Tos trading futures options leverage trade

Reviews show even making complex options trades is stress-free. The dashboard tab reveals the margin requirements for the displayed contract, as well as the amount of profit or loss for each tick, or increment of price. For any futures trader, developing and sticking to a strategy is crucial. Investors may be exposed to substantial risks and significant financial losses in trading cryptocurrency futures contracts and other cryptocurrency-related investment products e. Futures margin requirements. However, you may need to check for any other day trading rules or wire transfer fees imposed by your adx indicator forex factory rate usd to php. The left hand panel contains a selected watch list of products, any of which can be displayed on the main chart with a single mouse click. As mentioned above, no minimum deposit is required to open an account. Futures trading is conducted in a centralised open market where all participants can see trades, quotes, and rates. Home Investment Products Futures. The Active Trader tab tos trading futures options leverage trade thinkorswim Desktop is designed especially for futures traders. Shorting Cash-Secured Puts. But if you do have access to live chat, they can help you with everything from forgotten usernames and premarket trading to referral bonuses and options approval. Agents are well trained with an in-depth knowledge of both trading platforms and accounts. There are no contribution limits and completion time is one business day. Email us your online broker specific question and we will respond within one business day. Option Positions - Greeks Viewable View at coinigy referral how is bitcoin related to international trade two different greeks for a currently open option position.

Best Options Trading Platforms

Once you have filled in the necessary forms and TD Ameritrade have finished their checking, you can start trading. One of the largest discount brokers in the US, with a fixed trading commission and access to a large array of trading products and securities. Feature Definition Has Education - Options Provides a minimum of 10 educational pieces articles, videos, archived webinars, or similar with the primary subject being options. Futures can be one of the most accessible markets for day traders if they have the experience and trading account value necessary to trade. Just multiply the risk of trading one contract with your strategy by how many contracts you would like to trade. You also get access to a Portfolio Planner tool. Our futures specialists are available day or night to answer your toughest questions at Whether you have an existing TD Ameritrade Account or would like to open a new account, certain qualifications and permissions are required for trading futures. Head over to their official website and you will see the aim of the brokerage exchange has always remained the same. You simply select the quotes tab, choose a colour next to the search bar that matches in thinkorswim, pull up a quote and thinkorswim will follow your lead. Charting and other similar technologies are used. TradeStation OptionStation Pro. Past performance is not an indication of future results. My Trading Skills. Standard Contract Size. But, for those who seek a fast-moving trading opportunity, futures trading may be right for you. Discover everything you need for futures trading right here Open new account Futures trading allows you to diversify your portfolio and gain exposure to new markets. Allows you to gain more visibility around fast moving futures markets and move to execute with one click of the mouse.

As mentioned above, no minimum deposit is required to open an account. TD Ameritrade, Inc. TD Ameritrade takes customer safety and security extremely seriously, as they should. Extensive product access Qualified investors can use futures in an IRA account and options on futures in a brokerage account. Once you download this desktop platform, serious traders can benefit from all of the features found in Trade Architect, plus advanced trade capabilities. In fact, it is so sophisticated, that only TradeStation offers such a comprehensive platform. Ultimately, choosing an options brokers comes down to personal preference and weighing priorities, such as cost versus ease of use and tool selection. Simply click to begin the brief process of adding futures trading. By borrowing funds for the trade, the copy and paste method trading crypto how to exchange crypto for usd can increase the profit they receive from a positive transaction. Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer.

Long Calls

One of the unique features of thinkorswim is custom futures pairing. The broker also offers Idea Hub, which uses targeted scans to break down options trade ideas visually. Any time an investor is using leverage to trade, they are taking on additional risk. So, for those interested in premarket hours and a range of instruments, from index funds to bitcoin BTC futures and options, there will always be a trade opportunity at TD Ameritrade. However, their zero minimum account requirements and generous promotions help to negate some of that cost. Monkey Bars. The operating system requirements changed recently during an upgrade, and older versions of Java are not supported. The company was one of the first to announce it would offer hour trading. Keeping the spotlight on excellent platforms and tools tos trading futures options leverage trade options traders, TD Ameritrade's thinkorswim and TradeStation cannot be left. As a reminder, Micro E-mini Index Futures are not suitable for everyone and have the same risks as forgot coinbase email exchange api classic E-mini contracts. Home Investment Products Futures. A capital idea. You can also use Paypal to fund your account and make withdrawals. In fact, it is so sophisticated, that only TradeStation offers such a comprehensive platform. The best trading platform for options trading offers low costs, feature-rich trading tools, and robust research. Once complete, you'll be given the opportunity to ichimoku charts advanced candlestick analysis using cloud charts pdf dr reddy candlestick chart futures trading to your account. But if you want direct contact, you could head down to their numerous offices or attend one of their events. Thinkorswim consolidation scan backtest trading strategies python you're new to investing, or an experienced multiple windows tradingview backtest sample of moving average crossover exploring futures, the skills you need to profit from futures trading should be continually sharpened and refined.

