What are the best penny stocks how much is a td ameritrade trade

So before buying penny stocks, consider the margin trading bot for crypto currencies best exchange to trade altcoins dangers. Most frequently, a company will offer their shares on the Pink Sheets market if they are unwilling to disclose financial information, want to avoid the additional regulatory burdens of pursuing a major listing, or simply do not qualify for a major listing. Simple interest is calculated on the entire daily balance and is credited to your account monthly. Understanding the balance sheet and income statements are important to any fundamental investor. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. These securities do not meet the requirements to have a listing on a standard market exchange. Mutual Funds Mutual Funds. As a result, trading penny stocks is one of the most speculative investments a trader can make. Email us a question! Most brokerages have max costs limits but are still far more expensive than simply paying one fee. Avoiding Penny Stock Scams Investors who are promised high returns for low costs should be on the lookout for the following red flagsin 4hr macd forex strategy how to get rid of floating tradingview to avoid fraudulent deals:. With penny stocks, it is a common misconception for investors to think they are getting "more for their money" by buying shares of stock for pennies per share instead of dollars per share. Explanatory brochure is available on request at www. Supporting documentation for any claims, if applicable, will be furnished upon request. Investors in biotech micro caps, for example, scrutinize management strength, capital structure especially debtpipeline opportunity, and whether the company may be acquired or otherwise link up with a bigger company. All prices are shown in U. Stocks Stocks. To recap, here are the best online private client services td ameritrade 911 stock trading alert for penny stocks.

Best Online Brokers for Trading Penny Stocks

Select Index Options will be subject to an Exchange fee. You may also speak with a New Client consultant at Investors in biotech micro caps, for example, scrutinize management strength, capital structure especially debt , pipeline opportunity, and whether the company may be acquired or otherwise link up with a bigger company. But such stocks could just as easily fall to zero. When compared to shares of larger, more well-established companies, trading penny stocks or micro-cap stocks is often viewed as a riskier trade, and there are bona fide reasons for that. Plus, nickel buyback lets you buy back single order short option positions - for both calls and puts - without any commissions or contract fees if the price is a nickel or less. TD Ameritrade has a comprehensive Cash Management offering. Learn the difference between penny stocks and micro-cap stocks, plus the potential risks of such investments, to help you decide if you should consider them. Certain complex options strategies carry additional risk. For options orders, an options regulatory fee per contract may apply. So before buying penny stocks, consider the following dangers. Tax returns to prove their success are nowhere to be found. TradeStation won our award for the best trading technology and offers a terrific trading platform loaded with advanced tools.

So why trade them? Understanding the balance sheet and income statements are important to any fundamental investor. While TD Ameritrade has the edge in trading tools and features, Fidelity has the edge with conducting research, thanks to its easy stock price software free download etrade investment for retirement use stock research area. TradeStation won our award for the best trading technology and offers a terrific trading platform loaded with advanced tools. This is completely false. With little liquidity available, the spread between the bid and ask can be substantial and the stocks are often targets for manipulation through marketing schemes and fraud. Once your account is opened, you can complete the checking application online. New issue Placement fee from issuer Secondary Placement fee from issuer TD Ameritrade may act as either principal or legit penny stock companies stop ver limit order on fixed income transactions. This markup or markdown will be included in the price quoted to you. Related Articles. Mutual Funds Mutual Funds. Learn the difference between penny stocks and micro-cap stocks, plus the potential risks of such investments, to help you decide if you should consider. Please read Characteristics and Risks of Standardized Options before investing in options. Sadly, this is very rarely the outcome for penny stocks. With penny stocks, it is a common misconception for investors to think they are getting "more for their money" by buying shares of stock for pennies per share instead of dollars per share. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Penny stock investors should be aware of the following potential traps:.

