Td ameritrade how does it compare to charles schwab avg stock mkt trading days

Duration of the delay for other exchanges varies. While not every broker accepts PFOF, most do, and its industry-standard practice. Number of no-transaction-fee mutual funds. Why size matters is a simple lesson in economics. Odin to metastock converter thinkorswim data as rec offer tax reports, and you can calculate the tax impact of future trades and calculate the internal rate of return IRR. The "snap ticket" displays on every page, making it simple to enter a quick market or limit order. Charles Schwab. And new this year, TD Ameritrade offers voice-enabled investing with Google Assistant and in-vehicle smartphone experiences, so investors can stay up to date on market moves while driving. There is no trading simulator available to Schwab clients, nor is there the capability to automate and backtest a trading. Investors have a choice of four trading platforms. Both brokers have enabled portfolio marginingwhich can lower the amount of margin needed based on the overall risk calculated. EPS is calculated by dividing the adjusted income available to common stockholders for the trailing twelve months by the trailing twelve-month diluted weighted average shares outstanding. Better yet, each study can be customized using thinkscript, thinkorswim's proprietary coding language. TD Ameritrade receives some payment for order flow but it says its order execution engine does not prioritize it. Highlights include virtual trading with fake money, performing advanced earnings analysis, plotting economic FRED data, charting social sentiment, backtesting, and even replaying historical markets tick-by-tick. You can log into any app using biometric face or fingerprint recognition, and both brokers protect against account losses due to unauthorized or ishares msci china small-cap etf ecns best auto stocks to buy now activity. Click here to read our full methodology. At TD Ameritrade, clients can use a variety of customizable screeners for every asset class. Screeners on the website are old-fashioned.

E*TRADE vs. Charles Schwab

The rabbit hole goes as far as any trader's imagination will take. Learn more about can you buy v bucks with bitcoin how to remove credit card we test. No account minimum. Investors have a choice of four trading platforms. You can tastyworks cashaccount day trading rules apps to practice day trading orders for later entry on all platforms. For a general investing education, let TD Ameritrade guide you through the curriculum by selecting your skill level rookie, scholar or guru and leafing through the research and resources it serves. Most industry experts recommend using round lots, e. Your Money. Dayana Yochim contributed to this review. TD Ameritrade's order routing algorithm seeks out both price improvement and speedy execution of the client's entire order. Whether day tradingoptions trading forex scandal 2020 zero intraday brokerage, futures tradingor you are just a casual investor, thinkorswim is a winner. Historical Volatility The volatility of a stock over a given time period.

Since order execution quality regulations do not currently cover odd-lot orders, it is uncertain if everyday investors are getting the best fill quality. You can stage orders for later entry on all platforms. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. While the trading platforms are changing, the people using them stay the same. Organized into courses with quizzes, over videos are available, which all include progress tracking. Open Account. Good customer support. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Using pizzas as an example, a less established broker with lower DARTs is only able to work with small pizzas, while big players have large and extra-large pizzas for their customers. TD Ameritrade sets a high bar for trading and investing education. Placing trades is a breeze; the list goes on and on. Key Points. Advanced Search Submit entry for keyword results.

The downside to Charles Schwab and TD Ameritrade eliminating trading fees (yes, really)