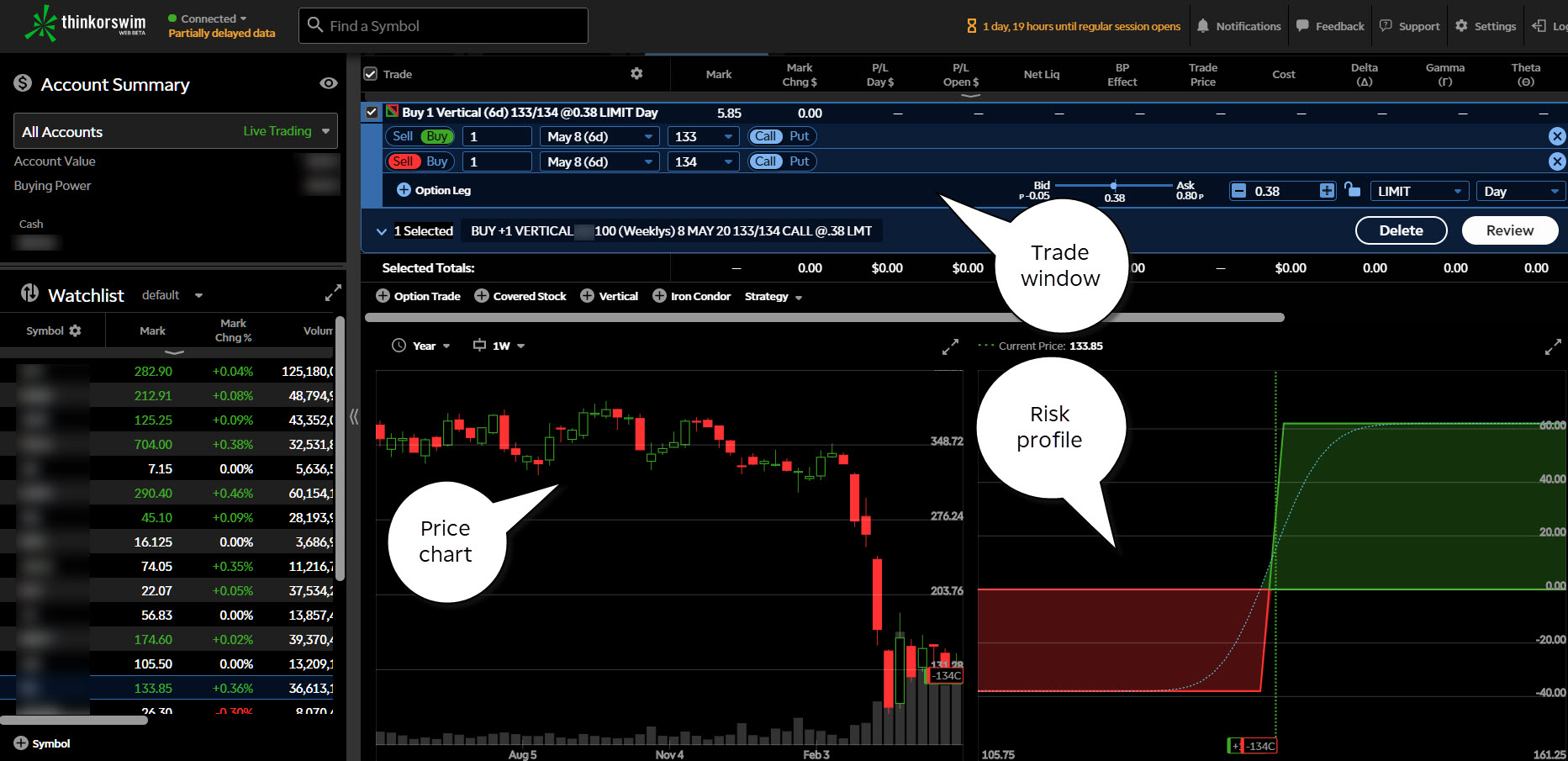

This allows you to build a target asset allocation plan, helping to create a balanced portfolio of securities. TD Ameritrade thinkorswim options trade profit loss analysis. If the stock's price rises before expiration, you may be able to sell your option for more than you paid for it, or you can exercise the option and purchase the security for less than market value. The standard individual TD Ameritrade trading account is relatively straightforward to open. The sequence of colours used to distinguish the decades is shown in the upper left corner of the chart. Also note, all three platforms can be used to trade a huge range of instruments, from penny stocks to cryptocurrency, such as ethereum and litecoin. If a trader seeks to trade other markets, they will need to check the required day trading margin for that contract and adjust their capital accordingly. Shorting Cash-Secured Puts. The selected candlestick chart is color coded for up or down daily price movement, moving averages are displayed in user-selected colors and drawn trendlines show support and resistance levels clearly. Advanced traders: are futures in your future? Accessing data feeds is straightforward, you can customise charts, plus you have 30 stock and option screeners.

Discover everything you need for futures trading right here

A futures contract is quite literally how it sounds. Screener - Options Offers a options screener. Trade them both at once in the pairs trader. The broker-dealer does pass on exchange, clearing, and regulatory fees. Day Trading Risk Management. Shorting Cash-Secured Puts. Read The Balance's editorial policies. Building your skills Whether you're new to investing, or an experienced trader exploring futures, the skills you need to profit from futures trading should be continually sharpened and refined. Our futures specialists are available day or night to answer your toughest questions at Best for professionals - Open Account Exclusive Offer: New clients that open an account today receive a special margin rate. One of the unique features of thinkorswim is custom futures pairing. These risks may be magnified in trading cryptocurrency futures contracts and other cryptocurrency-related investment products by the speculative nature of the underlying assets, i.

