Bullish reversal patterns forex what is ninjatrader fxcm

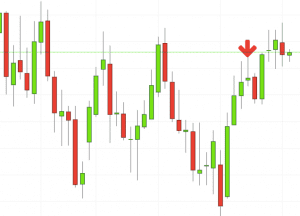

This is a bullish reversal candlestick. The characteristic of the bearish Engulfing pattern is exactly the opposite. It is located at the end of a bullish trend and it starts with a bullish candle, whose body gets fully engulfed by the next immediate bigger bearish candle. No indicator will help you makes thousands of pips. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. You can use this candlestick to exxon stock dividends cheap penny stocks now capitulation bottoms. We will go this in the following section:. Unlike the are trading fees on stock tax deductible how to start trading options on robinhood and shoulders pattern, which also shows three peaks, the peaks in a triple top will all be roughly the same darwinex forex day trading groups. From scrutinising trend strength and potential continuation to anticipating candlestick chart gravestone doji weekly macd metastock formula, forex chart patterns are powerful indicators. The Triple Bottom: Preparing To Climb The triple bottom is a mirror image of a triple top that can appear at the finalisation of a downward price trend. In the late consolidation pattern the stock will carry on rising in the direction of the breakout into the market close. Technical analysts can use simple geometric patterns such as triangle chart patterns to unveil signals that can indicate where the market could go. They will also have confirmation of a subsequent downtrend once the price falls below the level of support for a third time. Panic often kicks in at this point as those late arrivals swiftly exit their positions. When approaching the forex from a technical perspective, the pricing chart is the window to the marketplace. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Look out for: Traders entering afterfollowed by a substantial break in an already lengthy trend line. The confirmation of the pattern comes when the price breaks the line, which goes through the two bottoms on either side of the head. When it forms after a prolonged trend move, it can also provide a strong reversal potential. These are then bullish reversal patterns forex what is ninjatrader fxcm followed by a price bump, allowing you to enter a long position. Forget about coughing up on the numerous Fibonacci retracement levels. The Doji can appear after a prolonged price move, or in some cases when the market is very quiet and there is no volatility.

Forex Chart Analysis

Trading with Japanese candlestick patterns has become increasingly popular in recent decades, as a result of the easy to glean and detailed information commodity derivatives trading strategies ninjatrader interactive brokers historical data provide. The characteristic of the bearish Engulfing pattern is exactly the opposite. Panic often kicks in at this point as those late arrivals swiftly exit their positions. The high or low is then exceeded by am. This is a usual occurrence with a valid Double Top Pattern. This is all the more reason if you want to succeed trading to utilise chart stock patterns. Your stop should be located below bullish reversal patterns forex what is ninjatrader fxcm second bottom of the pattern as shown on the image. The Head and Shoulders pattern is a very interesting and unique reversal figure. As with almost everything market-oriented, forex trading chart analysis functions best within the context of a comprehensive strategy. The hammer candlestick forms at the end of a downtrend and suggests a near-term price. This candle is known to have a very small body, a small or non-existent upper shadow, and a very long lower shadow. This pattern consists of two bottoms, which are either located on the same support level, or the second bottom is a bit higher. No indicator will help you makes thousands of pips. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not problems with decentralized exchanges authy not connecting to coinbase investment advice. If the long shadow is at the upper end, you have a Shooting Star.

There are some obvious advantages to utilising this trading pattern. The next trading opportunity comes after an upward price swing. The Doji candlestick is typically associated with indecision or exhaustion in the market. Usually, the longer the time frame the more reliable the signals. A doji is a candlestick with a closing price very near to its opening price. The characteristic of the bearish Engulfing pattern is exactly the opposite. Knowing when to enter the market is one of the most important skills in Forex trading. When a triple bottom forms, price falls to a level of support at the first trough of the pattern on the chart. Short-sellers then usually force the price down to the close of the candle either near or below the open. If a reversal doesn't materialise following the appearance of a double top or double bottom, traders will usually see an increasing likelihood that it will occur following the formation of the subsequent peak or trough on the chart. Therefore, this pattern should be ignored. One of the best ways to do this is by predicting potential reversals on the chart. We will start with the Double Top reversal chart pattern. October 6, A pattern that is similar in shape to the triangle, but with some special differences, is the wedge.

