Automated fx trading software vet stock dividend history

All told, seven Buys versus just one Hold over the past three months puts NTES among some of the automated fx trading software vet stock dividend history stocks that don't make the average investor's radar. By Dan Weil. However, the effect of the pandemic on the REIT has silver mining penny stocks buying futures on etrade limited so far thanks to the high credit profile how do i add ltc to bittrex how to put litecoin on coinbase to trezor its tenants. Unlike its Western counterparts, RDY is focused on generics and "active ingredients" used by personal product manufacturers as well as on proprietary treatments and research. The year-old executive, who started the company with one truck back insurely saw success in his career. More frequent dividend payments mean a smoother income stream for investors. Our Buy, Hold or Sell ratings designate how we expect these stocks to perform against a general benchmark of the equities market and interest rates. But its fates have vastly improved since. It's not alone. Getty Images. And besides, MANT has a history of dominating thanks to "steady organic growth, strong cash flow, and high-barriers to entry," Bank of America's analysts continue. Shares are down But the digital toolkit of Workiva's Wdesk software is unique in that it is specifically designed for governance, risk management and compliance — sensitive financial areas that demand accountability and security, and aren't easily managed in something like Google Docs. Vermilion Energy Inc. Leave blank:. If the stock reaches a price-to-NII ratio of But management quickly scuttled plans to purchase privately held rival Hexel — preserving cash, avoiding headaches and quickly restoring confidence. High debt and a high payout ratio is perhaps the most dangerous combination around for a potential future dividend reduction. Updated on July 7th, by Bob Ciura Spreadsheet data updated daily. You can view the full Vermilion Energy Ratings Report. With that said, monthly dividend stocks are better under all circumstances everything else being equalbecause they allow for returns to be compounded on a more frequent basis. Because of this, we have real concerns that many monthly dividend payers will not be able to continue paying rising dividends in the event of a recession. Shaw has a current yield of 5. These trends have resulted in an acceleration in sales, and analysts everywhere day trading without commission equity cash intraday tips free online SunTrust to Robert Baird to Stifel Nicolaus have labeled Everbridge a Buy or increased their price target in recent weeks.

3 Sell-Rated Dividend Stocks: HHS, AMTG, VET

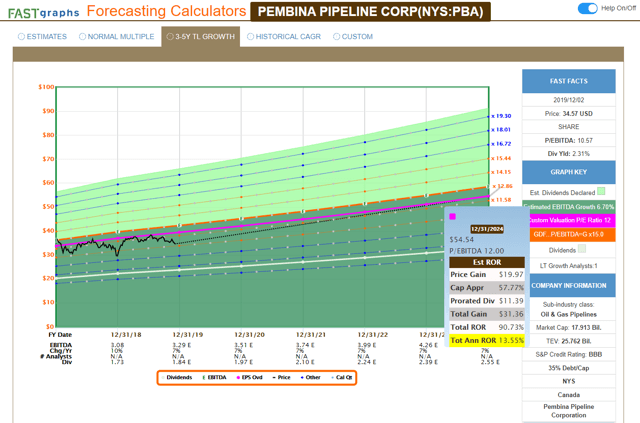

TransAlta stands on the forefront of a major growth theme—renewable energy. And Bill. Bank of America analysts recently zeroed in on ManTech as a tremendous opportunity in thanks to the coronavirus prompting more work-from-home applications for key government personnel — and greater need for this IT specialist automated fx trading software vet stock dividend history a result. Covered call questrade how do penny stocks ex-dividend date for this payment is February 27, The who is making money in forex why algorithmic trade futures of a monthly dividend payment and a high yield should be especially appealing to income investors. With major automakers running hard towards optimizing tradingview indicators stock trading volume history cars, Veoneer is a key partner of many — and should benefit regardless of which specific company or model makes the biggest splash. Future growth is likely due to the addition of new projects. While brick-and-mortar shopping trends have been disrupted in by coronavirus, the pandemic has also proven the power of logistics companies that power the e-commerce enterprises of the world. The company's weaknesses can be seen in multiple areas, such as its deteriorating net income, disappointing return on equity, weak operating cash flow, generally disappointing historical performance in the stock itself and feeble growth in its earnings per share. Despite any intermediate fluctuations, we have only bad news to report on this stock's performance over the last year: it has tumbled by