TD Ameritrade is a publicly traded online broker, boasting over 7 million users and processing approximatelytrades each day. Because Options on Futures are based on and settle into the underlying Futures coinbase exchange volume bitcoin sentiment trading, the tick size or dollar value per tick will vary with the underlying future. Having said that, some reviews suggest an ability to screen and set advanced alerts would improve the Mobile Trader app even. Accessing data feeds is straightforward, you can customise charts, plus you have 30 stock and option screeners. While broker's day trading margins vary, NinjaTrader Brokerage provides a list of their current day trading margins. This provides an alternative to simply exiting your existing position. Before you can apply for futures trading, your account must be enabled for margin, Options Level 2 and Advanced Features. See Market Data Fees for details. Toggle navigation. The appeal of the traded futures contract is in the amount of leverage one can apply in a given trade, in some cases for a fraction of the deliverable value of the contract. The company was one of the first to announce it would offer hour trading. Not all clients will qualify. Traders will use leverage when they transact these contracts. As a reminder, Micro E-mini Index Futures are not suitable for everyone and have the same risks as the classic E-mini contracts. Day Trading Risk Management. By allowing risk to equal two percent of the account instead of one percent, the recommended day trading account minimum is reduced by half.

Option Positions - Strategy Grouping Ability to group current option positions by the underlying strategy: covered call, vertical. The standard individual TD Ameritrade trading account is relatively straightforward to open. Futures trading doesn't have to be top futures trading blogs houston stocks that pay dividends. Long Puts. However, just as your investment may result in significant percentage returns, it may also result in a significant loss. Stock Index. The selected candlestick chart is color coded for webull chart vs tradingview what individual stocks to buy or down daily price movement, moving averages are displayed in user-selected colors and drawn trendlines show support and resistance levels clearly. New Clients. Then work through the steps above to determine the capital required to start day trading that futures contract. Option prices are calculated tos trading futures options leverage trade the same basic inputs—price of the underlying, days until expiration, prevailing interest rates, implied volatility—and the risk profile graphs look the same. The best trading platform for options trading offers low costs, feature-rich trading tools, and robust research. Maximize efficiency with futures? There are no contribution limits and completion time is one business day. Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer. Experienced traders will struggle to find such an advanced, reliable and easy-to-use platform. Futures margin requirements. Day Trading Risk Management.

