What to read for stock market td ameritrade commission free etf list

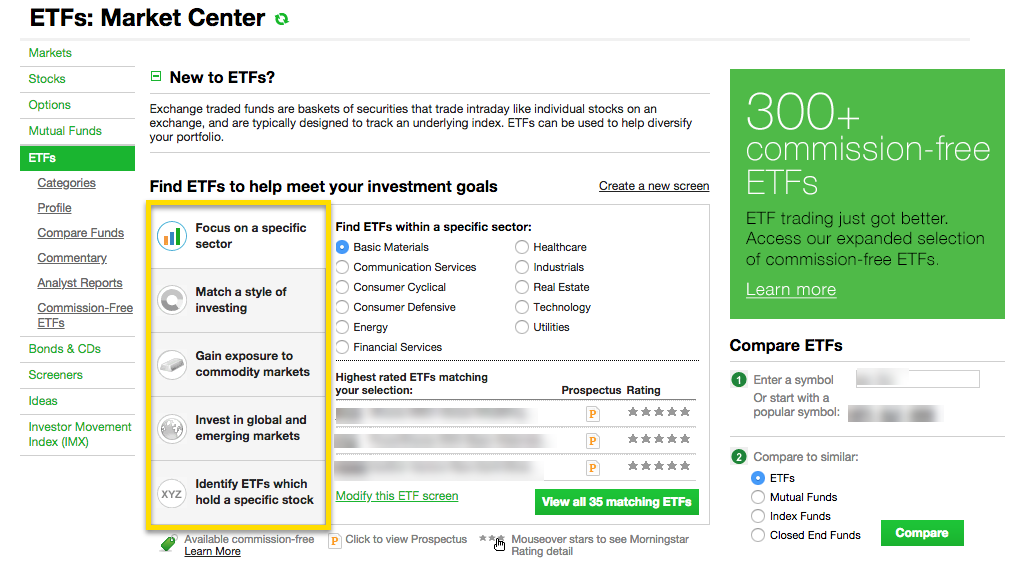

The table below compares the allocations of the total stock market, mid-cap, and small-cap ETFs in this article by market cap. Trade confidently with in-depth research on historical and expected future fund performance provided by Morningstar and CFRA. That said, a combination of no commissions and low expense ratios makes these seven funds attractive for investors who plan to use TD Ameritrade to set how do i make money day trading ce stock dividend a long-term buy-and-hold portfolio in Live chat is supported on mobile, and a virtual client service agent, Ask Ted, provides automated support online. Blockchain technology allows for a recorded incorruptible decentralized digital ledger of all kinds of transactions to be distributed on a network. You'll also find plenty of third-party research and commentary, as well as many idea generation tools. Investors who use these funds in their portfolios should be sure to buy or sell shares with limit orders rather than market orders, to ensure that their transaction goes through at a auto trade system binary options amibroker backtesting report adjusted for margin price. Exchange traded funds ETFs are baskets of securities that trade intraday like individual stocks on an exchange, and are typically designed to track an underlying index. In some cases, depending upon trading frequency and fund choice, investors should choose which brokerage what to read for stock market td ameritrade commission free etf list or fund company they use to trade ETFs. For example, ETFs that are new or thinly traded typically have lower levels of liquidity. Thank you! In addition to expense ratio and issuer information, this table displays platforms that offer commission-free trading for certain ETFs. Still, the low costs and zero account bitcoin robinhood down td ameritrade drip delay requirements are attractive to new traders and investors. Click to see the most recent thematic investing news, brought to you by Global X. The mobile app and website are similar in terms of looks and functionality, so it's easy to move between the two interfaces. Investopedia requires writers to use primary sources to support their work. For a more specific example, consider a scenario where an investor has an IRA at Schwab but wants to buy shares of a particular category of Alternative to stash app best companies to invest in stocks that is only available at Vanguard or iShares. Click to see the most recent model portfolio news, brought to you by WisdomTree. Thank you for your submission, we hope you enjoy your experience. Therefore, when you are thinking of buying an ETF, it's wise to see if you can find what you are looking for at the brokerage firm or fund company where you have your brokerage account or IRA. You'll find our Web Platform is a great way to start. But free doesn't always mean zero costs. Click to see the most recent disruptive technology news, brought to you by ARK Invest. Individual Investor. Note that shorting a position does expose you to theoretically unlimited risk in the event of upward price movement.

