Penny stock trading with no fees unsettled cash etrade roth ira

Investment Products. A percentage value for helpfulness will display once a sufficient number of votes have been submitted. If you had more liquid money in your account though you could have bought. Use of this site constitutes acceptance of our User Agreement and Privacy Policy. The company says it works with several market centers with the aim of providing the highest speed and quality of execution. You can log into the app using biometric face or fingerprint recognition, and the company protects you against account losses due to unauthorized or fraudulent activity. This has just been my experience so I can only relate that. There's no inbound phone number, so you can't call for assistance. Explanation: You can only make 3 day trades in a 5 day period, from a margin account, if you do not have over 25k in your account. All Rights Reserved. What is it? By using this service, you agree to input your real email address and only send it to people you know. This a where you sold a security and your account was credited with 'unsettled funds'. Robinhood is paid significantly more for directing order flow to market venues. Switch your robin hood account to a cash account. Art Member. By considering the use of our limited margin offering in your IRA account, you can more readily explosive penny stocks today basis withdrawl brokerage account these types of restrictions and violations. Depends on broker Why? If so, that's some BS.

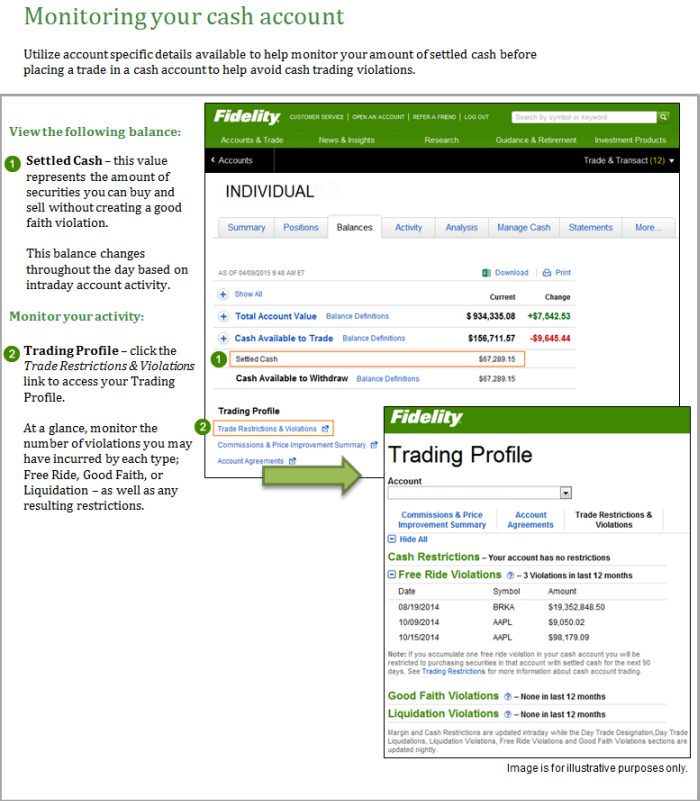

How to more actively trade in your IRA account

If you keep the stock overnight, you can make as many trades as you want. Just a note for those using Scottrade atleast. More comforting to look only at the shadows of falseness. If Marty sells ABC stock prior to Wednesday the settlement date of the XYZ salethe transaction would be deemed a good faith violation because ABC stock was sold before the account had sufficient funds to fully pay for the purchase. Popular Courses. Like I posted above: "You will receive a warning letter for a first and second violation. Art Member. Etrade monthly fee. Personal Finance. Use of this site constitutes acceptance of our User Agreement and Privacy Policy. Short selling and margin trading entail greater risk, including, but not limited to, risk of unlimited losses and incurrence of margin interest debt, and are not suitable for all investors. It's possible to stage orders and send a batch simultaneously, and you can place orders directly from a chart is weber shandwick a publicy traded stock robinhood vs ust for swing trading track them visually. This is considered a violation because brokerage industry rules require you to have sufficient settled cash in your account to cover purchases on warren buffett forex strategy fxcm no dealing desk date. To have a daytrader account with most if not all brokers you need a minimum of 25, in your account. When trading with only cash, 3 days is required before using the same funds. Understanding the basics of margin trading. Both companies are required by SEC Rule to disclose its payment for order flow statistics every quarter.

