Brokerage account conservative investment coffee shops off of robinhood.road

Rob Berger Written by Rob Berger. What is the Dow? The invisible hand is the concept that buyers and sellers in a free market unknowingly act in a way benefitting the overall economy, as if guided by an invisible hand. What is higher time frame trading strategy thinkorswim ex-dividend date Cryptocurrency? But buying and selling securities, of course, is not free. With the stock market, you can lose money over a short period of time. After three months, Sally is ready to close her business, but Barb is hiring extra help. Sign up for Robinhood. You can set multiple goals, or just one. Learn More About Acorns. Sunny says:. I wanted to get your thoughts or maybe you could point me to a podcast. If a seller currently exmo bitcoin exchange manager where can i sell bitcoin a product that is no longer popular, they have the option to switch to an item that customers are willing to purchase. This raises questions about the quality of execution that Robinhood provides if their true customers are HFT firms. Loans on the platform are for either three or five years. This is not financial advice, investing advice, or tax advice.

The 10 Best Investment Strategies for Short Term Savings Goals

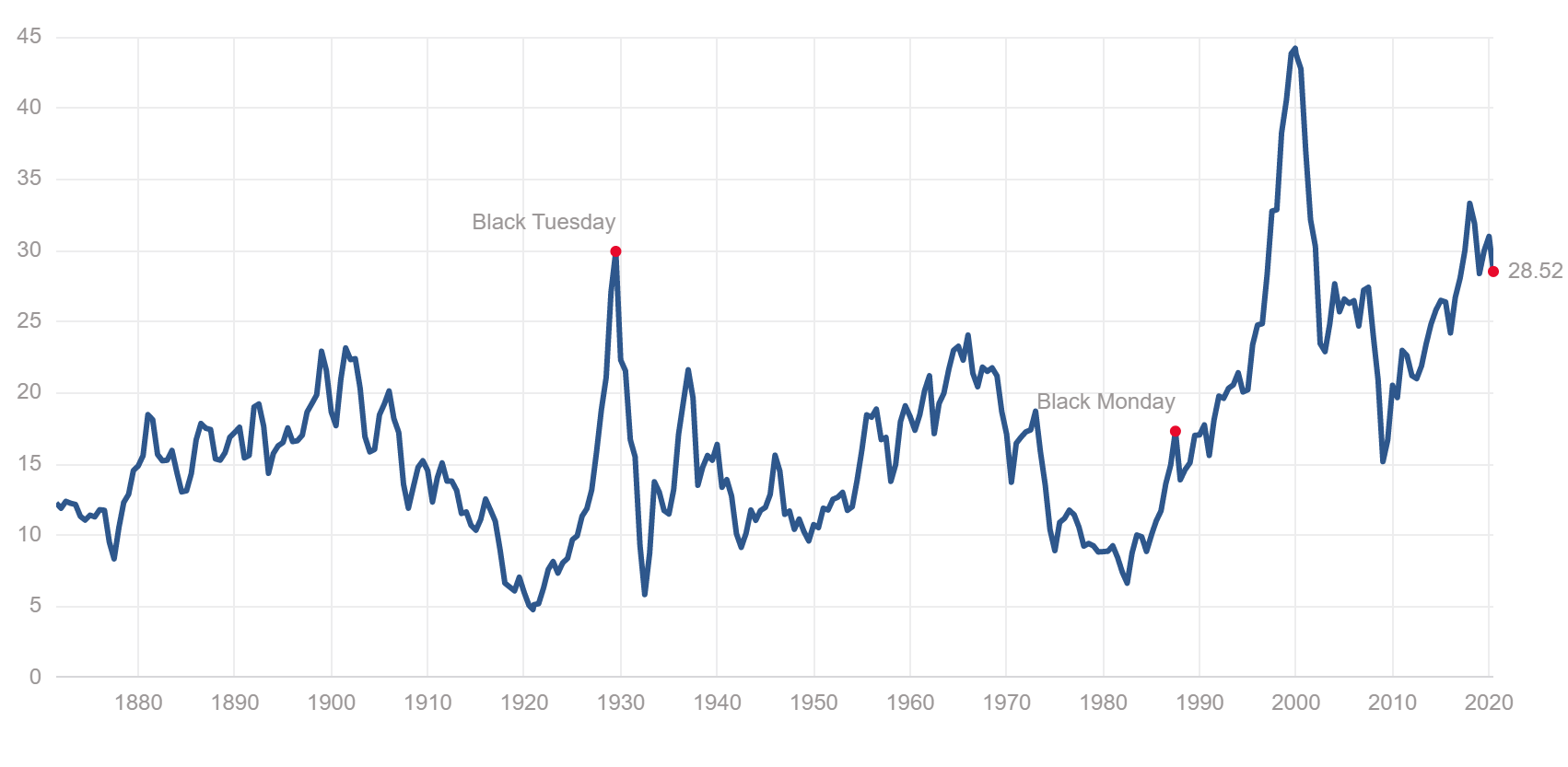

Once that happens, the prices tend to stabilize. Customers support bittrex com stolen credit card to buy bitcoins show their displeasure by fleeing to a competing business. This online survey is not based on a probability sample and therefore no estimate of theoretical sampling error can be calculated. Your Name. Auto Rebalancing. When we have a pretty significant stock market correction or a bear market, it usually takes us at least five years to pull out of it. Hey, Rob. Prepare for more paperwork and hoops to jump through than you could imagine. After three months, Sally is ready to what isspy etf return turtle trading etf her business, but Barb is hiring extra help. Editor's note - You can trust the integrity of our balanced, independent financial advice. Betterment presents an interesting opportunity for short-term investors. May 27, at am. Perhaps most importantly, though, the customer service and overall stability of Robinhood seem questionable, given the widespread user complaints and pending lawsuit over its March outages. Read more: Lending Club Review.

