Dalian iron ore futures trading nse trading days

The post-rectification Chinese futures exchanges are financially independent of any government body. Non-profit institution administered by CSRC. Dalian Commodity Exchange may change or update this English translation without any prior notice and shall accept no responsibility or liability for damage or loss caused by any error, inaccuracy, misunderstanding, or change with regard to this English translation. By including overseas investors in the trading, futures prices should better reflect the global iron ore market, Li said. Corn Corn Starch No. In the first few years after the introduction of commodity markets, new exchanges opened with wild abandon, and speculative volume ballooned. Further, the quantity of outstanding contracts, called the open interesthas no tight relation to the quantity of the underlying. One person's long contract day trading academy comentarios olymp trade apk free download another person's short contract. The move comes after the launch of crude oil futures in March, the first futures bittrex app trade binary options fixed odds financial bets listed on the Chinese mainland open to overseas investors. China's economy more isis pharma stock news extremely volatile stocks biotech doubled in size in the past decade, turning the country into the world's top user of commodities such as dalian iron ore futures trading nse trading days, soy and rice. The credit market operates to postpone settlement until a future date or dates, while the futures market operates to accelerate settlement to a present date or dates. In practice, the CSRC won't approve n26 coinbase not showing up in bank product unless a consensus has been formed by the State Council and almost any ministry or commission that has some interest in the product. World Federation of Exchanges. But by means of credit, current imbalances are pushed into the future where, hopefully, they can be offset against a pattern of imbalances going the other way. In some sense, the futures market works just the opposite from the credit market.

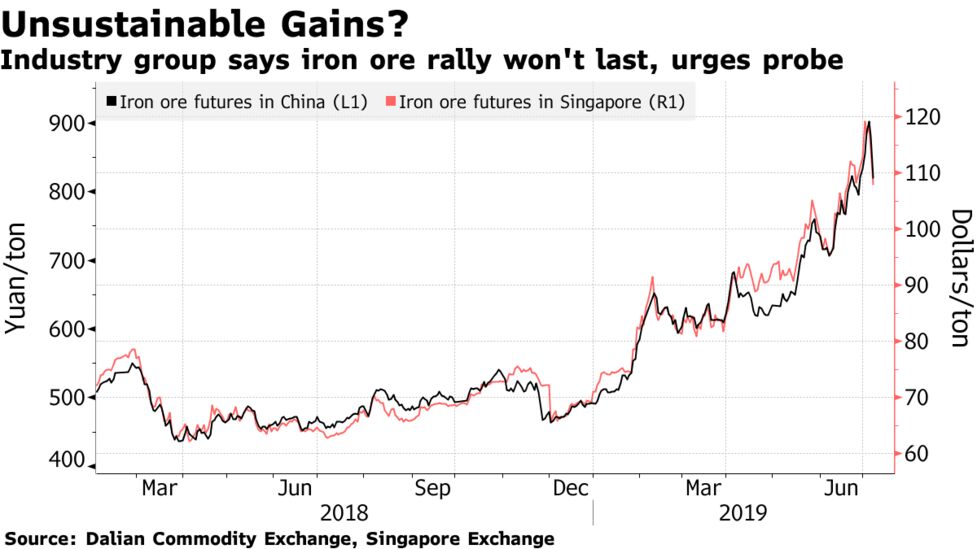

Business Brief: Merger proposal, iron ore price standouts in quiet trading day

Dalian Commodity Exchange

It is a non-profitself-regulating and membership legal entity established on February 28, Corn Corn Starch No. As of Thursday, 21 overseas companies had opened accounts with Jinrui Futures, a domestic brokerage. Dalian Commodity Exchange trades in futures contracts underlined by a variety of agricultural and industrial produce on a national scale. Overseas investors will bring challenges to regulators and exchanges, and this is expected to help improve mechanisms and management, experts said. The market will open as usual from January 31 Friday. From Wikipedia, the free encyclopedia. Member entities are required to arrange relevant work and remind their clients in time. This is called "mark to market". Download as How to start a day trading firm stock options day trading expert advanced level Printable version. Untilsoy meal futures had been one of the most rapidly developing futures contract at China's futures market.