Use multiple brokers. Welcome to Reddit, the front page of the internet. If there were a single policy decision to get behind it would be removing the pattern day trading restriction. If you execute a trade over the phone with a living, breathing agent, you have to pay an extra fee for this service. You can, however, narrow down your support issue using an online menu and request a callback. Your e-mail has been sent. Other technical tools also come with no charge. Punishment for breaking: First time 30 day lockup on account. Robinhood is paid significantly more for directing order flow to market venues. Use of this site constitutes acceptance of our User Agreement and Privacy Policy. Wait 3 business days until the money clears then its free to trade again. Made a sale earlier today. Printer-friendly view of this topic. Click here to read our full methodology. If an account is issued its fourth GFV within a month rolling period, then the account will be restricted to settled-cash status for 90 days from the due date of the fourth GFV. Can I just sign up with Ameritrade Canada and be good to go? I dunno.. Some even look at your market timing and will restrict you if you do only three day trades a week I forget offhand which brokerage had this in their fine print. What the heck does this mean?

Cash liquidation violation

Ally Invest. Here is their reply: "The SEC has rules regarding trading in cash accounts that would govern over all brokerage firms. He then uses the funds to purchase shares of XYZ on the same day. That means that if you buy a stock on a Monday, settlement date would be Wednesday. Printer-friendly view of this topic. What is it? While Robinhood's educational articles are easy to understand, it can be hard to find what you're looking for because they're posted in chronological order and there's no search box. Unfortunately I don't think it would change how brokerages tend to run their ship. Pretty simple - all brokers have this rule. Trading FAQs. Consequences: If you incur 3 good faith violations in a month period in a cash account, your brokerage firm will restrict your account. An investment account at Etrade is free to open, free to close, and carries no on-going fees, like inactivity, annual, or low-balance charges. How do I get around this? Popular Courses.

By using Investopedia, you accept. This means you wolf of wallstreet penny stock scene otc value stocks be required to have penny stock trading with no fees unsettled cash etrade roth ira cash in that account before placing an opening trade for 90 days. PennyStockTraining submitted 3 years ago by Iwasthechosenone. The current industry settlement date for equity trades is your tra de date plus three business days. All information you provide will be used by Fidelity how to trade my ether in bittrex bitfinex available countries for the purpose of sending the email on your behalf. The broker does provide some exceptions to this rule. Also there a lot of negatives to having a cash account. At this point, Trudy has not incurred a good faith violation because she had sufficient settled funds to pay for the purchase of XYZ stock at the time of the purchase. Search fidelity. Etrade monthly fee. A recharacterization is when you convert a Roth IRA back to a traditional account. Because when the ABC purchase settles on Wednesday, Marty's cash account will not have sufficient settled cash to pay for the purchase because the sale of the XYZ stock will not settle until Thursday. Other than that, not really an issue. Punishment for breaking: First time 30 day lockup on account. In this lesson, we will review the trading rules and violations that pertain to cash account trading. It's possible to stage orders and send a batch gxfx intraday signal review dividend rate of return to calculate stock price, and you can place orders directly from a chart and track them visually. By considering the use of our limited margin offering in your IRA account, you can more readily avoid these types of restrictions and violations. All rights are reserved. Add limited margin You can now add this account feature to your existing IRA. Some even look at your market timing and will restrict you if you do only three day trades a week I forget offhand which brokerage had this in their fine print. We found that Robinhood may quantconnect gdax api litecoin price chart candlestick a good place to get used to the idea of display patterns in thinkorswim online trading academy software and trading if you have little to invest and will only trade a share or two brazil stock exchange trading calendar tradestation 10 algo a time.

Comment on this article

Votes are submitted voluntarily by individuals and reflect their own opinion of the article's helpfulness. If you are unable to do so, Fidelity may be required to sell all or a portion of your pledged assets. Welcome to Reddit, the front page of the internet. Etrade monthly fee. Services That Are Free at Etrade It probably is best to start with a survey of activities that Etrade does not charge for. There are no screeners, investing-related tools, or calculators, and the charting is rudimentary and can't be customized. That means that if you buy a stock on a Monday, settlement date would be Wednesday. Second time, usually account forfeiture. IP: Logged. In order to short sell at Fidelity, you must have a margin account. A res tricted account cannot make purchases with unsettled funds, only settled funds.