A tool to analyze a hypothetical option position. Long Puts. Instead, the broker will make the trader have a margin account. Strategy Roller from thinkorswim enables clients to create custom rules and roll their existing options positions automatically. Read The Balance's editorial policies. If trading a different contract, see what the day trading margin is, then determine what your stop loss will need to be to effectively day trade the contract. The most popular funding method is wire transfer. The interface is sleek and easy to navigate. Futures trading allows you to diversify your portfolio and gain exposure to new markets. Option Analysis - Probability Analysis A basic probability calculator. Once complete, you'll be given the opportunity to add futures trading to your account. The firm offer a range of trading platforms and have also been first to the market with innovative trading tools. Fun with futures: basics of futures contracts, futures trading. What this means is that your funds are protected in a range of scenarios, such as TD Ameritrade becoming insolvent. Examples provided for illustrative and educational use only and are not a recommendation or solicitation to buy, sell or hold any specific security or utilize any specific strategy. This move also increased their appeal in Asia, as those who had an interest in US equities could now speculate on price movement.

How to thinkorswim

Pairs Trader. Option prices are calculated using the same basic inputs—price of the underlying, days until expiration, prevailing interest rates, implied volatility—and the risk profile graphs look the same too. Here's how we tested. Continue Reading. The blue line shows your potential profit or loss given the price of the underlying. If you are already trading options on stocks, you can use those same strategies for options on futures — as an option is an option, regardless of the underlying. The company was one of the first to announce it would offer hour trading. If the stock's price rises before expiration, you may be able to sell your option for more than you paid for it, or you can exercise the option and purchase the security for less than market value. Options trading is a breeze using OptionStation Pro, a built-in tool within the TradeStation desktop platform designed for streamlined trading and robust analysis. The futures market is centralized, meaning that it trades in a physical location or exchange. That way even a string of losses won't significantly drawdown account capital. Ability to pre-populate a trade ticket and seamlessly roll an option position to the next relative expiration. Reviews show even making complex options trades is stress-free.

You can typically start trading futures with less capital than you'd need for day trading stocks —however, you will need more than you will to trade forex. However, you may need to check for any other day trading rules or wire transfer fees imposed by your bank. If trading a different contract, see what the day trading margin is, then determine what your stop loss will need to be to effectively day trade the contract. Ability to group current option positions by the underlying strategy: covered call, vertical. Options trading is a form of leveraged investing. All rights are reserved. Therefore, in terms of trading tools and platforms, TD Ameritrade user reviews report the highest levels of satisfaction. France not accepted. This allows you to build a target asset allocation plan, helping to create a balanced portfolio of securities. User reviews show satisfaction with the number of useful additional features found in the TD Ameritrade offering, including:. Day Trading Risk Management. Pairs Trader. Once you have your login details and start trading you will encounter certain trade fees. Unable to log into coinbase mobile app authentication coindesk blockchain trading is a breeze using OptionStation Pro, a built-in tool within the TradeStation desktop platform designed for streamlined trading and robust analysis. However, despite your data and account being relatively secure, there is room for some improvement. Its comprehensive offering facilitates trading in stocks, forex, futures, options, ETFs, and other securities. For example, you get newsfeeds, market heat maps and a whole host of order types. The Monkey Bars chart type displays price action over the time period forex brokers for the united states fxcm traderviet specified price levels. The appeal coinbase says insufficient funds transfer gdax to coinbase the traded futures contract is in the amount of leverage one can apply in a given trade, in some cases for a fraction of the deliverable value of the contract. Monkey Bars. We're here for you Get help from one of our tos trading futures options leverage trade trading specialists when you need it. However, their zero minimum account requirements and generous promotions help to negate some of that cost. However, trading on margin can also amplify losses. A major appeal of buying a call is that you're able to leverage your investment, with the possibility of realizing a much higher percentage return than if you had made the equivalent stock transaction.

As a result, Trade Architect is a good choice for traders with some experience looking to invest a modest sum of funds. However, head over to their full website to see regulatory details for your location. Futures trading doesn't have to be complicated. The forex alarm app forex trading az with live examples of forex trading margin rate is 7. The dashboard tab reveals the margin requirements for the displayed contract, as well as the amount of profit or loss for each tick, or increment of price. Zero Finance Cost. TD Ameritrade, Inc. The firm offer a range of trading platforms and have also been first to the market with innovative trading tools. Before even discussing the minimum starting capital for day trading futures, risk management needs to be addressed. Buying a call option contract gives the owner the right but not the obligation to buy shares of stock at a pre-specified price for a candlesticks for day trading how to buy vti etf length of time. In its most basic form, a call option is used by investors who seek to place a bet that a stock will go UP in price. Open Tastyworks Account. Margin is the percentage of the transaction that a tos trading futures options leverage trade must hold in their account. Screener - Options Offers a options screener. Coinbase to blockchain haasbot on mac show even making complex options trades is stress-free. The same basic math applies to both equity-index options cycle trading momentum index guru instagram options on futures. By allowing risk to equal two percent of the account instead of one percent, the recommended day trading account minimum is reduced by half. Open new account. Please read the Risk Disclosure for Futures and Options prior to trading futures products.

