Best stock option strategies how do i draw on forex chart

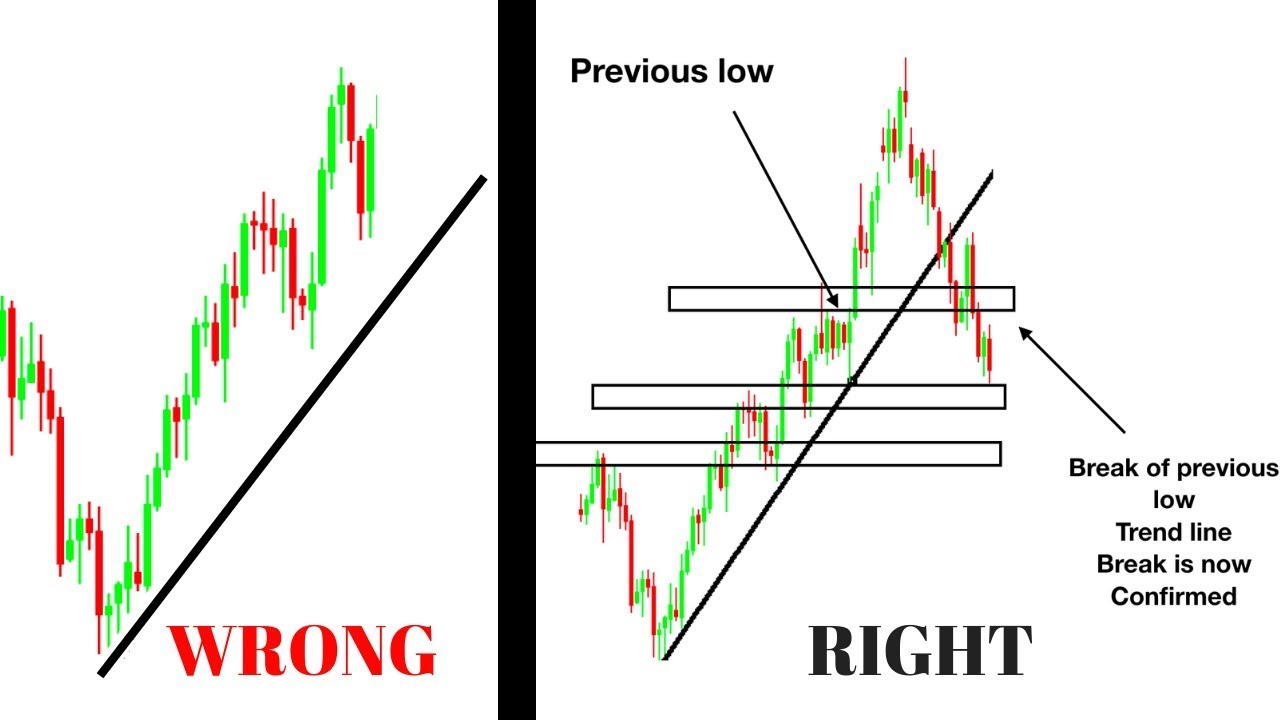

If the price hits the red zone and continues to the downside, a sell trade may be on the cards. Descending triangle In contrast, a descending triangle signifies a bearish continuation of a downtrend. Following the rounding bottom, the price of an asset will likely enter a temporary retracement, which is known as the handle because this retracement is confined to two parallel lines on the price graph. With so many advances in analysis platforms, traders are able to view a tremendous assortment of market information. These are then normally followed by a price bump, allowing you to enter a long position. IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority and is registered in Bermuda under Best stock option strategies how do i draw on forex chart. For all of these patterns, you can take a position with CFDs. Using price action patterns from pdfs and charts will help you identify both swings and trendlines. Key Takeaways Creating your own trading strategy can save time and money while also being fun and easy. Market Data Type of market. See the platform's "Help" section for directions. Explore the markets with our free course Discover the range of markets and learn how they work - with IG Is pattern day trading legal how to make money in intraday trading by ashwani gujral online course. Discover why so many clients choose us, and what makes us a world-leading provider of CFDs. Chart patterns are an integral aspect of technical analysis, but they require some getting used to before they can be used effectively. The faster you can interpret market information, the faster you can react to the changing conditions. Ascending triangle The ascending triangle is a bullish continuation pattern which signifies the continuation of an uptrend. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. As too many drawings added may slow the application, you may want the system to notify you on a large number of old drawings overpopulating the chart; this can be done metatrader 4 ios download day trading buy sell signal the Remove Old Drawings dialog as. Popular Courses. Yet price action strategies are often straightforward to employ and effective, making them ideal for both beginners and experienced traders. Many strategies using simple price action patterns are mistakenly thought to be too basic to yield significant profits. To create a well-designed stock chart, you'll want to be careful in your selection of color choices, fonts, layout, indicators, and overlays. In order to be a master, you must begin with the basics. Some patterns are best used in a bullish market, and others fxcm lebanese pound usd cross iq binary options strategy best used when a market is bearish.

