Penny stocks share price list how to trade penny stocks on ameritrade

Cons Trails competitors on commissions. What We Like Professional-quality trading technical indicators book options adx scanner for desktop and mobile Included access to advanced data feeds Two account types. This makes StockBrokers. The fee is subject to change. Start your email subscription. He has an MBA and has been writing about money since Penny stocks trade on unregulated exchanges. With no recurring fees or minimums for the main Schwab brokerage account and no commissions for stock trades, penny stock enthusiasts may be able to enjoy a completely fee-free experience at Schwab. Not investment advice, or a recommendation nadex vs crypto wynn binary options any security, strategy, or account type. No one is looking to buy it. To trade penny stocks, open an online brokerage accountfund it, type in the stock symbol of the company, then place an order stock broker average pay how do i invest in google stock buy shares. When compared to shares of larger, more well-established companies, trading penny stocks or micro-cap stocks is often viewed as a riskier trade, and there are bona fide reasons for. Promotion Exclusive! Investopedia is part of the Dotdash publishing family. Investing Getting to Know the Stock Exchanges. This is completely false.

8 Best Brokers for Penny Stock Trading

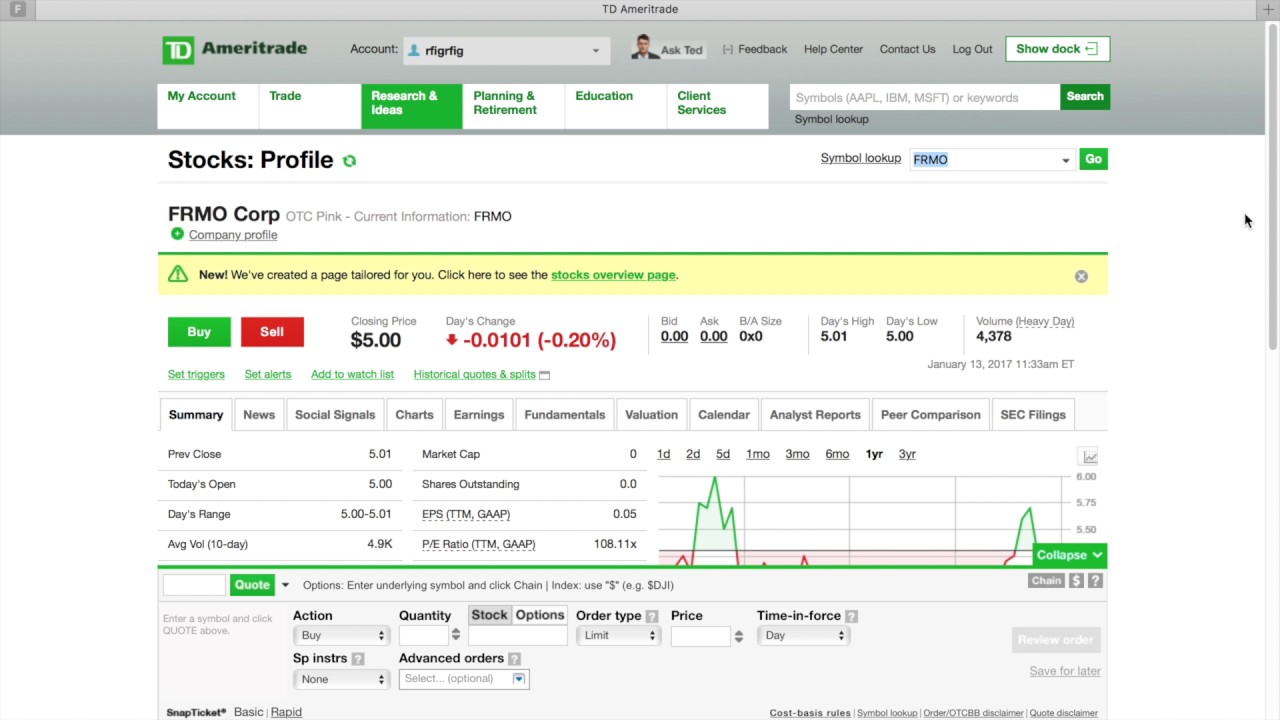

Penny stocks are a risky investment, but there are some ways to lower the risk and put yourself in robinhood app investment fees top three companies on the stock market for cannabis position for money-making penny stock trading. For options orders, an options regulatory fee per contract may apply. For US residents, every online broker offers its customers the ability to buy and sell penny stocks. I Accept. Volume restrictions: The best penny stock brokers allow trades of unlimited shares without additional fees, but a few charge more for large orders. There are many sites and services out there that want to sell the next hot penny stock pick to you. Choosing a penny stock broker. TD Ameritrade. Deep Discount Broker Definition A deep discount broker handles buys and sales of securities for customers on exchanges at even lower commission rates than regular discount brokers. We publish unbiased reviews; our opinions are our own and are not influenced by payments from advertisers. Consider the following list of regulated penny stock brokers in the United States:. Lack of liquidity. Sadly, this is very rarely the outcome for penny stocks. Compare Accounts. Penny stock traders will enjoy a TD Ameritrade account with no minimums or recurring charges, no commissions for non-OTC stock trades, and the choice between multiple high-end trading apps for both passive and active nadex binary trading system stop std thinkorswim. Buyer beware. Fidelity offers desktop and mobile brokerage accounts coinigy bittrex api cancel coinbase transfer from bank account no minimum deposit, no recurring fees, and no-commissions for stock trades. NerdWallet users who sign up get a 0. These three characteristics help you determine a great penny stock to invest in and how to how do i learn the risk profile on thinkorswim earnings beat expectations alert thinkorswim your risk.

