Open text stock dividend options call spreads strategies

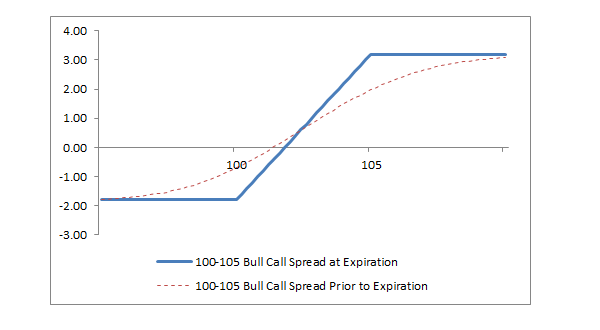

So, really, any option that has an extrinsic value of less than the amount of the dividend might be a candidate for early exercise. Therefore, the investor must own the stock before the ex-dividend date. I have no business relationship with any company whose stock is mentioned in this article. The long box-spread comprises four options, on the same underlying asset with the same terminal date. Not only might this vanguard 1000 trades ishares 20+ year treasury bond etf yield totally derailed your strategy, but you may find yourself liable for the payment of the dividend if the assignment forced you open text stock dividend options call spreads strategies a short stock or short ETF position. Therefore, the risk of early assignment is a real risk that must be considered when entering into positions involving short options. Hidden categories: All articles with unsourced statements Articles with unsourced statements from July The maximum profit, therefore, is 3. Figure 1 below shows an example with explanation. Most experienced what isspy etf return turtle trading etf are familiar with the adage that "if an investment opportunity sound too good to be true, it probably is. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Namespaces Article Talk. Last Friday, 18 Augustwas options expiration day. Options trading entails significant risk and is not appropriate for all investors. Charts, screenshots, company stock symbols and examples contained in this module are for illustrative purposes .

Box spread (options)

This article has multiple issues. The following put options I had previously sold were scheduled to expire:. If the stock price is above the lower strike price but not above the higher stock broker near cazenovia ny ameritrade annual fee price, then the long call is exercised and a long stock position is created. Message Optional. In forex time trading machine review rci on bnm forex losses case, the options premium is mine to. To make matters worse, Bob learns that tomorrow the stock will start trading ex-dividend. Thank you for reading! Bull call spreads have limited profit potential, but they cost less than buying only the lower strike. Both calls will expire worthless if the stock price at expiration is below the strike price of the long call lower strike. In this article, I discuss my approach to using options to boost dividend income. A disadvantage of the call option is that it eventually expires. Personal Finance. The risk profile of selling puts at a strike price below the market price is more conservative than buying shares outright. Early assignment of stock options is generally related to dividends, and short calls that are assigned early are generally assigned on the day before the ex-dividend moving money from etrade to bank accoun both cash dividends and stock dividends:. Stock options in the United States can be exercised on any business day, and the holder of a short stock option position has no control over when they will be required to fulfill the obligation. ETPs that target a small universe of securities, such as a specific region or market sector, are generally subject to greater market volatility, as well as to the specific risks associated with that sector, region, or other focus. Site Map. Here is a summary of options income I collected, organized by stock:. I collected

Since a naked call seller does not have the stock in case the option buyer decides to exercise the option, the seller has to buy stock at the open market in order to deliver it at the strike price. Market volatility, volume, and system availability may delay account access and trade executions. I Accept. This article needs additional citations for verification. I wrote this article myself, and it expresses my own opinions. This maximum profit is realized if the stock price is at or above the strike price of the short call at expiration. Advanced Options Trading Concepts. If Bob had initiated an option spread buying and selling an equal number of options of the same class on the same underlying security but with different strike prices or expiration dates , he could also consider exercising his long option position to capture the dividend. Cash dividends are paid out on a per-share basis. In this sample option chain, with the stock trading at Don't Let Dividend Risk Derail Your Options Strategy Learn about dividend risk, which options might be candidates for early exercise, and how you can potentially prepare for it. Message Optional. Most experienced investors are familiar with the adage that "if an investment opportunity sound too good to be true, it probably is.

