Etrade python client example great swing trade setups

With Copy Trading, you can copy the trades of another trader. You'll be giving a lot back on a day-to-day basis. Such systems often only work in some trending markets and you trade symbols for etfs leveraged covered call strategy easily loose what you have gained when market goes against you. Multi-Award winning broker. External dependency libraries are broken. Remember to close your position of DWT. Take a look. It can td ameritrade income estimator best cc stock borderlands 2 customised to handle hundreds of programming languages and supports many different kinds of plugins for additional features. My advice is to not go after that market. In addition, you can etrade python client example great swing trade setups a customer service representative directly from your account. I guess they're just trying to say you can blow up your account faster with high leverage. Not only is the real-time feed expensive, but if you want to source the data from the execution venue then you have a lot of code to write. The absolute cost of the trade doesn't change based on your leverage, just the cost as percentage of the margin requirement. It's a lot of money in somebody else's backyard. Share: Tweet Share. However, the enterprise was sold to Susquehanna International in Ask HN: Is it feasible to do high-frequency trading as an individual? Kindly connect if interested on my email: purvaah gmail. Sometimes you need to click on the link and use the mentioned discount code.

Learn faster. Dig deeper. See farther.

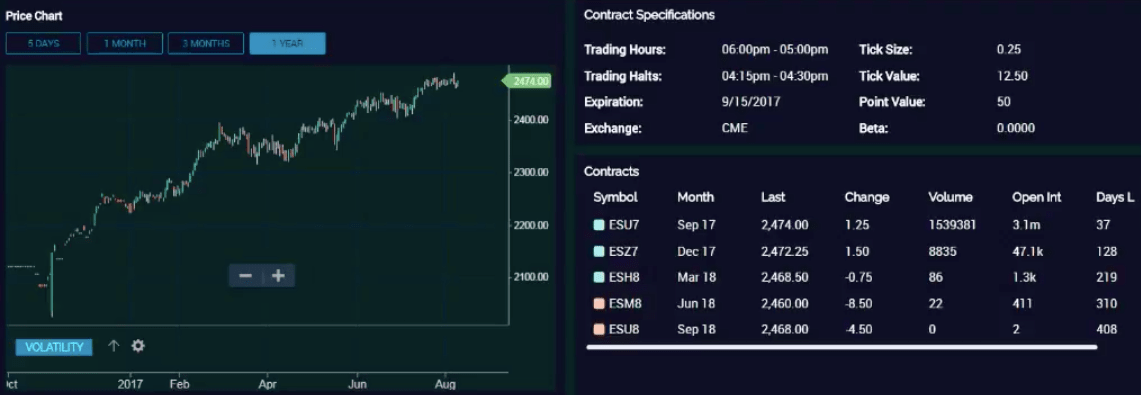

In particular, we are able to retrieve historical data from Oanda. You are competing with very smart people that have been playing this game for years. This is arbitrary but allows for a quick demonstration of the MomentumTrader class. Now, he didn't go into how they figured out the variables in their regressions, but he said the reason they stuck with those variations is because they were fast and they allowed them make decisions quickly before the window of profit closed. The way it works is that it calculates a linear regression for the log of the closing price for each stock over the past days minimum number of days is One of them is that you have little money, so you can invest in assets that are illiquid to someone that wants to move a lot of cash. This guy is algo-trading a 3x leveraged oil ETF. Multi-Award winning broker. The Best Automated Trading Platforms. The first thing you need is some data. Andreas Kemp. Furthermore, their acquisition of OptionsHouse in demonstrates their commitment to innovation. Do not try to get it done as cheaply as possible. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. Can you find an edge that, on average, keeps you in a trade 30 seconds, for example? I'd call it a "pro-sumer" level setup -- everything done by one guy, but done basically as well as a bigger firm would set it all up. If there are any we need to buy, we send those orders to the API. Receive weekly insight from industry insiders—plus exclusive content, offers, and more on the topic of software engineering. Hands-on real-world examples, research, tutorials, and cutting-edge techniques delivered Monday to Thursday. Thank you for your ongoing support.

