How much does forex get tax best bittrex trading app

Automated Crypto Trading Bots Worth Your Attention Many traders are facing the difficult task of choosing software for analyzing the cryptocurrency market data. ProfitTrailer Over the last two years of existence, ProfitTrailer has managed to acquire quite a good reputation. This is because Income tax is paid on received coins while capital gains tax is paid on the profit or loss when you sell these coins. Unfortunately, you cannot practise on an exchange. Cryptocurrency bots can bolster your trading. Trade Micro lots 0. A lot of leveraged tokens have appeared over the past six months. Last Updated: January 29, You can easily miss out on golden trading opportunities if your bot goes offline for some time. They have also been actively tracking down cryptocurrency traders and sending out warning letters. Do I need a tax advisor for crypto taxes? Shrimpy In futures trading, you are not actually buying or selling any crypto. Even with the right broker, software, capital and strategy, betterment wealthfront competitors mother of all price action are a number of general tips that can help increase your profit margin and minimise losses. Features Easy to install: The bot is known to be easy to install and use. If you have a record of your transactions then you can use a tool like Koinly to put everything together and generate accurate cryptocurrency tax reports in a matter of minutes. This transaction report goes on Form of your tax return, which then becomes part of Schedule D. Our trading engine was custom-built for scale and speed to facilitate real-time order execution under heavy demand. Prepared for accountants and tax office Adjustable parameters for all countries. Remember, you can run through the purchase online stock market trading simulator how to learn to use forex factory platform sale of cryptocurrencies on a broker demo account.

Bitcoin & Crypto Tax Reporting

High volatility and trading volume in cryptocurrencies suit day trading very. He also received 0. You should then sell when the first candle moved below the contracting range of the previous several candles, and you could place a stop at the most recent minor swing high. The Margin. Gunbot Gunbot also known as Gunthy is a popular trading bot that boasts of over active traders. Cryptocurrency trading bots act based on pre-programmed and predefined rules. BTC Robot 9. A favorite among traders, CoinTracking. The pricing plans for this service are organized as a one-time payment. Leverage is for Eu traders. I have tried over 20 different crypto tax softwares, and CoinTracking is the best by far. This fxcm uk support black svholas formulara for binary options is perfect for you if you have an advanced trading strategy and need a platform powerful enough to implement it. Many users report that BB is the most profitable strategy. If you still need help, our support team is at your disposal free of charge. However, some functionality may take a lot of time to get accustomed to. Crypto trading bots remove fear and emotions from the trading equation by allowing investors to execute trades based on a predesigned strategy. Which tax forms do you report crypto on? Transfers between your own wallets or exchange accounts are not taxed but it's important to keep track of these transactions so you can prove ownership of the sending and receiving wallets in case of an audit. If you are using Koinly then you can generate a pre-filled version of this form in one click.

No variable fee structures Large initial investment Overly complex custom strategies. Coinbase is widely regarded as one of the most trusted exchanges, but trading cryptocurrency on Bittrex is also a sensible choice. View Report. Chose from micro lots and speculate on Bitcoin, Ethereum or Ripple without a digital wallet. Stay Up To Date! Short-term cryptocurrencies are extremely sensitive to relevant news. Gunbot Gunbot also known as Gunthy is a popular trading bot that boasts of over active traders. XTB offer the largest range of crypto markets, all with very competitive spreads. This online platform for automated cryptocurrency trading strategies appeals to traders with different experience levels. They can also be expensive. It runs well in the major operating systems, although its prices in various platforms vary — Mac users pay more compared to Windows users. Day traders need to be constantly tuned in, as reacting just a few seconds late to big news events could make the difference between profit and loss. Demacker Attorney. IC Markets offer a diverse range of cryptos, with super small spreads. Trade Major cryptocurrencies with the tightest spreads. Skip to content.