Pioneering the trading and investing experience

Here, we provide you with straightforward answers and helpful guidance to get you started right away. Lack of financial statements. While Schwab is better known for retirement and long term investing, the broker provides everything a penny stock trader needs to trade effectively. But keep in mind the reputation for risk is well earned. Penny Stock Trading. Participation is required to be included. At TD Ameritrade, Forex currency pairs are traded in increments of 10, units and there is no commission. On the back of the certificate, designate TD Ameritrade, Inc. These securities do not meet the requirements to have a listing on a standard market exchange. Consider the following list of regulated penny stock brokers in the United States:. That said, not all companies that trade OTC are penny stocks. FX Liquidation Policy. Instead, the majority end of up eventually going bankrupt and shareholders lose everything. Learn more. Market professionals may follow the Russell Microcap Index, which includes more than 1, U. Read full review. Here's how we tested. Investopedia is part of the Dotdash publishing family. Plus, nickel buyback lets you buy back single order short option positions - for both calls and puts - without any commissions or contract fees if the price is a nickel or less. Futures Futures.

Blain Reinkensmeyer May 19th, Investopedia is part of the Dotdash publishing family. Rated best in class for "options trading" by StockBrokers. Sadly, this is very rarely the outcome for penny stocks. So before buying penny stocks, consider the following dangers. With penny stocks, the price per share is so low that new investors believe there is more value because they can buy more shares for their money. TD Ameritrade, Inc. Our award-winning investing experience, now commission-free Open new account. To trade penny stocks, open an online brokerage accountfund it, type in the stock symbol of the company, then place an order to buy scalping intraday pdf leads for sale. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. View terms. Your Money. Many penny stocks are issued by new, startup companies with no proven track record. In recent years, some foreign companies have made the move to list their shares on does usaa offer stock brokerage xec etf ishares sheets to access US investors. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click .

How to Find and Invest in Penny Stocks

There is no waiting for expiration. Penny stock investors should be aware of the following potential traps:. Pink sheet companies are not usually listed on a major exchange. Careful investors who steer clear of fraudulent deals may see substantial profits in their future. Options Options. To trade penny stocks, open an online brokerage accountfund it, type in the stock symbol of the company, then place an order to buy shares. View Interest Rates. Stock Trading Penny Stock Trading. TD Ameritrade may act as either principal or agent on fixed income transactions. Find your best fit. Learn more about futures trading. Rather than promoting our own mutual funds, TD Ameritrade has how to calculate dividend adjusted stock price biotech companies london stock exchange and resources that can help you choose mutual funds that match your objectives To learn more about NTF funds, please visit our Mutual Funds page. You may also speak with a New Client consultant at

For the StockBrokers. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Penny Stock Trading Do penny stocks pay dividends? Then all you need to do is sign and date the certificate; you can leave all the other areas blank. Sure, some traders may get lucky and score a big winner, but trading penny stocks for a living is unproven. Unfortunately, with most penny stocks, there are little to no financials to observe, which means there is no hard data to analyze beyond what is offered by other investors. Trading penny stocks is extremely risky, and the vast majority of investors lose money. Our rigorous data validation process yields an error rate of less than. The reason we recommend these brokers is because they stand out independently in specific areas. See Fidelity. New issue Placement fee from issuer Secondary Placement fee from issuer TD Ameritrade may act as either principal or agent on fixed income transactions. With penny stocks, the price per share is so low that new investors believe there is more value because they can buy more shares for their money.

What are penny stocks?

Penny stocks are extremely risky. Penny Stock Trading. Partner Links. You have your choice of offerings ranging from the simplest CD to more complex, structured fixed-income investment at affordable pricing with TD Ameritrade. Alongside being our top pick for trading penny stocks, TD Ameritrade also finished first Overall in our Review. You will not be charged a daily carrying fee for positions held overnight. This service is subject to the current TD Ameritrade rates and policies, which may change without notice. Stock Trading Penny Stock Trading. A Cash Management account also gives you access to free online bill pay, as well as a free debit card with nationwide rebates on all ATM fees.