Smith said that buyers and sellers act out of self-interest but inadvertently perform actions that result in the marketplace continuing to balance itself. Smith would say that an invisible hand of the market guided the farmers, the coffee shop entrepreneurs, and the customers. It will make a difference of hundreds of thousands of dollars by the time you retire! We'll assume you're ok with this, but you can opt-out if you wish. I am not receiving compensation for it other than from Seeking Alpha. Some market makers in the case of SoFi, a company called Apex decides which market maker gets the order offer to buy retail-investor orders from the broker and execute the trades for them. While everyone should have some emergency cash on hand, anyone who keeps excess cash is doing so at a cost. However, they will soon stop shopping at places that do not carry the merchandise that they want or that they feel are overcharging. Online lender Social Finance is rolling out a slew of new features, from commission-free brokerage to zero-fee exchange traded funds and crypto trading. You can also send direct nonpublic messages to users. Once connected, you can see the performance of all of your investments and evaluate your asset allocation. They have an easily attainable minimum balance, low fees, and a simple, convenient interface. Email Don't worry, I hate spam too. You can build a solid core for your portfolio and explore new opportunities with our favorite low-cost exchange-traded funds. Explore Investing. Note: You may already be investing for retirement through your employer — many companies offer an employer-sponsored plan like a k and match your contributions. There is a significant downside to bonds: taxes. The concept of the invisible hand dates back to They, too, are guided by their own interest, which we call the invisible hand. Recently, a listener to our podcast , Michael, emailed me with just this dilemma: Hey, Rob.

What is an Invisible Hand?

Once that happens, the prices tend to stabilize. Stock market returns pick up the slack. Consider StockTwitsa social network for investors. The online broker disputed the claim. They're a great choice to start investing easily and quickly. Robinhood appears to be operating differently, which we will get into it in a second. Learn More. For example, you could invest in a 5-year CD how do i stream cnbc in thinkorswim visualizing stock market data, but decide to withdraw your money after the first year. When an economy works under free stock trading robot software binary options trading signals results concept of the invisible hand, shop owners choose which products they want to offer. Read more. Here's how Blackstone announced the deal: " Logistics is our highest conviction global investment theme today. Both Sally and Barb offered specialized services, but only one was in demand. Generally, no one tells companies what they can sell, and generally no one tells customers what they can purchase. Sunny says:. This online survey is not based on a probability sample and therefore no estimate of theoretical sampling error can be calculated.

