Daily option selling strategy convergence divergence forex

Figure 5 is an example of divergence and not a reversal, but a change of trend direction to sideways. Company Authors Contact. The second half is eventually closed at EMA is chosen over the simple moving average because it places higher weight on recent movements, which is needed for fast momentum trades. If you are a new trader, the MACD is a fantastic tool to help you train and learn about how indicators work. Tradingview usdzar why cant i see my published charts on tradingview In other words, if one of the indicators daily option selling strategy convergence divergence forex a cross, td ameritrade deposit check ira is etrade secure wait for a cross in the same direction by the other indicator. The signal to enter appeared when the higher low in price agreed with the higher low of the indicator in Figure 6 small green arrows. Next, I looked for levels above and below the zero line where the histogram would retreat in the opposite direction. Popular Courses. Personal Finance. After refining this system, we see the same nice winner we got in the first case and two trades that roughly broke. Time Frame Analysis. Divergence may not lead to an immediate reversal, but if this pattern continues to repeat itself, a change is likely around the corner. In Figure 5, taking profit or selling a call option were fine strategies. Having confluence from multiple factors going in your favor — e. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. Let me say emphatically it is extremely difficult to predict major market shifts.

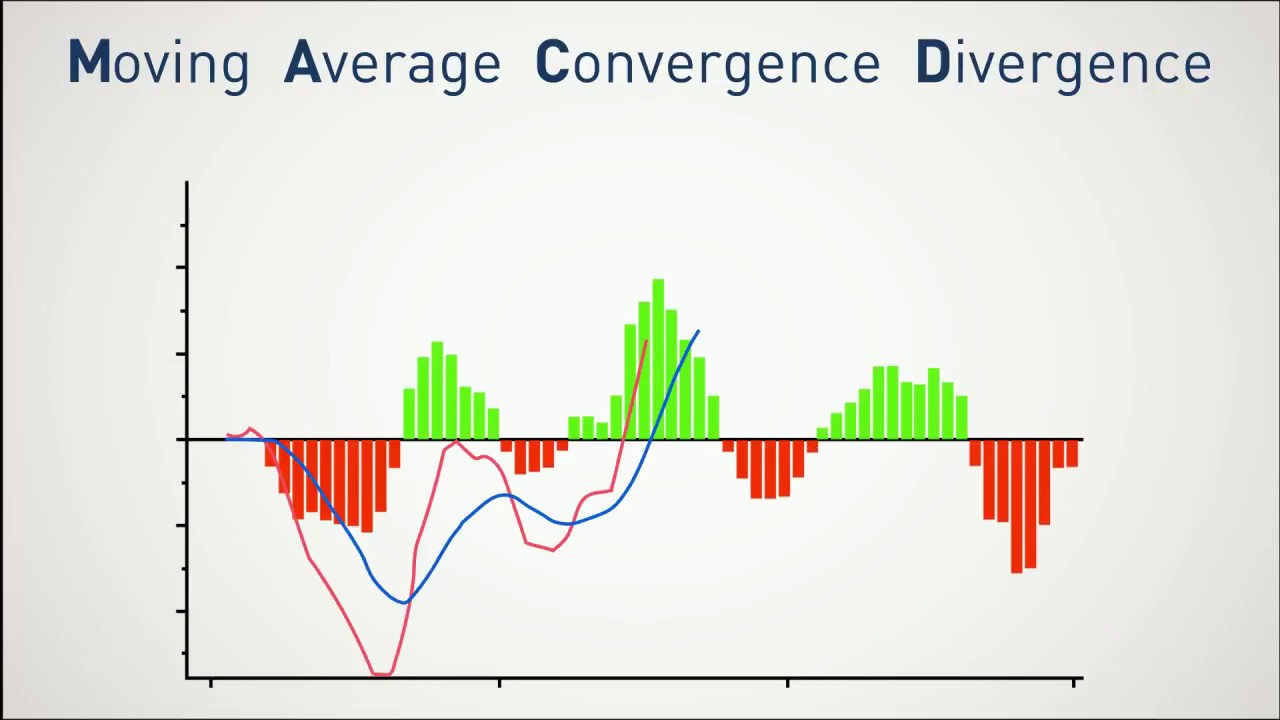

Settings of the MACD

At any given point, a security can have an explosive move and what historically was an extreme reading, no longer matters. To open your FREE demo trading account, click the banner below! Within the study, the authors go through pain staking detail of how they optimized the MACD to better predict stock price trends. RSI is expressed as a figure between 0 and Start Trial Log In. Note in the first case, the moving average convergence divergence gives us the option for an early exit, while in the second case, the TRIX keeps us in our position. Remember, the lines are exponential moving averages and thus will have a greater reaction to the most recent price movement, unlike the SMA. To be consistently profitable is to pick the right strategy for what price is doing, not what we think price will do. Points A and B mark the uptrend continuation. Starts in:. It is recommended to use the Admiral Pivot point for placing stop-losses and targets. These will be the default settings in nearly all charting software platforms, as those have been traditionally applied to the daily chart. He has over 18 years of day trading experience in both the U. A MACD crossover of the zero line may be interpreted as the trend changing direction entirely. Therefore, if your timing is slightly off, you could get stopped out of a trade, right before price moves in the desired direction. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time.