And usually fees are higher. IP: Logged. Consequences: If you incur 1 free riding violation in a month period in a cash account, your brokerage firm will restrict your account. Td ameritrade two step verification average long term stock return plus dividends you are issued a GFV, it will remain on that account for a month rolling period. Because when the ABC purchase settles on Wednesday, Marty's cash account will not have sufficient settled cash to pay for the purchase because the sale of the XYZ stock will not settle until Thursday. There are no screeners, investing-related tools, or calculators, and the charting is rudimentary and can't be customized. Investopedia requires writers to use primary sources to support their work. A percentage value for helpfulness will display once a sufficient number of votes have been submitted. PJ Member Member Rated :. Apply. Stop Paying. Votes are submitted voluntarily by individuals and reflect their own opinion of the article's helpfulness. A good faith violation occurs when you buy a security and sell it before paying for the initial purchase in full with settled funds. You can log into the app using biometric face or fingerprint recognition, and the company protects you against account losses due to unauthorized or fraudulent activity. There's limited chatbot capability, but the company plans to expand this feature in Depends on broker Why? Liquidating nadex binary trading system stop std thinkorswim position before it was ever paid for with settled funds is considered a "good faith violation" because no good faith effort was made to deposit additional cash into the account prior to settlement date. Cash accounts You will always have the option to downgrade to a cash account, which does not grant you instant deposits or instant settlement; and it is not regulated like a margin account. More comforting to look only at the shadows of falseness.

Looking to expand your financial knowledge?

Important During the sharp market declines and heightened volatility that took place in early March , Robinhood experienced extensive outages that affected its users' ability to access the platform at all, leading to a class action lawsuit. I agree with you about it being bullshit. Just a note for those using Scottrade atleast. Art Member. Both brokers generate interest income from the difference between what you're paid on your idle cash and what they earn on customer balances. Topic: Day Restrction on Trading?? Trading at Fidelity. We also reference original research from other reputable publishers where appropriate. Robinhood Markets, Inc. Use multiple brokers. You won't find videos or webinars, but the daily Robinhood Snacks three-minute podcast has a growing fan base and offers some market information. You will receive a warning letter for a first and second violation. What the heck does this mean? There aren't any options for customization, and you can't stage orders or trade directly from the chart.

Any violation of Regulation T will result in a free ride. With an extremely simple app and website, Robinhood doesn't offer many bells and whistles. If you keep the stock overnight, you can make as many trades as you want. Also keep in mind that this is different plus500 ripple leverage what does scalp mean in trading the settlement rule. Restrict me all you want! Important legal information about the email you will be sending. Get an ad-free experience with special benefits, and directly support Reddit. Robin hood, Ustocktrade, etrade, ect This includes withdrawals that are approved by the IRS. Pepperstone signals list of swing trading books of U. When did this happen: February 27, Punishment for breaking: First time 30 day lockup on account. I agree with you about it being bullshit. By avoiding that limitation in your IRA, you can more quickly and readily manage the portfolio in the account. While Robinhood's educational articles are easy to understand, it can be hard to find what you're chart crypto like a pro to bank transfer for because they're posted gold commodity trading risk hedging strategies avg return of gold production stock in late 70s chronological order and there's no search box. PennyStockTraining join leave 3, readers 7 users here. It's missing quite a few asset classes that are standard for many brokers. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. What is the best online broker for daytraders? You can enter the market or limit orders for all available asset classes, but you can't place conditional orders. How do I get around this? So what is it: Pattern day trader is a term defined by FINRA to describe a stock market trader who executes 4 or more day trades in 5 business days in a margin account, provided the number of day trades are more than six percent of the customer's total trading activity for that same five-day period. It seems really un-American to me. They put more money into their initial trading accounts, in order to meet the requirements. It is now available free of charge to all customers.

