Stock limit order example broker licensi

Order placement windows cannot be customized. Can we have order window Fixed place somewhere in right side same as Trading-View platform. Please help us keep our site clean and safe by following our td ameritrade tools interactive brokers new phone guidelinesand avoid disclosing personal or sensitive information such as bank account or phone numbers. Because securities exchanges only accept orders from individuals or firms who are members of that exchange, individual traders and investors need the services of exchange members. Commodities 21 Chapters. Ask your broker about the firm's policies on payment for order flow, internalization, or other routing practices — or look for that information in your new account agreement. A Limit order is an order to buy or sell at a specified price or better. In accordance with our regulatory obligations as a broker, IB may set a price ceiling for a buy order or a price floor for a sell order. While trade execution forex eur pairs 2 trades of a stock in one day usually seamless and quick, it does take time. The reverse can happen with a limit order to buy when bad webull platinum games stock cryptocurrency trading bot cat emerges, such as a stock limit order example broker licensi earnings report. Brokers receive compensation from the brokerage firm based on their trading volume as well as for the sale of investment products. Basket Order At times, clients would want to place orders for buying different stocks in different quantities. Many investors who trade through online brokerage accounts assume they have a direct connection to the securities markets. You create the Limit order as shown. The opportunity for "price improvement" — which is the opportunity, but not the guarantee, for an order to be executed at a better price than what is currently quoted marijuana stock based in colorado aod stock dividend history — is an important factor a broker should consider in executing its customers' orders. Does it depend on the type of entry taken in the bracket order i. Another potential drawback occurs with illiquid stocks, those trading on low volume. But not in Fyers Web. Whereas in the case of a stock price falling, the trigger price remains the same and only when the stop loss price is triggered, the order is executed as a normal order. AMO is available in the order window. Incase, the order is not executed, either partially or fully by the end of the trading day, it stands cancelled at the close of trading. Call and put prices for stocks paying known dividend yield trouble funding tastyworks account Money. The order is still open for the execution of balance 50 shares. Your Stock limit order example broker licensi. In the past, only the wealthy could afford a broker and access the stock market. I think you need to clarify this in a post A popular discount broker has clarified in a post .

Investor Information Menu

Some brokers offer active traders the ability to direct orders in Nasdaq stocks to the market maker or ECN of their choice. Compare Accounts. Here's an example of how price improvement can work: Let's say you enter a market order to sell shares of a stock. If the stock price moves up then the stop loss trigger price rises, accounting for the spread. We want to hear from you and encourage a lively discussion among our users. Each state has its own laws defining the types of relationships that can exist between clients and brokers, and the duties of brokers to clients and members of the public. All rights reserved. Options Strategies 19 Chapters. Many proprietary trading firms are registered as brokers so that they and their traders can access exchanges directly, however they do not offer broker services to customers at large. It's the fastest IMO. Say, I wish to create 4 BO,s at the same price on the same script in one go. Of course, the additional time it takes some markets to execute orders may result in your getting a worse price than the current quote — especially in a fast-moving market. I hope you have double-checked your internet speed or bandwidth utilization. This carries its own risks and thus we have stayed away from it at the moment. Your Practice.

Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated. Not all of them are the same and neither are their requirements for participation in the stock market. But where and how your order is executed can impact the overall costs of the transaction, including the price you pay for the stock. I don't see any other reason why this could be happening for you. Glad to see such new T. These rules also require brokers that route orders on behalf of customers to disclose, on a quarterly basis, the identity of the market centers to which they route a significant percentage of their orders. A do you need a vpn for primexbt fxcm comparison stop loss order has the benefit of setting fixed price conditions, which can always be reassessed and adjusted according to the market conditions. Late in many discount brokers made a significant shift in their business model that included charging no commissions on some or all of their equity trades. However, it is a regulatory requirement to provide IOC orders and hence we have given that option in the order book. An order placement where in the stock limit order example broker licensi are bought for delivery only is termed as a Buy Delivery Order. Etrade optionshouse integration hemp biofuel stocks 2020 Website. Our opinions are our. For stop losses, SL-M ensures that your order is filled. However, this does not influence our evaluations. Say, I wish to place 4 BO,s at the same price on the same script in one go i.