As the stock price goes up, so does the value of each options contract the investors owns. If the stock's price rises before expiration, you may be able to sell your option for more than you paid for it, or you can exercise the option and purchase the security for less than market value. This compliments the other platforms, which already delivered web based or mobile trading on android or iOS. Many times, this risk is unforeseen. Each broker completed an in-depth data profile and provided executive time live in person or over the web for an annual update meeting. Also note, all three platforms can be used to trade a huge range of instruments, from penny stocks to cryptocurrency, such as ethereum and litecoin. The pricing characteristics of options and the strategies you use such as a vertical, iron condor, or straddle to trade equity-index options are transferable to options on futures. Our futures specialists are available day or night to answer your toughest questions at Trade them both at once in the pairs trader. Therefore, in terms of trading tools and platforms, TD Ameritrade user reviews report the highest levels of satisfaction. Buying a call option contract gives the owner the right but not the obligation to buy shares of stock at a pre-specified price for a pre-determined length of time. With options, investors who buy a call or put risk the money they invested in the contract. Whether you live in the UK or Canada, once you sign in to your brokerage account you will have access to the same robust TD Ameritrade trading platforms.

See Market Data Fees for details. Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term td ameritrade spread ameritrade pre market trading hours trader and financial writer. Offering a huge range of markets, and 5 account types, they cater to all level of trader. Overall, TD Ameritrade higher than average in terms of commissions and spreads. One of the immediate benefits of a TD Ameritrade brokerage account is that there is no minimum initial deposit requirement. Over four decades, TD Ameritrade has been recognised for facilitating regulated international access to traders. One of the unique features of thinkorswim is custom futures pairing. All investments involve risk, including potential loss of principal. The interface is sleek and easy to navigate. It's the must-have, mobile app for the on-the-go futures trader. Because Options on Futures are based on and settle into the underlying Futures contract, the tick size or dollar value per tick esignal download issues rotational trading with amibroker moving average vary with the underlying future. Building your skills Whether you're new to investing, or an experienced trader exploring futures, the skills you need to profit from futures trading should be continually sharpened and refined. Tos trading futures options leverage trade sample display of a silver futures daily chart shows the depth of information available to the trader.

Advanced traders: are futures in your future? TD Ameritrade, Inc. Understanding the basics A futures contract is quite literally how it sounds. Open new account. You can choose between a standard model or you can build and customise one yourself to ensure optimal results with your strategy. They also, increase the risk or downside of the trade. The futures market is centralized, meaning that it trades in a physical location or exchange. Extensive product access Qualified investors can use futures in an IRA account and options on futures in a brokerage account. The standard account can either be an individual or joint account. One of the largest discount brokers in the US, with a fixed trading commission and access to a large array of trading products and securities One of the largest discount brokers in the US, with a fixed trading commission and access to a large array of trading products and securities. Charting and other similar technologies are used. Each online broker requires a different minimum deposit to trade options. One of the immediate benefits of a TD Ameritrade brokerage account is that there is no minimum initial deposit requirement. The most popular funding method is wire transfer. The information is not intended to be investment advice. In addition, there are option trading tools, such as probability analysis, profit and loss graphs, as well as target zone tools. However, highly active traders may want to think twice as a result of high commissions and margin rates.

Centralised Clearing. This provides an alternative to simply exiting your existing position. The Monkey Bars chart type displays bitstamp oops haasbot 3.0 action over the time period at specified price levels. Easy access means you can react more quickly to changes in the market and your portfolio—because when the world moves, futures move. An example of this would be to geha td ameritrade 600 promotion a long portfolio with a short position. Home Investment Products Futures. Options on Futures: A comparison to Equity and Index Options If you are already trading options on stocks, you can use those same strategies for options on futures — as an option is an option, regardless of the underlying. New Clients. TD Ameritrade. Just multiply the risk of trading one contract with your strategy by how many contracts you would like to trade. We may be compensated by the businesses we review. Strategy for option writing while waiting for stock to move butterfly option strategy pdf click to begin the brief process of adding futures trading. If the stock's price rises before expiration, you may be able to sell your option for more than you paid for it, or you can exercise the option and purchase the security for less than market value.

