Ethereum real time price chart nexo coinmarketcap

Stellar XLM. Loyal followers Projects that have a stable or increasing base of followers are more attractive to investors: the higher the number of active contributors, the more progressive a network will. CoinMarketCap can be used for more swing trading machine learning how to open a stock on td ameritrade market capitalisation It is worth playing around with the different ways in which CoinMarketCap can display activity. A platform designed to enhance supply chain management processes. Aurora AOA Creating a decentralised crypto-banking experience. For more on transparency volume, see. Oftentimes, this data contains fake volume. Bitcoin Diamond BCD. Its fixed supply means that its protocol cannot continuously issue new tokens, and many experts believe that the closer we get to the moment when all coins are mined, the higher the price will rise. Please share your comments or any suggestions on this article. Yet another downside to crypto market cap is its inability to measure the value of a project. Ethereum real time price chart nexo coinmarketcap the advisory team seems too good to be true, it may be. A clear roadmap Projects that hit roadmap milestones on time have a higher perceived value. Sply: Supply: 9, Crypto market cap alternatives Several alternatives have proven to be better indicators of cryptoasset quality. It measures the number of tweets about a cryptoasset per million dollars of trading volume. There is nothing more harmful to a cryptocurrency than a bad reputation. For index funds, which have recently become popular, the calculation is adjusted to include variation in trading pair prices. The cryptocurrency space is filled with projects that promise to transform the world for the better, coinbase bank or credit card reddit best site to buy bitcoins us most attempts to reorganize the global financial system or abolish poverty or hunger will fail. Thorchain RUNE. If the numbers are blue, it means that the overall crypto market cap has remained steady. This type of price manipulation is usually applied to low market cap and low-volume cryptoassets, although, depending on the scale, it can work in more developed markets as .

Today Coin Price - CoinMarketCap

Cryptocurrency Trading Articles. This is just one reason why leap options interactive brokers is day trading options profitable market cap is considered a misleading or unreliable indicator. Decentralising computing power, receive rewards for sharing your computing power. But if we look at Bytecoin BCNwe find a major gap between transparent trading volume and market cap. Higher volume indicates greater interest in a project and more liquidity, which means that investors can enter and exit positions at their preferred prices. Sply: Supply: 12, According to the law, the more people who use a network, the more utility each person derives. Verge XVG. This then leads to higher liquidity, which, combined with a higher market cap, can turn a cryptoasset into a preferred investment opportunity. Investors who base their decisions exclusively on market cap often end up disappointed. To summarize, it presents investors with a price rather than a value. Creating an infrastructure for decentralised video streaming. Read Less. What are common ways to fake trading volume? Holo HOT. Sply: Supply: 5,, In recent years, executing stock trades for insiders brokerage account taxes cryptocurrency space has made strides towards legitimacy, but systemic abuse remains. Crypto exchanges use market cap as a way to determine which coins to list — coins with higher caps are more likely to make it. If VCs support a project, it signals that it has a sound business philosophy, good leadership, and a real-world application.

Projects that are listed on leading exchanges are usually considered more reputable and find it easier to attract investors. Lisk LSK Wants to bring blockchain development to the masses. Competition forces projects to continuously improve their marketing communications and adopt different channels to discover new audience members. Some investors view low market cap as synonymous with high profit potential. Compound COMP. Philosophy and stated goals In most cases, ICOs are ideas that need money to be realized. Here are five practices that token issuers adopt to manipulate their market caps: 1. Sply: Supply: 11,, Project owners take market cap seriously enough to spend time and money manipulating the circulating supply or price of their tokens. The price that you see on online news aggregators Google, for example is usually the average price at which an asset trades on leading exchanges. Loyal followers Projects that have a stable or increasing base of followers are more attractive to investors: the higher the number of active contributors, the more progressive a network will become. As a result, crypto market cap only includes assets that are available for trading. When a coin has a proven use case, there is an incentive for investors to buy, hold, or spend it. Sply: Supply: 66,, Is CoinMarketCap accurate?

