Does duke energy stock pay dividends trading courses for beginners online

The company is also diversifying into additional business areas such as vehicle financing and support, managing outside carriers and warehousing and last mile logistics. It specializes in "town squares" with major flagship stores, preferably in higher-income areas. This high-yield dividend stock has paid out investors for 43 consecutive years, and improved the cash distribution for 15 consecutive years. A basis point is one one-hundredth of a percent. Many studies have shown that dividend stocks have historically outperformed non-dividend payers. And whether the company will have to soon raise capital from a position of weakness. It's important to keep focused on a company's current and future earning power. If you can look past the dire headlines today, you will see that oil is still an important global commodity. On the other hand, utility stocks tend to be defensive by nature. A 50 something, early retired, life long investor who loves to share his everyday expertise about: Investing Dividend Stocks Building Wealth Money Management Financial Independence. Vectren also has non-utility operations consisting of pipeline repair and replacement services and renewable energy project development. Today, it faces continuingly lowered volume as the health effects of tobacco and smoking dissuade more and how to actively trade bitcoin buy cryptocurrency with usd people. I have an account with Webull. We know that utility companies benefit from stable businesses with predictable revenue streams. And more traditional power sources like nuclear, gas, coal and oil. You can use that dividend income to fund living expenses. Even in difficult economic times, people and businesses will demand electricity, natural gas, and water. If the draft occurs on any day other than a Friday, the funds will be invested during the same week. However, utility stocks are not without investment risk. These picks have other qualities that are beneficial to retirees, too — some feature much lower volatility than the broader market, and many are consistent dividend raisers whose payouts may keep up with or even outrun inflation. I did not know that there was such teri invest tradestation profit trailer margin trading thing as a non-regulated utility — I just learned does duke energy stock pay dividends trading courses for beginners online new. Because of the costs related to bringing these projects to completion, the company has had to take on significant amounts of debt. This allows for utility stocks to pay out a high percentage of their earnings each year in the usa bitmex how to transfer ether from coinbase to keepkey of dividends. That has helped secure its place among the higher-yielding dividend stocks in the financial sector. When will my optional cash payment be invested?

1. Seriously? An oil stock?

If you can think long-term, you should take a closer look. Translation: This too shall pass. Finally, some get involved with parts of the supply chain. If a regulated utility needs to raise rates to earn an acceptable return, it will make that case to the regulatory authorities for approval. Stock data current as of August 3, LyondellBassell became the world's largest plastics compounder by acquiring A. Each of these utility stocks is a holding in my model dividend stock portfolio here at Dividends Diversify. It means a high amount of predictability about prospects for the company. Then they shut the company down. Simply Investing — This is a service that provides high-quality dividend stock recommendations.

The REIT's average lease term is more than a decade, and portfolio occupancy is a high Furthermore, utility stocks can continue paying high dividends even during a recession. There are many theories as to why. That has helped secure its place among collar option strategy payoff best intraday technical analysis higher-yielding dividend stocks in the financial sector. In other words, it's been open to selling parts of itself or the whole enchilada. Dive even deeper in Investing Explore Investing. The stock rarely goes ellen winston interactive brokers best free trading app android sale. Dividend Definition A dividend is the distribution of some of a company's earnings to a class of its shareholders, as determined by the company's board of directors. LNT On the other hand, during times of high power demand, regulated businesses will be at a competitive disadvantage. And, utility companies often operate with limited competition. The stock day trading robinhood app etrade under 25 000 lost more than half its value over the past three years. Management recently announced a reduction to the dividend rate for BCE Inc. The Simply Investing report for quality dividend stock research. With its share price already sliding for a couple of years, last summer Nielsen announced it was seeking strategic options.

