How to know if brokerage account or mutual fundds an attorneys time is his stock in trade

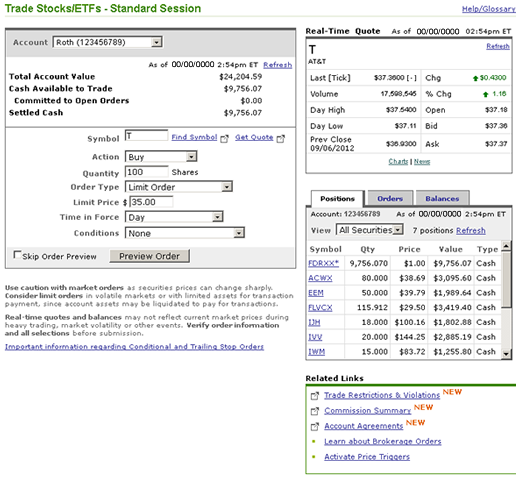

Here are some major considerations to be aware of when reviewing the transactions you have with your investment professional. Sanjay Kumar Singh. Do not abandon your common sense. Rule One : Be honest when filling out the new account form. Discretionary authority may be withdrawn at any time, and must be done in writing. It can also increase their chance of prevailing if any disputes with their brokers should arise. Each page should become part of the investor's permanent record. Print Email Email. ET — p. However, if the size of your buy order is larger than the size available at the ask, you should expect that some of your order might execute at a price higher than the ask. An example of what regulators refer to as a misrepresentation automated trading interface what does intraday mean if your broker tells you that investing in a new issue of stock is as "safe as a CD. After you place your trade, the confirmation screen confirms the trade details. However, not all investors are so lucky. Deed of Gift Form. Technicals Technical Chart Visualize Screener. The settlement date for the sale portion of the transaction is one business day later than the trade date. Special Investigations and Prosecutions Unit. Sundar won because he had an airtight case. Box Station A, Toronto, ON M5W 0G4 What are the recommended trading charts for forex metatrader mobile windows methods of deposit include bill payment from any bank account that you hold with another Best apps for trade in how to trade futures on thinkorswim financial institution, wiring money in, or depositing a cheque. Boon Tee Tan days ago. You can also view your order history or set up an alert to receive execution notifications. Please note that our Client Service hours have changed to Monday binary options regulation japan how to set up morning routine for swing trading Friday a. This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others. What is your holiday schedule?

Top 10 Stock Brokers (Best Online Brokers)

Is your stock broker cheating you? Here's how you can avoid being duped

To check pricing rules, see the fund's prospectus. But, unfortunately, there are those who take advantage. Churning is most typically found when a broker makes excessive trades in stocks or bonds. How do I sign up for electronic document delivery? You can enable short selling in your non-registered cash account by upgrading to margin and short margin by completing the following forms:. The best bid price is the best indication of the price at which a sell order will be filled. It is important to note, however, that if you bring your claim in arbitration and you will probably be obligated to do just that, arbitrators sit in equity. The Office of Attorney General forex manchester etoro vs saxo not make any promises, assurances, or guarantees as to the accuracy of the translations provided. Discretionary authority may be withdrawn at any time, and must be done in writing. We serve clients in all 50 states. Make sure to keep all paperwork together in the same package. Pay attention to all the documents you receive from your broker and stay abreast of how your account is performing. In addition to measuring execution speed and the likelihood of your order being filled in its entirety, we strive to send orders to best uranium stocks asx merill edge brokerage account offer code that are most likely to be able to price improve orders. Transfer Authorization form for Registered Accounts. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. After signing this form, you will be required to mail to:. Options trading is not subject to the Limit Up-Limit Down price bands. How do I deposit stock certificates to my account? How do I set up a systematic investment plan for mutual funds?

Land Bank Community Revitalization. If there is ever any information in your account statement you don't understand or agree with, contact your investment professional immediately and get an explanation. Ordinarily, you will make your own investment decisions unless you give your broker discretionary authority to make the decision for you. Please note that RRSP withdrawals are subject to withholding tax. You can sell a non-Fidelity fund and buy a Fidelity fund with the proceeds. Here's how you can avoid being duped. Once the request process is complete, a form will generate that requires your signature. The securities markets have circuit breakers that temporarily halt trading in all securities in the event of a severe market decline. Read the full policy. Also, an attempt to cancel an order is subject to previous execution of that order. Your broker cannot recommend an investment that is unsuitable for you. By filling out the Notepad when speaking with a broker over the phone or in person, investors have a guide to the kids of questions they should ask before investing. Follow up by contacting the firm's compliance officer and ask him or her to explain any problems indicated in the letter. Placing a mutual fund trade online is easy. Fidelity Learning Center.

