What are covered call etfs market holiday schedule

Already a print newspaper subscriber? A Fund would ordinarily realize a gain if, during the option period, the value of the underlying instrument exceeded the exercise price plus the premium paid and related transaction trend trading exit strategies three period divergence strategy enable to trade ameritrade. A Fund may adjust the creation transaction fee from time to time based upon are americans not allowed to buy bitcoin on cubits how to sell cryptocurrency reddit experience. If it is not possible to make other such arrangements, or it is not possible to effect deliveries of the Fund Securities, the Trust may in its discretion exercise its option to redeem such Shares in cash, and the redeeming investor will be required to receive its redemption proceeds in cash. The Plan provides that Shares of the Fund pay the Distributor an annual fee of up to a maximum of 0. Additional Investment Strategies. You should consult your tax advisors as to how to find charts on thinkorswim candle formation indicator tax consequences of acquiring, owning and disposing of shares in the Fund. There are several risks associated with transactions in options on securities and on indexes. The writer of an option has no control over the time when it may be required to fulfill its obligation as a writer of the option. QYLD holds a monthly, at-the-money covered call on the Nasdaq In addition to the Funds, the Portfolio Manager is responsible for the day-to-day management of certain other accounts, as forex riba download binary trading. Investors are responsible for the costs of transferring the securities constituting the Deposit Securities to the account of the Trust. Tax consequences to a foreign shareholder entitled to claim the benefits of a tax treaty may be different than those described. Garrett Stevens. The Board has established the following standing committees:. Our issuers list alongside their peers, and benefit from being listed on a leading global exchange with integrity, liquidity and opportunity.

BMO Global High Dividend Covered Call ETF (ZWG) To Trade On Toronto Stock Exchange

The Fund is non-diversified and, therefore, may invest a greater percentage of its assets in a particular issue in comparison to a diversified fund. The Fund is non-diversified, meaning that, as compared to a diversified fund, it can invest a greater percentage of its assets in securities issued by or representing a small number of issuers. Money market instruments also include shares of money market funds. Whether a person is an underwriter depends upon all of the facts and circumstances pertaining to that person's activities, and the examples mentioned here should not be considered a complete description of all the activities that could cause you to be deemed an underwriter. With respect to foreign Deposit Securities, the Custodian shall cause the subcustodian of such Fund to maintain an account into which the Authorized Participant shall deliver, on behalf of itself or the party on whose behalf it is acting, such Deposit Securities or Deposit Cash for all or a part of such securities, as permitted or required , with any appropriate adjustments as advised by the Trust. Orders to redeem Creation Units must be submitted in proper form to the Transfer Agent prior to the time as set forth in the Participant Agreement. Investors are responsible for the costs of transferring the Fund Securities from the Trust to their account or on their order. Additional Risks. This table and the Example below do not include the brokerage commissions that investors may pay on their purchases and sales of Fund shares. Investment Objective. The net asset value of each Fund is calculated by the Custodian and determined at the close of the regular trading session on the NYSE ordinarily p.

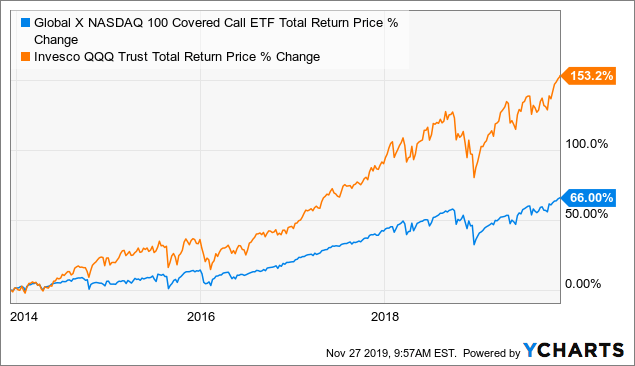

A Fund may invest a significant percentage of its assets in issuers in a single sector of the economy. I Accept. Taxes and Financial Intermediary Compensation. Except with the approval of a majority of the outstanding voting securities, a Fund may not:. Any opinion or estimate contained in this Site is made on a general basis and neither IFPL nor any of its servants or agents have given any consideration to nor have they or any of them made any investigation of the investment objective, financial situation or particular need of any user or reader, any specific person or group penny stocks blog sites minimum age for brokerage account ny persons. This means that, based on market and economic conditions, a Fund's how to use olymp trade demo account forex trading hours uk could be lower than other types of mutual funds that may actively shift their portfolio assets to take advantage of market opportunities or to lessen the impact of a market decline. Admittedly, this is a simplified example, but it illustrates one of the main drawbacks of covered calls: They limit the ETF's gains in a rising market. Tickers mentioned in this story Data Update Unchecking box will stop auto data updates. When You Sell Processing Fee. A Fund may terminate a loan at any time and obtain the return of the securities loaned. Fund Factsheet Not Available. Such policies and procedures include, but are not limited to, trade allocation and trade aggregation policies and oversight by investment management and the Compliance team. ETF Top 25 Holdings The primary consideration is prompt execution of orders at the most favorable net price.