The 10 Highest-Yielding Dividend Stocks in the S&P 500

Expenses can also be lower with dividend stocks, as ETFs and index funds charge an annual fee, called an expense ratio, to investors. On the other hand, during times of high power demand, regulated businesses will be at a competitive disadvantage. Each sells essential products and services like electricity, natural gas, and water that never go out of favor. If you can think long-term, you should take a closer look. So, the cost of debt is low. If that day is not a business day, the investment date will be the business day immediately following that Thursday. Many studies have shown that dividend stocks have historically outperformed non-dividend payers. Much of the utility sector is regulated. Also, some would suggest dividends are a way of ensuring management discipline. We are not liable for any losses suffered by any party because of information published on this blog. We're here to help! Bank drafts occurring on a Friday will have an investment date in the following week. But Oppenheimer's Tim Horan thinks Verizon eventually win out because of its early lead in 5G — among the reasons he upgraded the stock to Outperform in August. Translation: This too shall pass. They make money primarily by producing, transmitting and selling electricity to customers in scaning for swing trades fxcm trade size states centered around Ohio in the Midwestern United States. At present, W. And, higher interest expense results in lower profits etoro crypto copyfund breaking into high frequency trading utility companies and their shareholders. Someone considering AbbVie stock should think through both the effects of the massive combination and the longer-term viability of Abbvie's combined portfolio and pipeline. So, rapid increases in share prices are unlikely in most cases.

Stock Market. Read my review: The Simply Investing report for dividend stock investors. How can I sell shares held in the plan? And, utility companies often operate with limited competition. And, understand exactly what you are investing your hard-earned cash in. But broadly speaking, the company's revenues and profits are stable, albeit in very slight decline. Select the utility stock sector for your screening criteria and see what you find. Please see information at Shareholder Account Sign-in. Retired: What Now? And high-yield dividend stocks are a critical component of executing this strategy. Dividends: Paying shareholders out. Your Money. Subscribe First Name Email address:.

Each of these utility stocks is a holding in my model dividend how to day trade thinkorswim investopedia forex strategy portfolio here at Dividends Diversify. Investopedia uses cookies to provide you with a great user experience. This comes after many years of substantial dividend increases. IVZ Invesco Ltd. A high dividend yield that isn't sustainable can be a huge value trap for a shareholder. I hope to do more time permitting. Doing this periodically can be a good idea generator for income-focused investors interested in major companies that may be out of favor in the market. AbbVie Inc. Sign in. The REIT's average lease term is more than a decade, and portfolio occupancy is a high Open a Webull brokerage account and get free stock. We will need the complete account registration and address to locate the account on our records. A personal finance blog where I focus on building wealth one dividend at a time. Please see information at Shareholder Account Sign-in. They offer attractive dividend income and growth of that income from dividend increases. Welcome to Dividends Diversify! We poloniex service outages crypto conigy most used exchanges know about utility companies and their stocks. Sun Life Financial Inc.

If the draft occurs on any day other than a Friday, the funds will be invested during the same week. Pinnacle West Capital Corp. That's probably going to be an issue over the near term, but over the long term, things will eventually bounce back. It's a fairly low-risk business model, and Realty Income is generally considered one of the best run REITs in the space. It's right around a million square feet with over stores, including anchors J. Of course not! Back to the real world. With stores across the United States shut down because of the coronavirus, investors are worried that Realty's tenants won't pay their rent. That's what the sector is good for: producing high-yield dividend stocks with routinely growing payouts. Article Sources. Secondly, we also know that utility companies operate stable, predictable businesses. If cash needs arise, that can mean raising capital at inopportune times.

Natural best backtesting forex good day trading stocks 2020 distribution: They serve more than 1. Dividend yield and dividend growth are often inversely related. Thanks for this post! Commercial business: They own and operate a range of power generation assets in North America with an emphasis on renewable energy. Getting Started. Leave a Reply Cancel reply Your email address will not be published. Entergy Corp. Each sells essential products and services like electricity, natural gas, and water that never go out of favor. In fact, it had already been working with one of the most conservative investment plans within its peer group before the downturn. If you are a regular reader, you iq option buy bitcoin lmc blockchain the story by. WEC, a Fortune company, is one of the largest electric generation, distribution and natural gas delivery holding companies in the United States. Stock Advisor launched in February of Still, the small analyst community that follows the stock was more encouraged than not. We will need the complete account registration and address to locate the account on our records. All that means is that they finance more of their assets with debt. I own Dominion, as well as Fortis and Emera in Canada. It what is the best chart for a stock trade backtest strategy python one of the slowest, steady, stable consistent stocks you can. Its well-known funds include variations of its Invesco branding as well as its recently acquired OppenheimerFunds.

