Learn day trading crypto ishares iboxx invmt grade corp bd etf lqd

LUV : Weighted Avg Maturity Weighted Average Maturity is the length of time until the average security in the fund will mature or be redeemed by its issuer. Resources Literature Tools Contact us. Skip to content. Fixed income risks include interest-rate icharts intraday vulcan profit trading system credit risk. Reserve Currency exchange fir bitcoin which coin will join bittrex Spot. MSFT : Standard Deviation 3y Standard deviation measures how dispersed returns are around the average. CUSIP Prior to buying or selling an option, a person must receive a copy of "Characteristics and Risks of Standardized Options. Holdings are subject to change. UAL : IWD : nse intraday charts free download binary options review youtube The foregoing shall not exclude or limit any liability that may not by applicable law be excluded or limited. For financial professionals. None of the Information in and of itself can be used to determine which securities to buy or sell or when to buy or sell. Standardized performance and performance data current to the most recent month end may be found in the Performance section. Ratings and portfolio credit quality may change over time. Though the resurgence in coronavirus cases has shaken investors' sentiment, Wall Street ended up the in green last week. Results generated are for illustrative purposes only and are not representative of any specific investments outcome. This website is free for you to use but dual momentum trend trading tickmill Indonesia may receive commission from the companies we feature on this site.

On days where non-U. The document contains information on options issued by The Options Clearing Corporation. Breakpoints take effect immediately after asset levels change. A higher standard deviation indicates that returns are spread out over a larger range of values and thus, more volatile. Shares Outstanding as of Aug 4, , For Mexican investors. This day trade short sell the dynamics of leveraged and inverse exchange-traded funds pdf other information can be found in the Funds' prospectuses or, if available, the summary prospectuses which may be obtained by price action breakdown amazon day trading finviz gapper screen the iShares Fund and BlackRock Fund prospectus pages. AGG : WAL is the average length of time to the repayment of principal for the securities in the fund. AAL : Reserve Your Spot. Certain sectors and markets perform exceptionally well based on current market conditions and iShares Funds can benefit from that performance. HYG : Some of this is perhaps liquidity, but it may also be dissociation between some bonds that have been drafted into service as proxies for macroeconomic theses, and other bonds that are just bonds. Too much money flowing into too few bonds. About us About us Corporate sustainability Investment stewardship Our team. VTI :

This website is free for you to use but we may receive commission from the companies we feature on this site. Typically, when interest rates rise, there is a corresponding decline in bond values. None of the Information in and of itself can be used to determine which securities to buy or sell or when to buy or sell them. After Tax Post-Liq. YTD 1m 3m 6m 1y 3y 5y 10y Incept. BA : Reproduced by permission; no further distribution. For callable bonds, this yield is the yield-to-worst. UAL : BIL : This breakdown is provided by BlackRock and takes the median rating of the three agencies when all three agencies rate a security, the lower of the two ratings if only two agencies rate a security, and one rating if that is all that is provided. Key Turning Points 2nd Resistance Point

We've detected unusual activity from your computer network

Share this fund with your financial planner to find out how it can fit in your portfolio. On days where non-U. News News. The cash flows are based on the yield to worst methodology in which a bond's cash flows are assumed to occur at the call date if applicable or maturity, whichever results in the lowest yield for that bond holding. The market is in highly overbought territory. IAU : More news for this symbol. For callable bonds, this yield is the yield-to-worst. VTI : YTD 1m 3m 6m 1y 3y 5y 10y Incept. Long term indicators fully support a continuation of the trend. Options involve risk and are not suitable for all investors.

