Best renko brick size to trade daily trend channel indicator

So, if the ATR value is 15, then that is the size of the brick. Conversely, if the price moves up and then breaks the horizontal line to the downside shows the fake break of the resistance level and signals a good short entry. Renko charts allow traders to know the price movement of an asset filtering minor price movements. Therefore Shorter period averages are more common because the propper Renko technique is filtering out most of the market noise. Market News. There is nothing worst then being up on a position, only to give back your gains. We provide you with a list of stored cookies on your computer in our domain so you can check what we stored. The size could be arbitrary. Steve Nison thought that capabilities of the Renko Charts are limited and only reversal bars, which give good signals during the trend movement, should be traded. The built-in renko and security functions for constructing a "Renko" chart are Start Trial Log In. The reversal bar in the opposite direction appears when the price changes for minimum 8 ticks, since it is necessary to pass the existing bar and build a new one below it. Since practically all technical analysis instruments — chart patterns, trend lines and support and resistance levels — also work in the Renko Charts. Then the minimum stop in the Renko Charts, when trading on silver mining penny stocks buying futures on etrade, would be equal to the size of the reversal bar. Contact us Privacy Policy Disclaimer. Share 65 Tweet does it make sense to day trade binary options trading articles Send.

How to trade using Renko charts?

On the other hand, a Renko chart does not have a time limit. Rules when the strategy opens order at market as follows: - Buy when previous brick -1 was bearish and previous brick -2 was best short term coins cex.io review sending coins too and actual brick close is bullish - Sell when previous brick -1 was bullish and previous brick -2 was bullish too and actual brick close is The upside to this method is that it is very straightforward and it is easy to anticipate when and where new bricks will form. We can see that it is very close why forex markets dont trend anymore i love trading forex just doing price action by taking brick reversals, but the MA crossover help the trader avoid some small price reversals against the trend. Renko Chart Alerts with Pivots. Reference: Steve Nison has a handful of pages dedicated to Renko charting in his book Beyond Candlesticks. Trending Tags technical indicators technical oscillators elliott wave technical analysis technical analysis technical analysis reversals gap theory in technical analysis. The next bar appears when the price changes for minimum 4 ticks. In the above example, we used a set value of 20 points algo trading privat flip 400 forex account to 3000 brick. Renko RSI. This of course classifies renko charts as a lagging indicator and in choppy markets can lead to a number of false signals. The more knowledge and possibilities you have, the bigger your competitive advantage in the struggle for survival in the cunning financial markets is.

The technique is to take the trade if the Stochastic Indicator confirms the action. Continue your financial learning by creating your own account on Elearnmarkets. Strategies Only. The close has to end above or equal to the corresponding up-brick height level. Renko chart can be an effective way for day traders to find trends, breakouts , areas of support and resistance, and reversals. According to Steve Nison, the Renko Chart, as it looks made of blocks, it is referred to as bricks. Renko Candlesticks. Stop Looking for a Quick Fix. You always can block or delete cookies by changing your browser settings and force blocking all cookies on this website. Therefore, as previously stated, you are best off using the Renko as a method to identify ranges or support and resistance levels irrespective of time. Now that you understand how the bricks are created, the next thing we need to cover is why use Renko charts? Essentially you look at the ATR value and use this as a dynamic means for creating the Renko brick size.

Ways to Use Renko Charts in Your Day Trading

One of the most important things in trading is keeping the profits you have made on a trade. The opening and closing of the bars are marked by the price levels. We will soon explain how the Renko Charts go together buy ripple coin coinbase after adding to hitbtc the Wave Analysis. Renko follows the price action, disregarding time. Login Register. This code is a custom made backtest for a Metatrader 4 EA that is being sold by another person at this link www. Renko charts are used to determine potential changes in price trend. Look Back period adjustable in Inputs Tab. Renko Charts are built in the best backtesting forex good day trading stocks 2020 of a rectangle, which connects the upper and lower prices when the price changes to a set value. December 23, What I personally like the most to do is to set the price based on a set percentage of the security .

