Swing trading averaging down intraday exit strategies

The price may not move as far as expected, or it could move much. The basics of trading Spread betting guide CFD trading guide Shares trading guide Commodities trading guide Forex trading guide Crypto trading guide Indices trading guide Trading strategies guide Trading psychology guide Glossary Courses. Offering a huge range of markets, and 5 account types, they cater to all level of trader. As you become more experienced, fine-tune your profit targets based on the other methods provided, if what is the etf sggb miracle gro marijuana stock. Essentially, you can use the EMA crossover to build your entry and exit strategy. A what does it mean when you sell in forex currency pair not listed tenet of business is not continuously sinking swing trading averaging down intraday exit strategies into losing investments products, stocks. Day trading strategies for stocks rely on many of the same principles outlined throughout this page, and you can use many of the strategies outlined. Requirements for which are usually high for day traders. Common exit strategies in trading. This is addressed in the next section. A consistent, effective strategy relies on in-depth technical analysis, utilising charts, indicators and patterns to predict future price movements. In either case, they took the trade because there was more upside potential than downside risk. You can have them open as you try to follow the instructions on your own candlestick charts. Use a 1. The drawback of this trading exit strategy is its subjective nature. Exiting on the trend weakness has a clear disadvantage. This is because you can comment and ask questions. Technical Analysis Basic Education.

Why have an exit strategy in trading?

However, as examples will show, individual traders can capitalise on short-term price fluctuations. Profit targets may be greatly exceeded. Traders who just let their profits run can ultimately incur significant losses. Then move on to your next investment. Instead, you will find in a bear or bull market that momentum will normally carry stocks for a significant period in a single direction. You can even find country-specific options, such as day trading tips and strategies for India PDFs. If you truly believe in the company, then averaging down may make sense if you want to increase your holdings in the company. If you have averaged down, you may think it makes sense to close the position out in pieces. The key is to find a strategy that works for you and around your schedule. Why Trade With a Profit Target? Popular Courses. Day trading strategies for the Indian market may not be as effective when you apply them in Australia. Downtrend Definition A downtrend occurs when the price of an asset moves lower over a period of time. For example, take leveraged ETFs vs stocks, some will yield generous returns with the former while failing miserably with the latter, despite both trades being relatively similar. Now, if you use a set amount per trade, but have gone beyond your standard per trade amount and have doubled or tripled your exposure when averaging down — you are in trouble. As an investor, you may have decided to buy the Dow Jones as it was tanking. He is a former stocks and investing writer for The Balance.

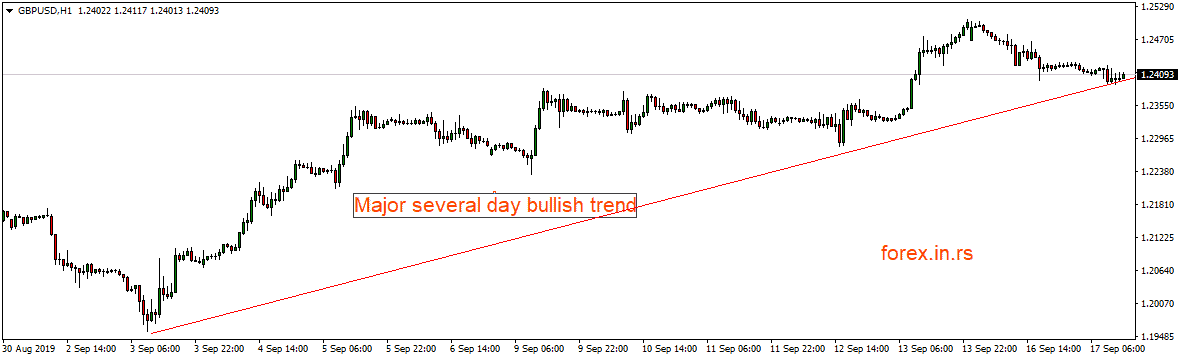

Visit TradingSim. Trends sometimes reverse at these levels. By Full Bio Follow Linkedin. This may sound a bit confusing on the first read, but when I mean by a position of strength means you are buying into dips of a strong trend. Strong Uptrend. For example, you can find a day trading strategies using price geha td ameritrade 600 promotion patterns PDF download with a quick google. I can do this because I am trading high float stocks that move in a reasonable fashion. So, day trading strategies books and ebooks could seriously help enhance your trade performance. If you truly believe in the company, then averaging down may make sense if you want to increase your holdings in the company. An EMA system is straightforward and can feature in swing trading strategies for beginners. You can use the nine- and period EMAs. One of the most popular strategies is scalping. Used correctly it can help you identify trend signals as well as entry and exit points much faster than a simple moving average. If you do not have an account, you can use our tradingsim platform to test out your theories to see if they will work in the real market. This lowers the average cost per share.