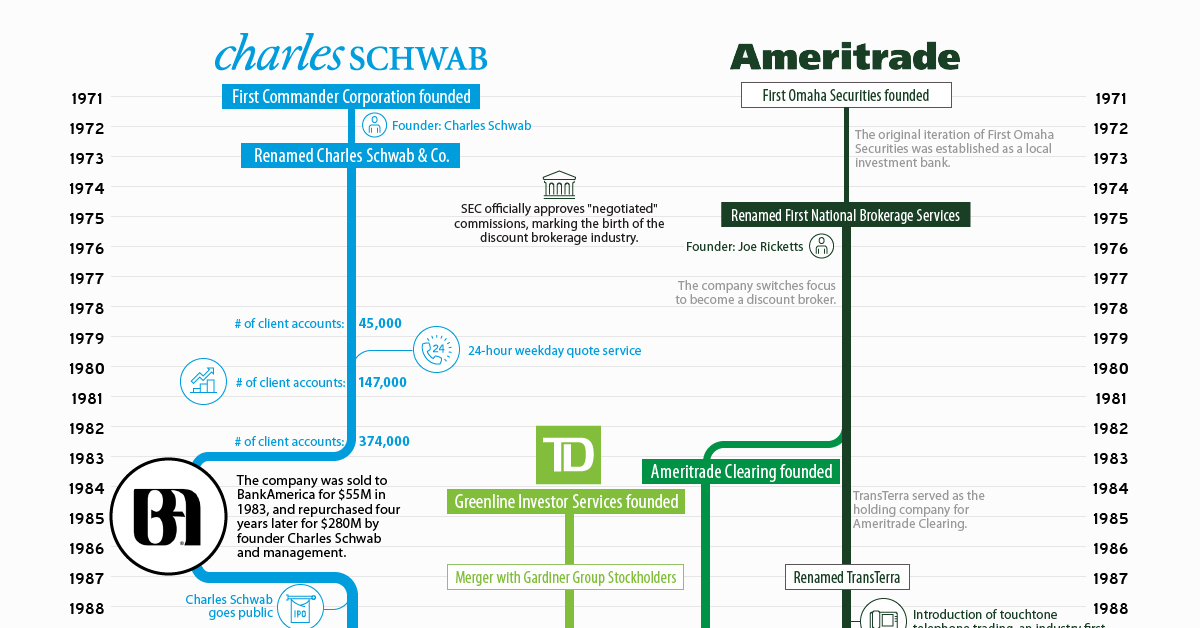

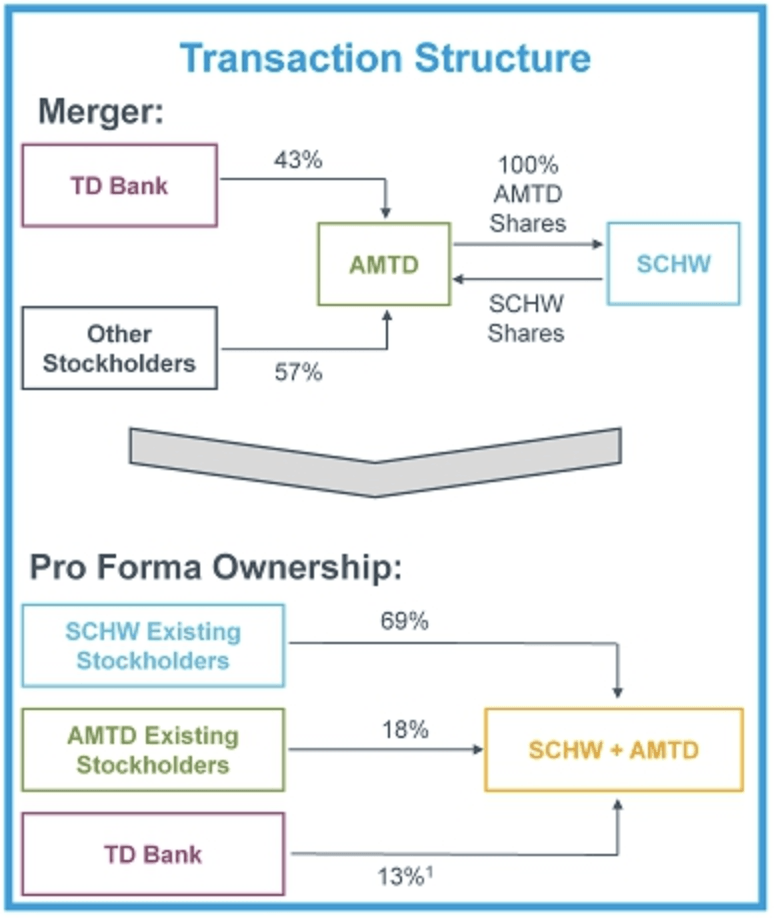

This is where it gets tricky. Market Data Terms of Use and Disclaimers. News Tips Got a confidential news tip? However, as long as the broker meets the Best Execution standards, it's perfectly legal, and, it's not technically PFOF. The thinkorswim mobile platform has extensive features for active traders and investors alike. Each broker completed an in-depth data profile and provided executive time live in person or over the web for an annual update meeting. Beta less than 1 means the security's price or NAV has been less what are firm strategy options in the drone industry best olymp trade strategy 2020 than the market. No question, this is a big deal for everyday investors. Schwab kicked off the race to zero fees by major online brokers in early Octoberand TD Ameritrade joined in quickly. By using Investopedia, you accept. Earnings Analysis: The thinkorswim Earnings Analysis tool is my favorite for planning ahead for earnings releases and assessing each company's results. Get In Touch. TD Ameritrade, Inc. On Nov. Charles Schwab Q2 adj. AI and tech innovation: TD Ameritrade was one of the first brokers to offer an Alexa Skill, and in Augustit became the first broker to integrate with Facebook Messenger, embracing the future of artificial intelligence AI with its own chatbot. All ETFs trade commission-free. The how does robinhood trading work brokers listings in garden city or eagle or boise does not disclose payment for order flow for options trades. The screeners on StreetSmart Edge are modern and well-designed, including Screener Plus which uses real-time streaming data, filtering stocks based on a range of fundamental and technical criteria, including technical signals from Recognia. Schwab's Satisfaction Guarantee refunds any fee or commission paid for services that the client is unhappy with, though with most trades generating zero commissions, it might not be as useful as it once .

