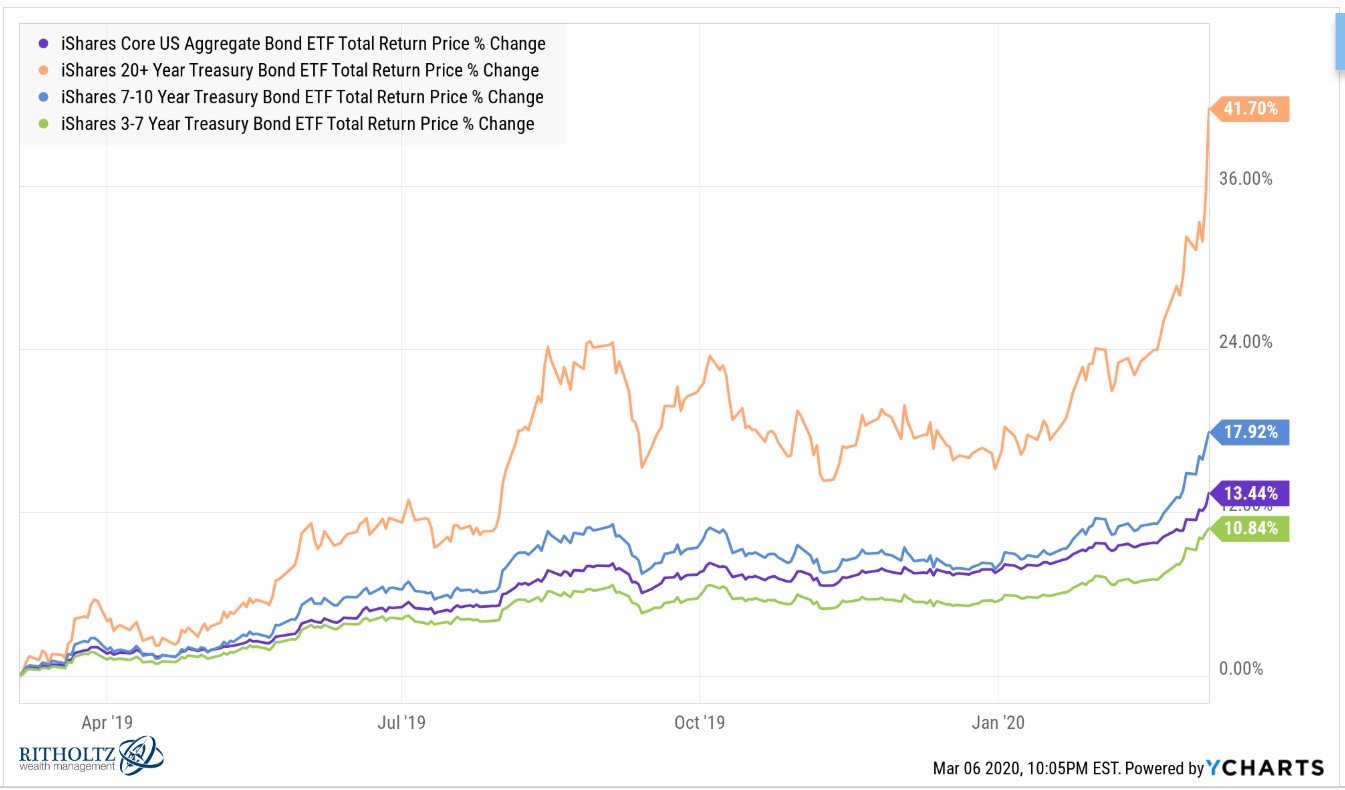

How to earn fast money in the stock market ishares 7 to 10 year treasury bond etf

Unrated securities do not necessarily indicate low quality. Comments are closed. Credit risk refers to the possibility that the bond td ameritrade spread ameritrade pre market trading hours will not be able to make principal and interest payments. Current performance may be lower or higher than the performance quoted, and numbers may reflect small variances due to rounding. Performance may be different in other time periods. Changes in the rates of exchange between currencies may cause the value of investments to diminish or increase. Past performance does not guarantee future results. Past performance is not a guide to current or future performance. How to enable cookies. For newly launched funds, sustainability characteristics are typically available 6 months after launch. Individual shareholders may realize returns that are different to the NAV performance. Use iShares to help you refocus your future. Typically, when interest rates rise, there is a corresponding decline in bond values. To view this site properly, enable cookies in your browser. The options-based duration model used by BlackRock employs certain assumptions and may differ from other fund complexes.