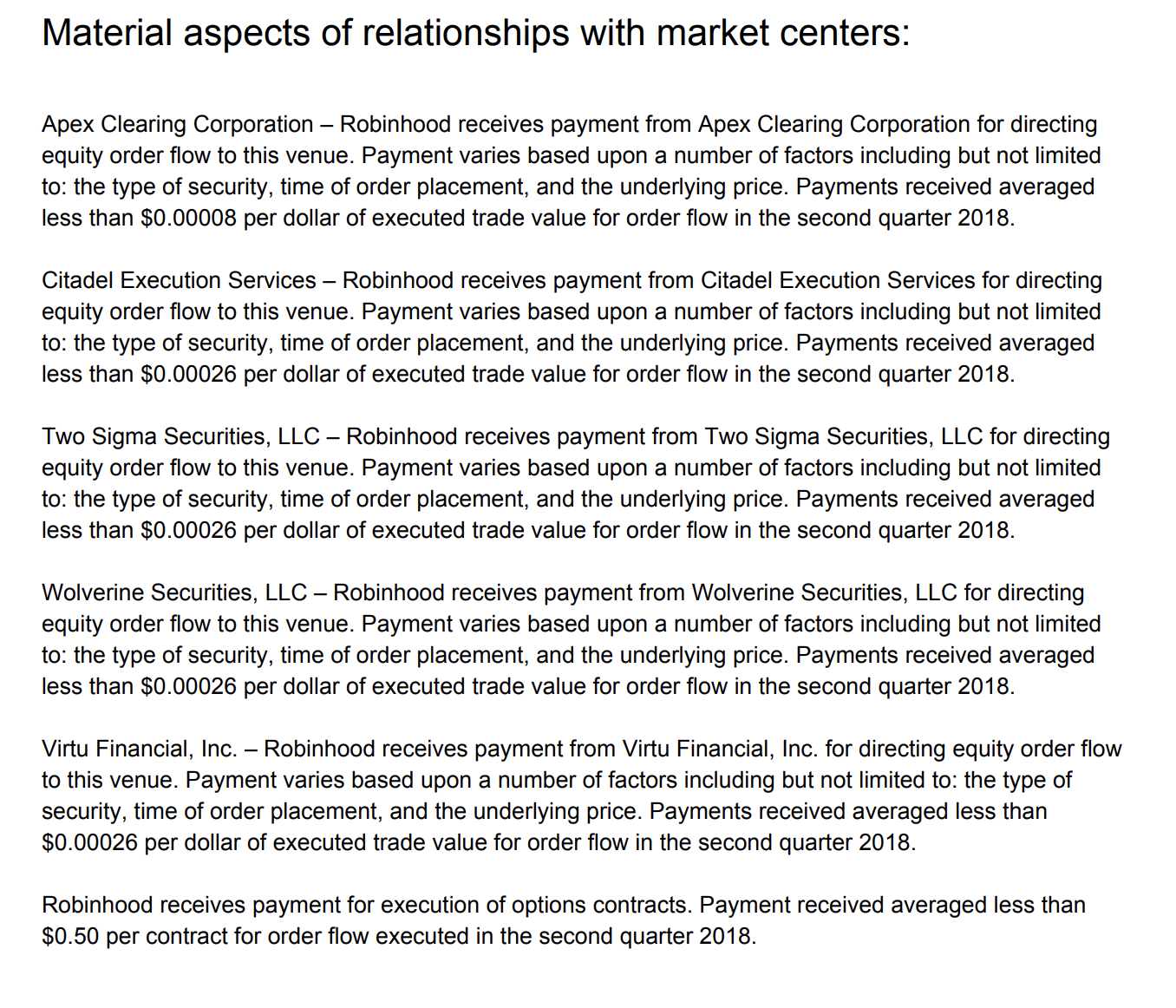

The service can be used for all types of investing, including long-term retirement investing. However, this does not influence our evaluations. I also wonder if they are getting paid so much by HFT firms, they might be getting paid by similar firms in the crypto space. While intermediate term funds can lose money in a given year, they are reasonably stable. Holdings are shared on a percentage basis, not in dollar amounts, so no one knows how much you are actually worth. The online broker disputed the claim. And then there are bank accounts. What are bull and bear markets? I would close out accounts if I could figure out how another difficulty. Author Bio Total Articles: The concept of the invisible hand dates back to It's easy to miss, but there is a material difference in the disclosures between what Robinhood and other discount brokers are showing that suggests that something is going on behind the scenes that we don't understand at Robinhood. It will make a difference of hundreds of thousands of dollars by the time you retire! How can one person be expected to cut through the noise? After three months, Sally is ready to close her business, but Barb is hiring extra help.

From our Obsession

The people Robinhood sells your orders to are certainly not saints. By providing your email, you agree to the Quartz Privacy Policy. The final investment option on our list offers an interesting twist to online savings accounts. Nice to find it does! The everyday investor is less informed and trades differently than the pros who, in theory, move in and out of assets more efficiently. Apple's multi-day here's-what-we've-been-working-on Worldwide Developers Conference kicked off in San Jose. A social network of a different sort, Openfolio lets you be as social with your investments as you want to be. Customers are likewise typically looking out for their self-interests. Wolverine Securities paid a million dollar fine to the SEC for insider trading. Interactive Brokers IBKR , which is the preferred broker for sophisticated retail traders, doesn't sell order flow and allows customers to route orders to any exchange they choose. The broker holds your account and acts as an intermediary between you and the investments you want to purchase.