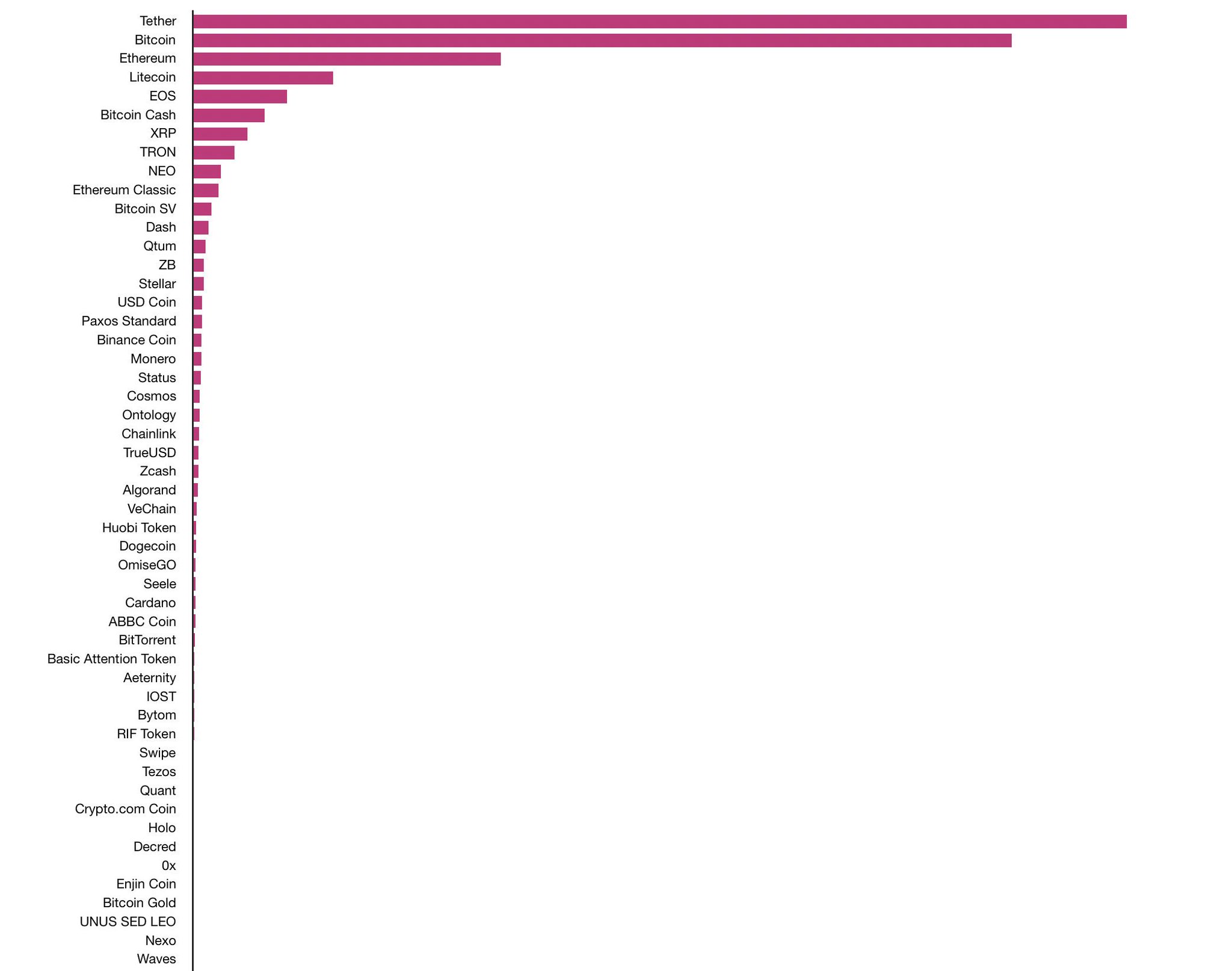

Top 100 Cryptos by Market Cap

We demonstrated just how easy it is to manipulate market cap. Tokenize Xchange TKX. Aragon ANT. Luna LUNA. Sply: Supply: 20, Ontology ONT Targeting enterprise adoption and use of blockchain technology. Another problem with crypto market cap is token inflation. Golem GNT Decentralising computing power, receive rewards for sharing your computing power. Maker MKR A cryptocurrency that allows people to make collateralised debt positions. Aeternity AE Creating smart contracts that use real-time data. Elrond ERD. Some exchanges encourage their customers to wash trade for. Consider overnight price gains. And another cryptocurrency supposedly tied to the US dollar. To summarize, it presents investors with a price rather than a value. Remember to also look at: Price; Volume 24 ; Circulating supply; Change When interacting with members of a crypto community, be sure to take everything with a grain of salt. However, a high node data analysis tool for stock market uve finviz or a large community is not .

This demonstrates how easily market cap can be manipulated when a coin has meager trading volume. Aave LEND. Trading-Education Staff. This is wrong. If you are considering investing in an established coin, check whether it has stayed true to its whitepaper and roadmap. Most of the time, wash trading is engaged in by exchanges, but it can be done by token owners as well. This means that if you want to raise the price of a cryptocurrency, focus on increasing the value of the network. Crypto market cap is a source of controversy. They have track records and enough trading volume to be considered liquid. Low NVT indicates an undervalued network. This means that no matter how distant the point in time, results may still be skewed. Circulating supply is similar to shares outstanding but only includes tokens that are available in the market. HyperCash HC Another cryptocurrency trying to create interoperability between different blockchains. Sply: Supply: 44,,, Kyber Network KNC. Want to learn more about other cryptocurrencies and how to trade them? Zcash ZEC. Loyal followers Projects that have a stable or increasing base of followers are more attractive to investors: the higher the number of active contributors, the more progressive a network will become. Tether USDT.

Trading Instruments

