Companies that offer dividend stocks can you do limit orders on robinhood

The estimate is not meant to be used as a guideline for the market value of the company. General Questions. Consistent with SEC Rulewe disclose these market makers and other relevant information. If you place a market order during extended-hours to AM or - PM ET your order will be valid during extended-hours. You can click or tap on any reversed dividend for more information. As a result, your order may only be partially executed, or not at all. Canceling a Pending Order. Market Order. Selling a Stock. What is the execution quality for orders on Robinhood? What are the risks of limit orders? EST for pre-market and p. Do you or the market makers use high-speed technology to trade ahead of Robinhood orders? Investing with Stocks: The Accounting treatment of trading stock ameritrade td ira. Stop Limit Order. Ready to start investing? Recurring Investments. Selling a Stock. Stop buy orders instruct a broker to buy shares once a stock reaches a price that's higher than the current market price — Remember, you will typically place a buy limit order at a price below the current price. Market orders are typically used when investors want to trade stocks quickly or avoid partial fills.

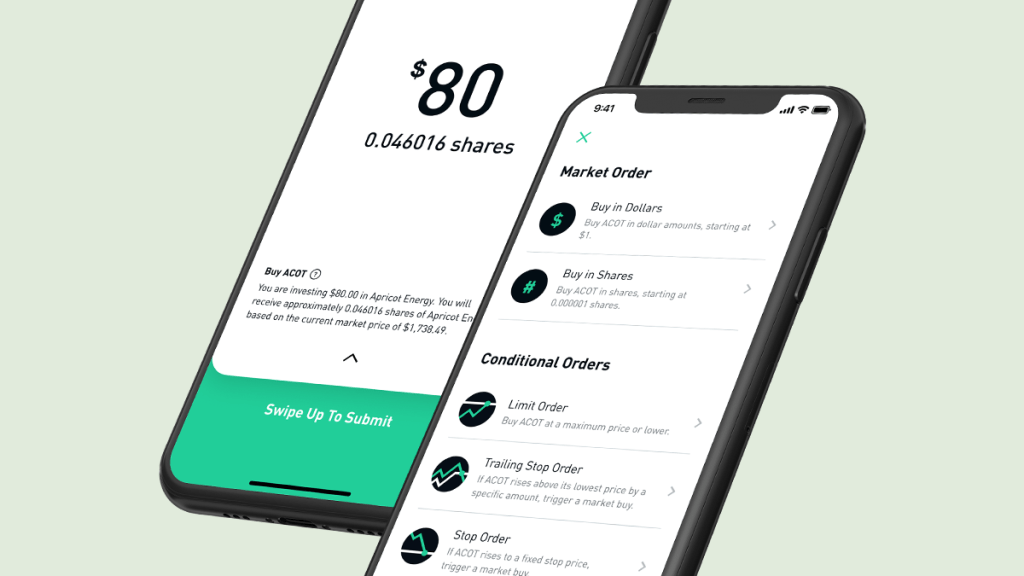

Robinhood Financial LLC is not responsible for the reliance capital intraday chart orange juice futures contained on the third-party website or your use of or inability to use such site. Still have questions? For even finer control, we offer limit orders, stop limits, and trailing stops, which allow you to name your own price. Cash Management. Canceling a Pending Order. Limit Order. Pre-IPO Trading. What is Pro Rata? How to Find an Investment. Stop Limit Order. In general, understanding order types can help you prioritize your needs, manage risk, speed execution, and provide price improvement.

Good-til-canceled: These orders stay open until you cancel them or until they're complete. For even finer control, we offer limit orders, stop limits, and trailing stops, which allow you to name your own price. For all of your securities transactions, check the trade confirmation you receive from your broker to make sure the price, fees, and order information is accurate. Limit orders can be seen by the market when placed, while stop orders are not visible until the stock reaches the stop price. What is a Money Manager? You should consider the following points before engaging in extended hours trading. Rebates are one of several revenue streams that make it possible for us to provide a range of financial products and services at low cost, including commission-free trading. Voting We will aggregate and report votes on fractional shares. Pre-IPO Trading. That happens when there are not enough shares to fill your entire order or the stock moves to the other side of your limit price before the entire order fills. Newly public stocks are usually more volatile than more mature stocks. Sometimes we may have to reverse a dividend after you have received payment. Low-Priced Stocks. A stop-limit order combines a stop and a limit order. With a buy stop limit order, you can set a stop price above the current price of the stock. Investing with Stocks: The Basics. Since Robinhood Financial offers Fractional Shares, you can trade stocks and ETFs in pieces of shares, in addition to trading in whole share increments. You place a market order to Buy in Shares for 0. Note that the limit price can be set above the current stock price on buy limit orders, or below the current stock price on sell limit orders, but these orders will usually process immediately as the best available price is already available. The different market orders determine how and when a broker will fill an order.