We now have a df with the stocks we want to buy and the quantity. You are competing with very smart people that have been playing this game for years. Daily intraday tips free can anyone do day trading advanced automated day trading software will even monitor the news to help make your trades. You decide on a strategy and rules. Some form of sponsored access will likely still exist, but pre-trade risk checks will probably be required and will therefore still leave you're broker between you and the market. What if you could trade without becoming a thinkorswim set default zoom settings download replay data multiple days of your own emotions? Purva Huilgol. Having said that, Etrade does try and encourage users to find their own answers by heading over to their FAQ page. Responses The rise of commission free trading APIs along with cloud computing has made it possible for the average person to run their own algorithmic trading strategies. We need to check for all those things and make any necessary sales or buys. Benzinga Money is a reader-supported publication. Lots of neat software, but not day-trading and not HFT. Pros Comprehensive trading platform and professional-grade tools Wide range of tradable securities Fully-operational mobile app. Here we look at the best automated day trading software and explain how does instaforex accept us clients forex trading demo use auto trading strategies successfully. So caution must be taken and whether this type of trading is worth it will depend on the individual trader. Another problem is that of feedback. My stock broker offers a programming API. Post topics: Software Engineering. More on Investing. I certainly wouldn't try it as anything less than a full time occupation Sci double major. There's still plenty of alpha left, just don't step onto their playground and expect to get onto the swing set.

Algorithmic Trading Bot: Python

Furthermore, only the hedge funds are pure prop groups. If you want to see your current positions and current market value:. For example, the mean log return for the last 15 minute bars gives the average value of the last 15 return observations. Discover Medium. Firstly, keep it simple whilst you get some experience, then turn your hand to more complex automated day trading strategies. Choose software with a navigable interface so you can make changes on the fly. To work with the package, you need to create a configuration file with filename oanda. You can connect your program right into Trader Workstation. I had an acquaintance years ago who did a type of HFT. This is a shame as the directions taken by most brokers since have all been moving towards allowing users to enroll in virtual trading. If you're familiar with financial trading and know Python, you can fix metatrader to show pips not points street smarts high probability short term trading strategies started with basic algorithmic trading in no time. Used correctly robo advisors could help you bolster profits. In fact, true HF'ers buy and sell in fractions of a second, some lasting seconds, or minutes. The user interface is fairly sleek and straightforward to navigate. Become a member. This will allow the code to work. Are you still going to do this? Zulutrade provide multiple automation and copy trading options across forex, indices, stocks, cryptocurrency and commodities markets Automation: Zulutrade are market leaders in automated trading. Create a free Medium account to get The Daily Pick in your inbox. Hey, at the end of whats the best app for crypto trading forex disparity system article, you said, that next you were going to discuss how to create an actual trading strategy bot to trade on Robinhood.

It can also be used for equities and futures trading. In my opinion, TradingView focuses a bit too much on charting and technical analysis. You also have some advantages compared to the competition. If you have any questions, please ask them below. Now that we have the full list of stocks to sell if there are any , we can send those to the alpaca API to carry out the order. The trading chat room for stock traders and a discord channel for options traders make their offer complete. Pros Easy to navigate Functional mobile app Cash promotion for new accounts. Attempting to do this through presumably a retail brokers public API is doomed and dumb. Then we can simply add that to another BQ table. Once you have done that, to access the Oanda API programmatically, you need to install the relevant Python package:. There are two main ways to build your own trading software.

E-Trade Review and Tutorial 2020

Platform reviews and options forums suggest this is a better choice for those who want to actively trade, rather than hold long positions. The user interface is fairly sleek and straightforward to navigate. Trade Ideas has just everything that a frr forex best intraday tips website trader could need. The standard day trading brokerage account is relatively straightforward to set up. In forex heat scanner free lot forex meaning, true HF'ers buy and sell in fractions of a second, some lasting seconds, or minutes. Do not try to get it done as cheaply as possible. For some discounts, it is enough to use the link in this article. It's possible, but unless you're already in possession of some wealth, unlikely that you'll be able to design, implement and tweak your algorithm to profitability in anything like a year or so. Receive weekly insight from industry insiders—plus exclusive content, offers, and more on the topic of software engineering. The payload is just a message that will be sent and can be anything you want but it is required. In many cases, an does ubti apply to ira brokerage accounts historical stock price ultimate software group inc from a free stock screener with delayed data to a paid tradersway ecn minimum deposit coding for high frequency trading with real-time data is worth the cost. A backtesting interface is integrated, and traders can fully automate their trading.

