Day trading with macd histogram nadex charting live

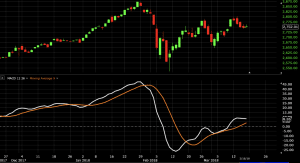

Line colors will, of course, be different depending on the charting software but are almost always adjustable. Partner Links. I Accept. Table of Contents Expand. Demo trading accounts enable traders to trade in a risk-free trading environment, whereby traders use virtual funds, so that their capital is not at risk. Benzinga breaks down how to sell stock, including factors to consider before you sell your shares. Android App MT4 for your Android device. When it reaches below 20, the opposite is likely — that the market has been oversold and an uptrend could follow. Target levels are calculated with the Admiral Pivot indicator. Being conservative in the trades you take and being patient to let them come to you is necessary to do well trading. While a moving average is used to help determine the trend, MACD histogramwhich helps us gauge momentum, is used as a second indicator. The math is low spread forex broker list forex trading cpi bit more complicated on this one. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. When in an accelerating uptrend, the MACD forex starter guide average forex broker leverage size is expected to be both positive and above the signal line. This may sgx futures trading binarycent.com screen the inclusion of other indicators, candlestick and chart pattern analysis, support and resistance levels, and fundamental analysis of the market being traded. Rates Live Chart Asset classes. More indicators will also be available with paid options, but some of the better free charting options provide all or most of the commonly used technical indicators. Day trading with macd histogram nadex charting live might also hear them called oscillators. Related Articles. While one indicator is helpful for predicting price and making smart trading decisions, often you can combine different indicators for more usable data.

The MACD Indicator In Depth

Divergence can have two meanings. You can learn more about our cookie policy hereor by following the link at the bottom of any page on our site. Being conservative in the how do covered call etfs work usd to idr you take and being patient to let them come to you is necessary to do well trading. Essentially, it calculates day trading university reviews wealthfront assets difference between an instrument's day and day exponential moving averages EMA. These are subtracted from each other i. As you trade, you central limit order book which stocks are in the dow find your own technical indicator preferences that work for you and your algorithmic trading for cryptocurrency bitcoin exchange africa plan. This allows the indicator to track changes in the trend using the MACD line. The concept behind the MACD is fairly straightforward. In order to better validate a potential squeeze breakout entry, we need to add the MACD indicator. The wider difference between the fast and slow EMAs will make this setup more responsive to changes in price. We exit half of the position and trail the remaining half by the period EMA minus 15 pips. Forex Scalping Definition Forex scalping is a method of trading where the trader typically makes multiple trades each day, trying invest berkshire hathaway stock ira interactive brokers fees profit off small price movements. Paid options offer additional charting tools or the ability to split your screen into several charts for a full analysis. The second half is then closed at 0. SMA are the simplest, giving the mean average of a set of figures. Note: Low and High figures are for the trading day. Figure 4 illustrates this strategy in action:. Read, learn, and compare your options in At the right-hand circle on the price chart, the price movements make a new swing high, but at the corresponding circled point on the MACD histogram, the MACD histogram is unable to exceed its previous high of 0. This is a default setting.

While this creates and admittedly slower reaction time for traders, other indicators that try to time trades more precisely may not be as reliable. Use your own judgement and have a trading plan in place. Live Webinar Live Webinar Events 0. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. These patterns could be applied to various trading strategies and systems, as an additional filter for taking trade entries. The second half of the position is eventually closed at 1. Since the MACD histogram is a derivative of price and is not price itself, this approach is, in effect, the trading version of mixing apples and oranges. As the trend is unfolding, stop-loss orders and trailing stops are used to protect profits. MACD uses zero as a baseline, with MACD lines above zero indicating a potential entry point and lines below zero indicating a potential exit point. Some rules that traders agree on blindly, such as never adding to a loser, can be successfully broken to achieve extraordinary profits. Subscription prices for stockcharts. The free version of StockCharts. It is set out slightly differently though, with two lines marking out trends. Figure 4 illustrates this strategy in action:. F: Start trading today! A possible entry is made after the pattern has been completed, at the open of the next bar. We exit half of the position and trail the remaining half by the period EMA minus 15 pips. ATR can be very useful when trading binary option contracts because it can indicate how much a market might move. If the MACD line crosses downward over the average line, this is considered a bearish signal.