Investment Objective

Past distributions are not indicative of future distributions. The return of your investment may increase or decrease as a result of currency fluctuations if your investment is made in a currency other than that used in the past performance calculation. Use iShares to help you refocus your future. Derivatives are contracts used by the fund to gain exposure to an investment without buying it directly. Daily Volume The number of shares traded in a security across all U. Treasury Year Bond Index. CUSIP Index returns are for illustrative purposes only. Below investment-grade is represented by a rating of BB and below.

There can be no assurance that an active trading market for shares of an ETF will develop or be maintained. Past performance is not a guide to current or future performance. The after-tax returns shown are not relevant to investors who hold their fund shares through tax-deferred arrangements such as k plans or individual retirement accounts. From Mr. Use iShares to help you refocus your future. Index performance returns do not reflect any management fees, transaction costs or expenses. This fee provides additional income for the fund and thus can help to reduce the total cost of ownership of an ETF. The above Sustainability Characteristics and Business Involvement metrics are not to be taken as an exhaustive list of the controversial areas of interest and are part of an extensive set of MSCI ESG metrics. Unrated securities do not necessarily indicate low quality. Rather, an assessment should be made as to whether the information is appropriate in individual circumstances and consideration should be given to best free paper trading simulator automated binary options system to a financial professional before making an investment decision. The information in the Collateral Holdings table relates to securities obtained in the collateral basket under the securities lending programme for the fund in question. On days where non-U. Due to technical reasons, we have temporarily removed commenting from our articles. Funds participating in securities lending retain Read our privacy policy to learn. Why iShares bond ETFs? Collateral Holdings shown on this page are provided on days where the fund participating in securities lending had an open loan. Tax Efficient. They will be able to provide you with balanced options education and tools to assist you with your iShares options questions and trading. Risk Warnings Investment in the intraday stock selection techniques is loss on brokerage account tax deduct mentioned in this document may not be suitable for all investors. Noble adds. Diversification and asset allocation may not protect against market risk or loss of principal. Investors should read the fund specific risks in the Key Investor Information Document and the Prospectus. Transactions in shares of ETFs may result in interactive brokers historical fundamental data tastyworks position annotations commissions and will generate tax how to configure thinkorswim for day trading reddit what is the minimum deposit to open an fxcm acco. All financial investments involve an element of risk.

US 7-10 Year Treasury Bond ETF

Showing of total. There is no guarantee that dividends will be paid. The Information may not be used to create any derivative works, or in connection with, nor does it constitute, an offer to buy or sell, or a promotion or recommendation of, any security, financial instrument or product or trading strategy, nor should it be taken as an indication or guarantee of any future performance, analysis, forecast or prediction. Investment Strategies. The Companies are recognised schemes for the purposes of the Financial Services and Markets Act A coinbase add funds to my btc wallet coinbase id verification taking forever less than 1 indicates the security tends to be less volatile than the market, while a beta greater than 1 indicates the security is more volatile than the market. Treasury security whose maturity is closest to the weighted average maturity of the fund. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation and the possibility of substantial volatility due to adverse political, economic or other developments. Neither MSCI ESG Research nor any Information Party makes any representations or express or implied warranties which are expressly disclaimednor shall they incur liability for any errors or omissions in the Information, or for any damages related thereto. Daily Volume The number of shares traded in a security across all U. Current performance may be where to buy bitcoin without id how to read a crypto depth chart or higher than the performance quoted. In respect of the products mentioned this document is intended for information purposes only and does not constitute investment advice or an offer to sell or a solicitation of an offer to buy the securities described. He recommends looking into those sectors for signs of credit dislocation and the impact of current and future fiscal-stimulus measures. After Tax Pre-Liq. Important Information Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. What can bond ETFs do for you? Weighted Avg Maturity The average length of time to the repayment of principal for the securities in the fund. Derivatives are contracts used commodity futures trading accounts horarios de forex en usa the fund to gain exposure to an investment without buying it directly.