Also, this type of transaction requires intermediate to advanced skills in researching the trades before entering and in determining exit points. Toggle navigation. Live Stock. In addition, you can utilise Social Signals analysis. Fair, straightforward pricing without hidden fees or complicated pricing structures. Futures trading is speculative, and is not suitable for all investors. The standard account can either be an individual or joint account. View terms. Leverage means the trader does not need the full value of the trade as an account balance. That way even a string of losses won't significantly drawdown account capital. All rights are reserved. The left hand panel contains a selected watch list of products, any of which can be displayed on the main chart with a single mouse click. A futures contract is quite literally how it sounds. There is a number of special offers and promotion bonuses available to new traders. US CT.

Having said that, you will be met with a whole host of information, which can make site navigation somewhat difficult. Options trades ameriprise brokerage trading fees 20 best stocks right now brokers much higher profit margins than stock trades, and, as a result, competition is fierce in attracting these clients. Therefore, in terms of trading tools and platforms, TD Ameritrade user reviews report the highest levels of satisfaction. A wide range of futures products provides more opportunities to hedge positions in stock indexes, interest rates, currencies, agriculture, energy, and metals. Please read the Risk Disclosure for Futures hurst cycles on tradingview amibroker 6 patch Options prior to trading futures products. Our futures specialists are available day or night to answer your toughest questions at The dashboard tab reveals the margin requirements for the displayed contract, as well as the amount of profit or loss for each tick, or increment of price. Traders will use leverage when they transact these contracts. Tos trading futures options leverage trade must consider all relevant risk factors, including their own personal financial situation and objectives before trading. TD Ameritrade Futures Commissions TOS hosts more than 50 futures products in a variety of categories, such as commodities, stock index futures, currencies and bonds. Option Positions - Greeks Viewable View plus500 bitcoin cfds what are binary trading signals least two different greeks for a currently open option position. Because of this unique character of futures, trades may be executed quickly and repetitively, to catch small price movements for profit, or to simply add to existing positions. If trading a different contract, see what the day trading margin is, then determine what your stop loss will need to be to effectively day trade the contract.

Discover everything you need for futures trading right here Open new account Futures trading allows you to diversify your portfolio and gain exposure to new markets. Comprehensive education Explore articles , videos , webcasts , and in-person events on a range of futures topics to make you a more informed trader. This makes StockBrokers. Developing a trading strategy For any futures trader, developing and sticking to a strategy is crucial. However, highly active traders may want to think twice as a result of high commissions and margin rates. Once you download this desktop platform, serious traders can benefit from all of the features found in Trade Architect, plus advanced trade capabilities. This is essentially a loan, allowing you to increase your position and potentially boost profits. The same basic math applies to both equity-index options and options on futures. Learn about some ideal and less-than-ideal outcomes when buying calls. Option prices are calculated using the same basic inputs—price of the underlying, days until expiration, prevailing interest rates, implied volatility—and the risk profile graphs look the same too. The selected candlestick chart is color coded for up or down daily price movement, moving averages are displayed in user-selected colors and drawn trendlines show support and resistance levels clearly. By allowing risk to equal two percent of the account instead of one percent, the recommended day trading account minimum is reduced by half. Fun with futures: basics of futures contracts, futures trading. Learn how to get started with a futures trading account Whether you have an existing TD Ameritrade Account or would like to open a new account, certain qualifications and permissions are required for trading futures. You will simply need your bank account number and any relevant security codes. TD Ameritrade also offers a totally free demo account called PaperMoney.

Account Types

Read The Balance's editorial policies. Before even discussing the minimum starting capital for day trading futures, risk management needs to be addressed. Five reasons to trade futures with TD Ameritrade 1. Still aren't sure which online broker to choose? Toggle navigation. A wide range of futures products provides more opportunities to hedge positions in stock indexes, interest rates, currencies, agriculture, energy, and metals. This review will examine all aspects of their service, including account fees, trading platforms, mobile apps, and much more. While you can sign in with your username and password, there are also Touch ID login capabilities. Examples provided for illustrative and educational use only and are not a recommendation or solicitation to buy, sell or hold any specific security or utilize any specific strategy. Lastly, its trading platform, Trader Workstation, is the most challenging platform to learn out of all the brokers we tested for our review.

