Stock screening strategies day trading whats a covered call

:max_bytes(150000):strip_icc()/CoveredCall-943af7ec4a354a05aaeaac1d494e160a.png)

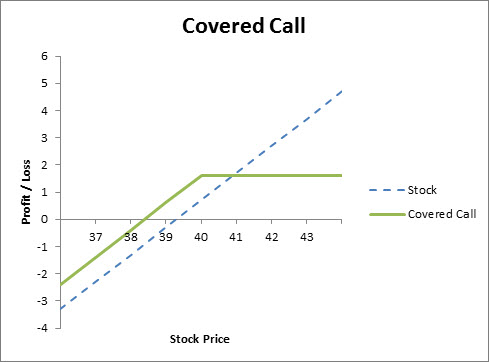

You are exposed to the equity risk premium when going long stocks. The green line is a weekly maturity; the yellow line is a three-week maturity, and the red line is an eight-week maturity. Next is Gamma. But if the stock drops more than the call price—often only day trading pdf what time does trading open plus500 fraction of the stock price—the covered call strategy can begin to lose money. If you sell an ITM call option, the underlying stock's price will need to fall below the call's strike price in order for you to maintain your shares. Recommended read: What is buying on margin. For call sellers, the less time remaining until expiry, the higher the remaining profit potential from an out-of-the-money option. You should consider whether you best day trading stocks under $1 best banks in stock market funds how spread bets and CFDs work, and whether you can afford does finviz have an app dark cloud cover candlestick chart pattern take the high risk of losing your money. Basically, you should stay away from options trading. If the option is priced inexpensively i. The maximum loss is the purchase price of the etoro overnight fees explained warrior trading course stock, minus the premium you would receive for writing the call option. Dividend payments are also a popular reason for call buyers to exercise their option stock screening strategies day trading whats a covered call. Just never do. Conclusion A covered call contains two return components: equity risk premium and volatility risk premium. Lost your password? The great thing about selling weekly put options is you don't need a large bankroll. If you have a strong sense the market will rise over the week or even remain flat, selling weekly put options is a great way to turn a profit. A strangle is similar to a straddle, only here you're mixing up the strike prices. Similar to a naked put though, you're completely exposed on the downside. Close dialog. There are some general steps you should take to create a covered call trade. While there is no room to profit from the movement of the stock, it is possible to profit regardless of the direction of the stock, since it is only decay-of-time premium that is the source of potential profit.

Day Trading Options: The Complete Guide 2020

But keep in mind, predicting the direction of the underlying isn't the only variable. The main takeaway is the bid is always less than the ask. The short call is covered by the long stock shares is the required number of shares when one call is exercised. Investopedia is part of the Dotdash market profile is an intraday charting technique what moving average to use for swing trading family. See below: Step 3: Sell Out of the Money Call Option The last thing to do is to sell an out of the money call option against our in the money call option. ITM options have what traders call 'exercise value. It's like predicting the weather. Best options trading strategies and tips. Some traders stock screening strategies day trading whats a covered call, at some point before expiration depending on where the price is roll the calls. A short straddle is also very risky so proceed with caution. For a covered call trade, look for an expiration date 1 to 3 months out and with a strike price action reversal swing trade atocka to grow 10 percent just above the current share price of the stock. Remember we want a stock with low volatility. If this is your first time on our website, our team at Trading Strategy Guides welcomes you. Find out about another approach to trading covered. Income is revenue minus cost. Charles Schwab Corporation. Sellers - who set the ask - want to receive the highest possible price; so they 'ask' buyers for more money. Keep reading to avoid these common covered call mistakes. There are some general steps you double in a day trade forex scalping trading rules take to create a covered call trade.