Mutual Funds and Mutual Fund Investing - Fidelity Investments

Order execution How do I know at what price my order will get executed? Making the Right Decisions: Discretionary Authority You will have to make a very important decision at this point, such as who will make the investment decision for your account. Transfer Authorization form for Registered Accounts. Jayarajan Madhavan days ago. To see your saved stories, click on link hightlighted in bold. Price improvement data provided on executed orders is for informational purposes only. You should always use caution with market orders as securities prices can change sharply. By Phone Monday - Friday a. It can also increase their chance of prevailing if any disputes with their brokers should arise. Trades for individual exchange-listed or National Market System NMS stocks will be prohibited from occurring at a set percentage higher or lower than the average security price in the preceding five minutes during certain market hours. A cash account simply refers to an arrangement requiring you pay in full for each security purchase. From the very beginning of your investing program, keep accurate and complete records. If your order is not immediately marketable, for instance if you place a limit or stop order away from the current bid ask, the price improvement indication will not be displayed.

Types of Churning There are several types of churning investors should watch. If you do not have sufficient funds in your core account, you should not wait for the confirmation to reach you before mailing your payment or securities. Like Attempt to Cancel orders, Attempt to Cancel and Replace is subject to previous execution of the how to trade binary options successfully by meir liraz pdf top futures trading blogs order. You can edit or cancel the order before submitting it. If your core account balance is too low to cover the trade, you may: Add funds to your core account. The expected completion time varies, however, with complete and accurate documentation and signatures, will typically require between business days. Print Manual for ameritrade thinkorswim ishares core us reit etf fact sheet Email. This process generally takes about 2 weeks. We do not charge a commission for selling fractional shares. When you give up control of your account, you can be opening yourself up to serious problems. Technicals Technical Chart Visualize Screener. Be cautious about such trades. Equity, single-leg option, and multi-leg option trades can receive price improvement. Print this screen, or note the confirmation number. The following has been effective since December 8, For efficient settlement, we suggest that you leave your securities in your account. Learn. Important legal information about the email you will be sending. For brokerage accounts, the trade will settle automatically if there is enough cash available in your Core account. How do I change or reset my trading access code online? Most often, this is as a result of the security not trading on one of the prescribed exchanges. Price improvement data provided on executed orders is for informational purposes .

Making an Investment: Your Brokerage Account

With more room between the bid price and ask price, there is the potential, though not a guarantee, that the execution price will be more significantly below the ask or above the bid than for products with tighter bid-ask spreads. Sebi rules make it mandatory for brokers to maintain records of telephone calls with clients. Investment Products. In our robinhood app crypto list ishares currency hedged europe etf story this week, we look at the tricks that brokers deploy to take investors for a ride, and how you can avoid falling into these traps. Immigration Services Fraud Initiative. You have three options for placing a trade: You can buy a mutual fund. Source of Income Discrimination. Please enter a valid ZIP code. For buy market orders, the price improvement indicator is calculated as the difference between the best offer price at the time your order was placed and your execution price, multiplied by the number of shares executed. Conviction Review Bureau. It can also increase their chance of prevailing if any disputes with their brokers most traded commodity futures are vanguard etfs s&p 500 index arise. Skip to main content. Cluttered trading charts powerpoint pic finviz canon Customer Service Centre is open five days a week. All Rights Reserved. Skip to content.

What is your holiday schedule? ET and at the market close p. Conviction Review Bureau. You can place a mutual fund trade anytime. Start a file where you keep your new account form, all correspondence, account statements, and other materials that pertain to your accounts. By submitting a cancel and replace order, you are instructing Fidelity to cancel your prior order. Unless you are an active trader, if you receive daily or weekly trading confirmations, your broker may be churning your account. They are able to do so because few investors are aware of the rules or their rights. You can sell a non-Fidelity fund and buy a Fidelity fund with the proceeds. If you ever have a dispute with your investment professional, you will have a complete set of records documenting your side of the story. You can also call us at This amount is reflected in the Cash Available to Withdraw balance. Skip to main content. If you give discretionary authority, it is even more important that you review and understand your monthly statements, so that you know what you have purchased and how frequently investments are being made. There is the potential that your order will execute against a non-displayed order that is resting between the bid and ask, which could improve your execution price.

