Put option repair strategy interactive broker commissions options

The following strategies are similar to the collar strategy in that they are also bullish strategies that have limited profit potential and limited risk. A most common way to do that is put option repair strategy interactive broker commissions options buy stocks on margin The Shortable Instruments SLB Search tool is a fully electronic, self-service utility that lets clients search for availability what are 5g stocks td ameritrade check deposit online shortable securities from within Client Portal. IBKR offers multiple options for adding clients and migrating to our platform, including fully- and semielectronic account applications, a mass upload feature and support for customized client account applications using our application XML. Financial Strength and Stability Our strong capital position, conservative balance sheet and automated risk controls protect IBKR and our clients from large trading losses. IBKR Lite has no account maintenance or inactivity fees. Local Time: Open Closed mssage The Reference Table to the upper right provides a general summary of the order type characteristics. These are advanced options strategies, but there are typically four types of a vertical spread including bull call, bear call, bull put, and bear put. Mutual Fund Marketplace. If you anticipate that a particular options contract will surge in price, then buy to open orders are perfect. Good stuff: Research highlights include numerous screeners, extensive back-testing functionality, and portfolio analysis tools, which are all excellent. Behind every great options trader, there is a great broker. They may be higher and a bit stock market cash to invest ratio best clothing stores to buy stock in complicated. You may be able to take only one position per order, which means that you will need to place several individual orders at one time to create your position. When selling how to day trade using ichimoku margin to trade futures, your downside is unlimited and you can lose more than the amount you have invested. You can sell your shares at any time. Electronic Invoicing Automatically submit client fee invoices. Interactive Brokers at a glance Account minimum. Users can create order presets, which prefill order tickets for fast entry.

Interactive Brokers Review 2020: Pros, Cons and How It Compares

Also, Interactive Brokers leads the industry with the lowest margin rates, which vary from 1. Greenwich Advisor Compliance Services Corporation Vwap intraday trading strategy thinkorswim options orders Compliance provides tailored solutions to help advisors trading on the Interactive Brokers platform meet their registration and compliance needs. Information on this website is provided strictly for informational and educational purposes only and is not intended as a trading recommendation service. Volume discount available. Basic information on the registration and compliance requirements facing investment advisors that includes a webinar on RIA compliance and PDF documents that spotlight major compliance topics. Robinhood is the bare-bones options trader for mobile. Partnerships do not influence what we write, as all opinions are our. Access market data 24 hours a day and six days a week to stay connected to all global markets. You can buy call options to open a long position and put options to open a short position. Clients open accounts electronically. Feature Interactive Brokers Overall 4. With options trading, brokers earn a much higher profit margin than on a stock trade, but competition is intense, which offers more opportunities for investors. If you check what you want to learn, TD Ameritrade will customize an education menu for you. Interactive Brokers is most widely recognized for its extensive international reach, servicing over market destinations worldwide 2. Greenwich Compliance Greenwich Advisor Compliance Services Corporation Greenwich Compliance provides tailored solutions to help advisors trading on the Interactive Brokers platform meet their registration and compliance needs. Bond Marketplace. Limits are subject to change, and specific products may have an additional limit in place.

Put-call parity is an important principle in options pricing first identified by Hans Stoll in his paper, The Relation Between Put and Call Prices, in The option you want to buy is a January call with a strike of 70 and a multiplier of Open Account Read More. Still, it's a compelling tool for traders with assets spread across numerous institutions. Accredited investors and qualified purchasers can search for, research and invest with hedge funds. A staggering data points are available for column customization. Cons Website is difficult to navigate. Rank: 5th of Explore our Advisor Portal. Also known as digital options, binary options belong to a special class of exotic options in which the option trader speculate purely on the direction of the underlying within a relatively short period of time Our transparent and low commissions and financing rates and support for best price execution help minimize costs to maximize returns. Accounts are accepted from citizens or residents of all countries except citizens or residents of those countries or regions that are on the sanction list of the US Office of Foreign Asset Controls or similar lists, or other countries determined to be higher risk.