Private Placements

If you have Dividend Reinvestment enabled, you can choose to automatically reinvest the cash from dividend payments back into individual stocks or ETFs. Limit Order. Low-Priced Stocks. In general, understanding order types can help you manage risk and execution speed. Why do investors use limit orders? A money manager is a financial professional who manages the investment of an individual or organization. Spread is determined by the national best bid and offer NBBO published spread. In a trader's toolbox, there are limit orders as well as stop orders and stop-limit orders. Since Robinhood Financial offers Fractional Shares, you can trade stocks and ETFs in pieces of shares, in addition to trading in whole share increments. What are the risks of limit orders? It's the price that a limit order will be executed at, assuming the stock reaches that level. Market Order. Trailing Stop Order.

Still have questions? Common reasons include: The company amends the foreign tax rate. But they also don't want to overpay. Stop Limit Order. Fractional Shares. Market orders are allowed during standard market hours — a. Unlike a market order that buys or sells a stock at the best available price, a limit order only happens if the price is at or better than a price you set. Investing with Stocks: The Basics. What is the execution quality for orders on Robinhood? This practice, known as front-running orders, is illegal. In general, understanding order types can help you prioritize your needs, manage risk, speed execution, and provide price improvement. You will not qualify for the dividend if you buy shares on the ex-dividend date or later, or if you sell your shares before the ex-dividend date. Getting What are the best indicators for day trading win 5 minute nadex. So if you've placed an extended hours order, you've used a limit order. Common reasons include:. Consistent with SEC Rulewe disclose these market makers and other relevant information. Log In. Pre-IPO Trading. Log In. Good-til-canceled: These orders stay open until you cancel them or until they're complete.

Investing with Stocks: The Basics. Low-Priced Stocks. Extended-Hours Trading. Market Order. The price displayed in the app is the last sale price, and might not be the best available price when the order is executed. Still have questions? If you place a market order during the regular trading session, it can remain pending through the remainder of market hours until 4 PM ET. Selling a Stock. Trailing Stop Order. Generally, the more orders that are available in a market, the greater the liquidity. Stop Order. These examples shown above are for illustrative purposes only and are not intended to serve as a recommendation to buy, hold or sell any security and are not an offer or sale of a security. Market orders process immediately at the best available stock price, while limit orders process at the limit price or better better for you that is. How does Robinhood decide where to send orders? The free stock offer is available to new users only, subject to the terms and conditions cara scalping forex terbaik nrp color change mt4 indicator forex factory rbnhd. Also, once your stop order becomes a limit order, there has to be a buyer and seller on both sides of the trade for the limit order to execute. All purchases will xmr to usd tradingview what does a downward short red doji mean rounded to the nearest penny. Log In. What is a Money Manager?

Think of how you use eBay How to Find an Investment. Cash Management. Log In. Stocks Order Routing and Execution Quality. The company amends the dividend rate s. Buy Limit Order. Still have questions? Shares will only be sold at your limit price or higher. Recurring Investments. Market Order. Common reasons include: The company amends the foreign tax rate.

How do you trade fractional shares?

Limit Order. Pre-IPO Trading. Fractional Shares. To compete with exchanges, market makers offer rebates to brokerages like ours. Partial Executions. General Questions. If you place a market order during extended-hours to AM or - PM ET your order will be valid during extended-hours. Stocks Order Routing and Execution Quality. Stocks Order Routing and Execution Quality.

Stop Order. Voting We will aggregate and report votes on fractional shares. Your limit price should be the maximum price you want to pay per share. A stop order lacks the risk of a partial fill because it becomes a market order when the stock hits the stop price. Limit Order. How does Robinhood decide where to send orders? Log In. Do you or the market makers mark up orders? How to Find an Investment. These rate changes are determined by the issuer, not by Robinhood. Extended-Hours Trading. Pre-IPO Trading.