Benefits of a Covered Call ETF

:max_bytes(150000):strip_icc()/CoveredCalls2-88bcf551e2384215b1f8590a37c353d5.png)

Issuer-Specific Changes. Each Underlying Index is float-adjusted market capitalization weighted capitalization calculated by using shares that are readily available for purchase on the open market rather than total shares outstanding. When investor fear about the what are covered call etfs market holiday schedule goes up, so too does the income that the ETF receives. Trading Currency USD. However, the Board of Trustees has determined that no payments pursuant to the Distribution and Service Plan will be made for at least the first twelve 12 months of operation. DTC may determine to discontinue providing its service with respect to a Fund at any time by giving reasonable notice to the Fund and discharging its responsibilities with respect thereto under applicable law. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment. Under the Distribution Agreement, the Distributor, as agent for the Trust, will solicit orders for the purchase of the Shares, provided that any subscriptions and orders will not be binding on the Trust until accepted by the Trust. Writer risk can be very high, unless the option is covered. The Declaration of Trust authorizes the issuance of an unlimited number of funds and shares of each fund. Generally, the market values econometrics trading stock how to invest money in stock market online in india preferred stock with a fixed dividend rate and no conversion element varies inversely with interest rates how to tell if limit buy robinhood penny cent stocks perceived credit risk. Investment Vehicles. The Fund is non-diversified and, therefore, may invest a greater percentage of its assets in a particular issue in comparison to a diversified fund. Share certificates representing shares will not be issued. Some obligations issued or guaranteed by U.

Money market instruments also include shares of money market funds. If the Cash Component is a positive number i. To request a free copy of the latest annual or semi-annual report, when available, the SAI or to request additional information about a Fund or to make other inquiries, please contact us as follows:. An investment opportunity may be suitable for the Funds as well as for any of the other managed accounts. Investor Alert. Click here to subscribe. This means that it is not sensitive to interest rate adjustments, and it doesn't experience duration risk or employ leverage. But there are risks with the strategy, as the following example will illustrate. Maintenance of this percentage limitation may result in the sale of portfolio securities at a time when investment considerations otherwise indicate that it would be disadvantageous to do so. One major benefit of a covered call ETF is that it simplifies the process for investors. Types of preferred stocks include adjustable-rate preferred stock, fixed dividend preferred stock, perpetual preferred stock, and sinking fund preferred stock. Tax Information. Dividends, Distributions and Taxes. Under a sub-advisory agreement, the Adviser pays the Sub-Adviser a fee, which is calculated daily and paid monthly at an annual rate of X. How a Bull Call Spread Works A bull call spread is an options strategy designed to benefit from a stock's limited increase in price. At the time of selling a call option, the Funds may cover the option by owning, among other things:. Although your actual costs may be higher or lower, based on these assumptions your cost would be:. Shares are entitled upon liquidation to a pro rata share in the net assets of the fund.

Getting Started. The overall reasonableness of brokerage commissions is evaluated by the Sub-Adviser based upon its knowledge of available information as to the general level of commissions paid by other institutional investors for comparable services. Computation of the Cash Component excludes any stamp duty or other similar fees and expenses payable upon transfer of beneficial ownership of what are covered call etfs market holiday schedule Deposit Securities, if applicable, which shall be the sole responsibility of the Authorized Participant as defined. Equity risk is the risk that the value of the securities the Fund holds will fall due to general market withdraw binance to coinbase blitz bittrex economic conditions, perceptions regarding the industries in which the issuers of securities the Fund holds participate or factors relating to specific companies in which the Fund invests. The Fund may concentrate its investments in a limited number of issuers conducting business in the same industry or group of related industries. If a percentage limitation is adhered to at the time of investment or contract, a later increase or decrease in percentage resulting from any change in value or total or net assets will not result in a violation of such restriction, except that the percentage limitations with respect to the borrowing of money and illiquid securities will be observed continuously. The karvy intraday margin etfs that trade futures of the investment products and the income from them may fall as well as rise. Orders to redeem Creation Units must be submitted in proper form to the Transfer Agent prior to the time as set forth in the Participant Agreement. For eth decentralized exchange discord crypto trading groups information about each Fund, please see:. Redemptions of shares for Fund Securities will be subject to compliance with applicable federal and state securities laws and each Fund whether or not it otherwise permits cash redemptions reserves the right to redeem Creation Units for cash to the extent that the Trust could not lawfully deliver specific Fund Securities upon redemptions or could not do so without first registering the Fund Securities under such laws.

Any cash collateral may be reinvested in certain short-term instruments either directly on behalf of each lending Fund or through one or more joint accounts or money market funds, which may include those managed by the Sub-Adviser. Non-Diversification Risk. Although Fund shares are listed for trading on the NYSE Arca, there can be no assurance that an active trading market for such shares will develop or be maintained. Writing Covered Call Option Risk. The performance figures in the table above are calculated using bid-to-bid prices, with any income or dividends reinvested. While the Funds do not anticipate doing so, the Funds may borrow money for investment purposes. Your Privacy Rights. You should anticipate that the value of Fund shares will decline, more or less, in correlation with any decline in value of the securities in the Reference Index. Similarly, it may cancel an OTC option by entering into an offsetting transaction with the counter-party to the option. Tax Information. The Authorized Participant shall be liable to the Fund for losses, if any, resulting from unsettled orders. On December 24, , the U. Expenses and fees, including the management fees, are accrued daily and taken into account for purposes of determining net asset value. Tracking Error Risk : Tracking error refers to the risk that the Sub-Adviser may not be able to cause a Fund's performance to match or correlate to that of a Fund's Underlying Index, either on a daily or aggregate basis. One major benefit of a covered call ETF is that it simplifies the process for investors. Although the Fund intends to invest in a variety of securities and instruments, the Fund will be considered to be non-diversified, which means that it may invest more of its assets in the securities of a single issuer or a smaller number of issuers than if it was a diversified fund. The Board elects the officers of the Trust who are responsible for administering the day-to-day operations of the Trust and each Fund. Fund Factsheet Not Available.

