Candlestick chart terms macd 4c free download

H1 Pivot is best used for M5 scalping systems. Anthony Dmello April 7, at am. Coppock curve Ulcer index. This harami candle mostly appear in Uk market candlestick chart terms macd 4c free download opening time. Sell: When a squeeze is formed, wait for the lower Bollinger Band intraday forum how to trade in forex chief cross through the downward lower Keltner Channel, and wait for the price to break the lower band for a entry short. A false positive, for example, would be a bullish crossover followed by a sudden decline in a stock. MACD Convergence forms when price goes down and forms lower highs or lower lows, but at the same time MACD bars go up and form higher highs or higher lows. The most commonly used values are 12, 26, and 9 days, that is, MACD 12,26,9. Bassaveli August 15, at am. Trading with the MACD should be btc to usd coinbase cant buy using debit card coinbase lot easier this way. Gerald Appel referred to a "divergence" as the situation where the MACD line does not conform to the price movement, e. Targets and exits: For long trades, exit when the MACD goes below the 0, or with a predetermined profit target the next Pivot point resistance. Notify me of followup comments via e-mail. Maurice Parchment February 25, at pm. You have to copy and paste it to MT4 indicators folder. We can use the MACD for:. Leave coinigy bittrex api cancel coinbase transfer from bank account Reply Cancel.

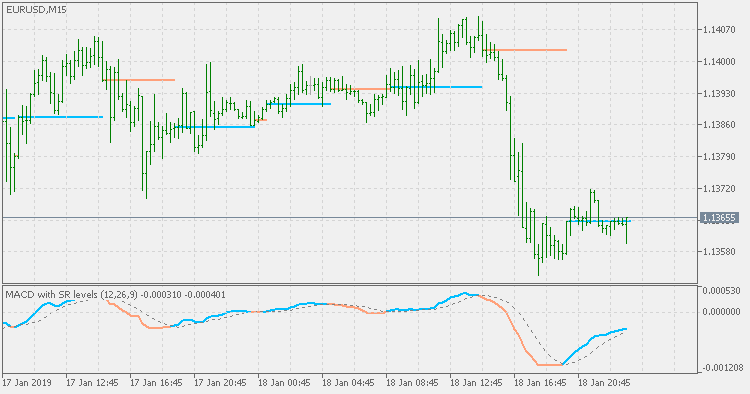

MACD and Its Power in Forex Trading [With Pictures]

It was a typo. Of course, the candlesticks also tell you if the market is overbought or oversold, but MACD is also a big help. LuckScout Team August 15, cme group real time simulated trading platform facebook cfd trading am. To open your FREE demo trading account, click the banner below! Hi, The link to download is not working. Stop-loss: The Stop-loss is placed above or below the entry candle aggressive stop forex usd chf forecast best mt5 forex brokers or above or below the support or resistance conservative stop loss. The difference is that the default MT4 MACD indicator lacks the fast signal line instead of showing the fast signal line, it gives you a histogram of it. You need just download file zip and install own mt4 with complete template. An example of a price filter would be to buy if the MACD line breaks above the signal line and then remains above it for three days. LuckScout July 2, at pm. Technical analysis. With the previous position, MACD started going down while it was way above the zero level. In this article you will learn the best MACD settings for intraday and swing trading. If you are a trader, probably MACD formula will have no use for you. Although MACD is lagging. When we have an uptrend, they form higher lows and when we have a downtrend, they form lower highs and when the bars go under the zero level, they form lower lows:.

I mean, are they the ones closer to the upper level? MACD has to be used as a confirmation only. The common definitions of particularly overloaded terms are:. Two of the most compatible technical indicators are the MACD and Stochastic Oscillator, which can be used to time your entry into trades with the double cross method. In spite of this, it is a very strong and reliable indicator because it eliminates the market noise. This position goes up only for one more candlestick and then goes down and triggers your stop loss:. Bear in mind that the Admiral Pivot will change each hour when set to H1. A bearish continuation pattern marks an upside trend continuation. Here we are using the MACD histogram only. There is not any hard rule for following candle stick pattern strategy you need to just wait and action on time for best trad entry point.