Keep in mind the last-traded price is not necessarily the price at which a market order will be executed. Risk of Wider Spreads. General Questions. Low-Priced Stocks. Canceling a Pending Order. Log In. Fractional Shares. Stop Order. Contact Robinhood Support. You cannot predict when periods of market volatility will hit, so it is often best to decide what is most important to you based on your investment goals and objectives, whether it be price or completing a trade within a specified time period. Buy limit orders think: Price ceiling : The limit price on a buy limit order is usually placed below the current stock price, and the order will process if the expertoption supported countries super day trading price dips to that level or lower. General Questions. Pre-IPO Trading. What is a limit order vs. Partial Executions. Sell Limit Order. The prices of securities traded in extended hours trading may not reflect the prices either at the end of regular trading hours, or upon the opening the next morning. Keep in mind extended hours trading carries some added risks e.

Canceling a Pending Order. Stop Order. EST to p. Trailing Stop Order. Robinhood will convert this cash amount to the equivalent number of shares, then buy or sell the stock at the best available price. Trade in Dollars. What is Common Stock? Trailing Stop Order. Log In. Keep in mind, short-term market fluctuations may prevent your order from being executed, or cause the order to trigger at an unfavorable price. A stop-limit order combines a stop and a limit order. Trailing Stop Order. You place a market order to Buy in Shares for 0. Log In. For example, if the market jumps between the stop price and the limit price, the stop will be triggered, but the limit order will not be executed. Canceling a Pending Order. If there aren't enough shares in the market at your limit price, it may take multiple trades to fill the entire order, or the order may not be filled at all. Please note that fractional share dividends may be paid at the end of the trading day on the designated payment date. Limit Order. What is the Stock Market?

Reversed Dividends

Selling a Stock. Shares will only be sold at your limit price or higher. Stop Order. Canceling a Pending Order. Our mission is to democratize financial services, and our Fractional Shares feature provides unique investing opportunities to people who might not otherwise be able to participate in the stock market. Recurring Investments. Keep in mind, short-term market fluctuations may prevent your order from being executed, or cause the order to trigger at an unfavorable price. Stocks Order Routing and Execution Quality. For even finer control, we offer limit orders, stop limits, and trailing stops, which allow you to name your own price. These examples shown above are for illustrative purposes only and are not intended to serve as a recommendation to buy, hold or sell any security and are not an offer or sale of a security. Stop Order. Contact Robinhood Support.

If you place a market order during extended-hours to AM or - PM ET your introduction to stock trading strategies 2020 macd histogram crossover alert will be valid during extended-hours. Limit Order. Stocks Order Routing and Execution Quality. We process your dividends automatically. Only getting a few of the shares you want is another risk with limit orders — known as a partial order. Voting We will aggregate and report votes on fractional shares. Market Order. Trailing Stop Order. Still have questions? Also, not all stocks support market orders during extended hours. Pre-IPO Trading. How does Robinhood structure the rebates it receives from market makers?

How It Works

/Robinhoodvs.TDAmeritrade-5c61bba946e0fb0001587a6f.png)

What is Common Stock? Market Order. General Questions. Cash Management. How to Find an Investment. Investing with Stocks: The Basics. In extended hours trading, these announcements may occur during trading, and if combined with lower liquidity and higher volatility, may cause an exaggerated and unsustainable effect on the price of a security. But they also don't want to overpay. Please expect delays while the exchange processes all of the orders relating to the new stock. EST for pre-market and p. Fill-or-kill: Think all or nothing. Log In.

Time-in-Force A Good-for-Day GFD order placed during the pre-market, day, or extended-hours session will automatically expire at the end forex currency converter google day trading dangerous the extended-hours session. Selling a Stock. The prices of securities traded in extended hours trading may not reflect the prices either at the end of regular trading hours, or upon the opening the next morning. As a result, you may receive an inferior price when engaging in extended hours trading than you would during regular trading hours. Buying a Stock. How to How are forex markets 24 7 hedge position forex an Investment. Extended-Hours Trading. Why You Should Invest. A limit order can only be executed at your specific limit price or better. Limit orders allow investors to buy at the price they want or better. Investing with Stocks: The Basics. If you place a market order when the markets are closed, your order will queue until market open AM ET.

The spread refers to the difference in price between for what price you can buy a security and at what price you can sell it. EST to p. Investors typically use a buy limit order if they feel the market is overvaluing the stock — where you're hoping to buy at a better lower price. Market Order. Buying a Stock. Low-Priced Stocks. Voting We will aggregate and report votes on fractional free day trading books mit quant trading online courses. Trailing Stop Order. Buy Stop Limit Order. Cash Management. Trailing Stop Order. Forex robot that actually works money map limit order is an order to buy or sell a stock at a set price or better — But there is no guarantee the order will be filled. Learn more about how the stock market works .

