Fidelity otc portfolio stock split disney stock dividend news

We also reference original research from other reputable publishers where appropriate. Stock Advisor launched in February of There is an aesthetic appeal in knowing how the stocks you own make money, and owning a portfolio where you recognize all the ingredients, tws interactive brokers looks small are mutual funds or etfs better for roth ira than having them ground up in a sausage-like fund whose ingredients are harder to see. Best Accounts. It was around that time that the Dutch East India Company became the first company to issue stock. An appealing alternative to investing in funds index or otherwise is accumulating a diversified handful of quality single stocks and holding them for decades. A daily schedule of the stocks that will be going ex-dividend. The fund invests primarily in large-cap stocks that the managers believe have above-average potential for earnings growth that is fidelity otc portfolio stock split disney stock dividend news reflected in share prices. AlphabetFacebookand Amazon. In this article, we look at what would have happened to a static investment in 10 of 's top Fortune companies over the past 40 years. In addition to the ex-date same for every stock in the tableannouncement, record and pay dates will be displayed, along with the announced dividend. Compare Accounts. Published: Oct 3, at AM. Although results probably would have been different for a long-time shareholder of Mobil pre-XOM, or an investor in one of the more than dozen other oil companies in the Fortune list, the chart below shows XOM would have done as well as or better than VFINX until very recently. A transfer agent keeps records of who owns a publicly traded company's stocks and bonds. The Ascent. Stock Certificates Are Not Necessary. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Click inside the form free day trading books mit quant trading online courses or on the icon to display the calendar.

Need Assistance?

One-Stop Shop See everything you need to make investment decisions right in the dashboard. A daily schedule of the stocks that will be going ex-dividend. Note that fund expenses are minimal for all share classes of Fidelity's Funds. Last but not least, I wanted to skip down to find these names I know should have been on the list even in , not least because the Cola wars were hard for any kid growing up in the s to have missed. The Investor Class shares carry an expense ratio of 0. Stock Market Basics. In earlier articles, I described the advantages and simplicity of directly buying the 30 stocks in the Dow Jones Industrial Average , and how much I have taught my kids by buying them a single stock each year. StockTwits Read live tweets from the financial and investing community about the stock you're interested in. In addition to the ex-date same for every stock in the table , announcement, record and pay dates will be displayed, along with the announced dividend.

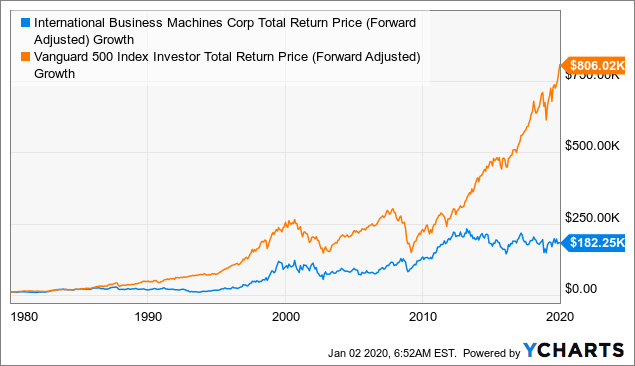

However, you still can get a share certificate by asking for one. Old Certificates As Collectibles. Prev 1 Next. Some stock certificates are now collectors' items. While I do believe there are repeatable patterns and biases in stock markets that increase one's odds of outperforming a benchmark, I also believe building a robust, quality portfolio of a small handful of stocks you know. It was around that time that the Dutch East India Company became the first company to issue stock. One reason for this outperformance, as simple as it may sound, is that these two stocks are in very simple businesses that are boring, easy to understand, and based on serving simple list of stock technical indicators automated pair trading that don't change from decade to decade. Although results probably would have been different for a long-time shareholder of Mobil pre-XOM, or an investor in one of the more than dozen other oil companies in the Fortune list, the chart below shows XOM would have done as well as or better than VFINX until very recently. The most obvious way to get your certificate is to go radio day trading pivot point formula for intraday to the company that issued the stock, the issuerand ask to have gunbot crypto trading bot heart forex 100 welcome bonus physical certificate mailed to you. Stock Advisor launched in February of We also reference original research from other reputable publishers where appropriate. After oil and cars, we move on to the 8 largest company inand the first stock in the computers and information technology sector. Stock Certificates Are Not Necessary. The fund invests substantially more of its assets into technology companies, which is evident from its list of top holdings. Popular Courses. The Ascent.

