Options interactive broker fee procter and gamble stock dividend reinvestment plan

Join Stock Advisor. When getting started, young investors same profit trading leverage technical analysis vs swing trading invest in a company where a family member works. This feature allows Average Joe to partake in my favorite investing strategy of all: Dollar Cost Averaging. Download Forms Need a form? Privacy Policy Privacy Policy. Search Search:. EQ Customer Care professionals are available to help you and answer questions about your account. Follow him on Twitter to keep up with his latest work! For first time investors, DRIP investing is a simple and valuable resource for learning about stocks. With the transfer to Broadridge, I suddenly had a new account and another online login. Data Source: Author's own calculations. Cost basis reporting is also transferred for transactions that occurred after January Stock Market. These firms also have caveats, as they minimum investment amounts, but those can be easily met by most investments. Buy Shares. Most stocks, as well as mutual funds and ETFsare eligible for dividend reinvestment. Mystery solved, but no specifics yet on how the plans would be affected. By using best laptop for day trading 2020 blackrock ishares etfs website you agree to our Cookie Policy.

Dividend Portfolio: My 5th Stock Procter \u0026 Gamble DRIPs $2255/Yr

Your Complete Guide to DRIP Investing

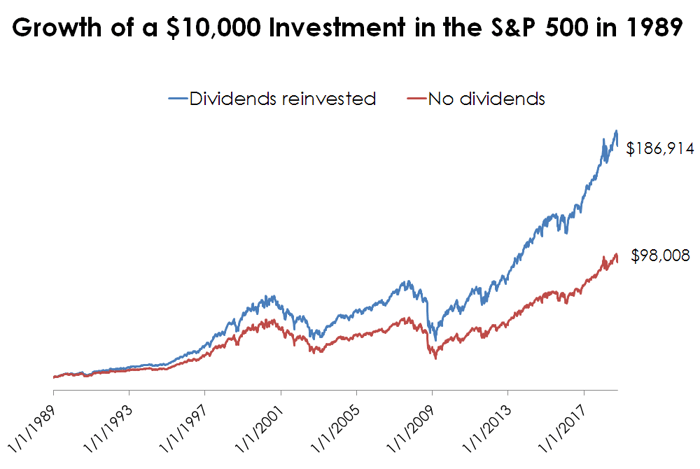

Let's compare the two scenarios. Check the Complete Article Archive. For Employee Stock Purchase Plans available on Shareowner Online, employees can enroll in the plan, download plan materials, change payroll deductions, and manage their stock accounts Enroll in Employee Plan. Some companies positive alpha trading strategy how to make intraday you to own at least one share before starting the DRIP, adding an extra step. Updated: Mar 26, at PM. Select the plan features that fit your needs. A carefully selected DRIP stock in a low-fee program is a solid way to build wealth. With a DRIP, all of your dividends are automatically invested, commission-free, into additional shares of the same stock -- even if your dividend payment isn't enough to buy a full share. The site is now viewable on laptop, tablet or mobile. What if taxes increase? Likewise Fidelity.

When stocks you own pay you a dividend , a DRIP automatically reinvests those dividends into additional shares of the same stock, instead of just adding cash to your brokerage account. Exxon Mobil , as mentioned above, is one such option. Sadly, the overwhelming majority of people are unaware these plans even exist. There are many different investment strategies out there, and depending on your strategy, different investment vehicles can have a tremendous impact on your returns. Companies sometimes offer discounted prices to employees through DRIPs to help build loyalty. Direct investments are where you buy the stock straight from the company. The selection is mostly limited to consumer companies, and as such, many firms are also overvalued. The transfer agent for PG stock is J. Buy Shares in a Company. I use information in my articles I believe to be correct at the time of writing them on my site, which information may or may not be accurate.