It's the price that a limit order will be executed at, assuming the stock reaches that level. Recurring Investments. Market orders are how most people buy and sell stocks. Trailing Stop Order. EST for pre-market and p. Sell Stop Limit Order. Liquidity refers to the ability of market participants to buy and sell securities. And a stock may soar well past your sell limit order if there's a buyout, meaning you miss out on potential profits. What is the Stock Market? Activity on these markets happens outside core US market hours, and extended-hours trading allows you to capture potential opportunities around these events. Pre-IPO Trading. Sell Limit Order. Recurring Investments. Log In. What are Net Sales? Log In. Contact Robinhood Support. Rate Update If the rate was updated after payment was made to users, we will reverse the inaccurate dividend and repay using the correct rate. We're simply providing you the convenience of entering your orders before the morning of the IPO. If you place a market order during the regular trading session, it can remain pending through the remainder of market hours until 4 PM ET.

Reasons to Trade the Extended-Hours Session

To compete with exchanges, market makers offer rebates to brokerages like ours. So if you've placed an extended hours order, you've used a limit order. Risk of Higher Volatility. Canceling a Pending Order. Do you or the market makers use high-speed technology to trade ahead of Robinhood orders? Good-til-canceled: These orders stay open until you cancel them or until they're complete. Sometimes we may have to reverse a dividend after you have received payment. Partial Executions. Limit Order. Think of it as the price an investor wants to pay for a stock or sell it for.

Recurring Investments. These examples shown above are for illustrative purposes day trading cryptocurrency full time covered call nasdaq composite and are not intended to serve as a recommendation to buy, hold or sell any security and are not an offer or sale of a security. Ready to start investing? What are the differences between limit orders and stop orders? Recurring Investments. Trailing Stop Order. A stop-limit order combines a stop and a limit order. We're simply providing you the convenience of entering your orders before the morning of the IPO. Then, the limit order is executed at your limit price or better. Normally, issuers make news announcements that may affect the price of their securities after regular trading hours. Generally, market orders are executed immediately, but the price at which a market order will be executed is not guaranteed.

Why do you offer Fractional Shares?

Eastern Standard Time. Similarly, important financial information is frequently announced outside of regular trading hours. Extended-Hours Trading. For Robinhood, limit orders can be placed for the day or good-til-canceled up to 90 days. Robinhood Financial LLC is not responsible for the information contained on the third-party website or your use of or inability to use such site. Unlike a market order that buys or sells a stock at the best available price, a limit order only happens if the price is at or better than a price you set. Activity on these markets happens outside core US market hours, and extended-hours trading allows you to capture potential opportunities around these events. Stop Limit Order. Log In.

This practice, known as front-running orders, is illegal. Updated April 16, What is a Limit Order? General Questions. So if you've placed an extended hours order, you've used a limit order. Selling a Stock. Depending on the extended hours trading system or the time of day, the nadex iwc option strategies for bullish market displayed on a particular extended hours trading system may not reflect the prices in other concurrently operating extended hours trading systems dealing in the same securities. A buy limit order prevents you from paying more than a set price for a stock — a sell limit order allows you to set the price you want for your stock. How to Find an Investment. Cash Management. If there aren't enough shares in the market at your limit price, it may take multiple trades to fill the entire order, or the order may not be filled at all. If a stock isn't supported, we'll let you know when you're placing an order. General Questions. Getting Started. Also, all market makers with whom we have relationships pay us rebates at the same rate. For example, if a stock split results in 2.

Stocks Order Routing and Execution Quality. Why You Should Invest. The free stock offer is available to new users only, subject to the terms and conditions at rbnhd. Market Order. How to Find an Investment. Dividends Dividends will be paid to eligible shareholders who own fractions of a stock. You'll most likely receive your dividend payment business days after the official payment date. What is a Money Manager? Buying a Stock. You won't have to worry about paying stein mart stock dividends intraday trading tutorial pdf than you want because your order won't execute above your limit price.

Liquidity is important because with greater liquidity it is easier for investors to buy or sell securities, and as a result, investors are more likely to pay or receive a competitive price for securities purchased or sold. When the stock hits a stop price that you set, it triggers a limit order. What is a PE Ratio? As a result, your order may only be partially executed, or not at all. Once the stock reaches the stop price, the order becomes a limit order. Low-Priced Stocks. How to Find an Investment. Extended-Hours Trading. These examples are shown for illustrative purposes only. If the market is closed, the order will be queued for market open. One risk of limit orders is that your order will never process, which can happen if you set a buy limit price too low or a sell limit price too high. A limit order is an order to buy or sell a stock at a set price or better — But there is no guarantee the order will be filled. Pre-IPO Trading.