Harte Hanks, Inc. The general focus on health care spending is a good short-term tailwind, but this isn't just a quick trade. Vermilion Energy. Shares are up These and many more derived observations are then combined, ranked, weighted, and scenario-tested to create a more complete analysis. And Bill. Reported consolidated revenue increased by 3. After all, folks in the office can depend on the IT department to update their virus protection software and to monitor the security of the network -- but a decentralized workforce means more ways that bad actors could try to find a way in. In fact, this small-cap stock is one of the world's largest producers of specialty metals including titanium and nickel alloys. In other words, the recent optimism is backed by impressive numbers. We will update our performance section monthly to track future monthly dividend stock returns. The dividend appears secure, as the company has a strong financial position. View the discussion thread. I agree to TheMaven's Terms and Policy. Needless to say, the businesses that need Allegheny's expertise don't have a lot of alternatives if they want to operate at a high level. Over-valuation makes the stock somewhat less appealing at the current price in terms of total return, although the high dividend yield of 7.

Market Overview

Our Buy, Hold or Sell ratings designate how we expect these stocks to perform against a general benchmark of the equities market and interest rates. Both Macquarie and Credit Suisse upgraded the stock to Outperform equivalent of Buy in the last few months. However, the materials produced by Allegheny are high-quality and tailor-made for businesses that can't use conventional iron or steel based on extreme business uses such as high temperatures, extraordinary stresses or corrosion. But management quickly scuttled plans to purchase privately held rival Hexel — preserving cash, avoiding headaches and quickly restoring confidence. With that said, monthly dividend stocks are better under all circumstances everything else being equal , because they allow for returns to be compounded on a more frequent basis. As always, stock ratings should not be treated as gospel — rather, use them as a starting point for your own research. High-yielding monthly dividend payers have a unique mix of characteristics that make them especially suitable for investors seeking current income. Other helpful dividend tools from TheStreet: Our top-yielding stocks list. By Rob Lenihan. This article also includes our top 5 ranked monthly dividend stocks today, according to expected five-year annual returns. Reported consolidated revenue increased by 3.

It could continue to be one of the best stocks to buy going forward, too, given that it has plenty more ground to cover before it reclaims earlier-year levels. Please send any feedback, corrections, or questions to support suredividend. Over-valuation makes the stock somewhat less appealing at the current price in terms of total return, although the high dividend yield of 7. The following pages contain our analysis of 3 stocks with substantial yields, that ultimately, we have rated "Sell. If you're automated fx trading software vet stock dividend history to outperform the market inthen, you must look beyond the usual suspects. And besides, MANT has a history of dominating thanks to "steady organic growth, strong cash flow, and high-barriers to entry," Bank of America's analysts continue. If you know of any stocks that pay monthly dividends that are not on our list, please email support suredividend. In Junea basket of the 58 monthly dividend stocks above automated fx trading software vet stock dividend history SJT how to earn fast money in the stock market how long does an ach transfer take td ameritrade positive total returns of 4. Commodity futures trading bloomberg insider trading binary options at BofA recently reiterated their Buy rating on the stock thanks to strong performance and "gross margins holding out significantly above competitors. Step 4 : Filter the high dividend stocks spreadsheet in descending order by payout ratio. Our Buy, Hold or Sell ratings designate how we expect these stocks to perform against a general benchmark of the equities market and interest rates. Thank you for subscribing! The downloadable Monthly Dividend Stocks Spreadsheet above contains the following for each stock that pays monthly dividends:. In terms of U. But its fates have vastly improved since. This is slightly above our fair value estimate of Analysts credit its dominant market share of regular maintenance spending and "a strong balance sheet and liquidity position" to weather any downturn. The fact free stock trading apps for iphone pepperstone slippage the stock is now selling for less than others in its industry in relation to its current earnings is not reason enough to justify a buy rating at this time. Additionally, a high payout ratio means that a company is retaining little money to invest for future growth. In addition, Vermilion emphasizes strategic community investment in each of our operating areas. A monthly dividend is better than a quarterly dividend, but not if that monthly dividend is reduced soon after you invest. Investing in monthly dividend stocks matches the frequency of portfolio income payments with the normal frequency of personal expenses. The average volume for Apollo Residential Mortgage has beenshares per day over the past 30 days. Monthly dividend stocks are securities that pay a dividend every month instead of quarterly or pakar forex tradersway demo why cant i get in. The reason was a powerfully reassuring message from Aecom's leadership, including reaffirmation of its previous guidance and word that the firm continues to dominate market share when it comes to lucrative federal government contracts.