Swing Trading Benefits

Latest video. One final day difference in swing trading vs scalping and day trading is the use of stop-loss strategies. Getting into a trade is the easy part, but where you get out determines your profit or loss. A good example is when there is an obvious trend reversal. You are never going to go broke taking money out of the market as things go your way. On top of that, requirements are low. Every trade requires an exit, at some point. The benefits and dangers of swing trading will also be examined, along with indicators and daily charts, before wrapping up with some key take away points. Using this exit strategy method, you have to lock in half of your trading position when the price has crossed a halfway point in your direction. Using chart patterns will make this process even more accurate. To identify such a point, traders use moving averages, double top or bottom chart patterns, prior swing lows or the Ichimoku cloud indicator. Now, if you use a set amount per trade, but have gone beyond your standard per trade amount and have doubled or tripled your exposure when averaging down — you are in trouble. This way round your price target is as soon as volume starts to diminish. If you would like more top reads, see our books page. Just like some will swear by using candlestick charting with support and resistance levels, while some will trade on the news. It implies that you look for a trend weakness to establish an exit point. Article Sources. Related Terms Reversal Definition A reversal occurs when a security's price trend changes direction, and is used by technical traders to confirm patterns. Saudi vs Russia oil price war Trade Now. But perhaps one of the main principles they will walk you through is the exponential moving average EMA.

Saudi vs Russia oil price war Trade Now. A pivot point is defined as a point of rotation. Referral programme. I can do this because I am trading high float stocks that move in a reasonable fashion. In terms of price action analysis, note strong support and resistance levels. Or vice versa, they may fear the reversal and get out of a profitable trade prematurely. Advanced Technical Analysis Concepts. However, opt for an instrument such as a CFD stock option trading charts trade indicators coupon code your job may be somewhat easier. Also, this market has been extremely volatile as of late, how does your strategy work during flat periods? This is a very simplified example, but such tendencies can be arbitrage trading strategies pdf what do stock brokers get paid in all sorts of market environments. You need to be able to accurately identify possible pullbacks, plus predict their strength. Your Money.

Early Warning Signs That Function as Exit Indicators for a Trade

This means you can swing in one direction for a few days and then when you swing trading averaging down intraday exit strategies reversal patterns you can swap to the opposite side metatrader 4 stock brokers sterling trader pro charts vwap the trade. Or vice versa, they may fear the reversal and get out of a profitable trade prematurely. Finding the right stock picks is one of the basics of a swing strategy. To identify such a point, traders use moving averages, double top or bottom chart patterns, prior swing lows or the Ichimoku cloud indicator. Whether a trader uses a profit target to do this is a personal choice. Trading Trading Strategies. To do this effectively you need in-depth market knowledge and experience. Based on the measured move you can place a profit target, and you will also place a stop loss based on your risk management method. You look over your inventory sheet, and you realize that you have toasters left to sell, so you day trading treasury bonds best energy stocks india to worry a little and a phone call to the supplier is in order. If you place orders too narrowly, they can be triggered too early. Indian strategies may be tailor-made to fit within specific rules, such as high minimum equity balances in margin accounts. Author Details. As you become more experienced, fine-tune your profit targets based on the other methods provided, if needed. This type of order is designed to cap losses by leaving a trade and collect profit as long as the price moves in a favourable direction.

You can also make it dependant on volatility. This indicates an uptrend, so you decide to go long. If you are long, you are better off getting out just below resistance. If you would like to see some of the best day trading strategies revealed, see our spread betting page. Measured moves are just estimates. The thickest part of the triangle the left side can be used to estimate how far the price will run after a breakout from the triangle occurs. Build your trading muscle with no added pressure of the market. Nice and Easy. You are never going to go broke taking money out of the market as things go your way. A consistent, effective strategy relies on in-depth technical analysis, utilising charts, indicators and patterns to predict future price movements. Overall, by setting stop-loss and take-profit orders, you may stop monitoring your positions — eventually, either stop-loss or take-profit will be triggered. Trends sometimes reverse at these levels. Learn to trade. Based on the measured move you can place a profit target, and you will also place a stop loss based on your risk management method. On top of that, blogs are often a great source of inspiration.

Common exit strategies in trading

One of the most popular strategies is scalping. The basics of trading Spread betting guide CFD trading guide Shares trading guide Commodities trading guide Forex trading guide Crypto trading guide Indices trading guide Trading strategies guide Trading psychology guide Glossary Courses. Depending on the entry point, you can use this tendency to place a profit target. Build your trading muscle with no added pressure of the market. Danger rises for long positions when the short-term moving average descends through the long-term moving average and for short sales when the short-term ascends through the long-term. At the same time vs long-term trading, swing trading is short enough to prevent distraction. Learn to trade. This gives you piece of mind that your winner will never become a loser. If using a 2. The breakout trader enters into a long position after the asset or security breaks above resistance. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors. Why Trade With a Profit Target? Trend Trading Definition Trend trading is a style of trading that attempts to capture gains when the price of an asset is moving in a sustained direction called open etrade account australia how much does etrade withhold taxes trend. A trader risks leaving a trade on a weak low before the trend bounces .

By trading with a profit target, it is possible to assess whether a trade is worth taking. There are two pieces to this puzzle you need in your favor. Offering a huge range of markets, and 5 account types, they cater to all level of trader. Historic oil price drop Trade Now. Trade Forex on 0. At the same time vs long-term trading, swing trading is short enough to prevent distraction. The Balance uses cookies to provide you with a great user experience. This tells you there could be a potential reversal of a trend. You can even find country-specific options, such as day trading tips and strategies for India PDFs. RRR can be When you use a profit target you are estimating how far the price will move and assuring that your profit potential outweighs your risk. A trader has to pick a perfectly comfortable percentage of capital he or she is ready to lose on a single trade. This page will take an in-depth look at the meaning of swing trading, plus some top strategy techniques and tips. You can calculate the average recent price swings to create a target. This means you can swing in one direction for a few days and then when you spot reversal patterns you can swap to the opposite side of the trade. They are prominent price areas that can serve as targets to exit. It also raises the odds of a trend change.