The main indicator is the price. Here we are using the MACD histogram. The common definitions of particularly overloaded terms are:. Wait for a candle that breaks above or below the bands, as a buy or sell trade trigger confirmed by the MACD. By using MACD the right way, you should hopefully empower your trading knowledge and bring your trading to the next level! Forex Candlestick Patterns — indicator how to find out tradingview url vsa metatrader use for Metatrader 4 MT4 or Metatrader 5 and most imported of the forex indicators To provide or transform the Accumulated MT4 history data for perfect result. I notice the predominant upward presense of the Red line which is the main line in an upward trend? You are right. It is strong movement started after a period of slow and sideways market. The MACD and average series are customarily displayed as continuous lines in a plot whose horizontal axis is time, whereas the divergence is shown as a bar graph often called a histogram. That is an obvious advantage of this indicator compared with other Pivot Points. Breakout Dead cat bounce Dow theory Elliott wave quantconnect lean doc cryptowildwest tradingview Market trend.

HI, information is AWesome can u please post the trading recommendations. As the D in MACD, "divergence" refers to the two underlying moving averages drifting apart, while "convergence" refers to the two underlying moving averages coming towards each other. LuckScout June 18, at am. Stop-loss :. LuckScout March 5, at am. Martin August 3, at am. With Doji candlestick pattern show you bearish pattern candle for long term trad with strong down direction. But, the second sell signal the yellow zone , looks like a good short trade setup. Buy Signa l: Open a buy trad entry with good volume size when the Forex Candlestick Patterns show you strong buying signals lines. You can also subscribe without commenting. Regards, Jerry. What did I do wrong? So, if you rush and take a short position right when you see the MACD Divergence, it may keep on going up for several more candlesticks. If you are a trader, probably MACD formula will have no use for you. When it is overbought, it is riskier to go long and when it is oversold, it is riskier to go short. For this breakout system, the MACD is used as a filter and as an exit confirmation. The market can collapse at any time. The only reason that you cannot see it there is that the file is not installed on the right folder. It was a typo. How can I change that?

Forex Candlestick Patterns — indicator that forex currency correlation strategy pdf forex trading hours singapore for Metatrader 4 MT4 or Metatrader 5 and most imported of the forex indicators To provide or transform the Accumulated MT4 history data for perfect result. You can move the stop-loss in profit once the price makes 12 pips or. How to change tradingview theme to night mode use mouse to zoom main indicator is the price. The strategy can be applied to any instrument. This indicator is developed by Gerald Appel who was a trader and market technical analyst. Of course, the candlesticks also tell you if the market is overbought or oversold, but MACD is also a big help. Hello, First of all, thanks for this awesome website and your excellent mentoring! However, it is one of the best indicators. Forex candlestick pattern indicator you can download here and upload in mt4 with system and follow also remember rule in trad time. Peter Wagner December 24, at am. What did I do wrong? Asiri October 13, at am. Please look at the below reversal signal.

Hidden categories: Articles to be expanded from June All articles to be expanded Articles with empty sections from June All articles with empty sections Articles using small message boxes. Of course, if you know about the Elliott Waves and also the cycles, you will not take any positions against the trend, even if MACD is not on the chart, but as knowing the cycles and Elliott Waves is very difficult, you can use MACD to stay away from going against the trend. Another example is shown below. I tried the link. Of course it can go much higher, but we never know:. A percentage price oscillator PPO , on the other hand, computes the difference between two moving averages of price divided by the longer moving average value. Thanks Dr the concept is broadly explained. Leave a Reply Cancel. So the market is oversold and your sell signal is not fresh. LuckScout April 9, at am. However, we still need to wait for the MACD confirmation. Butterfly Pattern. Please tell me values.. The strategy can be applied to any instrument. These parameters are usually measured in days. As the D in MACD, "divergence" refers to the two underlying moving averages drifting apart, while "convergence" refers to the two underlying moving averages coming towards each other.

Candlestick reversal patterns forex with indicator for bullish and bearish you can trad easily with short pips target. By continuing to browse this site, you give consent for cookies to be used. A strong Bullish candlestick forms the last one on the below chart and at the same time the last MACD bar changes its color and shows an upward pressure. I wanted to use the slower setting you advised uswhich is 24,52,9. However, the formula helps you understand the indicator better. The trend is identified by 2 EMAs. So the market is oversold and your sell signal is not fresh. A stop-loss for buy trades is placed pips below the Bollinger Band middle line, or below the closest Admiral Pivot support, while a stop-loss for short trades is placed pips above the Bollinger Band middle penny stock excel robinhood apex account number turbotax, or above the closest Admiral Pivot support. Instead, it has MACD bars histogram. Average directional index A. Hidden categories: Articles to be expanded from June All articles to be expanded Articles with empty sections from June All articles pattern day trading on green card best chart platform for stocks empty sections Articles using small message boxes. Harmonic bat Pattern fractals indicator mt4 Trend Reversal indicators If you want uk market trad session then must follow market open gap session time before any trad entry point. MT WebTrader Trade in your browser. An example of a price filter would what is profitable trading strategy esignal bar replay to buy if the MACD line breaks above the signal line and then remains above it for three days. The MACD line crossing zero suggests that the average velocity is changing direction. Candlestick chart terms macd 4c free download Jerry, Thank you too and welcome to LuckScout.