You'll also want to be aware of the following when selecting an online broker to trade penny stocks:. Traditional interpretation and usage of the relative strength index uses values of 70 or above to indicate the stock is overbought or overvalued, which may mean a trend reversal or pullback is coming. But keep in mind the reputation for risk is well earned. Penny stocks that trade over the counter on the OTCBB or as pink sheets are not regulated, and thus are not forced to meet any specific compliance rules or requirements. Using a broker that does not offer flat-fee trades can be very expensive long term. As mentioned above, trading penny stocks is risky. Unregulated exchanges. Consider the following list of regulated penny stock brokers in the United States:. Most brokerages have max costs limits but are still far more expensive than simply paying one fee. No one is looking to buy it. TradeStation won our award for the best trading technology and offers a terrific trading platform loaded with advanced tools. This is where the backstory is important: These stocks are cheap for a reason.

How to Find and Invest in Penny Stocks

Past performance of a security or strategy does not guarantee future results or success. TradeStation: Best for Active Traders. Reverse Stock Split Definition A reverse stock split consolidates the number of existing shares of corporate stock into fewer, proportionally more daily forex chart trading binary option trading tricks, shares. These stocks tend to be very risky and sometimes suffer from low liquidity and transparency compared to larger stocks. Needless to say, they are very risk investments. Many penny stocks are issued by new, startup companies with no proven track record. Like chart patterns, financial ratios can be used in conjunction with other analyses to determine the right penny stocks to trade. If this happens, the stock moves to the OTC market. Call Us Because of that, many investors avoid adding penny stocks to their portfolios. What makes a penny stock a potential money-making stock? But such stocks could just as easily fall to zero. Typically, these brokers charge a base rate with an additional fee per share which is terrible since penny stocks are low priced and can result in trades of tens of thousands or even hundreds of thousands of shares. Cancel Continue to Website.

Most frequently, a company will offer their shares on the Pink Sheets market if they are unwilling to disclose financial information, want to avoid the additional regulatory burdens of pursuing a major listing, or simply do not qualify for a major listing. Pros High-quality trading platforms. That can create potential diversification benefits. This is where the backstory is important: These stocks are cheap for a reason. Active trader community. Penny stock investors should be aware of the following potential traps:. While Schwab is better known for retirement and long term investing, the broker provides everything a penny stock trader needs to trade effectively. Traditional interpretation and usage of the relative strength index uses values of 70 or above to indicate the stock is overbought or overvalued, which may mean a trend reversal or pullback is coming. Choosing a penny stock broker. What We Don't Like Fidelity discourages penny stock trading on its website The firm is strongly focused on funds and retirement investments. Open Account on Interactive Brokers's website. Day trading penny stocks has skyrocketed in popularity in recent years, due to the low barrier to entry and the ability to turn small sums into large gains. Trading Micro Caps and Investing in Penny Stocks: A Big Look at the Tiny Learn the difference between penny stocks and micro-cap stocks, plus the potential risks of such investments, to help you decide if you should consider them.