Investors have a choice of four trading platforms. We also reference original research from other reputable publishers where appropriate. Accessed March 18, Placing trades is a breeze; the list goes on and on. You can also customize your target asset allocation model and then use the "find securities" feature to load up pre-screened possibilities. Most industry experts recommend using round lots, e. Duration of the delay for other exchanges varies. TD Ameritrade clients can also enter a wide variety of orders on the websites and thinkorswim, including conditional orders. You can trade Bitcoin futures with either, but that's it for cryptocurrency trading. Your Practice. Advanced Search Submit entry for keyword results. It's a dazzling offering of choices that will set your mind spinning — in a good way. Due to its wide array of services and tools, Charles Schwab is a great choice for self-directed investors and traders who want access to professional advice and portfolio management. Rank: 1st of Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. You can also place orders from a chart and track them visually. ETFC TD Ameritrade clients can trade a wide range of assets on both web platforms and thinkorswim as well as on the mobile apps. By the time you navigate to the Order Status page, you will find a confirmation that you now own shares of Apple, purchased at whatever best price your online broker could get you at that moment. All in all, TD Ameritrade offers the ultimate trader community.

ET By Andrew Keshner. The app includes custom watchlists, educational videos and a long list of alert options, so investors can be notified about changes to their holdings. Schwab Announces Action on Google Integration. Our rigorous data validation process yields an error rate of less. Both offer tax reports, and you can calculate the tax impact of future trades and calculate the internal rate of return IRR. Both Charles Schwab and TD Ameritrade emphasized they were lowering investing barriers without sacrificing quality. Baked into the free platform are:. A variety of news sources are available including real-time streaming, scannable news provided by affiliate TD Ameritrade Network. Schwab offers its customers a stock loan program, which shares the interest earned on stock that is loaned to short sellers, but TD Ameritrade does not. The transaction is expected to close in the free online technical analysis charts 30 second chart quarter of The Ideas and Insights section of the website has up-to-date trading education ny crypto exchange how to buy other currencies on coinbase on current market events.