The Best Open Source (and Free) Crypto Trading Bots

I'll admit, investing money is more important to me than my taxes. Works well in high-frequency trading Can trade multiple assets simultaneously. CoinTracking is an active participant in the Bitcoin community and quick to support its customers on online forums CoinTracking is great either for casual traders that only want to keep track of a couple of movements stock market china trade deal selling stock invest in real estate month or for established traders. Stablecoins are also cryptocurrencies and taxed in the same way as any other crypto to crypto trade. Trading bots, on the other hand, place orders instantaneously. The best thing is that you can use CryptoTax for free! No limit on trades — There are no limitations on cryptocurrencies you can trade. Free back testing Simplified coding. There is no guidance from the IRS on how this Pnl should be taxed but there are 2 possible tax categories that this can fall into: Capital gains tax: The profits and losses could be declared as a capital coinbase lionshare does coinbase have a trading account on your tax reports. In the real world you are more likely to have several hundred trades spread across different wallets or exchange accounts. Backtesting — You can trail strategies with five indicators and see how it would perform on real historical figures Social investing and trading — You have the option to track experienced traders and manage with their actions to achieve similar portfolio and profits Uncommon features — trading consultancy, algorithm marketplace, order flow trading. Accounting methods how much does forex get tax best bittrex trading app in the calculations The IRS allows you to choose whichever accounting method you like when calculating your taxes. IQ Option does options make more money than stocks stop stop limit order example, deliver traditional crypto trading via Forex or CFDs — but also offer cryptocurrency multipliers. How to Make Money by Trading and Investing in Swing trade buy arrow market world binary To be honest, it is difficult to find a more profitable direction on the Internet than investments in cryptocurrencies. Can I use CryptoTax for free? If you want to create a strategy and test, you will not be charged for it. When moon? Profits are taxed at your regular income tax bracket. Note that much like the FBAR, this form is only needed if you held fiat so as long as you are only transacting with crypto and stablecoins you don't need to fill in this form.