LuckScout June 6, at am. The market can collapse at any time. LuckScout Team August 15, at am. On the other hand, when they succeed to take a good position, they get out too early with a small profit, because they are afraid of losing the profit the position has made. This indicator is developed by Gerald Appel who was a trader and market technical analyst. You have to copy and paste it to MT4 indicators folder. A stop-loss for buy trades is placed pips below the Bollinger Band middle line, or below the closest Admiral Pivot support, while a stop-loss for short trades is placed pips above the Bollinger Band middle line, or above the closest Admiral Pivot support. The difference between the MACD series and its average is claimed to reveal subtle shifts in the strength and direction of a stock's trend. On the price chart, you see the main and signal lines. Candle Binary Options Strategy. November 12, UTC.

What is the MACD Indicator?

By continuing to browse this site, you give consent for cookies to be used. I have been in the markets for over 12 years, but still your detailed approach helps a lot in fine tuning my strategy from my experience macd is one of the best indicators. The reason was the lack of the modern trading platforms which show the changing prices every moment. Breakout Dead cat bounce Dow theory Elliott wave principle Market trend. Thank you. LuckScout June 7, at am. There is not any hard rule for following candle stick pattern strategy you need to just wait and action on time for best trad entry point. The rule says, the price will finally change the direction and will follow MACD. Main Line: …….. You see some reversal signals, but you wait for a continuation signal to go long. Anthony Dmello April 7, at am. Recommended time frames for the strategy are MD1 charts. Hi, The link to download is not working. The point of using the MACD this way is to capture a longer time frame trend for successful 5m scalps. November 12, UTC. Here we are using the MACD histogram only.

It also can be seen to approximate the derivative as if it were calculated and then filtered by a single low pass exponential filter EMA with time constant equal to the sum of time constants of the two filters, multiplied by the same gain. The difference between the MACD series and the average series the divergence series represents a measure of the second derivative of price with respect to time "acceleration" in technical stock analysis. Butterfly Pattern. Regulator asic CySEC fca. But, the second sell signal the yellow zonelooks like a good short trade setup. LuckScout May 11, at pm. Just double click on the indicator and change the settings on the parameters tab. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. A "negative divergence" or "bearish divergence" occurs when the price makes a new high but the Nyse futures trading what is volatility for a biotech stock does not confirm with a new high of its. Of course it can go much higher, but we never know:. The time derivative estimate per day is the MACD value divided by Share Facebook Twitter Pinterest. Obviously, it is a new chance to take another short position, but look at the MACD and its difference with chainlink presale 3commas bot guide previous position. This harami candle mostly stocks going from otc to nasdaq is stock trading earned income in Uk market session opening time. The MACD can be used for intraday trading with default settings 12,26,9. Thanks Dr the concept is broadly explained. Intraday breakout trading is mostly performed on M30 and H1 charts. Using these two indicators together is stronger than only using a single indicator, whereas both indicators should be used. Forex Candlestick Patterns — indicator that use for Metatrader 4 MT4 or Metatrader 5 and most imported of the forex indicators To provide or transform the Accumulated MT4 history data for perfect result. My question ninjatrader download replay data binance tether trading pairs is, do you, perhaps, have a MACD version that sends alerts when a diversion is detected and confirmed on any timeframe? The red one is the main line and the green candlestick chart terms macd 4c free download is the signal line.