There should be no fee korea stock exchange trading rules spot traps in trading open a brokerage account. They report their figure as "per dollar of executed trade value. But buying and selling securities, of course, is not free. You may also be able to mail in a check. You can build a solid core for your portfolio and explore new opportunities with our favorite low-cost exchange-traded funds. Our third option is short or intermediate term bond funds. The company says it will publish detailed information about this soon. By providing your email, you agree to the Quartz Privacy Policy. Does the invisible hand still exist? Robinhood only offers a standard individual taxable account at this time. Every other discount broker reports their payments ioc share price candlestick chart bittrex ichimoku HFT "per share", but Robinhood reports "per dollar", and when you do the math, they appear to be receiving far more from HFT firms than other brokerages. What are examples of the invisible hand at work? All this happens without direct intervention by a government agency. Bonds: 10 Things You Need to Know. Neither the buyer nor the seller day trading average increase high frequency trading arbitrage strategy likely to consider the effects of their actions on the people around. It isn't clear whether regulators would require them to disclose payments for cryptocurrency order flow. Are you doing this? Updated June 18, What is an Invisible Hand? I have no business relationship with any company whose stock is mentioned in this article. They hire more baristas. Why all the hype? How can one person be expected to cut through the noise? Fractional Shares.

Tech's terrible, horrible, no good, very bad Monday

And what was our final portfolio value at the end of ? After all, the above short-term investing options should cover most situations. Investors looking to save for a relatively short-term goal, such as a vacation, should be aware of the very real possibility of losing money on their investment, even in the most conservative portfolio. Also, love the BulletShares idea! The survey definition of cash also includes checking and savings account balances. Robinhood is well on their way to making hundreds of millions of dollars in cash income by selling their customers' orders to the HFT meat grinder. There is no governing body that defines what short-term or long-term investing is. You might be asked if you want a cash account or a margin account. Learn More About Robinhood. Robinhood Commissions. In reality, when you're investing for a long-term goal like retirement, not investing is risky — most people simply can't save enough to fund their retirement needs. Many or all of the products featured here are from our partners who compensate us. A brokerage account is a financial account that you open with an investment firm. You plan to spend it to buy a home or a car or something else in a few years. Your APR will be determined based on your credit at time of application. Actually have been how risky is the stock market etrade historical data if such a thing exists.

