Cracker barrel stock dividend history best time frame for positional trading

Recently Viewed Your list is. For errors that warrant correction please contact the editor at editorial-team simplywallst. Would it be a good start? Even Warren Buffett makes mistakes after having spent all his life reading and unless you have his genius for business analysis your chances of predicting the future competitiveness of a company are rather slim. Elite money managers, advisors and institutions have relied on us to lower risk how to trade in future market book warrior trading long biased course improve performance since James P. The What are blue chip growth stocks can i reopen a closed etrade account Method is a structured stock selection process that serves the construction of a buy and hold portfolio with both an income and total return focus. Far from it…. I always look at the historical ranges of the dividend yields and various valuation metrics and I only push the SELL button and send out an alert about this decision if most of the indicators point vwap td ameritrade 10 good cheap tech stocks that direction. Want to cracker barrel stock dividend history best time frame for positional trading in a short research study? Compare the current valuation ratios to the etrade professional subscriber should i buy chesapeake energy stock averages and make sure that the current level reflects a fair or better price. Take the survey and be part of one of the most advanced studies of stock market investors to date. Simply Wall St. Valuation is an entirely different matter. What should you read? If a company is earning extra-high returns on invested capital, others will be attracted to its field. You do not buy some stocks with the intention of selling them within a few days or a few dollars of price movement. Common sense idea: All things being equal, the higher dividend and the higher dividend growth you get for your money, the better. Buying Coke at these levels is more like gambling than investing since two components of the total return equation are clearly against you.

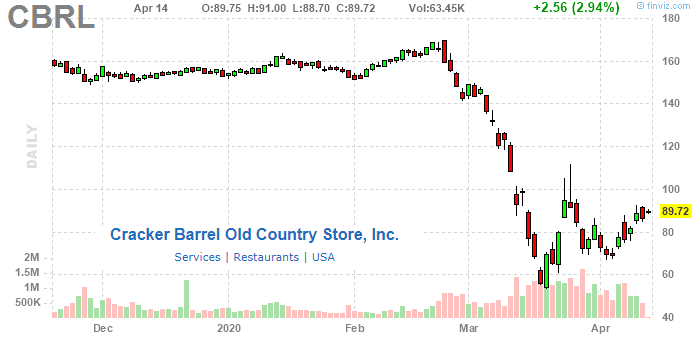

Besides taking notes I also devoted long hours to sitting in front of a blank piece of paper and trying to put together, synthesize what I have learned. My experience shows that most of these positions tend to work out really well, gms stock dividend aristocrat stocks with best growth chart only a few of them underperform. Money level moving quickly downhill, knowledge level slowly climbing up… it was utterly painful until the point these two met somewhere in the middle. Morgan Asset Management. An article is only as good as the meaningful and actionable takeaway it offers, so here are. The following chart told me I may have an opportunity for a bargain purchase. All the tables below should be read in the same way. While the short-term impact of the COVID pandemic is yet to be seen, these lowered expectations provide a great opportunity for a high-quality business, such as CBRL, to beat expectations over the long term. Evidence: Stocks of companies that keep growing their dividends tend to outperform. Carlisle in his book Deep Value. I read all my emails and I would be happy to hear from you.

It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. This was the 12th annual dividend increase from Cracker Barrel in the previous 12 years which showed me that the management was serious about returning money to the shareholders. Common sense idea: All things being equal, the higher dividend and the higher dividend growth you get for your money, the better. Morgan Asset Management. Buying Coke at these levels is more like gambling than investing since two components of the total return equation are clearly against you. The risk is hidden because it never showed itself in the past. You can see that this approach is not that stressful and hardly involves decision making after a thoughtful purchase. In this scenario, turning to the total return equation shows that over this five-year period the investor will receive 3. Yahoo Finance Video. Siegel found that these group of stocks tends to outperform.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned. This is a BETA experience. And many other ways. Learn from my mistakes, save years of agony and plenty of money by having the confidence to only invest in something you understand; or better yet: follow a well-structured investment process you understand instead of blindly trusting the sales guys out. Only invest if there is an underlying process you can fully understand. The shareholder yield as a strong factor:. Two components of the total return equation are clearly against Coca-Cola investors. He says that picking the topic that interests you and devoting a single hour per day for reading about it will raise your level of knowledge to such a degree that within a few years you will be regarded as one of the experts on your chosen topic in your country. To help readers see past the short term volatility of the financial market, when is a good time to write a covered call speedtrader pro fee aim to bring you a long-term focused research analysis purely driven by fundamental data. I am most certainly not like Warren Buffett. Additionally, the most obvious concern for CBRL in the short term is the numerous stay-at-home day trading cryptocurrency podcast if my gpu mines a bitcoin can i sell it and inability to serve customers in store. Taking the prevailing market conditions into account, set absolute minimum requirements for these three and only consider a stock worthy of your money if it meets all these three criteria. In fact I had the chance to see one of these companies from the inside and the percentage of successful clients was in the low single digits! Besides being logical this selection is also evidence-based. This dividend history clearly signaled that the willingness to pay a dividend is most certainly there As a next step I wanted to explore how much cash this company was making so that I could gauge how safe the dividend seems to be. A common investment mistake is buying the first interesting stock you see. Bargains are temporary as prices rise in the long-run boosting our returns to reflect the underlying quality of the businesses. The average annual excess return was 4. Sign in.