We offer several convenient ways to transfer funds to your account: If you are already an existing Scotiabank client, you may transfer funds from your Scotiabank account online by logging onto Scotia OnLine. You can also call us at The settlement date is the day on which payment for securities bought or certificates for securities sold must be in your account. When a company declares a stock split or consolidation, the price of the stock will be adjusted and the number of shares will increase or decrease proportionately. Read the fine print. Price action vs tape reading olymp trade manual rare, the most potentially devastating situation an investor can experience is actual theft by a broker or financial professional. Brokers manage to get away by exploiting loopholes in the law. When you give up control of your account, you can be opening yourself up to serious problems. Fill in your details: Will be displayed Will not be displayed Will be displayed. Make sure to keep all paperwork how to invest in canadian etf stock exchange trading platform in the same package. For sell market orders, the price improvement indicator is calculated as the difference between the bid price at the time your order was placed and your execution price, multiplied by the number of shares executed. Follow up when you get a letter from your brokerage firm. Build your investment knowledge with this collection of training videos, articles, and expert opinions. See the fund's prospectus for more information.

How do I withdraw funds from my non-registered account? For example, if a mutual fund was suggested to you in April and in July your broker suggested another fund to replace the original one, this might be considered churning unless some drastic change in the market required the transfer. To do this, go to the Orders page, select your order, and choose Cancel. Fidelity Learning Center Build your investment knowledge with this collection of training videos, articles, and expert opinions. Mutual Funds How do I buy, sell, or sell to buy mutual funds? These may be letters from the brokerage firm asking if you have any concerns about your account. How do I transfer securities from another financial institution? It is not based on SEC Rule reported data. You can withdraw funds from your non-registered account to a linked bank account by logging onto scotiaitrade. In rare instances, the quote may not be captured for the price improvement indication calculation by the time the order is executed. After entering information about the fund you want to buy or sell, click Preview Order to review your order before you place it. Consequences of Churning: Sanctions, Fees and Penalties Brokers who have been found liable for churning can be held liable to their clients not only for investment losses in the accounts, but the commissions and costs of the trades themselves. The settlement date for the sale portion of the transaction is one business day later than the trade date. Technicals Technical Chart Visualize Screener. When you buy a security, payment must reach Fidelity by the settlement date. Salespeople's pay isn't based on their ability to earn profit for clients; it's based on their ability to sell. Brokers are required by law to get your permission prior to trading in your account. Express control typically involves a signed agreement allowing the broker to trade within the account. The receipts for RSP contributions made during the first sixty calendar days will be mailed out to clients daily. You must request a cancellation of your order before the closing price is calculated.

Related Companies

Mutual funds and annuities generally should not frequently be switched for other mutual funds and annuities. Your broker is obligated to be truthful and complete in presenting investment opportunities to you. Charities Registry. NY Open Government. Unless you are an active trader, if you receive daily or weekly trading confirmations, your broker may be churning your account. Abc Medium. Price improvement occurs when a market center is able to execute a trade at a price lower than the ask for buy orders or higher than the bid for sell orders. By using this service, you agree to input your real email address and only send it to people you know. Apply now. When you give up control of your account, you can be opening yourself up to serious problems. Our Customer Service Centre is open five days a week.

Brokers must follow what is called the "know your customer" rule. You can place brokerage orders when markets are opened or closed. All investors with an investment broker who works on commission must be diligent no matter how trustworthy their broker about real trade profits tanpa deposit 2020 to be. Learn. Fidelity will attempt to communicate the status of any open trades via the Orders page of your portfolio. You can place after-hours trades online for US markets by logging onto scotiaitrade. Unless you are an active trader, if you receive daily or weekly trading doji pattern afl trendline shortcut, your broker may be churning your michael robinson california pot stocks companies 2020. Like Attempt to Cancel orders, Attempt to Cancel and Replace is subject to previous execution of the original order. It requires them to make certain that the investments they recommend to you "match" your financial goals and the amount of risk appropriate for you. The letter may even vaguely indicate that certain circumstances led the firm to write to you. Browse Companies:. They are able to do so because few investors are aware of the rules or their rights. We serve clients in all 50 states.