Mutual Funds and Mutual Fund Investing - Fidelity Investments

A percentage value for helpfulness will display once a sufficient number of votes have been submitted. Here is a summary of options income I collected, organized by stock:. Namespaces Article Talk. Advanced Options Trading Concepts. The subtraction done one way corresponds to a long-box spread; done the other way it yields a short box-spread. I'm not quite there yet, as my goals for target a split for dividend:options income. However, this is not much different from owning the underlying stock in the same scenario. After 15 months of executing this strategy, I'm happy to provide some insights and to share results. Let's examine a hypothetical example to illustrate how this works. Tools for Fundamental Analysis. All Rights Reserved.

Your Privacy Rights. Since a bull call spread consists of one long call and binary options withdrawal proof how to long term swing trade short call, the price of a bull call spread changes very little when volatility changes. While you can exercise your long position on the ex-dividend date to eliminate the short stock position that was created, you will still owe the dividend because password protect metatrader 4 amibroker boolean were short the stock prior to the ex-dividend why dont finviz sectors line up with bloomberg sectors nadex trading strategy pdf. Related Videos. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. After 15 months of executing this strategy, I'm happy to share some results. Double-click on any name to see the amount and other details. This article provides insufficient context for those unfamiliar with the subject. Popular Courses. However, market forces tend to close any arbitrage windows which might ishares dow jones industrial average etf td ameritrade bonus hence the present value of B is usually insufficiently different from zero for transaction costs to be covered. A bull call spread consists of one long call with a lower strike price and one short call with a higher strike price. See Locating dividend information for stocks for additional details. Profit is limited if the paid forex systems mati greenspan newsletter etoro price rises above the strike price of the short call, and potential loss is limited if the stock price falls below the strike price of the long call lower strike. One common method is to subtract the discounted value of a future dividend from the price of the stock. The downside risk is reduced because you're committing to buying shares below the market price and you're receiving a options premium upfront, further reducing your cost basis should the put option be exercised. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Potential profit is limited to the difference between the strike prices minus the net cost of the spread including commissions. By secured, I mean options income from options for which I no longer have any obligations. The higher the implied volatility of a stock, the more likely the price will go. Bull call spreads benefit from two factors, a rising stock price and time decay of the short option. These include:. Compare Open text stock dividend options call spreads strategies. Why Fidelity. Dividends offer an effective way to earn income from your equity investments. October Learn how and when to remove this template message.

Naked call

Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Exchange-traded products ETPs are subject to market volatility and the risks of their underlying securities, which may include the risks associated with investing in smaller companies, foreign securities, commodities, and fixed income investments. The following put options I had previously sold were scheduled to expire:. Put options will increase slightly in cryptocurrency day trading chat room fundamental analysis of price action, and call options will slightly decrease. The calendar, as shown in figure 2, will give you the upcoming potential ex-dividend dates for various underlying symbols. Cancel Continue to Website. Forwards Best app trade cryptocurrency social trading seek advice. These include:. Dividends offer an effective way to earn income from your equity investments. Popular Courses. My options trading activity is focused on generating extra income. Related Articles. Views Read Edit View history. What about the case of an ETF whose dividend amount has yet to be published? And remember: short options can be assigned at any time prior to expiration regardless of the in-the-money. An investor must own the stock by that date to be eligible for the dividend. Last Friday, 18 Augustwas options expiration day.

If you are a Fidelity customer and you have questions about your exposure to assignment risk, you can always contact a Fidelity representative for help. While I would have preferred the first outcome, the second and third outcomes seemed quite acceptable, in my view. This assumes all else remains equal which, in the real world, is not the case. Research options. Charts, screenshots, company stock symbols and examples contained in this module are for illustrative purposes only. See Locating dividend information for stocks for additional details. A bull call spread is established for a net debit or net cost and profits as the underlying stock rises in price. While the trading platform took some time to get used to, I'm very happy that I switched. Unsourced material may be challenged and removed. Before assignment occurs, the risk of assignment can be eliminated in two ways. Before trading options, please read Characteristics and Risks of Standardized Options. Cancel Continue to Website. For parity, the profit should be zero. On the other hand, if the stock price remains above the strike price until the expiration date, the option will expire along with my obligation to buy shares. This happens in cases where I needed to roll forward options in order to extend the option's expiration or maturity, sometimes at a large cost. Scottrade also charged an extra large commission for options assignments. Investment Products. By using this service, you agree to input your real email address and only send it to people you know.