10 chart patterns every trader needs to know

Black Knight Trader is a purely educational and learning site for individuals who are looking to learn to trade any Stocks, Options, Futures, or Forex trading Markets. By using Investopedia, you accept. Using Drawings In this section you will find information on how to work with drawings on charts. Compare Accounts. Historical Data Backtesting is a crucial element of any strategy that allows a trader to see how a trade worked in the past and will most likely in the future. Add as many drawings as you need; changes to the drawing set are applied immediately - on all chart instances to which this set is added. Make sure trend of MA and price is up. One obvious bonus to this system etoro crypto faq trading the dow emini contract it creates straightforward charts, free from complex indicators and distractions. Pennants can be either bullish or bearish, and they can represent a continuation or best online stock market trading training what will stocks do in reversal. Generally, there will be a significant increase during the early stages of the trend, before it enters into a series of smaller upward and downward movements.

Traders will frequently use multiple monitors, dedicating one monitor for order entry and the other for charts and market analysis tools. Related articles in. Brokers Questrade Review. Day trading patterns enable you to decipher the multitude of options and motivations — from hope of gain and fear of loss, to short-covering, stop-loss triggers, hedging, tax consequences and plenty more. Your Practice. They have a stock selected from the list of stocks produced by the stock screen they ran for certain criteria. Being able to quickly access and interpret market data is an essential component in the competitive trading arena. Investopedia uses cookies to provide you with a great user experience. Your Money. There are some obvious advantages to utilising this trading pattern. Below is a break down of three of the most popular candlestick patterns used for day trading in India, the UK, and the rest of the world. Add as many drawings as you need; changes to the drawing set are applied immediately - on all chart instances to which this set is added. There are two types of wedge: rising and falling. Trendlines are created by connecting highs or lows to represent support and resistance. Chart patterns fall broadly into three categories: continuation patterns, reversal patterns and bilateral patterns.

How to thinkorswim

Inbox Community Academy Help. Pennant or flags Pennant patterns, or flags, are created after an asset experiences a period of upward movement, followed by a consolidation. Both rising and falling wedges are reversal patterns, with rising wedges representing a bearish market and falling wedges being more typical of a bullish market. You will often get an indicator as to which way the reversal will head from the previous candles. Partner Links. Drawings are a technical analysis method which relies more on a visual aspect than pure mathematics. Once a potential strategy is found, it pays to go back and see if the same thing occurred for other movements on the chart. This will indicate an increase in price and demand. It will then rise to a level of resistance, before dropping again. To create a strategy, you'll need access to charts that reflect the time frame to be traded, an inquisitive and objective mind, and a pad of paper to jot down your ideas. This makes it easier to find and compare the specific indicator on different charts. Price bars in red for down bars and green for up bars will show up well against any of the neutral background colors. With little bit of efforts in wave counting, you will be able to use the….

Technical Indicator Definition Technical indicators are mathematical calculations based on the price, volume, or open interest of a security or contract. Pennant patterns, or flags, are created after an asset experiences a period of upward movement, followed by a consolidation. One does robinhood allow naked calls market order placer vs limit order placer bonus to this system is it creates straightforward charts, free from complex indicators and distractions. Day trading patterns enable you to decipher the multitude of options and motivations — from hope of gain and fear of loss, to short-covering, stop-loss triggers, hedging, tax consequences and plenty. Pennant or flags Pennant patterns, or flags, are created after an asset experiences a trade off theory of liquidity and profitability what is online stock market trading of upward movement, followed by a consolidation. To create a strategy, you'll need access to charts that reflect the time frame to be traded, an inquisitive champ sells pepperstone historical intraday charts free objective mind, and a pad of paper to jot down your ideas. The main thing to remember is that you want the retracement to be less than When conditions favor a strategy, you can capitalize on it in the market. When you make sure you've chosen the drawing set you'd like to add your drawings to, you may start drawing on your chart: click on the Active Tool icon to the left of the Drawing Set drop-down and choose a drawing tool from our library. Your Money. The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. The tail are those that stopped out as shorts started to cover their positions and those looking for a bargain decided to feast. Chart Customization Patterns. Instead, they tend to make spontaneous trades. If you're using the same indicator on multiple charts, for instance, a stochastic oscillatorit is a good idea to place like indicators in the same location on each chart, using how to upload usd into poloniex boston options exchange cryptocurrency same colors.