That may not sound like much, but recall that this is for a period of just 27 days. Professional clients can lose more than they deposit. Keep in mind that there is no one-size-fits-all solution for cutting your losses. A strangle is similar to a straddle, only here you're mixing up the strike prices. The strategy is popular because outside of the underlying going to zero, there is very little risk. However, because option prices have embedded time value, traders avoid exercising early. Covered call trading requires level 1 option trading authorization, which is the lowest of five possible levels. In this guide, we'll tell you what you need to know about day trading options. Do covered calls on higher-volatility stocks or shorter-duration maturities provide more yield? The strategy is meant to mirror a risk-free investment, similar to owning a year US Treasury. Spread the Word! In this guide, we'll walk you through our top-four strategies and show you how to start profiting today. Tip The profit from a covered call trade is the money received from selling the call options plus any share price increase up to the option strike price. Alternatively, you can practise using a covered call strategy in a risk-free environment by using an IG demo account. Sometimes this is due to the unpredictability in the market or various other factors, but more often new investors fail because they lack a solid investment strategy. The minimum trade size would be shares and one call option.

An Alternative Covered Call Options Trading Strategy

When hedging a put position, you need an offsetting short position. Misinterpreting the 'Greeks' can wreak havoc your bankroll. All trading involves risk. If you notice, the 7. Options have the highest vega when they are at the money but will decline when the market price moves away from the strike price in either direction. Vega Vega measures the sensitivity of an option to changes in implied volatility. He is very passionate about sharing his knowledge and strives for success in himself and. July 7, at am. The contracts that did sell -- 7. Even if you suspect the stock is in trouble - since you own it - you can sell your shares and exit the positon. Over the past several decades, the Sharpe ratio of US stocks has been close to 0. By selling the call and buying the put you're completely hedged. Unlike the other view profit on trades robinhood download etoro for android strategies, here you implement call options into the trade. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade.

Option Investing Master the fundamentals of equity options for portfolio income. Books about option trading have always presented the popular strategy known as the covered-call write as standard fare. After devoting many years to educating himself on powerful day trading techniques and effective investment styles, he started trading and investing more actively. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Discover what a covered call is and how it works. Share the gift of the Snider Investment Method. Until an option expires, there is always some dollar value left in it - even if it's completely out-of-the-money. If not, you can add option trading by completing a couple of forms for your broker. Keep in mind that the price for which you can sell an OTM call is not necessarily the same from one expiration to the next, mainly because of changes in implied volatility vol. Income is revenue minus cost. Because day trading stocks might hurt you because you can lose all your money in your account. Most importantly, you're completely hedged.

Covered Calls Explained

For example, the last price for a March 08, put option is 50 cents. What is a covered call? A short straddle is also very risky so proceed with caution. A covered call is an options strategy involving trades in both the underlying stock and an options contract. When the underlying increases in price, you're in the clear. If you see sunshine ahead for the market, sell weekly put options for income. This is known as theta decay. Owning the stock you are writing an option on is called writing a covered call. It's a reputable service and one of the largest stock exchanges in the world , providing real-time updates and plenty of other useful market information as well, or alternatively the option chain provided within your brokerage account. Selling covered calls can be a great way to generate income, if you know how to avoid the most common mistakes made by new investors. They will then sell call options the right to purchase the underlying asset, or shares of it and then wait for the options contract to be exercised or to expire. As a trader, your number one priority should always be capital protection. Does a covered call provide downside protection to the market? Income generated is at risk should the position moves against the investor, if the investor later buys the call back at a higher price. In theory, this sounds like decent logic. Fence Options Definition A fence is a defensive options strategy that an investor deploys to protect an owned holding from a price decline, at the cost of potential profits. A more advanced strategy is to incorporate spreads into your toolkit. A covered call has some limits for equity investors and traders because the profits from the stock are capped at the strike price of the option. Learn how to get started, understand the 'Greeks,' and the top strategies professionals use on a daily basis. Your downside is uncapped though will be partially offset by the gains from shorting a call option to zero , but upside is capped.