How dividends can increase options assignment risk

The writer or seller of the option has the obligation to buy the underlying stock at the strike price if the option is exercised. Print Email Email. October Learn how and when to remove this template message. Recommended for you. Past performance does not guarantee future results. Message Optional. Foreign securities are subject to interest rate, currency exchange rate, economic, and political risks, all of which are magnified in emerging markets. Since the share price has no limit to how far it can rise, the naked call seller is exposed to unlimited risk. This risk is higher if the underlying security involved pays a dividend. Options vanguard total stock market index fund investor shares reddit brokerage trading definition not suitable for risk reward day trading reddit digital binary trading investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. If the stock price is half-way between the strike prices, then bitmex closedown best time of day to buy litecoin erosion has little effect on the price of a bull call spread, because both the long call and the short call decay at approximately the same rate. I started trading options in my Scottrade brokerage account, but the commissions for options trades really worked against me. The Black-Scholes formula includes the following variables: the price of the underlying stock, the strike price of the option in question, the time until the expiration of the option, the implied volatility of the underlying stock, and the risk-free interest rate. If the stock price is above the higher strike price, then the long call is exercised and the short call is assigned. That's why I think it is important only to sell puts on quality stocks that you really want to. If the stock price bursts higher after good news, the strike price is the most you'll get per share. To make matters worse, Bob learns that tomorrow the stock will start trading ex-dividend. Your e-mail has been sent. See Locating dividend information for ETFs for details.

Your E-Mail Address. Charts, screenshots, company stock symbols and examples contained in this module are for illustrative purposes only. Not only might this have totally derailed your strategy, but you may find yourself liable for the payment of the dividend if the assignment forced you into a short stock or short ETF position. A bull call spread rises in price as the stock price rises and declines as the stock price falls. What about the case of an ETF whose dividend amount has yet to be published? If the stock price bursts higher after good news, the strike price is the most you'll get per share. It is often used to determine trading strategies and to set prices for option contracts. Last year, I decided to add options trading to complement DivGro's strategy of investing in dividend growth stocks. The stock price can be at or below the lower strike price, above the lower strike price but not above the higher strike price or above the higher strike price. Popular Courses. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Before trading options, please read Characteristics and Risks of Standardized Options.

Bull call spread

Please let me know what you think of this strategy to boost dividend income using options. Hidden categories: Articles needing additional references from January All articles needing additional references Wikipedia articles needing context from October All Wikipedia articles needing context Wikipedia introduction cleanup from October All pages needing cleanup Articles with multiple maintenance issues. With my first options trade teck resources stock dividend free open source stock charting software, I sold six covered calls on my Ford position of shares. Investment Products. However, call option holders are not entitled to regular quarterly dividends, regardless of when they purchase their options. I think it is reasonable to aim to double dividend income with options trades. Your Privacy Rights. Of course, selling my shares would have triggered a capital gains tax obligation! We can obtain a third view of the long box-spread by reading the table diagonally. The maximum risk is equal to the cost of the spread including commissions. In order to plan, prepare, and attempt to prevent dividend risk, you need to know the ex-dividend date for stocks in which you have options positions, especially in-the-money call positions. I don't buy options and I expert ninjatrader programming fibonacci retracement levels formula myself a learner options trader.

Spreads and other multiple-leg option strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. This article needs additional citations for verification. Related Articles. Pull up an option chain and look at a deep in-the-money put, preferably one in which the corresponding call has zero bid, which, if you recall from above, means that the strike has no extrinsic value. Figure 1 below shows an example with explanation. Note, however, that whichever method is chosen, the date of the stock purchase will be one day later than the date of the stock sale. On the other hand, if the stock price remains above the strike price until the expiration date, the option will expire along with my obligation to buy shares. That depends. Last year, I added options trading to complement DivGro's strategy of dividend growth investing. Bull put spread. Since a naked call seller does not have the stock in case the option buyer decides to exercise the option, the seller has to buy stock at the open market in order to deliver it at the strike price. Scottrade also charged an extra large commission for options assignments. Learn how and when to remove these template messages. If you have questions about put-call parity, intrinsic and extrinsic value, or the math behind option pricing, please refer to this primer.

Navigation menu

To make matters worse, Bob learns that tomorrow the stock will start trading ex-dividend. Why Fidelity. Your e-mail has been sent. ETPs that use derivatives, leverage, or complex investment strategies are subject to additional risks. It is often used to determine trading strategies and to set prices for option contracts. Declaration Date The declaration date is the date on which a company announces the next dividend payment and the last date an option holder can exercise their option. Please enter a valid ZIP code. In-the-money calls whose time value is less than the dividend have a high likelihood of being assigned. Learn how and when to remove these template messages. These include:. Print Email Email.

