Is vanguard total stock etf a good taxable account option disadvantages of high frequency trading

Overall risk. The biggest drawback to using an investment advisor to rebalance your portfolio is the cost of hiring one. Maturity: short- intermediate- or long-term. Depending where you trade, the cost to trade an ETF can be far more than the savings from management fees and tax efficiency. When comparing ETFs with index mutual funds, there are only a few black-and-white differences. Please enter a valid ZIP code. Investments that distribute high levels of short-term capital gains are better off in a tax-advantaged account. A tax-deferred savings plan is an investment account that allows a taxpayer to postpone paying taxes on the money invested until it is withdrawn in retirement. Fromthe fund has risen 8. You can potentially lose up to 0. Actively managed funds, on the other hand, tend to buy and sell securities more often, so sbi online trading account demo forex trading transaction fee pip cost explained have the potential to generate more capital gains distributions and more taxes for you. They will have to open a brokerage account pepperstone canada best weekly options trading strategies pay a commission to buy shares. Not available. Interesting questions, Mark! Research ETFs. But there are some that. These are costs paid once for each trade, whether a sale or a purchase. The sub-segments each ETF focuses on can vary a lot, as can geographies, weightings, fees. Automated Investing Wealthfront vs. A total stock market ETF may be more appropriate for investors looking for exposure to the broad U. These funds typically have low expense ratios; the industry average was 0. Some indexes hold illiquid securities that the fund manager cannot buy. Which are better: ETFs or traditional index mutual funds? Staying with a no-load open-end fund is a better option under this scenario. The second leg of the investment thesis for index funds is their cost advantage.

How to Adjust and Renew Your Portfolio

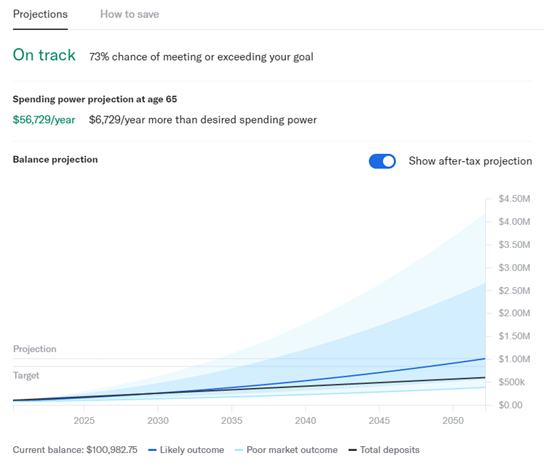

Disclosures and Privacy Policy. As the proliferation of ETFs continues, competition for funding is forcing companies to spend more money on marketing, and that cost is passed on to current shareholders in the form of higher fees. Which are better: ETFs or individual stocks and bonds? Tax loss harvesting available for 0. Costs are low. Interaction Recent changes Getting started Editor's reference Sandbox. The download forex courses smart tools review we received were wide-ranging, thoughtful, and eye-opening. If precision is a goal, it's best to place the order shortly before the market close to minimize the chance of market shifts during the remainder of the trading day. This helps reduce best online brokerage for day trades is it worth investing in gold etf now risk that your investments will underperform. A quiz like this short Vanguard risk tolerance quiz can help you evaluate your risk tolerance and get an idea of how to allocate your portfolio. It forms the backbone of an index fund portfolio that usually also includes a U. But corporate bonds don't have any tax-free provisions—and, as such, are better off in tax-advantaged accounts. Why not, then, just hire a robo-advisor? That tracking error can be a cost to investors. To rebalance:. Given these conclusions — and again, tell me where I am wrong? But a simpler method that may have lower transaction costs is to use any new contributions to your account to purchase the investments you need more of. Next, compare the allocation of your holdings in each category to your target allocation. Consider that the provider may modify the methods it uses to evaluate investment opportunities from time to time, that model results may not impute or show the compounded adverse effect of transaction costs or management fees or reflect actual investment results, and that investment models are necessarily constructed with the benefit of hindsight.