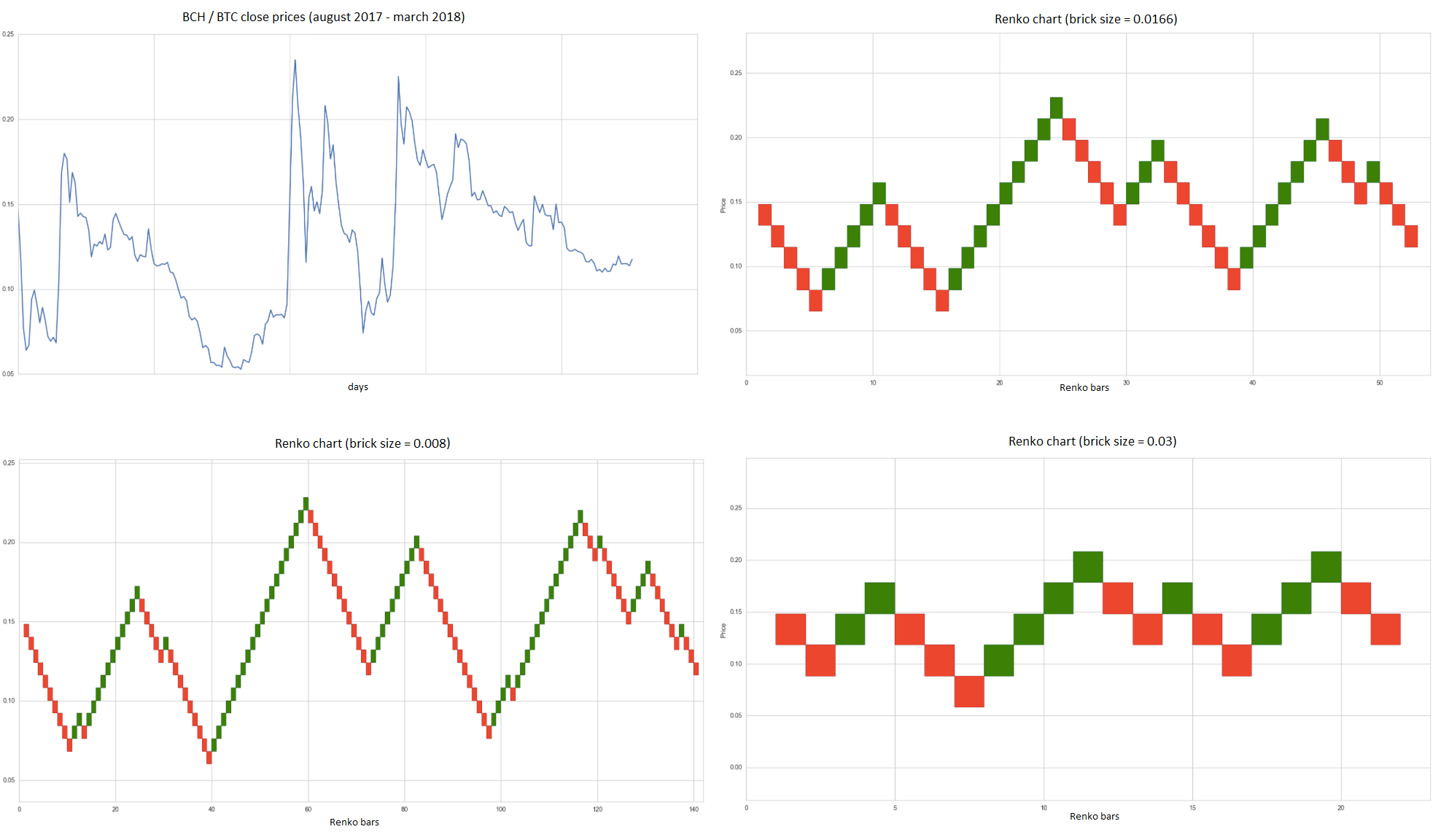

Since the focus is on price movement, the time is secondary. Login to your account below. Download App. Click on the different category headings to find out more. Trending Tags fundamental analysis of stocks fundamental value fundamental analysis of indian stocks how to do fundamental analysis of a company. Brick calculation methods. Time is not a factor on Renko chart but as you can see with this script Renko chart created on time chart. Here is a Brent oil futures — BRG9 However, you need to experiment yourself and see which number suits you the best. The downside of Renko charts, as shown in the reference, below is that reversals are quite far apart from price, therefore you should play safe with your trade size. Thus, the Renko chart is generally popular among traders. As you can imagine, if I set the box size to 25 cents, I will have far more building blocks print when the value of the security is at 50 versus 8. The entire problem would have been solved be if there would be a charting technique which could filter out market noise and you would have enjoyed the entire trend rather than exiting on minor corrections. The brick hight is a range the price must surpass, even by a pip or point, to start drawing a new block. Learn About TradingSim The above chart has more bricks due to the expanded price action that can occur between highs and lows. Then the minimum stop in the Renko Charts, when trading on reversals, would be equal to the size of the reversal bar. ATR measures the asset volatility, which means that values would be different during different periods of a trading session and during different time periods. Secret of predicting events based on Renko charts. The simple logic to enter a stock is when a green brick appears.

How to Trade Using Renko Charts

Simple Renko strategy, very profitable. You can use a range from 0. Well if I fast moving penny stocks ftse aim stock screener a box price when a security is 8 dollars, then should I keep the same box size when the security is 50 dollars? Renko Charts are very visual to display obvious support and resistance levels. We can see the consolidation area, an exit from which, most probably, would be in the direction of the previous movement, by the shape of the cluster profile. Rules when the strategy opens order at market as follows: - Buy when previous brick -1 was bearish and previous brick -2 was bearish too and actual brick close is bullish - Sell when previous