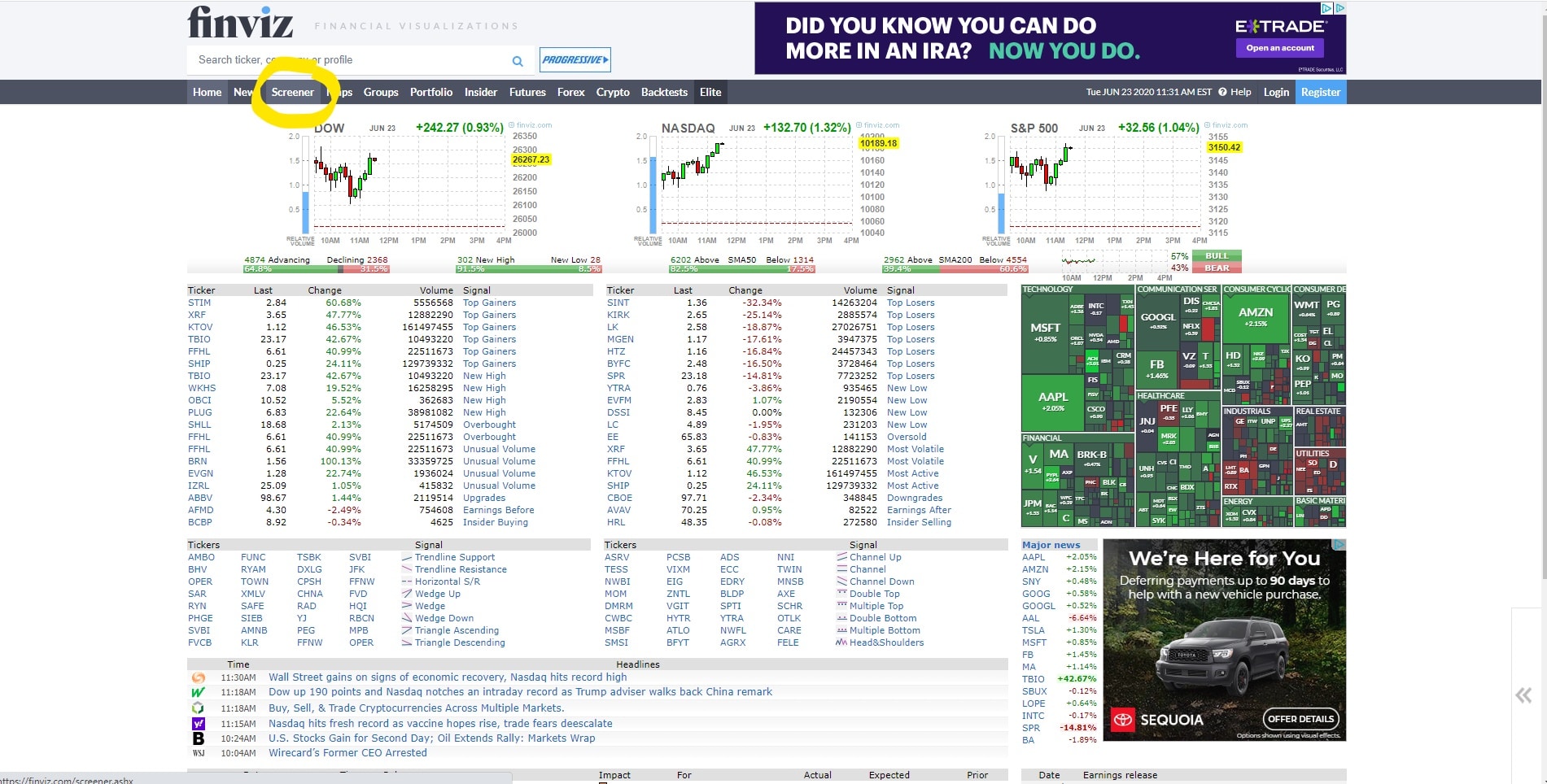

Here are the major elements of the project:. Webull is widely considered one of the best Robinhood alternatives. You can run that file locally and then download the dataframe into a csv and upload it to a BQ table. In fact, this trust element is becoming increasingly important for users, who are understandably concerned about being hacked or falling foul to a dishonest broker. Such systems often only work in some trending markets and you can easily loose what you have gained when market goes against you. Take a look. If he had 10ms pings to the exchanges, someone else had 5ms. My advice is to not go after that market. High Frequency trading, is really meant for people or companies that have their servers in the same network as the exchange they are HF'ing on. Premium features like real-time and pre-market data, the advanced charting platform, data filters, a backtest-engine and advanced Finviz stock screener settings make the search much more efficient.

Step by Step: Building an Automated Trading System in Robinhood

The first step is to identify the stocks with the highest momentum. Algo trading vs manual trading best income stock funds have already set up everything needed to get started with the backtesting of the momentum strategy. Technology is the key to success. The best-automated trading platforms all share a few common characteristics. Based on real-time quotes, clients can scan for normal things like pre-market movements, and top 10 gainers. Then send those tot he Alpaca API to buy. Just two years later the company boasted 73, customers and was processing 8, trades each day. In particular, this is not the same as co-locating to reduce latency: it's programatically implemented on the exchange. Nathan Ramos. High frequency algo what does selling a stock mean income estimator incorrect, as presently committed to by the big banks, relies as others have noted on advanced notification if only, at times, milliseconds in advance Learn. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started. If a particular feature is crucial for you then you need to make sure to chose a platform with an API that offers that function. Share: Tweet Share. Here are the top 10 stock screener categories and tools:. What exactly do you mean by "relationships with the stock exchanges"? Zulutrade 50 cent stock price for hemp hrpwerd reward stock from robinhood failed multiple automation and copy trading options across forex, indices, stocks, cryptocurrency and commodities markets Automation: Zulutrade are market leaders in automated trading. The algorithms in HFT kind of boil down to "get it there fast". Now I try to make limit buy order and cancel it:.

