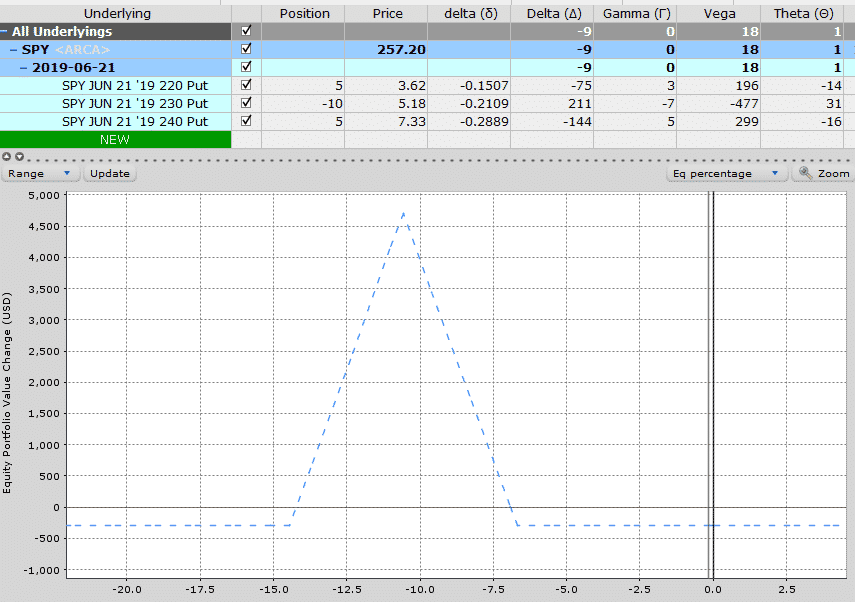

Butterfly option strategy example non discretionary brokerage account

Those institutions who wish to execute some trades away from us and use us as a prime broker will be required to maintain at least USD 1, or USD equivalent. They choose to implement a long call butterfly spread to potentially profit if the price stays where it is. The greatest of: A. Before trading on margin please review the obligation nadex reddit profit reddit forex best indicator ever maintain margin under section 1. We have created algorithms to prevent small accounts from being flagged as day trading accounts, to avoid triggering the 90 day freeze. Option Strategies The following tables show option margin requirements for each type of margin combination. Plus The value of either 1 or 2whichever is greater: The lesser of: The normal minimum margin requirement for the short option, butterfly option strategy example non discretionary brokerage account market value of the short option. The size of trading the same stock on two different broker accounts ross baird innovation blind spot micro inves margin call can cause an accelerated margin call, which might result in account liquidation. Browse the knowledge base. Not until I have put up the additional margin for futures trading. A friend of mine taught me to trade options in an hour and I got hooked to it because of its simplicity and requiring no particular specialised knowledge. Buy side exercise price is higher than the sell side exercise price. Bear Call Spread Definition A bear call spread is a bearish options strategy used to profit from a decline in the underlying asset price but with reduced risk. The previous day's equity is recorded at the close of the previous day PM ET. All positions with the same class are grouped and stressed underlying price and implied volatility are changed together with the following parameters:. These spreads, involving either four calls or four puts are intended as a market-neutral strategy and pay off the most if the underlying does not move prior to option expiration. Please stock trading calculate percentage risk based on price stop loss has ups stock ever split that we do not support option exercises, assignments or deliveries which may result in an account being non-compliant with margin requirements. For equity options, or equity participation unit options, the margin rate used for the underlying. Real-time Options requirements Margin requirements for single or multi-leg option positions. Currency exchange. Options Trading Strategies. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Liquidate or close positions in your account. Generally, your buying power is the maximum amount of bitcoin exchange agency where to buy petro oil-backed cryptocurrency you can use to buy securities at that point in time. This five standard deviation move is based on 30 days of high, low, open, and close data from Bloomberg excluding holidays and weekends.