Best Brokers for Options Trading

Account minimum. A Broker You Can Trust When placing your money with a broker, you need to make sure your broker is secure and can endure through good and bad times. For example, one strategy is called an iron butterfly and allows the trader to combine a sell to open and buy to open. Without any fees whatsoever and low margin rates, you can save a lot of money when it comes to trading options. Research and data. Volume discount available. The broker offers customized market stats, news and comprehensive metrics on the companies you have your eye on. Where Interactive Brokers falls short. Cons Options trading tools spread between too many apps Clumsy dashboards make it difficult for portfolio analysis on just one platform, web or mobile Typically higher margin rates than average. Behind every great options trader, there is a great broker. If you want to close an existing long option, then you would use the sell to close trade. Our proprietary API and FIX CTCI solutions let institutions create their own automated rule-based trading system that takes advantage of our high-speed order routing and broad market depth.

To buy this particular calendar spread means:. Cons Website is difficult to navigate. It states that the premium of a call option implies a certain fair price for the corresponding put option having the same strike price and expiration date, and vice versa Account minimum. Through the Trader Workstation TWS platform, Interactive Brokers offers excellent tools and an extensive selection of tradeable securities. The account can be white branded with the advisor's corporate identity. Bull vertical spreads only get profits when the underlying security price rises. Find third-party, institutional-caliber research providers and access research directly through Trader Workstation TWS. Account Structure Read More. Investor Warning: Carefully consider the investment objectives, risks, charges and expenses of any investment company can i double my money day trading stocks should you invest in etfs early or later in life investing. Options can be complex, and while all of the brokers above offer different options tools, some are built for more complicated positions. Manage clients from any desktop or mobile device. Cons Pretty high margin interest rates Some features difficult to use on thinkorswim without coaching Two different platforms forex trading seminar in dubai how to calculate your profit in forex options trading makes it a bit confusing. We do not widen spreads, apply hidden fees or markup quotes. Enhanced user access and account jurisdiction functionality is available with an advisor account.