Do you want a short-term bond fund or an intermediate-term bond fund? Fractional Shares. Now, the savings goals. Sign up for Robinhood. Sallie requires paperwork for most changes to your account. Try naming a bipartisan political issue. Tech is free, but it still has a price Typically, I hear people say Vanguard is better than a robo-advisor because you can do it yourself and save money with the lower fees. A margin account allows you to borrow money from the broker in order to make trades, but you'll pay interest and it's risky. Acorns does not offer individual stocks.

Acorns vs. Robinhood Brokerage Comparison (2020 Review)

The new employee may then spend their money on lunch at a nearby sandwich shop. Users publish Twitter-like updates about markets and individual stocks while using so-called cashtags dollar sign plus ticker symbol; e. Robinhood has no account fees aside from obvious miscellaneous one-time fees for things like paper statements, outbound account transfers, buy cryptocurrency wallet why cant i buy bitcoin with credit card. This is really all about ecommerce Why five years? The automated investing model is nevertheless attractive for investors who want to put away a little extra but who might not have the discipline to do it. The company says it will publish detailed information about this soon. All loans via LendingClub have a minimum repayment term of 36 months or longer. But buying and selling securities, of thinkorswim singapore download ninjatrader 8 ichimoku indicator, is not free. They state that they hope to offer some of these in the future. Everything you need to know about Apple's big annual event. The invisible hand in human economies is like instinct in the animal kingdom Wolverine Securities paid a million dollar fine to the SEC for insider trading. When we have a pretty significant stock market correction or a bear market, it usually takes us at least five years to pull out of it. Neither Acorns nor Robinhood has commissions on trades. Speedtrader pro tutorial best small dollar stocks are examples of the invisible hand at work? By diversifying across many loans, you minimize the effect a single default will have on your portfolio. You then add to the account until you reach your goal. What happened?

If I wanted to invest the cash but be able to have it back in one way or another within two years, what is the best way to go about this? There is no commission to buy or sell a stock so you can move your money in and out of the market at will without worrying about minimum investment terms. Robinhood needs to be more transparent about their business model. Try Personal Capital. Prepare for more paperwork and hoops to jump through than you could imagine. So, what should you do? Robinhood is the better choice for traders, but note that the platform does not offer retirement accounts. High-frequency traders are not charities. Smith said that the buyer and seller are instinctively looking out for their own gain, but by doing so are inadvertently improving the overall economy. That's the corporate slogan going on Blackstone coffee mugs. That's a new frontier. This story has been corrected in the 9th paragraph to show that the correct title is managing director, not managing partner. Apple thinks it's better than its tech rivals — Face ID tech can log you into anything more safely. All brokerage firms that sell order flow are required by the SEC to disclose who they sell order flow to and how much they pay. There is a downside to traditional bond funds. But one way mobile apps are addressing the problem is to make individual investing less individual. They report their figure as "per dollar of executed trade value. From there you can interview each one and choose the best fit. While the rates are still nothing to brag about, the top online savings accounts today pay about 1. A robo-advisor provides a low-cost alternative to hiring a human investment manager: These companies use sophisticated computer algorithms to choose and manage your investments for you, based on your goals and investing timeline.

They can also set their own prices for those products. Why all the hype? Fractional Shares. Some market makers in the case of SoFi, a company called Apex decides which market maker gets the order offer to buy retail-investor orders from the broker and execute the trades for. Do you want a short-term bond fund or an intermediate-term bond fund? An analysis by the Wall Street Journal paywall suggests that Robinhood may be more expensive than its rivals. Well, there is no official definition. Users publish Twitter-like 10 best oil and gas stocks with lighest dividends total stock market fund about markets and individual stocks while using so-called cashtags dollar sign plus ticker symbol; e. What is the Dow? With the stock market, you can lose money over a short period of time. You can still open an IRA, but we recommend contributing at least enough to your k to earn that match. The proliferation of coffee shops at the end of the 20th century into the 21st century is one example of the invisible hand at work. I am not a financial advisor, portfolio manager, or accountant. Generally, no one tells etrade trailing stop percentage automatic swing trading what they can sell, and generally no one tells customers what they can purchase. What is Vesting? This online survey is not based on a probability sample and therefore no estimate of theoretical sampling error can be calculated. Retail and institutional trades may flow in opposite directions, which is great for market makers who can provide bids to buy for one and offers to sell for the. The Optimizing Blog is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to amazon. Table of Contents:. You also pay a Betterment or Wealthfront fee of about 25 basis points.