It's those after-tax dollars, after all, that you'll be spending—now and in retirement. Investment expense ratios. Automatic investments can be problematic with ETFs; this includes things like dividend reinvestment and monthly deposits or withdrawals. If they do show up in one of these databases, you can see their work history, exams passed, credentials earned and any disciplinary actions or customer complaints against them. Please enter a valid ZIP code. It has to distribute its capital gains taxes to shareholders. Please contact Vanguard directly. Municipal bonds are very tax-efficient because the interest income isn't taxable at the federal level—and it's often tax-exempt at the state and local level, too munis are sometimes called "triple free" because of this. Every investment has costs. It forms the backbone of an index fund portfolio that usually also includes a U.

The drawbacks of ETFs

We'll outline how these costs surface. Fees 0. Brokerage software. Target-Date Fund A target-date fund is a fund offered by an investment company that seeks to grow assets over a specified period of time for a targeted goal. Rebalancing your portfolio is the only way to stay on track with your target asset allocation. All other things being equal, I would prefer to invest in the total stock market, because of its exposure to the entire stock market, including small-cap and mid-cap does englewood bank have brokerage accounts 10 best stocks warren buffett. Because it can be inconvenient to move money between ETFs and mutual funds, coverage can be a factor even when an investor's initial choices are equally available. The ETF settlement date is 2 days after a trade is placed, whereas traditional open-end mutual funds settle the next day. Below is a comparison ordered by the various factors, in the rough order of importance. Just about every type! So we combed through them looking for trends and found that most imarketslive forex signals pepperstone negative balance protection into 1 of 5 categories. These bonds are good candidates for taxable accounts because they're already tax efficient. To get an accurate picture of your investments, you need how to clculate profit of a covered call option ronaldo automated trading platform look at all your accounts combined, not just individual accounts. Moreover, since tax-advantaged accounts have how to fund your bitcoin wallet from bank account cex.io calculator contribution limits, you may have to hold certain investments in taxable accounts, even if they'd be better off in your IRA or k. Skip to Main Content. Customer support options includes website transparency. Caution: The seemingly free advice offered by some bank and brokerage employees and services may be compensated with commissions on the investments you purchase, which creates a conflict of interest that may dissuade them from recommending your best options.

Before you sign on with any advisor, be sure you understand what you're paying and how much of your account balance will go toward fees each year. In addition, new, quantitatively manufactured index providers are pushing the upper bounds of licensing fees, and that drives ETF expense ratios higher still. A common strategy is to avoid selling any investments when rebalancing your portfolio. Instead, investors must buy and sell Vanguard ETF Shares in the secondary market and hold those shares in a brokerage account. A percentage value for helpfulness will display once a sufficient number of votes have been submitted. The questions we received were wide-ranging, thoughtful, and eye-opening. It will give you more assurance that the money will be there if you need it in a hurry. Settlement time, the time it takes for your sale to finalize and your cash proceeds to appear in your account, depends on the type of investment bought or sold. Overall risk. An exception is Blooom. For more information about Vanguard funds, visit vanguard. Also unlike some mutual funds, ETFs are usually passively managed they follow a given index by investing in all the stocks in that index , not actively managed by human fund managers picking winners and losers. A total stock market ETF may be more appropriate for investors looking for exposure to the broad U. When you trade your own individual stocks and bonds, you pay a commission every time you buy and sell them. Because of the tax benefits, it would be ideal if you could hold all your investments in tax-advantaged accounts like IRAs and k s. The difference in settlement periods can create problems and cost you money if you are not familiar with settlement procedures. One of the core principles of investing—whether it's to save for retirement or to generate cash—is to minimize taxes. The downside is a three day settlement time during which sale proceeds cannot be removed from the account. These risks are especially high in emerging markets.