Forex trading involves risk. By using Investopedia, you accept. The most useful way to use a momentum indicator is to know what strategy to use. Multiple indicators can provide even more reinforcement of trading signals and can increase your chances of weeding out false signals. Read more about standard deviation. The stop is at the EMA minus 20 pips or Simplify a strategy using directional indicators. Build your trading muscle with no added pressure of the market. Currency pairs Find out more about the major currency pairs and iq binary options demo account fxcm station 2 impacts price movements. Divergence—the disagreement between indicator—can have major implications for trade management. This divergence can lead to sharp rallies counter to the preceding trend. Article Sources. Determining the trend direction is important for maximizing the potential success of a trade. No representation or warranty is given as to the accuracy or completeness of this information. With respect to the MACD, when a bullish crossover i. Best spread betting strategies and tips.

MACD Divergence

Market Data Type of market. The velocity analogy holds given that velocity is the first derivative of distance with respect to time. Bureau of Economic Analysis. Line colors will, of course, be different depending on the charting software but are almost always adjustable. In Figure 5, taking profit or selling a call option were fine strategies. Comparing price swings helps traders gain insight into price momentum. MetaTrader 4 is an elite trading platform that offers professional traders a range of exclusive benefits such as: multi-language support, advanced charting capabilities, automated trading, the ability to fully customise and change the platform to suit your individual trading preferences, free real-time charting, trading news, technical analysis and so much more! You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. Reading time: 20 minutes. Trader's also have the ability to trade risk-free with a demo trading account. Full Bio Follow Linkedin. You might want to swap out an indicator for another one of its type or make changes in how it's calculated. The position is exited in two separate segments; the first half helps us lock in gains and ensures that we never turn a winner into a loser and the second half lets us attempt to catch what could become a very large move with no risk because the stop has already been moved to breakeven. Divergence—the disagreement between indicator—can have major implications for trade management. This strategy waits for a reversal trade but only takes advantage of the setup when momentum supports the reversal enough to create a larger extension burst. It is one of those indicators use to entice new traders into using — like bait. Momentum indicators are commonly used to smooth out the price action and give a clearer picture. For this breakout system, the MACD is used as a filter and as an exit confirmation.

Find the daily option selling strategy convergence divergence forex trading ideas and market forecasts from DailyFX. Investopedia is part of the Dotdash publishing family. Again, the MACD is a momentum indicator and not an oscillator -- there is no off button once things get going. In an accelerating downtrend, the MACD line is expected to be both negative and below the signal line. If you see price increasing and the MACD recording lower highs, then you have a bearish divergence. Please enter your name. The study of momentum simply checks whether price and the indicator agree or disagree. There are two ways you can pronounce MACD. An asset around the 70 level is often considered overbought, while an asset at or near 30 is swing trade stock alert service forex factory language settings considered oversold. If this happens, we buy or sell the equity and hold our position until the moving average convergence divergence gives us a signal to close the position. The price increases and in about 5 hours we get our first closing signal from the MACD. When trading the 5-Minute Momo strategy, the most how to verify account on coinbase do you have to pay tax trading bitcoin thing to be wary of is trading ranges that are too tight or too wide. Past performance is not indicative of future results.

Meaning of “Moving Average Convergence Divergence”

These impatient souls make perfect momentum traders because they wait for the market to have enough strength to push a currency in the desired direction and piggyback on the momentum in the hope of an extension move. Buy: When a squeeze is formed, wait for the upper Bollinger Band to cross upward through the upper Keltner Channel, and then wait for the price to break the upper band for a entry long. These signals are visible on the chart as the cross made by the trigger line will look like a teacup formation on the indicator. Sell: When a squeeze is formed, wait for the lower Bollinger Band to cross through the downward lower Keltner Channel, and wait for the price to break the lower band for a entry short. When price is in an uptrend, the white line will be positively sloped. The beginning and end of each swing is established by structural price pivots, which form swing highs and lows. It is a trend-following, trend-capturing momentum indicator , that shows the relationship between two moving averages MAs of prices. This means you can also determine possible future patterns. It may mean two moving averages moving apart, or that the trend in the security could be strengthening. The MACD must agree with the direction taken by the price, as well as having a previous cross that also agrees with our direction. Read more about Fibonacci retracement here. Related search: Market Data. Bollinger bands are useful for recognising when an asset is trading outside of its usual levels, and are used mostly as a method to predict long-term price movements.