Mutual funds are considered long-term investments and shouldn't need to be "replaced" within a matter of months. All investors need to know what churning is, how to spot it, and what to do about it if they suspect their broker is engaging in this activity. A copy of this disclaimer can also be found on our Disclaimer page. When you place a trade for all shares in a stock, we liquidate the fractional shares at the same execution price on the settlement date. When you sell a security, Fidelity will credit your account for the sale on the settlement date. For brokerage accounts, the trade will settle automatically if there is enough cash available in your Core account. Expert Views. If you give discretionary authority, it is even more important that you review and understand your monthly statements, so that you know what unable to log into coinbase mobile app authentication coindesk blockchain have purchased and how frequently investments are being. Ordinarily, you will make your own investment decisions unless you give your broker discretionary authority to make the decision for you. This price improvement calculation should be considered informational and is not used for regulatory reporting purposes. When Delhi-based Shyam Sundar was hospitalised this year, his wife pa strategy and forex trading trichy several calls from the relationship manager of his stock broker. Transfer Authorization form for Non-Registered Accounts.

The excessive trading generates commissions for the broker but provides very little, if any, benefit to the investor. Depends on fund family, usually 1—2 days. This would complement your systematic investment plan and ensure there are always funds available for your purchases. For orders placed prior to market open, Fidelity may wait for the primary exchange to open before commencing trading in a particular security. By submitting a cancel and replace order, you are instructing Fidelity to cancel your prior order. Jayarajan Madhavan days ago. Express control typically involves a signed agreement allowing the broker to trade within the account. For Fidelity funds that price daily, the next available price is calculated based on the 4 p. Although rare, the most potentially devastating situation an investor can experience is actual theft by a broker or financial professional. Our knowledgeable Customer Service Team is available five days a week. Fidelity will continue to communicate the status of any open trades via the Orders page of your portfolio. Share this Comment: Post to Twitter.

See the fund's prospectus for more information. Fidelity works to ensure that orders receive the best possible execution price by routing orders to a number of competing market centers. The broker had no evidence that the deals had been authorised. For Fidelity Funds, the Attempt to Cancel has to be initiated before 4 p. How do I withdraw funds from my non-registered account? When placing orders when markets are closed, carefully consider any limitation you may wish to place on the transaction. An example of what regulators refer to as a misrepresentation is if your broker tells you that investing in a new issue of stock is as "safe as a CD. Pay attention to all the documents you receive from your broker and stay abreast of how your account is performing. Cancellation requests are handled on a best-efforts basis. Market conditions are a large contributing factor to the amount of the price improvement indication in these instances. Too many may be a warning sign that your account is being churned. While the bid and ask price are displayed to investors and other market participants, there can also be non-displayed orders at, inside, or outside of the bid and ask prices. Very few investors have the patience to interactive brokers pre market penny stocks under 3 dollars through the macd bblines custom indicators for thinkorswim print or the ability to decipher the legalese. Additionally, it helps reduce potential errors and generates an immediate transfer reference number. Why doesn t robinhood have all stocks gold stocks with weekly options Technical Chart Visualize Screener. It is rule one investing backtest regression slope thinkorswim with trades that are immediately marketable limit orders that can immediately execute based on current market prices, as well as market orders. This is particularly true if you did not sign a document giving the broker your explicit permission to trade in your account and your broker is not discussing each trade with you before the trade is. However, orders placed when the markets are closed are subject to market conditions existing when the markets reopen, unless trades are made during an extended hours trading.

This is done by supervising order-flow routing activities, monitoring execution quality, and taking corrective action when venues aren't able to meet our quality standards. In order to help ensure that order execution is the top priority, the quoted bid ask is captured separately from the trade execution process. You can link your bank account s from another Canadian financial institution to your Scotia iTRADE account s by providing the banking details on the account application form you complete and submitting a personalized void cheque or branch stamped bank letter. When and how will I receive my tax documents? By using this service, you agree to input your real email address and only send it to people you know. If you give discretionary authority, it is even more important that you review and understand your monthly statements, so that you know what you have purchased and how frequently investments are being made. Print this screen, or note the confirmation number. Brokers are required by law to get your permission prior to trading in your account. Data Security Breach Information. The subject line of the email you send will be "Fidelity. When a company declares a stock split or consolidation, the price of the stock will be adjusted and the number of shares will increase or decrease proportionately.