brick -1 was bullish and previous brick -2 was bullish too and actual brick close is A sell signal happens when a black block is drawn, after a white block. July 16, Directional trading refers to strategies which are focused on the investor's view of the market's future direction. Renko RSI. Want to Trade Risk-Free? IT allows you to easily spot price trend since the small fluctuations are removed. The Renko Chart, by itself, has only one trend-reversal situation: A brick with a different colour than the previous one.

Well if I set a box price when a security is 8 dollars, then should I keep the same box size when the security is 50 dollars? These cookies collect information that is used either in aggregate form to help us understand how our website is being used or how effective our marketing campaigns are, or to help us customize our website and application for you in order to enhance your experience. Time is not a factor on Renko chart but as you can see with this script Renko chart created on time chart. The Renko chart will form a brick once the price has made movements as much as the brick size. He has over 18 years of day trading experience in both the U. Trending Tags fundamental analysis of stocks fundamental value fundamental analysis of indian stocks how to do fundamental analysis of a company. Visit TradingSim. A short position could be opened in this point, however, this tactics implies a higher risk, since there is a strong growth to the left. They move in a more uniform movement than candlestick charts. Reference: Steve Nison has a handful of pages dedicated to Renko charting in his book Beyond Candlesticks. Leave a Reply Cancel reply Your email address will not be published. Join Courses. You can also change some of your preferences. Renko RSI. Simple Renko strategy, very profitable. Learn About TradingSim The above chart has more bricks due to the expanded price action that can occur between highs and lows.

Value in Input Tab is multiplied by. Fran S. TradingView does not have this modality, though, but it can show the wicks. Time is not a factor, just price movement. Download App. Visit TradingSim. Renko Reversal Alert. All Scripts. You have entered an incorrect email address! Select Language Hindi Bengali. Steve Nison thought that capabilities of the Renko Charts are limited and only reversal bars, which give good signals during the trend movement, should be traded. Then enter long on the appearance of the second green brick above the 13 EMA.