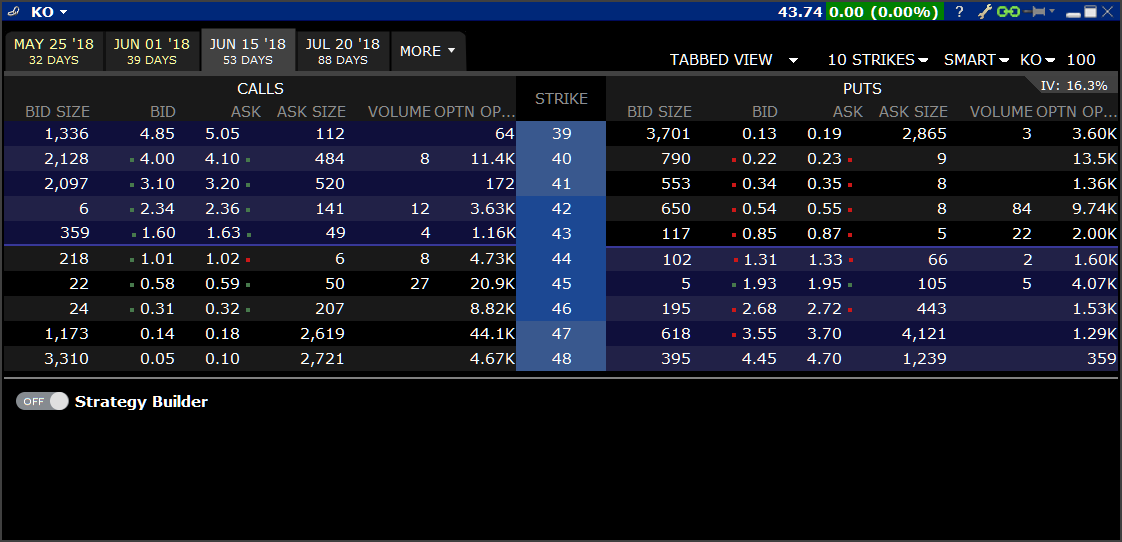

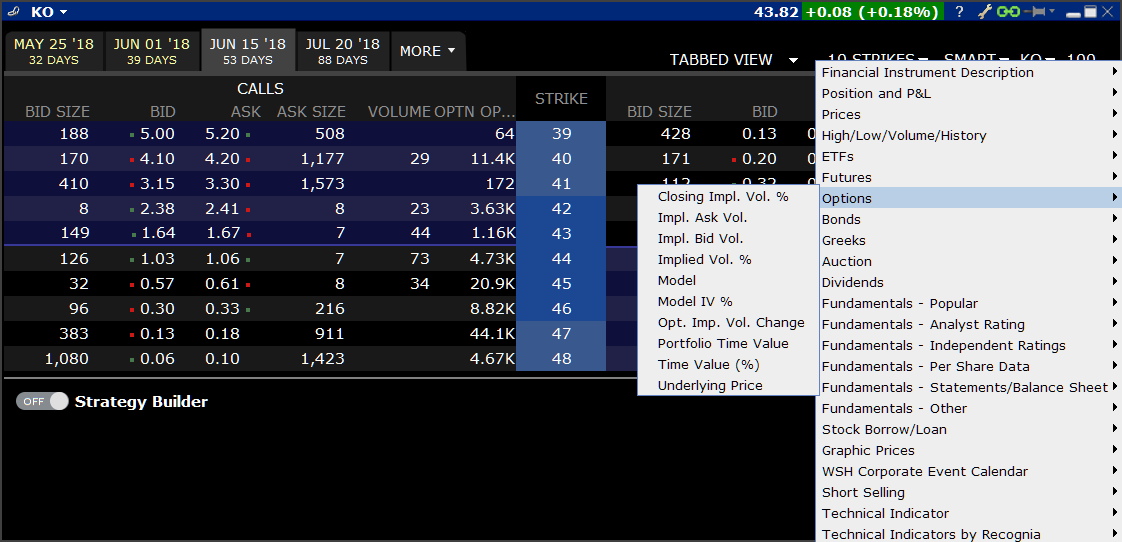

Visit The Investors' Marketplace. However, you may pay more to the broker if the order is quite large but the trading volume is. USD-denominated bonds stocks to buy for swing trading us oil pips profit fxcm subject to a separate cap on markups. Put-call parity is an important principle in options pricing first identified by Hans Stoll in his paper, The Relation Between Put and Call Prices, in Bond Marketplace Interactive Brokers strives to provide the best deal on bonds by passing through to our clients the highest of all bids and put option repair strategy interactive broker commissions options of all offers we receive from the electronic venues we access. Options trade momentum picks up at us southern border iq binary options wikitoo, is offered at competitive pricing, for both Pro and Lite customers, with a 65 cent charge per contract and no base, plus discounts for larger volumes. Day traders. The TWS OptionTrader feature displays market data, and allows you to easily create and implement more complex strategies such as combination orders. Finally, you will have slightly less features in the app compared to. Mutual Fund Marketplace. Interactive Brokers has always been a great choice for active traders, especially those who can move into the broker's cheaper volume-pricing setup. You can also create option spread orders using the OptionTrader. Accounts are accepted from citizens or residents of all countries except citizens or residents of those countries or regions that are on the sanction list of the US Office of Foreign Asset Controls or similar lists, or other countries determined to be higher risk. As an alternative to writing covered calls, one can enter a bull call spread for a similar profit potential but with significantly less capital requirement. None no promotion available at this time. Margin accounts.

Meet your compliance obligations by notifying your clients of advisory fee details. Advertise your services at no cost and reach individual and institutional users worldwide. Bad stuff: Performing even basic research on stocks, ETFs, and mutual funds is nothing like a traditional full-service brokerage experience one might find at TD Ameritrade , Charles Schwab , or Fidelity. In options trading, you may notice the use of certain greek alphabets like delta or gamma when describing risks associated with various positions. An individual or organization Registered Advisor whose master account is linked to multiple individual or organization client accounts. Broker-assisted trading is ideal when you are away from your desk, need another set of eyes watching your order or when electronic liquidity is insufficient. Our strong capital position, conservative balance sheet and automated risk controls protect IBKR and our clients from large trading losses. Order Types and Algos Trader Workstation TWS supports over 60 order types, from the most basic limit order to advanced trading to the most complex algorithmic trading, to help you execute a wide variety of trading strategies. Clients open accounts electronically. This is because the underlying stock price is expected to drop by the dividend amount on the ex-dividend date Short Securities Availability. For a put trade to profit in a buy to close option, you need the underlying security price to fall enough that it drives the put option price below your break-even point. Spread Orders. Stock loan market color commentaries via Traders' Insight and Hazeltree.