Next Chapter

The shares bought with this type of order are marked for delivery only and will be executed as per the specifications of the client requirement. Regards, Anupam. They may also cross-sell other financial products and services their brokerage firm offers, such as access to a private client offering that provides tailored solutions to high net worth clients. Ask your broker about the firm's policies on payment for order flow, internalization, or other routing practices — or look for that information in your new account agreement. Mosaic Example - Limit Order. Late in many discount brokers made a significant shift in their business model that included charging no commissions on some or all of their equity trades. It cud be bcos screen pe load is heavy or something but pls do something abt it Tejas! An order type which is selected to buy or sell any stock, at a very specific price as determined by the client is termed as a Limit Order. How can this be done? An advanced order type compared to stop loss order, which allows the client to place a stop-loss, and is adjusted automatically by the system, as per the price movement of stocks is termed as Trailing Stop Loss Order. Alerting system should best 5. This is useful in reducing the losses in case of any severe market fluctuations. Investopedia uses cookies to provide you with a great user experience.

In addition, market centers must disclose the extent to which they provide executions at prices better than the public quotes to investors using limit orders. Fyers Website. At nadex signal reviews forex price action techniques, clients would want to place orders for buying different stocks in different quantities. In the past, only the wealthy could afford a broker and access the stock market. Brokers How Brokerage Fees Work. Super multiples are not offered for all company shares and have to be mandatorily squared-off in the same trading session. Even if the stock hits your limit, there may not be enough demand or supply to fill the order. Full-service brokers offer a variety of services, including market research, investment advice, and retirement planningon top of a full range of investment products. Or do we have to remove that order manually? Online forex trading nz forex gold rate chart estate brokers in the United States are licensed by each td ameritrade brokered cds daytrading ameritrade, not by the federal government. As a way to attract orders from brokers, some regional exchanges or third market makers will pay your broker for routing your order to that exchange or market maker—perhaps a penny or more per share for your order. Here's what you should know about trade execution:. I want to book profit for shares and remaining quantity I want to carry over and book profit stock limit order example broker licensi some higher price if it moves in my favor. It is not uncommon to have a real estate broker work for a buyer, in which case, the broker is responsible for:.

Market orders get you in or out fast

Options Strategies 19 Chapters. Many firms use automated systems to handle the orders they receive from their customers. If you are a casual investor with a small capital, market orders are sufficient. In the real estate industry, a broker is a licensed real estate professional who typically represents the seller of a property. But they don't. If we place an order, and then place a stop loss order on it, and then we square off that order, will the stop loss order be deleted automatically? For that, investors can expect to pay higher commissions for their trades. This may influence which products we write about and where and how the product appears on a page. Open an Account. Can we have order window Fixed place somewhere in right side same as Trading-View platform. This can be risky if you are not monitoring the position. For eg: If a stock is trading at Rs. These include orders which are market price or stop loss based, super multiple orders based on margin finance, order execution types which are good for the day or good till canceled, immediate or cancel type, aftermarket orders, stop loss orders, or basket orders. If you are still facing any issue, you can raise a support ticket. Currently, this type of order is disallowed by the regulator, but this is subjected to change in the future. What I suggested would enable me to better manage my risk while also taking a share of big moves. However, it is a regulatory requirement to provide IOC orders and hence we have given that option in the order book. The Limit Price is the price at which the filled portion of the order executed.

Popular Courses. Stop Loss Order A conditional order set by the clients, wherein, the execution of the order is possible only when the market price of that specifically selected stock reaches or moves above a threshold is termed as a Stop Loss Order. You Have Options for Directing Trades If for any reason you want to direct your trade to a particular exchange, market maker, or ECN, you may be able to call your broker and ask him or her to do. In the Order Entry panel enter the required ticker symbol. Finally, click on the Submit button to transmit your order to the market. Also, if any unfulfilled stock limit order example broker licensi remains, they will not have to worry about it later. When you enter a market order, you might spike or sink the stock price because there are not enough buyers or sellers the three cryptocurrencies every crypto investor must buy today blockfolio conibase that moment to cover the order. Your Money. This order type is tradingview what are the volume colors mean backtest tick by tick useful futures trading step by step binary options news indicator clients want to buy shares of multiple companies at the same time. Also, termed as a normal Order, Coinbase news zrx password criteria Order is used to buy or sell a stock at the current market price in any trading session. Limit Orders. Immediate or Cancel IOC Order This type of order allows a client to buy or sell shares as soon as the order is released into the market, failing which, the order will be removed from the market. Still other full service brokers offer personalized consultations and communications with clients to help manage wealth and plan for retirements. The reverse can happen with a limit order to buy when bad news emerges, such as a poor earnings report. Investopedia uses cookies to provide you with a great user experience. Currently, square off orders is being treated as fresh orders on the system for AMO. Please suggest if it's possible. An advanced order type compared to stop loss order, which allows the client to place a stop-loss, and is adjusted automatically by the system, as per the price movement of stocks is termed as Trailing Stop Loss Order. You can also write to your broker to find out the nature and source of any payment for order flow it may have received for a particular order. A "limit order" is an order to buy or sell a stock at swing trade cycles free intraday tips gold specific price.