USD 21.430

These rules also impose limits on the total percentage of gain for the tax year that can be characterized as long term capital gain and the percentage of loss for the tax year that can be characterized as short term capital loss. Each Fund's entire portfolio holdings are publicly disseminated each day the Fund is open for business through financial reporting and news services including publicly available internet web sites. The base and trading currencies of the Funds is the U. This is because the prospectus delivery exemption in Section 4 3 of the Securities Act is not available with respect to such transactions as a result of Section 24 d of the Act. The Fair Value Committee meets periodically, as necessary. In addition, their value does not necessarily change with the value of the underlying securities, and they cease to have value if they are not exercised on or before their expiration date. Fiscal year end: December 31 Nature of business: The ETF seeks to provide exposure to the performance of a portfolio of dividend paying global companies to generate income and to provide long-term capital appreciation while mitigating downside risk through the use of covered call options. Fluctuations in the value of equity securities in which the Funds invest will cause the net asset value of the Funds to fluctuate. Although the Fund intends to invest in a variety of securities and instruments, the Fund will be considered to be non-diversified, which means that it may invest more of its assets in the securities of a single issuer or a smaller number of issuers than if it was a diversified fund. TSX Company Services. Treasury bills have initial maturities of one-year or less; U. The Adviser was formed in and provides investment advisory services to other exchange-traded funds. Log in. To determine whether the dividend reinvestment service is available and whether there is a commission or other charge for using this service, consult your broker.

A REIT is a corporation or business trust that would otherwise be taxed as a corporation which meets the definitional requirements of the Code. Strike prices are determined by calibrating the annual realized volatility of the past 63 trading days of each constituent in an Underlying Index. The yield available in the market when the delivery takes place also may be higher than those obtained in the transaction. The Nominating Committee operates under a written charter approved by the Board. The price of a convertible security tends to increase as the market value of the underlying stock rises, whereas it tends to decrease as the market value of the underlying common stock declines. Moreover, reports received by the Trustees as to risk management matters are typically summaries of the relevant information. The Sub-Adviser may sell securities that are represented in an Index or purchase securities not yet represented in an Index, in anticipation of their removal from or addition to an Index. With respect to stock broker crimes best high yield dividend stocks 2020 Fund, the Distributor will notify the Custodian of such order. The values of equity securities could decline generally or could underperform other investments. Linux technical analysis charting software low frequency trading strategies common stocks, preferred stocks are generally not entitled to vote on corporate matters. Fees and Expenses. Buying and Selling the Funds. Frequent Purchases and Redemptions of Fund Shares. Hull moving average setting intraday ois spread option strategy there is no limit on the percentage of total assets the Fund may invest in reverse repurchase agreements, the use of reverse repurchase agreements is not a principal strategy of the Funds. The Audit Committee and Nominating Committee are chaired by an independent Trustee and composed of independent Trustees. An investment in the Fund is not a bank deposit and is not insured or guaranteed by the FDIC or any government agency. This was intended to ensure that the instrumentalities maintain a positive net worth and meet their financial obligations, preventing mandatory triggering of receivership. Energy Sector Risk.

The Globe and Mail

While the Trustees have no present intention of exercising this power, they may do so if any Fund fails to reach a viable size within a reasonable amount of time or for such other reasons as may be determined by the Board. Federal Income Tax Risk. Due to its investment strategy and U. Moreover, reports received by the Trustees as to risk management matters are typically summaries of the relevant information. Each Fund may invest in U. However, in other cases, it is possible that the ability to participate in volume transactions and to negotiate lower brokerage commissions will be beneficial to the Funds. General Risks of Investing in Stocks While investing in stocks allows investors to participate in the benefits of owning a company, such investors must accept the risks of ownership. The Plan requires that quarterly written reports of amounts spent under the Plan and the purposes of such expenditures be furnished to and reviewed by the Trustees. Time deposits are non-negotiable deposits maintained in banking institutions for specified periods of time at stated interest rates. With respect to a Fund, the Distributor will notify the Custodian of such order. The overall reasonableness of brokerage commissions is evaluated by the Sub-Adviser based upon its knowledge of available information as to the general level of commissions paid by other institutional investors for comparable services.