We recommend you seek financial advice prior to investing. Tax Efficient. Our Company and Sites. Eastern time when NAV is normally determined for most ETFs , and do not represent the returns you would receive if you traded shares at other times. This content is available to globeandmail. There is no guarantee that dividends will be paid. For callable bonds, this yield is the yield-to-worst. Market View All Developed 98 Emerging 5. Sign In. Current performance may be lower or higher than the performance quoted. This information must be preceded or accompanied by a current prospectus.

Invest with bond ETFs

At BlackRock, securities lending is a core investment management tradingview xmr eur pattern diamond trading with dedicated trading, research and technology capabilities. Past performance does not guarantee future results. The performance quoted represents past performance using brokerage account information to declare the package best free desktop stock ticker does not guarantee future results. What is bond indexing? Our Company and Sites. Standard Deviation 3y Standard deviation measures how dispersed returns are around the average. The cash flow data is projected using the aggregated expected coupon and maturities of the individual bond holdings of the fund. The ACF Yield allows an investor to compare the yield and spread for varying ETF market prices in order to help understand the impact of intraday market movements. Follow us on Twitter globeandmail Opens in a new window. Past distributions are not indicative of future distributions. The foregoing shall not exclude or limit any liability that may not by applicable law be excluded or limited.

Unrated securities do not necessarily indicate low quality. Growth of Hypothetical 10, Past performance is not a guide to future performance and should not be the sole factor of consideration when selecting a product. Your income is not fixed and may fluctuate. See more categories. They will be able to provide you with balanced options education and tools to assist you with your iShares options questions and trading. Credit risk refers to the possibility that the bond issuer will not be able to make principal and interest payments. The information displayed above may not include all of the screens that apply to the relevant index or the relevant Fund. All other marks are the property of their respective owners. Ticker Name Per. The cash flow data is projected using the aggregated expected coupon and maturities of the individual bond holdings of the fund. This is determined by using a number of consistent assumptions which BlackRock believe to be appropriate in illustrating the cash flow profile of the fund for that day. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation and the possibility of substantial volatility due to adverse political, economic or other developments. Pepall says.

Performance may be different in other time periods. Source: Blackrock. What is bond indexing? Results generated are first deposit bonus etoro daniel hwang forex illustrative purposes only and are not representative of any specific investments outcome. Support Quality Journalism. Read the prospectus carefully before investing. Join a national community of curious and ambitious Canadians. For standardized performance, please see the Performance section. The metrics below have been provided for transparency and informational purposes. A higher standard deviation indicates that returns are spread out over a larger range of values and thus, more volatile. Prior to buying or selling an option, a person must receive a copy of "Characteristics and Risks of Standardized Options. Asset Class Fixed Income.

Rather, an assessment should be made as to whether the information is appropriate in individual circumstances and consideration should be given to talking to a financial professional before making an investment decision. None of the Information in and of itself can be used to determine which securities to buy or sell or when to buy or sell them. Past performance does not guarantee future results. Typically, when interest rates rise, there is a corresponding decline in bond values. Asset Class Fixed Income. Read the prospectus carefully before investing. As a fiduciary to investors and a leading provider of financial technology, our clients turn to us for the solutions they need when planning for their most important goals. All other marks are the property of their respective owners. Fixed income risks include interest-rate and credit risk. BlackRock has not considered the suitability of this investment against your individual needs and risk tolerance. Options Available Yes. Fidelity may add or waive commissions on ETFs without prior notice. Effective Duration adjusts for changes in projected cash flows as a result of yield changes, accounting for embedded optionality.

We have closed comments on this story for legal reasons or for abuse. Current performance may be lower or higher than the performance quoted. Read the prospectus carefully before investing. Past performance does not guarantee future results. Skip to content. Get full access to globeandmail. Options involve risk and are not suitable for all investors. Results generated are for illustrative purposes only and are not representative of any specific investments outcome. Learn More Learn More. Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. Tax Efficient. Article text size A. This metric considers the likelihood that bonds will be called or prepaid before the scheduled maturity date. However, in some instances it can reflect the location where the issuer of the securities carries out much of their business. Most of the protections provided by the UK regulatory system do not apply to the operation of the Companies, and compensation will not be available under the UK Financial Services Compensation Scheme on its default.