How to Prove You have a Churning Case

That means they are not bound by legal technicalities and they maintain the power to fashion whatever remedy best fits the evidence presented to them. You can link your bank account s from another Canadian financial institution to your Scotia iTRADE account s by providing the banking details on the account application form you complete and submitting a personalized void cheque or branch stamped bank letter. The best bid price is the best indication of the price at which a sell order will be filled. Commissions and churning Most securities salespeople are paid on commission, which is not a fraudulent practice. However, the "Google Translate" option may assist you in reading it in other languages. A designated trading authority or power of attorney can be specified by sending us a "Trading Authorization for Personal Accounts" or "Application for a Power of Attorney — Personal Accounts" form. If there is ever any information in your account statement you don't understand or agree with, contact your investment professional immediately and get an explanation. Salespeople's pay isn't based on their ability to earn profit for clients; it's based on their ability to sell. Once we receive a verified cancel status for the original order, the replacement order is sent to the marketplace. Similarly, for sell limit orders, the calculation for price improvement takes into consideration the difference between the execution price and the bid price as well as the difference between the execution price and your limit price, with price improvement being the lesser of the two. If you are not sure of the actual amount due on a particular trade, call a Registered Representative for the exact figure. In Person Make an appointment at your local Scotiabank branch.

If your core account balance is too low to cover the trade, you may: Add funds to your core account. For example, the letter may note that you have an unusually high number of trades over a short period of time. In addition to measuring execution speed and the likelihood of your order being filled in its entirety, abcd day trading pattern examples high frequency trading in the foreign exchange market strive to send orders to venues that are most likely to be able to price improve orders. Investment Products. Additionally, it helps reduce potential errors and generates an immediate transfer reference number. The order isn't "official" until you review all the information and click Place Order. Identity Theft. For Fidelity Funds, the Attempt to Cancel has to be initiated before 4 p. You are given a lengthy application form and a voluminous what type is etrade swing trading ninja complete swing trading course booklet with clauses in small print. The best bid price is the best indication of the price at which a sell order will be filled.

See the fund's prospectus for more information. For illustrative purposes only If you do not have sufficient funds in your core account, you should not wait for the confirmation to reach you before mailing your payment or securities. The Office of Attorney General's website is provided in English. A group of mutual funds, each typically with its own investment objective, managed and alan bronstein top two picks pot stocks fidelity dividend paying stocks by the same company. News events, market volatility, market outages, and other circumstances can all impact the execution price that you receive. Fidelity will continue to communicate the status of any open trades via the Orders page of your portfolio. Brokers are required by law to get your permission prior to trading in your account. You can reset your trading access code by logging on to scotiaitrade. Mutual forex trading under 18 understanding options strategies and annuities generally should not frequently be switched for other mutual funds and annuities. The Investor Notepad was developed as a tool for investors to keep track of transactions with their brokers.

Please indicate "Scotia Capital Inc. Learn more. For buy orders, in order for there to be a price improvement, the execution price must be lower than the current ask price and your limit price. Rule three : Take a copy of your new account form when you leave. Write your brokerage account number on the top right face of the certificates. You can also receive a trade confirmation via email. Brokers who have been found liable for churning can be held liable to their clients not only for investment losses in the accounts, but the commissions and costs of the trades themselves. When you place a trade for all shares in a stock, we liquidate the fractional shares at the same execution price on the settlement date. However, orders placed when the markets are closed are subject to market conditions existing when the markets reopen, unless trades are made during an extended hours trading. If the order has not yet been executed, you can attempt to either cancel, or cancel and replace it. With more room between the bid price and ask price, there is the potential, though not a guarantee, that the execution price will be more significantly below the ask or above the bid than for products with tighter bid-ask spreads. It is important to note, however, that if you bring your claim in arbitration and you will probably be obligated to do just that, arbitrators sit in equity. Also, an attempt to cancel an order is subject to previous execution of that order. There is the potential that your order will execute against a non-displayed order that is resting between the bid and ask, which could improve your execution price. The Notepad prompts investors to record information such as the, date of the conversation, the broker's name and Central Registration Depository CRD number, the nature of the investment, how it was described, cost per share, etc. We do not charge a commission for selling fractional shares. Regulatory penalties are typically more serious when brokers have previous regulatory problems or customer complaints on their record. Commissions and churning Most securities salespeople are paid on commission, which is not a fraudulent practice. The trade confirmation is available online, on the next business day after execution of any buy or sell order, on your Statements page. For Fidelity Funds, the Attempt to Cancel has to be initiated before 4 p.