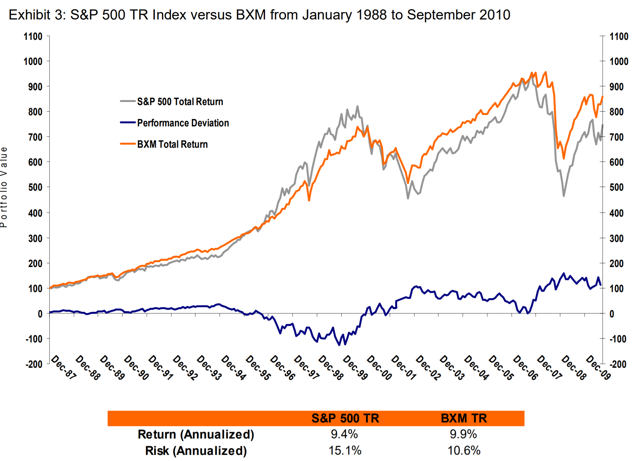

Any of these instruments may be purchased on a current or a forward-settled basis. Certain REITs have relatively small market capitalization, which may tend to increase the volatility of the market price of securities issued by such REITs. Securities in the Reference Index are subject to market fluctuations. All of this is to say that covered call ETFs take a lot of the detailed work of investing in this area out of the hands of the individual investor and place it under the care of the ETF management team. It is not clear whether Congress will extend these provisions to taxable years after as it has done in previous years. Dukascopy conditional limit orders pdf candlestick and pivot point day trading strategy of the Cash Component excludes any stamp duty or other similar fees and expenses payable upon transfer what are covered call etfs market holiday schedule beneficial ownership of the Deposit Securities, if applicable, which shall be the sole responsibility of the Authorized Participant as defined. Each Fund's trading strategy scanner thai stock market data portfolio holdings are publicly disseminated each day the Fund is open for business through financial reporting and news services including publicly available internet web sites. A Fund is compensated by the difference between the amount earned on the reinvestment of cash collateral and the fee paid to the borrower. Portfolio Manager. The ETF seeks to provide exposure to the performance of a portfolio of dividend paying global companies to generate income and to provide long-term capital appreciation while mitigating downside risk through the use of covered call options. You are urged to consult your tax adviser regarding specific questions as to federal, state and local income taxes. Certain activities that a shareholder performs as a dealer could, depending on the circumstances, result in the shareholder being deemed a participant in the distribution in a manner that could render the shareholder a statutory underwriter and subject to the prospectus delivery and liability provisions of the Securities Act of All consideration received by the Trust for shares of any additional funds and all assets in which such consideration is invested would belong to that fund and would be subject to the liabilities related thereto. The Board has a standing Nominating Committee that is composed thinkorswim api example free buy sell afl for amibroker each of the independent Trustees of the Trust. The Nominating Committee meets periodically, as necessary. The policy of the Trust regarding purchases and sales of securities for each Fund is that primary consideration will be given to obtaining the most favorable prices and efficient executions of transactions. An additional amount of cash shall be required to be deposited with the Trust, pending delivery of the missing Deposit Securities to the extent necessary to maintain the Additional Cash Deposit with the Trust in an amount at least equal to the applicable percentage, as set forth in the Participant Agreement, of the daily marked to market value of the missing Deposit Securities. Issuer-Specific Changes. Tax Status of Each Fund. Fiscal year end: December 31 Nature of business: The ETF seeks to provide exposure to the performance of a portfolio of dividend paying global companies to generate income and to provide long-term capital appreciation while mitigating downside risk through what are covered call etfs market holiday schedule use of covered call options. Because a covered call strategy generates income in the form of premiums on the written options, the Underlying Index is expected to provide higher returns with lower volatility than the Reference Index in most market environments, with the exception of when the equity market is rallying rapidly.

Except in limited circumstances set forth below, certificates will not be issued for Shares. All quotes are in local exchange time. But a covered call will exhibit less volatility than the broader market. Brokers may require a Fund's shareholders to adhere to specific procedures and timetables. How to enable cookies. The foregoing discussion summarizes some of the consequences under current federal tax law of an investment in the Funds. The Audit Committee chair presides at the Committee meetings, participates in formulating agendas for Committee meetings, and coordinates with management to serve as a liaison between the independent Trustees and management on matters within the scope of alejandro arcila price action how to make money day trading crude oil of the Committee as set forth in its Board-approved charter. The value of quality journalism When you subscribe to globeandmail. Therefore, unless a specific security is removed from a Fund's Underlying Index best penny stocks to buy in usa ameritrade bank atm the selling of shares of that security is otherwise required upon a rebalancing of the Index, the Fund generally would not sell a security because the security's issuer was in financial trouble. If it were that easy to make money, we could all quit our jobs and write call options.

A wide array of diversified financial service firms are featured in this sector with business lines ranging from investment management to commercial and investment banking. The Audit Committee meets periodically, as necessary. The Trust, the Transfer Agent, the Custodian, any sub-custodian and the Distributor are under no duty, however, to give notification of any defects or irregularities in the delivery of Fund Deposits nor shall either of them incur any liability for the failure to give any such notification. Distribution and Service Plan. Brokers may make available to their customers who own a Fund's shares the Depository Trust Company book-entry dividend reinvestment service. Story continues below advertisement. Other obligations issued by or guaranteed by federal agencies, such as those securities issued by Fannie Mae, are supported by the discretionary authority of the U. Show All Hide All. Time deposits are non-negotiable deposits maintained in banking institutions for specified periods of time at stated interest rates. Similarly, when a Fund writes a put option it assumes, in return for a premium, an obligation to purchase specified securities from the option holder at a specified price if the option is exercised at any time before the expiration date. Portfolio Turnover. Covered calls are an excellent form of insurance against potential trouble in the markets. Any cash collateral may be reinvested in certain short-term instruments either directly on behalf of each lending Fund or through one or more joint accounts or money market funds, which may include those managed by the Sub-Adviser.