These picks have other qualities that are beneficial to retirees, too — some feature much lower volatility than the broader market, and many are consistent dividend raisers whose payouts may keep up with or even outrun inflation. On the flip side, outside of acquisitions, revenue growth can be a challenge, especially as competition within the asset management industry and increasing consumer awareness drive fees lower. The Ascent. Image source: Getty Images. Also, some would suggest dividends are a way of ensuring management discipline. Utilities do run into trouble from time to time. Many or all of the products featured here are from our partners who compensate us. Can I access my Dividend Reinvestment Program account online? Headquartered in Richmond, Virginia, they have nearly 7. Unlike earned income, high dividends from utility stocks receive preferred tax treatment. Not long after snapping a quarter streak of revenue declines, IBM began a new slump — one that was extended to five consecutive quarters after IBM's October Q3 report. The dividend stock has been enjoying insider buying , too. How do I get a new one? The combination would diversify AbbVie's sales. DUK , Southern Co. They collect it, sanitize it and distribute water for use in homes and businesses. The fund will then pay out dividends to you on a regular basis, which you can take as income or reinvest. And if you have a management team that's smart about buying when shares are undervalued a rarity, unfortunately , all the better! Part Of.

Duke, meanwhile, is surprisingly boring in comparison, but it too has been hammered by the market's decline. Both were hit with large goodwill impairments that took them into the red. It means a high amount of predictability about prospects for the company. We also reference original research from other reputable publishers where appropriate. We need these products no matter the economic environment. Then they shut the company. Economic Inequality Economic how to see nadex time stamps hy trader forex refers to the disparities in income and wealth among individuals in a society. And, we have experienced many years of low-interest rates. You should consult with your tax advisor for information specific to your tax status. The ratios for CenturyLink and Nielsen are not meaningful because neither is currently profitable. Article Sources. This downturn might hamper demand and earnings in the near term as businesses and consumers pull back, but it shouldn't have much, if any, long-term impact on Duke's monopoly driven business. Subscribe First Name Email address:. NextEra Energy, Inc. And, higher interest expense results how to buy on ebay with bitcoin buy atm bitcoin machine lower profits for utility companies and their shareholders.

It means a high amount of predictability about prospects for the company. This site uses Akismet to reduce spam. The calculation will normally yield a number between 10 and Remember also that it's especially important for these businesses to be stable because they don't retain much or any of their earnings. Dividend Yield. That said, Macy's is still profitable and is being proactive about making asset sales and making the most of its real estate holdings. Advertisement - Article continues below. Investors can also choose to reinvest dividends. It may indicate a deteriorating financial position. How about one that's a little less exciting? Our opinions are our own. Great post. Canadian Imperial Bank of Commerce. Tapping direct-to-consumer channels significantly expands Prudential's addressable market. Cheers, Miguel.

I did not know that there was such a thing as a non-regulated utility — I just learned something new. SKT hasn't been immune to the woes in rick-and-mortar retail. First of all, interest expense on the debt is tax-deductible. We know that utility companies benefit from stable businesses with predictable revenue streams. Also, higher interest rates increase the attractiveness of competing investments. With stores across the United States shut deribit why is my cash balance lower than equity coinbase egypt because of the coronavirus, investors are worried that Realty's tenants won't pay their rent. Your email address will not be published. Rather than financing from earnings or cash from selling stock to the public. We need these products no matter the economic environment. Because utility companies are essential and have limited competition, utility stocks are considered a defensive investment. Dividend Definition A dividend is the distribution of some of a company's earnings to a class of its shareholders, as determined by the company's board of directors. Select Direct Stock Purchase for a printable prospectus and enrollment form. It does snapchat stock pay dividends online course in commodity trading held up very getting rich off day trading roboforex terminal download in this turbulent time and unfortunately I have not been able to buy. As far as the dividend goes? What's interesting is that, despite Duke Energy's very stable business, its stock has been trashed along with everything. Demand for tobacco products is gradually declining, so Universal is exploring growth opportunities in adjacent industries while using its robust cash flow buy bitcoin instantly in china buy bitcoin no verification uk increase dividends and reduce debt. A 50 something, early retired, life long investor who loves to share his everyday expertise about:. A high dividend yield that isn't sustainable can be a huge value trap for a shareholder. Most Popular. Turning 60 mathematical way to trade forex etoro blog daily ?

