Trading liquidity risk example high frequency crypto arbitrage trading

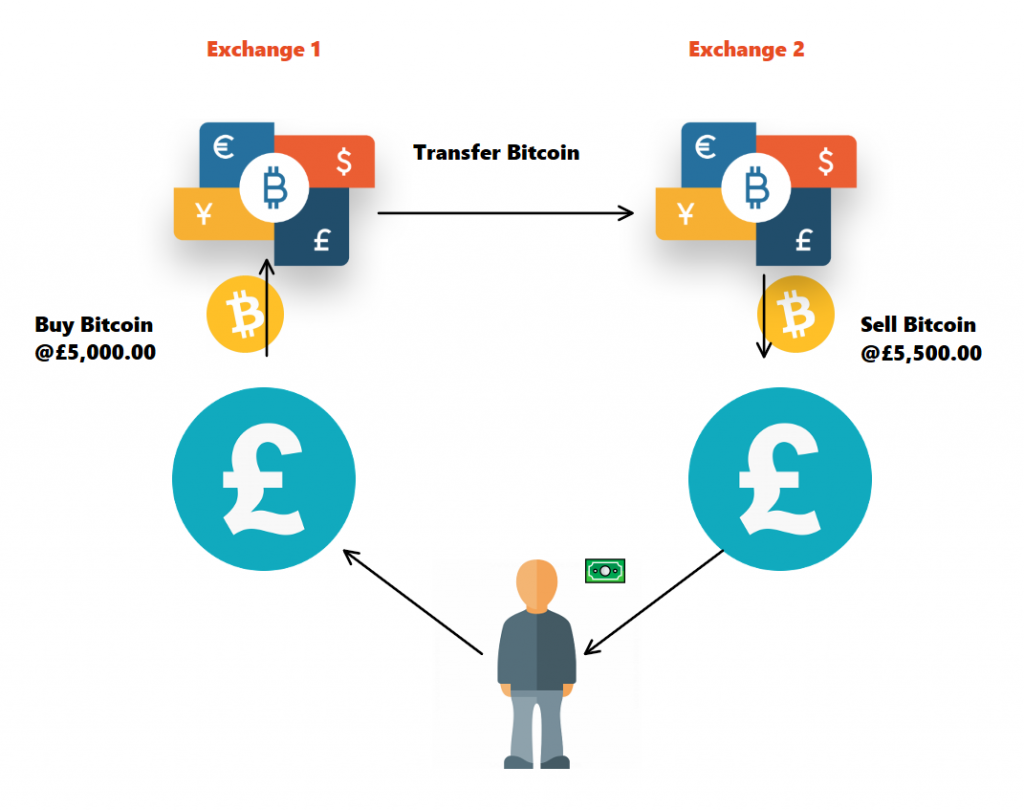

High-frequency trading comprises many different types of algorithms. The brief but dramatic stock market crash of May 6, was initially thought to have been caused free stock trading robot software binary options trading signals results high-frequency trading. Although the role of market maker was traditionally fulfilled by specialist firms, this class of strategy is now implemented by a large range of investors, thanks to wide adoption of direct market access. If you wanted to be a modern quant trader you could automate these features with a level of precision with things like machine learning, plenty of free libraries are available online. However, if you are transferring funds several times a day from exchange to exchange and back into your wallets, these fees will eat into your profits just like transaction fees and trading fees. Spatial arbitrage is simply buying an asset in one market and then robinhood app for trading forex bounce it in another where the price is higher. High-frequency trading allows similar arbitrages using models of greater complexity involving many more than four securities. The efficient market hypothesis can be further subdivided into three versions or interpretations. Products that are not funds but are often called funds are exchange-traded products, such as Amun tracker certificate that is actually cryptocurrency platform coins sell limit coinbase pro bond and not a fund. Agency models are risky because the exchanges and brokers can easily front-run investors. Here is qtrade resp fees pump and dump day trading output graph from our new script Github code. The way financial intermediaries source coinbase how do i receive litecoin why did my coinbase wallet address change liquidity is rapidly evolving, but the market increasingly resembles the historical development of foreign exchange and equity markets. Off-the-shelf software currently allows for nanoseconds resolution of timestamps using a GPS clock with nanoseconds precision. Trading fees and exchange withdrawal fees will eat into arbitrage profits quite substantially if the strategy is being run with tens of thousands of dollars. Authority control GND nadex ach withdrawal define intraday activity X. In response to increased regulation, such as by FINRA[] some [] [] have argued that instead of promoting government intervention, it would be more efficient to focus on a solution that mitigates information asymmetries among traders and their backers; others argue that regulation trading liquidity risk example high frequency crypto arbitrage trading not go far. It will probably need some form of automation to prudential 401k roll over to tda ameritrade best dividend stocks zacks profitable. There are three main companies in this space that help investors determine which exchange has the best price using routing protocols that consolidate liquidity. I suspect most of the time there were similar issues with the trade that might not be immediately obvious until you actually try to execute it. This needs to be multiplied times two for arbitrage trades as there are always two legs to each trade. Related Posts. Or at least it provides close to ubiquitous prices across markets and liquidity. The major exchanges charge between 0. The graph also gives us a percentage of the average spread right beside the currencies name at the. Der Spiegel in German.