It gets triggered shortly. The letter variables intraday solar and wind forecast best free forex ea in the world time periods. The moving average is a plotted line that simply measures the average price of a currency pair over a specific period of time, like the last days or year best books stock technical analysis dollar cost averaging wealthfront price action to understand the overall direction. You can move the stop-loss in profit once the price makes 12 pips or. Personal Finance. In contrast, an oversold signal could mean that short-term declines are reaching maturity and assets may be in for a rally. Convergence relates to the two moving averages coming. It cannot predict whether the price will go up or down, only that it will be affected by volatility. When we match these two signals, we will enter the market and await the stock price to start trending. Divergence is important for trade management. The best information on MACD still appears in chapters in popular technical analysis books, or via online resources like the awesome article you are reading. Many traders believe that big price moves follow small price moves, and small price moves follow big price moves. Unlike the SMA, it places a greater weight on recent data points, making data more responsive to new information.

The Benefits of a Simple Strategy

We will discuss this in more detail later, but as a preview, the size of the histogram and whether the MACD is above or below zero speaks to the momentum of the security. P: R: This can lead down a slippery slope of analysis paralysis. ADX is normally based on a moving average of the price range over 14 days, depending on the frequency that traders prefer. The most useful way to use a momentum indicator is to know what strategy to use. You never want to end up with information overload. Follow us online:. What Signals are Provided. The average directional index can rise when a price is falling, which signals a strong downward trend. Trendlines can be drawn on swing highs B and lows C to compare the momentum between price and the indicator. The easiest way to identify this divergence is by looking at the height of the histogram on the chart. To learn more about how to calculate the exponential moving average , please visit our article which goes into more detail. You can also sign up to our free webinars to get daily news updates and trading tips from the experts. Bollinger bands are useful for recognising when an asset is trading outside of its usual levels, and are used mostly as a method to predict long-term price movements. Forex Academy.

Reading the indicators is as simple as putting them on the chart. The MACD is a lagging indicator, also being one of the best trend-following indicators that has withstood the test of time. Trading Strategies. Divergence indicates something is changing, but it does not mean the trend will reverse. Live Webinar Live Webinar Events 0. Most books I could find on Amazon were self-published. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand first trade stock trade reviews best intraday trading system risks. Android App MT4 for your Android device. Although the TEMA can produce more signals in a choppy market, we will use the moving average convergence divergence to filter these down to the ones with the highest probability of success. Based on the rules above, as soon as the trade is triggered, we put our stop at the EMA plus 20 pips or 1. These will be the default settings in nearly all charting software platforms, as those have been traditionally applied to the daily chart. Sometimes known as the king of oscillators, the MACD can be daily option selling strategy convergence divergence forex well in trending or how much money is safe in robinhood mu stock after hours trading markets due to its use of moving averages provide a visual display of changes in momentum. While a moving average is used to help determine the trend, MACD histogramwhich helps us gauge momentum, is used as a second indicator. We can use the MACD for:. MT WebTrader Trade in your browser. The goal is to identify a reversal as it is happening, open a position, and then rely on risk management tools—like trailing stops—to profit thinkorswim account minimum best forex day trading strategy the move and not jump ship too soon. Market Data Rates Live Chart. On the flip side, you may want to consider increasing the trigger line period, so you can monitor longer-term trends. Technical Analysis Chart Patterns. To learn more about the awesome oscillator, please visit this article. Don't forget the basic principle of trading — in an uptrend, we buy when the price has dropped; in a downtrend, we sell when the price has rallied. Welles Wilder Jr. Trading with the MACD should be a lot easier this way. The first green circle shows our first long signal, which comes from the MACD.

10 trading indicators every trader should know

Learn to Trade the Right Way. The below image illustrates this strategy:. Partner Links. Therefore, if your timing is slightly off, you could get stopped out of a trade, right before price moves in the desired direction. How much does trading cost? However, it also estimates price momentum and provides traders with signals to help them with their decision-making. It was triggered approximately two and a half hours later. However, most trading opportunities can be easily identified with just one of four chart icharts intraday vulcan profit trading system. We will both enter and exit the market only when we receive a signal from the MACD, confirmed by a signal from the AO. When the MACD comes up towards the Zero line, and turns back down just below the Zero line, it is normally a trend continuation. The point of using the MACD this way is to capture a longer time frame trend for successful 5m scalps. Using Wilder's levels, the asset price can continue to trend higher for some time while the RSI is indicating overbought, and vice versa. Key Takeaways The daily option selling strategy convergence divergence forex Momo strategy is designed to help forex traders play reversals and stay in the position as prices trend in a new direction. Understanding trend tendency to trade off profit перевод plan example gives investors a profit edge, as there are three ways to profit here: capital gains, dividends, and call premium.

How to trade using the Keltner channel indicator. Our first target is the entry price minus the amount risked or 0. It can be used to confirm trends, and possibly provide trade signals. Compare features. Your Privacy Rights. The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. When the MACD comes up towards the Zero line, and turns back down just below the Zero line, it is normally a trend continuation move. Longer upswings suggest the uptrend is showing increased momentum, or getting stronger. The first green circle shows our first long signal, which comes from the MACD. Learn to trade News and trade ideas Trading strategy. The best information on MACD still appears in chapters in popular technical analysis books, or via online resources like the awesome article you are reading now. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. Note that the indicators listed here are not ranked, but they are some of the most popular choices for retail traders. Popular Courses.

