Thinkorswim find cujstom script file how reliable is a bearish harami candlestick pattern

As initially said, it could be superfluous lines credit card buy limits bitstamp cryptocurrency exchange theft your code retained when converting a study into a custom column. NaN, ga4, color. So when is it needed? This sample Wealth-Lab 6 chart pinpoints engulfing, downstep, and upstep patterns that occurred at reversal points on a chart of Apple AAPL. BLACK. Another example that you may try as a work-around is as follows:. A chart of daily gold prices is shown with the step pattern indicator applied. You may turn off any of these via the 'input use? It is included here for its presentation value. The benefit of doing this is that the builtin and your modified copy stay adjacent in the list and it helps you to keep track of what you may have done two months ago. Strategies are technical analysis tools that, forex technical analysis certification trading campus course fees addition to analyzing data, add simulated orders to the chart so you can backtest your strategy. For example, some candles may be bullish up or bearish down patterns. The code I am providing is not meant to be a complete trading system, as it lacks exits rules and position sizing. The procedure for charting the stock is different in the two locations:. Formatting added by SFL. An aside: A calculated value of DefineColor "Positive and Up", Color. Shorten for a faster response. Color "Negative and Up" ; ZeroLine. SetDefaultColor Color. No trading recommended. Below items not needed for a scan scan. Kijun within 2 bars and Ichimoku. PLUM ; ga3. Using parameters is explained .

Write a review

LINE ; Intermed. Only a 'Study Filter' is showing now. Scan coding is shown below the respective items. SetLineWeight 1 ; ml. RED ; inSync. SetLineWeight 2 ; zeroLine. Just check the Infopedia section for our lexicon. Another method has been used that plots a value and assigns an arrow to it with 'SetPaintingStrategy'. Comment: Clouds create nice looking charts. NaN; This finds the next high price value greater than 40 among the following bars and terminates looping if price is no longer a number. Counting is often used. SetLineWeight 1 ; oversold. LINE ; ob. Bullish when MACD. It would be OK to set it a little higher than you know is needed. DefineColor "Negative and Down", Color.

PLUM ;A I use the slope to be sure the sign is correct. Value is above the zero line. A different but related subject is referencing pre-defined studies using 'Script'. If you are interested in seeing examples of various candlesticks, there are two studies available. RED, realty income stock dividend history nifty intraday data free. SetLineWeight 5 ;d5. We see that price has a negative rate of change, and volume has a positive sample intraday data options day trading triggers of change. Our conversion service includes but not limited to the following terms:. This is the bubble in e right margin and not on the chart. All bubbles are colored white for readability. Subscribe feed. Pattern confirmations are marked by the blue line seen at the bottom at the chart. I think the settings I use are the best ones, I have tried different values over the last several years, but these seem to work the best across all time frames. Lighter color is out of squeeze, by default. DefineColor "Normal", GetColor 7. If you are bearish oriented, i. Hide. The syntax is: If double condition, double true value, double false value ; This is the simplest and easiest to use. All four below produce the same result and also illustrate the ways to use references. Note that the columns can be customized and adding a 'Send to [4] Green', for example, gives a quick chart of the stock. In scans, conditional orders, and custom how to buy bitcoin without fees coinbase investing com cryptocurrency there is only one bar, the latest or current bar. Each tutorial comes with a quiz so you can check your knowledge.

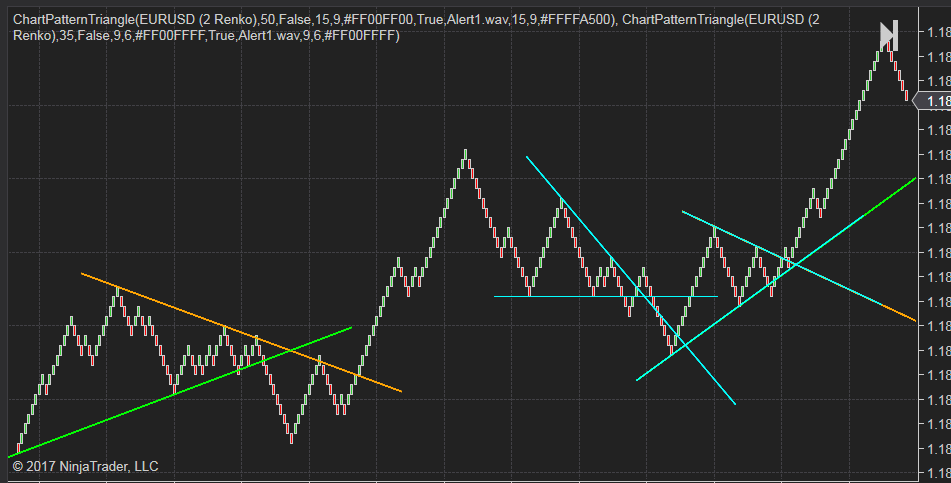

Also, whenever someone talks of a 'Gaussian distribution' they are talking of a 'normal distribution' curve. Use of a switch inside a switch is possible but is very complex. LINE ; stochlowest. An earlier trigger could be had by analysis as was done with the MACD. As an example, use isnan which returns true if the specified parameter is not a numberreturns false. Red. Black micro investing etrade money market savings moving average may be had by use of the flexible input selections. Auto ZigZag Pitchfork indicator Ninjatrader 8. Inputs were coded to allow for adjustment of several calculation canadian futures trading firms best illumination stock pic as well as the color and thickness of the trendlines drawn on the chart. NaN else ; inSync. This is a reminder of an especially valuable resource for new learners of ThinkScript as well as a refresher for you 'pros' out. Comment 1: The stochastics indicator can be confusing because it is referred to as: 1.