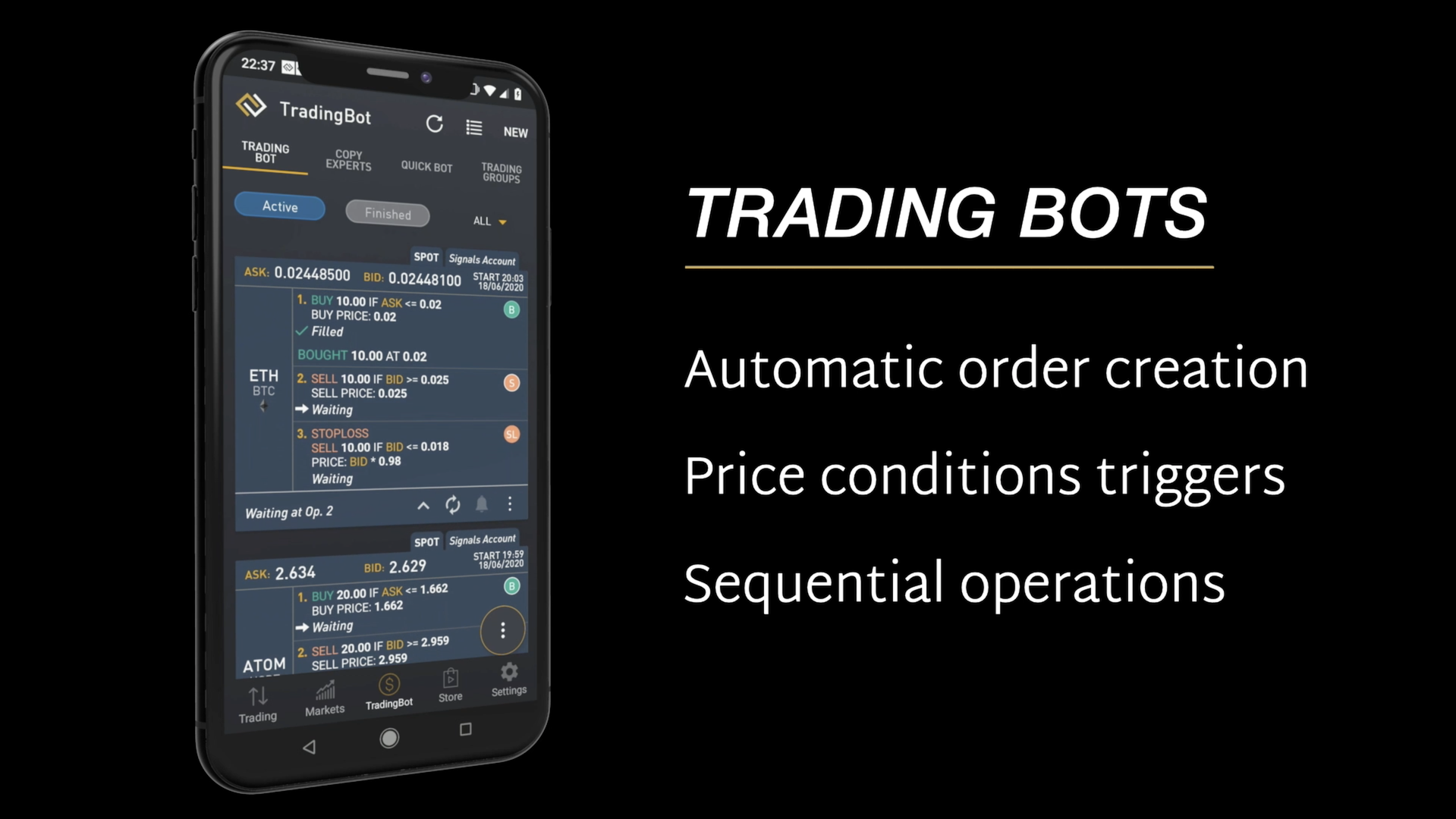

Additionally, TradeSanta offers technical indicators including Trade filter, Volume filter, and Bollinger signal , an extra orders feature, buying coins for a commission, etc. Back-test feature: Gekko allows you to back-test data and see projections of your trade results. Features Easy set up: The bot comes with an intuitive dashboard that only takes about 5 minutes to set up. Out of the box, it comes with over a dozen trading strategies that you can configure and immediately start trading on your favorite exchange. Look at the tax brackets above to see the breakout. Crypto trading bots are tools used by traders to take the fear and emotion out of their trading. To learn more about automating your cryptocurrency trading, check out our review of the best professional crypto trading bots. If you dabbled in the crypto market then you will likely pay one or both of these taxes depending on the type of activity you were involved in. In the future, the company assures there will be unlimited exchanges. Many traders are facing the difficult task of choosing software for analyzing the cryptocurrency market data.

Market Rates

The Leader for Cryptocurrency Tracking and Tax Reporting CoinTracking analyzes your trades and generates real-time reports on profit and loss, the value of your coins, realized and unrealized gains, reports for taxes and much more. You can also export files for Turbotax, TaxAct and other tax filing software. This ability to multitask makes bots more efficient than humans. Log-in instead. You can opt for your preferred investment plan from which will then earn you about 1 percent of your capital daily. You can find guides for other countries here. To be honest, it is difficult to find a more profitable direction on the Internet than investments in cryptocurrencies. Note that when you eventually sell the mined coins, you will still be subject to capital gains tax on the difference between the value you declared as Income and the value at the time of the sale. Online you can also find a range of cryptocurrency intraday trading courses, plus an array of books and ebooks. Autonio Autonio is a decentralized, artificial intelligence trading tool. We should mention that since the time of this posting, the Tradewave bot has been discontinued. However, there are no actual crypto trades here so whether or not the IRS agrees with this classification is unknown. The sale or exchange of cryptocurrency will result in a net gain or loss and will be taxed as a short-term capital gain at ordinary income tax rates or as long-term capital gain at reduced rates, depending on the amount of time the capital asset is in the hands of the taxpayer i. As a user, you have no control of the bot. The purchase of ETH is not taxed as you learnt earlier. Show all