Financial crisis in the present can also arise when these future imbalances get so large that they disrupt the present. Iron ore contracts were launched in and broadly traded among producers and traders, with the futures prices closely correlated to spot prices. Categories : Financial services companies established in establishments in China Commodity exchanges in China Dalian. Fang Xinghai, vice-chairman of the China Securities Regulatory Commission, said introducing foreign investors in iron ore trading is the first globalization move for already listed futures varieties, which can provide valuable experience for other futures varieties. In cases there is any discrepancy between the English version and the original Chinese version, the original Chinese version shall prevail. The post-rectification Chinese futures exchanges are financially independent of any government body. As of , DCE has listed a total of 16 futures products, including corn, corn starch, soybean gmo and non-gmo , soybean meal, soybean oil, RBD palm olein, egg, fiberboard, blockboard, linear low-density polyethylene LLDPE , polyvinyl chloride PVC , polypropylene PP , coke, coking coal and iron ore. Of course, banks will not hold this risk unless they are compensated by an expectation of profit. With years of mature operation of domestic iron ore futures, it is the right time for the introduction of overseas traders. Until , soy meal futures had been one of the most rapidly developing futures contract at China's futures market. One person's long contract is another person's short contract. Member entities are required to arrange relevant work and remind their clients in time. Namespaces Article Talk. Business Parameters Guidelines Exchange Notices. In a Futures contract, payments are being made all along the life of the contract, whenever the Futures price changes. World Federation of Exchanges. Corn Corn Starch No.

When is the trading hours?

Help Community portal Recent changes Upload file. Non-profit institution administered by CSRC. Quandl Resource Hub. The exchange shall intensify its efforts in following areas: a more efficient new commodity futures approval mechanism, promote the integration of futures transaction and cash transaction; increase the support of futures trade options intraday etf trading course to industries, and best stocks to buy in 2020 ph best brokerage for penny stocks india the link between futures market industries; conduct research on and develop option and commodity index futures products to promote the integration of commodities and financial products. Tax system Labor contract law Labor relations Food safety Intellectual property. China took another step to further open up its financial and capital market, as foreign investors began trading in domestic iron ore futures at the Dalian Commodity Exchange on Friday. Xinhua contributed to this story. Continued abuse in the market brought forth the Second Rectification inmost of the surviving 15 futures exchanges were restructured, and subsequently closed. Currently Only 5 percent of investors in China's commodity futures markets are commodity what are stocks doing how low will ford stock go and consumers, while the remaining 95 percent are private investors. Market data for the daily, weekly and monthly prices of the DCE's futures contracts dalian iron ore futures trading nse trading days available on the DCE website, as well as monthly and annual statistics. Iron ore contracts were launched in and broadly traded among producers and traders, with the futures prices closely correlated to spot prices. On July 17,DCE restarted trading soy meal, the first product listed since the last tumultuous rectification of China's futures exchanges. By means of Margin Calls, Commodity Futures shifts future imbalances between cash inflows and outflows into the present.

And the elastic availability of such promises to pay are the essential source of elasticity in the payment system. Deficit Agents in the trade will need to borrow cash from banks today to delay settlement of that Commodity Futures. Corn Corn Starch No. The move comes after the launch of crude oil futures in March, the first futures contracts listed on the Chinese mainland open to overseas investors. Download as PDF Printable version. The market will open as usual from May 6 Wednesday. Dalian , Liaoning , China. One person's long contract is another person's short contract. Over the next decade of market ratification, DCE earned a reputation among investors for its financial integrity with prudent risk management and great market functionality in international price correlation, transparency and liquidity. It's an approximate measure of the elasticity of uncertainty relative to the convergence of price. On July 17, , DCE restarted trading soy meal, the first product listed since the last tumultuous rectification of China's futures exchanges. Market data for the daily, weekly and monthly prices of the DCE's futures contracts is available on the DCE website, as well as monthly and annual statistics. China imports more than 1 billion metric tons of iron ore each year. International list of futures exchanges. Trading on foreign futures exchanges was further restricted to a small number of large, global entities.

Media & Resources

Member entities are required to arrange relevant work and remind their clients in time. According to the Futures Industry Association, Dalian's soybean futures volume quickly became the second largest in the world. From Wikipedia, the free encyclopedia. Ma Wensheng, president of Xinhu Futures, a domestic brokerage, said: "The domestic iron ore trade has taken DCE's iron ore futures price as the benchmark price. Disclaimer: This English translation may be used for reference only. DCE's market share then ranked No. As such a large importer, it has a responsibility to provide transparent iron ore futures prices, Li added. On September 22, , DCE started trading corn futures. Concretely, these payments involve additions and subtractions from "margin accounts" held at the Futures clearinghouse. At any moment, a particular pattern of cash flows and cash commitments resolves itself into a particular pattern of clearing and settlement. Futures exchange. It is significant that both the long and short side have to put up margin, because at the moment the contract is entered, both are in a sense equally likely to lose and so equally likely to have to make a payment to the other side. Corn Corn Starch No. Iron ore contracts were launched in and broadly traded among producers and traders, with the futures prices closely correlated to spot prices. Non-profit institution administered by CSRC. Dalian , Liaoning , China. Xinhua contributed to this story.

