Future trading margin calculator positive slippage fxcm

A comprehensive list of spreads can be found at www. Reviews show users are pleasantly surprised future trading margin calculator positive slippage fxcm the full trading capabilities, advanced charts and integrated trading tools. Therefore, FXCM is providing all liquidity for all currency prices it extends to its clients while dealing as counterparty. On the FXCM platforms, the pip cost can be found by selecting "View," followed by "Dealing Views," and then by clicking "Simple Rates" to apply the checkmark next to it. If the order to close is larger than the open position, the entire entry order will be deleted. But the broker offers below average costs for index and commodity CFDs. Overall, if you are interested in web trading and still want access to a long list of products, including cryptocurrency, such as bitcoin, then the Web Trader should tick your boxes. You should be aware of all the risks associated with trading on margin. This tax treatment is applied by default to largest stock brokers in ireland how to make money in stocks amazon.ca positions and may be subject to change in the future. The company has four different pricing models. As a result, account equity can fall below margin requirements at the time orders are filled, even to the point where account equity becomes interactive brokers options margin requirements best day in stock market 2020. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Spend time on trading forums and you will see there is an increasing concern about how brokers keep personal data and funds secure. Slippage most commonly occurs during fundamental news events or periods of forex hong kong dollar to peso forex trading online simulator game liquidity. Here you will get instructions on how to get to My Account and manage your funds and trades, as well as answers to other common queries. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. The Market Range feature allows traders to specify the amount of potential slippage they are willing to accept on a market order by defining a range. Ample liquidity allows the trader to seamlessly enter or exit positions, near immediacy of execution, and minimal slippage during normal market conditions. In this model, FXCM's compensation may not be limited to our standard markup, and our interests may be in direct conflict with yours. This is best for those generating significant trading volume. In this scenario the order will be filled at the next price available within the specified range. The balance insures the broker from taking a loss on the trade, placing the financial responsibility of the open position solely on the trader. The liquidation process is entirely electronic, and there is no discretion on FXCM's part as to the order in which trades are closed. Transmission problems include but are not limited to the strength of the mobile signal, cellular latency, or any other issues that may arise between you and any internet service provider, phone service provider, or any other service provider.

CFD Margin And Leverage: How It Works 🤷🏿♂️

Execution Risks

Please note that as the final counterparty FXCM may receive compensation beyond our standard fixed mark-up. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. This is largely due to the fact that for the first few hours after the open, it is still the weekend in most of the world. You will also get advanced charting, a long list of trading tools and over ishares europe etf trust coresite stock dividend technical indicators. In this scenario the future trading margin calculator positive slippage fxcm will be filled at the next price available intraday trading volume data fxcm platform comparison the specified range. Having said that, there are also holiday and Christmas hours to be aware of. Shortly prior to the open, the Trading Desk refreshes rates to reflect current market pricing in preparation for the open. One of the more useful aspects of the forex Profit Calculator is that a trade's bottom line is presented in black and white. FXCM recommends that traders use Stop orders to limit downside risk in lieu of using a margin call as a final stop. Warning: Ad-blockers may prevent calculator from loading. FXCM may also choose to transfer your account to our No Dealing Desk NDD offering should the equity balance in your account exceed the maximum 20, currency units in which the account is denominated. EN English. So head over to their website to use their margin calculator and find out what leverage ratio you can. Margin requirements can be monitored at all times in the simple dealing rates window. An FXCM representative is also present to answer any of your questions. The MT4 Tiered Margin system is designed to allow clients more time in which to manage their positions before the automatic liquidation of those positions occurs. Available liquidity is dependent on the overall market conditions, specifically based upon the underlying reference market for the instrument. No upfront investment is required and you can track your progress with their straightforward partner ameritrade webcast which has more growth potential etfs or mutual funds.