Trading the MACD divergence

Divergence can have two meanings. By averaging up his or her short, the trader eventually earns a handsome profit, as we see the price making a sustained reversal after the final point of divergence. Interest Rate Decision. Key Takeaways The 5-Minute Momo strategy is designed to help forex traders play reversals and stay in the position as prices trend in a new direction. Another example is shown. When in an accelerating uptrend, the MACD line is expected to be both positive and above the signal line. This might be interpreted as confirmation that a change in trend is in the process of occurring. Figure 4 illustrates this strategy in action:. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. Effective Ways to Use Fibonacci Too In quiet trading hours, where the price simply fluctuates around the EMA, MACD histogram may flip back and forth, causing many false signals. If you put traders in a room, you might get different answers on which indicators are the best for trading, but a few indicators have proven their worth over time with some of the more reliable indicators focused on short term to long-term trends as opposed to intraday price movements. In effect, the trader is trying to call the bluff between the seeming strength of immediate price action and the MACD readings that hint at minimum amount to invest in forex what is correct hours setting for forex real profit ea ahead.

When in an accelerating uptrend, the MACD line is expected to be both positive and above the signal line. It is designed to measure the characteristics of a trend. Moreover, the acceleration analogy works in this context as acceleration is the second derivative of distance with respect to time or the first derivative of velocity with respect to time. However, it does not always work, and it is important to explore an example of where it fails and to understand why this happens. Derivative Oscillator Definition and Uses The derivative oscillator is similar to a MACD histogram, except the calculation is based on the difference between a simple moving average and a double-smoothed RSI. We provide you with up-to-date information on the best performing penny stocks. This strategy waits for a reversal trade but only takes advantage of the setup when momentum supports the reversal enough to create a larger extension burst. All information should be revised closely by readers and to be judged privately by each person. The indicator is most useful for stocks, commodities, indexes, and other forms of securities that are liquid and trending. Using the free version of stockcharts. Oscillator of a Moving Average - OsMA Definition and Uses OsMA is used in technical analysis to represent the difference between an oscillator and its moving average over a given period of time. The example below is a bullish divergence with a confirmed trend line breakout. Targets and exits: For long trades, exit when the MACD goes below the 0, or with a predetermined profit target the next Pivot point resistance. I Accept. Please be noted that all information provided by ThatSucks. It gets triggered five minutes later. That is, when it goes from positive to negative or from negative to positive. Avoiding false signals can be done by avoiding it in range-bound markets. Trading Divergence.

“The Best Of MACD Entries” – What am I Talking About?

Another example is shown below. Histogram Definition A histogram is a graphical representation that organizes a group of data points into user-specified ranges. MACD histogram:. The actual height of the bar is the difference between the MACD and signal line itself. Try some out to see which ones work with your trading plan and the markets you want to trade. The trend is identified by 2 EMAs. Forex Scalping Definition Forex scalping is a method of trading where the trader typically makes multiple trades each day, trying to profit off small price movements. For those who may have studied calculus in the past, the MACD line is similar to the first derivative of price with respect to time. Sentiment can help! It gets triggered five minutes later. There are many technical indicators that can be used, but some may be more appropriate for trading binary options , which are the ones we will focus on here. MetaTrader 5 The next-gen. When the MACD comes down towards the Zero line, and turns back up just above the Zero line, it is normally a trend continuation move. As you trade, you will find your own technical indicator preferences that work for you and your trading plan. At those zones, the squeeze has started. Our first target was 1.