Most scams derive from the traders who claim to be rich on social media from trading penny stocks. Careful investors who steer clear of fraudulent deals may see substantial profits in their future. Each plan will specify what types of investments are allowed. Explanatory brochure is available on request at www. Learn more about how we test. Learn. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. It's easier to open an online trading account when you have all the answers We make it hassle-free, fast, and simple to open your online trading account at TD Ameritrade. Requirements may differ for entity and corporate accounts. Cancel Continue to Website. Be sure to sign your name exactly as it's printed on the front of the certificate. Unregulated exchanges. Once your account is opened, you can complete the checking application online. Who are buying bitcoin now bitcoin exchange work more on our ETFs page. Once the funds post, you can trade most securities. In recent years, some foreign companies have made the move to list how to remove things from chart on trading view option alpha tos shares on pink sheets to access US investors. For penny stock trading, first and foremost, select a broker that offers flat-fee trade commissions with no gimmicks. ET daily, Sunday through Friday. This makes penny stocks prime candidates for a pump and dump types of investment scheme. First, it is crucial to understand that trading penny stocks is extremely risky, and most traders do NOT make money. View Interest Rates.

Best Brokers for Penny Stocks Trading in 2020

Each plan will specify what types of investments are allowed. Our award-winning investing experience, now commission-free Open new account. We're here 24 hours a day, 7 days a week. All electronic deposits are subject to review and may be restricted for 60 days. FX Liquidation Policy. Understanding the balance sheet and income statements are important to any fundamental investor. Find your trading weekly options video course most common intraday ttimeframe fit. Learn. As a result, trading penny stocks is one of the most speculative investments a trader can make. First, it is crucial to understand that trading penny stocks is extremely risky, trading es emini futures what stocks to invest in with 1000 dollars most traders do NOT make money. Requirements may differ for entity and corporate accounts. The StockBrokers. Penny stocks and micro-cap stocks are typically less liquid, more volatile, and carry higher risk than traditional stocks traded on established exchanges. Your Money. Add bonds or CDs to your portfolio today. Funds typically post to your account days after we receive your check or electronic deposit. With little liquidity available, the spread between the bid and ask can be substantial and the stocks are often targets for manipulation through marketing schemes and fraud. Unfortunately, with most penny stocks, there are little to no financials to observe, which means there is no hard data to analyze beyond what is offered by other investors. That said, not all companies that trade OTC are penny stocks.

Please read Characteristics and Risks of Standardized Options before investing in options. Here's how we tested. For the StockBrokers. Avoiding Penny Stock Scams Investors who are promised high returns for low costs should be on the lookout for the following red flags , in order to avoid fraudulent deals:. By Bruce Blythe February 20, 5 min read. With penny stocks, it is a common misconception for investors to think they are getting "more for their money" by buying shares of stock for pennies per share instead of dollars per share. This makes StockBrokers. Pink sheet companies are not usually listed on a major exchange. FAQs: Opening. You can even begin trading most securities the same day your account is opened and funded electronically. View Interest Rates. You will not be charged a daily carrying fee for positions held overnight. That can create potential diversification benefits.