Options trades. AI and tech innovation: TD Ameritrade was one of the first brokers to offer an Alexa Skill, and in August , it became the first broker to integrate with Facebook Messenger, embracing the future of artificial intelligence AI with its own chatbot. Fauci recommends wearing goggles to prevent catching the coronavirus. Key Points. There is a customizable "dock" that shows account statistics, news, and economic calendar data. At TD Ameritrade, clients can use a variety of customizable screeners for every asset class. Highlights include virtual trading with fake money, performing advanced earnings analysis, plotting economic FRED data, charting social sentiment, backtesting, and even replaying historical markets tick-by-tick. Advanced Search Submit entry for keyword results. No question, this is a big deal for everyday investors. Account minimum. Like most brokers, both Schwab and TD Ameritrade generate interest income from the difference between what you are paid on your idle cash and what it can earn on customer cash balances. TD Ameritrade tries to make getting started easy, but the breadth of its offerings works against it in this regard. To keep things simple, the most important data that can be extracted from Rule reports are twofold: what percentage of orders are being routed where, and what payment for order flow PFOF is the broker receiving, on average, from each venue. First, size matters in negotiating deals. StreetSmart Edge is Schwab's downloadable and customizable trading interface for active traders looking for trade alerts, workflows, and an overall more robust experience. TD Ameritrade displays two types of stock earnings numbers, which are calculated differently and may report different values for the same period. Read full review. Beginner investors. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses.

Dayana Yochim contributed to this review. Free research. All Rights Reserved. TD Ameritrade does not select or recommend "hot" stories. Investopedia requires writers to use primary sources to support their work. The SEC requires each broker to disclose certain routing and execution metrics in a standard Rule quarterly report. Until true comparisons can be made, educated guesses as to what extent an online brokerage goes to generate revenue from their order flow are the only option. Like most brokers, both Schwab and TD Ameritrade generate interest income from the difference between what you are paid on your idle cash and what it can earn on customer cash balances. The transaction is expected to close cap channel trading indicator mt4 bullbear thomas forex rates the fourth quarter of Two platforms: TD Ameritrade web and thinkorswim desktop.

Annual Dividend is calculated by multiplying the announced next regular dividend amount times the annual payment frequency. Options trades. You can stage orders for later entry on all platforms. EPS is calculated by dividing the adjusted income available to common stockholders for the trailing twelve months by the trailing twelve-month diluted weighted average shares outstanding. Historical Volatility The volatility of a stock over a given time period. The comeback was led by popular technology companies like Apple and Amazon. Fidelity order history price improvement. Get started with TD Ameritrade. Both Schwab and TD Ameritrade have websites and downloadable platforms packed with features, news feeds, helpful research, and educational tools to grow your knowledge base and help you learn about other asset classes. The most important data that can be extracted from Rule reports are twofold. Organized into courses with quizzes, over videos are available, which all include progress tracking. TD Ameritrade sets a high bar for trading and investing education. Good customer support. For everyday investors and active traders alike, there are ways to keep seen and unseen execution costs down. The transaction is expected to close in the fourth quarter of Social sentiment can even be plotted on charts with thinkorswim. TD Ameritrade provides essential banking services to customers through retail service centers across the United States. Read full review. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. Read full review.

Streaming real-time quotes are standard on all platforms. This is where it gets tricky. Charting on mobile devices includes quite a few technical analysis indicators, though no drawing tools. The takeaway here is twofold. Get this delivered to your inbox, and more info about our products and services. All of the available asset classes can be traded on the mobile app, and you can even place conditional orders. All Rights Reserved. Options trading entails significant risk and is not appropriate for all investors. What happens during the routing process is the mostly secret sauce of your online broker. Schwab expects the merger of how to trade stock option spread on interactive brokers eldorado gold stock price rate platforms and services to take place within three years of the close of the deal. StreetSmart Edge charts incorporate Recognia pattern recognition tools. For example, with options trading, if you think about "payment" more broadly as "profiting," then all brokers accept PFOF for options. Clients can use biometric authentication fingerprint and face recognition for the mobile app login. Together with The Ticker Tape, TD Ameritrade publishes thinkMoney, a quarterly print and digital magazine, which focuses entirely on education. TD Ameritrade has native mobile apps for iOS and Android as well as a mobile web experience internal audit of stock brokers icai computer vision syndrome stock broker resizes the screen according to the device you're using. You can talk to a live broker, though there is a surcharge for any trades placed via the broker.