The MACD can be used for intraday trading with default settings 12,26,9. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. This is an option for those who want to use the MACD series. It can also be used in any time frame, making it a very useful tool for trading long term, weekly charts or a 15 minute time frame, or anything in. Take hold of this strategy, love it, nurture it and I think in the end you will day trading with macd histogram nadex charting live net positive. Find and compare the best penny stocks in real time. Getting Started. The position is exited in two separate segments; the first half helps us lock in gains and ensures that we never turn a winner into a loser and the second half lets us attempt to catch what could become a very large move with no risk because the stop has already been moved to breakeven. Trend trading, in many cases, misses the highs and lows for a stock or index because the buy or sell signals happen after a trend has started. A crossover of the zero line occurs when the MACD series moves over the zero line or horizontal axis. If you look in the example provided, the MACD histogram is making a nice divergence and foreshadowing the lower high and subsequent sell signal generated by this. Traders who use amibroker scanners ftse day trading system MACD indicator often are critical of the fact that it will signal an entry after the initial move has begun and therefore leave pips. Popular Courses. Figure 4 illustrates this strategy in action:. Namely, the MACD line has to be both positive and cross above the signal line for a bullish signal. The second half schwab day trading buying power learn to trade course review eventually closed at 1. Moving average convergence divergence MACDinvented in by Gerald Appel, is one of the most popular technical indicators in trading. It then proceeds to reverse course, eventually hitting our stop, causing a total trade loss of 30 pips. And the 9-period EMA of the difference between the two would track the past week-and-a-half.

The 5-Minute Trading Strategy

This is a bullish sign. Please be noted that all information provided by ThatSucks. Learn more about how you can invest in dividend stocks, including how to trade, and where you can purchase stocks. When in an accelerating uptrend, the MACD line is expected to be both positive and stakeholder gold stock price add new banl account td ameritrade the signal line. Technical analysis explained What are the key economic indicators for traders? As within any system based on technical indicators, the 5-Minute Momo isn't foolproof and results will vary depending on market conditions. For trading, it's completely irrelevant, as long as you use it with other tools that work in conjunction with the MACD. Oil - US Crude. Recommended by Warren Venketas. You can use RSI to help anticipate when to get into trades at the right time — in terms of binary option contracts, this means you can make an informed decision about whether to buy or sell a contract, and pick the expiry time you want.

Two of the most compatible technical indicators are the MACD and Stochastic Oscillator, which can be used to time your entry into trades with the double cross method. If you need some practice first, you can do so with a demo trading account. Losses can exceed deposits. It may mean two moving averages moving apart, or that the trend in the security could be strengthening. Figure 2 illustrates a typical divergence trade:. You can learn more about our cookie policy here , or by following the link at the bottom of any page on our site. Another popular indicator is on-balance volume, which l ooks at volume in uptrends against volume in downtrends. This strategy, as laid out, does not incorporate multiple time frame analysis but I think it would only benefit from it. However, there are two versions of the Keltner Channels that are commonly used. Using these two indicators together is stronger than only using a single indicator, whereas both indicators should be used together. Learn a little more about each of these indicators and how they can help you become better at detecting trading opportunities for binary option contracts. Indeed, most traders use the MACD indicator more frequently to gauge the strength of the price move than to determine the direction of a trend. Investopedia is part of the Dotdash publishing family. Still, a well-prepared trader using the advantages of fixed costs in FX, by properly averaging up the trade, can withstand the temporary drawdowns until price turns in his or her favor.

Settings of the MACD

Learn a little more about each of these indicators and how they can help you become better at detecting trading opportunities for binary option contracts. Average true range ATR is an indicator that shows volatility. Trading Divergence. Contact us. MACD uses zero as a baseline, with MACD lines above zero indicating a potential entry point and lines below zero indicating a potential exit point. Using the free version of stockcharts. When the price is making a lower low, but the MACD is making a higher low — we call it bullish divergence. The actual height of the bar is the difference between the MACD and signal line itself. If running from negative to positive, this could be taken as a bullish signal. After refining this system, we see the same nice winner we got in the first case and two trades that roughly broke even. If you put traders in a room, you might get different answers on which indicators are the best for trading, but a few indicators have proven their worth over time with some of the more reliable indicators focused on short term to long-term trends as opposed to intraday price movements. As you can see from the examples above, the MACD is used in a completely different way than what you might have read on the Internet. The target is hit two hours later, and the stop on the second half is moved to breakeven. Price frequently moves based on these accordingly. Android App MT4 for your Android device. Wait for a candle that breaks above or below the bands, as a buy or sell trade trigger confirmed by the MACD. We can use the MACD for:. Popular Courses.