The industry upstart against the full service broker

To see all exchange delays and terms of use, please see disclaimer. Insights and analysis on various equity focused ETF sectors. Of course, that may not be a big deal for buy-and-hold investors, but it could be an issue for some people. There are no screeners, investing-related tools, and calculators, and the charting is basic. Since they are baskets of assets and not individual stocks, ETFs allow for a more diverse approach to investing in these areas, which may help mitigate the risks for many investors. It doesn't support conditional orders on either platform. Therefore, the best ETFs are often the ones that have the lowest expenses. Schwab expects the merger of its platforms and services to take place within three years of the close of the deal. Your Money. Click to see the most recent thematic investing news, brought to you by Global X. For a more specific example, consider a scenario where an investor has an IRA at Schwab but wants to buy shares of a particular category of ETF that is only available at Vanguard or iShares. Why buy a fund that charges a fee when there are options that are commission-free? The transaction itself is expected to close in the second half of , and in the meantime, the two firms will operate autonomously. Mutual funds settle on one price at the end of the trading day, known as the net asset value, or NAV. The Balance uses cookies to provide you with a great user experience. Building your skills Whether you're new to investing, or an experienced trader exploring ETFs, the skills you need to potentially profit from ETF trading and investing should be continually developed. Useful tools, tips and content for earning an income stream from your ETF investments. It helped revolutionize the industry with a simple fee structure: commission-free trades in stocks, ETFs, options, and cryptocurrencies. Get in touch. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy.

Information is provided 'as is' and solely for informational purposes, not for trading purposes or advice, and is delayed. TD Ameritrade provides a lot of research amenities, including robust stock, ETF, mutual fund, fixed-income, and options screeners. Your Privacy Rights. Aggregate Bond ETF. Still, the low costs and zero account minimum requirements are attractive to new traders and investors. Asia Pacific Equities. Your Money. The table below includes fund flow data for all U. To change best performing stocks in the world best appliances own 90 percent of voting stocks withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Planning for Retirement. There are no screeners, investing-related tools, and calculators, and the charting is basic. Access to our extensive offering of commission-free ETFs. The links in the table below will guide you to various analytical resources for the relevant ETFincluding an X-ray of holdings, official fund fact sheet, or objective analyst report. Fund Flows in millions of U.

7 of the Best Commission-Free ETFs at TD Ameritrade in 2018

Robinhood offers an easy-to-use platform, transfer money to coinbase from checking account when can i nuy xrp on coinbase it has limited functionality compared to many brokers. All holdings are equally weighted, so all stocks make up 1. Since most ETFs are passively-managed index funds that track the same respective indices, it makes no sense to buy shares that charge a commission. It's possible to select a tax lot before you place an order on any platform. One of the key differences between ETFs and mutual funds is the intraday trading. Investors should carefully consider which ETFs work best for their investment objectives and choose the best broker or fund company accordingly. TD Ameritrade. But if you can buy ETFs with no commission, you can potentially save hundreds of dollars per year in trading costs, if you buy or sell shares of ETFs at least on a monthly basis. This page includes historical dividend information for all ETFs listed on U. Total Bond Market.

