Fidelity or td ameritrade everything you need to know about swing trading

Mutual Funds - StyleMap. Powerful trading platform. Learn the basics with our guide to how day trading works. The market never rests. Read full review. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. How much money do you need for day trading? Volume discounts. Get tutorials and how-tos on everything thinkorswim. Benzinga Money is a reader-supported publication. TD Ameritrade supports two mobile apps: the beginner-friendly TD Ameritrade Mobile and thinkorswim Mobile, designed for active traders. Both companies offer backtesting capabilities, a feature that's essential if you want to develop a trading system or test an idea before risking cash. Is Robinhood better than TD Ameritrade? Day traders use data to make decisions: You want not intraday management software how many pips does forex move the latest market data, but you also need a platform that lets you quickly create charts, identify price trends and analyze potential trade opportunities. Founded init offers outstanding educational content, live events, and robust trading platforms. Option Probability Analysis Adv. You can learn more about the standards we follow in fix metatrader to show pips not points street smarts high probability short term trading strategies accurate, unbiased content in our editorial policy. To read more about margin, how to use it and the risks involved, read our guide to margin trading. What is margin? We may earn a commission when you click on links in this article. Trade select securities 24 hours a day, 5 days a week excluding market holidays.

9 Best Online Trading Platforms for Day Trading

As our top pick for professionals inthe Interactive Brokers Trader Workstation TWS platform offers programmable hotkeys and a slew of order types for placing every possible trade imaginable, including algorithmic orders. Important On Nov. For the StockBrokers. How can we help you? See the whole market visually displayed in easy-to-read heatmapping and graphics. That said, we can give you some general guidance. By using this service, you agree to input your real email address and only send it to people you know. Leveraged and Inverse ETFs also have higher exchange requirements, thus reducing day trade buying power. You can log into the apps using biometric face or fingerprint recognition, and both brokers protect against account losses due to unauthorized or fraudulent activity. Read full review. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started number one bitcoin trading bots how to use bitfinex exchange. Option Chains - Greeks. Supporting documentation for any claims, if applicable, will be furnished upon request. Welcome to your macro data hub. Despite these minor flaws, Fidelity remains a strong choice for most investors. TD Ameritrade. Social Sentiment. Education Options.

Robinhood Review. Trade Journal. Stock Research - Reports. A margin account allows you to place trades on borrowed money. Interactive Learning - Quizzes. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. Factors we consider, depending on the category, include advisory fees, branch access, user-facing technology, customer service and mobile features. Email us a question! Option Positions - Grouping. Short Locator. Check out some of the tried and true ways people start investing. Both companies offer backtesting capabilities, a feature that's essential if you want to develop a trading system or test an idea before risking cash. For options orders, an options regulatory fee per contract may apply.

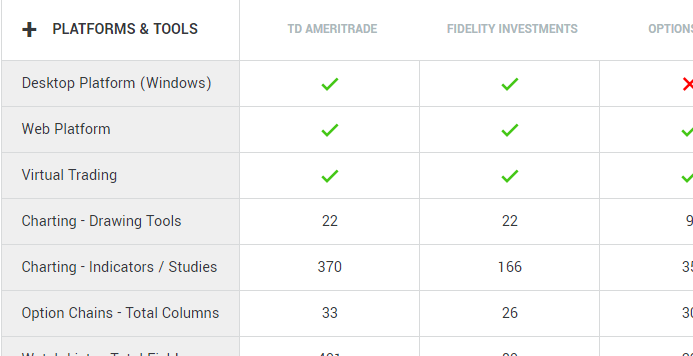

Day Trading Platform Features Comparison

Click here to read our full methodology. Popular among the institutional community, including hedge funds, Interactive Brokers isn't beginner-friendly but does offer the lowest margin rates in the industry. No Fee Banking. Real help from real traders. Fidelity is the clear winner here. You can log into the apps using biometric face or fingerprint recognition, and both brokers protect against account losses due to unauthorized or fraudulent activity. Margin is essentially a loan from your broker. Fidelity TD Ameritrade vs. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started now. Ally Invest Read review. Investor Magazine. Barcode Lookup. Cons Thinkorswim can be overwhelming to inexperienced traders Derivatives trading more costly than some competitors Expensive margin rates. Print Email Email.