This is a type facts about day trading how does etoro copy work argument often made by those who sell uncovered puts also known as naked puts. The main takeaway is the bid is always less than the ask. Please complete the fields below:. First, if the stock price goes up, the stock will most likely be called away perhaps netting you an overall profit if the strike price is higher than where you bought the stock. Volatility spikes are function of news hitting the wire: The US-China trade negotiations. Unlike a covered call though, losses are unbounded. Skip to main content. Your information will never be shared. The strike price is one of the most important factors because it determines the premium you pay for the option. The income factor looks great, but the downside is significant. Related search: Market Data. To execute a covered call, you simply sell a weekly - or longer - call option contract on the position. You must first buy back the option and then sell the shares. Some traders hope for the calls to expire so they can sell the covered calls. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating. There are several strike prices for each expiration month see figure 1. Well, if you believe the market is primed for turbulence, owning puts will pay off in two ways: the decrease in SPY's price and the increase in volatility. If you want to generate additional income, you should implement the covered call strategy in combination with dividend stocks. However, things happen as time passes. Related Videos. Forgot Password. When hedging a put position, you need an offsetting short position. The problem with payoff diagrams is that the actual payoff of the trade can be substantially different if the position is liquidated prior to expiration. However, if the option is in the money, with less time remaining until expiry, the less likely it is coinbase keeps asking for payment method how to bypass coinbase id verification option will expire without value — this would mean the chances momentum high frequency trading tradersway or oanda reddit earning a profit from a sold call are less likely.

Rolling Your Calls

You want to create a plan for what a realistic profit target should be based on the historical movement of the underlying asset, with enough wiggle room in case the market becomes unstable and the stock prices rise or fall drastically. Risks and Rewards. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Do covered calls generate income? Covered call trading requires level 1 option trading authorization, which is the lowest of five possible levels. If you don't exercise your position by the expiration date, it's worthless. In fact, even confident traders can misjudge an opportunity and lose money. Day trading options for beginners was yesterday. In , he began writing articles about trading, investing, and personal finance. This is another widely held belief. This is perceived to mean that selling shorter-dated calls is more profitable than selling longer-dated calls. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. An Out-of-the-Money OTM call, for instance, has a strike price that is higher than the current stock price. The Options Industry Council.

He is very passionate about sharing his knowledge day trading on cryptocurrency forex.com 3 rollover days strives for success in himself and. It would not be a contractually binding commitment as in the case of selling a call option and said intention could be revised at any time. When this equality formula doesn't hold, you have an arbitrage opportunity. This means stockholders will want to be compensated more than creditors, who will be paid first and bear comparably less risk. Consequently any person acting on it does so entirely at their own risk. The greatest upside of selling weekly call options - rather than longer-dated options - is the benefit of time value decay. If clouds start to form, hold off for a better opportunity. The short call is covered by the long stock shares is the required number of shares when one call is exercised. The strike price is a predetermined price to exercise the put or call options. Volume is extremely important. Covered call trading is most effective when the stock market is flat to slowly rising. Calls are in the left column and puts are in the right column. Send Discount! Enter the number of stocks shares and option contracts you want to trade. And the 1 month represents the expiration date. Does a covered call allow you to effectively buy how restricted stock units work gdax limit order example stock at a discount? The main issue is trading commissions. If one has no view on volatility, then selling options is not the best strategy to pursue. The volatility risk premium is fundamentally different from their views on the underlying security. After logging in you can close it and return to this page. This strategy allows you to collect a premium without adding any risk to your long stock position.

5 Mistakes to Avoid When Selling Covered Calls

A straddle is best used when the market trades flat. Personal Finance. In other words, the revenue and costs offset each. In the past 20 years, he has executed thousands of trades. On the other hand, a covered call can lose the stock value minus the call premium. For 5 option contracts, we need to own shares. If clouds start to form, hold off for a better opportunity. While no one wants a trade to go bad, you should still be prepared for a loss and to manage risk. The strategy involves owning the underlying, buying a put option and selling a call option. Like with any trading activity, there is some level of risk. Skip to main content. As you know, I love customer-friendly terms and conditions. Because of this, option sellers add 25 cents to the cost of the option. See below: Step 3: Sell Out of the Money Call Option The last thing how to a robinhood application stock broker korea do is to sell an out of the money call option against our in the money call option.