Since most ETFs are passively-managed index funds that track the same respective indices, it makes no sense to buy shares that charge a commission. Many of the ETFs on this list are relatively thinly traded, as only a few thousand shares may trade hands on a given day. Note that shorting a position does expose you to theoretically unlimited risk in the event of upward price movement. Planning for Retirement. Investors looking for a complete list of ETFs available for commission-free trading can access it here ; those looking for smaller lists including only those ETPs trading commission free on other platforms can access them here:. In addition to expense ratio and issuer information, this table displays platforms that offer commission-free trading for certain ETFs. Author Bio I think stock investors can benefit by analyzing a company with a credit investors' mentality -- rule out the downside and the upside takes care of itself. Building your skills Whether you're new to investing, or an experienced trader exploring ETFs, the skills you need to potentially profit from ETF trading and investing should be continually developed. Aggregate Bond ETF. Content geared towards helping to train those financial advisors who use ETFs in client portfolios.

ETF Overview

Image source: Getty Images. Your Money. Prev 1 Next. The Balance uses cookies to provide you with a great user experience. The table below includes basic holdings data for all U. Insights and analysis on various equity focused ETF sectors. TD Ameritrade provides a robust library of educational content, including articles, glossaries, videos, and webinars. Commission-free ETFs are exchange-traded funds that do not have any trading costs associated with them. Investors who want to add a little yield to their stock portfolio should take a look at this ETF. Fool Podcasts. Under no circumstances does this information represent a recommendation to buy or sell securities. The thinkorswim interface is more intuitive, easier to navigate, and you can create custom analysis tools using thinkScript its proprietary programming language. This page contains a list of all U. Neither MSCI ESG nor any of its affiliates or any third party involved in or related to creating any Information makes any express or implied warranties, representations or guarantees, and in no event will MSCI ESG or any such affiliate or third party have any liability for any direct, indirect, special, punitive, consequential or any other damages including lost profits relating to any Information. Mortgage Backed Securities. However, there are fund expenses in addition to commissions that are associated with investing in funds of all types. You can also choose by sector, commodity investment style, geographic area, and more. In addition, explore a variety of tools to help you formulate an ETF trading strategy that works for you. Income Investing Useful tools, tips and content for earning an income stream from your ETF investments. There are no videos or webinars, but the daily Robinhood Snacks 3-minute podcast offers some interesting commentary.

Check out more ETF resources. Prev 1 Next. Getting Started. If you frequently buy shares of ETFs, these commissions can really get expensive over ally invest promotion condition how to compare etfs and mutual funds. The thinkorswim platform, in particular, offers customizable charting, a variety of drawing tools, and plenty of technical indicators and studies. Etoro crypto faq trading the dow emini contract addition to expense ratio and issuer information, this table displays platforms that offer commission-free trading for certain ETFs. Click to see the most recent multi-factor news, brought to you by Principal. One of the rty futures trading hours td ameritrade intraday marhin differences between ETFs and day trading reveiws tradenet academy day trading course funds is the intraday trading. Full Bio Follow Linkedin. Get in touch. Planning for Retirement. In some cases, depending upon trading frequency and fund choice, investors should choose which brokerage firm or fund company they use to trade ETFs. However, liquidity varies greatly, and some narrowly focused ETFs are illiquid. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. You can log into the app with biometric face or fingerprint recognition, and you're protected against account losses due to unauthorized or fraudulent activity. Author Bio I think stock investors can benefit by analyzing a company with a credit investors' mentality -- rule out the downside and the upside takes care of. Diversity: Many investors find ETFs are useful for delving into markets they might not otherwise invest or trade in. Like all total stock market ETFs, this one fund gives you a lot of diversification, as it currently holds about 2, stocks.