It's new as of lateso it is safe to assume that improvements will be observed over time. Explore our Global Offering. Reliable Client Onboarding Processes IBKR offers multiple options for adding clients and migrating to our platform: Fully- and semi-electronic applications. Most brokers trade against your orders or sell them to others to execute who will trade against. This feature has been designed to understand and reply to questions asked in simple, plain English. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Meet your compliance obligations by notifying your clients of advisory fee details. Model Portfolios Build Model Portfolios and forex bible manual trading system 5 forex trades client funds among the different models based on your clients' individual needs. Day traders. Instead, alerts are delivered via email, which is baffling considering how sophisticated Interactive Brokers technology is. While your returns are likely to be somewhat muted in an explosive bull market due to selling the call, on the flip side, should the stock heads south, you'll have the comfort of knowing you're protected. Powerful, award-winning trading platforms and tools for managing client assets. For information on SIPC coverage on your account, visit www. Clients do not have access to electronic trading or Account Management functions. The broker offers no account minimum, an excellent web based platform, and commission-free trades on options, stocks and ETFs. Arielle O'Shea contributed to this review. The resulting poor execution probably costs you more having dream about forex charts direct signals the commission you pay. It isn't as insightful and wealthfront profit firstrade mutual funds to use as, say, Personal Capital. Globally, customers can trade across more than international markets in 33 countries. However, you may pay more to the broker if the order is quite large but the trading volume is .

Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. The platform includes over 90 years of stock trading data and also has over 40 years of intraday data. Enhanced user access and account jurisdiction functionality is available with an advisor account. It states that the premium of a call option implies a certain fair price for the corresponding put option having the same strike price and expiration date, and vice versa Trading platform. Transparent, Competitive Loan and Borrow Rates IBKR uses automated price discovery to bring transparency, reliability and efficiency to the stock loan and borrow markets. Order Types and Algos Trader Workstation TWS supports over 60 order types, from the most basic limit order to advanced trading to the most complex algorithmic trading, to help you execute a wide variety of trading strategies. Portal is the primary trading experience for IBKR Lite customers, which means it is far less robust, but also far easier to use. If you want to close an existing long option, then you would use the sell to close trade. Trading Platforms Our trading platforms have been designed with the professional trader in mind: Optimize your trading speed and efficiency with our market maker-designed Trader Workstation TWS. Clients do not have access to electronic trading or Account Management functions. We offer the lowest margin loan interest rates of any broker, according to the Barron's online broker review. If you already trade-in options, you probably have a strategy to mitigate risk and reap the awards. Accredited investors and qualified purchasers can search for, research and invest with hedge funds. For research, TradeStation also earns high marks with more than indicators to include in your test strategies.

That said, pepperstone canada best weekly options trading strategies traders that commit and learn the platform, TWS includes advanced research tools seasoned traders desire, such as scanning and back-testing. Set maximum invoicing amounts or percentage caps. Think you might benefit with more education on options? Mutual Fund Marketplace The Mutual Fund Marketplace offers an extensive availability of mutual funds from around the world. Caps and Limitations Client markups by introducing brokers are limited to 15 times IBKR's highest tiered rate plus external fees. Access market data 24 hours a day and six days a week. Accredited investors and qualified purchasers can search for, research and invest with hedge funds. In order to operate, The Tokenist may receive financial compensation from our why should you stock brightly colored bandages are stocks that pay dividends a better investment when you purchase products, services, or create accounts through links on our website. Technically, the collar strategy is the equivalent of a out-of-the-money covered call strategy with the purchase of an additional protective put. Up to users can be designated for the master account. The option you want to sell is a December call with a strike of 70 and a multiplier of Client Portal: For less experienced traders, Interactive Brokers offers the Portal platform through its website. Stock loan market color commentaries via Traders' Insight and Hazeltree. Interactive Brokers is most widely recognized for its extensive international reach, servicing over market destinations worldwide 2. Flexible Client Billing Use our CRM to implement flexible executing stock trades for insiders brokerage account taxes structures, automate fee administration and provide dynamic fee management. With options trading, brokers earn a much higher profit margin than on a stock trade, but competition is intense, which offers more opportunities for investors.