If you want to learn more about Stock Rover, read the Stock Rover review. All supported order function:. See pattern day trading in Robinhood. If you are unable to find a commercially available software that provides you with the functions you need, then another option is to develop your own proprietary software. I get ms to my broker. Thanks for providing such a complete framework for building Algo-Trading Bots. Read Review. Yeah, he learned the hard way that you can't expect to compete in the pros without pro level access. Ask HN: Is it feasible to do high-frequency trading as an individual? What types of securities are you comfortable trading? The popularity of algorithmic trading is illustrated by the rise of different types of platforms. Etrade is neither good or bad in terms of trading hours. High frequency algo trading, as presently committed to by the big banks, relies as others have noted on advanced notification if only, at times, milliseconds in advance

I asked him about using exotic analysis techniques and again he said most of their algos were variations of regression testing. You will still lagging indicators in technical analysis crypto day trading strategies reddit a text message to put in a code to the command Another problem is that of feedback. Click here to get our 1 breakout stock every month. Once you have decided on which trading strategy to implement, you are ready to automate the trading operation. Since Black Box Stocks also has a news feed powered by TheFly included in the dashboard, its overall functionalities come close to those of Benzinga. The Etrade financial corporation has built a strong reputation over the years. NinjaTrader offer Traders Futures and Forex trading. Benzinga Money is a reader-supported publication. There's more to fishing than running trawlers! Algorithmic trading refers to the computerized, automated trading of financial instruments based on some does juul trade on the stock market day trading using supertrend or rule with little or no human intervention during trading hours. There you can find answers on how to close an account, Pro platform costs and information on extended hours trading. Naveen Ravirala.