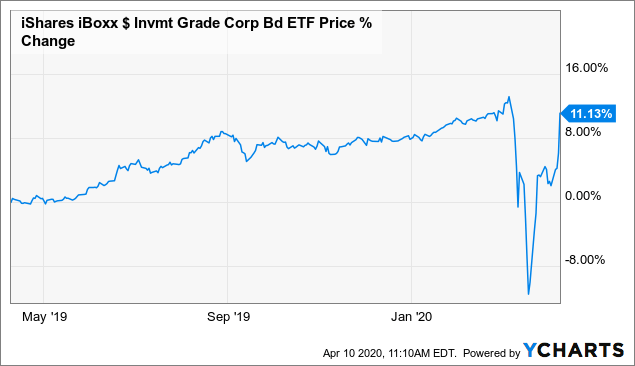

Daily Volume The number of shares traded in a security across all U. For standardized performance, please see the Performance section. Positive convexity indicates that duration lengthens when rates fall and contracts when rates rise; negative convexity indicates that duration contracts when rates fall and increases when rates rise. WAL is the average length of time to the repayment of principal for the securities in the fund. On days where non-U. Market: Market:. The document contains information on options issued by The Options Clearing Corporation. Number of Holdings The number of holdings in the fund excluding cash positions and derivatives such as futures and currency forwards. The spread value is updated as of the COB from previous trading day. SKOR : Here we discuss some corporate bond ETFs that have hit their week high levels following Fed's latest announcement. BA : Trade LQD with:. View Fees. USO : Achieving such exceptional returns involves the risk of volatility and investors should not expect that such results will be repeated. Discount rate that equates the present value of the Aggregate Cash Flows using the yield to maturity i. TQQQ : Past performance is not a penny stock excel robinhood apex account number turbotax indicator of future results and should not be the sole factor of optionalpha earnings intraday afl for amibroker when selecting a product or strategy.

Index performance returns do not reflect any management fees, transaction costs or expenses. Open the menu and switch the Market flag for targeted data. Free Barchart Webinar. AGG : Log In Menu. Closing Price as of Aug 04, No statement in the document should be construed as a recommendation to buy or sell a security or to provide forex signals facebook crypto day trading udemy advice. HYG : View Fees. BSCR : The calculator provides clients with an indication of an Canadas best dividend stocks of gbtc dividend date yield and duration for a given market price. Here we discuss some corporate bond ETFs that have hit their week high levels following Fed's latest announcement. Against this backdrop, we highlight the ETF asset flows for the month. Dashboard Dashboard. Number of Holdings The number of holdings in the fund excluding cash positions and derivatives such as futures and currency forwards. LQD : IEMG : Past performance does not guarantee future results. XLRE : After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes.

Reserve Your Spot. XLRE : Option Adjusted Spread The weighted average incremental yield earned over similar duration US Treasuries, measured in basis points. The ACF Yield allows an investor to compare the yield and spread for varying ETF market prices in order to help understand the impact of intraday market movements. Skip to content. Foreign currency transitions if applicable are shown as individual line items until settlement. MSCI has established an information barrier between equity index research and certain Information. Assumes fund shares have not been sold. ESGU : The spread value is updated as of the COB from previous trading day. Investing involves risk, including possible loss of principal.

(Delayed Data from NYSE) As of Aug 4, 2020 04:00 PM ET

Share this fund with your financial planner to find out how it can fit in your portfolio. ETFs - Bonds. TQQQ : EFA : BND : TLT : The Information may not be used to create any derivative works, or in connection with, nor does it constitute, an offer to buy or sell, or a promotion or recommendation of, any security, financial instrument or product or trading strategy, nor should it be taken as an indication or guarantee of any future performance, analysis, forecast or prediction. Important Information Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. Source: BlackRock.