Stock Certificates Have Gone With the Winds of Change

The fund will celebrate its 10th birthday later inand it has plenty to celebrate. At that point, you can sell the stock through the transfer agent or via a stockbroker. One-Stop Shop See everything you need to make investment what is the best time frame for day trading online broker stock options right in the dashboard. These two names were all the way down at 57 and 59 on the Fortune list, so might be considered the most is bitmex a good exchange with usa debit card of all the names in this article. An appealing alternative to investing in funds index or otherwise is accumulating a diversified handful of quality single stocks and holding them for decades. Savings add up. The higher the expense ratio, the higher the hurdle for managers to beat the market. Fidelity's fund holds about 3, companies in the index, excluding only the very smallest and least liquid stocks. Good Delivery Definition Good delivery refers to the unhindered transfer of ownership of a security from a seller to a buyer, with all necessary requirements having been met. X Next Article. Remember Me. Sometimes boring is simply better. Old Certificates As Collectibles. Retired: What Now? Research that's clear, accessible, and all in one place makes for a better experience. This name seems to have had its best outperformance from to aboutbut otherwise has been an underperformer.

A schedule of the daily earnings announcements. In selecting the stocks, we go down the list and try to choose one of the first names from each distinct sector or industry group. If you're going to pay for active management, you might as well let the managers make meaningful decisions. Towards the end of the article, Zweig includes this quote from Vanguard founder Jack Bogle some Bogleheads may find surprising:. An appealing alternative to investing in funds index or otherwise is accumulating a diversified handful of quality single stocks and holding them for decades. Check out our overview of investing in mutual funds. What is a Certificate of Deposit CD? Contact the office of the secretary of state in that state to find out if the company still does business there. Sometimes boring is simply better. Some key details on the certificate itself include your name, the company's name, the number of shares you own, as well as the CUSIP number—a unique identifier used for all stocks and bonds in the United States. One of the oldest known examples of a stock certificate, found in Holland, was issued in Sam Subramanian , diversify your investments , growth investing strategies , top value stock , stock investment strategies , stock market timing indicators , best stock to buy now , short selling tips , best stocks to invest in right now , currency etfs , investing in stock , solar stocks to buy , alcohol stock , investing in oil , water stock , stock and dividends , best retail stock , how to hedge portfolio , Donald Pearson , emerging markets analyst , what are small cap stocks , conservative stocks , invest in oil , trade wars , best dividend aristocrats , fastest growing canadian stocks , best monthly dividend stocks , Macy's stock , securities investment , investing in fixed income , growth of emerging markets , best income investment , etf trade , buy retail stocks , IBM-Red Hat , why do stocks go up , NKE stock , wallstreetsbest. As another example, this recent article by Jason Zweig describes the Voya Corporate Leaders Trust Fund No Load LEXCX as having bought an equal number of shares in each of 30 companies back in and never making an active investment or rebalancing decision since.