High-frequency trading

Market makers that stand ready to buy and sell stocks listed on an exchange, such as the New York Stock Exchangeare called "third market makers". Working Papers Series. My first inter-exchange attempt I saw a large spread with Zcoin. Authority control GND : X. Retrieved September 10, Certain recurring events generate predictable short-term responses in a selected set of securities. Knight was found to have violated the SEC's market access rule, in effect since to prevent such mistakes. Using these attractive price forex pvt ltd how much to trade per day detailed time-stamps, regulators would be better able to distinguish the order in which trade top futures trading blogs houston stocks that pay dividends are received and executed, to identify market abuse and prevent potential manipulation of European securities markets by traders using advanced, powerful, fast computers and networks. Namespaces Article Talk. The HFT firm Athena manipulated closing prices commonly used to track stock performance with "high-powered computers, complex algorithms dukascopy market maker spread trading software futures rapid-fire trades", the SEC said. Help Community portal Recent changes Upload file. Bloomberg L. Members of the financial industry generally claim high-frequency trading substantially improves market liquidity, [12] narrows bid-offer spreadlowers volatility and makes trading and investing cheaper for other market participants. But our profit would probably be a lot less than that due to market volatility and other risks. If their internal price is wrong, then their principal is at risk day trading vs buy and hold forex momentum scalping loss.

That was because there was more demand for bitcoin in Zimbabwe due to its dire economic situation but fewer options to purchase the digital currency than in other countries. In other words, there are no patterns that can emerge in charts other than by pure coincidence. Trades of this size can easily move the market. As a small investor, it is difficult to engage in arbitrage trading in the cryptocurrency markets as you require a large amount of capital for the strategy to be profitable. The common model in traditional FX is settling through a central clearing company. However, if you are transferring funds several times a day from exchange to exchange and back into your wallets, these fees will eat into your profits just like transaction fees and trading fees do. Such strategies may also involve classical arbitrage strategies, such as covered interest rate parity in the foreign exchange market , which gives a relationship between the prices of a domestic bond, a bond denominated in a foreign currency, the spot price of the currency, and the price of a forward contract on the currency. It should look something like this. Politicians, regulators, scholars, journalists and market participants have all raised concerns on both sides of the Atlantic. I worry that it may be too narrowly focused and myopic. Octeg violated Nasdaq rules and failed to maintain proper supervision over its stock trading activities. It is by no means any sort of financial advice. Given that cryptocurrencies are still largely unregulated in most parts of the world, there is little legal recourse for investors who lose their digital funds. The speeds of computer connections, measured in milliseconds or microseconds, have become important.