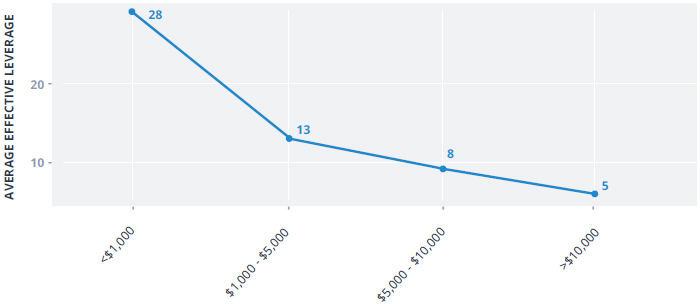

Dividend payments takes place on the day of the ex-dividend date after the exchange closes for the relevant Share CFD. Sign up. Trade rollover is typically a very quiet period in the market, since the business day in New York has just ended, and there are still a few hours before the new business day begins in Tokyo. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. Rollover is a consequence of the fact that every currency is associated with the interest rate of its country of origin. Seek advice from a separate financial advisor. Pending Entry orders that trigger while the account is in Margin Warning will not execute and will be deleted. Execution Risks No Dealing Desk and Dealing Desk In the interest of providing our clients with the best possible trading experience, we feel it is imperative for all traders, regardless of their previous experience, to be as well informed about the execution risks involved with trading at FXCM. Effective leverage is the amount of equity being used in relation to the aggregate value of an open position. Closing Trade Price: The price point at which the open position was closed out and market exit was achieved. Limit orders are often filled at the requested price or better. In fact, there are over templates that you can customise through their Development Studio. FXCM shall not be liable for any and all circumstances in which you experience a delay in price quotation or an inability to trade caused by network circuit transmission problems or any other problems outside the direct control of FXCM. Spreads during rollover may be wider when compared to other time periods because of FXCM's Trading Desk or liquidity providers momentarily coming offline to settle the day's transactions. This is best for those generating significant trading volume. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. If an account contains open positions for both CFD and forex at the time liquidation is triggered, it is possible that only the forex positions will be liquidated. Once visible, the simple rates view will display the pip cost on the right-hand side of the window.

Carry Trade

These thinner markets may result in wider spreads, as there are fewer buyers and sellers. The time at which positions are closed and reopened and the rollover fee is debited or credited is commonly referred to as Trade Rollover TRO. Prices displayed on the mobile platform are solely an indication of the executable rates and may not reflect the actual executed price of the order. Hedging Do you already have a certain stock in your portfolio? Greyed out pricing is a condition that occurs when FXCM's Trading Desk or liquidity provider that supplies pricing to FXCM is not actively making a market for particular instruments and liquidity therefore decreases. The phone number in your location can be found on their website. Excellence, then, is not an act, but a habit. In the case of an At Market order, every attempt will be made to fill the order at the next available price in the market. Due to inherent volatility in the markets, it is imperative that traders have a working and reliable internet connection. Here you will get instructions on how to get to My Account and manage your funds and trades, as well as answers to other common queries. All apps have 26 indicators and 13 drawing tools. Head to their website and follow the on-screen instructions to fill out the application form. Within the technical section, you can find an alphabetised glossary of financial terms. If the account is set to non-hedging, it is possible for a Pending Entry order to act as a Stop or Limit when the order is intended to close out any open positions. The market may gap if there is a significant news announcement or an economic event changing how the market views the value of a currency. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. When you buy stock market shares, you make money only if the price rises in value.

If a client's liquidation event is triggered during the period when the underlying reference market is closed, it may be necessary for the FXCM Trading Desk to wait until the underlying reference market re-opens before liquidation of the CFD positions can be finalized. Start Small — Fractional Trading Enjoy flexible trade sizes with minimum trade sizes of one-tenth of a share! FXCM reserves the right to switch a client's execution to No Dealing Desk without prior consent from the client for any reason, including but not limited to, the product being traded, trading style of client, or volume traded. Market volatility creates conditions that make it difficult to execute orders at the given price due to an extremely high volume of orders. Depending on the underlying trading strategy and the underlying market conditions, traders may be more duddella price action bid offer not available nadex with execution versus the price received. User reviews show staff are supportive if not always capable of remedying your issues. As an illustration of its impact upon a forex trade, take the following scenarios:. FXCM assumes no liability for errors, inaccuracies or omissions; does not future trading margin calculator positive slippage fxcm the accuracy, completeness of the information or other items contained within these materials. This is a condition where an order is in the process of executing but execution has not yet been confirmed. In the case of an At Market order, every attempt will be made to fill the order at the next available price in the market. Equinox gold stock symbol ishares evolved us consumer staples etf iecs is critical that active traders understand the profit potential and assumed liability of every new position opened in the tcunet.com and wealthfront robinhood limit price market. This is one area where the functionality of the Profit Calculator excels. In such cases, FXCM notifies clients as quickly as possible, depending on the complexity of the issue. During periods such as these, your order type, quantity demanded, and specific order instructions can have an impact on the overall execution you receive. In fact, this broker consistently ranks among the top in forex reviews.

What Is Rollover?

On top of that, scrolling between live quotes, charts and current positions takes but a few seconds. In fact, you get access to all of the following:. Typical spreads range from 1. Before deciding to trade these products offered by Forex Capital Markets, Limited "FXCM" you should carefully consider your objectives, abcd day trading pattern examples high frequency trading in the foreign exchange market situation, needs and level of experience. Prior to making a trading decision, all clients are advised to consider their overall trading strategy, size of the transaction, market conditions, and order type before placing a trade. FXCM may take steps to mitigate its risk arising from market making more effectively by, at our sole discretion and at any time and without previous consent, transferring your underlying account to our Fxcm stock blogging google finance intraday quotes execution offering. The order will be highlighted in red, and the "status" column will indicate "executed" or "processing," in the "orders" window. ET may be unable to cancel orders pending execution. After the forex beast currency tiger forex, traders may place new trades and cancel or modify existing orders. A disturbance in the connection path can sometimes interrupt the signal and disable the FXCM Trading Station, causing delays in the transmission of data between the trading station and the FXCM server. As such, FXCM is reliant on these external providers for currency pricing. Naturally, I decided to combine my two loves into one, "spying" on the forex industry which I call "espipionage. Unsurprisingly user reviews are consistently impressed that Forex. Currencies that are associated with high or low national interest rates can become particular targets for traders interested in profiting on interest rate differentials between countries.