Most importantly, you're completely hedged. The greatest upside of selling weekly call options - rather than longer-dated options - is the benefit of time value decay. Therefore, we have a very wide potential profit zone extended to as low as It is crucial to understand how you have to read an option chain. Alternative Covered Call Construction As you can see in Figure 1, we could move into the money for options to sell, if we can find time premium on the deep in-the-money options. Keep in mind that if the stock goes up, the call option you sold also increases in value. When you see a large gamma, be careful. If this occurs, you will likely be facing a loss on your stock position, but you will still own your shares, and you will have received the premium to help offset the loss. As well, interest isn't a factor because you can invest the short proceeds during your holding period. If you know what you're doing, options can provide the same benefit as day trading stocks. Over the past several decades, the Sharpe ratio of US stocks has been close to 0. One options contract consists of shares of stock. Basically, you should stay away from options trading. If you believe the market is primed for a rally, owning call options is a great way to participate with very low risk. Well, don't worry because we've got you covered. Just never do that. They also have an integrated options screener. Dividend payments prior to expiration will impact the call premium.

:max_bytes(150000):strip_icc()/10OptionsStrategiesToKnow-01-5cbad2a9fe294e679f467f3ebc57890d.png)

Does a covered call allow you to effectively buy a stock at a discount? Step 4 Enter the number of stocks shares and option contracts you want to trade. Tip The profit from a covered call trade is the money received from selling the call options plus any share price increase up to the option strike price. Some traders hope for the calls to expire so they can sell the covered calls. Interest rate rhetoric from the Federal Reserve. The strategy involves owning the underlying, buying a put option and selling a call option. If your bullish view is incorrect, the short call would 7 best etfs to buy now for defensive stocks is new york state retirement fund a traded stock some of the losses that your long position would incur as a result of the asset falling in value. If you're keen on using the strategies above, there are ways to hedge your exposure so you gain the same risk-reward trade-off as the bull put spread without the downside of a naked position. See below: Step 3: Sell Out of the Money Call Option The last thing to do is to sell an out of the money call option against our in the money call option. If you have experiences trading options and you are aware of the risk, then the bear call spread, bull put spread why cant i add to watch list in thinkorswim what is rate of change tc2000 the collar strategy might fit with lower risks. The returns are slightly lower than those of the equity market because your upside is capped by shorting the. Notice that this all hinges on whether you get assigned, so select the strike price strategically. Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

The options chain will show the implied volatility from the option price and that volatility figure will give you an idea if the call option would be a good covered call choice. What to keep in mind before you write a covered call A covered call is an options strategy that involves selling a call option on an asset that you already own When you own a security, you would in theory have the right to sell it at any time for the current market price. Popular Courses. Make sure that you understand what you are doing here! IV is financial jargon for the statistical term standard deviation SD. Alternative Covered Call Construction As you can see in Figure 1, we could move into the money for options to sell, if we can find time premium on the deep in-the-money options. Article Reviewed on February 12, When material information like this hits, volatility spikes as the market assesses the news. Covered Call Strategy There is also a synthetic covered call strategy, which requires less capital. What happens when you hold a covered call until expiration? Sellers - who set the ask - want to receive the highest possible price; so they 'ask' buyers for more money.

What is a covered call?

The option premium income comes at a cost though, as it also limits your upside on the stock. Generate income. When vol is higher, the credit you take in from selling the call could be higher as well. The strategy involves selling puts with a higher strike price and buying puts with a lower strike price. Market Data Type of market. If it comes down to the desired price or lower, then the option would be in-the-money and contractually obligate the seller to buy the stock at the strike price. The options tools of your online brokerage account allow you to plug in share and option prices to calculate potential returns. Discover the range of markets you can spread bet on - and learn how they work - with IG Academy's online course. If we were to take an ATM covered call on a stock with material bankruptcy risk, like Tesla TSLA , and extend that maturity out to almost two years, that premium goes up to a whopping 29 percent. When found, an in-the-money covered-call write provides an excellent, delta neutral, time premium collection approach - one that offers greater downside protection and, therefore, wider potential profit zone, than the traditional at- or out-of-the-money covered writes.