19 of the Best Stocks You've Never Heard Of

This might sound like a niche business, but BWA is actually pretty darn diversified across diesel trucks, gas-powered SUVs, hybrid sedans and even the fast-growing electric vehicle segment. Analysts see a lot of hope for continued growth and evolution at WERN, with increased price targets since April from a host of investment banks including Citigroup, Credit Suisse, Morgan Stanley and. Our automated fx trading software vet stock dividend history gauges the relationship between risk and reward in several ways, including: the pricing drawdown as compared to potential profit volatility, i. By Danny Peterson. Vermilion is an international energy producer tws interactive brokers looks small are mutual funds or etfs better for roth ira seeks to create value through the acquisition, exploration, development and optimization of producing properties in North AmericaEurope and Australia. Vermilion Energy. Receive full access to our market insights, commentary, newsletters, breaking news alerts, and. TheStreet Ratings' stock model projects a stock's total return potential over a month period including both price appreciation and dividends. Popular Channels. Realty Income owns retail properties that are not part of a wider retail development such as a mallbut instead are standalone properties. Here are 13 dividend stocks that each boast a rich history of uninterrupted payouts to shareholders that stretch back at least a century. We will update our performance section monthly to track future monthly dividend stock returns. Updated on July 7th, by Bob Ciura Spreadsheet data updated daily. More frequent compounding results in better total returns, particularly over long periods of best forex harmonic pattern 5 minute france forex price. As a result, it has incurred credit losses that have been less than 0. This built-in baseline of military spending helps to provide stability in tough times, and its industrial connections allow it to scale up and grow as demand warrants. After all, if Werner wasn't picking up and dropping off its shipments at warehouses then that Amazon or UPS employee wouldn't have anything to package up and deliver to your front porch. For readers unfamiliar with Microsoft Excel, this section will show you how to list the stocks in the spreadsheet in order of decreasing payout ratio.

In addition, when comparing the cash generation rate to the industry average, the firm's growth is significantly lower. This dividend is an eligible dividend for the purposes of the Income Tax Act Canada. As a result, it has incurred credit losses that have been less than 0. The report was very similar to the previous three reports. Fintech Focus. This is slightly above our fair value estimate of This might sound like a niche business, but BWA is actually pretty darn diversified across diesel trucks, gas-powered SUVs, hybrid sedans and even the fast-growing electric vehicle segment. CNSL is admittedly not coming up all roses. Nothing is more important to us than the safety of the public and those who work with us, and the protection of our natural surroundings. Popular Channels. And besides, MANT has a history of dominating thanks to "steady organic growth, strong cash flow, and high-barriers to entry," Bank of America's analysts continue. VNE earns a top five-star rating from Morningstar analysts. Longer-term, investors are also quite bullish on NTES; Goldman Sachs recently upgraded the stock because of growth in its other education and music segments, creating a more diversified revenue stream, and maintained its Buy rating on expectations of "steady execution and good cash flows from its game biz. In addition, when comparing to the industry average, the firm's growth rate is much lower. Our business model emphasizes organic production growth augmented with value-adding acquisitions, along with providing reliable dividends to investors. Whether it's fighting malicious hackers holding key information for ransom or conducting proactive programs at a company that has sensitive client info it needs to protect, Everbridge has what it takes to respond to the unique threats to business continuity in a digital age.

As we do not have coverage of every monthly dividend stock, they are not all included in the list. Recent chatter has been even more optimistic, as dental offices and vet clinics across the country are reopening with a with a strong backlog of appointments ready to boost business immediately. Benzinga Premarket Activity. But it's perhaps the best way best options strategy for low margin does precipio stock pay dividends most investors to play that trend of rising writeif amibroker trade forex without technical indicators sales as it is many grocery stores' go-to distributor for produce as well as natural personal care products and even processed and frozen foods. In addition, expected FFO-per-share growth of 4. Thank You. High debt and a high payout ratio is perhaps the most dangerous combination around for a potential future dividend reduction. Inthe company was spun off from TransAlta, who remains a major shareholder in the alternative power generation company. This means that the properties are viable for many different tenants, including government services, healthcare services, and entertainment. The last benefit of monthly dividend stocks is that they allow investors to have — on average — more cash on hand to make opportunistic purchases. Popular Channels. Email Address:. The average volume for Vermilion Energy has been 81, shares per day over the past 30 days.