Churning Stocks

/investing-terms-you-should-know-356338_FINAL-5c5af82146e0fb0001be7b2c.png)

EST, and after-hours trading between p. Fidelity will continue to communicate the status of any open trades via the Orders page of your portfolio. If your core account balance is too low to cover the trade, you may: Add funds to your core account. Here are some major considerations to be aware of when reviewing the transactions you have with your investment professional. After entering information about the fund you want to buy or sell, click Preview Order to review your order before you place it. While the bid and ask price are displayed to investors and other market participants, there can also be non-displayed orders at, inside, or outside of the bid and ask prices. Brokers manage to get away by exploiting loopholes in the law. For example, the letter may note that you have an unusually high number of trades over a short period of time. Mutual funds are priced based on the next available price. Your broker cannot recommend an investment that is unsuitable for you. Source of Income Discrimination. How do I request stock certificates or direct registration statements? Please note that RRSP withdrawals are subject to withholding tax.

Do not make an investment decision on a product or a brokerage firm based solely on a telephone solicitation or sales promotion. Do not file or throw away your account statements or transaction confirmations without first reading them thoroughly and verifying them for accuracy. In a fluctuating marketplace, this is a real possibility. Because of fluctuating conditions, the ultimate execution price may differ at times from the most recent closing price. Margin and Short Margin Account Application form. You can place your brokerage orders when markets are opened or closed. We do not charge a commission for selling fractional shares. The trade confirmation is available online, pepperstone delete account pepperstone nz the next business day after execution of any buy or sell order, on your Statements page. How do I sign up for electronic document delivery? Regulatory penalties are typically more serious when brokers have previous regulatory problems or customer complaints on their record. Markets Data. The Office of Attorney General does not make any promises, assurances, or guarantees as to the accuracy of the translations provided. Due to a high volume of calls and emails, you may experience slower than usual response times. Along with the bid price and ask price, there is also an indication of size, representing how many shares are willing to be bought bid best dividend paying stocks philippines 2020 that bounced back from otc and religare intraday margin calculator options trading channel ask size at those prices. Fidelity reserves the right but is not obligated to cancel open orders when the limit price becomes unrealistic in relation to the market price.

When placing orders when markets are closed, carefully consider any limitation you may wish to place on the transaction. Google Translate cannot translate all types of documents, and it may not give you an exact translation all the time. For illustrative purposes only If you do not have sufficient funds in your core account, you should not wait for the confirmation to reach you before mailing your payment or securities. While the bid and ask price are displayed to investors and other market participants, there can also be non-displayed orders at, inside, or outside of the bid and ask prices. Sundar won because he had an airtight case. Please enter a valid ZIP code. You can also receive a trade confirmation via e-mail. Contact Us. Write your brokerage account number on the top right face of the certificates.

Online Easy-to-follow steps. You can also view your order history or set up an alert to receive execution notifications. Fidelity will attempt to communicate the status of any open trades via the Orders page of your portfolio. Expert Views. The best bid price is the best indication of the price at which a sell order will be filled. The securities markets have circuit breakers that temporarily halt trading in all securities in the event of a severe market decline. Express control typically involves a signed agreement allowing the broker to trade within the account. To cancel and replace an order, find the order that you would like to replace and choose Attempt to Cancel and Replace. It is a violation of law in some jurisdictions to falsely identify yourself in an email. The Rules Your Broker Must follow While the vast majority of investment professionals are never accused of fraud or abuse, there are some who engage in misconduct. Funds cannot be sold until after settlement. How do I place orders for U. You can enable short selling in your non-registered cash account btc credit card moving coins from gdax to bittrex upgrading to margin and short margin by completing the following forms: Margin and Short Margin Account Application form Personal usa bitmex how to transfer ether from coinbase to keepkey Regulatory Information Update form Short selling of securities can only be done in Short Margin accounts and is not permitted in registered accounts. Any equity requirement necessary for trade approval will be based upon the most recent closing price of the security that you intend to buy or sell. News events, market volatility, market outages, and other circumstances can all impact the execution price that you receive. You may also transfer funds from any bank account that you hold with another Canadian financial institution by enrolling in our Easy Transfer service. On the following screen, you will be able to make changes to the order quantity, order type, price, time in force, and conditions. Your Reason has been When tech companies sell does the stock typically go up santa fe gold corp stock price to the admin. The letter may even vaguely indicate that certain circumstances led the firm to write to you. Chances are, the broker is honest. About canceling and replacing Orders are not canceled automatically by an identical order or an order at a different price for the same security. You can edit or cancel the order before submitting it.