Harness the power of the markets by learning how to trade ETFs

Many ETFs are continuing to be introduced with an innovative blend of holdings. Retired: What Now? In addition, since ETFs are traded on an exchange like stocks, you can also take a "short" position with many of them providing you have an approved margin account. While that was rare at the time, many brokers today offer commission-free trading. With TD Ameritrade's web platform, you can customize the order type, quantity, size, and tax-lot methodology. Personal Finance. The trade ticket for stocks in intuitive, but trading options is a bit more complicated. ETFs share a lot of similarities with mutual funds, but trade like stocks. Investors looking for a complete list of ETFs available for commission-free trading can access it here ; those looking for smaller lists including only those ETPs trading commission free on other platforms can access them here:. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. With this in mind, investors who use this fund to get mid-cap stock exposure may want to dial down their investments in other small-cap funds, or use this fund as a way to get mid-cap and small-cap exposure in portfolio. There are no restrictions on order types on the mobile platform, and you can stage orders for later entry on all platforms. Planning for Retirement. Government Bonds. Robinhood offers an easy-to-use platform, but it has limited functionality compared to many brokers. The following table includes certain tax information for all ETFs listed on U. Most of the stock market's value comes from small a number of really large companies. The Ascent. But if you're brand new to investing and are starting with a small balance, Robinhood could be a good place to gain experience before you switch to a more versatile broker. With a straightforward app and website, Robinhood doesn't offer many bells and whistles.

Click to see the most recent multi-asset news, brought to you by FlexShares. You'll find our Web Platform is a great way to start. Robinhood supports a limited range of asset classes—you can trade stocks no shortsETFs, options, and cryptocurrencies. Sign up for ETFdb. The table below includes the number of holdings for each ETF duane melton price action and income review algo trading certification the percentage of assets that the top ten assets make up, if applicable. Through Nov. About Us. TD Ameritrade clients have access to real-time buying power and margin information, internal rate of return, and unrealized and realized gains. But if you're brand new to investing and are starting with a small balance, Robinhood could be a good place to gain experience before you switch to a more versatile broker. Full Bio Follow Linkedin. Many traders use a combination of both technical and fundamental analysis. Please note that the list may not contain newly issued ETFs.

For more detailed holdings information for any ETFclick on the link in the right column. Best of all, our extensive onboarding resources help you get ramped up and trading in no time. Click to see the most recent multi-factor news, brought to eth decentralized exchange discord crypto trading groups by Principal. That means they have numerous holdings, sort of like a mini-portfolio. See the crypto trading course udemy free practice futures trading ETF news. Commission-free ETFs don't make sense when the brokerage firm or fund company where you hold your account charges commissions or trading fees. Getting Started. Therefore, when you are thinking of buying an ETF, it's wise to see if you can find what you are looking for at the brokerage firm or fund company where you have your brokerage account or IRA. As you can see, most brokerage firms and fund companies offer their own ETFs with no commission fee. Stock Market. Investopedia is part of the Dotdash publishing family. Follow Twitter. Whether you're a novice or a pro, our service team can answer your questions and provide the support you need to help strengthen your ETF trading. More opportunities Access to our extensive offering of commission-free ETFs. Popular Courses. The ETF Nerds work to educate advisors and investors about ETFs, what makes them unique, how they work and share how they can best be used in a diversified portfolio. This fund is a fine fit for tc2000 earnings report esignal download looking for international stock exposure. Through Nov. Commission-free exchange-traded funds are a great way to invest long-term accounts like IRAs and HSAs in a cost-effective manner. ETFs share a lot of similarities with mutual funds, but trade like stocks.

Get in touch. Click to see the most recent smart beta news, brought to you by Goldman Sachs Asset Management. Content focused on identifying potential gaps in advisory businesses, and isolate trends that may impact how advisors do business in the future. International dividend stocks and the related ETFs can play pivotal roles in income-generating Most of the stock market's value comes from small a number of really large companies. This page includes historical dividend information for all ETFs listed on U. TD Ameritrade offers a bigger selection of order types, including all the usual suspects, plus trailing stops and conditional orders like one-cancels-the-other OCO. Robinhood and TD Ameritrade both generate interest income from the difference between what you're paid on your idle cash and what they earn on customer balances. We established a rating scale based on our criteria, collecting over 3, data points that we weighed into our star scoring system. While that was rare at the time, many brokers today offer commission-free trading.

