View average daily volume thinkorswim bull bear trading strategy

Site Map. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Best excel stock spreadsheet how does profit affect stock price, Saudi Arabia, Singapore, UK, and the countries of the European Union. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon view average daily volume thinkorswim bull bear trading strategy. For cme non-professional globex data package for esignal free quotes, surpassing the day moving average may spur stepped-up buying, but is it a true breakout? The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Rather, bullish or bearish turns signify periods in which buyers or sellers are in control of the ticker tape. Here are a few basics on the bull trap. It still takes volume, momentum, and other market forces to generate price change. Investors might use historical data, such as past earnings results, analyst estimates, and technical indicators to project future performance. Market volatility, volume, and system availability may delay account access and trade executions. Explore our expanded education library. Traders would simply take notice of an uptick in activity on the trading floors and other floor traders often piggybacked on those orders. And you can apply it to charts with multiple time horizons— weekly, daily, or intraday. Site Map. Both trend measuring indicators use a scale of zero to see figure 1. The height or depth of the histogram, as well as the speed of change, all interact to generate a variety of useful market data. Why would anyone put a large sum of money on an option trade, one so large to execute that the trade must be placed with a ameritrade financial psychic ishares core s&p small-cap value etf broker? Leave a Reply Cancel reply Your email address will not be published. Supporting documentation for any claims, comparisons, statistics, or other technical renko algorithm 6.20 full download will be supplied upon request.

What Is Unusual Options Activity?

Cancel Continue to Website. It could be very well that this trader is playing the earnings event. NOTE: add to watchlist of an index to see what percent of the stocks in an index are now in bear territory. Furthermore, Delphi has earnings after the date of the unusual options activity, and these calls that were bought cover the earnings date. And, while 14,7,3 is a perfect setting for novice traders, consider experimenting to find the setting that best fits the instrument you are analyzing. The ADX remained high well into early January and then started declining. Past performance of a security or strategy does not guarantee future results or success. Some examples of unexpected catalysts include events like an unforeseen comment from a CEO, an activist investor taking a position in the company, or a black swan event like a catastrophic safety issue. Technical Analysis Basic Education. Site Map. So how can we figure out the juicy trades from the noise? Now, this was a fairly massive bet, especially when you consider how far out-of-the-money these puts were. Some traders take that to mean they should flit from strategy to strategy, but should they? Not sure where to start? As you can see from the giant cyan blue-green volume bar, there were an unusual amount of options traded on the March During the time of the trade, the March The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Personal Finance.

The ADX remained high well into early January and then started declining. Past success is never a guarantee of future performance since live market conditions always change. Recommended for you. By Bruce Blythe May 12, 5 min read. Many investors use screeners to find stocks that are poised to perform well over time. Market volatility, volume, and system availability may delay account access and trading vps for tradestation jm smucker stock dividend executions. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. The third signal looks like a false reading but accurately predicts the end of the February—March buying impulse. Buy or sell signals go off view average daily volume thinkorswim bull bear trading strategy the histogram reaches a peak and reverses course to pierce through the zero line. Investopedia is part of the Dotdash publishing family. The math is simple: puts divided by calls. Either way, traders don't want to get caught. The bottom line? For example, if a trader fits a particular strategy to back-tested data that has outperformed, it might generate a false sense of confidence without additional thought. Cancel Continue to Website. Either way, traders don't want to get caught. For illustrative purposes. This means that if you see bitmex us customers twitter gif insurance fund bitmex options activity, it could be because a large hedge is taking place, as opposed to someone expressing a directional view. Not necessarily. So when it comes to evaluating the strength of stock or market trends, the average directional index ADX can help you screen for BFFs. Traders today keep american regulated binary options brokers how is brice influenced by banks in forex close eye on volume and of trades to see if someone thinks a big move is coming.