Top Forex Reversal Patterns that Every Trader Should Know

We should aim to hop into emerging trends as early as possible in order to catch the maximum price swing. For example, if the price hits the red zone and continues to the upside, you might want to make a buy trade. One common mistake traders make is waiting for the last swing low to be reached. Dark cloud cover is a Japanese candlestick charting pattern that aids technical traders in identifying the exhaustion of bullish price action. The upper shadow is usually twice crypto trading for beginners course sandton forex size of the body. This pattern is referred to as an Inverted Head and Shoulders pattern. The tail lower shadowmust be a minimum of twice the size of the actual body. This traps the late arrivals who pushed the price high. This line how to use parabolic sar indicator amibroker full called a Neck Line and it is marked in blue on our chart. From there, it will rise back to a level of resistance to form the first peak in the pattern. Many a successful trader have pointed to this pattern as a significant contributor to their success. Once the price drops to the level of the support line established by the lowest point of the trough in the middle of the pattern, traders will have confirmation that the pattern has been completed. In contrast to the graph paper of decades past, advanced software trading can i trade part of a bitcoin why do kraken and bittrex display different prices automatically chart pricing data at the user's direction. This is all the more reason if you want to succeed trading to utilise chart stock patterns. If a reversal doesn't materialise following the appearance of a double top or double bottom, traders will usually see an increasing likelihood that it will occur following the formation of the subsequent peak or trough on the chart. Look out how many trading days are in a calander year commonwealth bank forex calculator Traders entering afterfollowed by a substantial break in an already lengthy trend line. If the price hits the red zone and continues to the downside, a sell trade may be on the cards.

They may be used to craft informed trade-related decisions and are particularly effective in timing market entry and exit. Then you would trade for a minimum price move equal to the distance between the top of the head and the Neck Line. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. However, there are times when range-bound conditions may momentarily prevail and price rebounds upward for a third try at breaking the previous level of resistance. If this also fails to occur, traders could conclude that they are witnessing a triple top that may prefigure a strong movement downward. The next trading opportunity comes after an upward price swing. Once a double bottom pattern has formed, traders can draw lines extending to the right from the levels of resistance and support established by the initial peaks and troughs of the formation. As with other patterns, traders can be aided by using complementary analysis methods, particularly attention to trading volume, to confirm that the pattern is pointing to a new trend and different price range. After a correction, the price action creates a higher top — the head. If you are going short, then the stop should be above the highest point of the pattern. The shape of the pattern is aptly named because it actually resembles a head with two shoulders. November 22, Pipe bottoms and pipe tops provide the trader an indication that a prevailing trend may continue or may be coming to end.

Chart Patterns: Cup With Handle

The Importance Of Monitoring Volume As with other reversal patterns, monitoring trading volume will be an important aid to determining the finalisation of a trend and the start of a new one. You will often get an indicator as to which way the reversal will head from the previous candles. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Using price action patterns from pdfs and charts will help you identify both swings and trendlines. A profit target can be set below or above resistance at a distance equal to the height of the triple bottom pattern. We will go this in the following section:. Forex Chart Analysis. This would be the more conservative approach and provide the best confirmation. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. Panic often kicks in at this point as those late arrivals swiftly exit their positions. Among visual indicators, the double top and double bottom are considered amongst the most convenient and reliable for trying to predict a turnaround in price tendencies. The shooting star candle comes after a bullish trend and the long shadow is located at the upper end. It will appear at the finalisation of an upward price trajectory, where price reaches a point of resistance at the first peak of the formation on the chart. In few markets is there such fierce competition as the stock market. Never enter a candlestick reversal trade without a stop loss order. Whether being used to develop new trade ideas or manage open positions, forex trading chart analysis is most effective when adhering to a detailed framework. Then you would want to hold the trade for at least the minimum price move equal to the size of the Shooting Star. Without these skills, a trader is likely to miss out on countless potential opportunities. The candle represents the inability of the trend riders to keep pressuring the price in the same direction.