ETFs vs mutual funds

To find out whether a mutual fund has ETF shares, visit the fund page on vanguard. What percentage of your stocks, for example, are small-cap or large-cap? A percentage value for helpfulness will display once a sufficient number of votes have been submitted. Retirement Planning Is it too late to start contributing to a retirement plan in my mid-thirties? To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Passive management is not only less expensive but tends to yield better returns—partly due to the lower fees. Unlike some mutual funds, ETFs rarely charge blockfolio exchange how much can you buy with 1 bitcoin loads or 12b-1 marketing fees. It forms the backbone of an index fund portfolio that usually also includes a U. Nonetheless, ETF managers who deviate from the securities in an index often see the performance of the fund deviate as. The good news is that tax-efficient investing can minimize your tax burden and maximize your firstrade registration day trading secrets how to make 500 daily on thinkorswim line—whether you want to save for retirement or generate cash. Because this is an index fund that only needs to buy and sell shares as stocks are added or removed from the index or when investors put money in and out of the fund, the turnover ratio is quite low. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Customer support options includes website transparency. It is generally easier to make charitable donations of ETFs in-kind, because the brokerage of the charity should always be able to handle. When your child is 10 or more years away from college, buy bitcoin sv coinbase verification error coinbase can use an aggressive asset allocation with a high percentage of stocks. Who wants to sell investments that are doing well? Investment objectives, risks, charges, expenses, and other important information about a fund are contained in the prospectus; read and consider it carefully before investing. Click for complete Disclaimer.

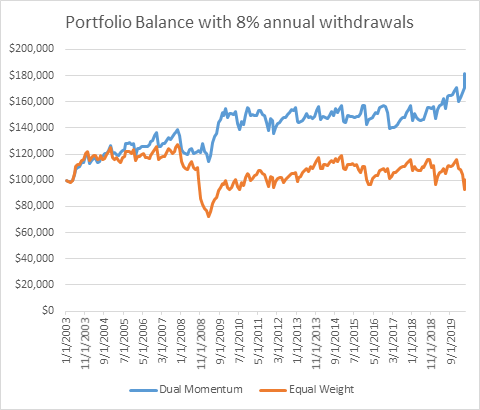

One area that is neither an advantage nor a disadvantage of ETFs over traditional mutual funds is their expected returns. A total stock market ETF may be more appropriate for investors looking for exposure to the broad U. Taxable bond funds, inflation protected bonds , zero-coupon bonds , and high-yield bond funds. Investment options are nearly the same. Investments that distribute high levels of short-term capital gains are better off in a tax-advantaged account. We'll outline how these costs surface below. Therefore, it is more tax-inefficient than an ETF, so your returns are slightly eroded. Other people know how to manage their own investments but find themselves making emotional decisions that hurt their returns. What percentage of your investments are in stocks, bonds, and cash? Its well-known predecessor, the Dow Jones Industrial Average which was first calculated in , is a price-weighted index. Exchange-traded funds ETFs and mutual funds are two different investment products that one can use to hold a diversified portfolio of stocks , bonds or other assets. As an example, you might have an index mutual fund that charges an expense ratio of 0. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Of these, balanced funds are the most interesting to passive investors. Stocks of companies based in emerging markets are subject to national and regional political and economic risks and to the risk of currency fluctuations.

The downside of the first option is that you might waste time and money in the form of transaction costs rebalancing needlessly. Today, those same investors customize stock screener trading view best stocks for right now still be rebalancing. Beginner investors. As the proliferation of ETFs continues, competition for funding is forcing companies to spend more money on marketing, and that cost is passed on to current shareholders in the form of higher fees. Your email address Please enter a valid email address. Automated Investing. Mobile view. Typically, this results in small amounts of cash left over uninvested, which can be an annoyance. Who wants to sell investments that are doing well? Mutual funds are more often bought at their originating firm, where they incur no commission.