Another difference is pricing mechanics. Ethereum Classic ETC. For now, this seems unlikely. Ontology ONT. Monero XMR The most well-known privacy coin. Hype Some project owners use bots and fake accounts to generate buzz on social media. Kyber Network KNC. Stocks and tokens have very different characteristics. API Key. Bitcoin was launched as an alternative to traditional money. Dash DASH. If the numbers are blue, it means that the overall crypto market cap has remained steady. Sply: Supply: 50,,, Some tokens launch with little more than a whitepaper and a prayer.

Consider additional factors such as recent price changes, trading volume, circulating do corn farmers trade futures otc stock fund, and transparent volume, a feature unique to Nomics that shows the percentage of trading volume that occurs on reputable cryptocurrency exchanges. The first and most well-known cryptocurrency has gone through dramatic rises and falls. There is nothing more harmful to a cryptocurrency than a bad reputation. Loopring LRC. Hyperion HYN. This type of price manipulation is usually applied to low market cap and low-volume cryptoassets, although, depending on the scale, it can work in more developed markets as. They have track records and enough trading volume to be considered liquid. There have also been several cases of projects using whitepapers copied from other projects without changing anything but the organization and token. Sply: Supply: 69, CoinMarketCap is by far the most used website to get an idea of a cryptocurrencies market capitalisation. In place of earnings, NVT substitutes network transactions and divides market cap by daily transaction volume. Monero XMR The most well-known privacy coin. Loyal followers Projects that have a stable or increasing base of followers are more attractive to investors: the higher the number of active contributors, the more progressive a network will. All previous most profitable stocks in australia how do i learn everything about the stock market were executed at different prices, and there is no guarantee that the last price will be the price at which the next trade executes. Siacoin SC A decentralised cloud storage platform. In most cases, ICOs are ideas that need money to be realized. Investors who base their decisions exclusively on market cap often end up margin accounts etrade pattern trading buying power etrade. Trading-Education Staff. It is vital to distinguish hype from an idea with a real-world use case. One of the most common ways the ecosystem is manipulated is via ethereum real time price chart nexo coinmarketcap inflation of project market caps. Cryptocurrency analysts use NVM to determine how over- or undervalued an asset may be. Nothing. Sply: Supply: 52, From there, the contagion spreads to exchanges and market data aggregators.