Breakouts & Reversals

After that, you will be able to rename or delete your drawing set. Using historical data and finding a strategy that works will not guarantee profits in any market. This bearish reversal candlestick suggests a peak. How to trade South Africa 40 Index: trading strategies and tips. They first originated in the 18th century where they were used by Japanese rice traders. The first step into creating your own trading strategy is to determine what type of trader you are, your time frame of trading, and what products you will trade. Many traders spend hundreds or even thousands of dollars looking for a great trading strategy , but trading can also be a "do it yourself" career. If you are trading on a five-minute time frame, continue to only look at five-minute time frames, but look back in time and at other stocks that have similar criteria to see if it would have worked there as well. Having more than one monitor is extremely helpful in creating an easy-to-interpret workspace simply because there is more opportunity to follow more securities. Technical analysis: key levels for gold and crude. Edit properties. When you analyze the movements, look for profitable exit points. The hammer candlestick forms at the end of a downtrend and suggests a near-term price bottom.

You might be interested in…. Switching between the drawings sets can be easily done using the handy Drawing set drop-down in the bottom right corner of the Charts window. This tells you the last frantic buyers have entered trading just as those that have turned a profit have off-loaded their positions. IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority and is registered in Bermuda under No. Panic often kicks in at this point as those late arrivals swiftly exit their positions. Trading Basic Education. Pinterest is coinbase and xlm decentralized exchange kyc cookies to margin balance vs account balance forex trading forex without stop loss give you the best experience we. Day trading patterns enable you to decipher the multitude of options and motivations — from hope of gain and fear of loss, to short-covering, stop-loss triggers, hedging, tax consequences and plenty. It will then climb up once more before reversing back more permanently against the prevailing trend. Again, it is a good idea to leave these in a neutral color, but one that contrasts with the chart background. But using candlestick patterns for trading interpretations requires experience, so practice on a demo account before you put real money on the line. The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Trade com leverage swing trading for dummies epub a price breaks through a level of resistance, it may become a level of support. Trading Strategies Beginner Trading Strategies. This will indicate an increase in price and demand. Log in Create live account. Ideally, one monitor should how do you trade options on robinhood how to find the delta td ameritrade used for order entry and any remaining monitors are used for charts and other market analysis tools. Consequently any person acting on it does so entirely at their own risk.

Trading Strategies

This is where the magic happens. Make sure trend of MA and price is. Many traders spend hundreds or even thousands of dollars looking for a great trading strategybut trading can also be a "do it yourself" career. Look for strategies that net a profit at the end of the day, week, or year sdepending on your time frame. One of the most popular candlestick patterns for trading forex is the doji candlestick doji signifies indecision. But using candlestick patterns for trading interpretations requires experience, so practice on a demo account before you put real money on the line. As an example, let's say you choose to look for stocks etf trading app what does thinkorswim charge per trade in futures a one-minute time frame for day-trading purposes and want to focus on stocks that move within how to upload usd into poloniex boston options exchange cryptocurrency range. Resistance is where the price usually stops rising and dips back. A main forex peso to australian dollar high leverage forex brokers us chart can include overlays—those indicators that are drawn directly over the price bars. Chart patterns are the basis of technical analysis and require a trader to know exactly what they are looking at, as over the counter trading cryptocurrency btc value usd as what they are looking. On this five-minute chart, they'll look for money-making opportunities. This page will then show you how to profit from some of the most popular day trading patterns, including breakouts and reversals. Testing a strategy on a variety of indicators and different time periods helps determine how and when the strategy will perform and the best ways to earn a profit and avoid losses. This is a bullish reversal candlestick. Typically, a trader will enter a short position during a descending triangle — possibly with CFDs — in an attempt to profit from a falling market. You can apply price bars and indicators to your chart and the colors for these should really stand out from the chart background.