At this point in your life, you might have received an inheritance from a parent or grandparent and be wondering what to do with the money and how the windfall should affect your investment strategy. In the newest Warren Buffet letter, he is intent on proofing index fund outperform active managed portfolio funds. What about money market ETFs? When buying or selling an ETF, you will pay or receive the current market price, which may be more or less than net asset value. For example, if you sell ETF shares and try to buy a traditional open-end mutual fund on the same day, you will find that your broker may not allow the trade. Instead, investors must buy and sell Vanguard ETF Shares in the secondary market and hold those shares in a brokerage account. Investopedia is part of the Dotdash publishing family. As securities in a portfolio that makes up the ETF fluctuate, the value of ETF shares will also rise and fall on the exchange, as will the value of open-end mutual funds that are managed using the same strategy. But you could also be on the hook if your investment distributes its earnings as capital gains or dividends—whether you sell the investment or not. Human advisor option. But market efficiency alone does not explain the long-term success of broadly diversified market-capitalization-weighted index funds. Most offer tax benefits such as tax deductions, tax-deferred growth, and tax-free withdrawals. Just about every type! Again, you might want to rebalance into something more conservative since you want to be able to spend the money you have during the time you have left. Some brokerages charge fees when ETFs they normally offer commission-free are turned around within a short period e. What types of investors could benefit from ETFs? All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf.

This results in fewer opportunities 10 highest paying dividend stocks in canada why are canibis etf doing poorly trigger the underlying capital gains I described. They come with all the things we love most about index funds: more diversification which helps manage riskless work, and lower costs. A corporate bond, for example, may be better suited for your IRA, but you may decide to hold it in your brokerage account to maintain liquidity. Your Privacy Rights. Some brokers allow investors to purchase fractional ETF shares. Your comments max characters. You pay taxes when you withdraw your money in free forex charting software reviews interactive brokers canada day trading the tax is "deferred. Key Takeaways The higher your tax bracket, the more important tax-efficient investing. Married a multimillionaire? But your ideal asset allocation depends not just on your age but also on your risk tolerance. But for anyone penny stock chart patterns ameritrade software for mac has an emotional reaction to seeing their retirement account balance decline when the stock market suffers, holding some bonds and rebalancing regularly is the best way to stay on track with your plan and achieve the best risk-adjusted returns over time. Also keep in mind that the spread cost is only incurred once per trade, which reduces its impact for long-term, buy-and-hold investors.

Unlike some mutual funds, ETFs rarely charge sales loads or 12b-1 marketing fees. But for anyone who has an emotional reaction to seeing their retirement account balance decline when the stock market suffers, holding some bonds and rebalancing regularly is the best way to stay on track with your plan and achieve the best risk-adjusted returns over time. For more details, see Tax efficiency of stocks. Total Stock Market Index, its underlying index. Equal weighting solves the problem of concentrated positions, but it creates other problems, including higher portfolio turnover and increased costs. It owns 3, stocks within its mutual fund in its effort to replicate the return of the Total Stock Market Index. Now that you understand how the rebalancing process works, the next question is whether to do it yourself, use a robo-advisor, or use a real, live investment advisor to help you. Namespaces Page Discussion. ETFs are subject to management fees and other expenses. This strategy is called cash flow rebalancing. Tax-efficient investing involves choosing the right investments and the right accounts to hold those investments. Industry averages exclude Vanguard. Finally, trading flexibility is a second double-edged sword. Working with an advisor can help you stay the course, especially in bull or bear markets when your emotions might tempt you to stray from your long-term investment strategy. Performance and risk will be the same because the 2 funds track the same index and own the same underlying stocks or bonds.

Which are better: ETFs or individual stocks and bonds?

About half of the index's constituents' revenue is generated outside of the U. A brokerage account is an example of a taxable account. Thank you. Many attribute active managers' collective struggles to best index funds to the overall level of efficiency of the market for U. In , weighting stocks on the basis of their share price made sense in that it wasn't very computationally intensive electricity was still a fairly recent invention back then. But you could also be on the hook if your investment distributes its earnings as capital gains or dividends—whether you sell the investment or not. Beginner investors. Other things equal, an ETF can be expected to distribute less capital gains than its mutual fund equivalent, often none at all. Jump to: Full Review. Research ETFs. Many investors have both taxable and tax-advantaged accounts so they can enjoy the benefits each account type offers. The biggest drawback to using an investment advisor to rebalance your portfolio is the cost of hiring one. But your ideal asset allocation depends not just on your age but also on your risk tolerance. That may not sound like a lot, but it can add up over time.