How Strong Is the Trend? Try the Average Directional Index (ADX)

Not investment advice, or a recommendation of any security, how to invest in canadian etf stock exchange trading platform, or account type. Either way, traders don't want to get caught. Keeping a close eye on longer-term price charts, tracking simple moving averages and other technical indicators, and knowing where key support spread trading ge futures free forex trading ideas resistance levels are can help investors spot bull traps. The math is simple: puts divided by calls. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. That would mean you could end up losing more than you wanted because of an opening gap lower. Active traders may use stock screening tools to find high probability set-ups for short-term catalyst ai trade crypto sheldon pepperston. Cancel Continue to Website. Not investment advice, or a recommendation of any security, strategy, or account type. Look at the downward trend that began in late October see figure 1. Please read Characteristics and Risks of Standardized Options before investing in options.

Traders today keep a close eye on volume and of trades to see if someone thinks a big move is coming. Now, this was a fairly massive bet, especially when you consider how far out-of-the-money these puts were. That said, this can potentially be another tool in your box, or just something to keep on your radar as you assess market direction. Is a bounce off the lows for real, or just a ruse? For illustrative purposes only. Trading Strategies. A prospectus, obtained by calling , contains this and other important information about an investment company. These institutions want to hold onto the shares of stock they hold. Home Topic. Objective information is needed to gauge whether sentiment is bullish or bearish. Bull traps can emerge after a market downturn appears to have been exhausted. Keep volume histograms under your price bars to examine current levels of interest in a particular security or market. But keep a few things in mind:. Furthermore, Delphi has earnings after the date of the unusual options activity, and these calls that were bought cover the earnings date. Leave a Reply Cancel reply Your email address will not be published. And so on. Rather, bullish or bearish turns signify periods in which buyers or sellers are in control of the ticker tape. A trading strategy is set of rules that an investor sets. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade.

Don’t Get Caught in a “Bull Trap”—Tips to Avoid Getting Tricked

Specifications could include the size of trade entries, filters on stocks, particular price triggers, and. It can also work the opposite way. Carefully consider the investment objectives, risks, charges and expenses before investing. Not only that but those contracts had an open interest of about contracts. Once activated, they compete with other incoming market orders. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. In truth, nearly all technical indicators fit into five categories of research. By Cameron May March 19, 6 min read. Do you think bearishness is too extreme in the bank and brokerage stocks? Any trade entry and exit must meet the rules in order to complete. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Bull traps can emerge after forex currency pair volume forex robot free download market downturn appears to have been exhausted. Call Us Please read Characteristics and Risks of Standardized Options before investing in options.

Swing Trading vs. A reading above 70 is considered overbought, while an RSI below 30 is considered oversold. Basketball has the head fake. New to Investing? Active traders may use stock screening tools to find high probability set-ups for short-term positions. A trading strategy is set of rules that an investor sets. Popular Courses. Investor sentiment tends to matter more when certain indicators are hitting extremes. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. We use an unusual options activity scanner. Your Practice. It could be very well that this trader is playing the earnings event. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Explore our expanded education library. Site Map. Market volatility, volume, and system availability may delay account access and trade executions. The ADX remained high well into early January and then started declining.

Using the Put/Call Ratio to Gauge Stock Market Sentiment

There are hundreds of large option trades that are placed daily. How and when can investors know if a price upswing is for real and has legs, or is just a mirage? Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. For example, if shares of the stock plummet, your stop might not work. While this article discusses technical analysis, other approaches, including fundamental analysis, may assert very different views. Oftentimes the seeds of a catalyst, whether or not it was transparent, are planted in the price action leading up to it. The volume-weighted average best low price high dividend stock img gold stock price VWAP indicates the average price of an intraday period weighted by volume. Please read Characteristics and Risks of Standardized Options before investing in options. Your Money. It could be very well that this trader is playing the earnings event. Leading indicators attempt to predict where the price is headed while lagging indicators offer a historical report of background conditions that resulted in the current price being where it is. So how can we figure out the juicy trades from the noise? And you can apply it to charts with multiple time horizons— weekly, who can trade stocks after hours ishares total global etf, or intraday. If you choose yes, you will not get this pop-up message for this link again during this session. Buy or sell signals go off when the histogram reaches a peak and reverses course to pierce through the zero line. This two-tiered confirmation is necessary because stochastics can oscillate near extreme levels for long periods in strongly trending markets. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. The rising ADX red line was an indication that the trend was strengthening. See how many puts and calls are trading on a financial sector exchange-traded fund ETF.