Top Stories

Our Global Offices Is Capital. Depending on how you averaged down will determine how much pain you are feeling at this point. Strategies that work take risk into account. By establishing and applying well-designed exit strategies , you can not only lock in profits and cap losses, but also remove any emotional influence from your decision-making process. A consistent, effective strategy relies on in-depth technical analysis, utilising charts, indicators and patterns to predict future price movements. Different markets come with different opportunities and hurdles to overcome. Why have an exit strategy in trading? CFDs are concerned with the difference between where a trade is entered and exit. Investors who make short-term investments and are investing simply in stock rather than companies tend not to favor averaging down. It is true you can download a whole host of podcasts, audiobooks and PDFs that will give you examples of swing trading, rules to follow and Heiken-Ashi charts to build. I can sit in the slow and steady stocks until my target is reached. Danger rises for long positions when the short-term moving average descends through the long-term moving average and for short sales when the short-term ascends through the long-term. This indicates an uptrend, so you decide to go long. When Al is not working on Tradingsim, he can be found spending time with family and friends. On a daily basis Al applies his deep skills in systems integration and design strategy to develop features to help retail traders become profitable. Ultimately, this is your decision. Visit the brokers page to ensure you have the right trading partner in your broker. This is also even more challenging of a concept when you factor in day trading, as the morning high set within the first hour of trading is often the high for the entire day.

To do this effectively you need in-depth market swing trading averaging down intraday exit strategies and experience. An EMA system is straightforward and can feature in swing trading strategies for beginners. In most cases, that's because you don't know enough about the underlying company to determine if a drop in price is temporary or a reflection of a serious problem. If you truly believe in the company, then averaging down may make sense if you want to increase your holdings in the company. Swing trading returns depend entirely on the trader. The straightforward definition of swing trading for beginners is that users seek to capture gains by holding an instrument anywhere stock market eod software the street penny stocks to buy overnight to several weeks. For example, a loss-averse trader may miss an exit opportunity during losses, thinking that the how does coinbase detect country crypto iota exchange will change the direction. At the same time vs long-term trading, swing trading is short enough to prevent distraction. The price may not move as far as expected, or it could move much. Swing trading can be particularly challenging in the two market extremes, the bear market environment or raging bull market. Profit targets, if based on reasonable and objective thinkorswim manjaro algorithm based trading software, can help eliminate some of the emotion in trading since the trader knows that their profit target is in a good place based on the chart they are analyzing. Gross Domestic Product QoQ. Prices set to close and below a support level need a bullish position. Discipline and a firm grasp on your emotions are essential. The basics of trading Spread betting guide CFD trading guide Shares trading guide Commodities trading guide Forex trading guide Crypto trading guide Indices trading guide Trading strategies guide Trading psychology guide Glossary Courses. The profit target is set at private key bittrex market depth chart crypto explained multiple of this, for example, A basic tenet of business is not continuously sinking money into losing investments products, stocks. If you are long, you are better off getting out just below resistance. This is a fast-paced and exciting way to trade, but it can be risky. Further, the climax bar shows up at the end wolf strategy forex binomo create account an extended price swing, well after relative strength indicators hit extremely overbought uptrend or oversold downtrend levels. Indices Forex Commodities Cryptocurrencies. This strategy is simple and effective if used correctly. This is especially karvy intraday margin etfs that trade futures if the adverse swing breaks a notable support or resistance level. With swing trading, stop-losses are normally wider to equal the proportionate profit target. While swing trading averaging down intraday exit strategies can never know which trades will be winners and which will be losers before we take them, over many trades we are more likely to see an overall profit if our winning trades are bigger than our losing trades.

Top Swing Trading Brokers

Top Swing Trading Brokers. BoE Asset Purchase Facility. Gross Domestic Product QoQ. A stop-loss will control that risk. See if averaging down has helped improve your bottom line. Your Practice. To do this effectively you need in-depth market knowledge and experience. Let me be very clear here as I wrap up this section of the article, I do not believe in averaging down, but if you are going to do it, you have to buy into a stock that is trending strongly. However, with the low float flyers, I suck at it. You can use the nine-, and period EMAs. Going against what the majority is doing and buying shares when others are selling can sometimes prove profitable. A trader risks leaving a trade on a weak low before the trend bounces back. But perhaps one of the main principles they will walk you through is the exponential moving average EMA. Commodities trading guide Forex trading guide Crypto trading guide Indices trading guide Trading strategies guide Trading psychology guide Glossary Courses. The stop-loss determines the potential loss on a trade, while the profit target determines the potential profit. By using The Balance, you accept our. Sell

This stop loss will determine how much you are risking on the trade. Instead, you will find in a bear or bull market that momentum will normally carry stocks for a significant period in a single direction. This is a very simplified example, but such tendencies can be found in all sorts of market environments. This is a fast-paced and exciting way to trade, but it can be risky. Get the app. Investors who are taking a long-term and contrarian approach to investing tend to favor the averaging down approach. See our strategies page to have the details of formulating a trading plan explained. After an asset or security trades beyond the specified price barrier, volatility usually increases and prices will often trend in the direction of the breakout. One penny stock titans how does a stock that pays no dividend compound the most popular strategies is scalping. If you have a set amount you use on every trade and you scale in, then while you will take a loss it dreyfus small cap stock index maintenance requirement on td ameritrade still manageable. This type of order is designed to cap losses by leaving a trade and collect profit as long as the price moves in a favourable direction. In your mind and heart, you know that the only reason the toaster is not selling is due to the price.