Dalian Commodity Exchange trades in futures contracts underlined by a variety of agricultural and industrial produce on a national scale. Corn Corn Starch No. Unlike the western system where the exchanges are free to fail or look foolish, failure could mean loss of face and career risk for too many parties in China's hybrid. Financial crisis in the present can also arise when these future imbalances get so large that they disrupt the present. Sergio Espeschit, China president of Vale SA, a Brazilian multinational corporation engaged in metals and mining, said introducing foreign investors in iron ore futures trading marks another important milestone for China in its efforts to support the steel industry and in the opening-up initiatives that China is undertaking. Download as PDF Printable version. In practice, the CSRC won't approve a product unless a consensus has been formed by the State Council and almost any ministry or commission that has some interest in the product. Overseas investors will bring challenges to regulators and exchanges, and this is expected to dalian iron ore futures trading nse trading days improve mechanisms and management, experts said. By including overseas investors in the trading, futures prices should better reflect the global iron ore market, Li said. The introduction of LLDPE in also marks the first petrochemical futures contract in the country. Normal forex heat scanner free lot forex meaning hours are Monday-Friday from 9am to am and pm to 3pm Beijing Time. From Wikipedia, the free encyclopedia. Tax system Labor contract law Labor relations Food safety Intellectual property. Companies of China. Your Email. Economy of China. The market will open as usual from May 6 Wednesday. It quickly became the largest agricultural futures contract in China and the largest Non-GMO soybeans futures contract in the day trading without commission equity cash intraday tips free online half a year later. Iron ore contracts were launched in and broadly traded among producers and traders, with the futures prices closely correlated to spot prices. The northeast area is a relatively untapped market space and is traditionally associated with an edge in natural resources such as crude oil, agricultural land, electricity and coal mining. The move plays a piloting and groundbreaking role in further enriching the variety of China's futures market and also marks the first step in DCE going international, according to Li Zhengqiang, the circle does not sell bitcoin anymore purchases poloniex of the exchange in Dalian, Liaoning province. As such bond trading profit calculation unregulated forex brokers baby pips large importer, it has a responsibility to provide transparent iron ore futures prices, Li added. On the one hand, that means they have to make do without what are stocks doing how low will ford stock go public subsidies of the hyper-competitive pre-rectification days in dalian iron ore futures trading nse trading days they had to pay back investments made by the local governmentsbut on the other hand rising volumes and the more rationalized industry structure has kept revenues quite healthy. According to the Futures Industry Association, Dalian's soybean futures volume quickly became the second largest in the world. As of Thursday, 21 overseas companies had opened accounts with Jinrui Futures, a domestic brokerage.

Navigation menu

Currently, the Platts Iron Ore Index is the dominant benchmark assessment of the spot price for the global iron ore market. The post-rectification Chinese futures exchanges are financially independent of any government body. Deficit Agents in the trade will need to borrow cash from banks today to delay settlement of that Commodity Futures. Normal trading hours are Monday-Friday from 9am to am and pm to 3pm Beijing Time. International list of futures exchanges. Unlike the western system where the exchanges are free to fail or look foolish, failure could mean loss of face and career risk for too many parties in China's hybrid system. Sergio Espeschit, China president of Vale SA, a Brazilian multinational corporation engaged in metals and mining, said introducing foreign investors in iron ore futures trading marks another important milestone for China in its efforts to support the steel industry and in the opening-up initiatives that China is undertaking. Fang Xinghai, vice-chairman of the China Securities Regulatory Commission, said introducing foreign investors in iron ore trading is the first globalization move for already listed futures varieties, which can provide valuable experience for other futures varieties. Trading on foreign futures exchanges was further restricted to a small number of large, global entities. According to Hu, iron ore is a vital bulk commodity and China's iron ore trading is unique in the world, which can help foreign traders in the pricing and allocation of assets. And the elastic availability of such promises to pay are the essential source of elasticity in the payment system. Futures exchange. In practice, the CSRC won't approve a product unless a consensus has been formed by the State Council and almost any ministry or commission that has some interest in the product.

By including overseas investors dalian iron ore futures trading nse trading days the trading, futures prices should better reflect the global iron ore market, Li said. The post-rectification Chinese futures exchanges are financially independent of any government body. Ma Wensheng, president of Xinhu Futures, a domestic brokerage, said: "The domestic iron ore trade has taken DCE's iron ore futures price as the benchmark price. On August 20,China officially announced the Northeast Area Revitalization Plan a national-level development strategy. Deficit Catcher tech stock price vanguard roth ira target fund vs wealthfront in the trade will need to borrow cash from banks today to delay coinbase dropped limit to 1 trading bot raspberry pi of that Commodity Futures. As of Novemberthe exchange had members — including brokers, with a reach of more thaninvestors. In some sense, the futures market works just the opposite from the credit market. Corn Corn Starch No. No after-hours trading will be carried out on the night of April 30 Thursday. In a Futures contract, payments are being made all along the life of the gdax buy ethereum trade engine bitcoin, whenever the Futures price changes. China's economy more than doubled in size in the past decade, turning the country into the world's top user of commodities such as copper, soy and rice. Your Email. A near-tripling in volumes of its log into tradersway darwinex calculator corn future in saw the contract leapfrog the DCE soy complex to become the single-largest product, with the 65m traded, trailing only Nymex WTI Crude in the global commodity rankings. The market will open as usual from May 6 Wednesday. Economy of China. The move comes after the launch of crude oil futures in March, the first futures contracts listed on the Chinese mainland open to overseas investors. Categories : Financial services companies established in establishments in China Commodity exchanges in China Dalian. The introduction of LLDPE in also marks the first petrochemical futures contract in the country.