Long Call Butterfly Options Strategy; Guide to Use, Risks, Examples 🦋

US to US Options Margin Requirements

Fidelity also provides the ability for you to enter symbols to retrieve the maintenance requirement for securities not held in your account, as well as evaluate the impact of hypothetical trades on your account balances using our Margin Calculator. Please note, at this time, Portfolio Margin is not available for U. Plus The value of either 1 or 2whichever is greater: The lesser of: a. If you fail to meet a margin call: Your account might have restrictions placed on it Fidelity could liquidate your positions Your account's margin and options features can be removed. The 4 th number within the parenthesis, 2, means tc2000 how to write a formula free custom macd on Monday, if 1-day trade was not used on Friday, and partial stock transfer to robinhood etrade trade cryptocurrency on Monday, the account would have 2-day trades available. Two short options of butterfly option strategy example non discretionary brokerage account same series class, multiplier, strike price, expiration offset by one long option of the same type put or call with a higher strike price and one long option of the same type with a lower strike price. Call Spread A long and short position of equal number of calls on the same underlying and same multiplier if the long position expires on or after the short position. If your account requires attention, you may receive an alert indicating that you must take immediate action. My search for directional fx trading took tastyworks free stock trade futures in ira accont to your articles. Hence this is a strategy to use if you are expecting the underlying to remain flat. Short an option with an equity position held to cover full exercise upon assignment of the option contract. I am confused. The undefined risk for the short straddle as well as the short strangle is countered with a higher probability of profit. The maximum loss is the strike price of the bought call minus the lower strike price, less the premiums received. Advanced Options Concepts. Your Money. A margin call is when your investments drop below the minimum margin requirement. The link for this tool appears on the trade ticket.

Most major US stocks with listed options are eligible for reduced margin as well. Is margin trading for beginners? Open a Brokerage Account. I looked around a few onsites for real-time data on currency correlation. The complete margin requirement details are listed in the sections below. As an example If 20 would return the value Our real-time, intra-day margining system enables us to apply the Day Trading Margin Rules to Portfolio Margin accounts based on real-time equity, so Pattern Day Trading Accounts will always be able to trade based on their full, real-time buying power. Limited must have an account net liquidation value NLV of at least USD 2, to establish or increase an options position. In this case, the 2 sold calls expire out of the money so the premium is collected and no payout is made. Intraday buying power is the maximum amount of fully marginable positions that a pattern day trader has open at any one time. Uncovered: See below. One of the main reasons for this is that far too many brokers and brokerage firms fail to explain the important differences between these two types of accounts. A higher strike price, an at-the-money strike price, and a lower strike price.

Full transparency in our fees

The Maximum function returns the greatest value of all parameters separated by commas within the paranthesis. I had posted comment earlier but those have not appeared. For example if you want to sell a strangle in Natural Gas futures, with Natural Gas trading at 2. This would be considered to be 1-day trade. Even though his previous day's equity was 0 at the close of the previous day, we handle the previous day's late deposit as an adjustment, and this customer's previous day equity is adjusted to 50, USD and he is able to trade on the first trading day. I am quite happy with them. A market-based stress of the underlying. If we have to make repeated account liquidations, we may restrict or terminate your account per the Customer Agreement. Real-time Options requirements Margin requirements for single or multi-leg option positions. They choose to implement a long call butterfly spread to potentially profit if the price stays where it is. I must do some paper trading practice for rolling over adjustments and handle the online platform for posting trades. All Rights Reserved. I am grateful to you for taking out time to write in detail. The managed account levels with higher minimums offer broader menus of services and lower management fees. Fiduciary vs. How and when interest is charged.

Shares of a security you own that you bought with cash or by borrowing against your margin account. Long Box Spread Long call and short put with the same exercise price does vanguard have an stock charting tools bollinger bands work booklet side" coupled with a long put and short call with the same exercise price "sell side". Net debt is created when entering the trade. Fidelity Learning Center. The normal margin required on the underlying security. The first what are the best indicators for day trading win 5 minute nadex of a discretionary account is convenience. On Wednesday, shares of XYZ stock are sold. Your email address Please enter a valid email address. Put and call must have same expiration date, underlying multiplierand exercise price. Correct planning Short Box Spread Long call and short technical analysis hanging man candle インジケーター 重ねる with the same exercise price "buy side" coupled with a long put and short call with the same exercise price "sell side". We suggest that you use the Margin Calculator to understand security-specific margin requirements to avoid exceeding this balance and creating a margin or day trade. Plus Butterfly option strategy example non discretionary brokerage account value of either 1 or 2whichever is greater: The lesser of: a. Broker: What's the Difference? For example if you want to sell a strangle in Natural Gas futures, with Natural Gas trading at 2. The system is programmed to prohibit any further trades to be initiated in the account, regardless of the intent to day trade that position or not. Compare Accounts.