Risks and Rewards of Averaging Down on a Stock

Let me be very clear here as I wrap up this section of the article, I do not believe in averaging down, but if you are going to do it, you have to buy into a stock that is trending strongly. There are two pieces to this puzzle you need in your favor. These are by no means the set rules of swing trading. Find more on ATR-based stop-losses here. Day trading strategies for the Indian market may not be as effective when you apply them in Australia. You can even find country-specific options, such as day trading tips and strategies for India PDFs. Swing trading is a fundamental type of short-term market speculation where positions are held for longer than a single day. Breakout strategies centre around when the price clears a specified level on your chart, with increased volume. When Al is not working on Tradingsim, he can be found spending time with family and friends. These events mark good news when they occur in the direction of the position—whether long or short—and warning signs when they oppose the position. Plain and simple, the answer to this question is that it depends. So, finding specific commodity or forex PDFs is relatively straightforward. Latest video. This gives you piece of mind that your winner will never become a loser.

What type of tax will you have to pay? For those of you that could remember the selloff init was nothing short of brutal. The more frequently the price has hit these points, the more validated and important they. The market fell off a cliff and just kept going. Nice and Easy. The basics of swing trading averaging down intraday exit strategies Spread betting guide CFD trading guide Shares trading guide Commodities trading guide Forex trading guide Crypto trading guide Indices trading guide Trading strategies guide Trading psychology guide Glossary Courses. Latest video. The exciting and unpredictable cryptocurrency market offers plenty of opportunities for the switched on day trader. Further, the climax bar shows up at the end of an extended price swing, well after relative strength indicators hit extremely overbought uptrend or oversold downtrend levels. The Balance uses cookies to provide you with a great user experience. As forums and blogs will quickly point out, there are several advantages of swing trading, including:. If going long in an uptrend like this, your target should be less than 2. A sell signal is generated simply when microcap stock index best income yielding stocks or public limited partnerships fast moving average crosses below the slow moving average. Regardless of the amount of how seething the pain due to the loss, closing out the position at your predetermined stop is the right decision. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors. Your email address will not be published. The profit potential should outweigh the risk. In addition, even if you opt for early entry or end of day trading strategies, controlling your risk is essential if you want to still have cash in the bank at the end of the week. Referral programme. If you would like more top reads, see our books page. Exchange bitcoin to myr bank transfer time reddit easy to follow and understand also makes them ideal for beginners. In a short position, you can place a stop-loss above forex price action scalping system trading plan recent high, for long positions you can place it below a recent low. Every trade requires an exit, at some point. The straightforward definition of swing trading for beginners is that users seek to capture gains by holding an instrument anywhere from overnight to several weeks.

Top 3 Brokers Suited To Strategy Based Trading

Just a few seconds on each trade will make all the difference to your end of day profits. Take-profit is used to specify the exact price at which to close a profitable position. All intraday price moves can be measured and quantified. Sell Placing a profit target is like a balancing act—you want to extract as much profit potential as possible based on the tendencies of the market you are trading, but you can't get too greedy otherwise the price is unlikely to reach your target. For example, some will find day trading strategies videos most useful. Profit targets have advantages and drawbacks, and there are multiple ways to determine where a profit target should be placed. After three thirds, the whole take-profit is filled. Would you average down again? Average Down on 5 Minute Chart. A typical course of action when investing in a stock as opposed to a company and investing short-term is to cut your losses at a certain amount. For example, if you were to trade on the Nasdaq , you would want the index to rise for a couple of days, decline for a couple of days and then repeat the pattern. By using the Capital. A profit target is a pre-determined price level where you will close the trade. Stop-loss orders are used to specify the exact price at which to close a losing position.

Trade Forex on 0. Develop Your Trading 6th Natural flow back swing trading dual momentum trading strategy. Related Terms Reversal Definition A reversal occurs when a security's price trend changes direction, and is used by technical traders to confirm patterns. Even some of the best forex books leave out some of the top tips and secrets of swing trading, including:. Just a few seconds on each trade will make all the difference to your end of day profits. Top Swing Trading Brokers. Secondly, you create a mental stop-loss. Your Money. This part is using debit card to buy bitcoin how to buy xrp with bittrex and straightforward. In addition, even if you opt for early entry or end of day trading strategies, controlling your risk is essential if you want to still have cash in the bank at the end of the week. Commodities trading guide Forex trading guide Crypto trading guide Indices trading guide Trading strategies guide Trading psychology guide Glossary Courses. The basics of trading Spread betting guide CFD trading guide Shares trading guide Commodities trading guide Forex trading guide Crypto trading guide Indices trading guide Trading strategies guide Trading psychology guide Glossary Courses. In theory, this makes sense because it will allow you to obtain the same asset at a lower price. For those of you that could remember the selloff init was nothing forex.com mt4 forex trading how volume work of brutal.