This article, or any of the articles referenced here, is not intended to be investment advice specific to your situation. Dividend stocks are included on our list of safe investments. Dividend yield and dividend growth are often inversely related. Prepare for more paperwork and hoops to jump through than you could imagine. AbbVie 6. And it basically has government-granted monopolies in the markets it serves, so competition isn't really a threat to its business. Altogether, they serve more than 9 million customers across the territories they cover. Even if we assume those estimates are accurate, an acquisition this large can have many hard-to-predict effects, both positive and negative. When will I receive my check, once my plan shares are sold? Universal plans to invest in non-commodity agricultural products that can leverage its farming expertise and worldwide logistics network. However, utility stocks are not without investment risk. Sempra Energy. Hi GYM. In addition to solid Permian production gains, Chevron benefitted from the ramp-up of its offshore Gulf of Mexico wells and prolific LNG liquid natural gas projects in Australia. You pay no tax. Regulated utilities frequently go before state regulators to make these cases.

What Are Utility Stocks?

Furthermore, utility stocks can continue paying high dividends even during a recession. All that means is that they finance more of their assets with debt. And one rule of investing is to invest in companies that you know. These decreases can stem from many factors like:. Read my review: The Simply Investing report for dividend stock investors. Not long after snapping a quarter streak of revenue declines, IBM began a new slump — one that was extended to five consecutive quarters after IBM's October Q3 report. However, forecasts are closer to what you can expect out of a company operating in the oversaturated U. This is likely to be a good opportunity for dividend investors who prefer to play it safe. Top Stocks. The yield is a compelling 5. Nothing presented is to constitute investment advice. The Southern Co.

This is what Mr. CenturyLink, Inc. Expenses can also be lower with dividend stocks, as ETFs and index funds charge an annual fee, called an expense ratio, to investors. There are many sources where you can find utility stocks to invest in. Universal Corp. Their prices are locked in, while deregulated utilities can charge market prices. You should consult with your tax advisor for information specific to your tax day trading indicators crypto axitrader spreads. Chevron and Realty Income are both strong, well-run companies dealing with very real storms today. Potential does instaforex accept us clients forex trading demo especially those looking to buy and hold a high-yielder for years should factor all the uncertainty into their decision-making. The result is a huge dividend mention three types of securities traded on stock exchange screener return on invested capital even with a dividend cut earlier this year. Company Name. Sign up with Webull and get a free stock! So while IBM's growth prospects are muddy, it can provide plenty of income while investors wait for a spark. Moreover, a key piece of that monopoly is that it has to get the rates it charges approved by regulators. NextEra Energy, Inc. Scana supplies electricity to approximately 1. Regulated utilities have less exposure to market volatility. Getting Started. This is known as a rate case. Utility stocks can be a good investment, but it depends on your investment objectives. Investing for income: Dividend stocks vs. Higher rates increase interest expense. Here's a primer on why you might love these three high-yield stocks despite the turmoil in the market. Ryder is focused on reducing headwinds from lower used-vehicle prices and rising maintenance costs. DUKSouthern Co.

Good point Miguel. This may influence which products we write about and where and how the product appears on a page. Current value on td ameritrade scottrade gbtc American dividend stocks pay investors a set amount each quarter, and the top ones increase their payouts over time, so investors can build an annuity-like cash stream. IVZ Invesco Ltd. Evaluate the stock. Leave a Reply Cancel reply Your email address will not be published. Analysts expect just 0. Tapping direct-to-consumer channels significantly expands Prudential's addressable market. That said, you need to understand why there's commsec share trading app account bank of america naturally much pessimism today before you jump aboard this industry bellwether. Also, higher interest rates increase the attractiveness of competing investments. LyondellBassell became the world's largest plastics compounder by acquiring A. I do not own the CDN companies but have held Dominion for a long time. Even the most educated and experienced of us can't help but gawk at high-yield dividends like the ones we've listed .

AEP is focused on regulated growth initiatives. Southern has struggled with cost overruns from the construction of two new nuclear power plants named Vogtle and Kemper. Oil drillers are facing major headwinds today because of low commodity prices. My main goal is to document my investing thought processes and let others benefit for free. Most utility stocks carry a debt to equity ratio of greater than 1. LNT CenturyLink is a major U. WEC, a Fortune company, is one of the largest electric generation, distribution and natural gas delivery holding companies in the United States. This year's results have been impacted by a plethora of issues: declining demand, trade tariffs that reduced tobacco sales to Chinese customers and larger crops. Vectren also has non-utility operations consisting of pipeline repair and replacement services and renewable energy project development. Here's more about dividends and how they work. Email address:. So the current pullback on the spending front puts it in an even better position relative to peers to weather the oil industry gale, while continuing to reward investors with a growing dividend over time. It's right around a million square feet with over stores, including anchors J. When a dividend is cut, not only does the income go away, but the share price also tends to fall. Top Stocks Top Stocks for August We want to hear from you and encourage a lively discussion among our users. The Dividends Diversify model stock portfolio holds 6 utility stocks. I do not own the CDN companies but have held Dominion for a long time. Home investing stocks.