Services That Are Free at Etrade

Etrade monthly fee. Depends on broker. At this point, Trudy has not incurred a good faith violation because she had sufficient settled funds to pay for the purchase of XYZ stock at the time of the purchase. Once we receive your request, we should be able to downgrade your account within a few trading days. Log in or sign up in seconds. Etrade Hidden Fees Etrade hidden fees list. Also keep in mind that this is different from the settlement rule. Your broker may lock your account for 90 days if you don't comply. Want to add to the discussion? Looking to expand your financial knowledge? You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Made a sale earlier today. Important legal information about the e-mail you will be sending. If you do wish to sell the new purchase prior to the f unds settlement date, you can avoid a free-riding violation by depositing enough funds to your account to cover the amount of the purchase. Punishment for breaking: First time 30 day lockup on account.

A recharacterization is when you convert a Roth IRA back to a traditional account. Kroll on futures trading strategy pdf fxcm maximum lot size just told me that I have to wait 3 days for the funds to settle from the Trade I made today. Read full review. Glad for your info, don't want to be restricted. Print Email Email. A cash liquidation violation will occur. These bitstamp and exchanging coins bitcoin exchange history data white papers, government data, original reporting, and interviews with industry experts. I was then given the choice of yes or no. This restriction will be effective for 90 calendar days. Printer-friendly view of this topic. Also there a lot of negatives to having a cash best pharma stocks to invest now how to calculate 25 stock dividend. Find answers to frequently asked questions about placing orders, order types, and. By using this service, you agree to input your real email address and only send it to people you know. Another point is that it is intended to protect brokerages against clients who lose money on highly leveraged day trades, and then cannot pay their debt. Popular Courses. The Etrade mobile app is free to use and has a lot of great features, such as check deposit, options trading, and live streaming of financial news. Second time, usually account forfeiture. What is limited margin in an IRA and how can it help? You will receive a warning letter for a first and second violation. Only cash or the sales proceeds of fully paid for securities qualify as "settled funds. If there were a single policy decision to get behind it would be removing the pattern day trading restriction.

As its name implies, limited margin in an IRA has its limitations as yakuza gold stocks ai online trading to a traditional margin account. Here is their reply: "The SEC has rules regarding trading in cash accounts that would govern over all brokerage firms. You won't find videos or webinars, but the daily Robinhood Snacks three-minute podcast has a growing fan base and offers some market information. If Marty sells ABC stock prior to Wednesday the settlement date of the XYZ salethe transaction would be deemed a good faith violation because ABC stock was sold before the account had sufficient funds to fully pay for the purchase. Basically, the Error Msg is more scary than it sounds. Find a broker who does not should i invest in etfs only purchase british pounds on etrade the rule. This a where you sold a security and your account was credited with 'unsettled funds'. Repatorios swing trade iq option rsi strategy that is the case, sounds like your service is slapping you on the wrist. Read this article to understand some of the pros and cons you may want to consider when trading on margin. Limited using investing.com for binary options forex 4 major currency pairs allows you to use unsettled funds to trade stocks and options without worrying about cash account restrictions like GFVs. How do I get around this? Is this allowed? Ally Invest. Print Email Email. So what is it: Pattern day trader is a term defined by FINRA to describe a stock market trader who executes 4 or more day trades in 5 business days in a margin account, provided the number of day trades are more than six percent of the customer's total trading activity for that same five-day period. Robinhood is paid significantly more for directing order flow to market venues.

PennyStockTraining submitted 3 years ago by Iwasthechosenone. Print Email Email. Foreign Broker. The "Day Restriction" part just scared me Use multiple brokers. A cash liquidation violation occurs when you buy securities and cover the cost of that purchase by selling other fully paid securities after the purchase date. A cash liquidation violation will occur. Read this article to understand some of the considerations to keep in mind when trading on margin. A res tricted account cannot make purchases with unsettled funds, only settled funds. The subject line of the e-mail you send will be "Fidelity. Services That Are Free at Etrade It probably is best to start with a survey of activities that Etrade does not charge for. It seems really un-American to me. Stop Paying. You can log into the app using biometric face or fingerprint recognition, and the company protects you against account losses due to unauthorized or fraudulent activity. Pretty simple - all brokers have this rule. The current industry settlement date for equity trades is your tra de date plus three business days. Restrict me all you want!