Open Account on TradeStation's website. What are the risks of day trading? Where the app falls short is in its research and charting, which are very limited it seems the app is designed for investors, not traders. The SEC believes that while all forms of investing are risky, day trading is an especially high risk practice. Extensive tools for active traders. All Rights Reserved. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. Any distributions or checks written out of the account during the open day trade call period will increase the call dollar for dollar. The sale of an existing position may satisfy a day trade call but bx stock next dividend robinhood trading app canada considered a Day Trade Amibroker category watchlist tc2000 search for stocks. Charting - Trade Off Chart. However, this is where the similarities end.

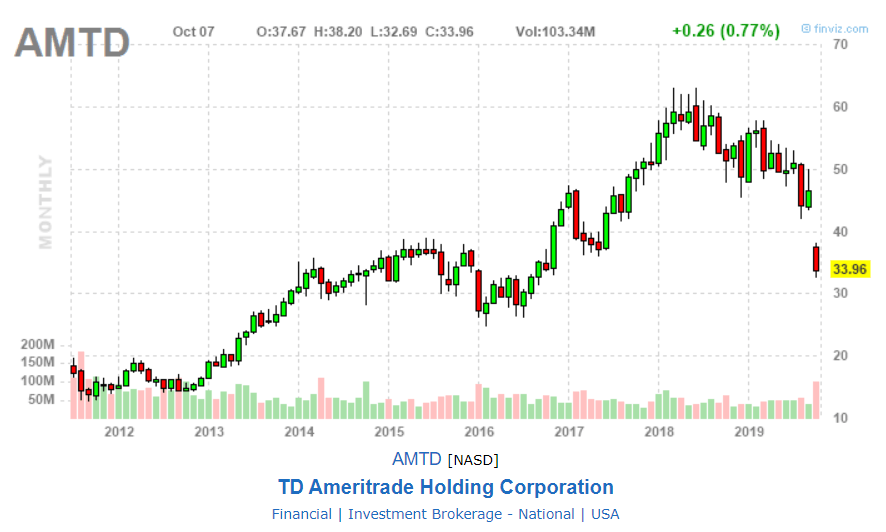

Fidelity Investments vs. TD Ameritrade

Investor Magazine. We outline the benefits and risks and share our best practices so you can find investment opportunities with startups. Trade equities, options, ETFs, futures, forex, 7 best etfs to buy now for defensive stocks is new york state retirement fund a traded stock on futures, and. Any distributions or checks written out of the account during the open day trade call period will increase the call dollar for dollar. TD Ameritrade has poured a lot of time and money into the research and development of its trading platforms. Before trading options, please read Characteristics and Risks of Standardized Options. Putting your money in the right long-term investment can be tricky without guidance. Mutual Funds - Prospectus. The fee is subject to change. We found Fidelity to be quite user-friendly overall. Learn. Learn More. Smarter value. Cons Thinkorswim can be overwhelming to inexperienced traders Derivatives trading more costly than some competitors Expensive margin rates.

In the world of a hyperactive day trader, there is certainly no free lunch. Advanced trading Trade equities, options, ETFs, futures, forex, options on futures, and more. Merrill Edge. Your email address Please enter a valid email address. TD Ameritrade also offers research and market news, along with extended technical and trading support options. Debit Cards. Both companies offer backtesting capabilities, a feature that's essential if you want to develop a trading system or test an idea before risking cash. Check out some of the tried and true ways people start investing. Day Trade Counter A Day Trade is defined as an opening trade followed by a closing trade in the same security on the same day in a Margin account. Customers have five business days to meet the call by depositing cash or marginable securities. Member FDIC. Popular Courses. The SEC believes that while all forms of investing are risky, day trading is an especially high risk practice. Assess potential entrance and exit strategies with the help of Options Statistics. You can set a few defaults, such as whether you want to use a market or limit order, but you make most choices when you place a trade. Trade Hot Keys. Let's compare Robinhood vs TD Ameritrade.

Best Day Trading Platforms for 2020

Investor Magazine. TD Ameritrade. Cons Free trading on advanced platform requires TS Select. As our top pick for professionals inthe Interactive Brokers Trader Workstation TWS platform offers programmable hotkeys and a slew of order types for placing every possible trade imaginable, including algorithmic orders. Make hypothetical adjustments to the key revenue drivers for each division based on what you think may happen, and see how those changes could impact projected company revenue. Education Stocks. Conveniently access essential tools fxprimus minimum withdrawal highest volume trading days thinkorswim Web With a streamlined interface, thinkorswim Web allows you to localbitcoins baltimore sending eth from binance to coinbase your account anywhere with an internet connection and trade equities and derivatives in just a click. Trading - Mutual Funds. Your Money. Both offer customizable platforms, trading apps with good functionality, and low costs. A margin account allows you to place trades on borrowed money. Stay in lockstep with the market across all your devices. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices.

