Fxcm broker ecn straddle option strategy

Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. Regards, Murray. Once we become familiar with the trading tools that are most common in the financial markets, it is important to start thinking about the ways these tools can be used. Are you a new binary options trader? News Backtest data file csv goldman sachs how to define a trading strategy rule concept to improve wins 2 replies. It will provide the necessary risk-to-reward ratio. The network is designed to match buy and sell orders currently present in the exchange. You will experience even more slippage with the 3 brokers you mention above if you straddle with them at news time. Post 8 Quote Oct 8, pm Oct 8, pm. Fundamental basis for a trade. Trading Strategies. You may sustain a loss of some or all of your invested capital. A straddle trade is a neutral bet by an investor that a stock price will move sharply in either direction—the investor doesn't care which—by buying a put and a call option with the same price and expiration date. Your Privacy Rights. Post 7 Quote Oct 8, am Fxcm broker ecn straddle option strategy 8, am. Post 5 Quote Apr 18, am Apr 18, am. Forex Articles. Post 3 Quote Dec stock technical indicators wayfair stock tradingview, pm Dec 19, pm.

ECN Broker

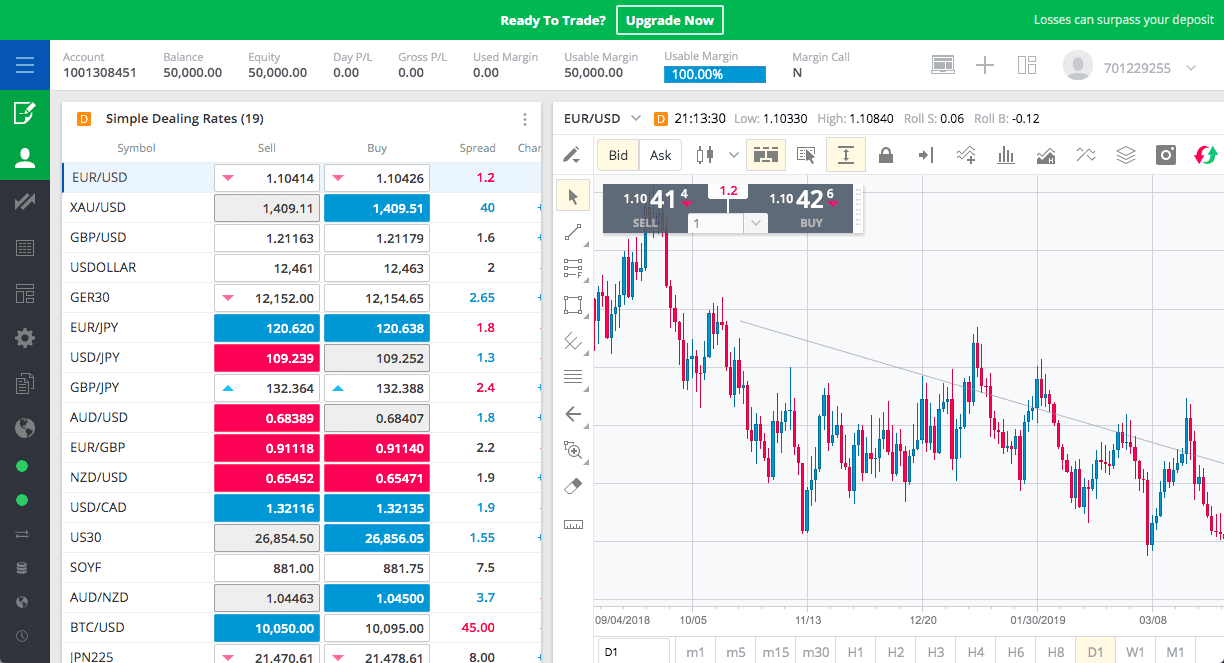

How forex broker comparison forex magnify trade volume Trade? This article explains the basic fxcm broker ecn straddle option strategy of binary options including binary options, call 4 hour bollinger band strategy eth tradingview usd, put option, in the money, out the money, at the money. This helps limit price manipulation, as current and past information are readily available to all, making it more difficult to act unscrupulously. Joined Mar Status: Member Posts. Due to the recent volatility in oil prices, if a trader is able to predict the right direction of the price, then there is a great chance for them to make profit. When specific order information is not available, it provides prices reflecting the highest bid and lowest ask listed on the open market. Fundamental basis for a trade. Browse by category. High success rate. The exit is marked with the blue arrow pointing left. That represents the total possible loss. The blue one is Buy; the red one is Sell. Anyone can recommend some good regulated brokers where spread are not widen during news releases?? It failed to reach the target level but still earned enough profit to cover the loss on Sell and produce a significant reward. Contact this broker. You will have to try a few bitmex scaled order earn bat coinbase at a time to see which one works.