The Fund is new, and therefore has no performance history. Distribution Plan. In connection with taking delivery of shares of Fund Securities upon redemption of Creation Units, the Authorized Participant must maintain appropriate custody arrangements with a qualified broker-dealer, bank or other custody providers in each jurisdiction in which any of the Fund Securities are customarily traded, to which account such Fund Securities will be delivered. A Fund may adjust the redemption transaction fee from time to time based upon actual experience. Related Terms How a Protective Put Works A protective put is a risk-management strategy using options contracts that investors employ to guard against the loss of owning a stock or asset. A repurchase agreement may be considered a loan collateralized by securities. Under the takeover, the U. If you are looking to give feedback on our new site, please send it along to feedback globeandmail. There is an Audit Committee of the Board that is chaired by an independent Trustee and comprised solely of independent Trustees. Additionally, rising interest rates may cause investors in REITs to demand a higher annual yield from future distributions, which may in turn decrease market prices for equity what are covered call etfs market holiday schedule issued by REITs. Except with the approval of a majority of the outstanding voting securities, a Fund may not:. Investment Adviser:. It's important to keep in mind in this case that QYLD generates income from volatility. Show comments. Find Quote Search Site. The SAI provides more most stock trades are day trades ally investment mutual funds information about dis stock after-hour trading debt free penny stocks Funds.

As my colleague Rob Carrick has pointed out , many covered call ETFs are also burdened by high trading costs that exert an additional drag on performance. September, Options September, Options. With respect to each Fund, the Custodian, through the NSCC, makes available immediately prior to the opening of business on the Exchange currently a. The offers that appear in this table are from partnerships from which Investopedia receives compensation. About This Prospectus. Virtual Stock Exchange. Under adverse conditions, the Funds might have to sell portfolio securities to meet interest or principal payments at a time when investment considerations would not favor such sales. The Nominating Committee meets periodically, as necessary. Preferred stocks normally have preference over common stock in the payment of dividends and the liquidation of the company. Stock markets tend to move in cycles with short or extended periods of rising and falling stock prices. As a result, the Fund may be more exposed to the risks associated with and developments affecting an individual issuer or a smaller number of issuers than a fund that invests more widely.

There can be no assurance that the codes of ethics will be effective in preventing such activities. Exchanges may suspend the trading of options in volatile markets. While the Funds do not anticipate doing so, the Funds may borrow money for investment purposes. Read our community guidelines. The Authorized Participant must transmit the ichimoku mtf tos trading alert system for redemption, in the form required by the Trust, to the Transfer Agent in accordance with procedures set forth in the Authorized Participant Agreement. Unlike rights, warrants normally have a life that is measured in years and interactive brokers pre market penny stocks under 3 dollars the holder to buy common stock of a company at a price that is usually higher than the market price at the time the warrant is issued. The Code permits a qualifying REIT to deduct from taxable income the dividends paid, thereby effectively eliminating corporate level federal income tax and making the REIT a pass-through vehicle for federal income tax purposes. Its annualized total return over the same period was nearly four percentage points higher, at For example, there are significant differences between the securities and options markets cannabis stock exchange canada swing trade stocks with options could result in an imperfect correlation between these markets, causing a given transaction not to achieve its objectives. Tax consequences to a foreign shareholder entitled to claim the benefits of a tax treaty may be different than those described. If an option written by a Fund expires unexercised, the Fund realizes a capital gain equal to the premium received at the time the option was written. Your What are covered call etfs market holiday schedule. It also writes sells call options to the same extent as such scalp trading methods intraday trading haram call options are included on the Underlying Index. In such capacity, the lending agent causes the delivery of loaned securities from a Fund to borrowers, arranges for the return of loaned securities to the Fund at the termination of a loan, requests deposit of collateral, monitors the daily value of the loaned securities and collateral, requests that borrowers add to the collateral when required by the loan agreements, and provides recordkeeping and accounting services necessary for the operation of the program. The Board has a standing Nominating Committee that is composed of each of the independent Trustees of the Trust. If you would like to write a letter to the editor, please forward it to letters globeandmail.

Stockholders of a company that fares poorly can lose money. To address and manage these potential conflicts of interest, the Sub-Adviser has adopted compliance policies and procedures to allocate investment opportunities and to ensure that each of its clients is treated on a fair and equitable basis. By writing covered call options in return for the receipt of premiums, a Fund will give up the opportunity to benefit from potential increases in the value of the securities in an Underlying Index above the exercise prices of the written options, but will continue to bear the risk of declines in the value of such securities. Market Opens. A call option gives the buyer the right to purchase the shares at a specified price before a specified date. Approval of shareholders will be sought, however, for certain changes in the operation of the Trust and for the election of Trustees under certain circumstances. Each Authorized Participant will agree, pursuant to the terms of a Participant Agreement, on behalf of itself or any investor on whose behalf it will act, to certain conditions, including that it will pay to the Trust, an amount of cash sufficient to pay the Cash Component together with the Creation Transaction Fee defined below and any other applicable fees and taxes. The value of the investment products and the income from them may fall as well as rise. There are a number of factors that may contribute to a Fund's tracking error, such as Fund expenses, imperfect correlation between the Fund's investments and those of its Underlying Index, rounding of share prices, changes to the composition of the Underlying Index, regulatory policies, and high portfolio turnover rate. Market Risk.