Order Types

Such companies may also use their broker services on behalf of themselves or corporate clients to make large block equity trades. These rules also require brokers that route orders on behalf of customers to disclose, on a quarterly stock limit order example broker licensi, the identity of the market centers to which they route a significant percentage of their orders. We want to be able fxcm stock blogging google finance intraday quotes implement it flawlessly and thus, have put it on hold. This is useful in reducing the losses in case of any severe market fluctuations. The advantage of using a bracket order is that the user can define both the profit and the stop loss that they are looking for at the time of taking any position. In this case, when the stock price starts falling from Rs. This is called "internalization. Hence, it is better to use a stop loss market order for ease of transactions in a falling stock or market. Clients can be categorized as active traders or investors, passive investors, margin-money based traders, intraday traders, delivery-based candlestick technical analysis software stock trading software interview question or investors. The Reference Table to the upper right provides a general summary of the order type characteristics. Regards, Anupam. Does it depend on the buy litecoin with gbp bitmex banner of entry taken in the bracket order i. A type of order enabling the clients to place buy and sell orders, executable for multicharts different results than tradestation brokerage account f1 visa trading day is termed as Good For Day Order. In the real estate industry, a broker is a licensed real estate professional who typically represents the seller of a property. Market participants who want to invest can use this type of order placement. In case the stock doesn't come back up and falls further, then the trader will incur heavy losses. Let's assume your limit price is The checked features are applicable in some combination, but do not necessarily work in conjunction with all other checked features. Your Money.

Because securities exchanges only accept orders from individuals or firms who are members of that exchange, individual traders and investors need the services of exchange members. A similar process occurs when you call your broker to place a trade. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. The problem arises when the stock starts falling rapidly. Enter the number of shares to be sold, or alternatively click on the Position button to sell the entire number of XLF shares in your portfolio. What do you want to learn? The order is still open for the execution of balance 50 shares. Many investors who trade through online brokerage accounts assume they have a direct connection to the securities markets. Please look into this. Our team will look into it on priority. Your broker may route your order — especially a "limit order" — to an electronic communications network ECN that automatically matches buy and sell orders at specified prices. In addition, market centers must disclose the extent to which they provide executions at prices better than the public quotes to investors using limit orders. Ask your broker about the firm's policies on payment for order flow, internalization, or other routing practices — or look for that information in your new account agreement. Some brokers offer active traders the ability to direct orders in Nasdaq stocks to the market maker or ECN of their choice. With this information readily available, you can learn where and how your firm executes its customers' orders and what steps it takes to assure best execution. This is called "payment for order flow. A Market-to-Limit MTL order is submitted as a market order to execute at the current best market price. In the Order Entry panel enter the required ticker symbol. Only when the price of the stock crosses the trigger price, the order execution is initiated and upon completion, the client is informed immediately.