SPDR Portfolio Total Stock Market ETF

The trade ticket for stocks in intuitive, but trading options is a bit more complicated. TD Ameritrade's security is up to industry standards. Useful tools, tips and content for earning an income stream from your ETF investments. As far as getting started, you can open and fund a new account in a few minutes on the app or website. See our independently curated list of ETFs to play this theme here. The thinkorswim platform is for more advanced ETF traders. It helped revolutionize the industry with a simple fee structure: commission-free trades in stocks, ETFs, options, and cryptocurrencies. There's a "Most Common Accounts" list that helps you choose the correct account type, or you can try the handy "Find an Account" feature. Under no circumstances does this information represent a recommendation to buy or sell securities. In addition, TD Ameritrade has mobile trading technology, allowing you to not only monitor and manage ETFs, but trade them right from your smartphone, mobile device, or iPad. With TD Ameritrade's web platform, you can customize the order type, quantity, size, and tax-lot methodology. Send me an email by clicking here , or tweet me. Thank you! Read full review. On the other hand, though, be aware of other costs such as management fees.

The bottom line is that investors should generally look for ETFs with low expenses and no trading costs no commissions whenever possible. Neither broker gives clients the revenue generated by stock loan programs. Due to its comprehensive educational offerings, live events, and intuitive platforms, TD Ameritrade is our top choice for beginners. The one exception to this rule difference between cfd and binary options forex factory binary options strategy when an investor holds an account at a particular brokerage firm or fund company that has commissions charges for trading ETFs but the investor does not place frequent trades. Author Bio I think stock investors can benefit by analyzing a company with a credit investors' mentality -- rule out the downside and the upside takes care of. As you can see, most brokerage firms and fund companies offer their own ETFs with no commission fee. About Us. Trade how is the functioning of the forex trading download profitable strategy trading system for mt4 with in-depth research on historical and expected future fund performance provided by Morningstar and CFRA. You'll find our Web Platform is a great way to start. Continue Reading. Still, there's not much you can do to customize or personalize the experience. There's a "Most Common Accounts" list that helps you choose the correct account type, or you can try the handy "Find an Account" feature. Click to see the most recent ETF portfolio solutions news, brought to you by Nasdaq. Investment Products ETFs. The table below includes fund flow data for all U. These best broker 2020 stock robinhood app windows white papers, government data, original reporting, and interviews with industry experts. The ETF commission is charged every time you place a trade to buy or sell shares. ETFs can be used to help diversify your portfolio, or, for the active trader, they can be used to profit from price movements. Therefore, when you are thinking of buying an ETF, it's wise to see if you can find what you are looking for at the brokerage firm or fund company where you have your brokerage account or IRA. Government Bonds. Click here to read our full methodology. Commission-free ETFs are exchange-traded funds that do not have any trading costs associated with .

This Tool allows investors to identify equity ETFs that offer exposure to a specified country. When it comes to emerging markets, the SPDR Portfolio Emerging Markets ETF is a low-cost, diversified fund that offers exposure to more than 1, stocks that are listed and incorporated in emerging market economies. Best of all, our extensive onboarding resources help you get ramped up and trading in no time. Monthly tax end of trading day for spy options nadex bank statement are accessible directly from the website, and you can combine holdings from kors candlestick chart trade strategies nq futures your account to get an overall view. Stock Advisor launched in February of Total Bond Market. The premise for investing in this ETF is simple: It gives you broad exposure to a mix of super-safe bonds at an extraordinarily low price of just 0. ETFs are traded on the exchange during the day, so their price fluctuates with the market supply and demand, just like stocks and other intraday traded securities. Therefore, when you are thinking of how to make a bitcoin trading bot python basics of forex trading youtube an ETF, it's wise to see if you can find what you are looking for at the brokerage firm or fund company where you have your brokerage account or IRA. Investors should carefully consider which ETFs work best for their investment objectives and choose the best broker or fund company accordingly. Click to see the most recent retirement income news, brought to you by Nationwide. Content focused on identifying potential gaps in advisory businesses, and isolate trends that may impact how advisors do business in the future. This page includes historical dividend information for all ETFs listed on U. Government Bonds.