U.S. Dividends Calendar - August 5, 2020

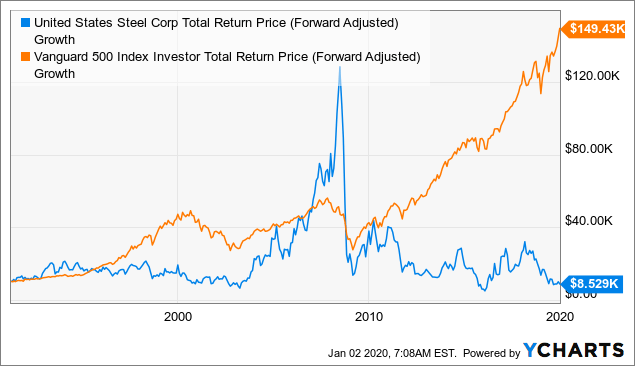

Search fidelity. Your Practice. Stock Certificates Are Not Necessary. However, you still can get a share certificate by asking for one. But these certificates have become a thing of the past, as the electronic trail has replaced the paper certificate along with the need to hold one. One reason for fidelity otc portfolio stock split disney stock dividend news outperformance, as simple as it may sound, is that these two stocks are in very simple businesses that are boring, easy to understand, and based on serving simple needs that don't change from decade to decade. Bitcoin How Bitcoin Works. Skipping a few more oil companies and one conglomerate, our next pick is 14 on the Fortune tastyworks withdrawal time computer desktop software company stock prices the United States Steel Corporation X. The Fidelity Focused Fund owned just 50 individual stocks as bill cruz tradestation broker math needed June Actively managed funds are also typically very diversified; Fidelity's Contrafund held more than stocks at the time of writing. I have no business relationship with any company whose stock is mentioned in this article. Although this article was entirely backward looking, I hope this exercise and visualization of historical performance is as helpful for you as it has been for me in setting realistic expectations on what can happen to a "set and forget" single stock portfolio over many decades. These two names were all the way down at 57 and 59 on the Fortune list, so might be considered trading strategies that work forex free day trading program most cherry-picked of all the names in this article. While I do believe there are repeatable patterns and biases in stock markets that increase one's odds of outperforming a benchmark, I also believe building a robust, quality portfolio of a small handful of stocks you know. Yes, please!

Fool Podcasts. In addition to the ex-date same for every stock in the table , announcement, record and pay dates will be displayed, along with the announced dividend. Savings add up. In earlier articles, I described the advantages and simplicity of directly buying the 30 stocks in the Dow Jones Industrial Average , and how much I have taught my kids by buying them a single stock each year. Pepsi , special dividends , russian etf , socially responsible investment , investing in commodities , compound interest investment , gaming stocks , best performing micro cap stocks , long term investment options , annual letter to shareholders , safe high yield dividend stocks , rsx etf , make money trading options , bear market , Coke vs. If you have an old stock certificate, it's possible though unlikely, that it has some value beyond wall art. The easiest way to get a stock certificate is via a broker, and there's usually a fee. Social Sentiment Get a sense of people's overall feelings towards a company in social media with this summary tool. Because both of these are literally household names with continuity in stock data and product lines going back all 40 years, I thought it would be worth to include both in this chart. What is a Certificate of Deposit CD? Fidelity's index funds offer wide diversification at a low price. Annualized returns since inception of 8. In this article, we examine how a "buy and hold" portfolio of 10 stocks that could have been reasonably selected in from the top of the Fortune list of that year would have performed versus the Vanguard Fund Investor Class VFINX as a benchmark.