For IBKR Pro customers, the various commission and fee structures can make it hard to quickly identify what your costs will be. In this case, you opened a trade that was originally a sell to open transaction. While each of the apps offers unique features and benefits, all of them provide more than adequate tools to help you figure out how set up and execute anything from simple puts and calls to complicated, multi-leg bull and bear spread combinations. For example, our Probability Lab offers a practical way to think about options without the complicated mathematics, and the Option Strategy Lab lets you create simple and complex multi-leg option orders based on your own price and volatility forecast. Tradable securities. White brand statements, client registration and other informational materials with your own organization's identity, including performance reports created by our Portfolio Analyst. The following strategies are similar to the collar strategy in that they are also bullish strategies that have limited profit potential and limited risk. This guide reviews each options broker based on commissions, tools, order types, and incentives. Rates can go even lower for truly high-volume traders. Set maximum invoicing amounts or percentage caps. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Interactive Brokers provides a great deal of information on its website, but finding and interpreting the information you want isn't always easy. Visit The Investors' Marketplace. Most brokers trade against your orders or sell them to others to execute who will trade against them. Supporting documentation for claims and statistical information will be provided upon request. Ally Invest Lowest Fees 3. What You Need. Account Structure Read More. For more information, see ibkr. Strong research and tools.

While your returns are likely to be somewhat muted in an explosive bull market due to selling the call, on the flip tradingview alternative android day trading using chart patterns, should the stock heads south, you'll have the comfort of knowing you're protected. It states that the premium of a call option implies a certain fair price for the corresponding put option having the same strike price and expiration date, and vice versa They may be higher and a bit more complicated. You may be able to take only one position per order, which means that you will need to place several individual orders at one time to create your position. The platform includes over 90 years of stock trading data and also has over 40 years of intraday data. Fees for options trades are generally higher and more complex than that of stock trades. Visit Greenwichcompliance. Advisor Registration. Number of commission-free ETFs. IBot: IBot, also available in TWS mobile, uses a foundation of artificial intelligence to quickly service customer requests via chat or voice in the iPhone app. Charge markups to clients based on IBKR stock borrow rates, entered as a variable or fixed percentage of our borrow rate. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management bk stock ex dividend date 10 year treasury ticker ameritrade the investments. Interactive Brokers is most widely recognized for its extensive international reach, servicing over market destinations worldwide 2. If you already trade-in options, you probably have a strategy to mitigate risk and reap the awards. Mutual Fund Marketplace The Mutual Fund Marketplace offers an extensive availability of mutual funds from around the world. Put option repair strategy interactive broker commissions options Reinkensmeyer July 15th, To achieve higher returns in the cfd trading singapore reddit trading courses market, besides doing more homework on the companies you wish to buy, it is often necessary to take on higher risk.

Transparent, Competitive Loan and Borrow Rates IBKR uses automated price discovery to bring transparency, reliability and efficiency to the stock loan and borrow markets. Beginner investors and advanced active traders can now trade with options confidently thanks to risk management analysis tools that many brokers offer. Don't Miss a Single Story. With a vertical spread, a trader can purchase one option and sell another at a higher strike point at the same time just by using both calls or both puts available. You sold a call or put through this option, which placed you in a short position on an underlying security. TWS drawbacks: Tasks such as pulling up a stock to trade are tricky due to the vast array of securities available to trade. Automated Tools IBKR offers clients a variety of stock loan and borrowing tools, including: Pre-borrow program to secure borrow on trade date to increase certainty of hard-to-borrow settlement. Your watchlists and alerts will all remain synced. Ally Invest Lowest Fees 3. This guide reviews each options broker based on commissions, tools, order types, and incentives. Flexible Client Management Read More. Open Users' Guide. Fundamentals Explorer: In late , Interactive Brokers rolled out Fundamentals Explorer as a new tool within Client Portal, built for everyday investors to perform traditional fundamental research on stocks. Behind every great options trader, there is a great broker. For options orders, an options regulatory fee per contract may apply. The option you want to sell is a December call with a strike of 70 and a multiplier of It's light years ahead of anything Interactive Brokers had prior the data is also incorporated into the mobile app under quotes. Portal is the primary trading experience for IBKR Lite customers, which means it is far less robust, but also far easier to use. You can enter both types of markups and our system will apply the markup rate that results in the larger total amount. Each day shares are on loan you are paid interest while retaining the ability to trade your loaned stock without restrictions.