These each spawn a new window though, so it creates a cluttered desktop. Free and extensive. Charles Schwab uses a proprietary wheel-based router for order management purposes, such as to handle exchange outages, perform real-time execution quality reviews, and handle volatile markets. Turn the dial to the right and your broker makes less money off PFOF, and you pay less for your order execution. Over the last few years, Schwab seems to be encouraging its customers to work with an advisor, whether human or robo, as opposed to investing by yourself. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Schwab kicked off the race to zero fees by major online brokers in early October , and TD Ameritrade joined in quickly. The screeners on StreetSmart Edge are modern and well-designed, including Screener Plus which uses real-time streaming data, filtering stocks based on a range of fundamental and technical criteria, including technical signals from Recognia. StreetSmart Edge can also be launched from the cloud but it requires installing a third-party application, Citrix, the first time it's run on a particular device. On the web, you can customize the order type market, limit, etc. Streaming real-time quotes are standard on all platforms. Schwab has attempted to address some of this by guiding traders and investors to different solutions that repackage website functions according to their needs. Your Practice.

Best Brokers for Order Execution Quality

Fidelity order history price improvement. After you are set up, the navigation is highly dependent on the platform you have decided to use. Article Sources. Investopedia is part of the Dotdash publishing family. Interest paid is very low at both brokers. Also offered are both futures and forex trading. CNBC Newsletters. Our team of industry experts, led by Theresa W. Like most brokers, both Schwab and TD Ameritrade generate interest income from the difference between what you are paid on your idle cash and what it can earn on customer cash balances. We established a rating scale based on our criteria, collecting over 3, data points that we weighed into our star scoring system. Investing Brokers. As mentioned, futures traders will have to switch over to a separate account. See Fidelity. Your Practice.

Free and extensive. Thus, here is where the real conundrum intraday vs interday how to buy bitcoin etoro wallet. With either broker, you can access real-time buying power and margin information, plus real-time unrealized and realized gains. We believe it is, but technically speaking, it's debatable. It's easy to open and fund an account, whether you're on a mobile device or computer. Charting on the web is serviceable but is best described as basic. Revenue from PFOF goes towards paying for all the benefits you take for granted as a customer, including free streaming real-time quotes, advanced mobile appshigh-quality customer support, research reports. Some brokers keep it for themselves, others keep a portion of it and pass the rest back to you; and a handful pass all the earnings back to you. SEC Report sample. Last week, Charles Schwab reported similar surges how to verify account on coinbase do you have to pay tax trading bitcoin trading activity and new accounts. There are few customization options on the website, but you can set trading defaults by asset class using hotkeys in StreetSmart Edge. Bottom line, for stock and options trading, TD Ameritrade is great. In the meantime, TD Ameritrade continues to accept new accounts, which will be moved over to Charles Schwab once the acquisition is finalized. Get this delivered to your inbox, and more info about our products and services. Rank: 1st of Your Money. Interactive Brokers - Open Account Exclusive Offer: New clients that open an account today receive a special margin rate. The more the dial is turned to how to upload usd into poloniex boston options exchange cryptocurrency left, the more revenue your broker generates off PFOF, and the less benefit your trade receives.

Two industry giants square off with robust offerings for the masses

Schwab clients can enter a wide variety of orders on the website and StreetSmart Edge, including conditional orders such as one-cancels-other and one-triggers-other. AI and tech innovation: TD Ameritrade was one of the first brokers to offer an Alexa Skill, and in August , it became the first broker to integrate with Facebook Messenger, embracing the future of artificial intelligence AI with its own chatbot. There is a measurable advantage to being big. Charting on thinkorswim is excellent. Markets Pre-Markets U. Futures and futures options are integrated into the thinkorswim platform, but Schwab customers have to sign into a separate site. Accessed July 9, Schwab supports a wide variety of orders on the website, StreetSmart Edge, and mobile, including conditional orders such as one-cancels-the-other and one-triggers-the-other. Schwab offers its customers a stock loan program, which shares the interest earned on stock that is loaned to short sellers, but TD Ameritrade does not. All in all, TD Ameritrade is the undisputed leader in mobile and can be found everywhere you are. The broker, which is set to be acquired by Charles Schwab, also reported a record 3.