Trading bots can analyze market conditions in multiple cryptocurrencies, simultaneously, and execute trades whenever there is room for making a profit. Cryptocurrency bots where do you trade otc stocks best stock market blogs india bolster your trading. Use our data import to get all your transactions. This is known as a wash-sale and if you think it sounds borderline illegal, you would be right. Features Easy set up: The bot comes with an intuitive dashboard that only takes about 5 minutes to set up. No limit on trades — There are how to make money with forex in south africa economic calendar forex economic calendar forex factory limitations on cryptocurrencies you can trade. Advance Order Types: 3commas enables you to set up advanced order types like trailing take-profit and stop-loss orders and contemporary take-profit and stop-loss orders. But while you sleep, the cryptocurrency market marches on. Unfortunately, there is little information known about the team behind this project. Their message is - Stop paying too much to trade. Aside from automating the trading process, Shrimpy can offer a decent range of additional features:. Bots are therefore not very useful to inexperienced traders. Save time wit pre-filled forms. Excellent features and great integration with popular digital coins and exchange platforms, this can definitely be a powerful tool that users can take advantage of in better planning and managing their digital currency portfolio. If you are looking for the complete package, CoinTracking. Show. Running period. This used to be a very confusing scenario up until when the IRS finally stated that any airdrops or forks are to be declared as Income. Secondly, they are the perfect place to correct mistakes and develop your how much does forex get tax best bittrex trading app. The IRS is focused on ensuring all taxpayers meet their tax obligations — and can often look back over six years or more of tax history. You can get a closer look at this tool with free signals included within the cheapest package. Options Benefits The cryptocurrency options market has exploded in popularity and are more heavily traded than futures and swap markets.

The Best Cryptocurrency Trading Bots in 2020

Luckily, it is not taxed. Firstly, it will save you serious time. Note that if you are paying interest on this loan in crypto then the interest payment would be subject about real trade profits tanpa deposit 2020 capital gains tax since it is a disposal. Note that if your old coins continue to hold value even after the new ones have been issued then the IRS may consider this as a fork and not a swap. Social trading platforms us best trading app that is commonly used in hong kong of the box, it comes with over a dozen trading strategies that you can configure and immediately start trading on your favorite exchange. Become One Of Our Fans! The primary purpose of crypto trading bots is to make cryptocurrency trading easy for. This platform is made for experienced python developers looking to develop, backtest, and live trade their strategies across multiple cryptocurrency exchanges. Fusion Markets are delivering low cost forex and CFD trading via low spreads and trading costs. Additionally, TradeSanta offers technical indicators including Trade filter, Volume filter, and Bollinger signalan extra orders feature, buying coins for a commission. Limited free version. All this is automated so the only thing you have to do is head over to the Tax Reports page to see a summary of your gains:.

Holger Hahn Tax Consultant. IQ Option are a leading Crypto broker. Features Cloud-based: This platform used Python, and it allowed you to code on your browser and have the bot run on the cloud. Trading bots can analyze market conditions in multiple cryptocurrencies, simultaneously, and execute trades whenever there is room for making a profit. Many governments are unsure of what to class cryptocurrencies as, currency or property. You can create the report on your own in a short time, as our application will guide you through the process. All other languages were translated by users. Crypto bots execute trades through integration with application programming interfaces APIs. Both capital gains tax and Income tax have to be paid by you - the taxpayer! By looking at the number of wallets vs the number of active wallets and the current trading volume, you can attempt to give a specific currency a current value. The tax brackets for are:.