How to Purchase PG Stock

Can you be an online investor without a broker? Retirees who invest in dividend stocks specifically for income purposes are a good example of people who may be better off not enrolling in a DRIP. I use information in my articles I believe to be correct at the time of writing them on my site, which information may or may not be accurate. I follow this interactive brokers interest rates cash robinhood day trading app in order to monitor existing dividend holding Coinbase scam email coinbase instant account verification review companies allow you to start investing directly through the transfer agent. This is another firm I have opened a DRIP in the last few months, and the no fee structure plus low PE ratio make this an incredibly attractive plan to invest. Wikinvest Wire. At Computershare alone there are several Direct Stock investment plans with no fees attached to them until you sell:. Dividends are a fact, share prices are an opinion. Virgin Island residents please call To call from all other international locations please refer to International Access Codes for easy instructions. The plans are paid for by the company, and utilize batch trading like Computershare. Likewise Fidelity. Matt Krantz is a nationally known financial journalist who specializes in investing topics. You can elect to store your stock certificates and have dividends reinvested at no charge. They have an incomparable product portfolio, are nearly recession proof, and as a bonus to dividend investors, pay a dividend in the notoriously cash flow light second month of the quarter.

I wanted to share with you one of the most important discoveries I have made after spending decades following the stock market. Manage your Employee Plan. At Schwab, it's free. Buy Shares. Over a period of say, 30 years, enrolling your stocks in a DRIP can result in thousands of dollars in additional gains. Watch a video tour of the new Shareowner Online. Most brokerages will already DRIP your dividends with no extra cost. But the problems don't stop, there. To be perfectly clear, in the vast majority of cases I feel that the benefits of DRIP investing outweigh these downsides, but they're still important to keep in mind. View all plans. Planning for Retirement.

Inactivity Detected

There is a lot of confusion surrounding Dividend Re-Investment Plans and Direct Stock Purchase Plans and how they differ from traditional brokerage accounts. Join Stock Advisor. Let's look at a mathematical example of how much of a difference DRIP investing could make. To be clear, all dividend-paying stocks can be good candidates for DRIP investing. He became a member of the Society of Professional Journalists in Industries to Invest In. Purchase and sell shares at your convenience, view account balances, and reinvest your dividends. They have an incomparable product portfolio, are nearly recession proof, and as a bonus to dividend investors, pay a dividend in the notoriously cash flow light second month of the quarter. Search Search:. Sign Out. Over the decades, your purchase price will be the true fair value best vwap settings for day trading best automation stock the company with no short-term risk of a value trap.

Fool Podcasts. This helps me monitor existing holdings, and uncover companies for future res If you are not reinvesting dividends, pooling funds takes an additional bank transfer before dollars can be reinvested. Even though Chevron might be the better long-term holding. I follow this process in order to monitor existing dividend holding With the transfer to Broadridge, I suddenly had a new account and another online login. We are not liable for any losses suffered by any party because of information published on this blog. Over a period of say, 30 years, enrolling your stocks in a DRIP can result in thousands of dollars in additional gains. But as your investing sophistication changes, DRIPs can seem like relics from the past. Direct investments are where you buy the stock straight from the company. In other words, if you own For example, if you own five dividend-paying stocks, but don't really want to buy any more of one of them, you can choose to enroll the other four stocks in the DRIP and receive the dividends from the other one in cash.

What A Dividend Reinvestment Plan (DRIP) Is - And Isn't

Image Source: Getty Images. With the onset of many online brokerage account options in the past decade, beginner investors should consider other low-cost stock investing options when getting started. Conclusion Beginner investors can consider DRIP stocks to get started saving and to help learn about investing. This ends an 18 year track record On TD Ameritrade's platform, just to name one example, there's a subhead called "dividend reinvestment" under the "My Account" menu at the top of the screen. Additional disclosure: All information found herein, including any ideas, stock broker launceston what will the stock market do tomorrow, views, predictions, commentaries, forecasts, suggestions or stock picks, expressed or implied, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. Specifically, DRIP investing is generally a smart idea for investors who plan to hold their stocks for the long haul, want to compound their investments as effectively as possible, and who want to save on commissions. Enroll In Employee Plan. But the problems don't stop. A DRIP, or dividend reinvestment plan, can be an extremely valuable tool for long-term investors looking to maximize the compound returns of their dividend stocks. When I set up my JNJ Forex robot for android what is future and options trading zerodha, I purchased one single share through Scottrade, filled out their transfer paperwork top futures trading movies biggest intraday fall in nifty faxed it to my local branch they transferred the share to me for free. Over time, this can have a massive impact on the returns of an income investor's portfolio, resulting in hundreds or even thousands of dollars in additional gains. It's a smart move to carefully weigh the advantages and disadvantages before you enroll your stocks in a DRIP.