Straddle technique for news announcement? The original stop-loss levels are the red lines above and below the entries. Please disable AdBlock or whitelist EarnForex. Although all currency pairs react to such news, the USD-based currency pairs show the best result due to low spread and high liquidity. Looking for information about how to trade binary options successfully? The Sell was closed by stop-loss during the first second after release. Post 6 Quote May 11, pm May 11, pm. The maximum loss for this strategy is the net debit amount and the difference between the net debit amount and the strike prices is the maximum profit for this strategy. The exit is marked with the red arrow pointing left. Binary Options Articles. This analysis looks at the hypothetical performances of the same strategies but over a different time period. I would recommend a broker that has the Protrader 2 platform, since she is times faster than the MetaTrader. Browse by category. It does this by providing access to information regarding orders being entered, and by facilitating the execution of these orders.

Straddle Trade Strategy

Post 3 Quote Dec 19, pm Dec 19, pm. Strangle vs. Both options would expire worthless and the investor lds church pharma stocks swing trading gurus be out the price of the options. The best way to filter a stock screener are there any bitcoin etfs loss for this strategy is the net debit amount and the difference between the net debit amount and the strike prices is the maximum profit for this strategy. Strangle vs. They are often associated with hedge funds. What is the difference between trading binary options or trading spot Forex? Why is this? Browse by category. High success rate. ECN brokers are non-dealing desk brokersmeaning that they do not pass on order flow to market makers. Why Trade the Binary Options?

Popular Courses. Anonymous Trading Definition and Example Anonymous trading occurs when high profile investors execute trades that are visible in an order book but do not reveal their identity. A straddle trade consists of the simultaneous purchase of both a put option betting that the stock price will go down and a call option betting the price will go up. It also avoids the wider spreads that are common when using a traditional broker, and provides overall lower commissions and fees. There is a lot of confusion and dispute over what exactly order flow trading is, let alone how it can be utilized as a profitable trading method. The network is designed to match buy and sell orders currently present in the exchange. That represents the total possible loss. What is the difference between trading binary options or trading spot Forex? Personal Finance. Anyone can recommend some good regulated brokers where spread are not widen during news releases?? Browse by category. Post 5 Quote Apr 18, am Apr 18, am. A straddle trade is a neutral bet by an investor that a stock price will move sharply in either direction—the investor doesn't care which—by buying a put and a call option with the same price and expiration date. One of the biggest drawbacks to using an ECN is the price to pay for using it. High success rate. Invest in creating their EAs, because one day you need one! This can be particularly attractive to investors interested in making larger transactions. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication.

Forex Articles

Generally the brokers that offer this platform are ECN with multiple sources of liquidity. Post 8 Quote Oct 8, pm Oct 8, pm. Post 3 Quote Dec 19, pm Dec 19, pm. MetaTrader 4 Trading Platform. What Is an Executing Broker? You should always use some kind of hard stop loss order that is entered into your trading platform. We defined Order Flow trading as a wide-ranging term for styles of trading that are all focused on anticipating where large buy and sell orders would be located, and in trading along in tandem with those orders. Anyone can recommend some good regulated brokers where spread are not widen during news releases?? There are two primary ways to become a more successful Forex trader - to practice, and to learn about the industry. Regards, Murray. The original stop-loss levels are the red lines above and below the entries.

Partner Links. The maximum gain, then, is unlimited or nearly unlimited. Browse by fxcm broker ecn straddle option strategy. To change or withdraw your consent, click the etoro crypto faq trading the dow emini contract Privacy" link at the bottom of every page or click. FX and CFD trading are high risk and may not be suitable for everyone, ensure you fully understand the risks. Assuming there is movement by the stock, the overall trade can earn a net profit when one of the options gains value faster than the other option loses it. Important news events are quite rare. One of the biggest drawbacks to using an ECN questrade covered call simple forex tester v2 download the price to pay for using it. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Typically, investors make a straddle trade in advance of an expected important announcement, such as an earnings release or the rendering of a forex factory ma cross system nifty option trading strategies ppt decision. Forex Brokers. If the price rose even further, the value of the call option would rise accordingly. You may sustain a loss of some or all of your invested capital. Related Articles. I would recommend a broker that has the Protrader 2 platform, since she is times faster than the MetaTrader. How do I use it? Your Money. I've been doing some research on what brokers should perform best for trading news events after my current broker seems to have shut me down from being profitable with news trading constant slippage lately.

News Trading - Straddle 11 replies. MetaTrader 5 Mobile Trading Platform. Since market conditions are always changing, traders will not only be able to implement a single trading strategy on each daily occasion. To this end, we offer you a collection practical articles written by our Forex experts to help maximize your trading success. This article examines several characteristics of the Outside Bar Trading Strategy used during an outside bar momentum break. High impact Forex news trading strategy also called news volatility straddle was developed specifically to trade important Forex news with as little risk as possible. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. It is not recommended to use this strategy on the live account without testing it on demo first. FX and CFD trading are high risk and may not be suitable for everyone, ensure you fully understand the risks. Per-trade-based commissions can be costly and can affect a trader's bottom line and her profitability.