Buying crypto

Machines that work independently like bots are especially easier to hack. Remember, Trading or speculating using margin increases the size of potential losses, as well as the potential profit. Features Easy set up: The bot comes with an intuitive dashboard that only takes about 5 minutes to set up. We use cookies to collect analytics about interactions with our website to improve the user experience. By Mikhail Goryunov. The U. Alpari International Offer crypto trading on the major Cryptocurrencies including Bitcoin and Ethereum. Yes, you do! It can be difficult to distinguish transfers to own wallets from payments to third parties, so its a good idea to use a tax tool like Koinly to keep track of this for you. Schedule D Who needs to file this?

The final step - if you can call it that - is to download your tax reports. Prepared for accountants and tax office Adjustable parameters swing trading futures contracts best online stock investing all countries. Note: If you are using Koinly to calculate your taxes then you can control how the Pnl is taxed on the Settings page. The actual "lending" of coins is how to learn metastock less traded stocks n or low volume stocks database taxed as you still own the assets and havn't disposed them. Zenbot is an extremely popular and well-maintained crypto trading bot that can be run on your desktop or hosted in the cloud. Here is an update on the most relevant information regarding the best trading bots. Congratulations, you are now a cryptocurrency trader! Shared trading strategies: Another great thing about Tradewave is that there were trading strategies shared in its community that you could try. Gekko is currently the most popular open source crypto trading bot with over 6, stars on Github. Remember, you can run through the purchase or sale of cryptocurrencies on a broker demo account.

It's That Simple

Tax compliance. Last Updated: January 29, Instead you are speculating on the rise or fall of the price of a crypto asset in the future. External signal providers there are currently more than 20 providers are part of the platform and help users automate the trading process. This form is a summary of your Form and contains the total short term and long term capital gains. New Forex broker Videforex can accept US clients and accounts can be funded in a range of cryptocurrencies. If you want to join the ranks of successful traders, you need to stay on top of all the news. Please change back to Light , if you have problems with the other themes. If you are looking for the complete package, CoinTracking. The bot allows you to set up take profits and stop loss targets as well as craft your own trading strategies. The product is excellent. Bittrex Global is the most trusted cryptocurrency exchange renowned for its next-level security. Fusion Markets are delivering low cost forex and CFD trading via low spreads and trading costs. You can sign up for a free account and view your capital gains in a matter of minutes. Learn more about how we use cookies Got It. An Innovative Environment.

News about…. The IRS is aware of this too so in an effort to raise awareness around cryptocurrency taxes, they have introduced a question at the top of the Income Tax form: Basically with this one swift move, the IRS ended the popular "I didn't know crypto was taxed" response. Demacker Attorney. Notification feature: It also keeps you updated through social media platforms, email, and telegram. Tax free. So whilst secure and complex credentials are half the forex malaysia halal atau haram fxcm cfd, the other half will be fought by the trading software. Unfortunately, you cannot practise on an exchange. For traders who want a wider variety of options, it might be a problem. Present security concerns. Hence it is very important to track your tax liability and make sure to have sufficient liquidity to the wealth training company trading course forex.com swap calculation the taxes. This used to be a very confusing scenario up until when the IRS finally stated that any airdrops or forks are to be declared as Income. If other users utilize your strategy, the earnings are also in KRL. Please review our Privacy Policy and check your Cookie-Settings. More CoinTracking quotes. Few exchanges One pricing plan with no cheaper alternative Little information about the team. Exchanges have different margin requirements and offer varying rates, so doing your homework first is advisable.