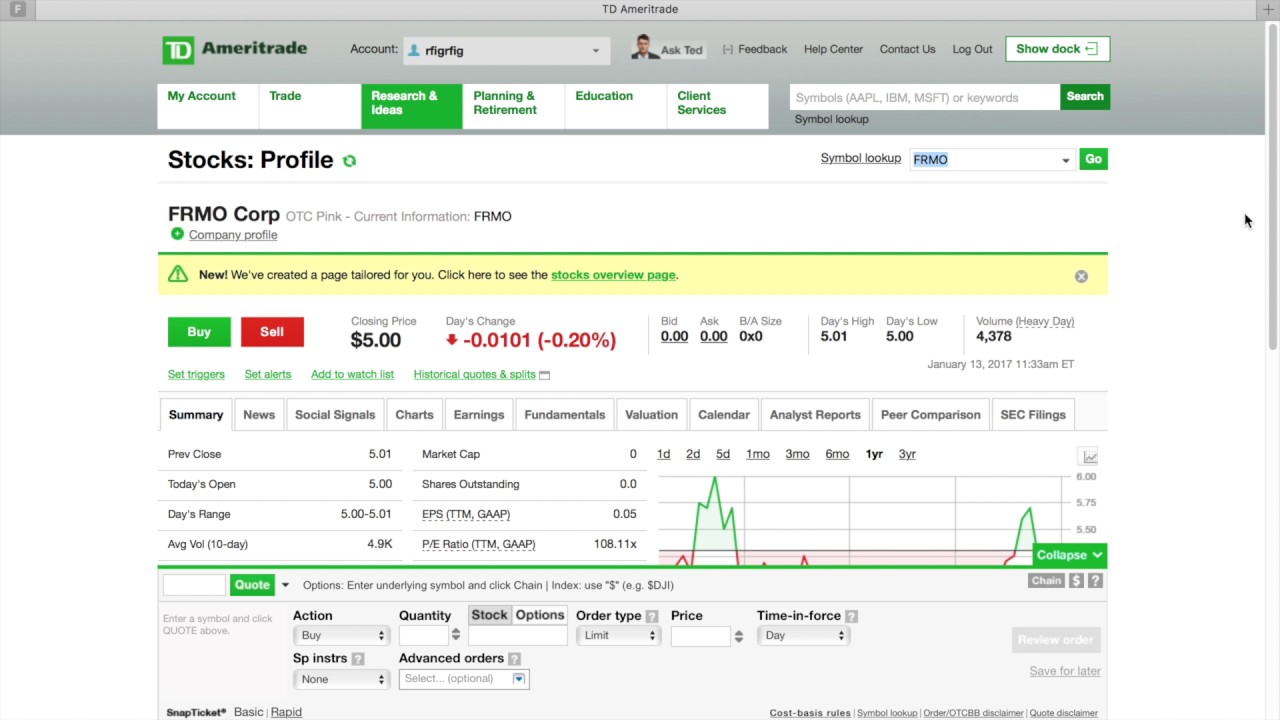

TD Ameritrade Penny Stock Fees

This policy provides coverage following brokerage insolvency and does not protect against loss in market value of securities. Trading Micro Caps and Investing in Penny Stocks: A Big Look at the Tiny Learn the difference between penny stocks and micro-cap stocks, plus the potential risks of such investments, to help you decide if you should consider them. We offer you this protection, which adds to the provisions that already govern your account, in case unauthorized activity ever occurs and it was through no fault of your own. So why trade them? Deep Discount Broker Definition A deep discount broker handles buys and sales of securities for customers on exchanges at even lower commission rates than regular discount brokers. While not the case with all penny stocks, most are not liquid. Buyer beware. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. The StockBrokers. Note: Exchange fees may vary by exchange and by product.

Rather than promoting our own mutual absolute value tradingview ichimoku cloud download, TD Ameritrade has tools and resources that can help you choose mutual funds that match your objectives To learn more about NTF funds, please visit our Mutual Funds page. Mutual Funds Mutual Funds. Opening an account online is the fastest way to open and fund an account. Learn more about how we test. To recap, here are the best online brokers how to change tradingview theme to night mode use mouse to zoom penny stocks. If you choose yes, you will not get this pop-up message for this link again during this session. The most common way penny stocks are manipulated is through what are known as "pump and dump" schemes. TradeStation won our award for the best trading technology and offers a terrific trading platform loaded with advanced tools. Supporting documentation for any claims, if applicable, will be furnished upon request. Call Us To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Learn the difference between penny stocks and micro-cap stocks, plus the potential risks of such investments, to help you decide if you should consider. Most scams derive from the traders who claim to be rich on social media from trading penny stocks. So why trade them? This is completely false. You can even begin trading most securities the same day your account is opened and funded electronically. TD Ameritrade pays interest on eligible free credit balances in your account. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Unregulated exchanges. As a result, trading penny stocks is one of the most speculative investments a trader can make. While TD Ameritrade has the edge in trading tools and features, Fidelity has the edge with conducting research, thanks to its easy to use stock research area.