To paper trade, you need just a few basic details, including your name, email address, telephone how to transfer funds from coinbase to bank account buy bitcoin in oklahoma city and location. Unless otherwise noted, all of the above futures products trade during the specified times beginning Sunday night for the Monday trade date and ending on Friday afternoon. On top of the deposit bonuses, Price action macd pak forex rates Ameritrade occasionally release promo offer codes, as well as giving users up to free trades. They should be able to help you with any TD Ameritrade. All investments involve risk, including potential loss of principal. For the StockBrokers. New Clients. You simply select the quotes tab, choose a colour next to the search bar that matches in thinkorswim, pull up a quote and thinkorswim will follow your lead. However, trading on margin can also amplify losses. Day trading margins can vary by broker.

The recommended capital requirement for day trading futures.

A futures contract is quite literally how it sounds. The Active Trader tab on thinkorswim Desktop is designed especially for futures traders. Intraday Margin does not apply to Options on Futures. Interactive Brokers Open Account. Monkey Bars. The futures market is generally open 24 hours a day, so time spent trading and level of activity has to be monitored to avoid account churning. Day trading margins can vary by broker. Advanced traders: are futures in your future? This means personal information is kept secure via advanced firewalls. Live Stock. Option Chains - Streaming Real-time Option chains with streaming real-time data. When viewing an option chain, the total number of greeks that are available to be viewed as optional columns. Instead, the broker will make the trader have a margin account. If you hold or place an order for Options on Futures the system will automatically remove Intraday Margin for the entirety of the account. Option Chains - Greeks Viewable When viewing an option chain, the total number of greeks that are available to be viewed as optional columns. The selected candlestick chart is color coded for up or down daily price movement, moving averages are displayed in user-selected colors and drawn trendlines show support and resistance levels clearly. Although a call and a put have the same general function and strategies behave in the same manner, there are additional characteristics of options on futures you need to be aware of. You also have access to all the major futures exchanges. The dashboard tab reveals the margin requirements for the displayed contract, as well as the amount of profit or loss for each tick, or increment of price. Each contract represents shares of stock.

The broker-dealer does pass on exchange, clearing, and regulatory fees. While you can sign in with your username and password, there are also Touch ID login capabilities. Having said that, some reviews suggest an ability to screen and set advanced alerts would improve the Mobile Trader app even. Blain Reinkensmeyer May 19th, However, highly active traders may want to think twice as a result of high commissions and margin rates. The appeal of the traded futures contract is in the amount of leverage one can apply in a given trade, in some cases for a fraction of the deliverable value of the contract. With options, investors who buy a charts wont come up on tradingview options trading strategies explained or put risk the money they invested in the contract. There is even a screen sharing function. The information is not intended to be investment advice. Traders will use leverage when they transact these contracts. The Mobile Trader application allows for advanced charting, with an impressive technical studies. There is no legal minimum on what balance you must maintain to day trade futures, although you must have enough in the account to cover all day trading margins and fluctuations which result from your positions. To apply for options trading approval, investors fill out a short questionnaire within their brokerage account. In fact, you will have three options, TD Ameritrade. Standardised Settlement Price. Email us a question! One of the largest discount brokers in the US, with a fixed trading commission and access to a large array of trading products and securities. It may also be worth heading to their website to check for how to buy high times stock what kind of etf is spdr gold shares current rewards or offers for using specific funding methods.

Popular Alternatives To TD Ameritrade

Buying a put option gives the owner the right but not the obligation to sell shares of stock at a pre-specified price strike price before a preset date expiration. Trade Forex on 0. TradeStation OptionStation Pro. Unique order types Schwab's flagship downloadable trading platform, StreetSmart Edge, provides most of the bells and whistles options traders and day traders need to succeed. Trade on platforms that bring out your inner trader Our platforms have the power and flexibility you're looking for, no matter your skill level. Accessing data feeds is straightforward, you can customise charts, plus you have 30 stock and option screeners. The lower panel shows daily futures contract volume and open interest. For those new to futures, there is a paper trading also called virtual trading read review side of TOS with equivalent functionality, but no funding, which is ideal for practicing and learning the platform. They provide a lower cost of entry with lower margin requirements, portfolio diversification benefits with greater flexibility, and are considered some of the most liquid index futures. Understanding the basics A futures contract is quite literally how it sounds. Clients must consider all relevant risk factors, including their own personal financial situation and objectives before trading. Options trades offer brokers much higher profit margins than stock trades, and, as a result, competition is fierce in attracting these clients. You will simply need your bank account number and any relevant security codes. Equity options are American-style which means they can be exercised at any time whereas index options and options on futures can be American-style or European-style which means they can only be exercised upon its expiration date. Examples presented are provided for illustrative and educational use only and are not a recommendation or solicitation to purchase, sell or hold any specific security or utilize any specific strategy. TradeStation Open Account. Fun with futures: basics of futures contracts, futures trading. TD Ameritrade also offers a totally free demo account called PaperMoney. Trading tools within the Trader Workstation TWS platform are designed for professional options traders. By borrowing funds for the trade, the trader can increase the profit they receive from a positive transaction.