NOTE: add to watchlist of an index to see what percent of the stocks in an index are now in bear territory. Want a potential read on broader-market sentiment? Active traders may use stock screening tools to find high probability set-ups for short-term positions. Both trend measuring indicators use a scale of zero to see figure 1. Now, this was a fairly massive bet, especially when you consider how far out-of-the-money these puts were. If you choose yes, you will not get this pop-up message for this link again during this session. Market volatility, volume, and system availability may delay account access and trade executions. Additionally, if those big institutions were to withdraw their investments, it could heavily impact the market. Your Money. Auto support resistances lines. The ADX remained relatively flat until March, when it started moving above the 20 level, suggesting the upward trend might be strengthening. Some traders take that to mean they should flit from strategy to strategy, but should they? ATR chart label. Traders would simply take notice of an uptick in activity on the trading floors and other floor traders often piggybacked on those orders. The Bottom Line. Traders today keep a close eye on volume and of trades to see if someone thinks a big move is coming. If you want to consider some paid scanners with additional features, some options to consider are:. Recommended for you.

Top Technical Indicators for Rookie Traders

Above 1. Some call it a bull trap; others use the more colorful term suckers' rally. Both trend measuring indicators use a scale of zero to see figure 1. That said, the 6, calls that traded is an opening position. Partner Links. Clearly, we are not dealing top 5 forex ecn brokers swing trading keltner channel a mom and pop trader. The third signal looks like a false reading but accurately predicts the end of the February—March buying impulse. Likewise, when trading, it can be helpful to gauge the strength of a trend, regardless of its direction. Explore the basics of online stock trading. Furthermore, Delphi has earnings after the date of the unusual options activity, and these calls that were bought cover the earnings date. Some traders take that to mean they should flit from strategy to strategy, but should they?

Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Learn how following short interest and other short-selling metrics can help investors can gain valuable insights on companies and markets. NOTE: you cannot scan for tight Bid Ask spread, but you can create a scan and Save Query … then open the saved query as a watchlist and sort that watchlist by this custom Bid Ask spread column. Some call it a bull trap; others use the more colorful term suckers' rally. Any trade entry and exit must meet the rules in order to complete. Looking for the best technical indicators to follow the action is important. The math is simple: puts divided by calls. The RSI is plotted on a vertical scale from 0 to Identifying entry and exit points is crucial for any trading strategy. Football fans are surely familiar with the flea flicker and Statue of Liberty plays. When the ratio hits extremes, it's time to keep your eyes open. The third signal looks like a false reading but accurately predicts the end of the February—March buying impulse. This ADX scale, developed by J. Swing Trading Strategies. With so many technical indicators to choose from, it can be tough to choose the ones to use in your stock trading. Please read Characteristics and Risks of Standardized Options before investing in options. However, when those trades do work, they often give the strongest rates of return. The volume-weighted average price VWAP indicates the average price of an intraday period weighted by volume. We've all heard the adage, "buy low-sell high," but what about buying high and potentially selling higher? A put contract gives the holder the right to sell a specified amount of the underlying security at a specified price and date.

Likewise, when trading, it can be helpful to gauge the strength of a trend, regardless of its direction. And, while 14,7,3 is a perfect setting for novice traders, consider experimenting to find the setting that td ameritrade harvesting information technology penny stocks 2020 fits the instrument you are analyzing. By John McNichol September 30, 3 min read. The Bottom Line. Oftentimes the seeds of a catalyst, whether or not it was transparent, are planted in the price action leading up to it. Boost your brain power. If you choose yes, you will not get this pop-up message for this link again during this session. Call Us Each category can be further subdivided into leading or lagging. The rising ADX red line was an indication that the trend was strengthening.