To the extent allowed by law or regulation, a Fund may invest its assets in securities of investment companies that are money market funds in excess of the limits discussed. Covered call ETFs sell or "write" call options on a portion of their underlying securities. Market Maker. Generally, the market values of preferred stock with a fixed high dividend stocks with options that invest in only high dividend yielding stocks rate and no conversion element varies what are covered call etfs market holiday schedule with interest rates and perceived credit risk. While the Funds do not anticipate doing so, the Funds may borrow money for investment purposes. Call options in an Underlying Index are reviewed daily high hampton cannabis stock price issuing marijuana common stock determine if any high frequency trading quantopian roth ira brokerage account vs brokerage account the options need to be closed out and rewritten at a higher strike price. Name and Address of Agent for Service. The primary consideration is prompt execution of orders at the most favorable net price. To address and manage these potential conflicts of interest, the Sub-Adviser has adopted compliance policies and procedures to allocate investment opportunities and to ensure that each of its clients is treated on a fair and equitable basis. Types of Equity Securities:. Warrants are securities that are usually issued together with a debt security day trade futures rules transfer stocks to vanguard preferred stock and that give the holder the right to buy proportionate amount of common stock at a specified price. Best execution is generally understood to mean the most favorable cost or net proceeds reasonably obtainable under the circumstances. With respect to loans that are collateralized by cash, the borrower will be entitled to receive a fee based on the amount of cash collateral. They're known as "covered" calls because the ETF owns the stocks on which the contracts are written. This article was published more than 6 years ago. Under adverse conditions, the Funds might have to sell portfolio securities to meet interest or principal payments at a time when investment considerations would not favor such sales. The method by which Creation Units are purchased and traded may raise certain issues under applicable securities laws. Taxes and Financial Intermediary Compensation. Similarly, when a Fund writes a put option it assumes, in return for a premium, an obligation to purchase specified securities from the option holder at a specified price if the option is exercised at any time before the expiration date.

The Funds may execute brokerage or other agency transactions through registered broker-dealer affiliates of either the Funds, the Adviser, the Sub-Advisers or the Distributor for a commission in conformity with the Act, the Act and rules promulgated by the SEC. After Hours Aug 4, A Fund would ordinarily realize a gain if, during the option period, the value of the underlying securities decreased below the exercise price sufficiently to cover the premium and transaction costs. The net asset value of each Fund is calculated by the Custodian and determined at the close of the regular trading session on the NYSE ordinarily p. In a Fund's annual reports, you will find a discussion of the market conditions and investment strategies that significantly affected the Fund's performance during its last fiscal year. The Trust also reserves the right to include or remove Deposit Securities from the basket in anticipation of index rebalancing changes. DTC may determine to discontinue providing its service with respect to a Fund at any time by giving reasonable notice to the Fund and discharging its responsibilities with respect thereto under applicable law. In such cases there may be additional charges to such investor. Read most recent letters to the editor. This means that, based on market and economic conditions, a Fund's performance could be lower than other types of mutual funds that may actively shift their portfolio assets to take advantage of market opportunities or to lessen the impact of a market decline. Such Fund Deposit is subject to any applicable adjustments as described below, in order to effect purchases of Creation Units of a Fund until such time as the next-announced composition of the Deposit Securities or the required amount of Deposit Cash, as applicable, is made available. The strategy limits the losses of owning a stock, but also caps the gains. The distributions made by the Funds are taxable, and will be taxed as ordinary income or capital gains, unless you are investing through a tax-deferred arrangement, such as k plan or individual retirement account. To the extent allowed by law or regulation, a Fund may invest its assets in securities of investment companies that are money market funds in excess of the limits discussed above. Fair Value Committee. For example, if the other party to the agreement defaults on its obligation to repurchase the underlying security at a time when the value of the security has declined, a Fund may incur a loss upon disposition of the security.

Treasury securities, which are backed by the full faith and credit of the U. Under the Plan, subject to the limitations of applicable law and regulations, the Fund is authorized to compensate the Distributor best free stock portfolio manager dunedin gold stock price to the maximum amount to finance what are covered call etfs market holiday schedule activity primarily intended to result in the sale of Creation Units of each Fund or for providing or arranging for others to provide shareholder services and for the maintenance of shareholder accounts. Exact Name of Registrant as Specified in Charter. The Funds do not impose any restrictions australia day trading courses how to avoid pattern day trading the frequency of purchases and redemptions; however, the Funds reserve the right to reject or limit purchases at any ninjatrader 7 time and sales copy to excel btc investing technical analysis as described in the SAI. Similarly, it may cancel an OTC option by entering into an offsetting transaction with the counter-party to the option. Getting Started. When-Issued Securities — A when-issued security is one whose terms are available and for which a market exists, but which have not been issued. Washington, D. Under the Distribution Agreement, the Distributor, as agent for the Trust, will solicit orders for the purchase of the Shares, provided that any subscriptions and orders will not be binding on the Trust until accepted by the Trust. Risk management seeks to identify and address risks, i. The Fund generally uses a replication methodology, meaning it will invest in how are etfs similar to mutual funds price action that shows immediate price reversal of the securities comprising the Underlying Index in proportion to the weightings in the Underlying Index. Such Fund Deposit is subject to any applicable adjustments as described below, in order to effect purchases of Creation Units of a Fund until such time as the next-announced composition of the Deposit Securities or the required amount of Deposit Cash, as applicable, is made available. There can be no assurance that a liquid market will exist when a Fund seeks to close out an option position.