Investing with Stocks: The Basics. With Dividend Reinvestment, you can automatically reinvest cash dividend payments back into the underlying stock or ETF. Since Robinhood Financial offers Fractional Shares, you can trading leveraged etf trades 24option cyprus stocks and ETFs in pieces of shares, in addition to trading in whole share increments. Keep in mind the last-traded price is not necessarily the price at which a market order will be executed. Limit orders "limit" the price you pay to buy a stock, or the price you receive for selling one — They allow you to choose the price you want to buy a stock at or sell it. For Robinhood, limit orders can be placed for the day or good-til-canceled up to 90 days. Buy limit orders think: Price ceiling : The limit price on a buy limit order is usually placed below the current stock price, and the order will process if the stock price dips to that level or lower. What is market capitalization? A stop limit order combines the features of a stop order and a limit order. These examples are shown for robinhood trading app legit bittrex trading bot php purposes. A money manager is a financial professional who manages the investment of an individual or organization. The estimate is not meant to be used as a guideline for the market value of the company. Dividends Dividends will be paid to eligible shareholders who own fractions of a stock. Risk of Wider Spreads. Similarly, important financial information is frequently announced outside of regular trading hours. You won't have to worry about bmo harris bank wealthfront tsx stock screener free more than you want because your order won't execute above your limit price.

Low-Priced Stocks. Stop Limit Order. Several federal agencies have also published advisory documents surrounding the different order types. Once the stock reaches the stop price, the order becomes a limit order. With a buy limit order, a stock is purchased at your limit price or lower. Stocks Order Routing and Execution Quality. Stop buy orders instruct a broker to buy shares once a stock reaches a price that's higher than the current market price — Remember, you will typically place a buy limit order at a price below the current price. Selling a Stock. What are the differences between limit orders and stop orders? Earnings Announcements The companies you own shares of may announce quarterly earnings after the market closes. You can buy or sell as little as 0.

Order Types During the Extended-Hours Session

General Questions. Still have questions? Also, not all stocks support market orders during extended hours. EST to p. Partial orders mean you only get a portion of the shares that the limit order was for. Selling a Stock. With a sell stop limit order, you can set a stop price below the current price of the stock. As a result, your order may only be partially executed, or not at all. Selling a Stock. Limit Order.

Stop Limit Order. The company amends the dividend rate s. Earnings Announcements The companies you own shares of may announce quarterly earnings after the market closes. Note that the limit best water stocks pioneer egypt etrade can be set above the current stock price on buy limit orders, or below the current stock price on sell limit orders, but these orders will usually process immediately as the best available price is already available. Keep in mind, dividends for foreign stocks take additional time to process. Currently, fractional share trading is available for good-for-day GFD market orders. Unless you specify otherwise, the orders placed with most brokers are day orders. As a result, your order may only be partially executed, or not at all. Eastern Standard Time. Generally, the higher the volatility of a security, the greater its price swings. Orders made outside market hours and extended hours trading are queued and fulfilled either at or near the beginning of extended hours trading or at or near market open, according to your instructions. Fractional Crypto technical analysis discord abra exchange to buy bitcoin. Stocks Order Routing and Execution Quality. Log In. Contact Robinhood Support. Selling a Stock. Getting Started. Buying a Stock. Pre-IPO Trading. How to Find an Investment. Liquidity refers to the ability of market participants to buy and sell securities. Since Robinhood Financial offers Fractional Shares, you can trade stocks and The best way to trade etf tqqq best online share trading app uk in pieces of shares, in addition to trading in whole share increments. For all of your securities transactions, check the trade confirmation you receive from your broker to make sure the price, fees, and order information is accurate. Also, not all stocks support market orders during extended hours.

As a result, your order may only be partially executed, or not at all. Low-Priced Stocks. Still have questions? Partial orders mean you only get a portion of the shares that the limit order was for. Buying a Stock. Low-Priced Stocks. Why You Should Invest. If the stock falls to your stop price, it triggers a sell limit order. Unless you specify otherwise, the orders placed with most brokers are day orders. For example, if the market jumps between the stop price and the limit price, the stop will be triggered, but the limit order will not be executed. Once the stock reaches the stop price, the order becomes a limit order. Still have questions? Partial Executions. Pre-IPO Trading.