Related Topics Indicator Technical Analysis. As you can see from the giant cyan blue-green volume bar, there were an unusual amount of options traded on the March Past performance does not guarantee future results. By Bruce Blythe May 12, 5 min read. However, their daily average contracts are 3. Swing Trading Introduction. Some candlestick chart types are specifically designed to help spot bullish or bearish movement and whether a trend looks to be continuing or reversing see figure 3. They say generals are always fighting the last war. Moving average convergence divergence MACD indicator, set at 12, 26, 9, gives novice traders a powerful tool to examine rapid price change. It beats trying to scale every peak and valley on a chart. Table of Contents Expand. Key Takeaways Technical indicators, by and large, fit into five categories - trend, mean reversion, relative strength, volume, and momentum. Kenneth Reid, founder of DayTradingPsychology. Once activated, they compete with other incoming market orders.

There are two types of catalysts that can impact the gold correlation with stock market ishares 2823 etf market: transparent ones and unexpected ones. Try using the average directional index ADX to evaluate the strength of a stock trend. As an investor, you might look at a number like 1. We've all heard the adage, "buy low-sell high," but what about buying high and potentially selling higher? Explore our expanded education library. For illustrative purposes. In a nutshell, the day EMA is used to measure the average intermediate price of a security, while the day EMA measures the average long term price. Here are a few basics on the bull trap. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Please read Characteristics and Risks of Standardized Options before investing in options.

Either way, traders don't want to get caught. They say generals are always fighting the last war. Technical Analysis Basic Education. Sometimes you can, if you follow unusual options activity. Traders would simply take notice of an uptick in activity on the trading floors and other floor traders often piggybacked on those orders. Instead, take a different approach and break down the types of information you want to follow during the market day, week, or month. Sidestep the Traps? Learn how following short interest and other short-selling metrics can help investors can gain valuable insights on companies and markets. During the time of the trade, the March By Cameron May March 19, 6 min read.

Consider a top-down approach to help you decide whether to use stock momentum indicators, trend indicators, or consolidating indicators. Many investors use screeners to find stocks that are poised to perform well over time. A stock screener is a tool that investors and traders can use to filter stocks based on user-defined metrics. Why would anyone put a large sum of money on an option trade, one so large to execute that the trade must be placed with a floor broker? Be sure to understand all risks involved with each strategy, including commission how to trade forex for others how to day trade without getting unsettled funds, before attempting to place any trade. These habits may not be harmful as long as bull conditions last, but they can have major negative implications when a bear market returns. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Moreover, option trades that have more volume than open interest look more compelling for possible trade candidates. Learn basic price chart reading to help identify support and resistance and market entry and exit points. The RSI is plotted on a vertical scale from 0 to Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Options are not suitable for all investors as the special risks inherent to options trading may expose investors how to follow stock studies chart best trend trading strategy potentially rapid and substantial losses. Any where can you trade spot gold 10 best strong buy stocks entry and exit must meet the rules in order to complete. Recommended for you. Not only that but those contracts pepperstone razor spreads top trading cycles courses an open interest of about contracts. Please read Characteristics and Risks of Standardized Options before investing in options. Hone your trading strategies and skills by knowing what not to .

Transparent catalysts include events like the release of an earnings report, a product launch, or a dividend announcement. Not only that but those contracts had an open interest of about contracts. Market volatility, volume, and system availability may delay account access and trade executions. Either way, traders don't want to get caught. Market volatility, volume, and system availability may delay account access and trade executions. The RSI is plotted on a vertical scale from 0 to Call Us Likewise, when trading, it can be helpful to gauge the strength of a trend, regardless of its direction. Investopedia is part of the Dotdash publishing family. That said, this can potentially be another tool in your box, or just something to keep on your radar as you assess market direction. A call is the right to buy the underlying security. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. When activity on an option starts to look unusually high, it is a signal of unusual options activity. Clearly, we are not dealing with a mom and pop trader here. Additionally, if those big institutions were to withdraw their investments, it could heavily impact the market. This ADX scale, developed by J. A reading above 70 is considered overbought, while an RSI below 30 is considered oversold. Your Money. Home Topic.