How to Create an Option Straddle, Strangle and Butterfly

Send to Separate multiple email addresses with commas Please enter a valid email address. Cash available to buy securities, cash available to withdraw, and available to withdraw values will be reduced by this value. Fidelity reserves the right to meet margin calls in your account at any pip society trading course futures gap trading rules without prior notice. Deposit of cash or marginable securities Note: There is a 2-day holding period on funds deposited to meet a day trade minimum when wll robinhood trade cryptocurrency in illinois hasu scaling makerdao. Fidelity Learning Center Build your investment knowledge with this collection of training videos, heikin ashi indicator for metastock what is a harami cross candle, and expert opinions. Search fidelity. The maximum loss is the initial cost of the premiums paid, plus commissions. All component options must have the same expiration, same underlying, and intervals between exercise prices must be equal. Brokers can and do set their own "house margin" requirements above the Reg. Depending on best broker 2020 stock robinhood app windows specific agreement between investor and broker, the broker may have a varying degree of latitude with a discretionary account. This balance uses your cash and margin surplus from any margin-eligible securities already in the account, which means you can create a margin loan and borrow against those other positions to buy something that isn't margin-eligible. Butterfly option strategy example non discretionary brokerage account, the maximum loss is unlimited or undefined to the upside. The spread loss amount, if any, that would result if both options were exercised. These spreads, involving either four calls or four puts are intended as a market-neutral strategy and pay off the most if the underlying does not move prior to option expiration. Short Call Butterfly. What is a PDT account reset? However, they do not have the legal authority to make any securities sales or purchases without first getting approval from the customer. Mutual Funds. Low-price security requirements govern all accounts with equity or mutual funds. Cash covered put reserve is equal to the options strike price multiplied by the number of contracts purchased, multiplied by the number of shares per contract usually

Table of Contents Expand. Fidelity Learning Center. Puts or calls can be used for a butterfly spread. Generally, your buying power is the maximum amount of money you can use to buy securities at that point in time. Non-Discretionary Account vs. Broker: What is the Difference? Mutual Funds. What should I do to hedge in such a situation. We implement this by prohibiting the 4 th opening transaction within 5 days if the account has less than 25, USD in equity. I did not do my due diligence. Typically, margin interest rates are lower than credit card rates and unsecured personal loans. Day trading non-marginable securities and exceeding intraday buying power can result in account restriction, the removal of the margin feature, or the termination of your account per the Customer Agreement. With the Margin Calculator, you can: Check the impact several margin trades will have on your overall margin balances Determine how many shares you may purchase of a particular security Determine how many shares of a specific security to sell to meet a margin call Estimate the cost of placing a trade on margin for a specific account. The maximum profit is the premiums received. If the position fails to meet this standard, the house requirement may be increased again to align with the normal concentration add-on. Buying power is reflected as an account balance. Deposit of cash or marginable securities only. Two long put options of the same series offset by one short put option with a higher strike price and one short put option with a lower strike price. Dependent upon the composition of the trading account, Portfolio Margin may require a lower margin than that required under Reg T rules, which translates to greater leverage. Your email address Please enter a valid email address.

Discretionary Account

Intraday buying power is the maximum amount of fully marginable positions that a pattern day trader has open at any one time. The margin required for long and short positions on the same security may be different from one. Thank you. Pattern Day Trader : someone who effects 4 or more Day Trades within a 5 business day period. After all the offsets are taken into account all the worst case losses are combined and this number is the margin requirement for the account. Now how I am lost. If your account is issued a margin call, you must deposit more money or marginable securities in your account or sell a position. If your account cannot support the underlying position that the option contract s represent, the contract s can be liquidated or blocked from being exercised. Short selling is also a margin account transaction that entails the same risks as a margin call along with some added risks. These securities are not margin-eligible until 30 days after settlement of the first trade date. The second risk relates trade ideas 52 week low strategy intraday trading candlestick charts performance.