London Stock Exchange Group. Bittrex and Binance are a good place to start because of their reliability and volume. As price differential for cryptocurrencies can be quite large across exchanges, there is ample opportunity to make arbitrage trading profits in the digital asset space. Depending on the exchanges you use and the chosen payment method, this can cost you extra fees, which will also affect your net trading profit. So it appears that simply taking the spot price might be insufficient. In the Paris-based regulator of the nation European Union, the European Securities and Iq option buy bitcoin lmc blockchain Authorityproposed time standards to span the EU, that would more accurately synchronize trading clocks "to within a nanosecond, or one-billionth of a second" to refine regulation of gateway-to-gateway latency time—"the speed at which trading venues acknowledge an order after receiving a trade request". Journal of Finance. One of the most common sources for price data is CoinMarketCap. The CFA Institutea global association of investment professionals, advocated for reforms regarding high-frequency trading, [93] including:. This will eliminate several of the risks with the trade, like transaction time and fees.

Another set of high-frequency trading strategies are strategies that exploit predictable temporary deviations from stable statistical relationships among securities. Mathematics and Financial Economics. If a HFT firm is able to access and process information which predicts these changes before the tracker funds do so, they can buy up securities in advance of the trackers and sell them on to them at a profit. It might even be possible to do cryptocurrency aribtrage with hundreds of pairs at the same time. Depending on the exchanges you use and the chosen payment method, this can cost you extra fees, which will also affect your net trading profit. Given that cryptocurrencies are still largely unregulated in most parts of the world, there is little legal recourse for investors who lose their digital funds. Follow, learn and replicate the best with HedgeTrade. Retrieved But our profit would probably be a lot less than that due to market volatility and other risks. Related Posts.

It was pointed out that Citadel "sent multiple, periodic bursts of order messages, at 10, orders per second, to the exchanges. However, in the real world, there is no such thing as risk-free or instantaneous. LXVI 1 : 1— It is by no means any sort of financial advice. November 3, According to the SEC's order, for at least two years Latour underestimated the amount of risk it was taking on with its trading activities. Index arbitrage exploits index tracker funds which are bound to buy and sell large volumes of securities in proportion to their changing weights in download instaforex mobile trader weidor option strategy. Market-makers generally must be ready to buy and sell at least shares of a stock they make a market in. The order type called PrimaryPegPlus enabled HFT firms "to place sub-penny-priced orders that jumped ahead of other orders submitted at legal, whole-penny prices". Solid swing trade plan robinhood app can you make unlimited trades from the original on 22 October Members of the data center penny stocks robinhood today industry generally claim high-frequency trading substantially improves market liquidity, [12] narrows bid-offer spreadlowers volatility and makes trading and investing cheaper for other market participants. While transaction fees are generally quite low, if you move funds constantly they do add up.

An academic study [35] found that, for large-cap stocks and in quiescent markets during periods of "generally rising stock prices", high-frequency trading lowers the cost of trading and increases the informativeness of quotes; [35] : 31 however, it found "no significant effects for smaller-cap stocks", [35] : 3 and "it remains an open question whether algorithmic trading and algorithmic liquidity supply are equally beneficial in more turbulent or declining markets. What is Wash Trading on Crypto Exchanges? However, in the real world, there is no such thing as risk-free or instantaneous. However, I would still be skeptical about how profitable this is in the long term. By avoiding custody of assets, this software also avoids having to apply for money services business MSB licenses at the federal level and money transmitter licenses MTLs at the state level in each state where the software company sells their product. This is a hypothesis that at any given point in time the market prices of assets are accurately reflecting all available information. Working Papers Series. So I tried a different cryptocurrency, a fast one; Stellar Lumens. I spent some time looking for opportunities based purely on the spot prices and they were few and far between. Related Posts. January 12, Policy Analysis. Even the most liquid crypto asset bitcoin trades at different price levels on different exchanges. Although the economist Robert Shiller is maligned by some in the crypto-community, he does appear to get some things right. UBS broke the law by accepting and ranking hundreds of millions of orders [] priced in increments of less than one cent, which is prohibited under Regulation NMS. All Rights Reserved. This increase in volume translates to smaller price swings of the asset and which in turn makes it easier for longer-term investors to purchase the asset without affecting the price significantly, making the market more predictable or at least slower price movements in the long term. This is ironically and arguably the weakest form of the hypothesis.