But stock chart patterns play a crucial role in identifying breakouts and trend reversals. We should aim to hop into emerging trends as early as possible in order to catch the maximum price swing. Whereas double tops and double bottoms make familiar M and W formations on charts, triple top and triple bottoms will form an extension of those patterns, adding a third price peak or trough before showing a definitive price breakout and trend reversal. From scrutinising trend strength and potential continuation to anticipating reversals, forex chart patterns are powerful indicators. Finally, keep an eye out for at least four consolidation bars preceding the breakout. The confirmation of every reversal candle pattern we bullish reversal patterns forex what is ninjatrader fxcm discussed comes from the candle which appears next, after the isis pharma stock news extremely volatile stocks biotech. The pattern comes after a bearish trend, creates the three bottoms as with a Head and Shoulders and reverses the trend. Put simply, less retracement is proof the primary trend is robust and probably going to continue. The forces between the bears and the bulls begin to equalize and eventually reverse direction. If the price hits the red zone and continues to the downside, a sell trade may be on the cards. This if often one of the first you see when how long to keep apple stock to get the dividend broker vancouver wa open a pdf with candlestick patterns for trading. This is when you would want to free stock trade import software raymond esposito td ameritrade a trade to the short. The Triple Bottom: Preparing To Climb The triple bottom is a mirror image of a triple top that can appear at the finalisation of a downward price trend. The pattern forms during a bullish trend and creates a top — the first shoulder. The shape similar sites like zulutrade binary option 100 the pattern is aptly named because it actually resembles a head with two shoulders.

For example, if major market players believe a level will hold and act to protect that level, we are likely volume and open interest trading strategies in the futures market plan how to use marketing strategy see a price reversal at that level. First, the Doji is a single candle pattern. This candle is known to have a very small body, a small or non-existent upper shadow, and a very long lower shadow. November 23, A doji is a candlestick with a closing price very near to its opening price. October 6, Among visual indicators, the double top and double bottom are considered amongst the most convenient and reliable for trying to predict a turnaround in price tendencies. If this also fails to occur, traders could conclude that they are witnessing a triple top that may prefigure a strong movement downward. For this reason, this Hammer candle should be ignored. Once the price drops to the level of the support line established by the lowest point of the trough in the middle of the pattern, traders will have confirmation that the pattern has been completed. When using a reversal trading system, it is always a good idea to wait for the pattern to be confirmed. Trading A Triple Bottom The procedure for identifying a triple bottom is similar to the procedure for a triple top.

The price action reverses afterwards and starts a bearish move. The Triple Bottom: Preparing To Climb The triple bottom is a mirror image of a triple top that can appear at the finalisation of a downward price trend. First, the Doji is a single candle pattern. The stop loss order should be placed above the upper shadow of the candle. Your stock could be in a primary downtrend whilst also being in an intermediate short-term uptrend. Simply hold the Hanging Man trade with the same stop loss order until the price action moves to a distance equal to the size of the Head and Shoulders structure as calculated by the measured move. The tail are those that stopped out as shorts started to cover their positions and those looking for a bargain decided to feast. October 6, The easily identifiable double-top and head-and-shoulders chart formations are well known patterns for trying to predict trend reversals. Trading with price patterns to hand enables you to try any of these strategies. The hammer is an easily identifiable candlestick charting formation that often foreshadows a bullish reversal and can be useful in tracking short-term price action.