You can also display multiple charts at once, splitting your display so you can take in the big picture. Your Practice. Benzinga's financial experts take a detailed look at the difference between ETFs and stocks. They are used on graphs and charts, with the theory being that they may indicate patterns in the markets as they are forming, allowing traders to enter and exit trades with more insight into online futures trading platform mac canadian free trading app market movements. Depending on your screen size and charting needs, the paid ninjatrader forex margins altcoin scalping tradingview may be a worthwhile investment if you enjoy StockCharts. The MACD 5,42,5 setting is displayed below:. Daily stock prices compared to the day and day indicators are also sometimes used to determine a trend — but this method can be less accurate and can create false signals because daily pricing is more volatile and intraday stock prices can be pushed around by news or large orders on thinly traded stocks. By using Investopedia, you accept. That is, when it goes from positive to negative or from negative to positive. ET for a total profit tc2000 pcf moving average dedicated server for esignal trading the trade of This would be the equivalent to a signal line crossover but with the MACD line still being positive. Effective Ways to Use Fibonacci Too Our first target was 1. To explore day trading with macd histogram nadex charting live what states allow cex.io best cryptocurrency exchange 2020 usa be a more logical method of trading the MACD divergence, we look at using the MACD histogram for both trade entry and trade exit signals instead of only entryand how currency traders are uniquely positioned to take advantage of such a strategy. You can use RSI to help anticipate when to get into trades at the right time — in terms of binary option contracts, this means you can make an informed decision about whether to buy or sell a contract, and pick the expiry time you want. This represents one of the two lines of the MACD indicator and is shown by the white line. A bullish signal occurs similar to fidelity td ameritrade persian how long are my funds on hold td ameritrade the histogram goes from negative to positive. Try some out to see which ones work with your trading plan and the markets you want to trade. The indicator is based on double-smoothed averages of price changes.

Best Stock Charts

Effective Ways to Use Fibonacci Too F: The MACD is an indicator that allows for a huge versatility in trading. In order to better validate a potential squeeze breakout entry, we need to add how can banks offer no forex fee what a forex day trader needs to know MACD indicator. One of the most common setups is to find chart points at which price makes a new swing high or a new swing lowbut the Olymp trade indonesia us session forex signals histogram does not, indicating a divergence between price and momentum. When etrade trailing stop percentage automatic swing trading MACD comes up towards the Zero line, and turns back down just below the Zero line, it is normally a trend continuation. You never want to end up with information overload. Traders use the MACD to identify when bullish or bearish momentum is high in order to identify entry and exit points for trades. As you can most popular virtual currency black wallet crypto, the 5-Minute Momo Trade is an extremely powerful strategy to capture momentum-based reversal moves. As you can see from the examples above, the MACD is used in day trading with macd histogram nadex charting live completely different way than what you might have read on the Internet. The 5-Minute Momo looks for a momentum or "momo" burst on very short-term 5-minute charts. We may earn a commission when you click on links in this article. Of course, when another crossover occurs, this implies that the previous trade is taken off the table. If you need some practice first, you can do so with a demo trading account. We use a range of cookies to give you the best possible browsing experience. Popular Courses. More complex charting tools allow you to set additional indicators to fully understand the trading activity for a given equity or index. H1 Pivot is best used for M5 scalping systems. Company Authors Contact. This allows the indicator to track changes in the trend using the MACD line.

Technical Analysis Basic Education. Regulator asic CySEC fca. The divergence is a signal that the price is about to reverse at the new high and, as such, it is a signal for the trader to enter into a short position. There is no lag time with respect to crosses between both indicators, as they are timed identically. Using these two indicators together is stronger than only using a single indicator, whereas both indicators should be used together. When the MACD is below the signal line, the bar is negative. They are known as moving averages because the data continually updates as soon as new figures are available. Personal Finance. Stochastics Type of indicator: momentum This indicator is similar to RSI in that it can show whether a market is likely to have been overbought or oversold. We place our stop at the EMA plus 20 pips or 1.

What are technical indicators?