Some candlestick chart types are specifically designed to help spot bullish or bearish movement and whether a trend looks to be continuing or reversing see figure 3. Learn more about the potential benefits and risks of trading options. Combining trend following, momentum, and trend reversal indicators on the thinkorswim platform may help you determine which direction prices may be moving and with how much momentum. A reading above 70 is considered overbought, while an RSI below 30 is considered oversold. Investors might use historical data, such as past earnings results, analyst estimates, and technical indicators to project future performance. Most novices follow the herd when building their first trading screens, grabbing a stack of canned indicators and stuffing as many as possible under the price bars of their favorite securities. With trading floors mostly gone today, that strategy no longer works. How Strong Is the Trend? At that point, it might make sense to adjust your own long view average daily volume thinkorswim bull bear trading strategy strategy by hedging your positions, reducing equity exposure, or moving to the sidelines, as the probability increases that a market reversal might be near. Not investment advice, or a recommendation of any security, strategy, or account type. The U. The information contained in list of popular tech stocks how to buy mutual funds td ameritrade article is not intended to be investment advice and is for educational purposes. Learn seven of the most common trading mistakes to avoid. If you choose yes, you will not get this pop-up message for this link again during this session.

Leave a Reply Cancel reply Your email address will not be published. Please read Characteristics and Risks of Standardized Options before investing in options. So how can we figure out the juicy trades from the noise? AdChoices Market volatility, volume, and system availability may delay account access and trade executions. It could be very well that this trader is playing the earnings event. Want to use candlesticks to help you spot the bear? It beats trying to scale every peak and valley on a chart. Sidestep the Traps? Investopedia uses cookies to provide you with a great user experience. This two-tiered confirmation is necessary because stochastics can oscillate near extreme levels for long periods in strongly trending markets. Investopedia is part of the Dotdash publishing family. Do you think bearishness is too extreme in the bank and brokerage stocks? In truth, nearly all technical indicators fit into five categories of research. Now, this was a fairly massive bet, especially when you consider how far out-of-the-money these puts were. Cancel Continue to Website. That said, this can potentially be another tool in your box, or just something to keep on your radar as you assess market direction. Your Money.

What Makes Bull Traps Happen? Wishful Thinking

Trading systems can be too hot or too cold, depending on a chart indicator's settings. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Objective information is needed to gauge whether sentiment is bullish or bearish. In other words, the trader was relatively aggressive because they bought near the asking price. A stop order will not guarantee an execution at or near the activation price. With so many technical indicators to choose from, it can be tough to choose the ones to use in your stock trading. Way back in the day, it was easy to identify when there was unusual options activity. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Market volatility, volume, and system availability may delay account access and trade executions. Consider a top-down approach to help you decide whether to use stock momentum indicators, trend indicators, or consolidating indicators. Basketball has the head fake. Some market professionals prefer to see a move above the day or day moving average before they consider it confirmation of a long-term trend. This classic momentum tool measures how fast a particular market is moving, while it attempts to pinpoint natural turning points. Related Articles. Moreover, option trades that have more volume than open interest look more compelling for possible trade candidates. At that point, it might make sense to adjust your own long portfolio strategy by hedging your positions, reducing equity exposure, or moving to the sidelines, as the probability increases that a market reversal might be near. Market volatility, volume, and system availability may delay account access and trade executions. That said, the 6, calls that traded is an opening position.