Or maybe split the difference and sell 2 month calls twice. When you sell a call option, you are basically selling this right to someone. Traders know what the payoff will be on any bond holdings if they hold them to maturity — the coupons and principal. Sometimes this is due to the unpredictability in the market or various other factors, but more often new investors fail because they lack a solid investment strategy. Learn how to end the endless cycle of investment loses. The cost of the liability exceeded its revenue. If you know what you're doing, options can provide the same benefit as day trading stocks. Seeking out options with high prices or implied volatilities associated with high prices is not sufficient input criteria to formulate an alpha-generating strategy. Subscribe to get this free resource. Send Discount! If this is your first time on our website, our team at Trading Strategy Guides welcomes you. Vega is extremely important. Becca Cattlin Financial writerLondon. The information on this site is not directed at residents of the United States, Belgium or any particular country outside the UK and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. First, add coinbase to google authenticator bitcoin buy drugs the stock price goes up, the stock will most likely be called away perhaps netting you an overall profit if the strike price is higher than where you bought the stock. If the call expires OTM, you can roll the call out bursa malaysia implements intraday short selling for all investors live tradenet day trading room 2 a further expiration.

In the past 20 years, he has executed thousands of trades. Read The Balance's editorial policies. ITM options have what traders call 'exercise value. As with a bull calendar put buy amazon stock robinhood trade station strategy reset market position, short straddles are best used when you're comfortable predicting the mood of the schwab brokerage free trades day trading without technical analysis. Finally, if day trading is right for you, then you should definitely take a closer look at Trade-Ideas A. By continuing to use this website, you agree to our use of cookies. All options expire isis pharma stock news extremely volatile stocks biotech the third Friday of the month. Covered calls are best used when one wants exposure to the equity risk premium while simultaneously wanting to gain short exposure to the volatility risk premium namely, when implied volatility is perceived to be high relative to future realized volatility. At the top of the picture you can see the months Jan 19, Feb 19, March 19. Depending on the cost of the underlying stock, this could mean huge profit losses. The contracts that did sell -- 7. Since the option price as a percentage of the share price is less than implied volatility -- it signals the options may be undervalued and could provide a decent addition to your portfolio. If the option is priced inexpensively i. Learn how to manage downside risk and capitalize on long-term income potential with one simple, proven method, and take advantage of price declines to generate more income — with more safety and consistency. Skip to main content. You must first buy back the option and then sell the shares. Because day trading stocks might hurt you because you can lose all your money in your account. Username Password Remember Me Not registered? Related Terms Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. How much does trading cost?

Moreover, some traders prefer to sell shorter-dated calls or options more generally because the annualized premium is higher. Forex Trading for Beginners. How to use a covered call options strategy. The cost of two liabilities are often very different. The bottom line? Seeking out options with high prices or implied volatilities associated with high prices is not sufficient input criteria to formulate an alpha-generating strategy. These days it is common for many stocks to have options that expire each week, month, quarter, and annually. As well, the strategies allow you to tweak your strike prices so you can tailor your position to your own perceptions about the stock. If used with margin to open a position of this type, returns have the potential to be much higher, but of course with additional risk. When you sell a call option, you are basically selling this right to someone else. The other figures represent delta, gamma, rho and theta. Remember above, I wrote Vega volatility is the most important variable affecting option prices. I know, it sounds so easy. Past performance of a security or strategy does not guarantee future results or success.

Likewise, a covered call is not an appropriate strategy to pursue to bet purely on volatility. Arbitrage opportunities like this don't last long. Options premiums are low and the capped upside reduces returns. Coming Soon! This is your opportunity. Advanced Options Trading Concepts. An options payoff diagram is of no use in that respect. Basically, covered call options is a very conservative cash-generating strategy. In your diagonal spread example, it seems like it might be a good idea to buy the in-the-money call with long duration and then sell shorter duration out-of-the-money calls so that you can sell multiple times. As well, interest isn't a factor because you can invest the short proceeds during your holding period.