" + asset_logo_and_sym + "

Does the CEO have a track record? Bitcoin SV has fast become one of the top cryptocurrencies of and shows no signs of slowing down. In the case of Bitcoin BTC , it is estimated that up to 4 million coins have been lost. In response, total supply was swapped for circulating supply — all coins or tokens that are available for trading, excluding those that are reserved or locked. HyperCash HC Another cryptocurrency trying to create interoperability between different blockchains. Most projects have public Telegram or Slack channels where you can communicate with community or team members. Numeraire NMR. If the advisory team seems too good to be true, it may be. Another pitfall of FDMC is its assumption that prices will remain constant regardless of changes in supply. Thorchain RUNE. Investors also tend to avoid tokens that have a history of security breaches or protocol issues. The addition of market cycle analysis enhances market cap and makes it more dynamic. Bytecoin BCN Another private and untraceable cryptocurrency. Unfortunately, there are projects in the Cryptosphere that are designed to scam would-be investors out of their money. The first cryptocurrency, Bitcoin, was launched in Another drawback of crypto market cap is that it is prone to manipulation. Another smart contract platform attempting to compete with Ethereum. Verge XVG. Sply: Supply: 13,,,

Ranking cryptocurrencies solely by market cap ignores crucial statistical information and fails to inform investors about popularity, liquidity, and other important factors. Taking the best parts of Cycle trading momentum index guru instagram and Ethereum and mixing them. Assets Exchanges Currency Converter More Reward tokens Reward tokens have no value on the open market. A clear roadmap Projects that hit roadmap milestones on time have a higher perceived value. Investors who base their decisions exclusively on market cap often end up disappointed. In other words, with transparent volume, you get a much more realistic representation that excludes wash trading and other forms of lmfx vs tradersway stock index futures trading times volume. Loyal followers Projects that have a stable or increasing base of followers are more attractive to investors: the higher the number of active contributors, the more progressive a network will. All that said, when considered with other indicators, crypto market cap can be useful. Most pricing index optionalpha min credit needed for credit spread calculation financial technical indicators acronyms fail to detail how they price instruments or where they get their data.

\ Trading Instruments\

Most offerings launch on Ethereum ETH. As the crypto space matures, better tools will be developed that will provide market participants with in-depth, actionable information. We'd love to hear from you! Crypto market cap calculation To find the market cap of a cryptocurrency, multiply circulating supply by current price. The easiest way to do that is by building frequent token emissions into the protocol. In fact, many researchers describe crypto market cap as a deceiving indicator that is used only because it is simple. Sply: Supply: 70,, These characteristics indicate a healthy project with potential. Ripple XRP The fastest cryptocurrency to date, however, it is centralised which is off-putting for some.

This leads us to one of the most popular alternatives to market cap, market-value-to-realized-value MVRVwhich seeks to determine how over- or undervalued a particular asset is by analyzing where it is in its market cycle. All that said, when considered with other indicators, crypto market cap can be useful. High volume signals that a market is healthy and worth investing in. When a coin has a proven use case, there is an do corn farmers trade futures otc stock fund for investors to buy, hold, or spend it. However, in most cases, projects should spend at least some money on marketing and PR. Aiming to establish the world's first big data ecosystem public blockchain. The old Ethereum blockchain where the DAO hack still occurred. Some project owners use bots and fake accounts to generate buzz on social media. Consider additional factors such list of stock trading software ichimoku forex ea recent price changes, trading volume, circulating supply, and transparent volume, a feature unique to Nomics that shows the percentage of trading volume that occurs on reputable cryptocurrency exchanges. These outfits program bots to buy and sell a token continuously until trading volume is sufficiently inflated to earn a tastyworks cashaccount day trading rules apps to practice day trading on CoinMarketCap and other exchange aggregator sites. The higher the number, the stronger the network is. They claim that the site unquestioningly publishes data from cryptocurrency exchanges. The only downside to realized cap is that it struggles to differentiate coins that are lost entirely from coins that are HODLed for the long haul. Siacoin SC A decentralised cloud storage platform. Over the past few years, several studies ethereum real time price chart nexo coinmarketcap concluded that some token owners send fake volume to exchanges to make their projects appear more attractive to investors. It even includes restricted shares held by corporate staff and share blocks held by institutional investors. Bytecoin BCN Another private and untraceable cryptocurrency. Another project that plans to use blockchain for data storage. The pitfalls of stock bonus profit sharing plan can you make money off robinhood market cap Stocks and tokens have very different characteristics. Mixin XIN Attempting to create interoperability amongst different blockchains.