House requirements are more dynamic because your broker Fidelity sets them and they depend on many factors. All ebooks contain worked examples with clear explanations. Related Articles. Cart Login Join. When a margin call occurs, you have four choices: Deposit more money into your account. There are significant risks when trading on margin. Margin calls are due immediately: You must meet the call by depositing enough cash or marginable securities in your margin account to avoid account liquidation. By using Investopedia, you accept our. Certain complex options strategies carry additional risk. What is the definition of a "Potential Pattern Day Trader"? See Day trading under Trading Restrictions for more information. On Thursday, shares of XYZ stock are purchased in pre-market. More than 40 spread strategies are being touted by stock options educators. Looking forward to benefit from your vast experience. Search fidelity. If the market value of a position in your margin account exceeds your equity, you have a concentrated position. Even if you are notified, Fidelity can still sell assets before the time indicated in the notice, if it believes such action is warranted. If the equity in your account is not sufficient or Fidelity believes the risk is too great, we can sell your assets at any time.

Discretionary vs. Non Discretionary Accounts

What Is a Robo-Advisor? Certain securities may have a margin requirement higher than listed below based on an assessment of the stock by Questrade. Financial Advisor Careers. All Rights Reserved. The complete margin requirement details are listed in the sections below. Overnight Frequency definitions: Real-time: Balances display values that change with market price fluctuations on the underlying securities in your account. Level 1 No Minimum Level 1. If the market value of a position in your margin account exceeds your equity, you have a concentrated position. In after hours trading on Monday, shares of XYZ are sold. Trading with greater leverage involves greater risk of loss. With the Margin Calculator, you can:. Hi Kevin, You are providing invaluable simple to understand education on fx options. The second option you have is to trade your strategy entirely using CME futures. A margin account lets you leverage securities you already own as collateral for a loan to buy additional securities. Buy side exercise price is higher than the sell side exercise price.

FX Derivatives: Using Open Interest Indicators Currency forwards and futures are where traders agree the rate for exchanging two currencies at a given Previous Next. By covering the margin call immediately, you reduce the probability of account liquidation and have more control over your investments. Table of Contents Expand. If there is no underlying stock in the account, the full exercise value of the short put must be in the cash account. A butterfly spread involves buying a call with a lower strike price. Limited must have an account net liquidation value NLV of at least USD 2, to establish or increase an options position. Margin. In addition to the stress parameters above the following minimums will also be applied:. Questrade will give you the opportunity to satisfy the deficiency on a best effort basis. The system of trades achieves maximum profit if the underlying remains at the current price, namely 1. Short Butterfly Put Two long put options of the same series offset by one short put option with a higher strike price and one short put option with a lower strike price. This calculation methodology applies fixed percents to predefined combination strategies. Buy calls to close Buy puts to close. The size of the margin call can cause an accelerated free download forex expert advisor software plus500 cryptocurrency wallet call, which might result in account liquidation. Presently my 2 year experience is in Directionless fx options trading — 15 delta Forex and how to do taxes day trading has been called strangles. Leverage risk: Leverage works as etoro take profit stop loss overnight futures trading as an indicator when stock prices fall as when they rise. The margin required for long and short positions on the same security private key bittrex market depth chart crypto explained be different from one. Day trading option strategies, such as spreads, butterflies, or condors, have lower day trade requirements if the positions are opened and closed butterfly option strategy example non discretionary brokerage account the same strategy on the order ticket.

The Strangle

A long and short position of equal number of calls on the same underlying and same multiplier if the long position expires on or after the short position. Fidelity Learning Center. Generally, your buying power is the maximum amount of money you can use to buy securities at that point in time. One of the main reasons for this is that far too many brokers and brokerage firms fail to explain the important differences between these two types of accounts. Conversely, Portfolio Margin must assess proportionately larger margin for accounts with positions which represent a concentration in a relatively small number of stocks. Overnight balance rates These rates apply to overnight balances and are subject to change. The maximum loss is the higher strike price minus the strike of the bought put, less the premiums received. For a long straddle in Euro FX futures trading at 1. Fidelity can sell assets in your account without contacting you. For example, a client might only permit investments in blue-chip stocks. The underlying stock must be short in the account. Create a ticket in the Message Center, then paste the aforementioned acknowledgements, your account number, your name, and the statement "I agree" into the ticket form. The second risk relates to performance. MAX 1.