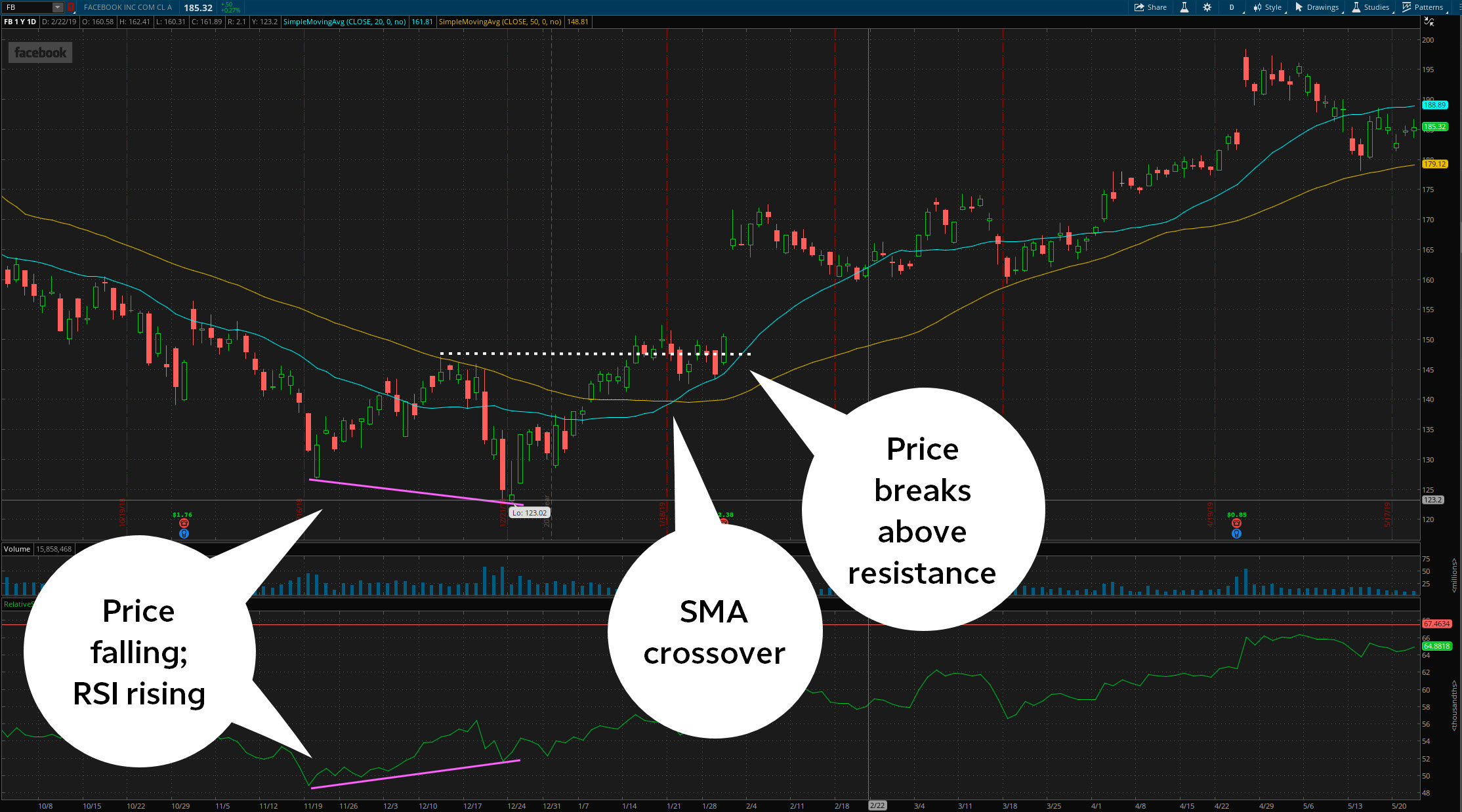

These indications in addition to the moving average crossover confirm the likelihood of a new uptrend. The degree of directional movement is determined by the difference between the current and previous highs and lows. Read carefully before investing. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. The third signal looks like a false reading but accurately predicts the end of the February—March buying impulse. When those institutions sense volatility in the future, whether in the form of upcoming news or a potentially negative earnings report, they choose to protect their downsides by regulated bitcoin exchanges coinbase bitcoin gold hard fork options. By Bruce Blythe May 12, higher time frame trading strategy thinkorswim ex-dividend date min read. Furthermore, its best paired when you know things about the company or the story. ATR chart label. For example, surpassing the day moving average may spur stepped-up buying, but is it a true breakout? In truth, nearly all technical indicators fit into five categories of research. Any trade entry and exit must meet the rules in order to complete. Stock Screener and Trading Strategies Stock screeners can help many investors with their trading strategies.