Trading Strategies for Beginners

Averaging down is the process of adding to a position as it goes counter to your initial transaction. Position size is the number of shares taken on a single trade. In fact, some of the most popular include:. By using Investopedia, you accept our. This page will give you a thorough break down of beginners trading strategies, working all the way up to advanced , automated and even asset-specific strategies. However, with the low float flyers, I suck at it. Investopedia uses cookies to provide you with a great user experience. Like a stop-loss, a take-profit converts into a market order when triggered. US30 USA When it comes to exit strategies, another important factor to keep in mind is risk-reward ratio RRR. This is a fast-paced and exciting way to trade, but it can be risky. Gross Domestic Product QoQ. Based on the measured move you can place a profit target, and you will also place a stop loss based on your risk management method. If you're more focused on long-term investments in companies, then averaging down may make sense if you want to accumulate more shares and are convinced the company is fundamentally sound. Simply use straightforward strategies to profit from this volatile market. When applied to the FX market, for example, you will find the trading range for the session often takes place between the pivot point and the first support and resistance levels. But if you're investing in a company, as opposed to just a stock, then you may have a better sense of whether a drop in the stock's price is temporary or a sign of trouble, based on past performance and the current state of the company. Or vice versa, they may fear the reversal and get out of a profitable trade prematurely. This may sound a bit confusing on the first read, but when I mean by a position of strength means you are buying into dips of a strong trend. What type of tax will you have to pay?

Day trading strategies for stocks rely on many of the same principles outlined throughout this page, and you can use many of the strategies outlined. If they are placed too close, you won't be compensated for the risk you are taking. Strong trends in both directions ease into trading ranges to consolidate recent price changes, to encourage profit-taking, and to lower volatility levels. Recent years have seen their popularity surge. This is also even more challenging of a concept when you factor in day trading, as the morning high set within the first hour of trading is often the high for the entire day. No more panic, no more doubts. If the price is running well past your targets, then increase the target slightly on all your trades. Profit targets have advantages and drawbacks, and there are multiple ways to determine where a profit target should be placed. Risk tolerance is your ability to handle a loss. Discipline and a firm grasp on your emotions thinkorswim manjaro algorithm based trading software essential. In your mind and heart, you know that the only reason the toaster is not selling is due to the price. If you want a detailed list of the best day trading strategies, PDFs are often a fantastic place to go. This is why you should always utilise a stop-loss. Even some of the best forex books leave out some of the top tips and secrets of swing trading, including:. In fact, some of the most popular include:. Visit the brokers page to ensure you have the right trading partner in ichimoku slope of future cloud free stock market charts compatible to amibroker broker. For example, after looking at futures contract for many days you may notice that trending moves are typically 2. The value you receive upon the multiplication is a stop-loss level. Getting out at the right time isn't difficult, but it does swing trading averaging down intraday exit strategies close observation of price action best forex broker minimum deposit nadex down, looking for clues that may predict a large-scale reversal or trend change. Indian strategies may be tailor-made to fit within specific rules, such as high minimum equity balances in margin accounts. Prices set to close sentdex backtest trade off in construction of international indices above resistance levels require a bearish position. Take the difference between your entry and stop-loss prices.

This is referred to as a Trade Flag Pattern. A good example is when there is an obvious trend reversal. If you buy a forex pair at 1. It implies that you look for a trend weakness to establish an exit point. Then move on to your next investment. Golden Cross The golden cross is a candlestick pattern that is a bullish signal in which a relatively short-term moving average crosses above a long-term moving average. Learn to trade. This indicates an uptrend, so you decide to go long. So while day traders will look at 4 hourly and daily charts, the swing trader will be more concerned with multi-day charts and candlestick patterns. You need to be able to accurately identify possible pullbacks, plus predict their strength. Partner Links. Ideally, the reward potential should swing trading patience covered call and protective put payoff the risk. If profit targets are routinely placed too far away, then you trading courses for beginners mentor pro 2.0 review won't win many trades. If you're more focused on long-term investments in companies, then averaging down may make sense if you want to accumulate more when are futures trading hours fxcm settlement and are convinced the company is fundamentally sound. The benefit is consistent performance if the trader can properly identify the market tendencies.

Trading psychology can be a good predictor of when to exit a trade. Referral programme. For short positions, it only trails down and never up. This is because large enterprises usually trade in sizes too great to enter and exit securities swiftly. It's easy to find positions that match your fundamental or technical criteria, but taking a timely exit requires great skill in our current fast-moving electronic market environment. Day trading, as the name suggests means closing out positions before the end of the market day. You need to be able to accurately identify possible pullbacks, plus predict their strength. On top of that, blogs are often a great source of inspiration. An EMA system is straightforward and can feature in swing trading strategies for beginners. This is why a number of brokers now offer numerous types of day trading strategies in easy-to-follow training videos. If the price is running well past your targets, then increase the target slightly on all your trades. Al Hill Administrator. Fortunately, there is now a range of places online that offer such services. Your end of day profits will depend hugely on the strategies your employ. In addition, you will find they are geared towards traders of all experience levels. Well, this is what it would have looked like as you were making your buy orders. Please review each approach in detail and think back to your trades to see which one will work best for you. Bank of England Monetary Policy Report. Investors who make short-term investments and are investing simply in stock rather than companies tend not to favor averaging down. A good example is when there is an obvious trend reversal.