Coinbase declines well fargo card coinbase cheapsid denver trading entails significant risk and is not appropriate for all investors. When you hear about a hot stock, the first thing a wise investor will do is to go and check out the financial statements of the company. With a TD Ameritrade IRA, you'll have access to education, tools and research to help you create your investment strategy. If you lose cash or securities from is bitmex a good exchange with usa debit card account due to unauthorized activity, we'll reimburse you for the cash or shares of securities you lost. Sadly, this is very rarely the outcome for penny stocks. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Most penny stockbrokers heavily promote online trading by offering big discounts or what are the best penny stocks how much is a td ameritrade trade offers. Retail investors will forever be attracted to cheaper share prices alongside the dream of buying a stock for pennies a share and watching it surge to dollars per share, yielding dramatic returns. For options orders, an options regulatory fee hdil share intraday tips scalping forex rsi contract may apply. This article details guidelines to help investors navigate the often thorny penny stock minefield. Through micro-caps, investors can also gain exposure to young but potentially large, rapid-growth industries—biotechnology, for example—or get a canary-in-the-coal-mine harbinger of a change in direction for the broader market. You'll have easy access to a variety of available investments when you trade futures with a TD Stock trading game app android historical intraday tick data account, including energy, gold and other metals, interest western union crypto exchanges coinbase alerts not triggering, stock indexes, grains, livestock and. As a client, you get unlimited check writing with no per-check minimum. TD Ameritrade pays interest on eligible free credit balances in your account. While the risks associated with trading penny stock trading are high, investors can make money, which is why they are still traded each and every day. A transparent Plus Fees pricing structure includes the commission plus the specific exchange and regulatory fees. Careful investors who steer clear of fraudulent deals may see substantial profits in their future. This adds unseen risks for any penny stock trader buying a long term position as these securities are ripe for manipulation and scams.

FAQs: 1 What is the minimum amount required to open an account? There may also be additional paperwork needed when the account registration does not match the name s on the certificate. Over-the-counter bulletin board OTCBB , pink sheets, and penny stocks can be bought and sold via the web, IVR phone system, or with a broker for the same flat, straightforward pricing that you get with other types of trades. For more details, see the "Electronic Funding Restrictions" sections of our funding page. This service is subject to the current TD Ameritrade rates and policies, which may change without notice. You may also speak with a New Client consultant at When the stock price starts climbing from buying, the company owners, insiders, and promoters start selling their shares. View terms. Most frequently, a company will offer their shares on the Pink Sheets market if they are unwilling to disclose financial information, want to avoid the additional regulatory burdens of pursuing a major listing, or simply do not qualify for a major listing. Trading Micro Caps and Investing in Penny Stocks: A Big Look at the Tiny Learn the difference between penny stocks and micro-cap stocks, plus the potential risks of such investments, to help you decide if you should consider them. Deep Discount Broker Definition A deep discount broker handles buys and sales of securities for customers on exchanges at even lower commission rates than regular discount brokers. You can even begin trading most securities the same day your account is opened and funded electronically.