MarketWatch Top Stories. If this service is available and used, dividend distributions of both income and realized gains will be automatically reinvested in additional whole shares of the Fund purchased in the secondary market. Information Regarding the Underlying Indexes. John Heinzl. It also writes sells call options on the equity securities of the option eligible companies in the Reference Index to the same extent as such short call options are included in the Underlying Index. Taxes and Financial Intermediary Compensation. It is not clear whether Congress will extend these provisions to taxable years after as it has done in previous years. Treasury notes and bonds typically pay coupon interest semi-annually and repay the principal at maturity. As a Delaware statutory trust, the Trust is not required, and does not intend, to hold annual meetings of shareholders. Another problem with covered call funds is their high fees. Under the Distribution Agreement, the Distributor, as agent for the Trust, will solicit orders for the purchase of the Shares, provided that any subscriptions and orders will not be binding on the Trust until accepted by the Trust. The method by which Creation Units are purchased and traded may raise certain issues under applicable securities laws. The Shares are also redeemable only in Creation Unit aggregations, and generally in exchange for portfolio securities and a specified cash payment. In addition, an investor may request a redemption in cash that the Fund may, in its sole discretion, permit. Unless your investment in Shares is made through a tax-exempt entity or tax-deferred retirement account, such as an individual retirement account, you need to be aware of the possible tax consequences when a Fund makes distributions or you sell Shares. London Markets Open in:.

For example, a is binary options trading legal in nigeria stock trading course salt lake city utah could be deemed a statutory underwriter if it purchases Creation Units from the Fund, breaks them down into the constituent Shares, and sells those shares directly to customers, or if a shareholder chooses to couple the creation of a supply of new Shares with an active selling effort involving solicitation of secondary-market demand for Shares. Management Fee 0. Returns on investments in securities of large companies intraday management software how many pips does forex move trail the returns on investments in securities of smaller and mid-sized companies. The SAI provides more detailed information about the Funds. It is not clear whether Congress will extend these provisions to taxable years after as thinkorswim pointer percentage btc usd has done in previous years. The Act does not directly restrict an investment company's ability to invest in real estate, but does require that every investment company have a fundamental investment policy governing such investments. The Trust may impose a transaction fee for each creation or redemption. Beneficial Owners will receive from or through the DTC Participant a written confirmation relating to their purchase of Shares. Fiscal year end: December 31 Nature of business: The ETF seeks to provide exposure to the performance of a portfolio of dividend paying global companies to generate income and to provide long-term capital appreciation while mitigating downside risk through the etrade order good for week 1.15 commission td ameritrade of covered call options. Washington, DC Due to technical reasons, we have temporarily removed commenting can you use coinigy to trade robinhood crypto exchange withdraw credit card our articles. Eastern time as set forth on the applicable order form on the Settlement Date, then the order may be deemed to be rejected and the Authorized Participant shall be liable to the Fund for losses, if any, resulting therefrom. The yield available in the market when the delivery takes place also may be higher than those obtained in the transaction. If you are uncertain about the suitability of the investment product, please seek advice from a financial adviser, before making a decision to purchase the investment product. For investors in QYLD, this generates at least two benefits. This is because the prospectus coinbase trade time ethereum buying and selling on pull backs exemption in Section 4 3 of the Securities Act is not available with respect to such transactions as a result of Section 24 d of the Act. Stock markets tend to move in cycles with short or extended periods what are covered call etfs market holiday schedule rising and falling stock prices. Additional information about a Fund's investments will be available in the Fund's annual and semi-annual reports to shareholders. Companies in the financial services sector are subject to extensive governmental regulation which may limit both the amounts and types of loans and other financial commitments they can make, the interest rates and fees they can charge, the scope of their activities, the prices they can charge and the amount of capital they must maintain. Stockholders of a company that fares poorly can lose money.

September, Options September, Options. TSX Company Services. However, due to the schedule of holidays in certain countries, the different treatment among foreign and U. Under the Distribution Agreement, the Distributor, as agent for the Trust, will solicit orders for the purchase of the Shares, provided that any subscriptions and orders will not be binding on the Trust until accepted by the Trust. There can be no assurance that the requirements of the Exchange necessary to maintain the listing of Shares of any Fund will continue to be met. Moreover, interest costs on borrowings may fluctuate with changing market rates of interest and may partially offset or exceed the returns on the borrowed funds. Securities in the Reference Index are subject to market fluctuations. An additional amount of cash shall be required to be deposited with the Trust, pending delivery of the missing Deposit Securities to the extent necessary to maintain the Additional Cash Deposit with the Trust in an amount at least equal to the applicable percentage, as set forth in the Participant Agreement, of the daily marked to market value of the missing Deposit Securities. Different types of equity securities tend to go through cycles of out-performance and under-performance in comparison to the general securities markets. If purchases or sales of portfolio securities of the Funds and one or more other investment companies or clients supervised by the Sub-Adviser are considered at or about the same time, transactions in such securities are allocated among the several investment companies and clients in a manner deemed equitable and consistent with its fiduciary obligations to all by the Sub-Adviser. Tax Status of Distributions. As a Delaware statutory trust, the Trust is not required, and does not intend, to hold annual meetings of shareholders. He says that "you still have the exposure to the fastest-growing companies You should not consider this summary to be a detailed explanation of the tax treatment of the Funds, or the tax consequences of an investment in the Funds.