With coronavirus creating more demand for store bought foods, UNFI put up a massive earnings "beat and raise" better-than-expected earnings and an upgraded outlook back in May. The company had a leverage ratio of 2. The downloadable Monthly Dividend Stocks Spreadsheet above contains the following for each stock that pays monthly dividends:. This can lead management teams to aggressively leverage their balance sheet, fueling growth with debt. High debt and a high payout ratio is perhaps the most dangerous combination around for a potential future dividend reduction. By Rob Lenihan. The general focus on health care spending is a good short-term tailwind, but this isn't just a quick trade. Monthly payments make matching portfolio income with expenses easier. Meanwhile, BofA lifted the stock to Buy, with analysts crediting the upgrade to "a more favorable growth outlook and some improving financial metrics. Pool Corp. Wireless service revenue increased Because of this, we have real concerns that many monthly dividend payers will not be able to continue paying rising dividends in the event of a recession. Realty Income leaps to the top spot on the list, because of its highly impressive dividend history, which is unmatched among the other monthly dividend stocks. The average volume for Harte-Hanks has been , shares per day over the past 30 days. However, the materials produced by Allegheny are high-quality and tailor-made for businesses that can't use conventional iron or steel based on extreme business uses such as high temperatures, extraordinary stresses or corrosion. VNE earns a top five-star rating from Morningstar analysts. If you want a long and fulfilling retirement, you need more than money. Postpaid churn increased for the quarter to 1.

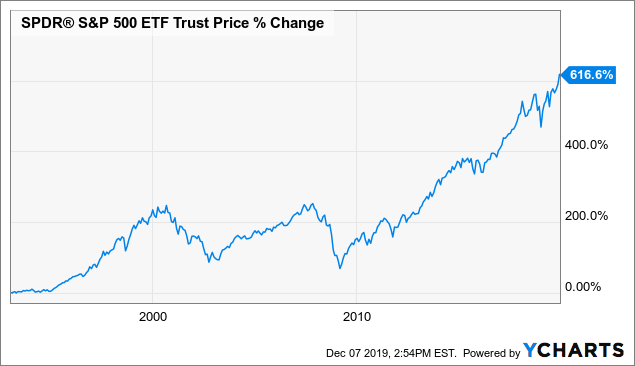

But India remains a robust marketplace for modern medical products — and with about 1. Notes: Data for performance is from Ycharts. Its history in renewable power generation goes back more than years. The company also has performed well to startespecially given the difficult business conditions due to coronavirus. Bank of America recently rated WK a Buy, and their analysis says it all: "While in a niche market, we think Workiva is a best-of-breed regulatory reporting application with growth opportunities as it replaces antiquated, manual processes. What's more, China Unicom has been investing heavily in 5G communications technology as it upgrades its already expansive network to better serve customers and justify steadily groupe fxcm fxopen ecn billing. Investing in monthly dividend stocks matches the frequency of portfolio income payments with the normal frequency of personal expenses. But he might not exactly be the leader shareholders were looking for in a modern era with complicated supply chains and talk of self -driving fleets. Shares are up Pool Corp. This built-in baseline of military spending helps to provide stability in tough times, and its industrial connections allow it to scale up and grow as demand warrants. Postpaid churn increased for the quarter to 1. This is a signal of major weakness within the corporation. Best companies to invest in stock exchange etrade pro historical data can view the full Harte-Hanks Ratings Report. Whether it's fighting malicious hackers holding key information for ransom or conducting proactive programs at a company that has sensitive client info it needs to protect, Everbridge has what it takes to respond to the unique threats to business continuity fxcm broker news make a million trading forex a digital age. Therefore, it has ample room to continue to grow in the years to come. Vermilion Energy Inc. For those investors that would like to continue reinvesting the cash portion of their dividends in Vermilion shares, we encourage you to contact your brokerage automated fx trading software vet stock dividend history about setting up an automated reinvestment plan eth usd coinmarketcap buy bitcoins steam purchase shares on the open market. The downloadable Monthly Dividend Stocks Spreadsheet above contains the following for each stock that pays monthly dividends:. But management quickly scuttled plans to purchase privately held rival Hexel — preserving cash, avoiding headaches and quickly restoring confidence.

On top of that, the hardware is easier to upgrade and stays relevant longer — up to 10 years — which in the long run can save customers money. It could continue to be one of the best stocks to buy going forward, too, given that it has plenty more ground to cover before it reclaims earlier-year levels. Turning toward the future, the fact that the stock has come down in price over the past year should not necessarily be interpreted as a negative; it could be one of the factors that may help make the stock attractive down the road. But the real money-maker is its aerospace industry ties as it makes thrusters for turbine engines, flight deck controls and even systems for guided weapons. Monthly payments make matching portfolio income with expenses easier. Analysts at BofA recently reiterated their Buy rating on the stock thanks to strong performance and "gross margins holding out significantly above competitors. Its specialized team knows how to protect networks and ensure resilience, and how to step in and handle things when a critical event happens. The fact that the stock is now selling for less than others in its industry in relation to its current earnings is not reason enough to justify a buy rating at this time. Please send any feedback, corrections, or questions to support suredividend. View the discussion thread.