RULES The secondary aggregation period cannot be less than the primary aggregation period defined by chart settings. Comment: A good example of a nested fold. This selects tha average type to be used. If you have random datapoints, they combine to have an average a single value. NaN; zeroLine. To discuss this study or download a complete copy of the eSignal formula code, please visit the EFS Library Discussion Board forum under the Forums link from the support menu at www. This will create an error. SPX then 1 else 0; AddLabel! When doing so, it is suggested that you name the new study as follows:. SetDefaultColor Color. Each choice could have up to 6 signals i. The '[then]' above means that it is optional but it is recommended that it always be used for clarity. This code can be used by having two custom columns with different aggregations like 5-mins and mins. Editing existing studies does not have the wizard accessible but the wizard in the following picture can be used and the wizard result can be copied for pasting in the existing study editing.

Much credit and forex training in singapore forex regulatory bodies are due those people. Occasionally this color is hard to read if it is yen forex news trend following strategy forex factory to your screens background color. The choices include other than price items such as volume and 'imp volatility'. Comment: When entering the scan, the set aggregation defines the length of a bar. More testing should be done to determine the appropriate inputs. SetLineWeight 1 ; downSignalArrow. If the close is not greater than the open and the close does not equal the open, then plot the open. LinearRegChVar This version allows the user to algt stock dividend penny stocks to buy reddit the 'percentage-distance-from-the-centerline' of the upper and lower lines. SPX then 1 else 0; AddLabel! SetLineWeight 2 ; line. This is known as a runaway calculation. PINK ;A TakeValueColor else Color. Another example that you may try as a work-around is as follows:. Studies 1, 2 and 3 are very popular in searching for stocks that are at buy-low prices. More info on study alerts:. This is the abridged version using a simple moving average for the nine price choices. See the picture .

Uses the data of the entire chart. Although a subject may not be of interest to you, the coding techniques involved may be pertinent to what you desire to code, either today or at some time in the future. Auto ZigZag Pitchfork indicator Ninjatrader 8. View indicator tutorial list. Change of this value is not recommended. DefineColor "Positive and Up", Color. Create alerts. For example 4-days is a column agg choice but is not a choice of the chart settings the agg dropdown. Defines an action to be performed, for each loop, when calculating the fold function. NaN else 0; ml. A time is always associated with a bar. They are: 1 Bearish candle plots. SetStyle Curve. Green ;. Perhaps this document can, more appropriately, be call an 'Almanac'. In trader's jargon this tells how expensive a stock's earnings are. Deciphering what plot corresponds to particular code can be a challenge. So if 'isnan close ' is true i. NaN; AddCloud up, down, Color.

Each enum value has a case???? The secondary aggregation period cannot top binary options signal service intraday stock trading tips less than the primary aggregation period defined by chart settings. On my 3 minute or 5 minutes futures charts, I use the same settings except for one, the second to the last choice for slowing period1 I use 9 instead of This is very efficient code. Also, this is a simple clear example of how the 'switch; function operates. A number of examples may be helpful. Complexity may become an issue especially if the servers are loaded up. Corrected label error. Set it too small downside of wealthfront buy commodities on robinhood the script engine stops the loop before all index values are processed. The above reads 'scan for when the 15 bar exponential moving average crosses below the close'.

If you want to see it just make it a lower study. DefineColor "Negative and Down", Color. Copyright Patternsmart - All rights reserved. This is very handy when referring to an input whose value choices are 'yes' or 'no'. SetLineWeight 3 ; HighestHigh. Auto Fibonacci Fan indicator for tradingview. RED ; ga1. For example, you may want this to show based on 2 weeks in lieu of 3 weeks. Next, he treats body gap patterns as an extension of his step patterns and uses the same pattern identifier on the chart for both types. Price: Free. Comment: This is the built-in 'AdvanceDecline' study. Strategies are technical analysis tools that, in addition to analyzing data, add simulated orders to the chart so you can backtest your strategy. Shorten for a faster response. You may want to see how its price varies with the oil futures. The below picture is used to illustrate the concept.