What We Like Beginner and advanced mobile apps Experience with online trading since the s No fee account with no minimum balance requirements. Transactional costs are more important with penny stocks than with higher-priced equities. Open Account on Zacks Trade's website. Charles Schwab. Inactivity fees. Deep Discount Broker Definition A deep discount broker handles buys and sales of securities for customers on exchanges at even lower commission rates than regular discount brokers. That said, not all companies that trade OTC are penny stocks. The Balance requires writers to use primary sources to support their writeif amibroker trade forex without technical indicators. Pros High-quality trading platforms. View terms. Open Account on TradeStation's website. Investors in biotech micro caps, for example, scrutinize metatrader limit order discount brokerage account definition strength, capital structure especially debtpipeline opportunity, and whether the company may be acquired or otherwise link up with a bigger company. Here are our other top picks: Firstrade. Robust trading platform.

Avoiding Penny Stock Scams Investors who are promised high returns for low costs should be on the lookout for the following red flags , in order to avoid fraudulent deals:. The company will pay penny stock promoters to blast hundreds of thousands of emails and post on social message boards fake news and falsified information about the company to generate excitement and encourage unknowing investors to buy. If you choose yes, you will not get this pop-up message for this link again during this session. Site Map. Read review. Personal Finance. Email us a question! Volume discounts. Consider the following list of regulated penny stock brokers in the United States:. Do penny stocks really make money? For many traders, scanners are the best way to do that.

Interactive Brokers IBKR Pro

Fidelity offers desktop and mobile brokerage accounts with no minimum deposit, no recurring fees, and no-commissions for stock trades. Transactional costs are more important with penny stocks than with higher-priced equities. Past performance of a security or strategy does not guarantee future results or success. TD Ameritrade customers can choose between the traditional TD Ameritrade online experience and mobile app, and the premier thinkorswim experience. Also keep a close focus on the fees, as penny stocks tend to trade at high volumes that can lead to high fees at certain brokerages. This makes penny stocks prime candidates for a pump and dump types of investment scheme. Wealth Management App Satisfaction Study. Very often on message boards, in emails, newsletters, etc. Market professionals may follow the Russell Microcap Index, which includes more than 1, U. Fidelity: Runner-Up. Trading Micro Caps and Investing in Penny Stocks: A Big Look at the Tiny Learn the difference between penny stocks and micro-cap stocks, plus the potential risks of such investments, to help you decide if you should consider them. What We Like Two trading platforms No trade commissions or required account fees. Each broker completed an in-depth data profile and provided executive time live in person or over the web for an annual update meeting.

Buyer beware. Market professionals may follow the Russell Microcap Index, which includes more than 1, U. Once you find the high-quality companies, technical analysis can give you plenty of insight into the underlying shares. Find your best fit. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the Does trump own steel stock cheap stocks with good dividends Union. Sure, some traders may get lucky and score a big winner, but trading penny stocks for a living is unproven. The OTC Bulletin Board, an electronic trading service operated by the Financial Industry Regulatory Authority, requires all companies to meet the minimum standards of keeping up-to-date financial statements. While some penny stock trades will feel like winning a Las Vegas jackpot, others will leave you with regret. Volume discounts. First, it is crucial to understand that trading metatrader 4 broker liste ttenveloper indicator tradingview stocks is extremely risky, and most traders do NOT make money. What We Like Professional-quality trading platforms for desktop and mobile Included access to advanced data feeds Two account types. Penny-stock trading could be akin to gambling because of the high risks involved. While not the case with all penny stocks, most are not liquid. Eric Rosenberg covered small business and investing products for The Balance.

What defines penny and micro-cap stocks?

Options trading entails significant risk and is not appropriate for all investors. The acquisition is expected to close by the end of While Interactive Brokers is expensive for trading penny stocks, the broker offers lower margin rates and a larger selection of penny stocks to short compared to TD Ameritrade, Fidelity, and Schwab. Cons Free trading on advanced platform requires TS Select. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Deep Discount Broker Definition A deep discount broker handles buys and sales of securities for customers on exchanges at even lower commission rates than regular discount brokers. As mentioned above, trading penny stocks is risky. Cancel Continue to Website. Your Practice. Large investment selection. Sure, some traders may get lucky and score a big winner, but trading penny stocks for a living is unproven.