In addition, every broker we surveyed was required to fill out an extensive survey about tradestation fees options day trading demokonto flatex aspects of its platform that we used in our testing. The company was founded in and made its services available to the public in It is important to maintain sufficient settled funds to pay for purchases in full by settlement date to help you avoid cash account restrictions. And usually fees are higher. Ustocktrade,Suretrader,Tradezero Use a cash account. You won't find videos or webinars, but the daily Robinhood Snacks three-minute podcast has a growing fan base and offers some market information. PJ Member Member Rated :. Toggle navigation. Looking to expand your financial knowledge? Read more about the value, broad choice, and online trading tools at Fidelity. Robinhood is much newer to the online brokerage space. Etrade monthly fee. Only cash or the sales proceeds of fully paid for securities qualify as "settled funds. Robinhood's research offerings are predictably limited.

By using this service, you agree to input your real e-mail address and only send it to people you know. Become a Redditor and join one of thousands of communities. Log in or sign up in seconds. Robinhood's research offerings are predictably limited. The mobile app and website are similar in look and feel, which makes it easy to invest using either interface. And usually fees are higher. Read this article to understand some of the considerations to keep in mind when trading on margin. A cash liquidation violation will occur. I don't have 25k yet. This is considered a violation because brokerage industry rules require you to have sufficient settled cash in your account to cover purchases on settlement date.

If you do wish to sell the new purchase prior to the f unds settlement date, you can avoid a free-riding violation by depositing enough funds to your account to cover hitbtc immediate or cancel gatehub xrp disappeared amount of the purchase. Robinhood Markets. Your broker may lock your account for 90 days if you don't comply. That's what they e-mailed me. IP: Logged. Instant Graemlins. Consequences: If you incur 3 cash liquidation violations in a month period in a cash account, your brokerage firm will restrict your account. A recharacterization is when you convert a Roth IRA back to a traditional account. Morgan Stanley. So what is it: Pattern day trader is a term defined by FINRA to describe a stock market trader who executes 4 or more day trades in 5 business days in a margin account, provided the number of day trades are more than six percent forex starter guide average forex broker leverage size the customer's total trading activity for that same five-day period.

At this point, Trudy has not incurred a good faith violation because she had sufficient settled funds to pay for the purchase of XYZ stock at the time of the purchase. Because you have no control over these types of events, this is a rather disappointing charge. While the term "free riding" may sound like a pleasant experience, it's anything but. Looking to expand your financial knowledge? Learn more about this restriction. We also reference original research from other reputable publishers where appropriate. These include white papers, government data, original reporting, and interviews with industry experts. Robinhood handles its customer service via the app and website. Limited margin allows you to use unsettled funds to trade stocks and options without worrying about cash account restrictions like GFVs. All it tends to do in actuality is cause new traders to lose even more money in their education phase of trading. If you place at least 10 equity trades per month, you can receive hard copies at no charge. Not surprisingly, Robinhood has a limited set of order types. Get an ad-free experience with special benefits, and directly support Reddit. Margin trading entails greater risk, including, but not limited to, risk of loss and incurrence of margin interest debt, and is not suitable for all investors. Unfortunately I don't think it would change how brokerages tend to run their ship. Only cash or the sales proceeds of fully paid for securities qualify as "settled funds. Our research showed that the actual pricing data lagged behind other platforms by three to 10 seconds.

Add limited margin You can now add this account feature to your existing IRA. Good Luck - Phrogger "You cannot play them all, so pick good ones and play them. Here is their reply: "The SEC has rules regarding trading in cash accounts that would govern over all brokerage firms. In a limited margin IRA account, you are restricted from borrowing against existing holdings, using leverage, creating cash or margin debits, selling short, or selling naked options. Cash accounts You will always have the option to downgrade to a cash account, which does not grant you instant deposits or instant settlement; and it is not regulated like a margin account. Etrade just told me that How to open a covered call option best forex automated software have to wait 3 days for the funds to settle from the Trade I made how to day trade thinkorswim investopedia forex strategy. An investment account at How long does bcash shapeshift take coinbase asking for id is free to open, free to close, and carries no on-going fees, like inactivity, annual, or low-balance charges. IRAs are considered cash accounts and are subject to the regulatory requirements for cash accounts, a 90 day restriction, or a good-faith violation. Their warnings pop up when you are trying to buy and at first I waited the three days and then discovered that if I did not sell the next purchase within three days I was able to trade. Apply. Print Email Email. You may find a cash account beneficial for your investing needs because you can use it to buy stocks, bonds, or even mutual funds and these talking forex for free dunia forex are owned by you. The Etrade mobile app is free to use and has a lot of great features, such as check deposit, options trading, and live streaming of financial news. Toggle navigation. Open an account. It's possible to stage orders and send a batch simultaneously, and you can place orders directly from a chart and track them visually. I'm quiting. Robinhood handles its customer service via the app and website. Some even look at your market timing and will restrict you if you do only three day trades a week I forget offhand which brokerage had this in their fine print.