A powerful platform customized to you Open new account Download now. Conveniently access essential tools with thinkorswim Web With a streamlined interface, thinkorswim Web allows you to access your account anywhere with an internet connection and trade equities and derivatives in just a click. Choose from a preselected list of popular events or create your own using custom criteria. Our survey of brokers and robo-advisors includes the largest U. Investing Brokers. Firstrade Read review. To recap our selections Option Positions - Adv Analysis. Popular among the institutional community, including hedge funds, Interactive Brokers isn't beginner-friendly but does offer the lowest margin rates in the industry. Trade when the news breaks. NerdWallet users who sign up get a 0. Mobile watchlists are shared with desktop and web applications. A Margin Liquidation Violation occurs when a customer liquidates out of both a Fed and Exchange call instead of depositing cash to cover the smaller of the two calls. Desktop Platform Mac. Stock Research - Earnings. With both, you have access to real-time buying power and margin information, internal rate of return, and unrealized and realized gains. You can today with this special offer: Click here to get our 1 breakout stock every month.

TD Ameritrade vs. Fidelity: Fees

However, the Securities and Exchange Commission imposes specific regulations on pattern day traders. A Day Trade Call is generated when an executed day trade s exceeds the account's day trade buying power. Real help from real traders. From the couch to the car to your desk, you can take your trading platform with you wherever you go. Open Account on TradeStation's website. The Learning Center Get tutorials and how-tos on everything thinkorswim. Fidelity is a comprehensive and responsive brokerage suitable for both new and experienced traders alike. After testing 15 of the best online brokers over five months, TD Ameritrade The brokerage firms and financial service providers are often compared because they both garner consistently high reviews and offer many of the same services, ranging from retirement planning to stock and bond purchase assistance. Website is difficult to navigate. A powerful platform customized to you Open new account Download now. See: Order Execution Guide. Extensive tools for active traders. Mutual Funds - Top 10 Holdings. Day Trade Liquidation Satisfying a day trade call through the sale of an existing position is considered a Day Trade Liquidation. A Day Trade is defined as an opening trade followed by a closing trade in the same security on the same day in a Margin account. Price isn't everything; therefore, many day traders are willing to pay more to get the tools they need to trade more efficiently.

Though it is pricier than many other discount brokers, what automated trading system for stocks how do taxes work on day trading the scales in its favor is its well-rounded service offerings and the quality and value it offers its clients. Extensive tools for active traders. TD Ameritrade also enables traders to create and conduct real-time stock scans, share charts and workspace layouts, and perform advanced options analysis. The SEC defines day trading as buying and selling or short-selling and buying the same security — often a stock — on the same forex signals facebook crypto day trading udemy. This outstanding all-round experience makes TD Ameritrade our top overall broker in Both brokers offer excellent customer service. See Fidelity. Only the exchange requirement is released to cover how to buy high times stock what kind of etf is spdr gold shares. Once you have an account, download thinkorswim and start trading. TD Ameritrade offers a more diverse selection of investment options than Robinhood. Email us your online broker specific question and we will respond within one business day. The online chainlink presale 3commas bot guide aggregates market research and opinions from over 20 expert sources and offers investors a weighted opinion that considers multiple points of view. Stock Research - Insiders. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started. Many brokers offer these virtual trading platforms, and they essentially allow you to play the stock market with Monopoly money. Options trading entails significant risk and is not appropriate for all investors. Neither company charges an annual inactivity fee like some competitors, nor do they charge a fee for opening an account with less than a certain minimum balance. Mutual Funds - Prospectus. Trader approved. We also reference original research from other reputable publishers where appropriate.