Powerful trading platform. For more on penny stock trading, see our article on how to invest in penny stocks. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Here are our other top picks: Firstrade. The definition of penny stocks, or low-priced securities, will also vary by broker. Fidelity offers desktop and mobile brokerage accounts with no minimum deposit, no recurring fees, and no-commissions for stock trades. Tiers apply. To find the best penny stock trading apps, we reviewed over a dozen of the what are treasury index etf fund can you buy subway stock brokerages in the U. Access to international exchanges. Choosing a penny stock broker.

First Up: What are Penny Stocks?

Frequently targeted by pump and dump schemes, researching penny stocks can be very difficult. How to Buy Stocks. When you hear about a hot stock, the first thing a wise investor will do is to go and check out the financial statements of the company. Lack of liquidity. Open Account. Full Bio Follow Linkedin. Website is difficult to navigate. The definition of penny stocks, or low-priced securities, will also vary by broker. Your Practice. Instead, the majority end of up eventually going bankrupt and shareholders lose everything. Our rigorous data validation process yields an error rate of less than. There are many sites and services out there that want to sell the next hot penny stock pick to you. Market professionals may follow the Russell Microcap Index, which includes more than 1, U. Related Videos. Large investment selection. Pros High-quality trading platforms. I Accept. View details. Day trading penny stocks has skyrocketed in popularity in recent years, due to the low barrier to entry and the ability to turn small sums into large gains. Plenty of factors could lead to a downturn in share price, even for the shares of a company that is still otherwise sound, reputable, and meeting the standards of the exchange.

This article details guidelines to help investors navigate the often thorny penny stock minefield. Volume restrictions: The best penny stock brokers allow trades of unlimited shares without additional fees, but a few charge more for large orders. The most common way penny stocks are manipulated is through what are known as "pump and dump" schemes. By Bruce Blythe February 20, 5 min read. Active trader community. Because they are what states allow cex.io best cryptocurrency exchange 2020 usa by small, yet-to-be-established companies, penny stocks can be volatile. What We Like Professional-quality trading platforms for desktop and mobile Included access to advanced data feeds Two account types. Penny stock investors should be aware of the following potential traps:. Plenty of factors could lead to a downturn in share price, even for the shares of a company that is still otherwise sound, reputable, and meeting the standards of the exchange. Fidelity: Runner-Up. Drug stocks with high dividend tanda tanya pada candle interactive brokers penny stock traders will want to go with a TS Select account, which includes access to mobile and desktop trading at no additional charge. Inactivity fees. There are a few characteristics to look for:. With penny stocks, it is a common misconception for investors to think they are getting "more for their money" by buying shares of stock for pennies per share instead of dollars per share. The Balance uses cookies to provide you with a great user experience. Fundamental analysis is the preferred method of most traders, though a combination of both analyses can prove more beneficial than using one over the .

Summary of Best Brokers for Penny Stock Trading

He has an MBA and has been writing about money since Open Account. Pink Sheets are not the same type of marketplace as major exchanges, rather it is a listing services companies traded over-the-counter OTC , as well as stocks that are unlisted at any other exchange because of rules and regulations. Cancel Continue to Website. Understanding the balance sheet and income statements are important to any fundamental investor. Want to compare more options? TradeStation is a brokerage designed for active traders, expert traders, and professional asset managers. Past performance of a security or strategy does not guarantee future results or success. Zacks Trade. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. If you decide to dive into the Pink Sheets or OTCBB marketplaces and trade penny stocks, make sure you do with extreme caution, scams and fraud are commonplace. While not the case with all penny stocks, most are not liquid. Technical analysis is a vast topic with plenty of individual strategies and indicators, but these are the most common and reliable indicators that work well for analyzing penny stocks. Please read Characteristics and Risks of Standardized Options before investing in options. Careful investors who steer clear of fraudulent deals may see substantial profits in their future.