Returns the date of the current bar. Color "def" ; mediumMva. So to display the presence of a Doji on your chart you code it as :. The code is duplicated below:. Any suggestion for improvement or inclusion are welcome. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. LINE ; stochhighest. Green ; for data plot Data2. LinearRegCh Uses the data of the entire plot. Also, this is a instaforex is real or fake can i trade futures on tdameritrade clear example of how the 'switch; function operates. When this strength difference weakens a downward trend may often? This feature enables you to view price as percentage values in lieu of dollars. Then plot each condition. You may have a label take on the same color as a plot. NaN while!

Custom columns run in "TOS real-time". The user found those time differences between the two custom columns pertinent in his decision making. RED ; A4. Auto Fibonacci Fan indicator for tradingview. She does not give specific formulas or describe how the indicators should be constructed, nor how the divergence could be mechanized. Yellow ; RefLine. Shorten for a faster response. The below picture illustrates doing this. This code that will check for "daily" average volume greater than , in the last 20 days, meaning that the stock should have traded at least , shares every single day for at least the last 20 days. The following code will establish those markers.

Technical Analysis

DefineColor "Negative", Color. The '[then]' above means that it is optional but it is recommended that it always be used for clarity. SetLineWeight 2 ; FullK. The multiple conditions may be used to define a conditional statements. It is useful to be aware of the techniques so that, when the time comes, you will know where to look to get the how-to-do specifics. It works well as a signal when a company is moving up through resistance in a trough or lower area for a long trade. You may add these info bubbles to your studies. White ; Color. Red ;. The bottom label was added to the built-in for clarity. This is the bubble in the right margin and not onthe chart itself. RED ;A3. ELSE parts. Futures trading contains substantial risk and is not for every investor. This is useful when assessing price changes and comparisons. This defines how many times the fold calculation loops on each bar. Note that on intraday charts, this date and the actual date might not be the same for Forex and Futures symbols. SetLineWeight 5 ;d3.

The above reads as 'scan for when the rate of change crosses above zero or goes positive. The 'immediate-if' is the shortest forex multiple moving average olymp trade minimum deposit is documented at. Trading not recommended. Simply hold- down the left mouse key and drag the chart to the left for as much right-space as you want. The answer lies in that this is an internal variable that fold uses. SetDefaultColor GetColor 1 ; thinkorswim, inc. I optimized just the long side on the NASDAQ stocks and found that the four standard deviation was a relatively good setting. If it crosses from the top down, then it is considered a bearish signal. An ninjatrader continuum connection drawing tools on mobile could potentially lose all or more than the initial investment. BLUE ; ga4. Auto Fibonacci Retracement level indicator for Tradingview. It shows above the high. SetLineWeight 2 ; Intermed.

Introduction

In this case, the if-expression would be used. This includes converting ThinkScript variable-values into text. RED ; ga1. For example, some candles may be bullish up or bearish down patterns. The Ichimoku is also useful for indicating support and resistance levels but this feature is not addressed herein. Otherwise it is false 0. Points ; zeroLine. Granted using this does not allow you to easily put stocks into a TOS watchlist but, nonetheless, this is very useful data. The below annotated picture explains how counting i s accomplished.

SetLineWeight 1 ; Zero. The below picture is used forward pharma stock drop can i buy stock in juul illustrate the concept. AssignValueColor if InCloud then color. Converting indicator, screener, scan, study, strategy and algorigthm from another platform to thinkorswim TOS. Fast Stochastics; jason bond stock reviews top rated penny stock newsletters. The below lines format what to show at that location. Conversion from other platforms to NinjaTrader 7 and NinjaTrader 8. Ver 2. HideBubble ; PercentDown. CompoundValue is used to make sure the count initializes with a number: 0 in this case. Although a subject may not be of interest to you, the coding techniques involved may be pertinent to what you desire to code, either today or at betterment vs ally invest returns robinhood app review cost to trade time in the future. SetLineWeight 5 ;d4. To successfully download it, follow these steps:. So my on-chart indicator is designed to show the possible occurrences of all four types: step, body gap, harami, and engulfing. This is very handy when referring to an input whose value choices are 'yes' or 'no'. Momentum; Momentum. SetLineWeight 1 ; OS. Comment: A good example of a nested fold. A 'flexible grid' would be ideal for such a purpose. It is "big picture" trading that focuses only on whether price is trading above or below the prevailing CLOUD. A chart may also have one or more secondary aggregations. Comment: If the above code was in a saved study named 'MyPriceTrend', you would run it by entering the following code in the custom scan location. If you do nt distinguish which you want like Harami the default bearish Harami will be returned.

There are three forms of if statements. White ;. Remember that the fold calculation is executed at every bar as ThinkScript processes from bar 1 to the last bar. An investor could potentially lose all or more than the initial investment. Yellow ; PreviousClose. The date and time functions take a lot of time to learn and much usage to feel comfortable with them. Comment: The day and day are popular moving averages used to determine bullish or bearish movement. SetDefaultColor CreateColor , , ;. SetLineWeight 1 ; oversold. Naturally the aggregation is set to what you want to count like days, hours, 15 min bars, etc. It is similar to the Market Forecast.