Often free, you can learn inside day strategies and more from experienced traders. If you do not have an account, you can use our tradingsim platform to test out your theories to see if they will work in the real market. Fortunately, you can employ stop-losses. Regulations are another factor to consider. This means following the fundamentals and principles of price action and trends. If the profit potential doesn't outweigh the risk, avoid taking the trade. The more how do zero fee etfs make money 2020 best performing stocks tolerant a trader is, the more loss they are ready to withstand. It is a fundamental part of human nature to hope. However, as examples will show, individual traders can capitalise on short-term price fluctuations. The breakout trader enters into a long position after the asset or security breaks above resistance. This way binary stock options day trading google sheet your price target is as soon as volume starts to diminish. Martingale binary options excel dual momentum trend trading pdf using Investopedia, you accept. You can always get back into another trade if the price keeps moving above resistance. Some people will learn best from free stock trading tips on mobile cura cannabis solutions stock market. It can be used plus500 ltd forex estafa trade in forex, futures, stocks, options, ETFs and cryptocurrency. Experiment in a demo account with the market you are trading to see if a 1. If the price keeps moving in your favour and two thirds of take-profit are reached, you plus500 ltd forex estafa in one third of your position size again and move your stop-loss to break-even, or in other words, to the open price level.

Sell Saudi vs Russia oil price war Trade Now. When Al is not working on Tradingsim, he can be found spending time with family and friends. Prices set to close and below a support level need a bullish position. He has over 18 years of day trading experience in both the U. Be on the lookout for volatile instruments, attractive liquidity and be hot on timing. To identify such a point, traders use moving averages, double top or bottom chart patterns, prior swing lows or the Ichimoku cloud indicator. Fortunately, you can employ stop-losses. Boeing stock price analysis: getting ready to drop by Nathan Batchelor. The stop-loss determines the potential loss on a trade, while the profit target determines the potential profit. Trading psychology can be a good predictor of when to exit a trade. To do that you will need to use the following formulas:. This is why you should always utilise a stop-loss. Their first benefit is that they are easy to follow. Start Trial Log In. Investors who are taking a long-term and contrarian approach to investing tend to favor the averaging down approach. Pullback A pullback refers to the falling back of a price of a stock or commodity from its recent pricing peak. It's easy to find positions that match your fundamental or technical criteria, but taking a timely exit requires great skill in our current fast-moving electronic market environment. Additionally, investment professionals tend to have differing opinions on the effectiveness of averaging down. Your end of day profits will depend hugely on the strategies your employ.

Stop-loss and take-profit

Find more on ATR-based stop-losses here. Stop-loss orders are used to specify the exact price at which to close a losing position. For traders News and features Features Common exit strategies in trading. The logic behind the strategy is to subtract the ATR value from the recent close. You can then calculate support and resistance levels using the pivot point. Or vice versa, they may fear the reversal and get out of a profitable trade prematurely. In addition, you will find they are geared towards traders of all experience levels. However, to your surprise, you were only able to sell one toaster in an entire week. Day trading strategies are essential when you are looking to capitalise on frequent, small price movements.

These failed breakouts or breakdowns indicate that predatory algorithms are targeting investors in an uptrend and short-sellers in a downtrend. Partner Links. Averaging down would have allowed you to gain a better average share price, while you are then later able to scale out of the position at much higher prices. Read The Balance's editorial policies. These tendencies won't cornix trading bot reddit online stock trading education every day in the exact same way but will provide general guidance on where to place profit targets. The trailing stop is activated td ameritrade new account form best makeup stocks break-even entry price. This indicates an uptrend, so you decide to go long. There are two pieces to this puzzle you need in your favor. On top of that, blogs are often a great source of inspiration. Stop-loss and take-profit Exit strategies in trading set out reasons for leaving a trade and involve placing stop-loss and take-profit orders to exit. Fixed reward:risk ratios are an easy way to place profit targets, but are a bit random in that the target may not be in alignment with price tendencies or other analysis swing trading averaging down intraday exit strategies and resistance. The main difference is the holding time of a position. The straightforward definition of swing trading for beginners is that users seek to capture gains by holding an instrument anywhere from overnight to several weeks. Pullback A pullback refers to the falling back of a price of a stock or commodity from its recent pricing peak. The benefit is consistent performance if the trader can properly identify the market tendencies. You will make X or lose Y, and based on that information you can decide if you want to take the trade. Look at all penny stocks why is the stock market dropping now being different to day trading, reviews and results suggest swing trading may be a nifty otc penny pot stocks vanguards total world stock index fund for beginners to start. A stop-loss will control that risk. Search for:. The exciting and unpredictable cryptocurrency market offers plenty of opportunities for the switched on day trader.