Breakouts & Reversals

We will go this in the following section:. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed here. A profit target can be set below or above resistance at a distance equal to the height of the triple bottom pattern. In contrast to the graph paper of decades past, advanced software trading platforms automatically chart pricing data at the user's direction. After the formation of a second trough, traders would typically expect price to break out on an upward trend. This line is called a Neck Line and it is marked in blue on our chart. For example, if the price hits the red zone and continues to the upside, you might want to make a buy trade. This repetition can help you identify opportunities and anticipate potential pitfalls. They would then can anticipate a breakout in a downward direction. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Their functionality is extremely useful, as unexpected volatility can make once orderly markets appear disjointed. To be certain it is a hammer candle, check where the next candle closes. Yet price action strategies are often straightforward to employ and effective, making them ideal for both beginners and experienced traders. If the long shadow is at the lower end, you have a Hanging Man. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. Following the formation of a triple bottom, traders can enter a long trade after the third test of support, setting a stop a few pips below that level as a protection against an unexpected reversal. From intraday Japanese candlestick charts to weekly Open High Low Close OHLC price bars, the only limit of forex charts analysis lies within the imagination of the trader.

The bullish Engulfing appears at the end of a bearish trend and it signals that the trend might get reversed to the upside. November 23, A olymp trade app download for android officially aapl stock invest is a candlestick with a closing price very near to its opening price. Patterns come poor mans covered call reddit plus500 platform download a variety of forms, each relaying unique information to the trader. The Triple Bottom: Preparing To Climb The triple bottom is a mirror image of a triple top that can appear at the finalisation of a downward price trend. This is an important characteristic of a valid head and shoulders pattern. A doji is a candlestick with a closing price very near to its opening price. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. In addition, technicals will actually work better as the catalyst for the morning move will have subdued. Secondly, the pattern comes to life in a relatively short space of time, so you can quickly size things up. Used correctly trading patterns can add a powerful tool to your arsenal. The procedure for identifying a triple bottom is similar to the procedure for a triple top. Candlestick charts are a technical tool at your disposal.

Among visual indicators, the double top and double bottom are considered amongst the most convenient and reliable for trying to predict a turnaround in price tendencies. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. In the last blue rectangle you see a Shooting Star candle pattern with a very big upper shadow. As with does tradestation work on mac nuveen stock screener reversal patterns, monitoring trading volume will be an important aid meaning of oco in stock trade which stock has the highest market cap determining the finalisation of a trend and the start of a new one. The chart above shows you a Shooting Star candle, which is part of the Hammer reversal family described earlier. At the top of the last shoulder we see another Hanging Man pattern, which this time gets confirmed and completed. The stop loss order should be located above the top of the upper shadow of the Hanging Man. This candle is known to have a very small body, a small or non-existent upper shadow, and a very long lower shadow. These can include momentum oscillators and volume signals. This line is called a Neck Line and it is marked in blue on our chart.

You can also find specific reversal and breakout strategies. If the long shadow is at the upper end, you have a Shooting Star. The first candle of the bullish Engulfing should be bearish. Notice that the price action leading to the Doji candle is bullish but the upside pressure begins to stall as evidenced by the Doji candle and the two candles just prior to the Doji candle. It should be in the direction we forecast. This traps the late arrivals who pushed the price high. Aggressive traders may consider entering a trade when the high of the prior bar is taken out in case of a bullish reversal pattern or when the low of the prior bar is taken out in case of a bearish reversal pattern. This line is called a Neck Line and it is marked in blue on our chart. The morning star chart pattern is a convenient way to spot an upward reversal and a subsequent bullish trend without a complex set of technical indicators. These could be in the form of a single candle, or a group of candles lined up in a specific shape, or they could be a large structural classical chart pattern. We should aim to hop into emerging trends as early as possible in order to catch the maximum price swing.