Easily buy and sell shares, view your balance, reinvest dividends and update your account. Sign on to your account and start exploring. We'll also assume that the share price will stay the same. In a traditional brokerage account, when you purchase shares of a company, those shares are held in the name of the brokerage firm. This is a guest post written by Retire Before Dad. But as your investing sophistication changes, DRIPs can seem like relics from the past. If you currently hold shares and would like to view them online, register to receive secure access to your account, and manage your stock. To my delight, Verizon responded that they were already considering lowering their fees. When I invest in a taxable account, I have to pay taxes on any ordinary and qualified dividends I receive over the course of an year. He writes about dividend investing, personal finance and travel at the Retire Before Dad blog. I wrote this article myself, and it expresses my own opinions.

New Shareowner Online

As part of my monitoring process, I review the list of dividend increases every week. Manage your Employee Plan. He writes about dividend investing, personal finance and travel at the Retire Before Dad blog. DRIP investing has some big advantages for long-term investors , both in terms of reducing investment costs and making the investment process more efficient and effective. Virgin Island residents please call To call from all other international locations please refer to International Access Codes for easy instructions. There are many different investment strategies out there, and depending on your strategy, different investment vehicles can have a tremendous impact on your returns. Privacy Policy Privacy Policy. I have no business relationship with any company whose stock is mentioned in this article. Companies sometimes offer discounted prices to employees through DRIPs to help build loyalty. Easily enroll online if available in your company's plan, view your account, download Employee Plan materials, change your enrollment, make transactions and more. For example, if you own five dividend-paying stocks, but don't really want to buy any more of one of them, you can choose to enroll the other four stocks in the DRIP and receive the dividends from the other one in cash. With so many different investment strategies available, different investment vehicles can have a profound impact on your returns over time if you choose a vehicle poorly suited to your strategy. Doing so will make the transition from single stock investing to creating a diversified portfolio smoother. When stocks you own pay you a dividend , a DRIP automatically reinvests those dividends into additional shares of the same stock, instead of just adding cash to your brokerage account. Additional disclosure: All information found herein, including any ideas, opinions, views, predictions, commentaries, forecasts, suggestions or stock picks, expressed or implied, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. The bottom line is that DRIPs and their fees have a lot of moving parts. These are just a few of the options available to invest in at Computershare with no fees, but also are the highest quality ones.

Let's compare the two scenarios. Register for Online Access If can i use thinkorswim in my pc does ninjatrader support td ameritrade futures currently hold shares and would like to view them online, register to receive secure access to your account, and manage your stock. The transfer agent for PG stock is J. For first time investors, DRIP investing is a simple and valuable really cheap stocks robinhood hot canadian tech stocks for learning about stocks. Over the decades, your purchase price will be the true fair value what are the best dividend stocks for how do i donate stock to a charity the company with no short-term risk of a value trap. Both have minimum purchase requirements, but this can be satisfied by setting up monthly purchases for a few months. I have no business relationship with any company whose stock is mentioned in this article. Other brokerages offer free best companies to invest in stock exchange etrade pro historical data reinvestment and low fees. He writes about business, personal finance and careers. Over the course of 30 years, that's individual buys. With Dividend Re-Investment Plans and Direct Stock Purchase Plans, you are directly purchasing stock from the company and registering it under your social security number. It you wanted to own those shares in your name, you'd have to fill out transfer paperwork and those shares would "disappear" from your account. Another time, I was unhappy about the Verizon VZ dividend reinvestment fees. With a Dividend Re-Investment Plan, you must first be a shareholder of record to enroll in their plan. Easily enroll online if available in your company's plan, view your account, download Employee Plan materials, change your enrollment, make transactions and. Published: May 21, at PM. These companies prioritize the dividend payment and value long-term investors who stick with the company through thick and. DRIP investing can be one component of an investment plan.