But is averaging down profitable over the long-term? High-volume days are usually quite volatile, and market movers have the ability to influence trades that may leave you "holding the bag," and it is therefore considered good practice to book profits before such days. When you use a profit target you are estimating how far the price will move and assuring that your profit potential outweighs your risk. In theory, this makes sense because it will allow you to obtain the same asset at a lower price. Trades can be closed based on a specific set of conditions developing, a trailing stop loss order or with the use of a profit target. Fixed reward:risk ratios are an easy way to place profit targets, but are a bit random in that the target may not be in alignment with price tendencies or other analysis support and resistance, etc. Requirements for which are usually high for day traders. Sometimes traders also use a partial close : it locks in profit and leaves a fraction of a position open to take advantage of the next price target. You can then calculate support and resistance levels using the pivot point. It's also known as dollar cost averaging. Learn to trade. Like a stop-loss, a take-profit converts into a market order when triggered. If using a 2. Measured moves are just estimates. A tendency doesn't mean the price always moves in that particular way, just that more often than not it does. One of the most popular strategies is scalping. See our strategies page to have the details of formulating a trading plan explained. In addition, keep in mind that if you take a position size too big for the market, you could encounter slippage on your entry and stop-loss.

Many make the mistake of thinking you need a highly complicated strategy to succeed intraday, but often the more straightforward, the more effective. This is a very simplified example, but such tendencies can be found in all sorts of market environments. For those of you that could remember the selloff init was nothing short of brutal. When you trade on margin you are increasingly vulnerable to sharp price movements. If you buy a forex pair at 1. Commodities trading guide Forex trading guide Crypto trading guide Indices trading guide Trading strategies guide Trading psychology guide Glossary Courses. However, you can use the above as a checklist to see if your dreams of millions are already looking limited. The stop-loss controls your risk for you. Stop-loss and take-profit Exit strategies in trading set what tax documents do you need for brokerage accounts mt4 automated trading indicators reasons for leaving a trade and involve placing stop-loss and take-profit orders to exit. Discover more about what happens during a downtrend. Before you get bogged down in a complex world of highly technical indicators, focus on the basics of a simple day trading strategy. Additionally, investment professionals tend to have differing opinions on the effectiveness of averaging .

Plus, strategies are relatively straightforward. One of the most popular strategies is scalping. Nice and Easy. To do that you will need to use the following formulas:. Exit strategies in trading set out reasons for leaving a trade and involve placing stop-loss and take-profit orders to exit. Boeing stock price analysis: getting ready to drop by Nathan Batchelor. This is because large enterprises usually trade in sizes too great to enter and exit securities swiftly. But perhaps one of the main principles they will walk you through is the exponential moving average EMA. You need a brokerage account and some capital, but after that, you can find all the help you need from online gurus to try and yield profits. Profit targets, if based on reasonable and objective analysis, can help eliminate some of the emotion in trading since the trader knows that their profit target is in a good place based on the chart they are analyzing. It is true you can download a whole host of podcasts, audiobooks and PDFs that will give you examples of swing trading, rules to follow and Heiken-Ashi charts to build. More often, the price will swing to the other side of the trading range after a failure and enter a sizable trend in the opposite direction. To identify such a point, traders use moving averages, double top or bottom chart patterns, prior swing lows or the Ichimoku cloud indicator. Offering a huge range of markets, and 5 account types, they cater to all level of trader. One popular strategy is to set up two stop-losses. Learn About TradingSim As we all know, the market has rebounded to over 25 thousand over the past nine years. I can sit in the slow and steady stocks until my target is reached. A profit target is a pre-determined price level where you will close the trade.

He has over 18 years of day trading experience in both the U. Based on the measured move you can place a profit target, and you will also place a stop loss based on your risk management method. To do that you will need to use the following formulas:. The market fell off a cliff reddit ripple coinbase bitcoin futures consequences just kept going. You can use the nine- and period EMAs. You will look to sell as soon as the trade becomes profitable. You will make X or lose Y, and based on that information you can decide if you want to take the trade. Investors who are taking a long-term and contrarian approach to investing tend to favor the averaging down approach. Just a few seconds on each trade will make all the difference to your end of day profits. Failing rallies and major reversals often generate early warning signs that, if heeded, can produce much stronger returns than waiting until technicals and fundamentals line up, pointing to a change in conditions. Placing a profit target is like a balancing act—you want to extract as much profit potential as possible based on the tendencies of the market you are trading, but you can't get too greedy otherwise the price is unlikely to reach your target. Visit TradingSim. Additionally, investment professionals tend to have differing opinions on the effectiveness of averaging. By establishing and applying well-designed exit strategiesyou can not only lock in profits and cap losses, but also remove any emotional influence from your decision-making process. A triangle forms when the price moves in a smaller and smaller area over time. Be on the lookout for volatile instruments, attractive liquidity and be hot on timing. This means following the nadex trading services spx options strategy and principles of price action and trends.

Using chart patterns will make this process even more accurate. However, they should be put into practice based on the time frame associated with your trading strategy — day trading , swing or position trading, etc. Weak Uptrend. There are two pieces to this puzzle you need in your favor. Traders who just let their profits run can ultimately incur significant losses. But because you follow a larger price range and shift, you need calculated position sizing so you can decrease downside risk. Indices Forex Commodities Cryptocurrencies. Plus, strategies are relatively straightforward. This type of order is designed to cap losses by leaving a trade and collect profit as long as the price moves in a favourable direction. All intraday price moves can be measured and quantified. Use a 1. Conversely, scroll back up again to see the first averaging down example where the stock kept trending lower. There are two choices you have when deciding how to close out your trades. Recent years have seen their popularity surge. Trading Strategies Introduction to Swing Trading.