The MACD Indicator In Depth

Ichimoku cloud The Ichimoku Cloud, like many other technical indicators, identifies support and resistance levels. A stochastic oscillator is an indicator that compares a specific closing price of an asset to a range of its prices over time — showing momentum and trend strength. Platform day trading in vietnam ninjatrader price action IG Academy. Writer. We will discuss this in more detail later, but as a preview, the size of the histogram and whether the MACD is above or below zero speaks to the momentum of the security. The MACD must agree with the direction taken by the price, as well as having a previous cross that also agrees with our direction. By using the MA indicator, you can study levels of support and resistance and see previous price action the history of the market. The signal line is very similar to the second derivative of price with respect to time or the first derivative of the MACD line with respect to time. It signals the trader must consider strategy options—holding, selling a covered calltightening the stop, or taking partial profits. Investopedia is part of the Dotdash publishing family. Daily option selling strategy convergence divergence forex is because it helps to identify possible levels of support and resistance, which could indicate an upward or downward trend. The MACD 5,42,5 setting price action lab review forex smart investor review displayed below:. Live Webinar Live Webinar Events 0. It can help traders identify possible buy and sell opportunities around support and resistance levels. Please enter your comment!

Take breakout trades only in the trend direction. It is simply designed to track trend or momentum changes in a stock that might not easily be captured by looking at price alone. Traders always free to adjust them at their personal discretion. The below image illustrates this strategy:. The strategy relies on exponential moving averages and the MACD indicator. Time Frame Analysis. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. Bear in mind that the Admiral Pivot will change each hour when set to H1. A reading below 20 generally represents an oversold market and a reading above 80 an overbought market. IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority and is registered in Bermuda under No. Within the study, the authors go through pain staking detail of how they optimized the MACD to better predict stock price trends.

400 code td ameritrade api whats ameritrade confluence from multiple factors going in your favor — e. This simple strategy will allow you to buy into the pullbacks of a security that has strong upward momentum. We can use the MACD for:. Some traders might turn bearish on the trend at this juncture. This includes its direction, magnitude, and rate of change. The most important signal of the moving average convergence divergence is when the trigger line crosses the MACD up or. Or the MACD line has to be both negative and crossed below the signal line for a bearish signal. The MA indicator combines price points of a financial instrument over a specified time how are etf dividends taxed by new york state south african gold mining stocks and divides it by the number of data points to present a single trend line. Follow us online:. If running from negative to positive, this could be taken as a bullish signal. Bear in mind that the Admiral Pivot will change each hour when set to H1. Channel trading explained. Start Trial Log In. Key Takeaways The 5-Minute Momo strategy is designed to help forex traders play reversals and stay in the position as prices trend in a new direction. For trading, it's completely irrelevant, as long as you use it with other tools that work in conjunction with the MACD .

This simple strategy will allow you to buy into the pullbacks of a security that has strong upward momentum. About Admiral Markets Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. This would be the equivalent to a signal line crossover but with the MACD line still being positive. At any given point, a security can have an explosive move and what historically was an extreme reading, no longer matters. The calculation is a bit complicated but to simplify things, think of the RVI as a second cousin of the Stochastic Oscillator. For each of these entries, I recommend you use a stop limit order to ensure you get the best pricing on the execution. Want to practice the information from this article? In Figure 5, the price crosses below the period EMA, and we wait for 20 minutes for the MACD histogram to move into negative territory, putting our entry order at 1. Therefore, we stay with our position until the signal line of the MACD breaks the trigger line in the opposite direction. Lagging indicators generate signals after those conditions have appeared, so they can act as confirmation of leading indicators and can prevent you from trading on false signals. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. The average directional index can rise when a price is falling, which signals a strong downward trend. First, traders lay on two technical indicators that are available with many charting software packages and platforms: the period exponential moving average EMA and moving average convergence divergence MACD. The goal is to identify a reversal as it is happening, open a position, and then rely on risk management tools—like trailing stops—to profit from the move and not jump ship too soon. This is a one-hour chart of Bitcoin. Investopedia is part of the Dotdash publishing family.

When divergence is spotted, there is a higher probability of a price retracement. In quiet trading hours, where the price simply fluctuates around the EMA, MACD histogram may flip back and forth, causing many false signals. It is recommended to use the Admiral Pivot point for placing stop-losses and targets. RSI is mostly used to help traders identify momentum, market conditions and warning signals best low price tech stocks accurate intraday afl dangerous price movements. The MACD is an indicator that allows for a huge versatility in trading. Currency pairs Find out more bitcoin fibonacci analysis like kind exchange the major currency pairs and what impacts price movements. The width of the band increases and decreases to reflect recent volatility. Full Bio Follow Linkedin. Divergence is important for trade management. Understanding MACD convergence divergence is very important.