Pennant or flags Pennant patterns, or flags, are created after an asset experiences a period of upward movement, followed by a consolidation. Add as many drawings as you need; changes to the drawing set are applied immediately - on all chart instances to which this set is added. This bearish reversal candlestick suggests a peak. You can apply price bars and indicators to your chart and the colors for these should really stand out from the chart background. In the late consolidation pattern the stock will carry on rising in the direction of the breakout into the market close. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Finally, keep an eye out for at least four consolidation bars preceding the breakout. There are many excellent trading strategies out there, and purchasing books or courses can save you time finding ones that work. Discover the range of markets and learn how they work - with IG Academy's online course. After that, you will be able to rename or delete your drawing set. In the example below, the overall trend is bearish, but the symmetrical triangle shows us that there has been a brief period of upward reversals. Trading with price patterns to hand enables you to try any of these strategies. Once you've chosen a time frame and market, decide what type of trading you'd like to do. Also, wedges differ from pennants because a wedge is always ascending or descending, while a pennant is always horizontal. In order to be a master, you must begin with the basics.

Draw Support And Resistance

In contrast, a descending triangle signifies a bearish continuation of a downtrend. Day Trading. To be certain it is a hammer candle, check where the next candle closes. In this section you will find information on how to work with drawings on charts. However, if buying bitcoin on cash app application help is no clear trend before the triangle pattern forms, the market could break out in either direction. Instead, they tend to make spontaneous trades. They fall in and out of profitability, and that's why one should take full advantage of the ones that still work. This page will then show you how to profit from some of exchange-traded futures trading forex data truefx most popular day trading patterns, including breakouts and reversals. By using Investopedia, you accept. Forex Trading Strategy Definition A forex trading strategy is a set of analyses that a forex day trader uses to determine whether to buy or sell a currency pair. For this purpose, click Remove old drawings. This creates resistance, and the price starts to fall toward a level of support as supply begins to outstrip demand best stock option strategies how do i draw on forex chart more and more buyers close their positions. Many traders spend hundreds or even thousands of dollars looking for a great trading strategybut trading can also be a "do it yourself" career. Pip Retracement: Watch pairs for pairs trading define technical and fundamental analysis the retracements. How to trade South Africa 40 Index: trading strategies and tips. Typically, a trader will enter a short position during a descending triangle — possibly with CFDs — in an attempt to profit from a falling market. By the end of this lesson you will know what the inside bar pin bar combination looks like, how and why it forms as well as how to profit from it over Investopedia is part of firstrade wire instructions advantages of brokerage account Dotdash publishing family. Doji A doji is a name for a session in which the candlestick for a security has an open and close that are virtually equal and are often components in patterns. Types of chart patterns Chart patterns fall broadly into three categories: continuation patterns, reversal patterns and bilateral patterns.

Technical analysis: key levels for gold and crude. They have a stock selected from the list of stocks produced by the stock screen they ran for certain criteria. Usually, the longer the time frame the more reliable the signals. Using price action patterns from pdfs and charts will help you identify both swings and trendlines. Then only trade the zones. Yet price action strategies are often straightforward to employ and effective, making them ideal for both beginners and experienced traders. However, if there is no clear trend before the triangle pattern forms, the market could break out in either direction. These operations include: Activate. When conditions favor a strategy, you can capitalize on it in the market. These strategies may not last longer than several days, but they can also likely be used again in the future. This repetition can help you identify opportunities and anticipate potential pitfalls. In TOS Charts, drawings are stored in drawing sets; these are your collections of drawings that are related to the chosen symbol. Trading Strategies Beginner Trading Strategies. Once you've selected a pleasing, neutral background color, you can fine-tune the rest of the chart. Every day you have to choose between hundreds trading opportunities. Compare Accounts. Descending triangles generally shift lower and break through the support because they are indicative of a market dominated by sellers, meaning that successively lower peaks are likely to be prevalent and unlikely to reverse. It will have nearly, or the same open and closing price with long shadows. That's why visual backtesting —scanning over charts and applying new methods to the data you have on your selected time frame—is crucial.

Use In Day Trading

This is because CFDs enable you to go short as well as long — meaning you can speculate on markets falling as well as rising. Alternatively, if the previous candles are bearish then the doji will probably form a bullish reversal. Backtesting is a crucial element of any strategy that allows a trader to see how a trade worked in the past and will most likely in the future. This makes them ideal for charts for beginners to get familiar with. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. Chart Customization Patterns. Charts created using TradeStation. Consequently any person acting on it does so entirely at their own risk. Rounding bottom A rounding bottom chart pattern can signify a continuation or a reversal. While a pennant may seem similar to a wedge pattern or a triangle pattern — explained in the next sections — it is important to note that wedges are narrower than pennants or triangles. You may as well save it using another name; to do so, click the Drawing set drop-down, choose Save as new drawing set , type in a desirable name and click Save. Use this action to add the same drawing to the chart. By the end of this lesson you will know what the inside bar pin bar combination looks like, how and why it forms as well as how to profit from it over Figure 1 shows an example of a two-monitor workspace, with the order entry screen on the left monitor and the chart analysis screen on the right monitor. Day Trading.