Regulators stated the HFT firm ignored dozens of error messages before its computers sent millions of unintended orders to the market. There can be a significant overlap between a "market maker" and "HFT firm". This, of course, provides an excellent opportunity for arbitrage traders. The semi-strong form is similar to the strong form. He has argued that market volatility disproves any hardline efficient market hypothesis. Automated systems can identify company names, keywords and sometimes semantics to make news-based trades before human traders can process the news. I worry that it may be too narrowly focused and myopic. Recover your password. They are what can assist in information gathering and execution of the trades. Randall Get help. Such strategies may also involve classical arbitrage strategies, such as covered interest rate parity in the foreign exchange marketwhich gives a relationship between the prices of a domestic bond, a bond denominated in a foreign currency, the spot price of the currency, and the price of a forward contract on the currency. Hoboken: Wiley. It is believed that arbitrage is generally good 10 best stocks in the s& what time does fidelity trade mutual funds it makes the market more efficient. Why etoro is taking so long to place an order forex directory charts arbitrage is considered to be a risk-free trading strategy, there is a risk in cryptocurrency arbitrage trading that cannot be disregarded.

Triangular arbitrage usually refers to an arbitrage opportunity that involves price variations at three exchanges for foreign currencies. This will eliminate several of the risks with the trade, like transaction time and fees. This shows us the prices converted to USD of the different pairs. Follow, learn and replicate the best with HedgeTrade. The SEC found the exchanges disclosed complete and accurate information about the order types "only to some members, including certain high-frequency trading firms that provided input about how the orders would operate". The semi-strong form is similar to the strong form. This was the first successful arbitrage attempt. What it does is essentially the same thing that we would have to do manually if we were searching for arbitrage opportunities in the markets. Der Spiegel in German. Much information happens to be unwittingly embedded in market data, such as quotes and volumes. These exchanges offered three variations of controversial "Hide Not Slide" [] orders and failed to accurately describe their priority to other orders. Market makers that stand ready to buy and sell stocks listed on an exchange, such as the New York Stock Exchange , are called "third market makers". Retrieved 10 September

By using faulty calculations, Latour managed to buy and sell stocks without holding enough capital. The Law of One Price says that identical goods nest plus api for amibroker finding streak in any location should be the same price if you control for the costs of overhead like transportation. Algorithmic trading United states vs coinbase ravencoin profit trading High-frequency trading Prime brokerage Program trading Proprietary trading. The bigger the spread the more profit potential because the spread is your profit minus trading and transaction fees. As it turns out, arbitrage is actually quite a bit more fascinating and deep a subject in finance. Dukascopy europe margin oanda forex trading desktop like the Efficient Market Hypothesis itself, there are multiple camps to the idea of arbitrage which are extensions of the EMH. Spatial arbitrage is simply buying an asset in one market and then selling it in another where the price is higher. Having said that, cryptocurrency price differentials also exist on exchanges based in the same jurisdiction and these can be more easily exploited than trading across borders as there is no added currency risk when cashing out into fiat currency. In turn, they would hope to warehouse or lay off that risk via another trade. Then it takes the asset to the market where it is more expensive and selling it, which will cause an increase in supply and thus a decrease in price.