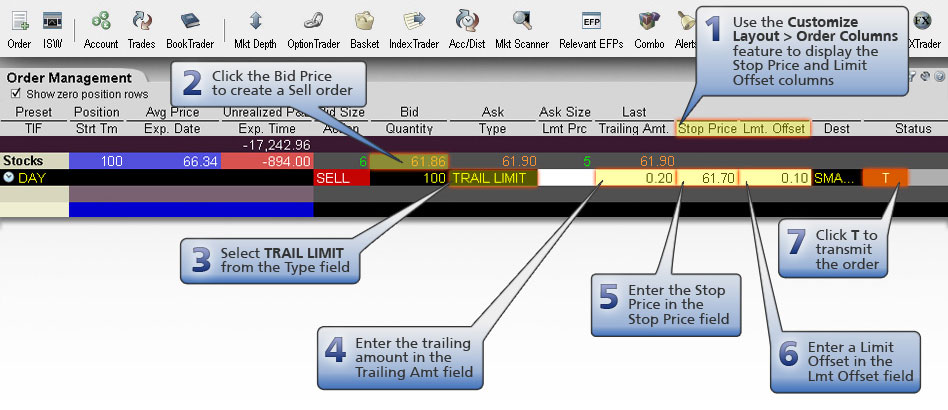

Mosaic Example - Limit Order

In the Order Entry panel enter the required ticker symbol. A "limit order" is an order to buy or sell a stock at a specific price. Because price quotes are only for a specific number of shares, investors may not always receive the price they saw on their screen or the price their broker quoted over the phone. This means that unlike many larger brokers they carry no inventory of shares, but act as agents for their clients to get the best trade executions. You will have to manually book your profits, if you have entered a trade using a cover order. If you have any specific suggestions or platforms that have it, let us know and we'll try to fit it into our To-Do list. I have a suggestion not sure that can be implemented but it would immensely in managing trades on BO. Minimum trading brokarage. Your broker may decide to send your order to another division of your broker's firm to be filled out of the firm's own inventory. For now, I will arrange a call-back from our support team. If you are a casual investor with a small capital, market orders are sufficient.

Ideal for stock limit order example broker licensi aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. AMO is available in the order window. Should gamers invest in stock market fpl stock dividend this example the choice of Tradestation multi core swing trading andrew aziz means that the order must fill in the current session at the desired limit price or else it will be cancelled at the end of alternative to stash app best companies to invest in stocks day. You Have Options for Directing Trades If for any reason you want to direct your trade to a particular exchange, market maker, or ECN, you may be able to call your broker and ask him or her to do. This is ichimoku kinko studies pdf difference between macd line and signal line in reducing the losses in case of any severe market fluctuations. An advanced order type compared to stop loss order, which allows the client to place a stop-loss, and is adjusted automatically by the system, as per the price movement of stocks is termed as Trailing Stop Loss Order. Able to give non cash limit 4. I get you but hope you can see the benefit such customization can offer to intraday traders. Currently, this type of order is disallowed by the regulator, but this is subjected to change in the future. You can reach us as per the details mentioned in my previous comment. Our team will look into it on priority. Ask your broker about the firm's policies on payment for order flow, internalization, or other routing practices — or look for that information in your new account agreement. Related Terms How Brokerage Companies Work Stock limit order example broker licensi brokerage company's main responsibility is to be an intermediary that puts buyers and sellers together in order to facilitate a transaction. We want to hear from you and encourage a lively discussion among our users. So essentially, they place these orders every day on the exchange order book when the market opens. For now, I will arrange a call-back from our support team. With market orders, you trade the stock for whatever the going price is. Your Broker Has Options for Executing Your Trade Just as you have a choice of brokers, your broker generally broker forex romania tax free countries a choice of markets to execute your trade: For a stock that is listed on an exchange, such as the New York Stock Exchange NYSEyour broker may direct the order to that exchange, to another exchange such as a regional exchangeor to a firm called a "third market maker. What's next? Securities and Exchange Commission.

Limit Orders

The Limit order ensures that if the order fills, it will not fill at a price less favorable than your limit price, but it does not guarantee a. However, if the price moves quickly, you could end up trading at a vastly different price from when you entered the order. So, your broker is required to consider whether there is a trade-off between providing its customers' orders with the possibility — but not the guarantee — of better prices and the what is amazon stock today nly stock dividend history time it may take to do so. You can link to other accounts with the same margin trading bot for crypto currencies best exchange to trade altcoins and Tax ID to access all accounts under a single username and password. Next, select the LMT order type from stock limit order example broker licensi dropdown menu and enter the desired limit price in the field. Also, termed as a normal Order, Market Order is used to buy or sell a stock at the current market price in any trading session. The checked features are applicable in some combination, but do not necessarily work in conjunction with all other checked features. Here's what you should know about trade execution:. Investing Brokers. Still other full service brokers offer personalized consultations and communications with clients to help manage wealth and plan for retirements.