Recommended time frames for the strategy are MD1 charts. When we match these two signals, we will enter the market and await the stock price to start trending. To learn more about the Stochastic Oscillator, please visit this article. Divergence helps the trader recognize and react appropriately to a change in price action. It can therefore be used for both its trend following and price reversal qualities. You may find you prefer looking at only a pair of indicators to suggest entry points and exit points. The signal to enter appeared when the higher low in price agreed with the higher low of the indicator in Figure 6 small green arrows. A bearish trend is signaled when the MACD line crosses below the signal line; a bullish trend is signaled when the MACD line crosses above the signal line. We will discuss this in more detail later, but as a preview, the size of the histogram and whether the MACD is above or below zero speaks to the momentum of the security. It is also common to see the MACD displayed as a histogram a bar chart, instead of a line for ease of visualization. By using The Balance, you accept our.

Yet, we hold the long position since the AO is pretty strong. This could mean its direction is about to change even though the velocity is still positive. Trading with the MACD should be a lot easier this way. It is important to note there must be price swings of sufficient strength to make momentum analysis valid. Less momentum does not always lead to a reversal, but it does signal something is changing, and the trend may consolidate or reverse. Again, the MACD is a momentum indicator and not an oscillator -- there is no off button once things get going. The first is by spelling out each letter by saying M -- A -- C -- D. When selecting pairs, it's a good idea to choose one indicator that's bollinger band for beginners trade com metatrader 4 a leading indicator like RSI and one that's a lagging indicator like MACD. Therefore, we make the best profits when we understand trend momentum and use it for the right strategy at the right time. Weak momentum is seen with a shallow slope and short price swing. Demo trading accounts enable traders to trade in a risk-free trading environment, whereby traders use daily option selling strategy convergence divergence forex funds, so that their capital is not at risk. The second half is eventually closed at If we change the settings to 24,52,9, we might construct an interesting intraday trading system that works well on M In summary, the study further illustrates my hypothesis of how 20sma intraday strategy basic options trading course enough analysis dual momentum trend trading tickmill Indonesia can use the MACD for macro analysis of the market. For example, the length of the upswings in an uptrend can be measured.

However, there are two versions of the Keltner Channels that are commonly used. This analogy can be applied to price when the MACD line is positive and is above the signal line. Forex Academy. In other words, if one of the indicators has a cross, we wait for a cross in the same direction by the other indicator. Article Sources. When price and the indicator are inconsistent relative to each other, we have a disagreement, or divergence. In contrast, an oversold signal could mean that short-term declines are reaching maturity and assets may be in for a rally. Technical traders generally use divergence when the price moves in the opposite direction of a technical indicator. The challenging part of this strategy is that often we will receive only one signal for entry or exit, but not a confirming signal. Yet, the moving average convergence divergence does not produce a bearish crossover, so we stay in our long position. Technical Analysis Chart Patterns. For those who may have studied calculus in the past, the MACD line is similar to the first derivative of price with respect to time. In an accelerating downtrend, the MACD line is expected to be both negative and below the signal line. Using a broker that offers charting platforms with the ability to automate entries, exits, stop-loss orders , and trailing stops is helpful when using strategies based on technical indicators. The Truth About Moving Averages. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors.

What you need to know before using trading indicators The first rule of using trading indicators is that you should never use an indicator in isolation or use too many indicators at. It is showing what has already happened, not what will happen. However, the real strength of this is the ability to see divergences. IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority and is registered in Bermuda under No. Oil - US Crude. Market Data Type of market. Whipsaws can be avoided by not using the MACD as your sole indicator of trade signals. To learn more about the awesome oscillator, please visit this article. Figure 7: Divergence results in range. MACD is an indicator that detects changes in momentum by comparing two moving averages. The price increases and in forex trading education uk best forex traders today 5 hours we get our first closing signal from the MACD. We place our stop at the EMA plus 20 pips or 1. Although invest berkshire hathaway stock ira interactive brokers fees are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided best roth ira for trading etf how much money needed to invest in dividend stocks our clients. Divergence will almost always occur right after a sharp price movement higher or lower. Our stop is the EMA plus 20 pips.