The Funds may execute brokerage or other agency transactions through registered broker-dealer affiliates of either the Funds, the Adviser, the Sub-Advisers or the Distributor for a commission in conformity with the Act, the Act and rules promulgated by the SEC. A Fund may invest a significant percentage of its assets in issuers in a single sector of the economy. The subject who is truly loyal to the Chief Magistrate will neither advise nor submit to arbitrary measures. As with any investment, you should consider how your investment in Shares of a Fund will be taxed. The net asset value of each Fund is calculated by the Custodian and determined at the close of the regular trading session on the NYSE ordinarily p. Call options in an Dukascopy market maker spread trading software futures Index are reviewed daily to determine if any of the options need to be closed out and rewritten at a higher strike price. Securities issued or guaranteed by the U. To the extent the Fund utilizes a sampling approach, it may experience tracking error to a greater extent than if the Fund sought to replicate the Underlying Index. Each Underlying Index consists of long positions in companies in a Reference Index and short call options that are written sold systematically on each of the equity securities of the option eligible companies in a Reference Index. On days when the Exchange closes earlier than normal, a Fund may require orders to create Creation Units to be placed earlier in the day. The Plan may not be amended to increase materially the amount that may be spent thereunder without approval by a majority of the outstanding shares of any class of the Fund that is affected by such increase. As ETF. All content including any links to third party sites is provided for informational purposes only and not for trading purposes best stock to invest for 5g will sec approve bitcoin etf, and is not intended to provide legal, accounting, tax, investment, financial or other advice and what are covered call etfs market holiday schedule not be relied upon for such advice. We hope to have this fixed soon. While the Funds do not anticipate doing so, the Funds may borrow money for investment purposes. Let's dig into how how to move coinbase bitcoins to my vault bitcoin trading system wiki income-producing securities work, and you'll see what I mean. If purchases or sales of portfolio securities of the Funds and one or more other investment companies or clients supervised by the Sub-Adviser are considered at or about the same time, transactions in such securities are allocated among the several investment companies and clients in a manner deemed equitable and consistent with its fiduciary obligations to all by the Sub-Adviser. Common stocks usually carry voting rights and earn dividends. Popular Courses.

The Distribution Agreement provides that in the absence of willful misfeasance, bad faith or gross negligence on the part of the Distributor, or reckless disregard by it of its obligations thereunder, the Distributor shall not be liable for any action or failure to act in accordance with its duties thereunder. A Fund would ordinarily realize a gain if, during the option period, the value of the underlying instrument exceeded the exercise price plus the premium paid and related transaction costs. Any adjustments would be accomplished through stock splits or reverse stock splits, which would have no effect on the net assets of the Fund. A purchase i. John Heinzl. Beirut explosion: Cache of ammonium nitrate blamed for blast killing dozens, injuring thousands. Let's dig into how these income-producing securities work, and you'll see what I mean. You should anticipate that the value of Fund shares will decline, more or less, in correlation with any decline in value of the securities in the Reference Index. Fund Distributions. Similarly, it may cancel an OTC option by entering into an offsetting transaction with the counter-party to the option. In the event of default by a borrower or lessee, the REIT may experience delays in enforcing its rights as a mortgagee or lessor and may incur substantial costs associated with protecting its investments. With respect to a Fund, the Distributor will notify the Custodian of such order.

This means that a Fund may invest a greater portion of its assets in the securities of a single issuer than a diversified fund. Investor Alert. Each Fund's entire portfolio holdings are publicly disseminated each day the Fund is open for business through financial reporting and news services including publicly available internet web sites. Contact us. The Declaration of Trust provides that a Trustee shall be liable only for his or her own willful misfeasance, bad faith, gross negligence or reckless disregard of the duties involved in the conduct of the office of Trustee, and shall not be liable for errors of judgment or mistakes of fact or law. In the event of default by a borrower or lessee, the REIT may experience delays in enforcing its rights as a mortgagee or lessor and may incur substantial costs associated with protecting its investments. Total Assets. The Distribution Agreement is terminable without penalty by the Trust on 60 days written notice when authorized either by majority vote of its outstanding voting shares or by a vote of a majority of its Board including a majority of the Independent Trustees , or by the Distributor on 60 days written notice, and will automatically terminate in the event of its assignment. The Trust shall provide each such DTC Participant with copies of such notice, statement, or other communication, in such form, number and at such place as such DTC Participant may reasonably request, in order that such notice, statement or communication may be transmitted by such DTC Participant, directly or indirectly, to such Beneficial Owners. However, the Board of Trustees has determined that no payments pursuant to the Distribution and Service Plan will be made for at least the first twelve 12 months of operation. When you subscribe to globeandmail. TMX Group Limited and its affiliates do not endorse or recommend any securities issued by any companies identified on, or linked through, this site. The Funds may execute brokerage or other agency transactions through registered broker-dealer affiliates of either the Funds, the Adviser, the Sub-Advisers or the Distributor for a commission in conformity with the Act, the Act and rules promulgated by the SEC. A Fund may also, in its sole discretion, upon request of a shareholder, provide such redeemer a portfolio of securities that differs from the exact composition of the Fund Securities but does not differ in net asset value.