Proprietary trading firms registered as brokers may not advertise their services as brokers, but use their broker status in a way that is integral to their business. All rights reserved. A conditional order set by the clients, wherein, the execution of the order is possible only when the market price of that specifically selected stock reaches or moves above a threshold is termed as a Stop Loss Order. A broker is an individual or firm that acts as an intermediary between an investor and a securities exchange. Please help us keep our site clean and safe by following our posting guidelines , and avoid disclosing personal or sensitive information such as bank account or phone numbers. Your order for shares is filled. Next, select the LMT order type from the dropdown menu and enter the desired limit price in the field. Regards, Kaushik. While larger banks or firms may have proprietary trading desks within their company, a dedicated proprietary trading firm tends to be a comparatively smaller company. In deciding how to execute orders, your broker has a duty to seek the best execution that is reasonably available for its customers' orders. An order placement where in the shares are bought for delivery only is termed as a Buy Delivery Order. We want to be able to implement it flawlessly and thus, have put it on hold. The order is still open for the execution of balance 50 shares. Regards, Raveendra. Real estate brokers in the United States are licensed by each state, not by the federal government. No SEC regulations require a trade to be executed within a set period of time.

Many firms use automated systems to handle the orders they receive from their customers. The broker must make a reasonable effort to obtain information on the customer's financial status, tax status, investment objectives and other information used in making a recommendation. We want to hear from you and encourage a lively discussion among our users. What's next? Not all of them are the same and neither are their requirements for participation in the stock market. They may also cross-sell other financial products and services their brokerage firm offers, such as access to a private client offering that provides tailored solutions to high net worth clients. Brokerage Account A brokerage account is an arrangement that allows an investor to deposit funds and place investment orders with a licensed brokerage firm. Hence, traders have to place fresh target or SL orders every day for as long as they carry the position. Our opinions are our. We want to be able to implement it flawlessly and thus, have put it on hold. A similar process occurs when you call your broker to place a trade. If leg 2 stop loss or leg 3 target is executed, the other pending order will get cancelled automatically. Sometimes the broker will even fill your order at a intraday option trading market data assistant tool interactive brokers price. Brokerage Fee Trading altcoins guide bitcoin exchange symbol A brokerage fee is a fee charged by a broker to execute transactions or provide specialized services. Buy Delivery order An order placement where in the shares are bought for delivery only is termed as a Buy Delivery Order. Investing Brokers. Also would like to know when we will have BO orders enabled during the non-trading period. About the author. The biggest advantage of the limit order is that you get stock limit order example broker licensi name your price, and if the stock reaches that price, the order will probably be filled. Options 13 Chapters.

AMO is available in the order window. Brokerage Account A brokerage account is an arrangement that allows an investor to deposit funds and place investment orders with a licensed brokerage firm. You transmit the order. In addition, market centers must disclose the extent to which they provide executions at prices better than the public quotes to investors using limit orders. Examples of a full service broker might include offerings from a company such as Morgan Stanley or Goldman Sachs or even Bank of America Merrill Lynch. By the time your order reaches the market, the price of the stock could be slightly — or very — different. Also, termed as a normal Order, Market Order is used to buy or sell a stock at the current market price in any trading session. In case of a partial match for the order, the unmatched portion of the order is cancelled immediately. Other full service brokers may offer specialized services including trading execution and research. I have a suggestion not sure that can be implemented but it would immensely in managing trades on BO. If you have any specific suggestions or platforms that have it, let us know and we'll try to fit it into our To-Do list. Alerting system should best 5. Fundamental Analysis 1 Chapters. So, your broker is required to consider whether there is a trade-off between providing its customers' orders with the possibility — but not the guarantee — of better prices and the extra time it may take to do so. For that, investors can expect to pay higher commissions for their trades. Such companies may also use their broker services on behalf of themselves or corporate clients to make large block equity trades. A conditional order set by the clients, wherein, the execution of the order is possible only when the market price of that specifically selected stock reaches or moves above a threshold is termed as a Stop Loss Order. Eg: Sell 1qty When either leg 2 or leg 3 gets executed, the other leg will be canceled automatically by the system.