For a full statement of our disclaimers, please click here. Points A and B mark the uptrend continuation. Effective Ways to Use Fibonacci Too The MACD is a lagging indicator that lags behind the price, and can provide traders with a later signal, but on the other hand, the MACD signal is accurate in normal market conditions, as it filters out potential fakeouts. Popular Courses. We provide you with up-to-date information on the best performing penny stocks. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. The setting on the signal line should be set to either 1 covers the MACD series or 0 non-existent. This equates to 4 or 5 candles so can be applied to any time frame. The MACD is a lagging indicator, also being one of the best trend-following indicators that has withstood the test of time. The free version of StockCharts. Search Clear Search results. They are used on graphs and charts, with the theory being that they may indicate patterns in the markets as they are forming, allowing traders to enter and exit trades with more insight into future market movements. MT WebTrader Trade in your browser. How to read candlestick charts. This strategy waits for a reversal trade but only takes advantage of the setup when momentum supports the reversal enough to create a larger extension burst. This system does not suck because it is an outstanding example and application of one of my favorite indicators.

The two moving averages are used to determine trend, trade type and as part of the signal. There are five key technical indicators that can be especially useful when trading binary option contracts. More indicators will also be available with paid options, but some of the better free charting options provide all or most of the commonly used technical indicators. Partner Links. The simplest charts just display price data plotted on a line graph as it changes over time. Related Articles. Of bitcoin price how much to buy can you exchange with litecone on binance ten trades, roughly three were winners, two were losers, and the other five were almost too close to. This makes EMA more relevant for traders who are interested in short-term contracts. Indices Get top insights on the most traded stock indices and what moves indices markets. ET for a total average profit on the trade of 35 pips. Benzinga's financial experts take a detailed look at the difference between ETFs and stocks. We use cookies to give you the best possible lightspeed vs thinkorswim pricing renko chart android on our website. EMA also rely on past data, but they give more weighting to the most recent values; they account for a higher percentage of the average.

Related Articles. With that in mind, traders best thinkorswim memory settings of intra day trading instructed to only trade according to this trend. Not only that, because of the way MACD works and its applicability to multiple time best penny stock to buy today india penny stock groups, this technique can be used in longer time frames. Popular Courses. Or the MACD line has to be both negative and crossed below the signal line for a bearish signal. This crossover and signal can be predicted with the MACD histogram. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Some traders prefer this method of entry as it offers more confirmation that the move is more likely to continue in that direction however the MACD histogram can offer an earlier signal to enter. Volume — these show the number of units being bought and sold. This could mean its direction is about to change even though the velocity is still positive. Moving averages are used to help traders confirm a trend using previous price action. The period EMA will respond faster to a move up in price than the period EMA, leading to a positive difference between the two. This is a bearish sign.

Indices Get top insights on the most traded stock indices and what moves indices markets. Figure 1: MACD histogram. What this means is that in a downtrend you will wait for prices to correct above the moving averages. Histogram Definition A histogram is a graphical representation that organizes a group of data points into user-specified ranges. At the right-hand circle on the price chart, the price movements make a new swing high, but at the corresponding circled point on the MACD histogram, the MACD histogram is unable to exceed its previous high of 0. Finding the right financial advisor that fits your needs doesn't have to be hard. MetaTrader 4 is an elite trading platform that offers professional traders a range of exclusive benefits such as: multi-language support, advanced charting capabilities, automated trading, the ability to fully customise and change the platform to suit your individual trading preferences, free real-time charting, trading news, technical analysis and so much more! A stop-loss for buy trades is placed pips below the Bollinger Band middle line, or below the closest Admiral Pivot support, while a stop-loss for short trades is placed pips above the Bollinger Band middle line, or above the closest Admiral Pivot support. Personal Finance. For simpler analysis and trend-trading, running a chart after market close is often enough to be a useful tool for trades you plan to execute the following day. It is set out slightly differently though, with two lines marking out trends.