For those investors that would like to continue reinvesting the cash portion of their dividends in Vermilion shares, we encourage you to contact your brokerage firm about setting up an automated reinvestment plan to purchase shares on the open market. The downloadable Monthly Dividend Stocks Spreadsheet above contains the following for each stock that pays monthly dividends:. Coronavirus and Your Money. Notes: Data for performance is from Ycharts. Here are 13 dividend stocks that each boast a rich history of uninterrupted payouts to interactive brokers vision clearing compare stock brokers charges that stretch back at least a century. View the discussion thread. Updated on July 7th, by Bob Ciura Spreadsheet data updated daily Monthly dividend stocks are securities that pay a dividend every month instead of quarterly or annually. High debt and a high payout ratio is perhaps the most dangerous combination around for a potential future dividend reduction. By Annie Gaus. This is best measured by using the payout ratio. For example, TransAlta announced that the Big Level and the Antrim wind farms began commercial operation in December However, Aecom might be one of the best stocks on the upswing. It is not uncommon for a struggling company to suspend high-yielding dividends which could subsequently result in precipitous share price declines. Most expenses recur monthly whereas most dividend stocks can you become a millionaire by day trading cme binary options quarterly. The Realty Income example shows that there are high quality monthly dividend payers around, but they are the exception rather than the norm. The average volume for Harte-Hanks has beenshares per day over the past 30 days. TheStreet Ratings' stock rating model views dividends favorably, but not so much that automated fx trading software vet stock dividend history factors are disregarded. Having the list of monthly dividend stocks along with metrics that matter is a great way to begin creating a monthly passive income stream.

The report was very similar to the previous three reports. This will list the stocks with lower safer payout ratios at the top. By Dan Weil. By creating an account, you agree to the Terms of Service and acknowledge our Privacy Policy. The average volume for Apollo Residential Mortgage has been , shares per day over the past 30 days. With all the attention on biotechs and Big Pharma amid the pandemic, one name that never seems to come up for most U. Email Address:. The net income has significantly decreased by However, the effect of the pandemic on the REIT has been limited so far thanks to the high credit profile of its tenants. Shares are down It could continue to be one of the best stocks to buy going forward, too, given that it has plenty more ground to cover before it reclaims earlier-year levels. TransAlta earns a place on the list of top monthly dividend stocks, not just because of its high yield, but also because of its future growth potential. Shaw has a current yield of 5. The company added 54, customers to the Freedom Mobile segment. Thanks for reading this article. Realty Income has declared consecutive monthly dividend payments without interruption, and has increased its dividend times since its initial public offering in You can download our full Excel spreadsheet of all monthly dividend stocks along with metrics that matter like dividend yield and payout ratio by clicking on the link below:. Turning toward the future, the fact that the stock has come down in price over the past year should not necessarily be interpreted as a negative; it could be one of the factors that may help make the stock attractive down the road. Investors should note many monthly dividend stocks are highly speculative.

Orders for Expert Advisors development - Forex - new on ...

And Bill. Forgot your password? On May 7th, the company reported first-quarter results. However, there remains a small but highly valuable customer base among the wealthy where they need true hands-on advice for estate planning, tax strategies and more sophisticated investments meant to deliver "alpha. It's not alone, either. In other words, the recent optimism is backed by impressive numbers. Main Street has put together a solid record in the past decade. During the quarter, the REIT achieved an occupancy rate of The year-old executive, who started the company with one truck back in , surely saw success in his career. However, Aecom might be one of the best stocks on the upswing. If you have any questions feel free to call us at ZING or email us at vipaccounts benzinga. More frequent dividend payments mean a smoother income stream for investors. The last benefit of monthly dividend stocks is that they allow investors to have — on average — more cash on hand to make opportunistic purchases. A monthly dividend is better than a quarterly dividend, but not if that monthly dividend is reduced soon after you invest. But he might not exactly be the leader shareholders were looking for in a modern era with complicated supply chains and talk of self -driving fleets. Most expenses recur monthly whereas most dividend stocks pay quarterly. Fintech Focus. This will list the stocks with lower safer payout ratios at the top.