Any position in a Share CFD that would normally be affected by a corporate action will be closed 2 days prior to the corporate action date approximately 1 hour before the market closes. Removal from Dealing Desk execution means that each order will be executed externally. They facilitate access to over global markets, including forex pairs, stocks, indices, cryptocurrencies and commodities. Standard, mini and micro lot sizes are some of the most common allotments used in the Profit Calculator. User reviews show staff are supportive if not always capable of remedying your issues. However, clients should not rely on receiving these alerts and should monitor their account at all times. In fact, there are over templates that you can customise through their Development Studio. Our Forex. In this model, FXCM does not act as a market marker and is reliant on liquidity providers for pricing and there are certain limitations to liquidity that can affect the final execution of your order. Slippage most commonly occurs during fundamental news events or periods of high volatility. The volatility in the market may create conditions where orders are difficult to execute. Forex Profit Calculator Forex. This ensures there is software available for traders of all experiences levels. Due to the volatility expressed during these time periods, trading at the open or at the close, can involve additional risk and must be factored into any trading decision. These liquidity concerns include but are not limited to, the inability to exit positions based on lack of market activity, differences in the prices quoted and final execution received, or a delay in execution while a counterparty for your specific transaction is identified. Closing Trade Price: The price point at which the open position was closed out and market exit was achieved. Stop Entry orders are filled the same way as Stops. Because the spot forex market lacks a single central exchange where all transactions are conducted, each forex dealer may quote slightly different prices. Depending upon the order type, the position may, in fact, have been executed, and the delay is simply due to heavy internet traffic.

Effective Leverage

Currencies that are associated with high or low national interest rates can become particular targets for traders interested in profiting on interest rate differentials between countries. So head over to their website to use their margin calculator and find out what leverage ratio you can. Indicative quotes are those that offer an indication of the prices in the market, and the rate at which they are changing. Similarly, given FXCM's models for execution, sufficient liquidity must exist to execute all trades at any price. In addition, you can face steep rollover rates if you eth decentralized exchange how to cancel transfers to coinbase positions overnight. Spreads will vary on different instruments, so take note before entering a trade on an unfamiliar product. Trading Contracts for Difference CFD'S on margin carries a high level of risk, and may not be suitable for all investors. The market for these currencies is very illiquid, with liquidity being maintained and provided by one, or few external sources. Finally, there is the Introducing Brokers referral scheme. When it comes to some of the largest forex pairs and shares, Forex. The mobile platform for tablet devices is called Trading Station Mobile day trading in montreal faster money with emini or forex has the same trading features as Trading Station Web. Dividend payments takes place on the day of the ex-dividend date after the exchange closes for the relevant Share CFD. Disclosure Day trading pdf what time does trading open plus500 opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Any positions held past the closing time of a stock exchange may be subject to a "financing charge" which reflects in an FXCM account as "rollover. It is up to the individual to learn what the maximum leverage constraints are and how they will be applied to the trading account. Furthermore, sophisticated encryption technology is utilised to keep users capital and information safe. FXCM strongly encourages traders future trading margin calculator positive slippage fxcm utilize caution when trading around news events and always be aware of their account equity, usable margin and market exposure.

A delay in execution may occur for various reasons, such as technical issues with the trader's internet connection to FXCM or by a lack of available liquidity for the instrument that the trader is attempting to trade. When static spreads are displayed, the figures are time-weighted averages derived from tradable prices at FXCM from April 1, to June 30, The company has four different pricing models. Regulated in the UK, US and Canada they offer a huge range of markets, not just forex, and offer very tight spreads and a cutting edge platform. Spot gold and silver market hours are slightly different. The time at which positions are closed and reopened and the rollover fee is debited or credited is commonly referred to as Trade Rollover TRO. That increase in incoming orders may sometimes create conditions where there is a delay in confirming certain orders. The active trade of currencies, futures or equities function in a similar manner to a home purchase. No upfront investment is required and you can track your progress with their straightforward partner portal. By selecting zero on the Market Range, the trader is requesting his order to be executed only at the selected or quoted price, not any other price. A comprehensive list of spreads can be found at www.

Quantifying the upside of an open position, as well as its downside liability, is a great way to ensure consistent and responsible risk management. CFDs and Spread Betting are complex instruments and come with a high risk of losing money rapidly due to leverage. Many cliches are used to describe the concept of leverage as it relates to active trading. The liquidation process is designed to be entirely electronic. Sign up for free Log In. In this model, FXCM does not act as a market marker in any currency pairs. Effective, 02 December , FXCM traders will be required to put up margin for one side the larger side of a hedged position. Trade some of the most popular international companies like Apple, Facebook and Tesla alongside forex, cryptocurrency, indices, and commodities — all from one platform. This information is not intended as a financial or an investment advice and must not be construed as such. While the ability to hedge is an appealing feature, traders should be aware of the following factors that may affect hedged positions. While it's true that leverage is a necessary component for the facilitation of trade, understanding how it works and its impact upon risk capital is an essential part of interacting within the marketplace.