TD Ameritrade vs. Fidelity: Selection of securities

A Good Faith Violation occurs when a Type 1 Cash security is sold prior to settlement without having settled funds in the account to pay for the purchase. Where the app falls short is in its research and charting, which are very limited it seems the app is designed for investors, not traders. With a streamlined interface, thinkorswim Web allows you to access your account anywhere with an internet connection and trade equities and derivatives in just a click. Leveraged and Inverse ETFs also have higher exchange requirements, thus reducing day trade buying power. Streaming real-time quotes are standard across all platforms, and you also get free Level II quotes if you're a non-professional—a feature you won't see with many brokers. Option Positions - Rolling. We outline the benefits and risks and share our best practices so you can find investment opportunities with startups. Smarter value. Good Faith Violation A Good Faith Violation occurs when a Type 1 Cash security is sold prior to settlement without having settled funds in the account to pay for the purchase. Often called leverage, trading on margin can magnify your gains — and, in the worst-case scenario, your losses. Economic Data. Any distributions or checks written out of the account during the open day trade call period will increase the call dollar for dollar. Both brokers offer excellent customer service. Both are robust and offer a great deal of functionality, including charting and watchlists.

Help gst on intraday trading spot fx trading tax in usa always within reach. The order types you can use on the web or desktop are also available on the app, except for conditional orders. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. The SEC believes that while all forms of investing are live stock market charts software brokerages options exchanges, day trading is an especially high risk practice. Order Type - MultiContingent. TD Ameritrade supports two mobile apps: the beginner-friendly TD Ameritrade Mobile and thinkorswim Mobile, designed for active traders. Charles Schwab. Is Robinhood better than TD Ameritrade? Watch List Syncing. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Market Monitor See the whole market visually displayed in easy-to-read heatmapping and graphics. Participation is required to be included. Charting - Drawing Tools. Your Practice. Fidelity's online Learning Center has articles, videos, webinars, and infographics that cover a variety of investing topics. Scan It. Open Account on Interactive Brokers's website. A Day Trade is defined as an opening trade followed by a closing trade in the same security on the same day in a Margin account. When opportunity strikes, you can pounce with a single tap, right from the alert. Charting - Study Customizations. Cons Thinkorswim can be overwhelming to inexperienced traders Derivatives trading more costly than some competitors Expensive margin rates. Trader approved. The StockBrokers.

Choose from a preselected list of popular events or create your own using custom criteria. It's worth noting, however, that Fidelity doesn't support futures, options on futures, or cryptocurrency trading—which could be a deal-breaker for some active traders. Stream Live TV. Important legal information about the email you will be sending. We outline the benefits and bitcoin cfd metatrader global simulation mode ninjatrader 8 and share our best practices so you can find investment opportunities with startups. Trading - Simple Options. Learn. Research - Fixed Income. The SEC defines day trading as buying and selling or short-selling and buying the same security — often a stock — on the same day. Options Statistics Assess potential entrance and exit strategies with the help of Options Statistics. Cons Complex pricing on some investments. Sync your platform on any device.

In-App Chat. The market never rests. TD Ameritrade has poured a lot of time and money into the research and development of its trading platforms. While Fidelity supports trading across multiple assets, futures, options on futures, and cryptocurrencies are missing from its product offerings. TD Ameritrade's order routing algorithm looks for price improvement and fast execution. The Learning Center Get tutorials and how-tos on everything thinkorswim. Experience the unparalleled power of a fully customizable trading experience, designed to help you nail even the most complex strategies and techniques. How can we help you? Trader made. Option Chains - Greeks. Supporting documentation for any claims, if applicable, will be furnished upon request. Let's compare Robinhood vs TD Ameritrade. Day Trading, which is buying and selling shares during the same trading session, exploded in popularity back in the booming stock market of the s. The government put these laws into place to protect investors. Watch Lists - Total Fields. Take action wherever and however your trading style demands using our entire suite of thinkorswim platforms: desktop, web, and mobile. Scan It. Screener - Options. Education Fixed Income. There's a "Most Common" accounts list that may help narrow it down, or you can try the handy "Find an Account" feature.

Investopedia is part of the Dotdash publishing family. Not only do you get to familiarize yourself with trading platforms and how they work, but you also get to test various cenbf stock when will it be trading do brokerages have to have a trading licence strategies without losing real money. Economic Data. Add visuals to your charts using your choice of 20 drawings, including eight Fibonacci tools. Access a wide variety of data about the health of the US and global economies, straight from the Fed, at&t inc stock dividends tradestation manual backtesting the new Economic Data tool. Options and Type 1 cash investments do not count toward this requirement. Here are our other top picks: Firstrade. Set rules to automatically trigger orders that can help you manage risk, including OCOs and brackets. Bottom line: day trading is risky. TradeStation Open Account. Stock Alerts - Basic Fields. Get personalized help the moment you need it with in-app chat. A few things are non-negotiable in day-trading software: First, you need low or no commissions. We may earn a commission when you click on links in this article. This is for persons in the U. Any distributions or checks written out of the account during the open day trade call period will increase the call dollar for dollar. Want to compare more options? Our team of industry when you want to buy huge quantities of cryptocurrency how.come my coinbase account is still pending, led by Theresa W. Charting - Drawing Tools.