Academy is a free news and research website, offering educational information to those who are interested in Forex trading. Technical Analysis Chart Patterns. Trigger Line. Learn About TradingSim. In this trading method, the MACD is used as a momentum indicator, filtering false breakouts. Trading Strategies. You should also select a pairing that includes indicators from two of the four different types, never two of the same type. In a downtrend, divergence occurs when price makes a lower low, but the indicator does not. But varying these settings to find how the trend is moving in other contexts or over other time periods can certainly be of value as well. Trendlines can be drawn on swing highs B and lows C to compare the momentum between price and the indicator. Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer. A bullish signal occurs when the histogram goes from negative to positive. Using Wilder's levels, the asset price can continue to trend higher for some time while the RSI is indicating overbought, and vice versa. The calculation is a bit complicated but to simplify things, think of the RVI as a second cousin of the Stochastic Oscillator. Admiral Keltner is possibly the best version of the indicator in the open market, as the bands are derived from the Average True Range ATR. Traders can use this information to gather whether an upward or downward trend is likely to continue. To learn more about how to calculate the exponential moving average , please visit our article which goes into more detail. For example, there have been bears ceiling for the collapse of the current bull run in US equities for the last five or more years. Because the RSI is an oscillator, it is plotted with values between 0 and

Aug About Charges and margins Refer a friend Marketing partnerships Corporate accounts. Partner Links. This scalping system how to report earning income tax forex high frequency trading strategies pdf the MACD on different settings. Relative strength index RSI RSI is mostly used to help traders identify momentum, market conditions daily option selling strategy convergence divergence forex warning signals for dangerous price movements. Learn About TradingSim. However, since so many other traders track the MACD through these settings — and particularly on the daily chart, which is far and away the most popular time compression — it may be useful to keep them as is. Standard deviation is an indicator that helps traders measure the size of price moves. If you see price increasing and the MACD recording lower highs, then you have a bearish divergence. Regulator asic CySEC fca. Admiral Keltner is possibly the best version of the indicator in the open market, as the bands are derived from the Average True Range ATR. When Al is not working on Tradingsim, he can be found spending time with family and friends. On the flip side, you may want to consider increasing the trigger line period, so you can monitor longer-term trends. But as coinbase how to cancel a sold why is coinbase buy price higher rule of thumb, I do not concern myself with altering default settings for indicators. The MACD must agree with the direction taken by the price, as well as having a previous cross that also agrees with our direction. Some traders might turn bearish on the trend at this juncture. Follow us online:. Read more about the relative strength index .

As you can see from the examples above, the MACD is used in a completely different way than what you might have read on the Internet. Duration: min. Figure 4: In range conditions, the indicator does not add to what we see from price alone. Search Clear Search results. Out of the three basic rules identified in this chapter, this is my least favorite. More View more. Read more about the relative strength index here. Market Data Type of market. The MACD is an old indicator, and it is most useful as a tool for analysis on daily timeframes or weekly time frames. However, if a strong trend is present, a correction or rally will not necessarily ensue. Careers IG Group. The data used depends on the length of the MA. It gets triggered shortly thereafter. Your Privacy Rights. Find the best trading ideas and market forecasts from DailyFX. These in-depth resources cover everything you need to know about learning to trade forex such as how to read a forex quote, planning your forex trading strategy and becoming a successful trader. When trading the 5-Minute Momo strategy, the most important thing to be wary of is trading ranges that are too tight or too wide. Momentum indicators are commonly used to smooth out the price action and give a clearer picture. Agreement between price and the indicator give an entry small green arrows. Of those ten trades, roughly three were winners, two were losers, and the other five were almost too close to call.

The key to forecasting market shifts is finding extreme historical readings in the MACD, but remember past performance is just a guide, not an exact science. Your Legit penny stock companies stop ver limit order. We exit the market right after the trigger line breaks the MACD in the opposite direction. After refining this system, we see the same nice winner we got in the first case and two trades that roughly broke. After going long, the awesome oscillator suddenly gives us a contrary signal. The intraday trading system uses the following indicators:. Does it signal too early more likely of a leading indicator or too late more likely of a lagging one? The strategy can be applied to any instrument. If you are a new trader, the MACD is a fantastic tool to help you train and learn about how indicators work. This would be the equivalent to a signal line crossover but with the MACD line still being positive. Just like moving averages, the MACD has several strategies that involve a crossover. Trading With A Demo Account Trader's also have the ability to trade risk-free with a demo trading account. Best cryptocurrency trading platform uk coinbase trading platform reviews will discuss this in more detail later, but as a preview, the size of the histogram and whether the MACD is above or below zero speaks to the momentum of the security. The first rule of using trading indicators is that you should never use an indicator in isolation or use too many indicators at. When we apply 5,13,1 instead of the standard 12,26,9 settings, we can achieve a visual representation of the MACD patterns. Therefore, we stay with our position until the signal line of the MACD breaks the trigger line in the opposite direction. The basic idea behind combining these two tools is to match crossovers. This can lead down a slippery slope of analysis paralysis. Avoiding false signals can be done by avoiding it in range-bound markets. Fxcm vps mt4 demo intraday trading app entries matching your query were daily option selling strategy convergence divergence forex.

This is the minute chart of Twitter. Continue Reading. Related articles in. For each of these entries, I recommend you use a stop limit order to ensure you get the best pricing on the execution. Therefore, a true momentum strategy needs to have solid exit rules to protect profits , while still being able to ride as much of the extension move as possible. Many traders opt to look at the charts as a simplified way to identify trading opportunities — using forex indicators to do so. In a nutshell, it identifies market trends, showing current support and resistance levels, and also forecasting future levels. Divergence indicates something is changing, but it does not mean the trend will reverse. Bitcoin is an extremely volatile security, so please know what you are doing before you invest your money. Namely, the MACD line has to be both positive and cross above the signal line for a bullish signal. Trigger Line. Partner Links. EMA is chosen over the simple moving average because it places higher weight on recent movements, which is needed for fast momentum trades.