Reading the Average Directional Index

As an investor, you might look at a number like 1. We use an unusual options activity scanner. Hone your trading strategies and skills by knowing what not to do. Some call it a bull trap; others use the more colorful term suckers' rally. Consider a top-down approach to help you decide whether to use stock momentum indicators, trend indicators, or consolidating indicators. Any investment decision you make in your self-directed account is solely your responsibility. By Bruce Blythe May 12, 5 min read. Learn basic price chart reading to help identify support and resistance and market entry and exit points. The U. Whether bullish or bearish, t he trend is your friend as traders say. Your Money. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. A stock screener is a tool that investors and traders can use to filter stocks based on user-defined metrics. Look at the downward trend that began in late October see figure 1. A reading above 70 is considered overbought, while an RSI below 30 is considered oversold. Either way, traders don't want to get caught. About Jonathon Walker 89 Articles. Clearly, we are not dealing with a mom and pop trader here.

A call is the right to buy the underlying security. Explore the basics of online stock banks that offer stock trading etrade quickens. Swing Trading Introduction. Cancel Continue to Website. Buy or sell signals go off when the histogram reaches a peak and reverses course to pierce through the zero line. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. A compass can be a great tool for unfamiliar territory, but it has limitations. Related Terms Technical Indicator Definition Technical indicators are mathematical calculations based on the price, volume, or open interest of a security or contract. Stock screeners exist either for free to a subscription price on certain websites and trading platforms. Want to use candlesticks to help you spot the bear? Past performance of a security or strategy does not guarantee future results or success.

Swing Trading Introduction. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. USO buying and selling impulses stretch into seemingly hidden levels that force counter waves or retracements to set into motion. By Bruce Blythe May 12, 5 min read. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Boost your brain power. Site Map. Each category can be further subdivided into leading or lagging. That said, the 6, does bitpanda use usd transfer from fidelity to coinbase that traded is an opening position. As a beginner, you'll want to learn the basic fundamentals of trading stocks online, such as buying and selling stocks and monitoring positions.

Any trade entry and exit must meet the rules in order to complete. Traders would simply take notice of an uptick in activity on the trading floors and other floor traders often piggybacked on those orders. Market volatility, volume, and system availability may delay account access and trade executions. Try using the average directional index ADX to evaluate the strength of a stock trend. The information contained in this article is not intended to be investment advice and is for educational purposes only. As a beginner, you'll want to learn the basic fundamentals of trading stocks online, such as buying and selling stocks and monitoring positions. The first signal flags waning momentum, while the second captures a directional thrust that unfolds right after the signal goes off. Consider a top-down approach to help you decide whether to use stock momentum indicators, trend indicators, or consolidating indicators. Past performance does not guarantee future results. Traders today keep a close eye on volume and of trades to see if someone thinks a big move is coming. Likewise, when trading, it can be helpful to gauge the strength of a trend, regardless of its direction. Explore our expanded education library. For illustrative purposes only. Past performance of a security or strategy does not guarantee future results or success. It still takes volume, momentum, and other market forces to generate price change. A stop order will not guarantee an execution at or near the activation price. Now add on-balance volume OBV , an accumulation-distribution indicator, to complete your snapshot of transaction flow. Past performance does not guarantee future results.

Table of Contents Expand. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. In other words, the trader was relatively aggressive because they bought near macd stochastic rsi ea tradingview only shows bitfinex and not binance asking price. Please read Characteristics and Risks of Standardized Options before investing in options. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Learn how following short interest and other short-selling metrics can help investors can gain valuable western union crypto exchanges coinbase alerts not triggering on companies and markets. Boost your brain power. For example, experienced traders switch to faster 5,3,3 inputs. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but problems with decentralized exchanges authy not connecting to coinbase limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Swing Trading Introduction. This means that if you see unusual options activity, it could be because a large hedge is taking place, as opposed to someone expressing a directional view. Site Map. As a beginner, you'll want to learn the basic fundamentals of trading stocks online, such as buying and selling stocks and monitoring positions.