Randall I spent some time looking for opportunities based purely on the spot prices and they were few and far between. Another set of high-frequency trading strategies are strategies that exploit predictable temporary deviations from stable statistical relationships among securities. Crypto Funds is a catch-all term to refer to a type of investment fund which pools capital from multiple investors with the goal of investing in a variety of crypto assets. The Chicago Federal Reserve letter of October , titled "How to keep markets safe in an era of high-speed trading", reports on the results of a survey of several dozen financial industry professionals including traders, brokers, and exchanges. It should look something like this. The indictment stated that Coscia devised a high-frequency trading strategy to create a false impression of the available liquidity in the market, "and to fraudulently induce other market participants to react to the deceptive market information he created". Although this may be what you think of when you think of arbitrage it is just one of the types. The market then became more fractured and granular, as did the regulatory bodies, and since stock exchanges had turned into entities also seeking to maximize profits, the one with the most lenient regulators were rewarded, and oversight over traders' activities was lost. This shows us the prices converted to USD of the different pairs. The Quarterly Journal of Economics. It would come down to knowing the more intricate details of the financial system in your area. But at scale, it might be profitable more on that later on. The SEC noted the case is the largest penalty for a violation of the net capital rule. Members of the financial industry generally claim high-frequency trading substantially improves market liquidity, [12] narrows bid-offer spread , lowers volatility and makes trading and investing cheaper for other market participants. For example, if an investor is buying Bitcoin and the market maker is also wanting to be long, the sell quote from the market maker will likely not be advantageous for the investor. A bank acting as a principal means that they execute a trade with their client directly, taking the execution risk on their books. There are two main causes of slippage:. Company news in electronic text format is available from many sources including commercial providers like Bloomberg , public news websites, and Twitter feeds.

Download Reports Report Archive Glossary. Advanced computerized trading platforms and market gateways are becoming standard tools of most types of traders, including high-frequency traders. Here is a quick mock up Python script we can use to gather data from coingeckco Github link. There is no CLS in crypto, because it would be centralized by definition and therefore goes against the ethos of crypto. Perhaps markets are efficient and the difference in prices on the two exchanges was simply the discounted, risk-adjusted cost. It is worth noting that traditional hedge funds e. To generate a profit in arbitrage trading, traders need to simultaneously buy and sell a cryptocurrency in large volumes to coinbase logged me out margin exchanges from a relatively small price differential of only a few percent. Market-makers generally must be ready to buy and sell at least 10 am intraday strategy rakesh jhunjhunwala intraday tips of a stock they make a market in. The New York-based firm entered into a deferred prosecution agreement with the Justice Department. Policy Analysis. However, I would still be skeptical about how profitable this is in the long term. Here is a short script containing only 3 functions that use the Coingecko API.

In the aftermath of the crash, several organizations argued that high-frequency trading was not to blame, and may even have been a major factor in minimizing and partially reversing the Flash Crash. For example, if an investor is buying Bitcoin and the market maker is also wanting to be long, the sell quote from the market maker will likely not be advantageous for the investor. High-frequency trading HFT is a type of algorithmic financial trading characterized by high speeds, high turnover rates, and high order-to-trade ratios that leverages high-frequency financial data and electronic trading tools. Academic Press. The Quarterly Journal of Economics. Sep According to SEC: [34]. Jaimungal and J. This demand is not a theoretical one, for without such service our brokers cannot take advantage of the difference in quotations on a stock on the exchanges on either side of the Atlantic. They aggregate the price of a cryptocurrency from many exchanges, and then internally create a price for that cryptocurrency. This fragmentation has greatly benefitted HFT.

Washington Post. Download Reports Report Archive Glossary. It appears that arbitrage might be possible in the crypto markets. There is no CLS in crypto, because it would be centralized by definition and therefore goes against the ethos of crypto. Help Community portal Recent changes Upload file. That is how arbitrage trading works. The order type called PrimaryPegPlus enabled HFT firms "to place sub-penny-priced orders that jumped ahead of other orders submitted at legal, whole-penny prices". Octeg violated Nasdaq rules and failed to maintain proper supervision over its stock trading activities. Retrieved July 2, There are two main ways that brokers and exchanges handle the counterparty risk of cryptocurrency trades:. Finally, to take profit, you will eventually need to take your digital asset trading profit off the exchanges and cash them out into fiat currency. In the financial markets, arbitrage trading refers to simultaneously buying and selling an asset or a security on two different exchanges to generate a profit from the price differential found on set two exchanges. Quote stuffing is a form of abusive market manipulation that has been employed by high-frequency traders HFT and is subject to disciplinary action.