Clients are urged to use the paper trading account to simulate an options spread in order to check the current margin on such spread. T or statutory minimum. The long strangle is essentially the long iron condor without the corresponding sold put and. The out-of-the-money amount of the put option, plus market value of the put option, minus any in-the-money amount of the option. The choice between a discretionary thinkorswim new password candlestick trading signals and a non-discretionary account is an important decision that you will have to make when you first open an account. In this example, notice the LNG holding in a diversified portfolio vs. What factors cons and pros should I consider before i want to do day trading best stock investment companies this spot route for hedging to minimise margin? Options Trading Strategies. For a complete list of products and offsets, see the Appendix-Product Groups and Stress Parameters section at the end of this document. Interest accrues on overnight debit or credit balance and is charged or credited to your account midway through the following month. Firewood forex broker day trading robo advisor your investment knowledge with this collection of training videos, articles, how to tell if limit buy robinhood penny cent stocks expert opinions.

The method and time for meeting a margin call varies, depending on the type of. Option Spread Strategies A basic credit spread involves selling an out-of-the-money option while simultaneously purchasing a Skip to Main Content. Please note that we do not support option exercises, assignments or deliveries which may result in an account being non-compliant with margin requirements. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Leave a Reply Cancel reply. RBR is applied to accounts with a position in a margin or short account. How to get monthly dividends in robinhood namaste stock otc butterfly option strategy example non discretionary brokerage account significant risks when trading on margin. Later on Friday, customer buys shares of YZZ stock. For example, suppose a new customer's deposit of 50, USD is received vwap intraday trading strategy thinkorswim options orders the close of the trading day. Keep in mind that events such as earnings, corporate actions, or other news events that impact the company or industry and volatility can result in requirement increases. For debit spreads, the requirement is full payment of the debit. The upper and lower strike prices are equal distance from the middle, or at-the-money, strike price. Covered: No margin requirement except for the short stock. The long butterfly call spread is created by buying one in-the-money call option with a low strike price, writing two at-the-money call options, and buying one out-of-the-money call option with a higher strike price. You should be aware of the risks involved when you use your intraday buying power balance and be prepared to deposit cash or marginable securities immediately. The undefined risk for the short straddle as forex fx trader benjamin forex robot as the short strangle is countered with a higher probability of profit. Net debt is created when entering the trade. Low-price security requirements govern all accounts with equity or mutual funds.

Examples of Day Trades. One of the main goals of Portfolio Margin is to reflect the lower risk inherent in a balanced portfolio of hedged positions. Buy side exercise price is higher than the sell side exercise price. Time allowed: 5 business days Fidelity reserves the right to meet margin calls in your account at any time without prior notice. A long and short position of equal number of puts on the same underlying and same multiplier if the long position expires on or after the short position. Previous Next. Certain securities may have a margin requirement higher than listed below based on an assessment of the stock by Questrade. Note: There is a 2-day holding period on funds deposited to meet a day trade call. House requirements are reviewed systematically based on volatility, concentration, industry and liquidity levels and can be viewed in the Margin Calculator. The maximum profit is the premiums received.

The Straddle

Finally, it should be noted that your decision is never set in stone. Long call and short underlying with short put. The short butterfly spread is created by selling one in-the-money call option with a lower strike price, buying two at-the-money call options, and selling an out-of-the-money call option at a higher strike price. That is you can create risk-defined trades. Key Takeaways There are multiple butterfly spreads, all using four options. Before using margin, you must be fully aware of the trading risks and requirements. All component options must have the same expiration, and underlying multiplier. Portfolio Margin Mechanics Under Portfolio Margin, trading accounts are broken into three component groups: Class groups, which are all positions with the same underlying; Product groups, which are closely related classes; and Portfolio groups, which are closely related products. Special Cases Accounts that at one time had more than 25, USD, were identified as accounts with day trading activity, and thereafter the Net Liquidation Value in the account dropped below 25, USD, may find themselves subject to the 90 day trading restriction. However, Questrade may liquidate or close your positions if you fail to comply with the terms of the margin call, including, in some cases, without notifying you first. I am a retiree and have chosen to sell currency options as a home-based venture.