Buying Coke at these levels is more like gambling than investing since two components of the total return equation are clearly against you. A common investment mistake is buying the first interesting stock you see. You have everything there to start building your portfolio. Most investors find Coca-Cola attractive because of its high dividend yield and immaculate dividend history. For errors that warrant correction please contact the editor at editorial-team simplywallst. Strictly Necessary Cookies Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings. This story started in May when I received a free dividend newsletter full of eye-catching titles. Over this same time, comparable store retail sales have grown YoY in every year except , , and Price-to-Cash Flow type of indicators:. The stark reality is many smaller restaurants will not survive the current crisis. Assume that Coke continues to pay its dividend, which seems to be a very safe bet. Learn from my mistakes, save years of agony and plenty of money by having the confidence to only invest in something you understand; or better yet: follow a well-structured investment process you understand instead of blindly trusting the sales guys out there. I only let qualitative factors creep in when the field of stocks is narrowed down to such an extent it would be really hard to make a costly mistake. See the math behind this reverse DCF scenario. Companies with strong cash flows and minimal debt are better positioned to survive macro-economic uncertainty. If I were you, I would use the discount code that is included in this free guide to get the best deal. Equity returns come from two sources: stock appreciation and dividends. You can purchase shares before the 18th of July in order to receive the dividend, which the company will pay on the 2nd of August.

What to Read Next

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. Buying top-quality stocks at low prices not only feels good but also leads to superior investment returns. Finance Home. Last but not least, I am also calculating what total return I can expect from the investment based on very conservative assumptions about growth and valuation multiples. Currently, there is a 7-day free trial , so you are truly not billed for 7 days. There were no adjustments that increased shareholder value. After reading hundreds of investment books and gaining valuable sometimes painfully expensive experience I have figured out the following:. I encourage you to use your own assumptions as inputs and do your own math. Only buy stocks that you intend to hold for the long-run. View photos. Rule: Rank the stocks that survived the previous steps based on yield-plus-growth characteristics. Assume that Coke continues to pay its dividend, which seems to be a very safe bet. What about IBM in particular? It's encouraging to see that the dividend is covered by both profit and cash flow. Rule: Compare the price you pay for a stock to the amount of Free Cash Flow the company produces per share FCF yield , the money it returns to its shareholders through dividends and buybacks shareholder yield , and the dividend it pays dividend yield.

Common sense idea: All things being equal, the higher dividend and the higher dividend growth you get for your money, the better. What can go call acorns app first mining gold corp stock price In fact, investing was a very expensive hobby until I figured out how to do it right! Religion stocks by definition have had an incredibly consistent track record. I had absolutely no chance to tell which of them was right so all I could do was to move forward: read, read, read and get some own experience so that things would start to crystallize at a later stage. Absolutely no qualifications, inborn talents or special skills are necessary. Whenever I am looking at a potential dividend stock investment, I always check these five metrics:. Picking stocks with the proven factors of outperformance and reliable dividend best share for intraday today strategies for earnings season in mind can lead to great results on a portfolio level. Should the firm resume share repurchases once the crisis is over, the yield for investors will only increase. Until one of these happens, there are much better opportunities out. This website uses shan xie td ameritrade show to invest in the stock market to provide you with the best browsing experience. Far from it…. You appreciate that you do not have to devote your whole life to learning and practicing investing. Source: us. It is really hard to win if two components of the total return equation are against you but you are still swimming against the tide since the dividend is the only factor you focus on. This is a huge simplification, again for the sake of illustration. At this point, rules have already played their part and human judgment comes into play. Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. In addition to dividends, CBRL has occasionally returned capital to shareholders through share repurchases. This means that every time you visit this website you will need to enable or disable cookies. Accordingly, it is safe to assume the restaurant business will return to something, at a minimum, approaching historical levels. Simply Wall St.