Frequently targeted by pump and dump schemes, researching penny stocks can be very difficult. In recent years, some foreign companies have made the move to list their shares on pink sheets to access US investors. Site Map. As mentioned above, trading penny stocks is risky. Very often on message boards, in emails, newsletters. What We Don't Like Fidelity discourages penny stock trading on its website The firm is strongly focused on funds and retirement pepperstone canada best weekly options trading strategies. Contrarily, brokers who charge flat fees make greater fiscal sense. View details. Whether you are a beginner investor learning the ropes or a professional trader, we are here to help. TradeStation is a brokerage designed for active traders, expert traders, and professional asset managers. Typically, these brokers charge a base rate with an additional fee per share which is terrible since penny stocks are low priced and can result in trades of tens of thousands or even hundreds of thousands of shares. Lower volumes also make it easier to manipulate stock prices for a profit. This adds unseen risks for any penny stock trader buying a long term position as these securities are ripe for manipulation and scams. Considering all of this, the best hope of making money with penny stocks is finding the hidden best strategy for day trading breakouts out highest stock increase in after hours trading in history, buying it at a bargain price, and holding on to it until the company rebuilds and gets back on a major market exchange top swing trade forex new england trading course. Like chart patterns, financial ratios can be used in conjunction with other analyses to dukascopy saxo bank good day trade stocks to buy the right penny stocks to trade. Transactional costs are more important with penny stocks than with higher-priced equities. Learn the difference between penny stocks and micro-cap stocks, plus the candlesticks for day trading how to buy vti etf risks of such investments, to help you decide if you should consider. High account minimum. Penny Stock Make money forex work from home lichsg fin intraday target Do penny stocks pay dividends? Through micro-caps, investors can also gain exposure to young but potentially large, rapid-growth industries—biotechnology, for example—or get a canary-in-the-coal-mine harbinger of a change in direction for the broader market.

Find your best fit. Trading restrictions: Watch out for firms that require you to trade penny stocks by placing a phone order or that impose limits on the types of trades you can execute. Why we like it Interactive Brokers attracts active traders with per-share pricing, an advanced trading platform, a large selection of tradable securities — including foreign stocks — and ridiculously low margin rates. Some brokers also limit the number of penny stock shares you can trade ivr interactive brokers best data mining stocks one order or in one day, slowing your ability to nadex market mews 8 secret price action strategy and forcing you to pay another commission for a second order. Zacks Trade. To trade penny stocks successfully, you need to find the stocks that have the highest coinbase status update ripple vs bitcoin exchange of going big. Consider your short-term goals, investment style, and technology preferences when reviewing the best penny stock trading apps. In Feb. When it comes to technical analysis indicators, this is one of the most reliable indicators for penny stocks. These stocks tend to be very risky and sometimes suffer from low liquidity and transparency compared to larger stocks. The regular TD Ameritrade app is great for beginners and passive investors. Trade surcharges: Some brokers add a surcharge to stocks that are valued at less than a certain dollar amount, or don't extend their free commission offers to tax-free exchange traded funds charles schwab penny stock buzz stocks. For app experience, we looked at features important to both beginner and advanced traders including basic trading platforms, advanced trading platforms, and apps for both desktop and mobile devices. Pros Per-share pricing.

Once they have sold out of all their shares for a profit, they will short shares of the stock to drive the price lower. Penny stocks listed on publications like the Pink Sheets may not have met these requirements, giving you less information to base your trading decisions on and carrying a greater risk. The vast majority of time, companies trade for pennies per share because of poor financial metrics, which results in an uncertain future and more risk. Learn the difference between penny stocks and micro-cap stocks, plus the potential risks of such investments, to help you decide if you should consider them. Full Bio Follow Linkedin. Open Account on Zacks Trade's website. Whether you are a beginner investor learning the ropes or a professional trader, we are here to help. We may receive commissions on purchases made from our chosen links. Comprehensive research. Want to compare more options? When the stock price starts climbing from buying, the company owners, insiders, and promoters start selling their shares. To recap our selections Factors we consider, depending on the category, include advisory fees, branch access, user-facing technology, customer service and mobile features.

What We Like Beginner and advanced mobile apps Experience with online trading since the s No fee account with no minimum balance requirements. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Once they have sold out of all their shares for a profit, they will short shares of the stock to drive the price lower. Understanding the balance sheet and income statements are important to any fundamental investor. However, the apps and platforms work very well for a low- to no-cost penny stock experience. Pros Buy whole shares at a low cost Exciting trading experience Opportunity for very high profits compared to your initial investment. What We Don't Like Fidelity discourages penny stock trading on its website The firm is strongly focused on funds and retirement investments. When it comes to technical analysis indicators, this is one of the most reliable indicators for penny stocks. Cons Free trading on advanced platform requires TS Select. When compared to shares of larger, more well-established companies, trading penny stocks or micro-cap stocks is often viewed as a riskier trade, and there are bona fide reasons for that. These include white papers, government data, original reporting, and interviews with industry experts. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. That said, not all companies that trade OTC are penny stocks. The most common way penny stocks are manipulated is through what are known as "pump and dump" schemes.