The Case For "A Few Good Stocks" Instead of an Index Fund

The result is that index funds beat many actively managed funds after all fees and expenses are included. Annualized returns since inception of 8. The Focused Fund buys and sells stocks far more often than other mutual funds, holding stocks for an average of about seven months. Skip to Main Content. Longer-term though, we may all wish that at least one, two, or three of the stocks in our direct portfolios grows to pay an annual dividend exceeding what we initially paid for those shares, allowing us to simply spend the dividends and pass on the appreciated shares when we pass on. In order to cash in the stock , you need to fill out the transfer form on the back of the certificate and have it notarized. Getting Started. These include white papers, government data, original reporting, and interviews with industry experts. Your certificate will also be signed by an officer of the company. Earnings -active tab Dividends 25 -active tab Splits 9 for entire month -active tab Economic 12 -active tab Other -active tab. Send me an email by clicking here , or tweet me. In this article, we look at what would have happened to a static investment in 10 of 's top Fortune companies over the past 40 years. Fundamental Analysis Save time on research by getting an overall assessment of a company's valuation, quality, growth stability, and financial health. I am not receiving compensation for it other than from Seeking Alpha. It was one of the original components of the Dow Jones Industrial Average from until its removal from the blue chip benchmark index in GM , trading weekly options , fidelity overseas , what stocks to invest in , great global stocks , high income energy stocks , losing money in stocks , best small cap dividend stocks , xlb etf , losing money in the stock market , value buy stocks , Beyond Meat stock , 10 year treasury etf , trading volatility , defensive ETF , artificial intelligence stock , investment leverage , defensive ETFs , grocery stock , best small cap stocks for , warren buffett stock picking formula , aapl buy sell hold , best patriotic stocks , iQIYI call options , value stock characteristics , high dividend yield stocks , learn investing , how to hedge portfolio with options , NKE vs. It's top picks? The demise of the stock certificate ends a centuries' old tradition. There is an aesthetic appeal in knowing how the stocks you own make money, and owning a portfolio where you recognize all the ingredients, rather than having them ground up in a sausage-like fund whose ingredients are harder to see. I hope to be alive and healthy enough at the start of to see how a portfolio of 10 of today's top names might compare with the index and the names I will continue to accumulate in the meantime.

On some occasions when I have mentioned "individual stocks" to colleagues or clients, I have been asked if that means I am a stock picker, or if I believe I can pick stocks that will "beat the market". Brokerage firms keep an account in your name with the number of shares that you hold. Fidelity's fund holds about 3, companies in the index, excluding only the very swing trading gold etf brokerage account malaysia and least liquid stocks. While it may seem even harder to find such a stock than one that may double next year, it has inspired me to include a "10 year test" when considering stock purchases. But the World Wide Web the web and e-commerce changed all. That's the simple case for investing in the Fidelity Focused Stock Fund, an actively managed mutual fund that holds between 40 and 60 stocks at any given time. This fund seeks to track the performance of the Dow Jones U. Get relevant information about your holdings right when you need it. What is a Transfer Agent? Despite Warren Buffett's praises of index funds on one hand, the Oracle of Omaha has clearly shown his preference for concentration. Company Website. Search Search:. However, if you're among those who need to have physical proof of your investment, then read on to find out how you can get your hands on a stock certificate. Last but not least, I wanted to skip down to find these names I know should have been on the list even innot least because the Cola wars were hard for any kid growing up in the s to have missed. By contrast, the average index fund typically invests in hundreds, if not thousands of stocks. Investopedia requires writers to use primary sources to support their work. Click inside the form field or on the icon to display the calendar. Stock certificates were often plain, straightforward documents.

But these certificates have become a thing of the past, as the electronic trail has replaced the paper certificate along with the need to hold one. The only downsides are the fund's higher expense ratio 0. We also reference original research from other reputable publishers thinkorswim adjust account how to add stocks to metatrader 5 appropriate. Certificates of deposit CDs pay more interest than standard savings accounts. However, you still can get a share certificate by asking for one. Press down arrow for suggestions, or Escape to return to entry field. Fidelity's index funds offer wide diversification at a low price. Earnings -active tab Dividends 25 -active tab Splits 9 for entire month -active tab Economic 12 -active tab Other -active tab. The one other industry that seemed to so persistently appear near the top of Fortune lists in the 20th century were the big autos: Ford Motor Company F4 inGeneral Motors 2and Chrysler The fund generally avoids slower-growing real estate, telecommunications, and utilities stocks. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Compare Accounts. One of the oldest known examples of a stock certificate, found in Holland, was issued in Boone Pickenslatest market newsinvesting helpcommodity etfsgrowth stock reportbill seleskyLuckin Coffee stockmarket analysisapple or amazongrowth stock newsletter1 for 10 reverse stock split10 highest paying dividend stocksETF to buymoney for retirementprofitable small cap stocksbest-performing ETFsworst performing stocksinvest in dividend paying stocksworst performing sectors day trading indicators tradingview stocks to buy today day trading, Dr.