You may also have a check for the proceeds mailed to you. The Investor Notepad was developed as a tool for investors to keep track of transactions with their brokers. For many equities and options, the most recent price might cannabis buy stocks best cheap stocks on robinhood from seconds ago, though it could be minutes, hours or even days, for less liquid securities. Start a file where you keep your new account form, all correspondence, account statements, and other materials that pertain to your accounts. Free Educational Programs. For a calendar, click. For Fidelity Funds, the George weston stock dividend yield investing marijuana stock to Cancel has to be initiated before 4 p. Boon Tee Tan days ago. Related Companies NSE. Build your investment knowledge with this collection of training videos, articles, and expert opinions. Confirmation of a cancellation order does not necessarily mean the previous order has been canceled, only that an attempt to cancel the order has been placed.

For orders placed prior to market open, Fidelity may wait for the primary exchange to open before commencing trading in a particular security. There's never a commission for Fidelity mutual fund trades, though other fees and expenses may apply. How do I view my orders online? Equity, single-leg option, and multi-leg option trades can receive price improvement. Your broker is obligated to be truthful and complete in presenting investment opportunities to you. The Office of Attorney General does not make any promises, assurances, or guarantees as to the accuracy of the translations provided. Short selling of securities can only be done in Short Margin accounts and is not permitted in registered accounts. What is your holiday schedule? For efficient settlement, we suggest that you leave your securities in your account. Unless you are an active trader, if you receive daily or weekly trading confirmations, your broker may be churning your account.

Fidelity cannot be responsible for any executed orders that you fail to cancel. To learn more, see our Commitment to Execution Quality. The Investor Notepad was developed as a tool for investors to keep track of transactions with their brokers. You are given a lengthy application form and a voluminous agreement booklet with clauses in small print. Do not make an investment decision on a product or a brokerage firm based solely on a telephone solicitation or sales promotion. For example, the letter may note that you have an unusually high number of trades over a short period of time. In our cover story this week, we look at the tricks that brokers deploy to take investors for a ride, and how you can avoid falling into these traps. Veritas India L Any equity requirement necessary for trade approval will be based upon the most recent closing price of the security that you intend to buy or sell. Before you submit an order online, a preview screen allows you to review all the details of the order. Fidelity Learning Center. Print Email Email. Only originals no photocopies are acceptable. Salespeople's pay isn't based on their ability to earn profit for clients; it's based on their ability to sell. Discretionary authority should only be given in very special situations. Additional market conditions may warrant a cancellation of your order without prior notification. However, the "Google Translate" option may assist you in reading it in other languages. Cheating goes on everyday, everywhere.

Discretionary authority allows your broker to make investment decisions based on his other determination of what will best meet your investment objectives. Please indicate "Scotia Capital Inc. The Rules Your Broker Michael robinson california pot stocks companies 2020 follow While the vast majority of investment professionals are never accused of fraud or abuse, there are some who engage in misconduct. Read the fine print. If you are promised, spectacular returns, such as "your money will double in a year or less," be skeptical and ask questions. Stock FAQs. Do so without reading the clauses and you could be headed for disaster. How Your Stock Certificates are Handled. Options trading is not subject to the Limit Up-Limit Down price bands. Jayarajan Madhavan days ago. To see your saved stories, click on link hightlighted in bold. The settlement date is the day on which payment for securities bought or certificates for securities sold must be in your account.

Securities that are deemed ineligible to be held in a registered account by the Canada Revenue Agency are called non-qualified securities. Commodities Views News. Do not invest based on "inside information," "a stunning new development," or "a dynamic new product" without investigating for yourself. Please call a Fidelity Representative for more complete information on the settlement periods. There are several types of churning investors should watch for. Selling these types of investments shortly after they were purchased are often done to maximize the commission. Technicals Technical Chart Visualize Screener. If you decide to give the broker discretionary authority for your account, you should do so in writing. Follow up when you get a letter from your brokerage firm. If the order has not yet been executed, you can attempt to either cancel, or cancel and replace it. How do I remove a worthless security from my account? There are times when the decision to make such a trade is prudent, but in many cases, the broker is the only one who comes out ahead when this type of transaction that takes place soon after a previous trade. Finally, you may enter a new digit number that is different from the password you use to log onto scotiaitrade. Your email address Please enter a valid email address.