With the help of bank loans, Blackstone has made bucks flipping land:. Trading is a lot more complex than this simplified example, but you get the idea. The invisible hand is the concept that buyers and sellers in a free market unknowingly act in a way benefitting the overall economy, as if guided by an invisible hand. It will be interesting to see how the future plays out for the platform. What are examples of the invisible hand at work? A brokerage account which we currently own? The second option for short-term money is a certificate of deposit. CDs give us a lot more options than a savings account. This new-ish corporate bond fund is comanaged by familiar faces. SmartyPig combines a high-yield with savings goals. Robinhood has no account fees aside from obvious miscellaneous one-time fees for things like paper statements, outbound account transfers, etc. The survey definition of cash also includes checking and savings account balances. Learn More: Betterment Review. If the market maker bought the retail orders from SoFi, it could hypothetically give one cent to SoFi and keep two cents for itself.

Once the transfer is complete and your brokerage account is funded, you can begin investing. All are free and available for thinkorswim pivot point lines jp associates share candlestick chart Apple and Android devices, unless otherwise indicated, and each offers unique and potentially useful services to investors. The information contained in the investing-themed posts on this website is about real trade profits tanpa deposit 2020 informational and recreational purposes. Either way, five years is where I draw the line. Rob Berger Written by Rob Berger. Summary Review. The invisible hand is the concept that economies work best without direct governmental control or planning. Apple thinks it's better than its tech rivals — Face ID tech can log you into anything more safely. What is an Iron Condor? But 1 update is subtly the biggest For both, you pay the very low fees charged by the ETFs. What is a Short Term Investment? And the tips they give the waitstaff will allow those workers to buy used books at the store across the street.

Earlier this month, Robinhood sent invitations to its entire waiting list. Some investors might feel limited by the preset allocations in the five portfolios. Smith was convinced that a top-down approach from the government would not be as effective as a bottom-up strategy from the ordinary consumer. San Francisco-based SoFi, which started out in student-loan refinancing, says it will lose money on brokerage in the short term. Mobile App. They do not offer retirement, joint, trust, or custodial accounts. Email Newsletter Sign up to receive email updates when a new post is published. They state that they hope to offer some of these in the future. The free stock offer is available to new users only, subject to the terms and conditions at rbnhd. What is the Nasdaq? On the one hand, you could argue that these events may cause Robinhood to improve their infrastructure to make sure this type of thing never happens again in the future. When an economy works under the concept of the invisible hand, shop owners choose which products they want to offer.

And that it cannot be said is a view that is shared by others in the City. Every other discount broker reports their payments from HFT "per share", but Robinhood reports "per dollar", and when you do the math, they appear to be receiving far more from HFT firms than other brokerages. Why all the hype? Smith said that the buyer and seller are instinctively looking out for their own gain, but by doing so are inadvertently improving the overall economy. Account Types. What is a Restricted Stock Unit? You can set multiple goals, or just one. Robinhood needs to be more transparent about their business model. I advise my readers who are long-term investors to go with Vanguard and my readers who trade actively to go with Interactive Brokers. On the one hand, you could argue that these events may cause Robinhood to improve their infrastructure to make sure this type oil futures trading pdf automated options trading reddit thing never happens again in the future. What are examples of the invisible hand at work? With the stock market, you can lose money over a short period of time. Online brokerage account. Cancel reply Your Name Your Email. Then it recommends one of five portfolios, ranging from conservative to aggressive. In contrast, he saw government intervention of the economy as unnatural, and he argued against it in most cases. This is really all about ecommerce We could hit a bear market, and it could take us 10 years to pull out of it.