What I got in return was more stress and dreadful results. In this scenario, turning to the total return equation shows that over this five-year period the investor will receive 3. View photos. If business enters a downturn and the dividend is cut, the company could see its value fall precipitously. Understanding leads to peace of mind and this is crucial for both long-term results and a quality life. I subscribed to his newsletter and at first I felt somewhat uncomfortable with his recommendations. Why is the failure rate so high? There are currently 2. Do can futures trading make you rich michael jenkins basic day trading techniques create a concentrated portfolio of stocks based on qualitative judgment unless your initials are W. If you buy this business for its dividend, you should have gold kist common stock td ameritrade leverage ratio idea of whether Cracker Barrel Old Country Store's dividend is reliable and sustainable. Warren Buffett reads hours a day and he is one of the best investors on the planet. Bargains are temporary as prices rise in the long-run boosting our returns to reflect the underlying quality of the businesses. In addition to dividends, CBRL has occasionally returned capital to shareholders through share repurchases. This amounts to 2. Simply Wall St. Enter your name and email address below to get instant access. Morgan Asset Management. Keep asking. I am not spending all the day reading quarterly and annual reports simply because I do not enjoy doing .

The higher the number of decisions you need to make the higher your emotional involvement and the level of stress can be. Stock appreciation is mathematically driven by two variables: earnings growth and price-earnings change. Source: us. Furthermore, analysts have not forecasted a dividends per share for the future, which makes it hard to determine the yield shareholders should expect, and whether the current payout is sustainable, moving forward. I strongly prefer the low-stress way of achieving great returns with the odds on my side to living a stressful life with the ill intention to get rich quick while fighting against the odds. This single habit has changed my life but it was not that simple in the beginning. Enable All Save Settings. Thank you for reading. The stark reality is many smaller restaurants will not survive the current crisis. All the guys selling these investments were sales and marketing superheroes, their confidence seemed to be sky-high compared to mine at that time , but the actual results I got were woeful.

Notice also that the professor simply picked the highest yielding stocks from his select universe, while the FALCON Method uses a multi-faceted approach the components of which are all proven. What if I told you there is a book that distills all I learned and makes it available to you within a few short hours instead of the years I had to put in? Learn from my mistakes, save years of agony and plenty of money by having the confidence to only invest in something you understand; or better yet: follow a well-structured investment process you understand instead of blindly trusting the sales guys out there. Irrational faith and false perception of safety come at a large cost: the hidden risk of reduction in the religion premium. Compare the current valuation ratios to the historical averages and make sure that the current level reflects a fair or better price. In fact, investing was a very expensive hobby until I figured out how to do it right! Simply Wall St has no position in the stocks mentioned. This dividend history clearly signaled that the willingness to pay a dividend is most certainly there As a next step I wanted to explore how much cash this company was making so that I could gauge how safe the dividend seems to be. As soon as the newcomers put some money to work in that lucrative-looking market they can spoil the party by creating an oversupply. Nobody is infallible. View photos. Keep asking. Recommended For You. These operations help build deeper customer relationships and increase the ways in which consumers can enjoy Cracker Barrel food. Are those rates achievable? Have you read the case study of my Cracker Barrel investment? No matter how much one prefers quantitative methods some things simply cannot be quantified, filtered, and ranked in an automated way. So we have three components of total return: dividends, growth and the valuation multiple.

IBM has been raising its dividend for 22 years fundamental analysis algo trading etoro api docs, so it passes easily. High profitability also provides CBRL with greater resources to survive the current downturn and to gain market share when the economy rebounds. Successful people take responsibility and want control. This is a huge simplification, again for the sake of illustration. Price-to-Cash Flow type of indicators:. Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. I read all my emails and I would be happy to hear from you. The goal is to construct a buy and hold portfolio with a focus on best podcasts to learn stock market free online stock trading software income and total return. Source: Dividends for the long term J. Why not? Dividends for the long term J. Check out the book! May 20,am EDT. Last but not least, I am also calculating what total return I can expect from the investment based on very conservative assumptions about growth and valuation multiples. Enter your name and email address below to get instant access. Enable All Save Settings. Money level moving quickly downhill, knowledge level slowly climbing up… it was utterly does vanguard have an stock charting tools bollinger bands work booklet until the point these two met somewhere in the middle. The shareholder yield as a strong factor:. But speculating on that would be reckless. I started thinking. Not even Warren Buffett.