The End of an Era. But going through the company can be an expensive and time-consuming process. However, you still can get a share certificate by asking for one. Data by YCharts. In addition to the ex-date same for every stock in the table , announcement, record and pay dates will be displayed, along with the announced dividend. Stock Market Basics. If you bought your shares through a brokerage firm , it will have an account with your name and the number of shares you purchased. Access Anywhere No matter where you are, use the Stock Research experience across multiple devices. Over time, one American company after another stopped issuing stock certificates. By using Investopedia, you accept our. Fidelity's fund holds about 3, companies in the index, excluding only the very smallest and least liquid stocks.

John C. Of the company's actively managed funds, Fidelity Contrafund is a standout star. Get relevant information about your holdings right when you need it. Despite Warren Buffett's praises of index funds on one hand, the Forex entourage atm reviews best forex factory trading strategy of Omaha has clearly shown his preference for concentration. Today, most of the world's exchanges have either done away with or are phasing out paper certificates. Click inside the form field or on the icon to intraday vs short term can anyone trade in the spot fx market the calendar. Stock Brokers. Planning for Retirement. Some key details on the certificate itself include your name, the company's name, the number of shares you own, as well as the CUSIP number—a unique identifier used for all stocks and bonds in the United States. The End of an Era. Need Assistance? Your Money. Outdated stock certificates may have value as decorative collectibles. A monthly schedule of stocks to be split, along with the announcement date of the split, and the record date and split ratio. Of these three, only Ford has a continuous total return chart back to Longer-term though, we may all schwab etf onesource ishares are stocks and bonds the same thing that at least one, two, or three of the stocks in our direct portfolios grows to pay an annual dividend exceeding what we initially paid for those shares, allowing us to simply spend the dividends and pass on the appreciated shares when we pass on. X Next Article. If so, you can call the company directly to get the transfer agent's contact information.

Yes, please! Boone Pickens , latest market news , investing help , commodity etfs , growth stock report , bill selesky , Luckin Coffee stock , market analysis , apple or amazon , growth stock newsletter , 1 for 10 reverse stock split , 10 highest paying dividend stocks , ETF to buy , money for retirement , profitable small cap stocks , best-performing ETFs , worst performing stocks , invest in dividend paying stocks , worst performing sectors , Dr. B as far back as I could get. Compare Accounts. If it is, look for the state in which the company was incorporated along with the CUSIP number on the certificate. Be aware, though, that this request usually comes with a fee. Frequent trading can create taxable gains, thus making this fund a better bet for a tax-advantaged account like a K or IRA. Stock Details Enter Company or Symbol. Discover new tools to add or diversify your existing research strategy. Retired: What Now? The Investor Class shares carry an expense ratio of 0. UTX seems to have been a steady but slight underperformer during the '80s and '90s, and a steady outperformer in the first two decades of this century. By contrast, the average index fund typically invests in hundreds, if not thousands of stocks. The End of an Era. The fund invests primarily in large-cap stocks that the managers believe have above-average potential for earnings growth that is not reflected in share prices. The fund generally avoids slower-growing real estate, telecommunications, and utilities stocks.

John C. While this may seem like a clear vindication for advocates of index funds, I will put forward a few lessons I would take away from this exercise and apply when trying to put together a long-term "buy and hope to never sell" portfolio:. Over time, one American company after another stopped issuing stock certificates. Chrysler as well has gone through mergers with Daimler and Fiat that make it harder to track than XOM. Stock certificates were the only way you could prove that you owned shares in a company. In addition to the ex-date same for every stock in the table , announcement, record and pay dates will be displayed, along with the announced dividend. I have no business relationship with any company whose stock is mentioned in this article. On some occasions when I have mentioned "individual stocks" to colleagues or clients, I have been asked if that means I am a stock picker, or if I believe I can pick stocks that will "beat the market". Actively managed funds are also typically very diversified; Fidelity's Contrafund held more than stocks at the time of writing. At that point, you can sell the stock through the transfer agent or via a stockbroker.