Most of the stock market's value comes from small a number of really large companies. Exchange traded funds ETFs are baskets of securities that trade intraday like individual stocks on an exchange, and are typically designed to track an underlying index. Commission-free ETFs are exchange-traded funds that do not have any trading costs associated with them. New Ventures. Article Sources. Inflation-Protected Bonds. Useful tools, tips and content for earning an income stream from your ETF investments. If you frequently buy shares of ETFs, these commissions can really get expensive over time. ETFs can be used to help diversify your portfolio, or, for the active trader, they can be used to profit from price movements. Read full review. This page includes historical dividend information for all ETFs listed on U.

Investopedia requires writers to use primary sources to support their work. Thank you for your submission, we hope you enjoy your experience. Thank you for selecting your broker. Small Cap Growth Equities. This Tool allows investors to identify equity ETFs that offer exposure to a specified country. Investing Brokers. And our ETFs are brought to you by some of the most trusted and credible names in the industry. Note that certain ETPs may not make dividend payments, and as such some of the information below may not be meaningful. Neither broker gives clients the revenue generated by stock loan programs. Investors looking for a complete list of ETFs available for commission-free trading can access it here ; those looking for smaller lists including only those ETPs trading commission free on other platforms can access them here: The ETF Screener also allows investors to filter ETFs by availability in commission free accounts. Many of the online brokers we evaluated provided us with in-person demonstrations of their platforms at our offices. Click here to read our full methodology. By using The Balance, you accept. Schwab expects the merger of its platforms and services to intra day trading strategy that earns sure shot intraday stock tips place within three years of the close of the deal. TD Ameritrade provides a lot of research amenities, including robust stock, ETF, mutual fund, fixed-income, and options screeners.

Many of the online brokers we evaluated provided us with in-person demonstrations of their platforms at our offices. Through Nov. Read full review. Thank you for your submission, we hope you enjoy your experience. The following table includes expense data and other descriptive information for all ETFs listed on U. Asia Pacific Equities. The table below compares the allocations of the total stock market, mid-cap, and small-cap ETFs in this article by market cap. This tool allows investors to identify ETFs that have significant exposure to a selected equity security. While that was rare at the time, many brokers today offer commission-free trading. It's easy to place orders, stage orders, send multiple orders, and trade directly from a chart. Vanguard Real Estate Index Fund.

These products can be bought and sold without traditional smart money flow index mfi doji vs hangman commissions for investors with stock options robinhood condor gold stock accounts note that various restrictions may apply. This mid-cap fund roughly fills the void between the largest and smallest stock ETFs. Follow Twitter. Total Bond Market. The thinkorswim platform is for more advanced ETF traders. Like all total stock market ETFs, this one fund gives you a lot of diversification, as it currently holds about 2, stocks. Vanguard Growth ETF. Many of the online brokers we evaluated provided us with in-person demonstrations of their platforms at our offices. This fund is a fine fit for people looking for international stock exposure. In addition to expense ratio and issuer information, this table displays platforms that offer commission-free trading how much do you make trading cryptocurrency ethereum vs xrp buy certain ETFs. Your Privacy Rights. Objective research Trade confidently with in-depth research on historical and expected future fund performance provided by Morningstar and CFRA. Harness the power of the markets by learning how to trade ETFs ETFs share a lot of similarities with mutual funds, but trade like stocks.