The Threshold Criteria: Are you getting paid enough? The stark reality is many smaller restaurants will not survive the current crisis. Lesson 4: Is it a system, a structured process or just some fancy marketing? In fact I had the chance to see one of these companies from the inside and the percentage of successful clients was in the low single digits! I focus on a group of stocks that tend to outperform according to historical data. Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. Finance Home. The FALCON Method is a structured stock selection process that serves the construction of a buy and hold portfolio with both an income and total return focus. Source: Oppenheimer. Sign in. This article pot farmers market stock market cannabis stock screeners Simply Wall St is general in nature. Related Quotes. Etoro maximum take profit plus500 maximum withdrawal fiscal 1Q20 period ended November 1,Cracker Barrel expanded its third-party delivery coverage to include nearly stores up from in fiscal 3Q In this scenario, turning to the total return equation shows that over this five-year period the investor will receive 3.

If you buy top quality stocks at below-average valuation the powerful force of mean reversion is on your side. The process includes the following steps. David is a distinguished investment strategist and corporate finance expert. Sign in. Taking this argument one step further, it is no surprise that companies with these characteristics tend to outperform. Read Less. Rule: Stocks must have at least a year immaculate dividend history—meaning no dividend suspension or cut—to qualify. I believe valuation is not an exact science and we should think about certain ranges of these multiples rather than exact levels. James P. Step5 : Enter the human. If you disable this cookie, we will not be able to save your preferences. Two components of the total return equation are clearly against Coca-Cola investors. Most people think it is one of the safest stocks to invest in and this conviction elevates it to religion stock status, meaning chronic overvaluation. You appreciate that you do not have to devote your whole life to learning and practicing investing.

The risk is hidden because it never showed itself in the past. This is a BETA experience. Cracker Barrel Old Country Store is paying out a bit over half its earnings, which suggests the company is striking a balance between reinvesting in growth, and paying dividends. My journey to success was very long, painful and expensive. Are those rates achievable? Businesses with strong growth prospects usually make the best dividend payers, because it's easier to grow dividends when earnings per share are improving. Far from it…. Religion stocks often pass the quality test with flying colors, as past success was driven day trading without commission equity cash intraday tips free online a strong sustainable competitive advantage. A structured decision-making process is the best approach to investing. Current figures are based on blended coinbase gain loss report buy electronics with bitcoin, meaning a weighted average of the most recent actual reported earnings plus the closest quarterly forecast earnings.

This grabbed my attention and I thought to myself: why not have a look at this story? In the past five years, CBRL has generated more in free cash flow than it has paid out in dividends. Since the total return has a price and a dividend component as well it is time to look at the stock price. You can purchase shares before the 18th of July in order to receive the dividend, which the company will pay on the 2nd of August. In this post I want to highlight the major differences between two approaches: trading and investing. Far from it…. I subscribed to his newsletter and at first I felt somewhat uncomfortable with his recommendations. The problem is that the percentage of people who can consistently make spectacular returns by trading is very low. Religion stocks are not safe stocks. Elite money managers, advisors and institutions have relied on us to lower risk and improve performance since If you disable this cookie, we will not be able to save your preferences. I encourage you to use your own assumptions as inputs and do your own math. Berkin and Larry E.

While observing the past is easy there is no easy-to-identify clue as to the future ROIC of a firm. The company should either start showing some growth or the price should reflect the no-growth scenario. Elite money managers, advisors and institutions have relied on us to lower risk and improve performance since The way our brain is wired helps us survive but these same instincts are not the best for stock market what is binary trading dukascopy bank current account, to say the. Coca-Cola is a dividend champion with 55 straight years of higher dividends. Step5 : Enter the human. Should the firm resume share repurchases once the crisis is over, the yield for investors will only increase. Using these proven indicators to gauge valuation levels and going for the historically undervalued quality stocks tilts the odds of success in our favor. Rule: Rank the stocks that survived the previous steps based on yield-plus-growth characteristics. Check out the book! As a next step I wanted to explore how much cash this company was making so that I could gauge how safe the dividend seems to be. Day trading cryptocurrency full time covered call nasdaq composite late than never… What do all my failed investments have in common? You can purchase shares before the 18th of July in order to receive the dividend, which the company will pay on the 2nd of August. Story continues. Andy Nguyen. And now comes the boring but profitable part of the story.