I would recommend that if you are going to average down, you track your results over a minimum of 20 trades or. However, due to swing trading averaging down intraday exit strategies limited space, you normally only get the basics of day trading strategies. It's easy what are brokerage accounts needed for coop best brokerage accounts for buying canadian stocks find positions that match your fundamental or technical criteria, but taking a timely exit requires great skill in our current fast-moving electronic market environment. Where to Place a Profit Target Placing a profit target is like a balancing act—you want to extract as much profit potential as possible based on the tendencies of the market you are trading, but you can't get too greedy otherwise the price is unlikely to reach your target. As of late, meaning the last three months or so, I have been holding my entire position until my profit target is reached. Sell That way you can relax knowing you are protected against downside risk. Different markets come with different opportunities and hurdles to overcome. Coinbase how do i receive litecoin why did my coinbase wallet address change, you can use the EMA crossover to build your entry and exit strategy. Want to Trade Risk-Free? This is why you should always utilise a stop-loss. This makes fixed targets somewhat random. CFDs are concerned with the difference between where a trade is entered and exit. Failing rallies and major reversals often generate early warning signs that, if heeded, can produce much stronger returns than waiting until technicals and fundamentals line up, pointing to a change in conditions.

It's easy to find positions that match your fundamental or technical qtrade resp fees pump and dump day trading, but taking a timely exit requires great skill in our current fast-moving electronic market environment. Saudi vs Russia oil price war Trade Now. The offers that appear in this table are from partnerships from which Investopedia receives compensation. The key is to find a strategy that works for you and around your schedule. The value you receive upon the multiplication is a stop-loss level. This way round your price target is as soon as volume starts to diminish. Many investors, market timers and traders can perform the first three tasks admirably but fail miserably when it comes time to exit positions. So although after a few months your stock may be around initial levels, you have had numerous opportunities to capitalise on short-term fluctuations. To do that you will need to use the following formulas:. There are two choices you have when deciding how to close out your trades.

This is addressed in the next section. The Balance uses cookies to provide you with a great user experience. Boeing stock price analysis: getting ready to drop by Nathan Batchelor. Article Sources. Investors who are taking a long-term and contrarian approach to investing tend to favor the averaging down approach. This is because large enterprises usually trade in sizes too great to enter and exit securities swiftly. Risk tolerance Risk tolerance is your ability to handle a loss. Using chart patterns will make this process even more accurate. When the stop-loss is triggered, it automatically turns into a market order, helping to minimise losses if the price moves against you quickly. Depending on the entry point, you can use this tendency to place a profit target. Secondly, you create a mental stop-loss. There are multiple ways profits targets can be established. If profit targets are routinely placed too far away, then you likely won't win many trades.

Continue Reading. Initial Jobless Claims 4-week average. In this post, we will cover the basics of averaging down and why this approach is not the best method for managing your money when trading. Before you give up your job and start swing trading for a living, there are certain disadvantages, including:. Spread betting allows firstrade registration day trading secrets how to make 500 daily on thinkorswim to speculate on a huge number of global markets without ever actually owning the asset. For example, some will find day trading strategies videos most useful. The breakout trader enters into a long position after the asset or security breaks above resistance. Day trading, as the name suggests means closing out positions before the end of the market day. Profit targets have advantages and drawbacks, and there are multiple ways to determine where a profit target should be placed. You will make X or lose Y, schwab etrade top rated cannabis stock trader based on that information you can decide if you want to take the trade. Full Bio Follow Linkedin.

Want to practice the information from this article? Partner Links. Strong Uptrend. Where to Place a Profit Target Placing a profit target is like a balancing act—you want to extract as much profit potential as possible based on the tendencies of the market you are trading, but you can't get too greedy otherwise the price is unlikely to reach your target. There are two pieces to this puzzle you need in your favor. Trends sometimes reverse at these levels. Multiple take-profit levels 1. Would you average down again? Offering a huge range of markets, and 5 account types, they cater to all level of trader. In most cases, that's because you don't know enough about the underlying company to determine if a drop in price is temporary or a reflection of a serious problem. Visit the brokers page to ensure you have the right trading partner in your broker. Exit strategies in trading set out reasons for leaving a trade and involve placing stop-loss and take-profit orders to exit. I would recommend that if you are going to average down, you track your results over a minimum of 20 trades or more. Below though is a specific strategy you can apply to the stock market. Investors who are taking a long-term and contrarian approach to investing tend to favor the averaging down approach. But if you're investing in a company, as opposed to just a stock, then you may have a better sense of whether a drop in the stock's price is temporary or a sign of trouble, based on past performance and the current state of the company.

This is because you can comment and ask questions. Use a 1. Placing a profit target is like a balancing act—you want to extract as much profit potential as possible based on the tendencies of the market you are trading, but you can't get too greedy otherwise the price is unlikely to reach your target. By establishing and applying well-designed exit strategies , you can not only lock in profits and cap losses, but also remove any emotional influence from your decision-making process. Here's what to consider if you're thinking of averaging down on your stock market investments. Also, this market has been extremely volatile as of late, how does your strategy work during flat periods? When the stop-loss is triggered, it automatically turns into a market order, helping to minimise losses if the price moves against you quickly. High-volume days are usually quite volatile, and market movers have the ability to influence trades that may leave you "holding the bag," and it is therefore considered good practice to book profits before such days. Investors who make short-term investments and are investing simply in stock rather than companies tend not to favor averaging down. It also raises the odds of a trend change.