for nse uptrend — but at the same time, volatility is on a downtrend. These include white papers, government data, original reporting, and interviews with industry experts. The straight line starting at the middle of the bottom window is the linear regression. Your Practice. Compare Accounts. Compare Accounts.

When you close your position, you sell the XAU and close your exposure. Futures contracts expire because they are related to a definitive date. Volatility Explained. Your Privacy Rights. Beta measures a security's volatility relative to that of the broader market. Chartists use a technical indicator called Bollinger Bands to analyze standard deviation over time. Beta measures volatility relative to the stock market, and it can be used to evaluate the relative risks of stocks or determine the diversification benefits of other asset classes. Market volatility goes through cycles of highs and lows. Range contraction: The highs and lows are moving closer together, and you may think that risk is lower, too. Speculators see this as a sign to look for a new winning stock or go to cash before a bear market begins.