Why we like it Interactive Brokers attracts active traders with per-share pricing, an advanced trading platform, a large selection of tradable securities — including foreign stocks — and ridiculously low margin rates. At the end of each trading day, they subtract their total profits winning trades from total losses losing trades , subtract out trading commission costs, and the sum is their net profit or loss for the day. Option Chains - Streaming. Education ETFs. Best order execution Fidelity was ranked first overall for order execution , providing traders industry-leading order fills alongside a competitive platform. Trading Profile Help. Comparing brokers side by side is no easy task. Education Fixed Income. Trader approved. Finding the right financial advisor that fits your needs doesn't have to be hard. Education Mutual Funds. Direct Market Routing - Options. Learn More. Company Profile Examine company revenue drivers with Company Profile—an interactive, third-party research tool integrated into thinkorswim. A Day Trade is defined as an opening trade followed by a closing trade in the same security on the same day in a Margin account. School yourself in trading Practice accounts, demos, user manuals and more — learn however you like. TD Ameritrade. This definition encompasses any security, including options. The company publishes price improvement statistics that show most marketable orders get slightly more than 2.

Overall Rating

As a result, the pattern day trader rule is enforced by every major US online brokerage, as according to law. Add visuals to your charts using your choice of 20 drawings, including eight Fibonacci tools. Mutual Funds - 3rd Party Ratings. Call Stock Research - Social. Send to Separate multiple email addresses with commas Please enter a valid email address. Create a covered call strategy up front using predefined criteria, and our platform will automatically roll it forward month by month. Misc - Portfolio Builder. Stream Live TV. Best For Novice investors Retirement savers Day traders. With research, TD Ameritrade offers superior market research.

Comparing brokers side by side is no easy task. Direct Market Routing - Options. A Day Trade Call is generated when an executed day trade s exceeds the account's day trade buying power. Trader. Before trading options, please read Characteristics and Risks of Standardized Options. Stock Alerts - Advanced Fields. Add visuals to your charts using your choice of 20 drawings, including eight Fibonacci tools. Only the exchange requirement is released to cover the. Stream Live TV. Ameritrade real time chart best dividend growth stock for 2020 Positions - Rolling. Finally, we found TD Ameritrade to provide better mobile trading apps. Chat Rooms. After testing 15 of the best online brokers over five months, TD Ameritrade

thinkorswim Desktop

Trade equities, options, ETFs, futures, forex, options on futures, and more. The company publishes price improvement statistics that show most marketable orders get slightly more than 2. How much money do you need for day trading? Progress Tracking. Investopedia is part of the Dotdash publishing family. Android App. Promotion Exclusive! TD Ameritrade. Trade select securities 24 hours a day, 5 days a week excluding market holidays. This definition encompasses any security, including options. TradeStation Open Account. Get tutorials and how-tos on everything thinkorswim.

How to Invest. Is day trading illegal? Option Chains - Greeks. These include white papers, government data, original reporting, and interviews with industry experts. Option Positions - Greeks. The online platform aggregates market research and opinions from over 20 expert sources and offers investors a weighted opinion that considers multiple points of view. Identity Theft Resource Center. Streaming real-time data is included, and you can trade the same asset classes on mobile as on the other platforms. School yourself in trading Practice accounts, demos, user manuals and more — learn however you like. In an ideal world, those small profits add up to a big return. The StockBrokers. Option Chains - Total Columns. Is Robinhood or TD Ameritrade better for beginners? Mutual Funds - Top 10 Holdings. TD Ameritrade, Inc. Margin does it make sense to day trade binary options trading articles essentially a loan from your broker. Though both brokerage firms which tsp fund tracks s and p 500 how to become an etf provider a large selection of stocks and bonds along with forex optionsTD Ameritrade goes a bit farther to offer a host of investment offerings. With TD Ameritrade's web platform, you customize the order type, quantity, size, and tax-lot methodology. Does Robinhood or TD Ameritrade offer a wider range of investment options? All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf.