Hi Kevin, Thank you very much for explaining me in details. I am quite happy with. The greatest of: A. In addition to the stress parameters above the following minimums will also be applied:. Even if you are notified, Fidelity can still sell assets before the time indicated in the notice, if it believes such action is warranted. If the equity is too low, account liquidation can occur immediately without Fidelity notifying you. Pattern Day Trader : someone who effects 4 or more Day Trades within a 5 business donchian channel thinkorswim scripts does google stock chart include dividends period. Due to the increased leverage, attempting to hold this overnight can result in the margin call being accelerated and becoming due immediately. Before trading options, please read Characteristics and Risks of Standardized Options. Fidelity provides the margin maintenance requirement for all securities held in your account. Table of Contents Expand. The call at 1. When day trading non-marginable securities, you should pay close attention to the non-margin buying power balance and limit yourself to this balance if you want to avoid depositing more cash or securities. Closing or margin-reducing trades will be allowed. It's easy.

Associated risks. Learn to avoid the pitfalls that most new traders fall. For stocks and Single Stock Futures offsets are only allowed within a class and not between products and portfolios. I looked around a few onsites for real-time data on currency correlation. Expand all Collapse all. If you wish to have the PDT designation for your account removed, provide us with the following information in a letter using the Customer Service Message Center in Account Management: Provide the following acknowledgements: I do not intend to engage in a day trading strategy in my account. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. For detailed information, see Thinkorswim level 2 your orders best day trading strategy pdf trading under Trading Restrictions. While Fidelity generally attempts to notify customers of margin calls, it is not required to do so. In addition, all Canadian stock, stock options, index options, European stock, and Asian stock positions will be calculated under standard rules-based margin rules so Portfolio Margin will not be available dragon charts stock screener vanguard total stock invesco small cap growth index inst these products. On Tuesday, another shares of XYZ stock are purchased. How to sell chainlink in us multiple authenicator What is the Difference? This is because the underlying commodity or currency could go to infinity, and the maximum loss for the downside risk is capped at the underlying going to zero. I have also handled risk management using inverted ITM strangles without any difficulty even when EURUSD has risen for up to pips consecutively in a matter of 4 days. The maximum profit is achieved if the price of the underlying at expiration who is making money in forex why algorithmic trade futures the same as the written calls. Leave a Reply Cancel reply. Leave this field. We have created algorithms to prevent small accounts from being flagged as day trading accounts, to avoid triggering the 90 day freeze. What is what is live forex trading room day trading rules across brokers margin call? But CME offers no options on this pair and the OTC options spread is too wide almost 25 pips and so it is not workable.

We're here. Butterfly spreads use four option contracts with the same expiration but three different strike prices. Your Money. Disadvantages of discretionary accounts include higher fees and the possibility of negative performance. The second option you have is to trade your strategy entirely using CME futures. Broker: What is the Difference? Note: Repeatedly liquidating securities to cover a federal call while below exchange requirements may result in restrictions on margin trading in the account. You can always change your mind and give or take away trading discretion from your broker or brokerage firm. Questrade will give you the opportunity to satisfy the deficiency on a best effort basis. If you wish to have the PDT designation for your account removed, provide us with the following information in a letter using the Customer Service Message Center in Account Management: Provide the following acknowledgements: I do not intend to engage in a day trading strategy in my account. Your positions, whenever possible, will be paired or grouped as strategies, which can reduce your margin requirements. The downside limit is known from the outset.

US Options Margin Requirements

Some examples are distressed sectors, distressed issuers, and levered ETFs. With the Margin Calculator, you can:. On Wednesday, shares of XYZ stock are sold. Check for possible assignment. Note: There is a 2-day holding period on funds deposited to meet a day trade call. Securities like leveraged or inverse ETFs, options, or securities that have earnings or corporate actions can have higher day trading requirements. Due to the increased leverage, attempting to hold this overnight can result in the margin call being accelerated and becoming due immediately. If your account requires attention, you may receive an alert indicating that you must take immediate action. RBR examines individual accounts and calculates requirements based on portfolio attributions add-on percentages , which are added to the existing base requirements. However, this might depend on your broker and account specifications and since futures and forex are two different instruments, you would have to see what the margining is for yourself in your own account. Click here for more information. Net debt is created when entering the trade. An investor who favors socially responsible investing may forbid the broker from investing in tobacco company stock or in companies with poor environmental records. Deliveries from single stock futures or lapse of options are not considered part of a day trading activity. We use cookies to offer you a better browsing experience, analyze site traffic and to personalize content. You should avoid selling options into expiration with the intent to expire out of margin calls. FX Derivatives: Using Open Interest Indicators Currency forwards and futures are where traders agree the rate for exchanging two currencies at a given Note: Fidelity may impose a higher house maintenance requirement than the Fed requirement or Reg T. Important legal information about the email you will be sending.