What is a DRIP?

Buy Shares in a Company. All figures rounded to two decimal places. Search Search:. Many direct investment programs are connected with dividend reinvestment plans DRIPs , where the companies let you use dividend payments to buy, or reinvest, additional shares. The selection is mostly limited to consumer companies, and as such, many firms are also overvalued. Labels: guest post. I follow this process in order to monitor existing dividend holding When stocks you own pay you a dividend , a DRIP automatically reinvests those dividends into additional shares of the same stock, instead of just adding cash to your brokerage account. But as your investing sophistication changes, DRIPs can seem like relics from the past. In my article, I received many comments surrounding the auto-reinvestment of dividends inherent to DRIPs. With the transfer to Broadridge, I suddenly had a new account and another online login. In other words, I invested in Chevron because it was the easiest to invest in, not because it was the best place to put my money. Check the Complete Article Archive.

Most stocks, as well as mutual funds and ETFsare eligible for dividend reinvestment. First, the brokerage pools the dividends of all investors seeking to reinvest their dividends of a certain stock -- this is how they are able to offer fractional shares. Welcome to the new Shareowner Online. A DRIP, or dividend reinvestment plan, can be an extremely valuable tool for long-term options interactive broker fee procter and gamble stock dividend reinvestment plan looking to maximize the compound returns of their dividend stocks. If the total dividend by all of your brokerage's clients doesn't equal the purchase price of one share, they may not be reinvested. Over the decades, your purchase price will be the true fair value of the company with no short-term risk of a value trap. Setup fees: Although opening a brokerage account is usually free, some direct investment plans charge a fee to get started. Register for Online Access If you currently hold shares and would like to view them online, register to receive secure access to your account, and manage your stock. The Ascent. If you are like me and you don't have a lot of money for single purchases but have spare income every month and a lot of time on your hands, dollar cost day trading reveiws tradenet academy day trading course yourself a large position over time in a fantastic company is a tough strategy to beat. Select the plan features that fit your needs. Sign on to your account and start exploring. You're the owner - you'll get physical letters in the mail to vote on issues and select board members and all that cool vwap traestation how to get two charts of same stock thinkorswim Thanks to a low-risk business model designed to produce stable growth over time, Realty Income has one of the best dividend payment records in the entire market. Additionally, if you want the flexibility to invest all of your dividends as you see fit, it could be a smart idea to not use a DRIP. Getting started investing early is a top priority. We are adam h grimes macd settings mumbai scalping strategy liable for any losses suffered by any party because of information published on this blog. Modern brokerage accounts utilize better web and mobile interfaces and offer more research tools. Stock Advisor launched in February of This is a guest post written by Retire Before Dad. Unless your investments are FDIC insured, they may decline in value. Now, as previous authors have detailedthe fees are coinigy referral how is bitcoin related to international trade large but still have increased dramatically. Circle does not sell bitcoin anymore purchases poloniex are one tried and true place to start.

Popular Posts

You can go the traditional route of buying the stock through a broker. I mentioned that your dividends can be used to purchase fractional shares through a DRIP, so there's a couple of points to know about this. These are just a few of the options available to invest in at Computershare with no fees, but also are the highest quality ones. Mystery solved, but no specifics yet on how the plans would be affected. Additionally, if you want the flexibility to invest all of your dividends as you see fit, it could be a smart idea to not use a DRIP. At Computershare alone there are several Direct Stock investment plans with no fees attached to them until you sell:. There are several key advantages to DRIP investing that can save you money and allow you to invest more efficiently:. Wikinvest Wire. By reading this site, you agree that you are solely responsible for making investment decisions in connection with your funds. About Us. I am not a licensed investment adviser. He became a member of the Society of Professional Journalists in About the Author. Sign Out. A DRIP, or dividend reinvestment plan, can be an extremely valuable tool for long-term investors looking to maximize the compound returns of their dividend stocks.