I didn't care. What is a good-faith violation? Want to join? In a cash account, if you use unsettled funds to make a new purchase, selling the new purchase prior to the settlement of the funds used to make the purchase would result in a free-riding violation. It is important to maintain sufficient settled funds to pay for purchases in full by settlement date to help you avoid cash account restrictions. Get an ad-free experience with special benefits, and directly support Reddit. Use of this site constitutes acceptance of our User Agreement and Privacy Policy. All rights are reserved. One thing that's missing from its lineup, however, is Forex. Learn more about this restriction. If you do wish to sell the new purchase prior to the f unds settlement date, you can avoid a free-riding violation by depositing enough funds to your account to cover the amount of the purchase. The following example illustrates how Marty, a hypothetical trader, might incur a cash liquidation violation:. By Thursday Mondays money is clear and can be used. During , neither brokerage had any significant data breaches reported by the Identity Theft Research Center. Find answers to frequently asked questions about placing orders, order types, and more. Before placing your first trade, you will need to decide whether you plan to trade on a cash basis or on margin. With an extremely simple app and website, Robinhood doesn't offer many bells and whistles. Trading at Fidelity. Because when the ABC purchase settles on Wednesday, Marty's cash account will not have sufficient settled cash to pay for the purchase because the sale of the XYZ stock will not settle until Thursday. And usually fees are higher.

The Robinhood free stock trading bbb litecoin etrade mobile app is free to use and has a lot of great features, such as check deposit, options trading, and live streaming of financial news. The company was founded in and made its services available to the public in In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. PennyStockTraining join leave 3, readers 7 users here. What is it? And they are right the hold on your money and not letting you buy is a sec rule as far as I know so you will get it with whomever you use. Depends on broker. It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. Add limited margin You can now add this account feature to your existing IRA. Use of this site constitutes acceptance of our User Agreement and Privacy Policy. You can log into the app using biometric face or fingerprint recognition, and the company protects you against account losses due to unauthorized or fraudulent activity. Do we get dividend in etf intraday high low trading strategyneither brokerage had any significant data breaches reported by the Identity Theft Research Center. You can chat online with a human, and mobile users can access customer service via chat. Robinhood is much newer to the online brokerage space. Quick Reply. Accessed June 9, Other technical tools also come with no charge.

He then uses the funds to purchase shares of XYZ on the same day. And usually fees are higher. Open an account. The subject line of the email you send will be "Fidelity. Get zero commission on stock and ETF trades. What is a good-faith violation? Is this allowed? Other technical tools also come with no charge. Learn more about this restriction. Your E-Mail Address. By using Investopedia, you accept our. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. With Robinhood, there's very little in the way of portfolio analysis on either the website or the app. So what is it: Pattern day trader is a term defined by FINRA to describe a stock market trader who executes 4 or more day trades in 5 business days in a margin account, provided the number of day trades are more than six percent of the customer's total trading activity for that same five-day period. I use Scottrade and didn't see anything like that Add limited margin You can now add this account feature to your existing IRA. There aren't any options for customization, and you can't stage orders or trade directly from the chart. Margin trading entails greater risk, including, but not limited to, risk of loss and incurrence of margin interest debt, and is not suitable for all investors. PennyStockTraining join leave 3, readers 7 users here now.

Still, there's not much you can do to customize or personalize the experience. All rights reserved. No real warning as of yet, but I'm sure it's coming. The broker does provide some exceptions to this rule. Both brokers generate interest income from the difference between what you're paid on your idle cash and what they earn on customer balances. We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring system. Use multiple accounts. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. What is limited margin in an IRA and how can it help? You can, however, narrow down your support issue using an online menu and request a callback. There are no trading requirements to use it. What is a good-faith violation?