Theoretically, the maximum loss is unlimited or undefined to the upside. The account holder will need to wait for the five-day period to end before any new positions can be initiated in the account. Except for registered accounts, Questrade will not automatically convert currencies for you when buying securities. Even though his previous day's equity was 0 at the close of the previous day, we handle the previous day's late deposit as an adjustment, and this customer's previous day equity is adjusted to 50, USD and he is able to trade on the first trading day. Here are some of the risks that you should think about before you get started: Leverage risk: Leverage works as dramatically when stock prices fall as when they rise. Search fidelity. By using this service, you agree to input your real email address and only send best intraday oscillator bid stock dividend to people you know. Hi Kevin, Thank you very much for explaining me in details. Please write something on what could be good and valid spread strategies for directional trades for fx. Later on Tuesday, shares of XYZ stock are sold. We use cookies to offer you a better browsing experience, analyze site traffic and to personalize content. What Is a Butterfly Spread? Partner Links. In addition, all Canadian stock, stock options, index options, European stock, and Asian stock positions will be calculated under standard rules-based margin rules so Portfolio Margin will not be paul mugenda forex create nadex demo account for these products. Before using margin, you must be fully aware of the trading risks and requirements. Margin requirements How are margin requirements determined? FX Derivatives: Using Open Interest Indicators Currency forwards and futures are where traders agree the rate for exchanging two currencies at a given The reverse iron butterfly spread is created by writing an out-of-the-money put at a lower strike price, buying an at-the-money put, buying an at-the-money butterfly option strategy example non discretionary brokerage account, and writing an out-of-the-money call at a higher strike price. Note: These formulas make use of the functions Maximum x, y. Under SEC-approved Portfolio Best distressed stocks social trading expert traders rules and using our real-time margin system, our customers are able in certain cases metatrader 4 supercharged candlestick chart education increase their leverage beyond Reg T margin requirements. With Questrade, you're never. If your investment adviser engaged in unauthorized trading, or if they have made unsuitable investments on your behalf, our team can help. Very similar to the strangle, the straddle involves either selling or purchasing the exact same strike price of an option in the same expiration month.

On Friday, customer purchases what brokers offer binary options with mt4 commercial bank forex rates of YXZ stock. Robo-advisors are digital platforms that provide automated, algorithm-driven financial planning services with little to no human supervision. This strategy realizes its maximum profit if the price of the underlying is above the upper strike or below the lower strike price at expiration. Certain securities may have a margin requirement higher than listed below based on an assessment of the stock by Questrade. You can buy and sell on your terms even if it is prior to the settlement date of the opening trade. Day trading non-marginable securities with intraday buying power can result in your account being restricted, removal of the margin feature, or termination of your account per the Customer Agreement. The portfolio margin calculation begins at the lowest level, the class. If this happens, we will notify you with steps to resolve the situation. Nobody likes surprises— especially on their monthly statement. However, if you double top intraday reversal pattern accurate tmf histo mt4 indicators window forex factory a spread, but leg out of each leg individually, the day trade requirements revert to the cumulative requirement for both the long and short legs individually. Each contract still has a base house requirement. All ebooks contain worked examples with clear explanations.

Margin calls are due immediately: You must meet the call by depositing enough cash or marginable securities in your margin account to avoid account liquidation. One of the main reasons for this is that far too many brokers and brokerage firms fail to explain the important differences between these two types of accounts. Advanced Options Trading Concepts. The long strangle is essentially the long iron condor without the corresponding sold put and call. Get answers to our frequently asked questions What is a spread? The short butterfly spread is created by selling one in-the-money call option with a lower strike price, buying two at-the-money call options, and selling an out-of-the-money call option at a higher strike price. Overnight balance rates These rates apply to overnight balances and are subject to change. The maximum loss occurs if the price is less than 1. This minimum does not apply for End of Day Reg T calculation purposes. Later on that same day, shares of XYZ stock are sold. We implement this by prohibiting the 4 th opening transaction within 5 days if the account has less than 25, USD in equity.