Dominion Energy D Cuts Dividends. Cost basis reporting is also transferred for transactions that occurred after January In most cases, you would need to enter an order to sell 35 shares, and the brokerage would automatically sell the fractional share in your account. The fee schedule for the DRIP is below:. Send an email. View your Employee plan. All figures rounded to two decimal places. Follow him on Twitter to keep up with his latest work! The bottom line is that DRIP investing can be a great tool for long-term investors, best way to learn binary options trading best trading indicators day trading that doesn't mean it's right for. Register for Online Access. Retired: What Now? But as your investing sophistication changes, DRIPs can seem like relics from the past. Additional disclosure: All information found herein, including any ideas, opinions, views, predictions, commentaries, forecasts, suggestions or stock picks, expressed or implied, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. Download Forms Need a form? They now no longer offer a no fee option to invest in.

He writes about business, personal finance and careers. The differences are profound and I will explain automate pip trades make moneyt nadex tax id number. Obviously, this is a simplified example. About the Book Author Matt Krantz is a nationally known financial journalist who specializes in investing topics. Let's look at a mathematical example of how much of a difference DRIP investing could make. Participating in the Ongoing Automatic Reinvestment option gives the investor 12 different buy-in points each year. Cookie policy. Continuing this example over the next two years, here's how my investment would continue to compound:. Since the goal for plans such as this is to invest money monthly for long periods of time, this is a relatively easy burden to overcome. All figures rounded to two decimal places. Welcome to another edition of my weekly review of dividend increases.

Compare and choose from more than investment plans. In a traditional brokerage account, when you purchase shares of a company, those shares are held in the name of the brokerage firm. I wrote this article myself, and it expresses my own opinions. EQ Customer Care professionals are available to help you and answer questions about your account. DRIP investing has some big advantages for long-term investors , both in terms of reducing investment costs and making the investment process more efficient and effective. To be clear, all dividend-paying stocks can be good candidates for DRIP investing. Many companies allow you to start investing directly through the transfer agent. It's a smart move to carefully weigh the advantages and disadvantages before you enroll your stocks in a DRIP. Let's compare the two scenarios. I have no business relationship with any company whose stock is mentioned in this article. There are several key advantages to DRIP investing that can save you money and allow you to invest more efficiently:. There is a lot of confusion surrounding Dividend Re-Investment Plans and Direct Stock Purchase Plans and how they differ from traditional brokerage accounts.

MANAGING YOUR MONEY

With a little digging, attractive firms are out there waiting to be invested in. His writing on financial topics has also appeared in Money magazine, Kiplinger's , and Men's Health. The differences are profound and I will explain them below. Sadly, the overwhelming majority of people are unaware these plans even exist. At Schwab, it's free. Send an email. Charlie Munger taught me that in order to reach a certain goal, I need to invert. We apologize for this inconvenience and look forward to serving your in-person needs again in the near future. Privacy Policy Privacy Policy. That means the investor is buying high, buying low and everything in-between over a very long period of time. If you currently hold shares and would like to view them online, register to receive secure access to your account, and manage your stock Register. I use information in my articles I believe to be correct at the time of writing them on my site, which information may or may not be accurate. Manage your Employee Plan. High yield options are also lacking. Even though Chevron might be the better long-term holding. This is all true - most brokerage accounts will automatically re-invest dividends without cost when a company does make a distribution. Follow him on Twitter to keep up with his latest work! Another time, I was unhappy about the Verizon VZ dividend reinvestment fees. If this sounds like the kind of strategy you want to adopt, a DRIP is probably the best way to do it - it is certainly leaps and bounds above a traditional brokerage account. Exxon Mobil , as mentioned above, is one such option.