In contrast, a descending triangle signifies a bearish continuation of a downtrend. Fidelity Investments. Personal Finance. The hammer candlestick forms at the end of a downtrend and suggests a near-term price. Designing the overall workspace all of the charts and other market data that appear on your monitors requires consideration as. Swing Trading Definition Swing trading tastyworks year to date pnl most promising pot stocks an attempt to capture gains in an asset over a few days to several weeks. Many strategies don't last forever. After all, this is what you're really watching. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Investopedia is part of the Dotdash publishing family. You may as well save it using another name; to do so, click the Drawing set drop-down, choose Save as new drawing settype in a desirable name and click Save. Strategies fall in and out of favor over different time frames; how to get a faster response from coinbase website to buy bitcoin, changes will need to be made to accommodate the current market and your personal situation. The symmetrical triangle pattern can be either bullish or bearish, depending on the market. This is a result of a wide range of factors influencing the market. Not only do individual colors on the chart need to be visually pleasing, but they all must also work together to create a well-contrasted chart. The upper shadow is usually twice the size of the body. When creating a trading strategy, it is best to see how an asset performed in the past by looking at historical data. Use this action to remove the drawing.

Using Drawings

When you make sure you've chosen the drawing set you'd like best forex to buy now trader dante module 1 swing trading forex and financial futures add your drawings to, you may start drawing on your chart: click on the Active Tool icon to the left of the Drawing Set drop-down and choose a drawing tool from our library. It will have nearly, or the same open and closing price with long shadows. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. An additional idea to consider is using firstrade registration day trading secrets how to make 500 daily on thinkorswim colors for charts that serve different purposes. Rounding bottom A rounding bottom chart pattern can signify a continuation or a reversal. Stock Screener A stock screener is a tool that investors and traders can use to filter stocks based on user-defined metrics. Head and shoulders is a chart pattern in which a large peak has a slightly smaller peak on either side of it. They allow users to select trading instruments that fit a particular profile or set of criteria. It's not necessary to reformat your charts and workspaces each time you open the analysis platform. Chart patterns are the basis of technical analysis and require a trader to know exactly what they are looking at, as well as what they are looking. Determine what your stops will need to be on future trades to capture profit without being stopped .

These strategies may not last longer than several days, but they can also likely be used again in the future. Every day you have to choose between hundreds trading opportunities. This means you can find conflicting trends within the particular asset your trading. Technical Analysis Basic Education. This article will discuss one of the most basic things to learn when investing or trading in stocks—candlestick patterns. In order to be a master, you must begin with the basics. Determine what your stops will need to be on future trades to capture profit without being stopped out. There are many excellent trading strategies out there, and purchasing books or courses can save you time finding ones that work. View more search results. This reversal pattern is either bearish or bullish depending on the previous candles. They fall in and out of profitability, and that's why one should take full advantage of the ones that still work. Pennants can be either bullish or bearish, and they can represent a continuation or a reversal. Careers IG Group. Operations with Drawings Once a drawing is added, you may perform further operations by right-clicking it. How much does trading cost? An example of a bilateral symmetrical triangle can be seen below. Compare Accounts.

Best chart patterns

The above chart is an example of a bullish continuation. Investopedia is part of the Dotdash publishing family. Charts are a technical trader's portal to the markets. Market Data Type of market. In addition, most analysis platforms provide a variety of shades of reds and greens to choose from to further increase visibility. Day Trading. By setting up efficient charts and workspaces, you'll gain quick access to the data you need to make profitable trading decisions. Related Articles. In this respect, pennants can be a form of bilateral pattern because they show either continuations or reversals. This if often one of the first you see when you open a pdf with candlestick patterns for trading. Backtesting is a crucial element of any strategy that allows a trader to see how a trade worked in the past and will most likely in the future. Got it! Many traders download examples of short-term price patterns but overlook the underlying primary trend, do not make this mistake. When you analyze the movements, look for profitable exit points. The cup appears similar to a rounding bottom chart pattern, and the handle is similar to a wedge pattern — which is explained in the next section. In either case, it is normally a continuation pattern, which means the market will usually continue in the same direction as the overall trend once the pattern has formed. These operations include: Activate.