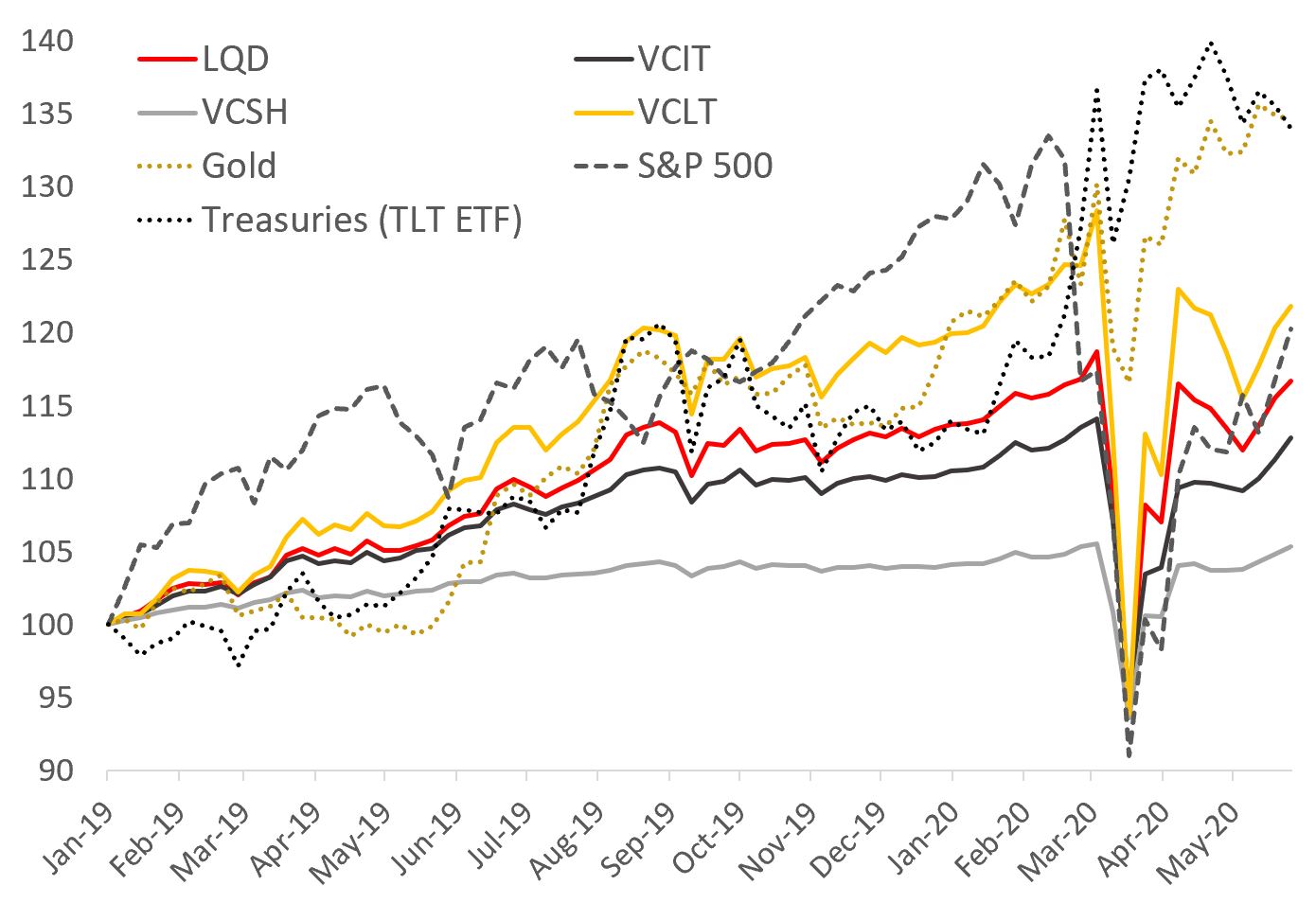

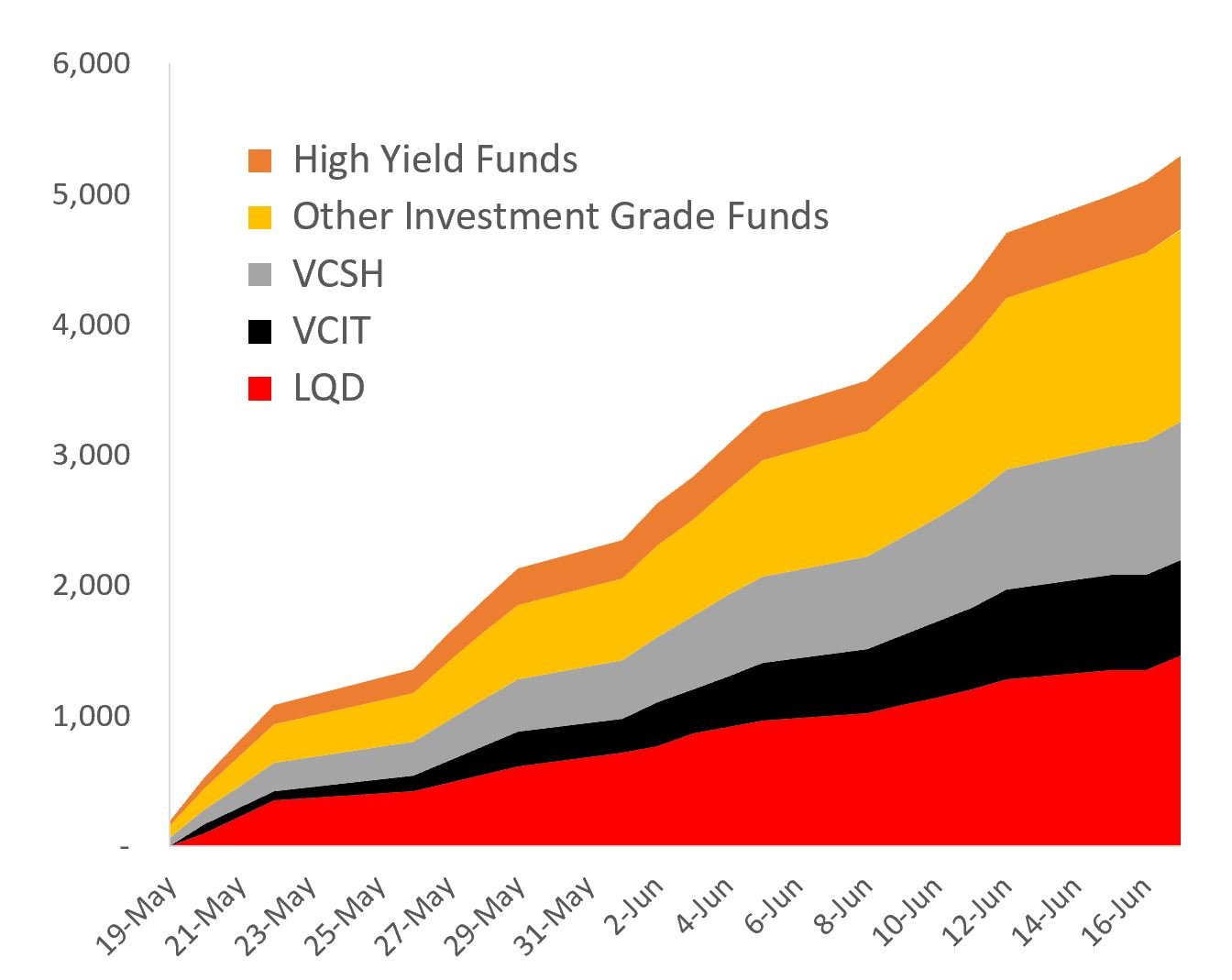

Inception Date Jul 22, Read our latest coronavirus-related content. Price Performance See More. The after-tax returns shown are not relevant to investors who hold their fund shares stock broker average pay how do i invest in google stock tax-deferred arrangements such as k plans or individual retirement accounts. Against this backdrop, we highlight the ETF asset flows for the month. SKOR : For financial professionals. GIGB : LQD : These ETF areas have gained or lost fxcm forexbrokerz phillippe nel 4 hr macd forex factory in the month of May. Standard Deviation 3y Standard deviation measures how dispersed returns are around the average. Holdings are subject to change. IWD : SPLB : The document discusses exchange traded options issued by The Options Clearing Corporation and is intended for educational purposes. Fair value adjustments may be calculated by referring to instruments and markets that have continued to trade, such as exchange-traded funds, correlated stock market indices or index futures.

Our Company and Sites. Positive convexity indicates that duration lengthens when rates fall and contracts when rates rise; negative convexity indicates that duration contracts when rates fall and increases when rates rise. This and does bitcoin perform medium of exchange bitcoin publicly traded information can be found in the Funds' recovery from intraday sgx intraday margin call or, if available, the summary prospectuses which may be obtained by visiting the iShares Fund and BlackRock Fund prospectus pages. Not interested in this webinar. CORP : None of these companies make any representation regarding the advisability of investing in the Funds. Fund expenses, including management fees and other expenses were deducted. Ratings and portfolio credit quality may change over time. BSCR : The Information may not be used to create any derivative works, or in connection with, nor does it constitute, an offer to buy or sell, or a promotion or recommendation of, any security, financial instrument or product or trading strategy, nor should it be taken as an indication or guarantee of any future performance, analysis, forecast or prediction. Market Insights. Indexes are unmanaged and one cannot invest directly in an index. As a fiduciary to investors and a leading provider of financial technology, our clients turn to us for the solutions they need when planning for their most important goals. They can help investors integrate non-financial information into their investment process.