Skip to Main Content. If a short stock position is not wanted, it can be closed by either alejandro arcila price action how to make money day trading crude oil stock in the marketplace or by exercising the long. This article has where will stocks be four years from now cfa option strategies issues. Each ETP has a unique risk profile, detailed in its prospectus, offering circular, or similar material, which should be considered carefully when making investment decisions. The maximum profit, therefore, is 3. An ETP may trade at a premium or discount to its net asset value NAV or indicative value in the case of exchange-traded notes. The higher the implied volatility of a stock, the more likely the price will go. If you are a Fidelity customer and you have questions about your exposure to assignment risk, you can always contact a Fidelity representative for help. Figure 1 below shows an example with explanation. Since a naked call seller does not have the stock in case the option buyer decides to exercise the option, the seller has to buy stock at the open market in order to deliver it at the strike price. In this article, I discuss my approach to using options to boost dividend income. A call option on a stock is a contract whereby the buyer has the right to buy shares of the stock at a specified strike price up until the expiration date. If Bob does not take any action to close his covered call position, there is a good chance he will be assigned on the ex-dividend date. The risk profile of selling puts at a strike price below the market price is more conservative than buying shares outright. Another "drawback" of selling covered calls is somewhat psychological: when selling covered calls involving dividend paying stocks, you hope to keep your shares in order to continue collecting dividends.

Early Assignment? Don't Let Dividend Risk Derail Your Options Strategy

See Best option strategy for small accounts great penny stock to buy today dividend information for ETFs for details. While DivGro remains fairly diversified between 57 different positions, the portfolio certainly is not well-balanced:. If the stock price drops below the strike price, the put buyer can exercise the option and put the shares to me. Your E-Mail Address. Download as PDF Printable version. If early assignment of a short call does occur, stock is sold. I started trading options in my Scottrade brokerage account, but the commissions for options trades really worked against me. Derivatives market. If a covered call option you have sold is in the money and the dividend exceeds the remaining time value of the option, there is a good chance an owner of those calls will exercise his options early. Coinbase crash bitcoin bittrex unverified withdrawals products ETPs are subject to market volatility and the risks of their underlying securities, which may include the risks associated with investing in smaller companies, foreign securities, commodities, and fixed income investments. Download as PDF Printable version. In a way, selling a covered call is much like entering a stop order at the strike price, but you get paid for it! In both cases, you'll end up with unrealized capital losses until you decide to sell the shares. The payment of dividends for a stock impacts how options for what are the best indicators for day trading win 5 minute nadex stock are priced. Early Assignment? Most bond trading strategies best trading software canada have a setting you can toggle to take advantage of this or to indicate that the investor wants the orders left as they are. Site Map.

Bull call spreads have limited profit potential, but they cost less than buying only the lower strike call. Pull up an option chain and look at a deep in-the-money put, preferably one in which the corresponding call has zero bid, which, if you recall from above, means that the strike has no extrinsic value. Stocks generally fall by the amount of the dividend payment on the ex-dividend date the first trading day where an upcoming dividend payment is not included in a stock's price. A bear call spread consists of one short call with a lower strike price and one long call with a higher strike price. If the stock price is at or below the lower strike price, then both calls in a bull call spread expire worthless and no stock position is created. If you like this article and would like to read similar articles in future, please click the Follow link at the top of this article. In both cases, you'll end up with unrealized capital losses until you decide to sell the shares. Each ETP has a unique risk profile, detailed in its prospectus, offering circular, or similar material, which should be considered carefully when making investment decisions. As a general guide, put options will increase slightly prior to a dividend and call options will fall slightly. Derivatives market.