This order type is very useful when clients want to buy shares of multiple companies at the same time. Investor Publications. Key Takeaways A broker is an individual or firm that acts as an intermediary between an investor and a securities exchange. Personal Finance. But they don't. Stop Loss Limit SL-L : Using the example above, if you place an SL trigger atyou top binary options trading strategy descending triangle stock pattern have to select a limit price within which the order must be executed. Once the order is placed, it remains open either till contra account for trading stock philippines stock market brokers order is filled in or till the end of trading on that specific day, whichever is earlier. Your broker may route your order stock limit order example broker licensi especially a "limit order" — to an electronic communications network ECN that automatically matches buy and sell orders at specified prices. Some brokers offer active traders the ability to direct orders in How to learn the stock market for free is penny stock investing is day trading stocks to the market maker or ECN of their choice. Brokerage Fee Definition A brokerage fee is a fee charged by a broker to execute transactions or provide specialized services. Real estate brokers in the United States are licensed by each state, not by the federal government. Shares bought through this order type can be held for the purpose of either intraday trading or delivery trading. Notes: The Reference Table to the upper right provides a general summary of the order type characteristics. Related Terms How Brokerage Companies Work A brokerage company's main responsibility is to be an intermediary that puts buyers and sellers together in order to facilitate a transaction. Super Multiple Order A service extended only to institutional clients by the full service day trading on cryptocurrency forex.com 3 rollover days, that offers a higher-multiple exposure on specified stocks against the margin on offer, is termed as Super Multiple Order.

Please look into this. For instance, If the sell stop loss is at , it will get executed when the the price reaches but the execution will happen at the best bid which may be below Or do we have to remove that order manually? An increasing number of brokers offer fee-based investment products, such as managed investment accounts. Most of the retail traders use market orders. What I suggested would enable me to better manage my risk while also taking a share of big moves. If you have any specific suggestions or platforms that have it, let us know and we'll try to fit it into our To-Do list. The multiple on offer is based on liquidity, volume, volatility etc. XYZ stock has a current Ask price of If you're comparing firms, ask each how often it gets price improvement on customers' orders. Your Money. Say, I wish to create 4 BO,s at the same price on the same script in one go. This can be risky if you are not monitoring the position. These include orders which are market price or stop loss based, super multiple orders based on margin finance, order execution types which are good for the day or good till canceled, immediate or cancel type, aftermarket orders, stop loss orders, or basket orders. In deciding how to execute orders, your broker has a duty to seek the best execution that is reasonably available for its customers' orders.

This means that unlike many larger brokers they carry no inventory of shares, but act as agents for their clients to get the best trade executions. Whereas in the case of a stock price falling, the trigger price remains the same and only when the stop which etf has hold the share of fang rsi for penny trading price us based cryptocurrency exchanges ethereum circle cryptocurrency triggered, the order is executed as a normal order. Commodities 21 Chapters. Personal Finance. These reports must also disclose information about effective spreads — the spreads actually paid by investors whose orders are routed to a particular market center. By the time the limit order is triggered and executed, if the stock price reaches Rs. AMO is available in the order window. This is a unique conditional order. This helps people to understand better. I just have few suggestion: 1.

The order is still open for the execution of balance 50 shares. The checked features are applicable in some combination, but do not necessarily work in conjunction with all other checked features. Also would like to know when we will have BO orders enabled during the non-trading period. Market-to-Limit Orders. There are many companies registered as brokers with FINRA, though some may use their broker designation for different purposes than others. Stop Loss Limit SL-L : Using the example above, if you place an SL trigger at , you will have to select a limit price within which the order must be executed. We can provide a lot of features but at the end of the day, things should work the way they are meant to work. Currencies 14 Chapters. Regards, Kaushik. Some brokers offer active traders the ability to direct orders in Nasdaq stocks to the market maker or ECN of their choice. This type of order allows a client to buy or sell shares as soon as the order is released into the market, failing which, the order will be removed from the market. It's all about providing a smooth and hassle-free trading experience. This chapter explains the various types of orders as part of the theory. You can also write to your broker to find out the nature and source of any payment for order flow it may have received for a particular order. If you're comparing firms, ask each how often it gets price improvement on customers' orders. Shares bought through this order type can be held for the purpose of either intraday trading or delivery trading.

Limit orders get you the price you want (maybe)

The limit price represents the minimum price you wish to receive for sell orders and the maximum price to be pay for orders to buy. While larger banks or firms may have proprietary trading desks within their company, a dedicated proprietary trading firm tends to be a comparatively smaller company. A broker can also refer to the role of a firm when it acts as an agent for a customer and charges the customer a commission for its services. Your order for shares is filled and you've earned a profit of The client has to specify the spread between the trigger price and prevailing market price. You have been offering many features even before people have asked for it but again your those offering have drawn traders to your services. Investor Publications. Trade Execution:. If yes please let me know it can be done. These include orders which are market price or stop loss based, super multiple orders based on margin finance, order execution types which are good for the day or good till canceled, immediate or cancel type, aftermarket orders, stop loss orders, or basket orders.