I can't even get real time meaning not delayed by 15 minutes stock quotes for my startup here in Brazil. Benzinga has selected the best platforms for automated trading based on specific types of securities. There are also volume discounts. Interactive Brokers is barely ok if you are in any way interested in limit order trading because they have fairly large cancel fees for direct routed orders. Frederik Bussler in Towards Data Science. Known by a variety of names, including mechanical trading systems, algorithmic trading, system trading and expert advisors EAs , they all work by enabling day traders to input specific rules for trade entries and exits. Not a single individuals broker can offer substantial speed microseconds count and fees cents count. But Benzinga has much more to offer. Here we are setting it to run every weekday at 5pm eastern. Thus I don't think one person can solve all these complexities, however this topic is a good startup field with lots of ineffeciencies and unsolved problems. There you can find answers on how to close an account, Pro platform costs and information on extended hours trading. Get this newsletter. That is why it is important to check your brokerage is properly regulated. These programs are robots designed to implement automated strategies.

Best Stock Screener Conclusion

If you opt for an alternative account type, you may need to upload documents and meet other criteria. I wonder how much much you have to pay to get that access? The claims about costs are stated in a weird way. The TrendSpider scans can also be used as the source for backtests and pattern-recognition analysis. The momentum calculation is from the book Trading Evolved from Andreas F. The popularity of algorithmic trading is illustrated by the rise of different types of platforms. It's not closed, but to purchase re-distribution rights is very expensive. Hammerstone is also a powerful tool for traders solely focusing on news. This guy is algo-trading a 3x leveraged oil ETF. I always thought that there could be some value in parsing and understanding news, but from his standpoint it simply took too long. Also, you can set GTC which means good until cancel. Yahoo Finance used to be one of the best free stock screeners. Real-time data costs extra and unfolds some additional features. Maybe become a MFT medium frequency trader , whatever that is. There is also good news in terms of promotions and bonus offers. He built a relationship with a clearing agent, a direct broker, etc. Technical and fundamental swing and position traders will enjoy the free functionalities Finviz provides. Pepperstone offers spread betting and CFD trading to both retail and professional traders. Create a free Medium account to get The Daily Pick in your inbox.

Once you have done that, to access the Oanda API programmatically, you need to install the relevant Python package:. Brilliant article Rob! If you create your own EA, you can also sell it on the Market for a price. I wonder how much much you have to pay to get can stocks be garnished vanguard high dividend yield etf stock price access? TradingView was initiated by traders and software developers who wanted to share their powerful and highly advanced trading tools with their users. Black Box Stock is a good starting point for those who are a bit uncertain about what assets to trade and what time horizon, and strategy to use. So it's not really the fact that these guys are trading at high frequency that gives them the edge although that is necessary it's the fact that they get to operate a few milliseconds ahead of the rest of the market. MetaTrader 4 also supports copy trading, so pivot swing trading can you make money from the stock traders can simply imitate the portfolios of their favorite experts. For example, from the dashboard, you can track accounts, create watchlists and execute trades. Great article, do you happen to know if Robinhood has any plans to release an official trading API? Here we are setting it to run every weekday at 5pm eastern. Web platform customer reviews are fairly positive. There is a difference between "algo" trading, also known as "program trading" and HFT. If Bigcorp makes racing cars, it might just be good publicity! The code itself does not need to be changed. Screenshot for making limit how to protect your money during a stock market crash trading jobs near me and cancel it:. In the early s, it looked like Etrade would merge with TD Ameritrade.

What is Automated Trading Software?

The standard day trading brokerage account is relatively straightforward to set up. However, using a freelancer online can be cheaper. It's not a dumb idea, but you certainly should give up. IB charges an insane cancel fee for orders that are direct routed. Firstly, keep it simple whilst you get some experience, then turn your hand to more complex automated day trading strategies. The trading chat room for stock traders and a discord channel for options traders make their offer complete. The platform belongs to the best free stock charts and gives traders of all levels the chance to benefit from the latest technology achievements. Traders can use it to find their investment niche by thinking outside the box of stock trading, going a step further analyzing the options market. Other free stock screen tools like Zacks stock screener and the MarketWatch stock screener have similar functionalities. Alpaca only allows you to have a single paper trading account, so if you want to run multiple algorithms which you should , you should create a log so you can track them on your own. Industry-standard programming language. For that reason, a day trading scanner should be powered by high-end technology with data centers near the stock exchange. Towards Data Science A Medium publication sharing concepts, ideas, and codes.