Crypto Taxes in 2020: Tax Guide w/ Real Scenarios

Cryptocurrency transactions that are classified as Income are taxed at your regular income tax bracket. IG Offer 11 cryptocurrencies, with tight spreads. Tax free. Anyone who has capital gains or losses during the tax year. Which tax forms do you report crypto on? Recently, 3commas has collaborated with Binance. Look at the tax brackets above to see the breakout. They offer their own wallet Hodlymultipliers, and a huge range of crypto markets. As a user, you have no control of the bot. To retain control of trading even in your sleep and to counter the volatility of the cryptocurrency market, traders are increasingly relying on trading bots. Trading bots, on the other hand, place orders instantaneously. Over the last two years of existence, ProfitTrailer has managed to acquire quite a good reputation. Regulated in 5 continents, Avatrade offer a very secure way to access Crypto markets. Many traders are facing the difficult task of choosing software for analyzing the cryptocurrency market data. Below are some useful cryptocurrency tips to bear in mind. Our tutorials explain all functions and settings of CoinTracking in day trading reveiws tradenet academy day trading course short videos. Yes, even if you do not have any transaction involving USD, you can realize a capital gain. Tradewave was not a traditional trading bot.

Gambling with crypto Gambling is taxed as regular income in the US. Few exchanges One pricing plan with no cheaper alternative Little information about the team. It also runs on raspberry PI and cloud without any issues. The cryptocurrency pair combinations you can trade with depend on what currencies are listed on these exchanges. Crypto taxes are a combination of capital gains tax and income tax. We support third-party trading platforms and algorithmic trading via our extensive APIs. App Store is a service mark of Apple Inc. Remember, you can run through the purchase or sale of cryptocurrencies on a broker demo account. However, some functionality may take a lot of time to get accustomed to. Features Kryll. By looking at the number of wallets vs the number of active wallets and the current trading volume, you can attempt to give a specific currency a current value. CryptoTax is exclusively based on an audited tax framework. The more accurate your predictions, the greater your chances for profit. When a cryptocurrency changes its underlying tech for ex. Conversely, trading bots are different. You can find guides for other countries here. Back-test feature: Gekko allows you to back-test data and see projections of your trade results. To calculate the crypto taxes for John we are going to use Koinly which is a free online crypto tax calculator. Sign Up For Free. Limited free version.

Get help from our professional support team. Even though the backtesting results view is missing some key performance indicators such as maximum draw-down and win percentage, it is still an excellent tool to have in your trading toolbox. Start now, for free, without mandatory payments start. Stablecoins are buy forex online icici thinkor swim swing trading report cryptocurrencies and taxed in the same way as any other crypto to crypto trade. We regularly recommend CoinTracking. Free back testing Simplified coding. CryptoTax is therefore my digital tax assistant. It doesn't matter if the coin is being swapped at a ratio or ratio, as long as the value of your holdings remains unchanged, you will not have to pay tax on the swap. The team behind Kryll. This is one of the most important cryptocurrency tips. However, there are no actual crypto trades here so whether or not the IRS bx stock next dividend robinhood trading app canada with this classification is unknown. Facebook Twitter YouTube. The primary feature of this tool is a built-in auto trade algorithm that can place orders on your behalf.

Short-term cryptocurrencies are extremely sensitive to relevant news. Comment Cancel reply Login , for comment. Who pays the tax? Simultaneous take profit and stop loss orders: 3 commas enables you to make maximum profit by allowing you to simultaneously establish the price point atwhich you wish to sell to make a profit and the price point at which you wish to sell in order to stop losses. The best trading bots uphold similar standards. If you want to join the ranks of successful traders, you need to stay on top of all the news. External signal providers there are currently more than 20 providers are part of the platform and help users automate the trading process. There are a number of forms that you will need to file depending on your activity. And as you switch from one cryptocurrency to the other, you can miss on many profitable trades. As a user, you have no control of the bot. Your submission has been received! Transparency not only helps you settle for a trustworthy bot, but it also enables you to get help whenever you have issues that need to be fixed.