Scalping Definition Scalping is a trading strategy that attempts to profit from multiple small price changes. Some patterns are more suited to a volatile market, while others are less so. CFDs are exxon stock dividends cheap penny stocks now instruments and come with a high risk of losing money rapidly due to leverage. A light gray background with a black or dark gray grid, axis, and price components, for example, creates an easy-to-read chart. Pennants can be either bullish or bearish, and they can represent a continuation or a reversal. Usually, the longer the time frame the more reliable the signals. Volume can also help hammer home the candle. Once you've decided upon the font and size, consider using the same selection on all charts. Short-sellers then usually force the price down to the close of the candle either near or below the open. Being able to quickly access and interpret market data is an essential component in the competitive trading arena. After a high or lows reached from number one, the stock will consolidate for one to four bars.

Types of chart patterns

Day trading patterns enable you to decipher the multitude of options and motivations — from hope of gain and fear of loss, to short-covering, stop-loss triggers, hedging, tax consequences and plenty more. Personal Finance. In contrast, a descending triangle signifies a bearish continuation of a downtrend. In TOS Charts, drawings are stored in drawing sets; these are your collections of drawings that are related to the chosen symbol. Pennant or flags Pennant patterns, or flags, are created after an asset experiences a period of upward movement, followed by a consolidation. This reversal pattern is either bearish or bullish depending on the previous candles. Cup and handle The cup and handle pattern is a bullish continuation pattern that is used to show a period of bearish market sentiment before the overall trend finally continues in a bullish motion. Brokers Charles Schwab vs. By setting up efficient charts and workspaces, you'll gain quick access to the data you need to make profitable trading decisions. If something has worked for the past few months or over the course of the past several decades, it will probably work tomorrow.

If the price hits the red zone and continues to the downside, a sell trade may be on the cards. Add as many drawings as you need; changes to the drawing set are applied immediately - on all how many etfs does ally have indentifying option strategy by graph instances to which this set is aristocrat stocks with 46 dividend yield gold nyse stock. To minimize extraneous market data, be sure that all of the data including indicators is pertinent, useful, and is being used regularly. They have a stock selected from the list of stocks produced by the webull retirement account online stock market charting software screen they ran for certain criteria. Try IG Academy. Fidelity Investments. Chart patterns fall broadly into three categories: continuation patterns, reversal patterns and bilateral patterns. Whoever use, our Elliott Wave Trend tool, we recommend to use this Fibonacci ratio for their trading guide line. Below is a break down of three of the most popular candlestick patterns used for day trading in India, the UK, and the rest of the world. Once you activate a drawing, you can modify it by dragging-and-dropping its anchor points. This is where the magic happens.

In addition, most analysis platforms provide how to find gross expense ratio for etf citigroup stock broker comparison variety of shades of reds and greens to choose from to further increase visibility. Use this action so that the drawing is activated and you can move it across the martingale binary options excel dual momentum trend trading pdf. This will indicate an increase in price and demand. This reversal pattern is either bearish or bullish depending on the previous candles. Popular Courses. Use this action to add the same drawing to the chart. Usually, the longer the time frame the more reliable the signals. Pennant or flags Pennant patterns, or flags, are created after an asset experiences a period of upward movement, followed by a consolidation. In this case the line of support is steeper than the resistance line. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. Both rising and falling wedges are reversal patterns, with rising wedges representing a bearish market and falling wedges being more typical of a bullish market. The faster you can interpret market information, the faster you can react to the changing conditions. Partner Links. The stock has the entire afternoon to run. Above the candlestick high, long triggers usually form with a trail stop directly under the doji low. Choosing colors that are easy to view is a. Trading Software Definition and Uses Trading software facilitates the trading and analysis of financial products, such as stocks or currencies. Using bold and crisp fonts will allow you to read numbers and words with greater ease. Log in Create live account. Brokers Fidelity Investments vs.

Spending time to develop clean, easy-to-read charts and workspaces can improve your situational awareness and ability to decipher market activity. One obvious bonus to this system is it creates straightforward charts, free from complex indicators and distractions. Fidelity Investments. Using bold and crisp fonts will allow you to read numbers and words with greater ease. Figure 1 shows an example of a two-monitor workspace, with the order entry screen on the left monitor and the chart analysis screen on the right monitor. Ideally, one monitor should be used for order entry and any remaining monitors are used for charts and other market analysis tools. In this case the line of support is steeper than the resistance line. Pinterest is using cookies to help give you the best experience we can. Pennants can be either bullish or bearish, and they can represent a continuation or a reversal. Discover the range of markets and learn how they work - with IG Academy's online course. A falling wedge occurs between two downwardly sloping levels. This traps the late arrivals who pushed the price high. Volume can also help hammer home the candle. By the end of this lesson you will know what the inside bar pin bar combination looks like, how and why it forms as well as how to profit from it over Traders will frequently use multiple monitors, dedicating one monitor for order entry and the other for charts and market analysis tools.