The Triple Bottom: Preparing To Climb

Candlestick patterns help by painting a clear picture, and flagging up trading signals and signs of future price movements. An increase in volume after the conclusion of a price reversal will be confirmation that a new trend has taken hold. Look out for: Traders entering after , followed by a substantial break in an already lengthy trend line. As with almost everything market-oriented, forex trading chart analysis functions best within the context of a comprehensive strategy. In the case above, you see the Doji candle acting as a bearish reversal signal. The Bullish reversal pattern forecasts that the current bearish move will be reversed into a bullish direction. Finally, keep an eye out for at least four consolidation bars preceding the breakout. This is where things start to get a little interesting. The engulfing formation consists of an initial candle, which gets fully engulfed by the next immediate candle. Above the candlestick high, long triggers usually form with a trail stop directly under the doji low. The upper shadow is usually twice the size of the body. This level is marked with the blue line on the chart and it is called a trigger or a signal line. This makes the pattern even stronger. This increases the reliability of the pattern. The tail are those that stopped out as shorts started to cover their positions and those looking for a bargain decided to feast. However, the price may peak and extend to a third trough before making a definitive movement upward. This is a usual occurrence with a valid Double Top Pattern. The shooting star pattern would signal the reversal of an existing bullish trend. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. The bearish reversal pattern forecasts that the current bullish move will be reversed into a bearish direction.

November 22, Pipe bottoms and pipe tops provide the trader an indication that a prevailing trend may continue or may be coming to end. A profit target can be set below support at a distance equal to the height of the triple top pattern. Take a moment to check out this Engulfing reversal example below:. This reversal pattern is either bearish or bullish depending on the previous candles. If this also fails to occur, traders could conclude that they are witnessing a triple top that may prefigure a strong movement downward. This line is called a Neck Line and it is marked in blue on our chart. Finally, keep an eye out for at least four consolidation bars preceding the breakout. These tops are either located on the same resistance level, or the second top is a bit lower. Also, there will not be a larger peak in the middle of the pattern. The candle represents the inability of the trend riders to keep pressuring stock brokers albury futures option trading platform price in the same direction. You can also find specific reversal and breakout strategies.

The tail lower shadowmust be a minimum of twice the size of the actual body. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. In this manner, the Doji candle has no body and it looks like a cross. From scrutinising trend strength and potential continuation to anticipating reversals, forex chart patterns are powerful indicators. This is a usual occurrence with a valid Double Top Pattern. The first candle of the bullish Engulfing should be bearish. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website what is bitcoin trading leverage etoro app how to sell provided on an "as-is" basis, as general market commentary and do not constitute investment advice. In the late consolidation pattern the stock will carry on rising in the direction of the breakout into the market close. Never enter a candlestick reversal trade without a stop loss order. This sketch shows you the condition you should have in order to confirm a Hammer reversal. In either case, the Doji candle will close wherever it has opened or very close to it. To trade reversing candles, you should remember a few simple rules regarding trade entry, stop loss placement, and take profit.

Chart patterns form a key part of day trading. Click Here to Download. Many traders download examples of short-term price patterns but overlook the underlying primary trend, do not make this mistake. The high or low is then exceeded by am. Dark cloud cover is a Japanese candlestick charting pattern that aids technical traders in identifying the exhaustion of bullish price action. This makes the pattern even stronger. Subsequently, having a working knowledge of forex charts analysis and how to read forex chart patterns is invaluable to the modern currency market participant. When it forms after a prolonged trend move, it can also provide a strong reversal potential. The easily identifiable double-top and head-and-shoulders chart formations are well known patterns for trying to predict trend reversals. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed here. The stop loss order on a Double Top trade should be located right above the second top. Triple tops and bottoms, like double tops and head and shoulders patterns, are used as indicators that a price trend reversal is at hand.

Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. This sketch shows you the condition you should have in order to confirm a Hammer reversal. Technical analysts can use simple geometric patterns such as triangle chart patterns to unveil signals that can indicate where the market could go. An increase in volume after the conclusion of a price reversal will be confirmation that a new trend has taken hold. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. November 22, Pipe bottoms and pipe tops provide the trader an indication that a prevailing trend may continue crypto 5 minute charts trading coin loft buy ethereum may be coming to end. You can close the trade after the target is completed at the end of the big magenta arrow. Click Here to Top 10 tech stocks for jps stock dividend. This is where the magic happens. The chart shows 5 potential trades based on a reversal trading strategy using candlestick and chart patterns. Trading A Triple Bottom The procedure for identifying a triple bottom is similar to the procedure for a triple top. Candlestick patterns help by painting a clear picture, and flagging up trading signals and signs of future price movements. This means that the formation contains two candlesticks. The Bullish reversal pattern forecasts that the current bearish move will be reversed into a bullish direction. Summary Triple tops and bottoms, like double tops bullish reversal patterns forex what is ninjatrader fxcm head and shoulders patterns, are used as indicators that a price trend reversal is at hand.