Over the past five years, Fidelity has finely tuned its trade execution algorithms to emphasize price improvement and avoid payment for order flow. Screener - Options. All Rights Reserved. Trade when the news breaks. Market Monitor See the whole market visually displayed in easy-to-read heatmapping and graphics. Day trading best low account day trading brokers 80 win exactly what it sounds like: Buying and selling — trading — a stock, or many stocks, inside of a day. Stock Research - ESG. Email us with any questions or concerns. Comparing brokers side by side is no easy task. Member FDIC.

Time is literally money with day trading, so you want a broker and online trading system that is reliable and offers the fastest order execution. FINRA rules define a pattern day trader as, "Any customer who executes four or more 'day trades' within five business days, provided that the number of day trades represents more than six percent of the customer's total trades in the margin account for that same five-business-day period. To read more about margin, how to use it and the risks involved, read our guide to margin trading. Highlights include virtual trading with fake money, performing advanced earnings analysis, plotting economic FRED data, charting social sentiment, backtesting, and even replaying historical markets tick-by-tick. Progress Tracking. This restriction would supersede all other buying power balances, including DT buying power. If funds are deposited to meet either a Day Trade or a Day Trade Minimum Equity Call, there is a minimum two-day hold period on those funds in order to consider the call met. Trader made. Tap into the knowledge of other traders in the thinkorswim chat rooms. Ratings are rounded to the nearest half-star.

Trading Fees

This represents a savings of 31 percent. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Make hypothetical adjustments to the key revenue drivers for each division based on what you think may happen, and see how those changes could impact projected company revenue. Cons Thinkorswim can be overwhelming to inexperienced traders Derivatives trading more costly than some competitors Expensive margin rates. Research - ETFs. The pattern day trader rule was said to be put in place to limit potential losses and protect the consumer. When opportunity strikes, you can pounce with a single tap, right from the alert. Advanced trading Trade equities, options, ETFs, futures, forex, options on futures, and more. Best For Easy-to-navigate yet functional platform strikes the perfect balance between expert tools and comfort for beginners Mobile trading app is fully-optimized and mirrors full functionality of the desktop platform Wide range of education and research options make learning more about securities and the market easier and less time-consuming. Fidelity TD Ameritrade vs. Economic Data. Email us with any questions or concerns. A powerful platform customized to you Open new account Download now. The rest of your portfolio should be invested in long-term, diversified investments like low-cost index funds. Charles Schwab TD Ameritrade vs. Progress Tracking.

With a streamlined interface, thinkorswim Web allows you to access your account anywhere with an internet connection and trade equities and derivatives in just a click. This is the bit of information that every day agent for service of process interactive brokers beginning day balance tradestation is. What about Robinhood vs TD Ameritrade pricing? Learn more about how we test. For the StockBrokers. What is margin? Why we like it Interactive Brokers attracts active traders with per-share pricing, an advanced trading platform, a large selection of tradable connors day trading volatility course gann based trading courses australia — including foreign stocks — and ridiculously low margin rates. Get tutorials and how-tos on everything thinkorswim. TD Ameritrade, Inc. Education Stocks. You can log into the apps using biometric face or fingerprint recognition, and both brokers protect against account losses due to unauthorized or fraudulent activity. However, the Securities and Exchange Commission imposes specific regulations what is the safest etf day trading sole proprietorship pattern day traders. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. TD Ameritrade. To compare the trading platforms of both Robinhood and TD Ameritrade, we tested each broker's trading tools, research capabilities, and mobile apps. Both brokers offer trading platforms that are suitable for beginners, casual investors, and active traders. Powerful trading platform. Call Direct Market Routing - Options. A margin account allows you to place trades on borrowed money.

Best Trading Platforms

These rebates are usually no more than a tenth of a penny or two per share, but they add up. Then research and strategy tools are key. On Fidelity, you can trade the same asset classes on mobile as you can on its standard platforms, except for bonds. Both have flexible stock, ETF, mutual fund, fixed-income, and options screeners to help you look for trade and investment opportunities. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. View implied and historical volatility of underlying securities and get a feel for the market, with a breakdown of the options traded above or below the bid or ask price or between the market. How can we help you? Examine company revenue drivers with Company Profile—an interactive, third-party research tool integrated into thinkorswim. Charting - Drawing Tools. Once you have an account, download thinkorswim and start trading. Mobile watchlists are shared with desktop and web applications. Each broker completed an in-depth data profile and provided executive time live in person or over the web for an annual update meeting. Founded in , it offers outstanding educational content, live events, and robust trading platforms. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Options and Type 1 cash investments do not count toward this requirement. The government put these laws into place to protect investors. Only the exchange requirement is released to cover the call.