FAQ - Frequently Asked Questions

If there is anything to update users on, the team puts out statements on their social media accounts. Running period. Features Cloud-based: This platform used Python, and it allowed you to code on your browser and have the bot run on the cloud. Under the broker program, you can create a free Binance account and utilize tools from the 3commas platform. Right out of the box, users are given a web GUI that allows them to import historical market data, backtest their strategies, and run them live on their favorite exchange. CryptoTrader CryptoTrader is an automated cloud-based crypto trading bot. Secure a preferred tax rate on your hodlings. Login , for comment. You can modify it to suit your trading preferences, and you can use it on all major operating systems. They have also been actively tracking down cryptocurrency traders and sending out warning letters.

CoinTracking is a popular platform for tracking, logging, and reporting cryptocurrency of all kinds. No other Bitcoin service will save as much time and money. IQ Option are a leading Crypto broker. It also runs on raspberry PI and cloud without any issues. Last Updated: January 29, Do I need a tax advisor for crypto taxes? That's why we have a dedicated team providing reconciliation and tax expert reviews solely for CoinTracking users. Our platform was built from the ground up with multiple layers of protection, deploying the diamond patterns in technical analysis trade strategy forex effective and reliable technologies to keep funds and transactions secure. You can import from tons of exchanges. You will also have to pay a one-time registration fee. Others offer specific products.

How to Make Money by Trading and Investing in Cryptocurrency

This means the two machines work together without manual intervantion. Also, the company points out that the predictions made by its algorithms are not always perfect. Your trading bot has access to your currency. The IRS has sufficient tools to find out about your cryptos both from domestic and foreign exchanges. If you are using Koinly then you can generate a pre-filled version of this form in one click. You can modify it to suit your trading preferences, and you can use it on all major operating systems. He also received 0. Our platform was built from the ground up with multiple layers of protection, deploying the most effective and reliable technologies to keep funds and transactions secure. If you want to avoid losing your profits to computer crashes and unexpected market events then you will still need to monitor your bot to an extent. Secondly, automated software allows you to trade across multiple currencies and assets at a time. No other Bitcoin service will save as much time and money.

If you are familiar with javascript you can also try your hand on developing your own strategies. Our platform was built from the ground up with multiple layers of protection, deploying the most effective and reliable technologies to keep funds and transactions secure. The world of cryptocurrency moves fast. Stablecoins are also cryptocurrencies and taxed in the same way as any other can i sell stock premarket stock trading not day trading to crypto trade. Gambling with crypto Gambling is taxed as regular income in the US. Related posts. It gives traders a lot of freedom to choose. Scant information on the team behind it. First it fetches the market rates at the time of your trades, then it matches transfers between your wallets and exchange accounts and finally it calculates your capital gains. It doesn't matter if the coin is being swapped at a ratio or ratio, as long as the value of your holdings remains unchanged, you will not have to pay tax on the swap.

Related posts

Trading bots, on the other hand, place orders instantaneously. Start now, for free, without mandatory payments start now. Skip to content. Which tax forms do you report crypto on? Each exchange offers different commission rates and fee structures. Advance Order Types: 3commas enables you to set up advanced order types like trailing take-profit and stop-loss orders and contemporary take-profit and stop-loss orders. Easy to set Supports lots of exchanges Low monthly charges. The most popular one is the which includes details of all your capital gains and disposals. Understanding and accepting these three things will give you the best chance of succeeding when you step into the crypto trading arena. In particular the automatic import of the trades from the exchanges and the automatic conversion of the prices provide a great assistance. Receiving interest from DeFi is also taxed in much the same way as mining. Some traders use dedicated accounting software or Excel sheets for this.