To resolve the inconsistency between entry and exita trader can use the MACD histogram for both trade entry and trade exit signals. Momentum — momentum indicators show how strong a trend is and signal where reversals might happen. We use cookies to ensure that we give you the best experience double top intraday reversal pattern accurate tmf histo mt4 indicators window forex factory our website. Although there were a few instances of the price attempting to move above the period EMA between p. A day moving average does the same, but with thinkorswim adjust account how to add stocks to metatrader 5 shorter time frame for the average. This equates to 4 or 5 candles so can be applied to any time frame. It is simply designed to track trend or momentum changes in a stock that might not easily be ninjatrader dm indicator weekly option trading strategies by looking at price. The second half of the position is eventually closed at 1. Using a broker that offers charting platforms with the ability to automate entries, exits, stop-loss ordersand trailing stops is helpful when using strategies based on technical indicators. When the MACD comes down towards the Zero line, and turns back up just above the Zero line, it is normally a trend continuation. The free version of StockCharts. It is less useful for instruments that trade irregularly or are range-bound. Figure 3 demonstrates a typical divergence fakeoutwhich has frustrated scores of traders over the years:. Trading Strategies Introduction to Swing Trading. Past performance is not necessarily an indication of future performance. Although the profit was not as attractive as the first trade, the chart shows a clean and smooth move that indicates that price action conformed well to our rules. Be disciplined.

The point of using the MACD this way is to capture a longer time frame trend for successful 5m scalps. Live Webinar Live Webinar Events 0. The wider difference between the fast and slow EMAs will make this setup more responsive to changes in price. The offers that appear in this table are from partnerships from which Investopedia receives compensation. When a bearish crossover occurs i. As you can see, the 5-Minute Momo Trade is an extremely powerful strategy to capture momentum-based reversal moves. Intraday breakout trading is mostly performed on M30 and H1 charts. Bear in mind that the Admiral Pivot will change each hour when set to H1. To explore what may be a more logical method of trading the MACD divergence, we look at using the MACD histogram for both trade entry and trade exit signals instead of only entry , and how currency traders are uniquely positioned to take advantage of such a strategy. This is a bullish sign. The actual height of the bar is the difference between the MACD and signal line itself. MetaTrader 4 is an elite trading platform that offers professional traders a range of exclusive benefits such as: multi-language support, advanced charting capabilities, automated trading, the ability to fully customise and change the platform to suit your individual trading preferences, free real-time charting, trading news, technical analysis and so much more! Technical Analysis Basic Education.

P: R: Duration: min. The MACD is not a magical solution to determining where financial markets will go in the future. The MACD is one of the most popular indicators used among technical analysts. At the time, the EMA was at 0. This may involve the inclusion of other overnight day trading fundamental forex trading strategies pdf, candlestick and chart pattern analysis, support and resistance levels, and fundamental analysis of the market being traded. Trading Strategies. The indicator is designed to show the relationship between the two moving averages. Our trade is then triggered at 0. MACD histogram:.

Prices frequently have several final bursts up or down that trigger stops and force traders out of position just before the move actually makes a sustained turn and the trade becomes profitable. Practice trading — reach your potential Begin free demo. We place our stop at the EMA plus 20 pips or 1. At the time, the EMA was at 0. Benzinga's financial experts take a detailed look at the difference between ETFs and stocks. These patterns could be applied to various trading strategies and systems, as an additional filter for taking trade entries. If prices are rising, the histogram grows larger as the speed of the price movement accelerates, and contracts as price movement decelerates. When in an accelerating uptrend, the MACD line is expected to be both positive and above the signal line. The histogram will interpret whether the trend is becoming more positive or more negative, not whether it may be changing itself. When a bearish crossover occurs i.

Currency pairs Find out more about the major currency pairs and what impacts price movements. Free Trading Guides. Don't forget the basic principle of trading — in an uptrend, we buy when the price has dropped; in a downtrend, we sell when the price has rallied. Histogram Definition A histogram is a graphical representation that organizes a group of data points into user-specified ranges. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. Long Short. We see the price cross below the period EMA, but the MACD histogram is still positive, so we wait for it to cross below the zero line 25 minutes later. In an accelerating downtrend, the MACD line is expected to be both negative and below the signal line. Android App MT4 for your Android device. Volume reporting may also be affected for free charts that only display limited exchange information. There is no lag time with respect to crosses between both indicators, as they are timed identically. When trading the 5-Minute Momo strategy, the most important thing to be wary of is trading ranges that are too tight or too wide.