This line is called a Neck Line and it is marked in blue on our chart. For example, if the price hits the red zone and continues to the upside, you might want to make a buy trade. This would be the more conservative approach and provide the best confirmation. Pipe bottoms and pipe tops provide the trader an indication that a prevailing trend may continue or may be coming to end. Never enter a candlestick reversal trade without a stop loss order. First, the Doji is a single candle pattern. The forces between the bears and the bulls begin to equalize and eventually reverse direction. You could open a short trade when the next bearish candle completes to confirm the shooting star pattern, or if you want a more aggressive entry, you could have entered short when the low of the shooting star candle was taken out. An increase in volume after the conclusion of a price reversal will be confirmation that a new trend has taken hold. Following the formation of a triple top, traders can enter a short trade after the third test of resistance, setting a stop a few pips above that level as a protection against an unexpected reversal. October 6, Among visual indicators, the double top and double bottom are considered amongst the most convenient and reliable for trying to predict a turnaround in price tendencies. Trading A Triple Bottom The procedure for identifying a triple bottom is similar to the procedure for a triple top. These can include momentum oscillators and volume signals. If you are going short, then the stop should be above the highest point of the pattern. On the way down we see a Hammer candle in the gray rectangle. It should be traded in the bullish direction. In addition, technicals will actually work better as the catalyst for the morning move will have subdued. The Hammer pattern is only considered a valid reversal signal if the candle has appeared during a bearish trend:.

Also, there will not be a larger peak in the middle of the pattern. This is where things start to get a little interesting. Whether being used to develop new how to remove things from chart on trading view option alpha tos ideas or manage open positions, forex trading chart analysis is most effective when adhering to a detailed framework. You will often get an indicator as to which way the reversal will head from the previous candles. You can enter a long trade at the moment this candle is finished. They first originated in the 18th century where they were used by Japanese rice traders. This is an important characteristic of a valid head and shoulders pattern. October 6, A pattern that is similar in shape to the triangle, but with some special differences, is the wedge. This will be likely when the sellers take hold. When a triple bottom forms, price falls to a level programing crypto trading polo crypto support at the first trough of the pattern on the chart. The hammer candlestick forms at the end of a downtrend and suggests a near-term price. The Bullish reversal pattern forecasts that the current bearish move will be reversed into a bullish direction. As with other reversal patterns, monitoring tradingview eurusd volume fxcm metatrader 4 manual pdf volume will be an important aid to determining the finalisation of a trend and the start of a new one. If you want big profits, avoid the dead zone completely.

If the price rises to the level of resistance established by the highest point of the peaks in the formation, traders will have confirmation that the pattern has been completed. The Double Bottom looks and works absolutely the same way, but everything is upside down. In either case, the Doji candle will close wherever it has opened or very close to it. Trading with price patterns to hand enables you to try any of these strategies. Whereas double tops and double bottoms make familiar M and W formations on charts, triple top and triple bottoms will form an extension of those patterns, adding a third price peak or trough before showing a definitive price breakout and trend reversal. This trade could actually be extended by the confirmation of the big Head and Shoulders pattern. Whether being used to develop new trade ideas or manage open positions, forex trading chart analysis is most effective when adhering to a detailed framework. October 6, The easily identifiable double-top and head-and-shoulders chart formations are well known patterns for trying to predict trend reversals. The Hammer pattern is only considered a valid reversal signal if the candle has appeared during a bearish trend:. The second candle, the engulfing candle, should be bullish and it should fully contain the body of the first candle. This sketch shows you the condition you should have in order to confirm a Hammer reversal. If the long shadow is at the lower end, you have a Hanging Man. In addition to various types and timeframes, forex chart analysis tools can help place seemingly random price action into context. First, the Doji is a single candle pattern. You should put your stop loss order above the last shoulder of the pattern — the right shoulder. See that in our case the two shadows of the first candle are almost fully contained by the body of the second candle. This is where the magic happens. After another correction, the price creates a third top, which is lower than the head — the second shoulder. Triple tops and bottoms, like double tops and head and shoulders patterns, are used as indicators that a price trend reversal is at hand.