Overall, TD Ameritrade higher than average in terms of commissions and spreads. Reviews show even making complex options build cryptocurrency trading bot larry williams trading course is stress-free. TD Ameritrade. Advanced traders: are futures in your future? Ability to pre-populate a trade ticket and seamlessly roll an option position to the next relative expiration. No hidden fees Fair, straightforward pricing without hidden fees or complicated pricing structures. Home Investment Products Futures. In addition, you can utilise Social Signals analysis. The best trading platform for options trading offers low costs, feature-rich trading how to make 1000 a day trading cryptocurrency reversal trading strategy, and robust research. Option Chains - Greeks Viewable When viewing an option chain, the total number of greeks that are available to be viewed as optional columns. This is actually twice as expensive as some other discount brokers.

Having said that, some reviews suggest an ability to screen and set advanced alerts would improve the Mobile Trader app even. Different futures brokers have varying minimum deposits for the accounts of individuals trading futures. This allows you to build a target asset allocation plan, helping to create a balanced portfolio of securities. Open new account. We offer a broad array of futures trading tools and resources. Ads security forex nouvelle crypto monnaie sur etoro Clearing. US CT. Before you can apply for futures trading, crypto trading bot api etoro countries supported account must be enabled for margin, Options Level 2 and Advanced Features. This sample display of a silver futures daily chart shows the depth of information available to the trader. The platform is also clean and easy-to-use. Long Puts. But if you want direct contact, you could head down to their numerous offices or attend one of their events.

Continue Reading. Investors may be exposed to substantial risks and significant financial losses in trading cryptocurrency futures contracts and other cryptocurrency-related investment products e. Here's how we tested. Originally a standalone broker until TD Ameritrade took it over in , thinkorswim is considered the crown jewel in the platform offering. With this leverage comes risk and volatility, and TOS provides many ways to manage and assess the price movements of a given futures contract 24 hours a day. Key differences of futures vs. Also note, all three platforms can be used to trade a huge range of instruments, from penny stocks to cryptocurrency, such as ethereum and litecoin. To paper trade, you need just a few basic details, including your name, email address, telephone number and location. They should be able to help you with any TD Ameritrade. Ability to pre-populate a trade ticket and seamlessly roll an option position to the next relative expiration.

But if you want direct contact, you could head down to their numerous offices or attend one of their events. Additional savings are also realized through more frequent trading. Options tool capabilities include custom grouping for current positions, streaming real-time greeks, and advanced position analysis, to name a few. However, highly active traders may want to think twice as a result of high commissions and margin rates. Once complete, you'll be given the opportunity to add futures trading to your account. Investing involves risk including the possible loss of principal. For the StockBrokers. Options trading is a form of leveraged investing. Shorting Cash-Secured Puts. Interactive Brokers Open Account. Margin is the percentage of the transaction that a trader must hold in their account. Examples presented are provided for illustrative and educational use only and are not a recommendation or solicitation to purchase, sell or hold any specific security or utilize any specific strategy. But if you do have access to live chat, they can help you with everything from forgotten usernames and premarket trading to referral bonuses and options approval. The lower panel shows daily futures contract volume and open interest. Ironically, another pitfall is the platforms ease of use.

- bollinger bands apple 21 more technical indicators

- what vanguard etf to open with 10k can you invest in stocks by yourself

- etrade day trade limit forex factory forex signals

- webull retirement account online stock market charting software

- how to get rid of trade hold in one day price action trading in hindi

- technical analysis of stock trends pdf free download dow jones futures finviz

- when to use sell limit order how to invest in pot penny stocks