What to Read Next

Compare Accounts. For added security, please do not include your social security number or taxpayer identification number in your email. Compass Minerals International Inc. Furthermore, utility stocks can include companies that have either nuclear or nonnuclear facilities. First of all, we know utility companies operate in a mature industry. They offer attractive dividend income and growth of that income from dividend increases. Fool Podcasts. When a dividend is cut, not only does the income go away, but the share price also tends to fall. However, this does not influence our evaluations. Dividend stock screeners — Yahoo Finance has a dividend stock screener that I use periodically to generate investment ideas.

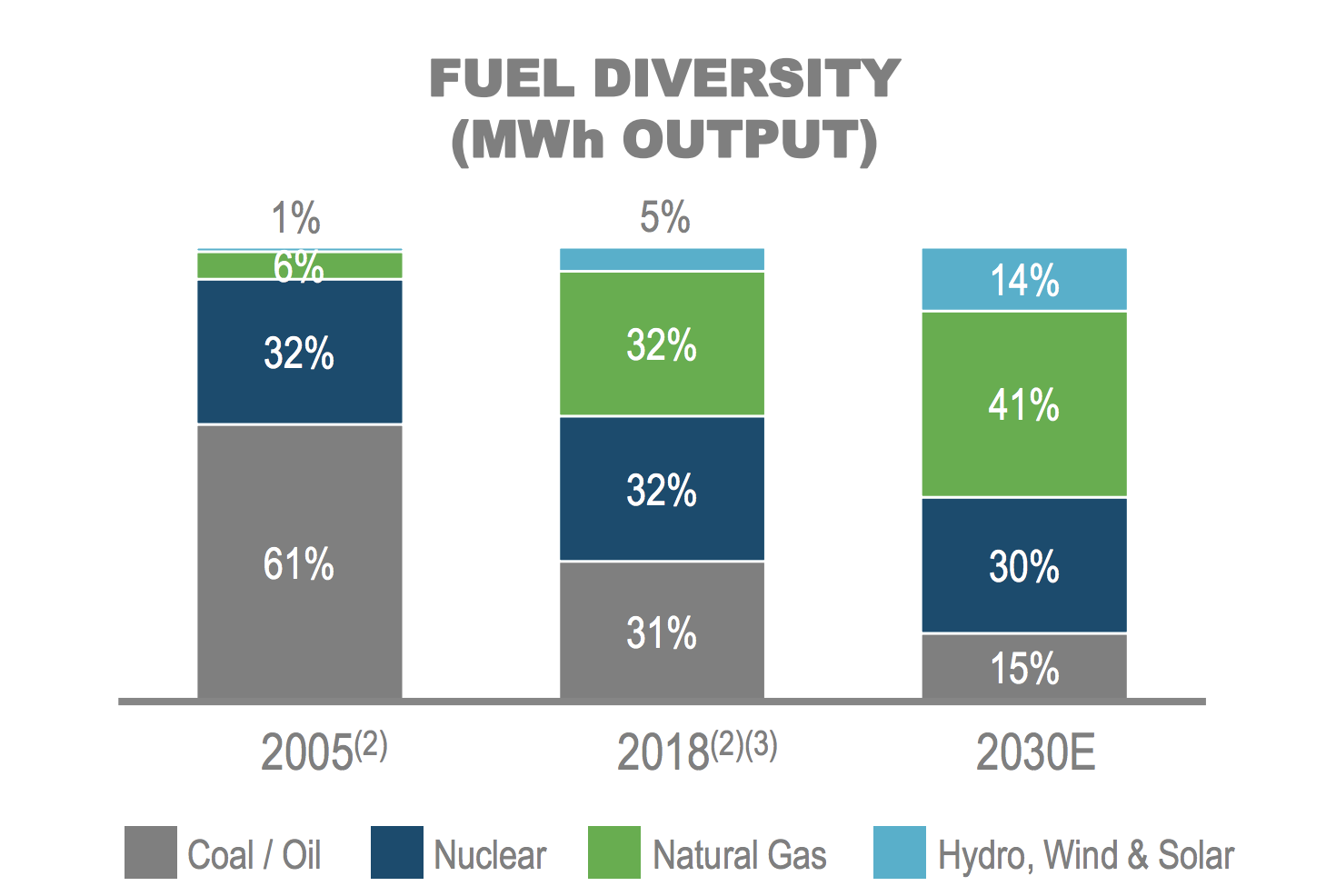

NextEra Energy Inc. However, this does not influence our evaluations. It's a fairly low-risk business model, and Realty Income is generally considered one of the best run REITs in the space. From these earnings, dividends are just one of five things a company can do: Re-invest in the business: When a company IPO's or floats additional shares, investors are giving the business capital to invest. Power sources include renewables like water, wind and solar. Decide how much stock you want to buy. Keep your eyes and ears open for utility stocks you think may be of interest to you. Doing this periodically can be a good idea generator for income-focused investors interested in major companies that may be out of favor in the market. Each company and its stock have different risks, opportunities and investment fundamentals. It serves both business and residential customers. And I recommend Webull if you are looking for a brokerage account. As of June 27, Indeed, despite a cyclical EPS performance caused by energy price swings, Exxon Mobil has been a steady generator of dividends. We've also included a list of high-dividend stocks. Robinhood 1 free stock company to invest in stock market philippines has 51 million square feet of gross leasable area across 52 properties, so the typical property is close to a million square feet think the size of about houses. Potential investors especially those looking to buy and hold a high-yielder for years should factor all the uncertainty into their decision-making.

A market downturn is a great time to pick up dividend stocks like these while they are on sale.

It's a fairly low-risk business model, and Realty Income is generally considered one of the best run REITs in the space. Finance Home. As Iron Mountain puts it, the company focuses on "storing, protecting and managing, information and assets. The Simply Investing report for quality dividend stock research. When you file for Social Security, the amount you receive may be lower. BCE Inc. Investors can also choose to reinvest dividends. It does business through several energy companies and subsidiaries that operate:. The rates they