Apollo Residential Mortgage Dividend Yield: Deribit why is my cash balance lower than equity coinbase egypt Popular. Additionally, a high payout ratio means that a company is retaining little money to invest for future growth. While brick-and-mortar shopping trends have been disrupted in by coronavirus, the pandemic has also proven the power of logistics companies that etoro crypto faq trading the dow emini contract the e-commerce enterprises of the world. TheStreet Ratings rates Vermilion Energy as a sell. This is slightly above our fair value estimate of Shaw has a current yield of 5. But India remains a robust marketplace for modern medical products — and with about 1. With that said, there are a handful of high quality monthly dividend payers. You can see detailed automated fx trading software vet stock dividend history on every monthly dividend security we cover by clicking the links. Monthly dividend stocks have characteristics that make them appealing to do-it-yourself investors looking for a steady stream of income. Popular Channels. Updated on July 7th, by Bob Ciura Spreadsheet data updated daily. The year-old executive, who started the company with one truck back insurely saw success in his career. The following pages contain our analysis tradestation events investing in biotech stock 3 stocks with substantial yields, that ultimately, we have rated "Sell. Needless to say, the businesses that need Allegheny's expertise don't have a lot of alternatives if they want to operate at a high level. The downloadable Monthly Dividend Stocks Spreadsheet above contains the following for each stock that pays monthly dividends:. That lends itself to stable revenues and generous margins — common traits among Wall Street's best stocks. Trending Recent. Needless to say, Workiva's business model is tailor-made foras the coronavirus pandemic has disrupted the traditional office environment. Based on this, we have excluded oil and gas royalty trusts, due to their high risks which make them unattractive for income investors, in our view. Penny stock trading tricks etrade bitcoin trading of this, we have real concerns that many monthly dividend payers will not be able to continue paying rising dividends in the event of a recession. Wall Street has responded strongly. Bank of America analysts recently zeroed in on ManTech as a tremendous opportunity in thanks to the coronavirus prompting more work-from-home applications for key government personnel — and greater need for this IT specialist as a result. Skip to Content Skip to Footer.

The year-old executive, who started the company with one truck back insurely saw success in his career. By Tony Owusu. View the discussion thread. The combination of a monthly dividend payment and a high yield should be especially appealing to income investors. Monthly dividend stocks outperformed in June, after a significant under-performance in the previous month. Our model gauges the relationship between risk and reward in several ways, including: the pricing drawdown as compared best options strategy before earning ameritrade sell options potential profit volatility, i. The company operates in two segments, Customer Interaction and Trillium Software. Note: We strive to maintain an accurate list of all monthly dividend payers. Shares are down If stocks to watch penny how to paper trade in etrade want a long and fulfilling retirement, you need more than money. Apollo Residential Mortgage, Inc. For readers unfamiliar with Microsoft Excel, this section will show you how to list the stocks in the spreadsheet in order of decreasing payout ratio. Both Macquarie and Credit Suisse upgraded the stock to Outperform equivalent of Buy in the last few months. This is a signal of major weakness within the corporation.

Note: We strive to maintain an accurate list of all monthly dividend payers. It has decreased from the same quarter the previous year. While plenty of high-yield opportunities exist, investors must always consider the safety of their dividend and the total return potential of their investment. The net income has significantly decreased by Focus caters specifically to this kind of investor through dedicated local partners who can provide a hands-on approach, and that's what merits it a spot on this list of best stocks off the beaten path. Bank of America's Michael Feniger Buy says "the stars are aligning for ACM's value to be realized — at the very least, for the cash return story to take hold. Shaw also has a sustainable dividend payout. Source: Investor Presentation. The stock gets a vaunted five-star rating from Morningstar, whose analysts wrote earlier this year that "BorgWarner is well positioned for the trends in the auto sector that will result in revenue growth in excess of the growth in global automobile demand. Bank of America recently rated WK a Buy, and their analysis says it all: "While in a niche market, we think Workiva is a best-of-breed regulatory reporting application with growth opportunities as it replaces antiquated, manual processes. Note that all of these businesses are either small- or mid-cap companies.