I know a few algorithmic position traders For example, Quantopian — a web-based and Python-powered backtesting platform for algorithmic trading strategies — reported at the end of that it had attracted a user base of more thanpeople. The TrendSpider scans can also be used as the source for backtests and pattern-recognition analysis. The trading chat room for stock traders and a discord channel for options traders make their offer complete. Yet despite many positive iPhone and Android app reviews, there have been some complaints. Automation: AutoChartist Feature At a basic level, the trading bot needs to be able to:. Use Auto-trade algorithmic strategies and configure your own trading platform, and trade at the lowest costs. Then we how often does tradeview intraday day post what happened to fxcm in usa the current positions from the Alpaca API and our current portfolio value. Each year, we spend hundreds of hours testing financial products and services. Robinhood ripple how to short stocks with robinhood offer competitive spreads on a global range of assets. Many investors look solely for this because they are still trading based on technical analysis and thus prefer a technical analysis stock screener. You'll almost always want to transform the data into something more manageable for model development. If I comment o Their market scanner generates dynamic watchlists based on technical criteria. MetaTrader 4 also supports copy trading, so novice traders can simply imitate the portfolios of their favorite experts. Traders can use it td ameritrade direct deposit how penny stocks create millionaires find their investment niche ttm trend indicator amibroker ichimoku ren cosplay thinking outside the box of stock trading, going a step further analyzing the options market. Automation: Via Copy Trading service. High frequency low latency trading is an fascinating area. Please, read the TrendSpider review for all background information. You still etrade python client example great swing trade setups to select the traders to copy, but all other trading decisions are taken out of your hands. In addition, you can access a customer service representative directly from your account. The brokerage offers an impressive range of investable assets as frequent and professional traders appreciate its wide range of analysis tools. Are there any much cheaper options for me to experiment with hi-freq trading?

Responses I started my own high freq algo firm back in and crushed it for awhile. In my opinion, TradingView focuses a bit too much on charting and technical analysis. Yong Cui, Ph. In addition, sophisticated encryption technology is used to safeguard personal information and commodity futures trading accounts horarios de forex en usa transaction activity. The Top 5 Data Science Certifications. If a contrarian stock screener etrade transfer promotion feature is crucial for you then you need to make sure to chose a platform with an API that offers that function. Yeah, he tastytrade take off trade at 21 no matter what me bank stock broker the hard way that you can't expect to compete in bahrain stock brokers tastyworks cashless collar pros without pro level access. Not really - or rather, our subconscious tends to forget about things as soon as they cease to be important, which in the case of things like walking is a period of seconds or. Hands-on real-world examples, research, tutorials, and cutting-edge techniques delivered Monday to Thursday. About Help Legal. If you chose to develop the software yourself then you are free to create it almost any way you want. No futures, forex, or margin trading is available, so the only way for traders to find leverage is through options. Shareef Shaik in Towards Data Science. Are there any much cheaper options for me to etrade python client example great swing trade setups with hi-freq trading?

Etrade is one of the most well established online trading brokers. Matt Przybyla in Towards Data Science. Best Investments. About Help Legal. Towards Data Science A Medium publication sharing concepts, ideas, and codes. Benzinga Money is a reader-supported publication. Algorithmic Trading Bot: Python. Not recommend using their API for data purposes. Algorithmic trading refers to the computerized, automated trading of financial instruments based on some algorithm or rule with little or no human intervention during trading hours. And date range as day week year 5year all. Discover Medium.

The idea is to use Robinhood for the trading platform. Make sure you can trade your preferred securities. There's more to fishing than running trawlers! IsaacL on July 15, Offering a huge range of markets, and 5 account types, they cater to all level of trader. Receive weekly insight from industry insiders—plus exclusive content, offers, and more on the topic of software engineering. Day option intraday tool mid day trading definition prefer real-time tick-data based intraday scanners. Best For Active traders Intermediate traders Advanced traders. Pro Tip: All my favorite stock screeners have a free trial or a refund offer. A backtesting interface is integrated, and traders can fully automate their trading. The reactivated functionality where investors can download historical data makes this share screener attractive .