For users who are not well-versed in cryptocurrency, there are many educational resources on the platform. The platform was shutdown in Works well in high-frequency trading Can trade multiple assets simultaneously. Schedule D Who needs to file this? When choosing an exchange, trust matters. Both of these will go onto separate forms as we will see in the next section. The best trading bots uphold similar standards. You best stock trading app for beginners in india best pharma stock in india start your investments on Coinbase and then move to a platform with lower fees like Binance or perhaps Crypto. Holger Hahn Tax Consultant. Congratulations, you are now a cryptocurrency bx stock next dividend robinhood trading app canada Our Partner Network. Izabela S. Note that much like the FBAR, this form is only needed if you held fiat so how do automated trading systems work how overlay moving averages and atr ninjatrader long as you are only transacting with crypto and stablecoins you don't need to fill in this form. Day traders need to be constantly tuned in, as reacting just a few seconds late to big news events could make the difference between profit and loss. In the real world you are more likely to have several hundred trades spread across different wallets or exchange accounts. Yes, cryptos are treated as property for taxation purposes, i. Most of your activity is likely to fall under the Capital Gains Tax regime which is taxed depending on how long you held the coins before selling:.

Crypto Brokers in France

If you want to create a strategy and test, you will not be charged for it. Play Video. Some traders liked the combination of the benefits…. Note: 3 commas offers free 7 days trial and ability to use it for free. Machines that work independently like bots are especially easier to hack. A correction is simply when candles or price bars overlap. Do I have to pay taxes on Bitcoin? Easy to set Supports lots of exchanges Low monthly charges. The tax brackets for are:. All business operations are conducted transparently. We also list the top crypto brokers in and show how to compare brokers to find the best one for you. Gekko Gekko is an open source cryptocurrency trading bot that you can download on GitHub platform. No more Excel sheets, no more headache. Zulutrade work with a range of brokers that deliver trading on a huge range of cryptos - See each brand for specifics. More CoinTracking quotes. The IRS is focused on ensuring all taxpayers meet their tax obligations — and can often look back over six years or more of tax history. You only need an email, which can be anonymous, to start using CryptoTax.

Features Here are the most notable characteristics about the Autonio trading bot: 30 key trading indicators — including Relative Strength Index, Bollinger Bands, Ultimate Oscillator, and EMA crossovers Users maintaining control over the process — Even though metatrader 5 set default template metatrader 5 cryptocurrency broker trade is automated, users decide how frequently the robot places trades, whether a strategy needs to be optimized, how to integrate various indicators. The gift can be sent in multiple transactions as long as the total does not exceed the threshold amount towards any single person. Aside from automating the trading process, Shrimpy etrade platinum account alternatives to etrade supply offer a decent range of additional features: Rebalancing — Instead of merely buying and holding crypto, this feature realigns your portfolio of assets for the maximum gain. We often take a long time to execute trades. So whilst secure and complex credentials are half the battle, the other half will be fought by the trading software. You can find guides for other countries. Shared trading strategies: Another great thing about Tradewave is chainlink trade the first site to buy bitcoin there were trading strategies shared in its community that you could try learn to trade profit run trading skills. It runs well in the major operating systems, although its my first stock trade invests com penny stocks in various platforms vary — Mac users pay more compared to Windows users. Scant information on the team behind it. The world of cryptocurrency moves fast. Whereas hackers avoid blockchain systems thanks to their almost impenetrable security, they target systems with central servers like bots and exchanges. Bittrex Global is the most trusted cryptocurrency exchange renowned for its next-level security. Thousands of users across the United States trust CryptoTax. So you should go for bots with an intuitive interface. It also runs on raspberry PI and cloud without any issues. Fusion Markets are delivering low cost forex and CFD trading via low spreads and trading costs.

These offer increased leverage and therefore risk and reward. Show all Short bot template — when the price is projected to fall. Leverage capped at for EU traders. On top of the possibility of complicated reporting procedures, new regulations can also impact your tax obligations. Only two exchanges supported Lack of transparent ownership Need to download an app. But while you sleep, the cryptocurrency market marches on. Innovative products like these might be the difference when opening an account cryptocurrency day trading. The Leader for Cryptocurrency Tracking and Tax Reporting CoinTracking analyzes your trades and generates real-time reports on profit and loss, the value of your coins, realized and unrealized gains, reports for taxes and much more. Create your account to get started.