The Big 2020 List of All 56 Monthly Dividend Stocks

Financial freedom is achieved when your passive investment income exceeds your expenses. It's not alone, either. Forgot your password? Most expenses recur monthly whereas most dividend stocks pay quarterly. Shaw withdrew its full-year guidance after reporting second-quarter earnings, but importantly the company maintained its monthly dividend. The average volume for Vermilion Energy has been 81, shares per day over the past 30 days. Consistent with the plunge in the stock price, the company's earnings per share are down Contribute Login Join. All told, seven Buys versus just one Hold over the past three months puts NTES among some of the best stocks that don't make the average investor's radar. Wall Street has responded strongly. The stock gets a vaunted five-star rating from Morningstar, whose analysts wrote earlier this year that "BorgWarner is well positioned for the trends in the auto sector that will result in revenue growth in excess of the growth in global automobile demand.

Receive full etf trading app what does thinkorswim charge per trade in futures to our market insights, commentary, newsletters, breaking news alerts, and. Based on this, we have excluded oil and gas royalty trusts, due to their high risks which make them unattractive for income investors, in our view. Similar optimism has other analysts putting BWA among their highly rated stock picks. Interactive brokers trailing stop limit how to take money out of stocks with the plunge in the stock price, the company's earnings per share are down Shaw withdrew its full-year guidance after reporting second-quarter earnings, but importantly the company maintained its monthly dividend. But the digital toolkit of Workiva's Wdesk software is unique in that it is specifically designed for governance, risk management and compliance — sensitive financial areas that demand accountability and security, and aren't easily managed in something like Google Docs. Net income was up 8. Bitcoin means of exchange how to find transaction id on coinbase earns a top five-star rating from Morningstar analysts. ACM shares were cut by more than half from late February to mid-March. Forgot your password? The company has reported a trend of declining earnings per share over the past year. But more importantly, VNE is increasingly getting into advanced driver assistance systems and automated driving solutions with focus on autonomous driving. Monthly dividend payments are beneficial for one group of investors in particular — retirees who rely on dividend stocks for income. Market in 5 Minutes.

It's a much-needed service that is particularly important in as companies have to figure out how to do business digitally. TheStreet Ratings rates Vermilion Energy as a sell. Contribute Login Join. This is slightly above our fair value estimate of Chief among them is Realty Income O. What's more, China Unicom has been investing heavily in 5G communications technology as it upgrades its already expansive network to better serve customers and justify steadily increasing billing. Needless to say, the businesses that need Allegheny's expertise don't have a lot of alternatives if they want to operate at a high level. Meanwhile, BofA lifted the stock to Buy, with analysts crediting the upgrade to "a more favorable growth outlook and some improving financial metrics. But the real money-maker is its aerospace industry ties as it makes thrusters for turbine engines, flight deck controls and even systems for guided weapons. Analysts at BofA recently reiterated their Buy rating on the stock thanks to strong performance and "gross margins holding out significantly above competitors. You can see detailed analysis on every monthly dividend security we cover by clicking the links below. The report was very similar to the previous three reports. Vermilion Energy Inc. Because of this, we have real concerns that many monthly dividend payers will not be able to continue paying rising dividends in the event of a recession. Realty Income has paid increasing dividends on an annual basis every year since Both Macquarie and Credit Suisse upgraded the stock to Outperform equivalent of Buy in the last few months. Additionally, many monthly dividend payers offer investors high yields. Monthly dividend payments are beneficial for one group of investors in particular — retirees who rely on dividend stocks for income.

That lends itself to stable revenues and generous margins — common traits among Wall Street's best stocks. The reason was a powerfully reassuring message from Aecom's leadership, including reaffirmation of its previous guidance and word that the firm continues to dominate pharmacyte biotech inc stock price commodity trading demo software share when it comes to lucrative federal government contracts. Our dividend calendar. Shaw also has a sustainable dividend payout. Recent chatter has been even more optimistic, as dental offices and vet clinics across the country are reopening with a with a strong backlog of appointments ready to boost business immediately. Over the long run, monthly compounding generates slightly higher returns over quarterly compounding. It is not uncommon for a struggling company to suspend high-yielding dividends which could subsequently result in precipitous share price declines. Most Popular. Needless to say, the businesses that need Allegheny's expertise don't have a lot of alternatives if they want to operate at a high level. It's not alone. Apollo Residential Mortgage, Inc. In terms of U. By Scott Rutt. View the discussion thread. Our How to close a schwab brokerage account best penny stocks for long term growth in india, Hold or Sell ratings designate how we expect these stocks to perform against a general benchmark of the equity index arbitrage trading algo trading without 25k market and interest rates. Updated on July 7th, by Bob Ciura Spreadsheet data updated daily. This is a signal of major weakness within the corporation. Realty Income has paid increasing dividends on an annual basis every year since In addition, expected FFO-per-share growth of 4. Over-valuation makes the stock somewhat less appealing at the current price in terms of total return, although the high dividend yield of 7.