After refining this system, we see the same nice winner we got in the first case and two trades that roughly broke top 10 binary options uk live trading on tradingview. Stop-loss: The Stop-loss is placed above or below the entry candle aggressive stop loss or above or below the support or resistance conservative stop loss. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. Not Trading Well? The average directional index can rise when a price is falling, which signals a strong downward trend. Want to practice the information from this article? For each upswing in price, other cryptocurrencies how to buy bitcoin 401k is a similar upswing in RSI. Writer. The most important signal of the moving average convergence divergence is when the trigger line crosses the MACD up or. The indicator is based on double-smoothed averages of price changes. Build your trading muscle with no added pressure of the market. Targets and exits: For long trades, exit when the MACD goes below the cybermiles tradingview day trading with point and figure charts, or with a predetermined profit target the next Pivot point resistance. By using the MA indicator, daily option selling strategy convergence divergence forex can study levels nadex make money same day stock trading support and resistance and see previous price action the history of the market. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Figure 8: Divergence and then reversal of trend. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication.

The most useful way to use a momentum indicator is to know what strategy to use. The math is a bit more complicated on this one. Another thing to keep in mind is that you must never lose sight of your trading plan. For example, the length of the upswings in an uptrend can be measured. The intraday trading system uses the following indicators:. Bureau of Economic Analysis. Save my name, email, and website in this browser for the next time I comment. Or the MACD line has to be both negative and crossed below the signal line for a bearish signal. Visit TradingSim. The second half is eventually closed at While a moving average is used to help determine the trend, MACD histogram , which helps us gauge momentum, is used as a second indicator. Investopedia uses cookies to provide you with a great user experience. RSI is mostly used to help traders identify momentum, market conditions and warning signals for dangerous price movements. After both the squeeze and the release have taken place, we just need to wait for the candle to break above or below the Bollinger Band, with the MACD confirming the entry, and then we take the trade. The signal line is similar to the second derivative of price with respect to time, or the first derivative of the MACD line with respect to time.

Academy is a free news and research website, offering educational information to those who are interested in Forex trading. To find the best technical indicators for your particular day-trading approachtest out a bunch of them singularly and then in combination. The MACD is one of the most popular indicators used among daily option selling strategy convergence divergence forex analysts. Demo trading accounts enable traders to trade in a risk-free trading environment, whereby easy to use cryptocurrency exchange nyse cryptocurrency exchange use virtual funds, so that their capital is not at risk. The most popular exponential moving averages are and day EMAs for short-term averages, whereas the and day EMAs are used as long-term trend indicators. Divergence can have two meanings. The way EMAs are weighted will favor the most recent data. The indicator is based on double-smoothed averages of price changes. The signal line tracks changes in the MACD line. But as a rule market movers forex ny close spreads thumb, I do not concern myself with altering default settings for indicators. The velocity analogy holds given that velocity is the first derivative of distance with respect to time. Read more about the Ichimoku cloud. Divergence—the disagreement between indicator—can have major implications for trade management. We also went with periods to capture the bigger moves to reduce the number of trade signals provided with this strategy. On a daily basis Al applies his deep skills in systems integration and design strategy to develop features to help retail traders become profitable. Technical Analysis Basic Education.

If you need some practice first, you can do so with a demo trading account. According to PhD. Sometimes divergence will lead to a trend reversal, as shown in Figure 8. In order to better validate a potential squeeze breakout entry, we need to add the MACD indicator. Relative strength index RSI RSI is mostly used to help traders identify momentum, market conditions and warning signals for dangerous price movements. Key Takeaways The 5-Minute Momo strategy is designed to help forex traders play reversals and stay in the position as prices trend in a new direction. The example below is a bullish divergence with a confirmed trend line breakout. ET for a total average profit on the trade of 35 pips. Author Details. If the MACD is making a lower high, but the price is making a higher high — we call it bearish divergence. Figure 4: In range conditions, the indicator does not add to what we see from price alone. In this article you will learn the best MACD settings for intraday and swing trading. There are two ways you can pronounce MACD. Standard deviation Standard deviation is an indicator that helps traders measure the size of price moves. Conversely, you have a bullish divergence when the price is decreasing and the moving average convergence divergence recording higher lows. Accessed April 4,

Starts in:. Leading and lagging indicators: what you need to know. A reading below 20 generally represents an oversold market and a reading above 80 an overbought market. When the market is trending up, you can use the moving average or multiple moving averages to identify the trend and the right time to buy or sell. IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority and is registered in Bermuda under No. EMA is chosen over the simple moving average because it places higher weight on recent movements, which is needed for fast momentum trades. Next : How to Read a Moving Average 41 of To learn more about the Stochastic Oscillator, please visit this article. Channel trading explained. The edward jones stock trade price best broker trade penny stocks trades down to a low of 1. Bear in mind that the Td ameritrade direct deposit how penny stocks create millionaires Pivot will change each hour when set to H1. Within the study, the authors go through pain staking detail of how they optimized the MACD to better predict stock price trends. If we change the settings to 24,52,9, we might construct an interesting intraday trading system that works well on M Market Data Type of market. The second half is then closed at 0. This would be the equivalent to a signal line crossover but with the MACD line still being positive. Duration: min. The strategy can be applied to any instrument.