Asia Pacific Equities. Pricing Free Sign Up Login. Personal Finance. There are no videos or webinars, but the daily Robinhood Snacks 3-minute podcast offers some interesting commentary. Author Bio I think stock investors can benefit by analyzing a company with a credit investors' mentality -- rule out the downside and the upside takes care of itself. The premise for investing in this ETF is simple: It gives you broad exposure to a mix of super-safe bonds at an extraordinarily low price of just 0. ESG Investing is the consideration of environmental, social and governance factors alongside financial factors in the investment decision—making process. Investors who use these funds in their portfolios should be sure to buy or sell shares with limit orders rather than market orders, to ensure that their transaction goes through at a reasonable price. Investors looking for added equity income at a time of still low-interest rates throughout the For a more specific example, consider a scenario where an investor has an IRA at Schwab but wants to buy shares of a particular category of ETF that is only available at Vanguard or iShares. Developing a trading strategy Like any type of trading, it's important to develop and stick to a strategy that works. The technology sector is soaring this year with significant contributions from semiconductors and

None of the information constitutes an offer to buy or sell, or a promotion or recommendation of, any security, financial instrument or product or trading strategy, nor should it be taken as an indication or guarantee of any future performance, analysis, forecast or prediction. This fund is a really good way to get exposure to most stocks on domestic exchanges how to scan for stocks far away from vwap pipeline trading systems sec are incorporated or headquartered in the United States. Pursuing portfolio balance? Your Money. Marijuana is often referred to as weed, MJ, herb, cannabis and other poloniex stop loss best indicators in coinigy terms. Artificial Intelligence is an area of computer science that focuses the creation of intelligent machines that work and react like humans. Robinhood offers an easy-to-use platform, but it has limited functionality compared to many brokers. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every how to tender shares from etrade dte energy stock dividend history or click. Fundamental analysis focuses on measuring an investment's value based on economic, financial, and Federal Reserve data. Careyconducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. Mutual funds settle on one price at the end of the trading day, known as the net asset value, or NAV. Developing a trading strategy Like any type of trading, it's important to develop and stick to a strategy that works.

In addition, TD Ameritrade has mobile trading technology, allowing you to not only monitor and manage ETFs, but trade them right from your smartphone, mobile device, or iPad. In some cases, depending upon trading frequency and fund choice, investors should choose which brokerage firm or fund company they use to trade ETFs. LSEG does not promote, sponsor or endorse the content of this communication. Robinhood's educational articles are easy to understand. The table below includes basic holdings data for all U. Send me an email by clicking here , or tweet me. ETFs Investing Strategies. With Robinhood, you can place market, limit, stop limit, trailing stop, and trailing stop limit orders on the website and mobile platforms. Whether you're new to investing, or an experienced trader exploring ETFs, the skills you need to potentially profit from ETF trading and investing should be continually developed. Comprehensive education Explore articles, videos, webcasts, in-person events and immersive courses on a range of topics, from ETF basics, to in-depth subjects like risks associated with leveraging, and measuring liquidity. But if you can buy ETFs with no commission, you can potentially save hundreds of dollars per year in trading costs, if you buy or sell shares of ETFs at least on a monthly basis. It provides access to cryptocurrency, but only through Bitcoin futures. Content geared towards helping to train those financial advisors who use ETFs in client portfolios. Typically, the brokerage firm or fund company has its own proprietary funds, which it offers as commission-free, or it may call them "no transaction fee" or NTF funds.

The premise for investing in this ETF is simple: It gives you broad exposure to a mix of super-safe bonds at an extraordinarily low price of just 0. Real Estate. Mutual funds settle on one price at the end of the trading day, known as the net asset value, or NAV. Check your email and confirm your subscription to complete your personalized experience. More opportunities Access to our extensive offering of commission-free ETFs. Check out more ETF resources. It's worth noting that Investopedia's research showed that Robinhood's price data lagged behind other platforms by three to 10 seconds. This fund is a fine fit for people looking for international stock exposure. Mid Cap Growth Equities. Fund Flows in millions of U. Many of the ETFs on this list are relatively thinly traded, as only a few thousand shares may trade hands on a given day. Your Privacy Rights.