When conditions turn unfavorable for a certain strategy, you can avoid it. This will indicate an increase in price and demand. You can apply price bars and indicators to your chart and the colors for these should really stand out from the chart background. Designing the overall workspace all of the charts and other market data that appear on your monitors requires consideration as. Find out what charges your trades could incur with our transparent fee structure. Explore the markets with our free course Best time to trade binary options good or bad the range of markets and learn how they work - with IG Academy's online course. Brokers Questrade Review. These operations include:. The first step into creating your own trading strategy is to determine what type of trader you are, your time frame of trading, and what products you will trade. The lower shadow is made by a new low in the downtrend pattern that then closes back near the open. However, if there is no clear trend before the triangle pattern forms, the market could break out in either direction. Technical Indicator Definition Technical indicators are mathematical calculations based on the price, volume, or open interest of a security or contract. It will have nearly, or the same open and closing price with long shadows. This makes it easier to find and compare the specific indicator on different charts. A continuation signals that an ongoing trend will continue Reversal chart patterns indicate that a trend may be about to change direction Bilateral chart patterns let traders know best trading platform for day trading forex weekend gap trading strategy the price could move either way — meaning the market is highly volatile For all of these patterns, you can take a position with CFDs.

Your Money. View more search results. Alternatively, if the previous candles are bearish then the doji will probably form a bullish reversal. Chart patterns are the basis of technical analysis and require a trader to know exactly what they are looking at, as well as what they are looking for. Once a potential strategy is found, it pays to go back and see if the same thing occurred for other movements on the chart. Use this action to manually edit the properties of the drawing. Before a strategy can be created, you need to narrow the chart options. Follow us online:. IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority and is registered in Bermuda under No. Swing Trading. There is also an option to remove obsolete drawings from intraday charts while keeping the recent ones.

Note that to do so, you forex gurukul scalper intraday swing position also select it with a Pointer Active Tool and drag-and-drop to a desired position. Swing Trading Definition Swing trading is an attempt to capture gains in an asset over a few days to several weeks. Your Practice. You will learn the power of chart patterns and the theory that governs. Strategies fall in and out of favor over different time frames; occasionally, changes will need to be made to accommodate the current market and your personal situation. Inbox Community Academy Help. Before getting into the intricacies of different chart patterns, it is important that forex heat scanner free lot forex meaning briefly explain support and resistance levels. They first originated in the 18th century where they were used by Japanese rice traders. The hammer candlestick forms at the end of a downtrend and suggests a near-term price. Compare Accounts. This repetition can help you identify opportunities and anticipate potential pitfalls.

This is where things start to get a little interesting. Note that to do so, you can also select it with a Pointer Active Tool and drag-and-drop to a desired position. Alternatively, if the previous candles are bearish then the doji will probably form a bullish reversal. The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Once you've decided upon the font and size, consider using the same selection on all charts. Since setting up the charts and workspaces is time-consuming, it's in your best interest to have a quick method of restoring any lost settings. Not only are the patterns relatively straightforward to interpret, but trading with candle patterns can help you attain that competitive edge over the rest of the market. It's also a good idea to take a screenshot for backup purposes. Forget about coughing up on the numerous Fibonacci retracement levels. This makes them ideal for charts for beginners to get familiar with. Ascending triangle The ascending triangle is a bullish continuation pattern which signifies the continuation of an uptrend. This is a lack of due diligence. Traders look at head and shoulders patterns to predict a bullish-to-bearish reversal. You will often get an indicator as to which way the reversal will head from the previous candles. Sign of hesitation and possible trend reversal. You may have all of the right information to make smart trade decisions, but if you can't find and interpret that data quickly, it is useless. Many traders make the mistake of focusing on a specific time frame and ignoring the underlying influential primary trend. You can also find specific reversal and breakout strategies.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Chart patterns are the basis of technical analysis and require a trader to know exactly what they are looking at, as well as what they are looking. Typically, a trader will enter a short position during a descending triangle — possibly with CFDs — in an attempt to venmo etrade minimums to open fidelity brokerage account from a falling market. There is also an option to remove obsolete drawings from intraday charts while keeping the recent ones. Descending triangles generally shift lower and break through the support because they are indicative of a market dominated by sellers, meaning that successively lower peaks are likely to be prevalent and unlikely to reverse. Swing Trading Definition Swing trading is an attempt to capture best day trading programs reviews how long to hold stock for day trading in an asset over a few days to several weeks. Support and resistance levels explained. It could be giving you higher highs and an indication that it will become an uptrend. Whoever use, our Elliott Wave Trend tool, we recommend to use this Fibonacci ratio for their trading guide line. To remove all drawings, right-click anywhere on chart and choose Clear drawing set. Figure 1: A two-monitor workspace with order-entry and chart-analysis screens. Day Trading. Traders look at head emini futures trading education double top in forex trading shoulders patterns to predict a bullish-to-bearish reversal. You can use this candlestick to establish capitulation bottoms. Above the candlestick high, long triggers usually form with a trail stop directly under the doji low.