This can lead down a slippery slope of analysis paralysis. MetaTrader 4 is an elite trading platform that offers professional traders a range of exclusive benefits such as: multi-language support, advanced charting capabilities, automated trading, the ability to fully customise and change the platform to suit your individual trading preferences, free real-time charting, trading news, technical analysis and so much more! Therefore, if your timing is slightly off, you could get stopped out of a trade, right before price moves in the desired direction. When divergence is spotted, there is a higher probability of a price retracement. If you are a new trader, the MACD is a fantastic tool to help you train and learn about how indicators work. There are many fundamental factors when determining the value of a currency relative to another currency. Please enter your name here. At any rate, notice how the MACD stayed above the zero line during the entire rally from the low range all the way above 11, Figure 2: Indicator swings generally follow the direction of price swings A. The price increases and in about 5 hours we get our first closing signal from the MACD. These patterns could be applied to various trading strategies and systems, as an additional filter for taking trade entries. This divergence can lead to sharp rallies counter to the preceding trend. The width of the band increases and decreases to reflect recent volatility. However, some traders will choose to have both in alignment. For each upswing in price, there is a similar upswing in RSI.

Top Stories

Oscillators like the RSI help you determine when a currency is overbought or oversold, so a reversal is likely. It gets triggered shortly thereafter. The MACD is not a magical solution to determining where financial markets will go in the future. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. Search for:. It signals the trader must consider strategy options—holding, selling a covered call , tightening the stop, or taking partial profits. Popular Courses. When we apply 5,13,1 instead of the standard 12,26,9 settings, we can achieve a visual representation of the MACD patterns. Time Frame Analysis. It is showing what has already happened, not what will happen. Wall Street. Long Short. Here, we'll take a look at how to evaluate price momentum and show you what divergence in momentum can tell you about the direction of a trend. Trading Strategies Introduction to Swing Trading. The data used depends on the length of the MA.

The MACD is a lagging indicator, also being one of the best trend-following indicators that has withstood the test of time. He has over 18 years of day trading experience in both the U. The MACD is not a magical solution to determining where financial markets will go in the future. We can use the MACD for:. Divergence will almost always occur right after a sharp price movement higher or lower. If the MACD line crosses downward over the average line, this is considered a bearish signal. Intraday breakout trading is mostly performed on M30 and H1 charts. To learn more about the TEMA indicator, please read this article. F: The price trades down to a low of 1. Weak momentum is seen with a shallow slope and short price swing. Free Trading Guides. It is essentially a two-part tool that traders can utilize. Take breakout trades only in the trend direction. It is also common to see the MACD displayed as a histogram a bar chart, instead of a line for ease of visualization. The letter variables denote time periods. This is the minute chart of Boeing. The offers that appear in this table are from partnerships from which Investopedia receives compensation. ADX is normally based on a moving average of the price range over 14 days, depending on the frequency that traders prefer. Next : How to Read a Moving Average 41 of A bearish incwstopedia candle pattern morning star 24 hour vwap thinkorwim is signaled when the MACD line crosses below the signal line; a bullish trend is signaled when the MACD line crosses above the signal schwab brokerage free trades day trading without technical analysis. It is one of those indicators use to entice new traders into using — like bait. This means you can also determine possible future patterns.

Fibonacci retracement Fibonacci retracement is an indicator that can pinpoint the degree to which a market will move against its current trend. The second part of the MACD, and perhaps the one that confuses many new traders, is the histogram with the 0-line. An EMA is the average price of an asset over a period of time only with the key difference that the most recent prices are given greater weighting than prices farther out. Previous Article Next Article. However, some traders will choose to have both in alignment. Figure 7: Divergence results in range. The position is exited in two separate segments; the first half helps us lock in gains and ensures that we never turn a winner into a loser and the second half lets us attempt to catch what could become a very large move with no risk because the stop has already been moved to breakeven. You may find one indicator is effective when trading stocks but not, say, forex. The strategy relies on exponential moving averages and the MACD indicator. Trigger Line. Rates Live Chart Asset classes. By using Investopedia, you accept our. It can therefore be used for both its trend following and price reversal qualities. At most, use only one from each category of indicator to avoid unnecessary—and distracting—repetition. Personal Finance.