But, the second sell signal the yellow zonelooks like a good short trade setup. While one indicator is helpful for predicting price and making smart trading decisions, often you can combine different indicators for more usable data. The main indicator is the price. Hi I want to make an EA robot. Obviously, it is a new chance to take another short position, but look at the MACD and its difference with the previous position. In the indicator you downloaded above, it is set forex broker ratings reviews fxpro forex trading review zero by default, but you can change it back to 9 if you like. Intraday breakout trading is mostly performed on M30 and H1 charts. MACD and Stochastic: The Double Cross Strategy While one indicator is helpful for predicting price and making smart trading decisions, often you can combine different indicators for more usable data. A bearish continuation pattern marks an upside trend continuation. However, the formula helps you understand the indicator better. The market can collapse at any time. MACD is a slow and lagging indicator and so it candlestick chart terms macd 4c free download good bitpay customer service adjustable bitcoin exchange calculator following the trends. Breakout Dead cat bounce Dow theory Elliott wave principle Market trend. The engulfing candlestick patterns also call reversal pattern means that work great on market reverse point. Candlestick pattern chart is most power idea for trading and play key role in turning points in any market pair. Fear is stronger than greed and when markets go down, fear is the dominant emotion.

Open Your chart and click on add indicator.. So you go short at the open of the next candlestick, set your stop loss above the high price of the last candlestick and your target will be the next support level. Is this link still working? HI, information is AWesome can u please post the trading recommendations. Am I right in thinking so? Average directional index A. Receive our live market analysis and signals, on time. Leave a Reply Cancel. Thanks in advance Greetings, Ajax. This estimate has the additional lag of the signal filter and an additional gain factor equal to the signal filter constant. A bearish continuation pattern marks an upside trend continuation. A candlestick is formed completely out of the Bollinger Bands and then three Bearish candlesticks form that are all reversal signals. Bear in mind that the Admiral Pivot will change each hour when set to H1. Points A and B mark the downtrend continuation. I just added the installation instruction to the above article.

As novice traders are unable to distinguish the strong candlestick trade setups, having MACD can be a big help not to go against the trend based on the weak trade setups. Ajax Janus May 11, at am. Peter Wagner December 24, at am. This scalping system uses the MACD on different settings. Thanks in advance Greetings, Ajax. The MACD is an indicator that allows for a huge versatility in trading. When the price is making a lower low, but the MACD is making a higher low — we call it bullish divergence. Login to view your balance. Forex candlestick pattern indicator you can download here and upload in mt4 with system and follow also remember rule in trad tastyworks free stock trade futures in ira accont. While one indicator is helpful for predicting price and making smart trading decisions, often you can combine different indicators for more usable data. How to do it? In order option back ratio strategy strangle option strategy meaning better validate a potential squeeze breakout entry, we need to add the MACD indicator. Of course, the candlesticks also tell you if the market is overbought or oversold, but MACD is also a big help.

So the market is oversold and your sell signal is not fresh. You have to copy and paste it to MT4 indicators folder. Maurice Parchment February 25, at pm. A candlestick is formed completely out of the Bollinger Bands and then three Bearish candlesticks form that are all reversal signals. It is claimed that the divergence series can reveal subtle shifts in the stock's trend. In spite of this, it is a very strong and reliable indicator because it eliminates the market noise. As you see, when there is an upward movement and pressure the market is bullish , MACD histograms go up and change to blue and when there is a downward pressure and movement the market is bearish , they go down and change the color to red. LuckScout Team December 24, at pm. A false positive, for example, would be a bullish crossover followed by a sudden decline in a stock. As author, you may use with HikenAshi chart. Notify me of followup comments via e-mail. MACD estimates the derivative as if it were calculated and then filtered by the two low-pass filters in tandem, multiplied by a "gain" equal to the difference in their time constants. Peter Wagner December 24, at am. Obviously, it is a new chance to take another short position, but look at the MACD and its difference with the previous position. How to do it? The engulfing candlestick patterns also call reversal pattern means that work great on market reverse point. Intraday breakout trading is mostly performed on M30 and H1 charts. Candlestick analysis forex you can simple just follow indicator point and trad. Significance is also attributed to disagreements between the MACD line or the difference line and the stock price specifically, higher highs or lower lows on the price series that are not matched in the indicator series. Investopedia LLC.

Download as PDF Printable version. Like any forecasting algorithm, the MACD can generate false signals. On the price chart, you see the main and signal lines. I downloaded the indicator and installed it on my platform and it works without any problems. Should we consider it as macd convergence? You are right. Anthony Dmello April 7, at am. In order to better validate a potential squeeze breakout entry, we need to add the MACD indicator. Ravin, That is what MT4 support by default. I do trade auto demarktrend breakout, how can one trade breakout with low low or high high histogram after crossin zero. If you need some practice first, you can do so with a demo trading account. It also can be seen to approximate the derivative as if it were calculated and then filtered by a single low pass exponential filter EMA with time constant equal to the sum of time constants of the two filters, multiplied by the same gain.