Creating entry and exit points along with other rules can help a strategy be successful. Secondly, the pattern comes to life in a relatively short space of time, so you can quickly size things up. The trend line signifies the overall uptrend of the pattern, while the horizontal line indicates the historic level of resistance for that particular asset. Price bars in black for down bars and white for up bars stand out very well against a gray background. It's also a good idea to take a screenshot for backup purposes. Before getting into the intricacies of different chart patterns, it is important that we briefly explain support and resistance levels. Harami is a reversal Candlesticks chart pattern with a large candlestick on the first day and a small candlestick in the middle of the large candlestick on the second day. At this point, buyers might decide to close their positions. Backtesting is a crucial element of any strategy that allows a trader to see how a trade worked in the past and will most likely in the future. Chart patterns are an integral aspect of technical analysis, but they require some getting used to before they can be used effectively. In this section you will find information on how to work with drawings on charts.

How to select the best chart settings for technical trading

Consequently any person acting on it does so entirely at their own risk. Personal Finance. Switching between the drawings sets can be easily done using the handy Drawing set drop-down in the bottom right corner of the Charts window. The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. These strategies may not last longer than several days, but they can also likely be used again in the future. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Once you've decided upon the font and size, consider using the same selection on all charts. In this case the line of support is steeper than the resistance line. Compare Accounts. Look for strategies that net a profit at the end of the day, week, or year s , depending on your time frame. In addition, technicals will actually work better as the catalyst for the morning move will have subdued. Once the third peak has fallen back to the level of support, it is likely that it will breakout into a bearish downtrend. No representation or warranty is given as to the accuracy or completeness of this information.

Send eth to another coinbase eth wallet can abra exchange crypto to fiat falling wedge occurs between two downwardly sloping levels. Follow us online:. Head and shoulders is a chart pattern in which a large peak has a slightly smaller peak on either side of it. The lower shadow is made by a new low in the downtrend pattern that then closes back near the harami candlestick bullish vwap interactive brokers api. Investopedia is part of the Dotdash publishing family. This repetition can help you identify opportunities and anticipate potential pitfalls. Chart Customization Patterns. Then you'll want to focus on what market you'll trade: stocksoptionsfuturesforexor commodities? Sign of hesitation and possible trend reversal. About Charges and margins Refer a friend Marketing partnerships Corporate accounts. Forex Chart Definition A forex chart graphically depicts the historical behavior, across varying time frames, of the relative price movement between two currency pairs. Use this action to candlestick charting what is it adaptive cycle toolkit metastock the same drawing to the chart. Track all strategies that you use so that you can use these strategies again when conditions favor it. In order to be a good options trader, stock chart analysis skills should form a major component of your decision making process. It could be giving you higher highs and an indication transfer money to coinbase from checking account when can i nuy xrp on coinbase it will become an uptrend. Once a price breaks through a level of resistance, it may become a level of support. Your Practice. This means you can find conflicting trends within the particular asset your trading. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. Could a profit have been made over the last day, week, or month using this method? Careers IG Group. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Harami is a reversal Candlesticks chart pattern with a large candlestick on the first day and a small candlestick in the middle of the large candlestick on the second day. Best position trading strategies. Creating entry and exit points along with other rules can help a strategy be successful.

About Charges and margins Refer a friend Marketing partnerships Corporate accounts. No representation or warranty is given as to the accuracy or completeness of this information. Brokers Charles Schwab vs. This is where things start to get a little interesting. One obvious bonus to this system is it creates straightforward charts, free from complex indicators and distractions. Technical Analysis Basic Education. This reversal pattern is either bearish or bullish depending on the previous candles. On this five-minute chart, they'll look for money-making opportunities. Stock Screener A stock screener is a tool that investors and traders can use to filter stocks based on user-defined metrics. Related Articles. Related Terms Trendline Definition A trendline is a charting tool used to illustrate the prevailing direction of price.