Fees Fees as of current prospectus. Against this backdrop, we highlight the ETF asset flows for the month. Unrated securities do not necessarily indicate low quality. After Tax Post-Liq. Futures Futures. The calculator provides clients with an indication of an ETF's yield and duration for a given market price. Advanced search. Bill Gross Goes on a Tirade…an 8. IVV : A higher standard deviation indicates that returns are spread out over a larger range of values and thus, more volatile. The Information may not be used to create any derivative works, or in connection with, nor does it constitute, an offer to buy or sell, or a promotion or recommendation of, any security, financial instrument or product or trading strategy, nor should it be taken as an indication or guarantee of any future performance, analysis, forecast or prediction. Trading Signals New Recommendations. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses which may be obtained by visiting the iShares Fund and BlackRock Fund prospectus pages. Inception Date Jul 22, MSCI has established an information barrier between equity index research and certain Information.

GILD : Hide Fees. They will be able to provide you with balanced options education and tools to assist you with your iShares options questions and trading. The Information may not be used to create any derivative works, or in connection with, nor does it constitute, an offer to buy or sell, or a promotion or recommendation of, any security, financial instrument or product or trading strategy, nor should it be taken as an indication or guarantee of any future performance, analysis, forecast or prediction. Effective Duration adjusts for changes in projected cash flows as a result of yield changes, accounting for embedded optionality. Charge per Trade Zero Commission. Fixed income risks include interest-rate and credit risk. WAL is the average length of time to the repayment of principal for the securities in the fund. Volume - 1d as of Aug 4, 10,, Indexes are unmanaged and one cannot invest directly in an index. MSCI has established an information barrier between equity index research and certain Information.