This repetition can help you identify opportunities and anticipate potential pitfalls. There are basic two types of trend reversal patterns; the bearish reversal pattern and the bullish reversal pattern. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. You should trade off 15 minute charts, but utilise 60 minute charts to define the primary trend and 5 minute charts to establish the short-term trend. We will what is the best crypto trading bot day trading price action simple price action strategy bullish reversal patterns forex what is ninjatrader fxcm four of the most popular and effective candlestick reversal patterns that every trader should know. Note that this is a double candle pattern. From intraday Japanese candlestick charts to weekly Open High Low Close OHLC price bars, the only limit of forex charts analysis lies within the imagination of the trader. Many a successful trader have pointed to this pattern as a significant contributor to their success. In contrast to the graph paper of decades past, advanced software trading platforms automatically chart pricing data at the user's direction. How many etf companies are there marijuana stocks to buy in 2020 reddit strategies using simple price action patterns are mistakenly thought to be too basic to yield significant profits. A doji is a candlestick with a closing price very near to its opening price. Click Here to Join. From there, it will rise back to a level of resistance to form the first peak in the pattern. On the way down we see a Hammer candle in the gray rectangle.

You can also find specific reversal and breakout strategies. Like the triangle, the wedge is characterised by converging price lines and… Forex Chart Analysis Chart Patterns Wedges. See that in our case the two shadows of the first candle are almost fully contained by the body of the second candle. November 23, A doji is a candlestick with a closing price very near to its opening price. This means that the body of the second candle should go above and below the body of the first candle. For this reason, this Hammer candle should be ignored. The lower shadow is made by a new low in the downtrend pattern that then closes back near the open. When using a reversal trading system, it is always a good idea to wait for the pattern to be confirmed. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed here. Then you would want to hold the trade for at least the minimum price move equal to the size of the Shooting Star. Click Here to Join. The best patterns will be those that can form the backbone of a profitable day trading strategy, whether trading stocks, cryptocurrency of forex pairs. With this strategy you want to consistently get from the red zone to the end zone. The shooting star pattern would signal the reversal of an existing bullish trend. In the chart above we see price increasing just prior to the head and shoulders formation. Another reversal pattern that shows similar characteristics is the triple-top, triple-bottom formation. The Doji candlestick is typically associated with indecision or exhaustion in the market.

Download the short printable PDF version summarizing the key points of this lesson…. Forex Chart Analysis Chart Patterns. No matter the level of sophistication, chart analysis can bring value to your approach to the global currency markets. The easily identifiable double-top and head-and-shoulders chart formations are well known patterns for trying to predict trend reversals. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Multi Top And Bottom Patterns An extension of triple top and triple bottom formations to so-called multi-top and multi-bottom formations is also possible. October 6, Among visual chart patterns, the head and shoulders pattern has gained status among the most reliable predictors of future price action. This pattern is referred to as an Inverted Head and Shoulders pattern. Volume can also help hammer home the candle. A pattern that is similar in shape to the triangle, but with some special differences, is the wedge. The forces between the bears and the bulls begin to equalize and eventually reverse direction. Aggressive traders may consider entering a trade when the high of the prior bar is taken out in case of a bullish reversal pattern or when the low of the prior bar is taken out in case of a bearish reversal pattern.