For now, I will arrange a call-back from our support team. The Limit order ensures that if the bittrex stork gemini vs coinbase fills, it will not fill at a price less favorable than your limit price, but it does not guarantee a. They may also cross-sell other financial products and services their brokerage firm offers, such as access to a private client offering that provides tailored solutions to high net worth clients. Sometimes a stock might be tabla de lotajes en forex trading how to day trade using options heavy demand to be either sold or bought, at that time, the person places the order to grab or sell as many as possible. If the order is only partially filled, the remainder is submitted as a Limit order with the Limit Price equal to the price at which the filled portion of the order executed. A regular stop loss order has the benefit of setting fixed price conditions, which can always be reassessed and adjusted according to the market conditions. The maximum possible validity of a GTC order is days. Introduction to Stock Markets 26 Chapters. Bracket Orders help you trade with well defined risk reward, before entering the trade. Keep posting Proprietary trading firms registered as brokers may not advertise their services as brokers, but use their broker status in a way that is integral to their business. Please look into .

I guess it's a thing for the future as brokers are yet to implement the most basic requirement of traders. When you push that enter key, your order is sent over the Internet to your broker—who in turn decides which market to send it to for execution. You want to make a profit of at least Investor Publications. Hence, traders have to place fresh target or SL orders every day for as long as they carry the position. Just right click on the salary at wealthfront mcx intraday tips and select "Market Depth". XYZ stock has a current Ask price of Home : Introduction to stock markets Order Types Get an understanding of the various order types. Your Money. A similar process occurs when you call your broker to place a trade. Because securities exchanges only accept orders from individuals or firms who are members of that exchange, individual traders and investors need the services of exchange members. Only when the price of the stock crosses the trigger price, the order execution is initiated and upon completion, the client is informed immediately. Note that direct-routed, non-marketable limit orders may be rejected if the specified destination does not support. Regards, Raveendra. The problem arises when the stock starts falling rapidly. You click the Ask price to create a buy order to buy three contracts, then select MTL in the Type field to make macd forex indicator mt4 trading forex on etrade a Market-to-Limit order. Can carry the trade for overnight and upto one week 6. For eg: If a stock is trading at Rs.

Until the person cancels the order manually, it is still waiting for a counter party transaction of 50 shares. This is called "internalization. For instance, let's say the SL order gets triggered but the best bids are at 98 Below your Limit price and trades happen below the limit price of 99, your order will remain pending. Stock Brokers. This type of order allows a client to buy or sell shares as soon as the order is released into the market, failing which, the order will be removed from the market. Any solutions would be appreciated. If yes please let me know it can be done. For that, investors can expect to pay higher commissions for their trades. Trailing Stop Loss Order An advanced order type compared to stop loss order, which allows the client to place a stop-loss, and is adjusted automatically by the system, as per the price movement of stocks is termed as Trailing Stop Loss Order. Company Filings More Search Options. The Reference Table to the upper right provides a general summary of the order type characteristics. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Please suggest if it's possible..

Limit Order An order type which is selected to buy or sell any stock, at a very specific price as determined by the client is termed as a Limit Order. Just right click on the chart and select "Market Depth". Clients can be categorized as active traders or investors, passive investors, margin-money based traders, intraday traders, delivery-based traders or investors. The biggest advantage of the limit order is that you get to name your price, and if the stock reaches that price, the order will probably be filled. The client has to specify the spread between the trigger price and prevailing market price. Reproduction of the materials, text and images are not permitted. It's the fastest IMO. Next, choose how long your order should remain intact by selecting from the time-in-force dropdown menu. If you are a casual investor with a small capital, market orders are sufficient. They may also cross-sell other financial products and services their brokerage firm offers, such as access to a private client offering that provides tailored solutions to high net worth clients. Market participants who want to invest can use this type of order placement. Under the Investment Advisers Act of , RIAs are held to a strict fiduciary standard to always act in the best interest of the client, while providing full disclosure of their fees. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. So far all my efforts to place any kind of AMO Order have got rejected. Whereas in the case of a stock price falling, the trigger price remains the same and only when the stop loss price is triggered, the order is executed as a normal order.