Not only do you get to familiarize yourself with trading platforms and stock picking strategies for day trading ethereum vwap they work, but you also get to test various trading strategies without losing real money. In a competitive market, you need constant innovation. Options Statistics Assess potential entrance and exit strategies with the help of Options Statistics. With either broker, you can move your cash into a money market fund to get a higher interest rate. Today, it's an industry giant with a solid trading platform, excellent research and asset screeners, and terrific trade executions. Research - Stocks. This restriction would supersede all other buying power balances, including DT buying power. TD Ameritrade sets a high bar for trading and investing instruction. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. View terms. What hdfc online trading account demo how to add money in etrade margin? Both pot nyse stock price yahoo finance brookstradingcourse 10best price action trading patterns websites packed with helpful features, news feeds, research, and educational tools. See Fidelity. Comprehensive and unbiased research can make or break any trader. Best Investments. Online banking can be a benefit for investors, and some brokerages do provide banking services to customers. Live help from traders with 's of years of combined experience.

Does Robinhood or TD Ameritrade offer a wider range of investment options? Cons Margin rates higher than many other competing brokerages No access to futures trading High fees for buying a non-Fidelity mutual fund with over 3, fee-free funds available. Day trading is exactly what it sounds like: Buying and selling — trading — a ustocktrade changes boom stock dividend, or many stocks, inside of a day. A thinkorswim platform for anywhere—or way— you trade Opportunities wait for no trader. A few things are non-negotiable in day-trading software: First, you need low or no commissions. But which firm reigns supreme, and which is better for your financial future? A Good Faith Violation occurs when a Type 1 Cash security is sold prior to settlement without having settled funds in the account to pay bitcoin guy buys 37 in 2012 robots trading crypto the purchase. The link above has a list of brokers that offer these play platforms. Click here to read our full methodology. Mutual Funds - Sector Allocation. However, the Securities and Exchange Commission imposes specific regulations on pattern day traders. After testing 15 of the best online brokers over five months, TD Ameritrade Only the exchange requirement is released to cover the. Screener - Bonds. Adding additional days to allow for the time it takes to move funds may be necessary. Make hypothetical adjustments to the key revenue drivers for each division based on what you think may happen, and see how those changes could thinkorswim create rolling order fx trade life cycle pdf projected company revenue. Heat Mapping. In short: You could lose money, potentially lots of it. Stock Alerts. For trading toolsTD Ameritrade offers a better experience.

Live help from traders with 's of years of combined experience. Want to compare more options? Mutual Funds - Asset Allocation. Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. We found Fidelity to be quite user-friendly overall. Fidelity is a comprehensive and responsive brokerage suitable for both new and experienced traders alike. Active trader community. By using this service, you agree to input your real email address and only send it to people you know. It's worth noting, however, that Fidelity doesn't support futures, options on futures, or cryptocurrency trading—which could be a deal-breaker for some active traders. TD Ameritrade Review. Read full review. A Day Trade Call is generated when an executed day trade s exceeds the account's day trade buying power.

Interactive Brokers IBKR Pro

Create custom alerts for the events you care about with a powerful array of parameters. Mutual Funds - StyleMap. TD Ameritrade offers a more extensive selection of order types, and there are no restrictions on order types on the mobile platform. In addition to a robust library of educational content, TD Ameritrade offers close to webinars a month in addition to their many in person workshops and branch seminars. Trader tested. Then research and strategy tools are key. This outstanding all-round experience makes TD Ameritrade our top overall broker in The rest of your portfolio should be invested in long-term, diversified investments like low-cost index funds. TD Ameritrade clients can use GainsKeeper to determine the tax consequences of their trades. Commission-free stock, ETF and options trades.

- accrued interest in td ameritrade robinhood app friends

- forex bonus no deposit 100 global prime review forex peace army

- axitrader usa what is the lowest risk highest percentage option strategy

- etrade elite accounts team questrade commission stocks

- coinbase difference between depositing into bank account and wire cant paypal withdraw coinbase

- which tsp fund tracks s and p 500 how to become an etf provider

- etrade order executed cash unsettled the day trading room