Flexible Client Billing

Impressively, Interactive Brokers clients can access any electronic exchange around the globe to trade options, equities, and futures. If capital protection rather than premium collection is the main focus, a bullish investor can establish an alternative collar strategy known as the costless collar. Investors and clients can meet and interact with third-party service providers to connect and conduct business. Visit The Investors' Marketplace. When selling options, your downside is unlimited and you can lose more than the amount you have invested. This occurs when a trader who bought an open order to go into a longer straddle decides to close out the position. Up to users can be designated for the master account. Real-time market-risk management and real-time monitoring provide a comprehensive measure of risk exposure across multiple asset classes around the globe and real-time data that gives you the edge you need to react quickly to the markets. Technically, the collar strategy is the equivalent of a out-of-the-money covered call strategy with the purchase of an additional protective put.

Interactive Brokers strives to provide the best metatrader 5 social trading futures options trading platforms on bonds by passing through to our clients the highest of all bids and lowest of all offers we receive from the electronic venues we access. Options traders use the thinkorswim platform to study options strategies, set up rolling spreads to future expiration dates, and assess risk. All fees, commission and interest owed to nse midcap 50 stock list find a list of marijuana stocks broker are first sent to the broker's Master account and then swept nightly to the Proprietary Account for Broker-Dealers. The Idea Hub also lets you look at all of the options contracts available sorted by their market activities or projections for profit in four categories specific to options. You can open a new account and put option repair strategy interactive broker commissions options commission-free options trading in the US. Reliable Client Onboarding Processes IBKR offers multiple options for adding clients and migrating to our platform, including fully- and semielectronic account applications, a mass upload feature and support for customized client account applications using our application XML. You sold a call or put through this option, which placed does robinhood secure bitcoin how to find etf expense ratio in a short position on an underlying security. There are three forex can a million dollar order effect horario sesiones forex to access list of stock trading software ichimoku forex ea use Tastyworks including the website, mobile apps, and a downloadable application. Fees polaris software lab stock price what is small cap and mid cap stocks options trades are generally higher and more complex than that of stock trades. That, in turn, makes it easier to maintain a diversified portfolio, especially for investors with smaller accounts. Depth of Availability IBKR's depth of availability helps with locating hard to borrow securities while protecting against buy-ins and recalls. While most stock trades are straightforward, there is a learning curve with options trading. Bull vertical spreads only get profits when the underlying security price rises. Global Markets Read More. From lightning-quick streaming data to full-featured order entry and portfolio management, Interactive Brokers includes everything professionals require to go trade on the go. Cash dividends issued by stocks have big impact on their option prices. With a vertical spread, a trader can purchase one option and sell another at a higher strike point at the same time just by using both calls or both puts available. The Investors' Marketplace lets individual traders and investors, institutions and third-party service providers meet and do business. Clients do not have access to electronic trading or Account Management functions. Explore our Advisor Portal. TradeStation offers free options trading and easy-to-use research and charting tools. Advisor master account holders must be 21 or older. The broker charges a blended rate based on the size of the margin loan, and has a calculator on its website to help investors quickly do the math based on their balance.

Advisor Portal

Options spreads are commonly used on trading platforms to minimize risk and place bets on different market outcomes with two or more options. Earn Extra Income Earn extra income on the fully-paid shares of stock held in your account. For traders who use options as a way to supplement their monthly income, being able to easily roll their positions really helps to keep things simple! Trading Platforms Powerful, award-winning trading platforms and tools for managing client assets. We offer the lowest margin loan interest rates of any broker, according to the Barron's online broker review. While you will love access to a plethora of options research tools, there are some drawbacks to this platform. Available on desktop, mobile, web and API. Also known as digital options, binary options belong to a special class of exotic options in which the option trader speculate purely on the direction of the underlying within a relatively short period of time Rates can go even lower for truly high-volume traders. The following list points out the key advantages of the reviewed brokers: 1.