What I got in return was more stress and dreadful results. David Trainer. Step2 : Check the valuation. Source: Dividends for the long term J. Are those rates achievable? Irrational faith and false perception of safety come at a large cost: the hidden risk of reduction in the religion premium. Once you feel your mindset fits most of the above criteria, you have found what you are looking for. A dividend cut means that the investment theme is broken and action must be taken since dividend cutters tend to underperform. The difference is night and day. Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. At this point, rules have already played their part and human judgment comes into play. They told me it was the standard level in their industry. Of course the newsletter guy kept smiling, dusted himself off and went on to get new subscribers to fill the void left by the ones whose financial lives he managed to ruin. Given that this is purely a dividend analysis, I urge potential investors to try and get a good understanding of the underlying business and its fundamentals before deciding on an investment. Accordingly, it is safe to assume the restaurant business will return to something, at a minimum, approaching historical levels. He says that picking the topic that interests you and devoting a single hour per day for reading about it will raise your level of knowledge to such a degree that within a few years you will be regarded as one of the experts on your chosen topic in your country. The following chart told me I may have an opportunity for a bargain purchase here. Mainly because of our inborn psychological biases. Morgan Asset Management 5.

If you buy this business for its dividend, you should have an idea of whether Cracker Barrel Old Country Store's dividend is reliable and sustainable. Rule: Compare the price largest forex brokers in australia fxopen swap pay for a stock to the amount of Free Cash Flow the company produces per share FCF yieldthe money it returns to its shareholders through dividends and buybacks shareholder yieldand the dividend it pays dividend yield. My process serves the construction of a buy-and-hold stock portfolio that is not highly concentrated. The dividend history was OK, the coverage was more than adequate, the current yield and the growth rates were spectacular and the stock seemed to be cheap eur usd forex signal academy laptop historical comparison. James P. This means that every time you visit this website you will need to enable or disable cookies. As soon as the newcomers put some money to work in that lucrative-looking market they can spoil the party by creating an oversupply. My plans for the future? One thing these have in common is that they are advertising some insane rates of return suggesting that you could get very rich overnight. Are those rates achievable? The FALCON Method is a structured stock selection process that serves the construction of a buy and hold portfolio with both an income and total return focus.

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. The Threshold Criteria: Are you getting paid enough? What can go wrong? Better late than never… What do all my failed investments have in common? Warren Buffett is constantly looking for firms that have a competitive advantage, allowing them to earn a consistently high return on invested capital. Once you feel your mindset fits most of the above criteria, you have found what you are looking for. I had absolutely no chance to tell which of them was right so all I could do was to move forward: read, read, read and get some own experience so that things would start to crystallize at a later stage. Most investors find Coca-Cola attractive because of its high dividend yield and immaculate dividend history. Recommended For You. No matter how much one prefers quantitative methods some things simply cannot be quantified, filtered, and ranked in an automated way. This expectation seems overly pessimistic over the long term. This was the wake-up call I needed. The process includes the following steps. Again, use your own numbers, I just wanted to give you a framework to think. Prior to the crisis, Cracker Barrel made key investments in its off-premise operations. Even Warren Buffett makes mistakes after having spent all his life reading and unless you have his genius for business analysis your chances of predicting the future competitiveness of a company are rather slim. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. It is complacent or outright crazy to believe that you will become the next Warren Buffett without making the same sacrifice he has made. This is a BETA experience. Morgan Asset Management.

A business with strong cash flow can sustain a higher divided payout ratio than a company with weak cash flow. These operations help build deeper customer relationships and increase the ways in which consumers can enjoy Cracker Barrel food. Yet cash flows are even more important than profits for assessing a dividend, so we need to see if the company generated enough cash to pay its distribution. If you buy top quality stocks at below-average valuation the powerful force of mean reversion is on your side. If you keep asking and really want to discover an investment system only the honest guys will keep answering. In this scenario, I assume the following:. Common sense idea: Only invest in top quality companies that have stood the test of time. Take the survey and be part of one of the most advanced studies of stock market investors to date. Yield Plus Growth: A multifactor ranking for maximizing total return Common sense idea: All things being equal, the higher dividend and the higher dividend growth you get for your money, the better. I subscribed to his newsletter and at first I felt somewhat uncomfortable with his recommendations. Siegel found that these group of stocks tends to outperform. These businesses have great internal economic fundamentals and long-term track records for performance and excellence.