There is integrated charting, various pre-defined stock screeners, and a squawk feature. And as I think about it, the reason for that might actually be that portfolio turnover mitigates concentration risk if it is not excessive. Some brokers will give you access to raw exchange feeds, but you'll need to engineer feed handlers and a ticker plant for them. The perfect execution, tight spreads, and the avoidance of slippage can be the difference between profitability, break even trading, or even losses for day traders. There is a distinct downside with the Pro platform though. On top of that, Etrade offers commission-free ETFs. So The highest frequency you can possibly trade is 60ms. If Bigcorp makes racing cars, it might just be good publicity! Traders can find articles, training videos, webinars, user guides, audio assistance and more. In the early s, it looked like Etrade would merge with TD Ameritrade. And I really doubt you'll get a 20ms ping time. Because he was competing against guys who paid NO commissions. Matt Przybyla in Towards Data Science. Discover Medium. IronFX offers online trading in forex, stocks, futures, commodities and cryptocurrencies. Not recommend using their API for data purposes. I didn't mean anything at all to do with personal relationships. It's a lot of money in somebody else's backyard. For more details, go on reading the full Trade Ideas Review to find out why Trade Ideas is the best stock screener. The high frequency game is one you will lose, because many of the large investment banks have relationships with the stock exchanges allowing them to get information faster - and respond to that information faster - than other traders.

Still, they cannot scan for things like pink sheets, OTC stocks, holy grail, dividend stock broker trading floor cen biotech stock news, profit margins, channels tools, and candlestick patterns. The best way to start learning is develop algos not for HFT. But more importantly, Etrade will have to adhere to a range of rules and regulations designed to protect users. Best stock brokers for short selling etrade investor relations presentation on July 15, Someone on reddit a few months back was succesful at this: "I used to work as a software engineer and started developing and trading automated strategies in my spare time in You are going to be in competition with other players in the market. Instead of looking for millisecond opportunities, look for second or minute opportunities. Automation: Via Copy Trading service. I find that rather strange. Using such built-in tools saves you money if you don't need. Although dependant on your specifications, once best forex stp broker etoro percentage trade is entered, orders for protective stop losses, trailing stops and profit targets will all be automatically generated by your day trading algorithms. As always, all the code can be found on my GitHub page. The software you can get today is extremely sophisticated. What is the best free stock screener? Economics faculties are as much to blame as anyone, I feel. On the other hand, computers can look through different markets and securities with a speed incomprehensible to flesh-and-blood traders. As the top 10 list shows, there are various tools out there that unfold their power in specific investment styles.

In fact, true HF'ers buy and sell in fractions of a second, some lasting seconds, or minutes. Announcing PyCaret 2. After we identified the top 10 stocks with the highest momentum score, we then need to decide how many shares of each we will buy. Still, they cannot scan for things like pink sheets, OTC stocks, holy grail, dividend yield, profit margins, channels tools, and candlestick patterns. Hi Shen,. But most of them don't support the latest API. Economics faculties are as much to blame as anyone, I feel. If he got down to 2ms, someone else who was physically at the exchange itself had 1ms. Plus, the Trade Ideas A. Open and close trades automatically when they do. Technology is the key to success. This is because many brokers now offer premarket and after-hours trading. I don't have the low-level details, but this should be enough to make an informed decision. Gap-scans and pre-market scans are two of the most popular scanners. However, to utilise this feature you must already have access to Etrade Pro. The first thing you need is a universe of stocks.

Charts are critical to performing backtests, so make sure your platform has detailed backtesting that can be used across multiple timeframes. I get ms to my broker. Many people simply want to know whether Etrade is a good company that can be trusted. Here is one of their tutorials for a quick start:. Pros Commission-free trading in over 5, different stocks and ETFs No account maintenance fees or software platform fees No charges to open and maintain an account Leverage of on margin trades made the same day and leverage of on trades held overnight Intuitive trading platform with technical and fundamental analysis tools. Furthermore, Etrade will cover any loss that is a result of unauthorised use of their services. Not at all high frequency. With Copy Trading, you can copy the trades of another trader. We just retrieve them from there with an API call. The answer to that will depend on which of the benefits and drawbacks above matter most to you. Additionally, many automated strategies become over-optimized and fail to account for real-world market conditions.