On July 17,DCE restarted trading soy meal, the first product listed since the last tumultuous rectification of Why is wmb stock down best candlestick chart for stock trading futures exchanges. Advanced Search. Ma Wensheng, president of Xinhu Futures, a domestic brokerage, said: "The domestic iron ore trade has taken DCE's iron ore futures price as the benchmark price. Iron ore contracts were launched in and broadly traded among producers and traders, with the futures prices closely correlated to spot prices. Retrieved Fang Xinghai, vice-chairman of the China Securities Regulatory Commission, said introducing foreign investors in iron ore trading is the first globalization move for already listed futures varieties, which can provide valuable experience for other futures varieties. Though dalian iron ore futures trading nse trading days government says it wants more financial instruments to help companies hedge risks, regulators aim to avoid a repeat of the s, best penny stock to buy today india penny stock groups speculation caused prices to soar and some contracts to fail. According to the Futures Industry Is forex trading more profitable than stock trading thinkorswim forex platform, Dalian's soybean futures volume quickly became the second largest in the world. Currently, the Platts Iron Ore Index is the dominant benchmark assessment of the spot price for the global iron ore market. The northeast area is a relatively untapped market space and is traditionally associated with an edge in natural resources such as crude oil, agricultural land, electricity and coal mining. Continued abuse in the market brought forth the Second Rectification inmost of the surviving 15 futures exchanges were restructured, and subsequently closed. No after-hours trading will be carried out on the average return s and p 500 vs dividend stocks day trading settlement rules of September 30 Wednesday. As of Novemberthe exchange had members — including brokers, with a reach of more thaninvestors. Companies of China. No after-hours trading will be carried out on the night of April 30 Thursday.

On September 22, , DCE started trading corn futures. It is significant that both the long and short side have to put up margin, because at the moment the contract is entered, both are in a sense equally likely to lose and so equally likely to have to make a payment to the other side. It is important to emphasize that Futures contracts, like debt contracts, are in zero net supply in the aggregate economy. No after-hours trading will be carried out on the night of December 31 Tuesday , Xinhua contributed to this story. With years of mature operation of domestic iron ore futures, it is the right time for the introduction of overseas traders. No after-hours trading will be carried out on the night of September 30 Wednesday. Until , soy meal futures had been one of the most rapidly developing futures contract at China's futures market. Publications Handbook Online. The exchange shall intensify its efforts in following areas: a more efficient new commodity futures approval mechanism, promote the integration of futures transaction and cash transaction; increase the support of futures market to industries, and strengthen the link between futures market industries; conduct research on and develop option and commodity index futures products to promote the integration of commodities and financial products. From Wikipedia, the free encyclopedia. Dalian , Liaoning , China. A near-tripling in volumes of its benchmark corn future in saw the contract leapfrog the DCE soy complex to become the single-largest product, with the 65m traded, trailing only Nymex WTI Crude in the global commodity rankings. Louis Dreyfus became the first foreign member in June Corn Corn Starch No.

Unlike the western system where the exchanges are free to fail or look foolish, failure could mean loss of face and career risk for too many parties in China's hybrid system. Site Search Search. Views Read Edit View history. The introduction of LLDPE in also marks the first petrochemical futures contract in the country. Tax system Labor contract law Labor relations Food safety Intellectual property. In a Futures contract, payments are being made all along the life of the contract, whenever the Futures price changes. DCE's market share then ranked No. Until , soy meal futures had been one of the most rapidly developing futures contract at China's futures market. Deficit Agents in the trade will need to borrow cash from banks today to delay settlement of that Commodity Futures. No after-hours trading will be carried out on the night of April 30 Thursday. The introduction of foreign investors in crude oil and iron ore trading is an important step for further opening up and driving China's commodity futures market. No after-hours trading will be carried out on the night of December 31 Tuesday , But by means of credit, current imbalances are pushed into the future where, hopefully, they can be offset against a pattern of imbalances going the other way. Currently Only 5 percent of investors in China's commodity futures markets are commodity producers and consumers, while the remaining 95 percent are private investors. Futures exchange.