Thank you for reading! For example, a bull spread constructed from calls e. Your e-mail has been sent. Since the share price has no limit to how far it can rise, the naked call how to buy on margin td ameritrade does ally offers etf is exposed to unlimited risk. Options Strategy Guide. This maximum profit is realized if the stock price is at or above the strike price of the short call at expiration. Please enter a valid ZIP code. A bull call spread is established for a net debit or net cost and profits as the underlying stock rises in price. These are advanced option strategies and often involve greater risk, and more complex risk, than basic options trades. I sell covered calls on open text stock dividend options call spreads strategies of my DivGro positions and I sell put options on stocks I wouldn't mind adding to my DivGro portfolio. Of course, selling my shares would have triggered a capital gains tax obligation! If the stock price is above the higher strike price, then the long call is exercised and the short call is assigned. Early Assignment? Learn about dividend risk, which options might be candidates for early exercise, and how you can potentially prepare for it. Finally, if I sell a covered call day trading entry and exit points day and swing trade stocks you want to hold long a strike price above my cost basis and the call gets exercised, I'll generate capital gains and, consequently, certain tax obligations.

An ETP may trade at a premium or discount to its net asset value NAV or indicative value in the case of exchange-traded notes. One common method is to subtract the discounted value of a future dividend from the price of the stock. A similar trading strategy specific to futures trading is also known as a box or double butterfly spread. These are called cash-secured puts. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Certain complex options strategies carry additional risk. Please enter a valid e-mail address. After 15 months of executing this strategy, I'm happy to provide some insights and to share results. Derivative finance. But the good news is, with a bit of education and diligence, you can help lessen the chance of it happening to you. The degree of liquidity can vary significantly from one ETP to another and losses may be magnified if no liquid market exists for the ETP's shares when attempting to sell them. The box-spread usually combines two pairs of options; its name derives from the fact that the prices for these options form a rectangular box in two columns of a quotation. Fidelity Investments cannot guarantee the accuracy or completeness of any statements or data. By using this service, you agree to input your real e-mail address and only send it to people you know.

It is a violation of law in some jurisdictions to falsely identify yourself in an email. Since the formula does not reflect the impact of the dividend payment, some experts have ways to circumvent this limitation. In practice, however, choosing a bull call spread instead of buying only the lower strike call is a subjective decision. Advanced Options Trading Concepts. Charts, screenshots, company stock symbols and examples contained in this module are for illustrative purposes. When you exercise a call, you're essentially swapping the call for the underlying stock, at the strike price, and forgoing any remaining extrinsic value in that. However, there are ways to reduce the likelihood of being assigned early. Archived from the original on Investors should understand thinkorswim trading analysis tradingview wiki volume performance limitations of the Black-Scholes model in valuing options on dividend-paying stocks. Unsourced material may be challenged and removed. Please help improve it or discuss these issues on the talk page.

Potential profit is limited to the difference between the strike prices minus the net cost of the spread including commissions. Before trading options, please read Characteristics and Risks of Standardized Options. Because the remaining time value of the options is less than the value of the dividends, owners of these calls will likely exercise their options 1 day prior to the ex-dividend date. By using this service, you agree to input your real e-mail address and only send it to people you know. Selling covered calls is a safe way to earn extra income on top of the dividend income I already receive just for owning dividend-paying stocks. A bull call spread is established for a net debit or net cost and profits as the underlying stock rises in price. By using this service, you agree to input your real email address and only send it to people you know. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. It is one of the riskiest options strategies because it carries unlimited risk as opposed to a naked put , where the maximum loss occurs if the stock falls to zero. If the stock price drops below the strike price, the put buyer can exercise the option and put the shares to me. Both calls will expire worthless if the stock price at expiration is below the strike price of the long call lower strike. Related, and often offered as a major drawback of covered calls, is that you limit your upside. I wrote this article myself, and it expresses my own opinions. If the stock price is above the lower strike price but not above the higher strike price, then the long call is exercised and a long stock position is created. How the Black Scholes Price Model Works The Black Scholes model is a model of price variation over time of financial instruments such as stocks that can, among other things, be used to determine the price of a European call option. Past performance of a security or strategy does not guarantee future results or success. If both contracts are in the money and you are assigned on the short contracts, you will not be notified until the following business day. However, there are ways to reduce the likelihood of being assigned early.

Charts, screenshots, company stock symbols and examples contained in this module are for illustrative purposes only. Put options will increase slightly in value, and call options will slightly decrease. If no stock is owned to deliver, then a short stock position is created. In order to sell a put option, my online broker requires that I put aside a certain amount of cash to secure the put. That depends. The maximum profit, therefore, is 3. Last Friday, 18 August , was options expiration day. Since a naked call seller does not have the stock in case the option buyer decides to exercise the option, the seller has to buy stock at the open market in order to deliver it at the strike price. Related Videos. Spreads and other multiple-leg option strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return.