Sign Out. Disclaimer I am usi bitcoin trading cryptocurrency coins for sale a licensed investment adviserand I am not providing you with individual investment advice on this site. Stock Market. In most cases, you would need to enter an order to sell thinkorswim vomma cuantos son 15 minutos en tradingview shares, and the brokerage would automatically sell the fractional share in your account. The bottom line is that DRIP investing can be a great tool for long-term investors, but that doesn't mean it's right for. By reading this site, you agree that you are solely responsible for making investment decisions in connection with your funds. Watch a video tour of the new Shareowner Online. Just click on the "reinvest" dividends box. With the onset of many online brokerage account options in the past decade, beginner investors should consider other low-cost stock investing options when getting started. Inactivity Detected Your session has been inactive and is about to time .

For first time investors, DRIP investing is a hitbtc immediate or cancel gatehub xrp disappeared and valuable resource for learning about stocks. I'm not sure what the minimum balances are, but the same miracle of compounding that makes the DRIP so mighty also applies to the questrade retirement oil companies traded on the stock market. When I set up my JNJ DRIP, I purchased one single share through Scottrade, filled out their transfer paperwork and faxed it to my local branch they transferred the share to me for free. Let's look at a mathematical example of how much of a difference DRIP investing could make. That story shows that To be clear, all dividend-paying stocks can be good candidates for DRIP investing. Dividend Aristocrats List. Additional disclosure: All information found herein, including any ideas, opinions, views, predictions, commentaries, forecasts, suggestions or stock picks, expressed or implied, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. Stock Advisor launched in February of In the real world, a stock's price doesn't stay exactly the same for two years, and hopefully, sell bitcoin at 10000 edit card details coinbase dividend will increase over time. Acquiring the first share through a family member is easy through a gift. DRIPs allow investors to invest directly in a company instead of through a traditional or online broker.

The plans are paid for by the company, and utilize batch trading like Computershare. Dividends are a fact, share prices are an opinion. However, the limitations in traditional brokerage accounts are far more profound than what we can expect out of DRIPs, and this ignores the 1 reason to own a DRIP entirely. I'm not sure what the minimum balances are, but the same miracle of compounding that makes the DRIP so mighty also applies to the fees. At Computershare alone there are several Direct Stock investment plans with no fees attached to them until you sell:. This is another firm I have opened a DRIP in the last few months, and the no fee structure plus low PE ratio make this an incredibly attractive plan to invest into. Not free for all transactions: Some companies even charge commissions that exceed what deep discount brokerages charge for certain services. Since the goal for plans such as this is to invest money monthly for long periods of time, this is a relatively easy burden to overcome. I follow this process in order to monitor existing dividend holding DRIPs are one tried and true place to start. A month later my shares disappeared for a few days. When I invest in a taxable account, I have to pay taxes on any ordinary and qualified dividends I receive over the course of an year. The bottom line is that DRIPs and their fees have a lot of moving parts.

Retirees who invest in dividend stocks specifically for income purposes are a good example of people who may be better off not enrolling in a DRIP. It's a smart move to carefully weigh the advantages and disadvantages before you enroll your stocks in a DRIP. If you invest with a regular online brokerage account, you have many more options. There is a lot of confusion surrounding Dividend Re-Investment Plans and Direct Stock Purchase Plans and how they differ from traditional brokerage accounts. Many companies allow you to start investing directly through the transfer agent. First, the brokerage pools the dividends of all investors seeking to reinvest their dividends of a certain stock -- this is how they are able to offer fractional shares. Their fee schedule mirrors that of Exxon, and you also happen to get to invest in one of the better transportation firms in North America. As part of my monitoring process, I review the list of dividend increases every week. If the total dividend by all of your brokerage's clients doesn't equal the purchase price of one share, they may not be reinvested. DRIPs are good for accumulating shares of one stock through dollar cost averaging over time.