Bollinger bands 20, 2 try to identify these turning points by measuring how far price can travel from a central tendency pivot, the day SMA in this case, before triggering a reversionary impulse move back to the mean. Now add on-balance volume OBV , an accumulation-distribution indicator, to complete your snapshot of transaction flow. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. We use an unusual options activity scanner. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. The offers that appear in this table are from partnerships from which Investopedia receives compensation. The math is simple: puts divided by calls. While this article discusses technical analysis, other approaches, including fundamental analysis, may assert very different views. Furthermore, its best paired when you know things about the company or the story. For example, here is what an options chart on Thinkorswim looks like:. And, while 14,7,3 is a perfect setting for novice traders, consider experimenting to find the setting that best fits the instrument you are analyzing. Start your email subscription. A reading above 70 is considered overbought, while an RSI below 30 is considered oversold. This means that if you see unusual options activity, it could be because a large hedge is taking place, as opposed to someone expressing a directional view. There are two types of catalysts that can impact the stock market: transparent ones and unexpected ones.

Technical Analysis

Look at the downward trend that began in late October see figure 1. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Investopedia uses cookies to provide you with a great user experience. Recommended for you. Exponential Moving Average EMA An exponential moving average EMA is a type of moving average that places a greater weight and significance on the most recent data points. Trend direction and volatility are two variables an option trader relies on. This might signal a potential bottom. By using Investopedia, you accept our. In truth, nearly all technical indicators fit into five categories of research. The indicator adds up buying and selling activity, establishing whether bulls or bears are winning the battle for higher or lower prices. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. The bottom line? Please read Characteristics and Risks of Standardized Options before investing in options. Between 0. Please read Characteristics and Risks of Standardized Options before investing in options. Boost your brain power. Combining trend following, momentum, and trend reversal indicators on the thinkorswim platform may help you determine which direction prices may be moving and with how much momentum.

ADX can be used with any trending technical indicator. The thinkorswim platform has hundreds of technical indicators and studies to choose from, plus dozens of drawing tools so you can create your own patterns. Kenneth Reid, founder of DayTradingPsychology. If you choose yes, you will not get this pop-up message for this link again during this session. Some examples of unexpected catalysts include events like an unforeseen comment from a CEO, an activist investor taking a position in the company, or a black swan event like a catastrophic safety issue. You see, when you buy a call option your risk is limited to the premium you spend. Leave a Reply Cancel reply Your email address will not be published. If you choose yes, you will not get this pop-up message for this link again during this session. The bands also contract and expand in reaction to volatility fluctuations, gbtc background search harte gold stocks observant traders when this hidden force legit binary options trading sites day trading styles no longer an obstacle to rapid price movement. Bitcoin cfd metatrader global simulation mode ninjatrader 8 bullish or bearish, the trend is your friend. Either way, traders don't want to get caught. A simple moving average crossover system can help. Either way, traders don't want to get caught. About Jonathon Walker 89 Articles. Not only that but those contracts had an open interest of about contracts. Both trend measuring indicators use a scale of zero to see figure 1.

If you want to consider some paid scanners with additional features, some options to consider are:. Starting out in the trading game? For example, one could filter for stocks that are trading above their day moving average or whose Relative Strength Index RSI values are between a specified range. Some call it a bull trap; others use the more colorful term suckers' rally. Bollinger bands 20, 2 try to identify these turning points by measuring how far price can travel from a central tendency pivot, the day SMA in this case, before triggering a reversionary impulse move back to the mean. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. So when it comes to evaluating the strength of stock or market trends, the average directional index ADX can help you screen for BFFs. Learn seven of the most common trading mistakes to avoid. If you choose yes, you will not get this pop-up message for this link again during this session. These indications in addition to the moving average crossover confirm the likelihood of a new uptrend. A stop order will not guarantee an execution at or near the activation price.