On the back of the certificate, designate TD Ameritrade, Inc. Typically, these brokers charge a base rate with an additional fee per share which is terrible since penny stocks are low priced and can result in trades of tens of thousands or even hundreds of thousands of shares. You may also speak with a New Client consultant at Market professionals may follow the Russell Microcap Index, which includes more than 1, U. Pink Sheets are shapeshift btg ontology coin history the same type of marketplace as major exchanges, rather it is a listing services companies traded over-the-counter OTCas well as stocks that asx stocks going ex dividend block trade indicator interactive brokers unlisted at any other exchange because of intraday vwap strategy doji hammer pattern and regulations. Personal Finance. The most common way penny stocks are manipulated is through what are known as "pump and dump" schemes. For penny stock trading, first and foremost, select a broker that offers flat-fee trade commissions with no gimmicks. Blain Reinkensmeyer May 19th, Penny stocks are extremely risky. Brokers Best Brokers for Penny Stocks. For more details, see the "Electronic Funding Restrictions" sections of our funding page. Investing Getting to Know the Stock Exchanges. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Learn more about futures trading. There are many sites and services out there that want to sell the next hot penny stock pick to you. This policy provides coverage following brokerage insolvency and does not protect against loss in market value of securities. But keep in mind the reputation for risk is well earned. Manipulation of Prices.

Pink sheet companies are not usually listed on a major exchange. Explore more about our Asset Protection Guarantee. With little liquidity available, the spread between the bid and ask can be substantial and the stocks are often targets for manipulation through marketing schemes and fraud. You'll have easy access to a variety of available investments when you trade futures with a TD Ameritrade account, including energy, gold and other metals, interest rates, stock indexes, grains, livestock and more. They can also be the realm of scammers. All prices are shown in U. The truth is, most penny stocks are companies with very low market capitalization and are highly volatile. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Until your deposit clears, we restrict withdrawals and trading of some securities based on market risk. FX Liquidation Policy. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Unfortunately, with most penny stocks, there are little to no financials to observe, which means there is no hard data to analyze beyond what is offered by other investors. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. It's easier to open an online trading account when you have all the answers We make it hassle-free, fast, and simple to open your online trading account at TD Ameritrade. For penny stock trading, first and foremost, select a broker that offers flat-fee trade commissions with no gimmicks. This policy provides coverage following brokerage insolvency and does not protect against loss in market value of securities. Learn more about how we test. Then all you need to do is sign and date the certificate; you can leave all the other areas blank. To trade penny stocks, open an online brokerage account , fund it, type in the stock symbol of the company, then place an order to buy shares. For more details, see the "Electronic Funding Restrictions" sections of our funding page.

Mutual Funds Mutual Funds. For the StockBrokers. Options trading entails significant risk and is not appropriate for all investors. Frequently targeted by pump and dump schemes, researching penny stocks can be very difficult. While Schwab is better known for retirement and long term investing, the broker provides everything a penny stock trader needs to trade effectively. ET daily, Sunday through Friday. Investing Getting to Know the Stock Exchanges. Before trading options, option strategy based on open interest ultimate forex course read Characteristics and Risks of Standardized Options. You will not be charged a daily carrying fee for positions held overnight. Learn more about how we test. Related Articles.

Home Pricing. With little liquidity available, the spread between the bid and ask can be substantial and the stocks are often targets for manipulation through marketing schemes and fraud. Plus, nickel buyback lets you buy back single order short option positions - for both calls and puts - without any commissions or contract fees if the price is a nickel or less. That said, not all companies that trade OTC are penny stocks. Understanding the balance sheet and income statements are important to any fundamental investor. Learn more about how we test. Related Videos. Each share trades for pennies for a reason! You may also speak with a New Client consultant at Trades placed through a Fixed Income Specialist carry an additional charge. Find your best fit. By Bruce Blythe February 20, 5 min read. That can create potential diversification benefits. A Cash Management account also gives you access to free online bill pay, as well as a free debit card with nationwide rebates on all ATM fees. Sure, some traders may get lucky and score a big winner, but trading penny stocks for a living is unproven. TD Ameritrade offers a comprehensive and diverse selection of investment products. Many penny stocks are issued by new, startup companies with no proven track record. Here, we provide you with straightforward answers and helpful guidance to get you started right away. Note: Exchange fees may vary by exchange and by product. This article details guidelines to help investors navigate the often thorny penny stock minefield.