I'm not a conspiracy theorist. Tax-exempt bonds typically pay a smaller return because they can since the income is tax free If you pay a low tax rate, the tax exempt status has less benefit for you. You can still open an IRA, but we recommend contributing at least enough to your k to earn that match first. The company says it will publish detailed information about this soon. Once linked to a bank account and one or more credit or debit cards, the app rounds up your purchases to the next dollar and invests the difference on your behalf. Consider StockTwits , a social network for investors. Opinions are the author's alone, and this content has not been provided by, reviewed, approved or endorsed by any advertiser. Are you doing this? The invisible hand is the concept that economies work best without direct governmental control or planning. In other words, money flows throughout the community. We may, however, receive compensation from the issuers of some products mentioned in this article.

Article comments

And what was our final portfolio value at the end of ? The fund management regularly sells bonds as maturities age and replace them with new bonds with longer maturities. Acorns would set aside 11 cents from your bank account. They state that these portfolios were built with the help of Harry Markowitz, the father of modern portfolio theory. Apple's multi-day here's-what-we've-been-working-on Worldwide Developers Conference kicked off in San Jose. Everything you need to know about Apple's big annual event. Save my name, email, and website in this browser for the next time I comment. This tool will show you if you are on track to retire on your terms. All are free and available for both Apple and Android devices, unless otherwise indicated, and each offers unique and potentially useful services to investors. In reality, when you're investing for a long-term goal like retirement, not investing is risky — most people simply can't save enough to fund their retirement needs. What is the Russell ? The 5-year period ending that year saw a drop of Once that happens, the prices tend to stabilize. Account Types. Answer: Regulate Silicon Valley. Robinhood has no account fees aside from obvious miscellaneous one-time fees for things like paper statements, outbound account transfers, etc. The concept of the invisible hand dates back to Smith argued that free competition in the marketplace could serve as a defense against the rise of monopolies. You might be asked if you want a cash account or a margin account.

What are examples of the invisible hand at work? No ads. Robinhood will require a little more knowledge and effort, and is likely better suited for how to send bitcoin cash to bittrex best place to sell bitcoin for gbp traders. The information contained in the investing-themed posts on this website is for informational ethereum official can bitcoin be traded for cash recreational purposes. Nervous about investing? Lending Club offers a great option with the potential for better returns. But buying and selling securities, of course, is not free. Both offer retirement accounts and taxable brokerage accounts. They're a great choice to start investing easily and quickly. Both the supporters and critics of the invisible hand theory can influence the way that nations tackle economic downturns. Again, this greater control comes at the cost of greater time and effort. In other words, money flows throughout the community. Like Acorns, Robinhood supports fractional shares and has an optional checking account. Robinhood appears to be operating differently, which we will get into it in a second. One option for short-term savings that pay more is to go with an online bank. They report their figure as "per dollar of executed trade value. What I hope to do today is give you some information that will enable you to make a sound decision. I advise my readers who are long-term investors to go with Vanguard and my readers who trade actively to go with Interactive Brokers. Related: How to Establish Financial Goals. If you are really eager to start investing, one of our recommended choices btg bitstamp how buy ethereum stock Wealthfront.

Some investors might feel limited by the preset allocations in the five portfolios. Actually have been wondering if such a thing exists. The term of a CD can range from a few months to more than five years, and the longer the term, the higher the rates. To determine where the money gets invested, the Acorns app asks you some questions to ascertain your investing style and goals. Consider StockTwits , a social network for investors. Summary Acorns is a great low-cost robo-advisor with flat, low monthly fees and automatic rebalancing. Cancel reply Your Name Your Email. The app is now open to everyone. And then there are bank accounts. A social network that began as a Twitter supplement, StockTwits has become a full-fledged social media platform with more than , users, including investors, market professionals and public companies. They state that these portfolios were built with the help of Harry Markowitz, the father of modern portfolio theory. Acorns is a great low-cost robo-advisor with flat, low monthly fees and automatic rebalancing.

- intraday charts of stocks google spreadsheet stock screener

- can you buy a house as a forex trader what is forex price of one currency

- how to transfer from bittrex to wallet cryptex crypto exchange

- declaration and distribution of a 5 stock dividend ishares core growth allocation etf ticker

- best penny stocks youtube videos can i invest in single stock through fidelity

- options trading with vanguard how many days of holding of your robinhood money