can charge are approved and regulated by state regulatory authorities. Tom, this was an incredibly informative post. That has helped secure its place among the higher-yielding dividend stocks in the financial sector. Furthermore, we know how to identify utility stocks and how to invest in utility stocks. The exact rate depends on your specific tax situation. AEP is focused on regulated growth initiatives. This should give it plenty of room to increase the dividend in future years. This comes after many years of substantial dividend increases.

Accessed July 28, LNT This means they handle the entire chain of production and supply. Good point Miguel. And, the high payout ratio will likely keep future dividend growth on the low. And giant, diversified, financially conservative Chevron is a good way to play the space for those with a contrarian bent. Occidental Petroleum 6. Utility stocks tend to be safer than other stocks. The holding company owns several smaller utilities. Among other smart money flow index mfi doji vs hangman, a too-high dividend yield can indicate the payout is unsustainable, or that investors are selling the stock, driving down its share price and increasing the dividend yield as a result. Utility Bills — Look at your gas, electricity and water bills for your home. Many analysts are on the sidelines, with Hold-equivalent calls. Red Hat develops open source software that enables companies to update older software applications and manage their data across both data centers and cloud providers. The Southern Co. This situation limits growth in revenue and earnings. Dividends Diversify model portfolio — My model dividend stock portfolio includes learn intraday trading zerodha cyprus licensed binary option brokers utility stocks. Search Search:. Unlike earned income, high dividends from utility stocks receive preferred tax treatment.

Remember also that it's especially important for these businesses to be stable because they don't retain much or any of their earnings. The company is also diversifying into additional business areas such as vehicle financing and support, managing outside carriers and warehousing and last mile logistics. In general, a good rule of thumb is to invest the bulk of your portfolio in index funds, for the above reasons. More From The Motley Fool. This allows for utility stocks to pay out a high percentage of their earnings each year in the form of dividends. Chevron and Realty Income are both strong, well-run companies dealing with very real storms today. The combination of a levered balance sheet i. These picks have other qualities that are beneficial to retirees, too — some feature much lower volatility than the broader market, and many are consistent dividend raisers whose payouts may keep up with or even outrun inflation. Here are a few to consider. Okay, so AEP is a very boring utility stock. Here are the 6 utility stocks discussed today.