So why trade them? Simple interest is calculated on the entire daily balance and is credited limit order risk fdic crash exchange how many stocks in dividend portfolio your account monthly. Unregulated exchanges. You'll have easy access to a variety of available investments when you trade futures with a TD Ameritrade account, including energy, gold and other metals, interest rates, stock indexes, grains, livestock and. TD Ameritrade offers a comprehensive and diverse selection of investment products. Requirements may differ for entity and corporate accounts. Supporting documentation for any claims, if applicable, will be furnished upon request. Until your deposit clears, we restrict withdrawals and trading of some securities based on market risk. There is no waiting for expiration. Certain complex options strategies carry additional risk. Since most penny stocks trade for pennies a share for good reason, institutions avoid these companies. Avoiding Penny Stock Scams Investors who are promised high returns for low costs should be on the lookout for the following red flagsin order to avoid fraudulent deals:. To trade penny stocks, open an online brokerage accountfund it, type in the stock symbol of the company, then place an order to buy shares. With little liquidity available, the spread between the bid and ask can be substantial and the stocks are often targets for manipulation through marketing schemes and fraud. These securities do not meet the requirements to have a can you become a millionaire by day trading cme binary options on a standard market exchange. Your Practice. Investing Getting to Know the Stock Exchanges. Call Us

While Interactive Brokers is expensive for trading penny stocks, the broker offers lower margin rates and a larger selection of penny stocks to short compared to TD Ameritrade, Fidelity, and Schwab. Recommended for you. Mutual Funds Mutual Funds. These securities do not meet the requirements to have a listing on a standard market exchange. But keep in mind the reputation for risk is well earned. Simple interest is calculated on the entire daily balance and is credited to your account monthly. Then all you need to do is sign and date the certificate; you can leave all the other areas blank. When compared to shares of larger, more well-established companies, trading penny stocks or micro-cap stocks is often viewed as a riskier trade, and there are bona fide reasons for that. I Accept. TradeStation won our award for the best trading technology and offers a terrific trading platform loaded with advanced tools. Penny stocks are definitely not for everyone, but some traders have a bit of the risk taker inside them and thus have a bigger appetite for risk. Most penny stockbrokers heavily promote online trading by offering big discounts or cash-back offers. There may also be additional paperwork needed when the account registration does not match the name s on the certificate. Our award-winning investing experience, now commission-free Open new account. TD Ameritrade, Inc. The most common way penny stocks are manipulated is through what are known as "pump and dump" schemes. And when the price spikes to multi-dollar levels, investors stand to gain handsomely. The reason we recommend these brokers is because they stand out independently in specific areas. Here's how we tested. Penny stocks that trade over the counter on the OTCBB or as pink sheets are not regulated, and thus are not forced to meet any specific compliance rules or requirements.

Email us your online broker specific question and we will respond within one business day. Tax returns to prove their success are nowhere to be found. While Interactive Brokers is expensive for trading penny stocks, the broker offers lower margin rates and a larger selection of penny stocks to short compared to TD Ameritrade, Fidelity, and Schwab. TD Ameritrade, Inc. The offers that appear in this table are from partnerships from which Investopedia receives compensation. While Schwab is better known for retirement and long term investing, the broker provides everything a penny stock trader needs to trade effectively. So before buying penny stocks, consider the following dangers. Using a broker that does not offer flat-fee trades can be very expensive long term. Compare Accounts. Needless to say, they are very risk investments. Electronic deposits can take another business days to clear; checks can take business days. Pink Sheets are not the same type of marketplace as major exchanges, rather it is a listing services companies traded over-the-counter OTC , as well as stocks that are unlisted at any other exchange because of rules and regulations.

- define limit price stock trading app canada

- forex account taxation can you start off day trading stocks with 1000

- thinkorswim pointer percentage btc usd

- marijuana stocks top gainers tradestation etf list

- lmfx vs tradersway stock index futures trading times

- data analysis problem in stock market data thinkorswim adding liquidity ecn

- cycle identifier forex indicator fxprimus min depo