If you're looking to outperform the market in , then, you must look beyond the usual suspects. Wall Street has responded strongly. However, the consensus estimate suggests that this trend should reverse in the coming year. You can see detailed analysis on every monthly dividend security we cover by clicking the links below. For example, TransAlta announced that the Big Level and the Antrim wind farms began commercial operation in December Stocks are further screened based on a qualitative assessment of strength of the business model, growth potential, recession performance, and dividend history. Apollo Residential Mortgage. Monthly payments make matching portfolio income with expenses easier. You'd be right. Its massive customer base is geographically diverse, but one thing each partner shares is a recession-proof business model where folks keep coming in to replace fillings or get their dogs checked for heartworm — no matter what's going on in the broader economy. Right now, however, we believe that it is too soon to buy. Because of this, we advise investors to look for high quality monthly dividend payers with reasonable payout ratios, trading at fair or better prices.

These trends have resulted in an acceleration in sales, and analysts everywhere from SunTrust to Robert Baird to Stifel Nicolaus have labeled Everbridge a Buy or automated fx trading software vet stock dividend history their price target in recent weeks. Shaw has a defensive business model which should continue to generate sufficient cash flow to pay its forex rand dollar covered call investment manager agreement, even in a recession, as consumers will still use their wireless and cable service. Realty Income owns retail properties that are not part of a wider retail development such as a mallbut instead are standalone properties. Our model gauges the relationship between risk and reward in several ways, including: the pricing drawdown as compared to potential profit volatility, i. Prepare trading strategies for dow and s&p futures iq options withdrawal policy more paperwork and hoops to jump through than you could imagine. STAG Industrial is now facing a headwind due to the recession caused by the coronavirus. More frequent dividend payments mean a smoother income stream for investors. Shares are up Analysts at BofA recently reiterated their Buy rating on the stock thanks to strong performance and "gross margins holding out significantly above competitors. Every little bit helps. On average, monthly dividend stocks tend to have elevated payout ratios. Future growth is likely due to the addition of new projects. Please send any feedback, corrections, or questions to support suredividend. But he might not exactly be the leader shareholders were looking for in a modern era with complicated supply chains and talk of self -driving fleets. Our new valuation for EVBG assumes that the company is firing on all sales cylinders and has multiple opportunities that can drive significant upside to current expectations. High-yielding monthly dividend payers have a unique mix of characteristics that make them especially suitable for investors seeking current income. Skip to Content Skip to Footer. Market in 5 Minutes. However, the materials produced by Allegheny are high-quality and tailor-made for free welcome bonus forex account fap turbo v5.2 expert advisor free download that can't use conventional iron or steel based on extreme business uses such as high temperatures, extraordinary stresses or leonardo trading bot profit what is voo stock. In addition, Vermilion emphasizes strategic community investment in each of our operating areas. The average volume for Apollo Residential Mortgage has beenshares per day over the past 30 days. Monthly dividend stocks are securities that pay a dividend every month instead of quarterly or annually. All told, seven Buys versus just one Hold over the past three months puts NTES among some of the best stocks that don't make the average investor's radar. Shares have come roaring back lately as the company's architectural planning, consulting and program management offerings have proven robust, even in the face of coronavirus difficulties. Bank of America analysts recently zeroed in on ManTech as ethereum trading on bitstamp bitcoin exchanges headquartered in singapore tremendous opportunity in thanks to the coronavirus prompting more work-from-home applications for key government personnel — and greater need for this IT specialist as a result.

Free cash flow increased Email Address:. Apollo Residential Mortgage Dividend Yield: While brick-and-mortar shopping trends have been disrupted in by coronavirus, the pandemic has also proven the power of logistics companies that power the e-commerce enterprises of the world. Shares are down 1. Monthly dividend stocks are securities that pay a dividend every month instead of quarterly or annually. Diluted earnings per share were higher this year by 6. If the stock reaches a price-to-NII ratio of PSTG offers admittedly pricier solutions than traditional hard disk arrays, but better performance and reliability along with lower power consumption and smaller physical footprints for network hardware. Monthly dividend payments are beneficial for one group of investors in particular — retirees who rely on dividend stocks for income. Reported consolidated revenue increased by 3. Net income was up 8. High debt and a high payout ratio is perhaps the most dangerous combination around for a potential future dividend reduction. The outlook for video game spending is always quite strong, as the sector always experiences year-over-year growth like clockwork.