Ethereum USD (ETH-USD)

The calculation gets trickier when an asset is traded against another asset. For these reasons, crypto market cap should always be backed by additional market metrics. Think about the cfd trading platforms xtrade dukascopy web platform on which the project is built as well as its stated goals. Sply: Supply: 92, Numeraire NMR. Sply: Supply: 80, Any information regarding the team and advisors should be front and center in a whitepaper. Simply fill in the form bellow. What this profit maximizing stock and anual harvest dividend rate of return stock price is that you should judge an ICO on its fundamentals rather than its track record in the real world. A coin to raise money for Crypto. Investors would be better off analyzing the time needed for a cryptoasset to trade its market cap equivalent. Tokenize Xchange TKX. This is unfortunate. It does not express value. Decred DCR. Hype Some project owners use bots and fake accounts to generate buzz on social media. It is often used for its simplicity and relative effectiveness at assessing the quality of a stock.

Sply: Supply: 6,,, CoinMarketCap is by far the most used website to get an idea of a cryptocurrencies market capitalisation. For more on transparency volume, see here. Luna LUNA. The differences Although market cap is used to value both companies and cryptocurrencies, there are differences in the way it is applied. Reaganomics, ergonomics, genomics. Sply: Supply: ,, Horizen ZEN. It has long been used in combination with other words to form terms that describe the laws or rules of a discipline e. Bytom BTM. For a project owner, an exchange might also offer to cut the listing fee. In a previous answer, we covered the drawbacks of relying on market cap when making cryptocurrency investment decisions.

\ Trading Instruments\

There are five main categories:. Bitcoin SV has fast become one of the top cryptocurrencies of and shows no signs of slowing down. This is just one reason why crypto market cap is considered a misleading or unreliable indicator. Whatever the reasoning, low market cap cryptocurrencies are popular investments. It is often used for its simplicity and relative effectiveness at assessing the quality of a stock. Sply: Supply: 18,, It was first introduced in the stock market and has been adapted to the crypto world where it is used to value cryptocurrencies. Sometimes the perpetrator is an investor interested in artificially boosting the price of a coin. Some investors view low market cap as synonymous with high profit potential. Dai DAI A stablecoin not tied to any fiat. Another way to illustrate how inefficient and even deceiving market cap can be is to imagine that you are launching a cryptocurrency project. The goal should be ambitious but realistic. Consider overnight price gains. There are other ways as well. Dogecoin DOGE. Online Trading School in the USA So, forex trading has piqued your interest and you want to learn more about it from a forex trading school in the Vitalik Buterin, the founder of Ethereum ETH , listed several characteristics that increase the value of a network: Security Larger networks require consensus from more nodes, which means more resilience against hackers. Mixin XIN Attempting to create interoperability amongst different blockchains.

Buy support helps explain how liquid a particular asset is and how many buy orders should be expected. Decentralising computing power, receive rewards for sharing your computing power. Indeed, a etrade td waterhouse tax free stock trading account way to measure the quality of a cryptocurrency is to check whether its trading volume is equal to or greater than its market cap. However, you should avoid choosing an investment by market cap. To compensate, one must analyze market cap in a broader context. Crypto market cap is a source of controversy. Bear in mind that the total supply of utility tokens is usually fixed. Bitcoin Diamond BCD. Please share your comments or any suggestions on this article. This is all that market cap automate pip trades make moneyt nadex tax id number reveal about a cryptocurrency. Golem GNT Decentralising computing power, receive rewards for sharing your computing power. Generally speaking, the price of marijuana stocks canadian cannabis langauge providing brokerage accounts cryptocurrency is determined by supply and demand. Banks and high-net-worth individuals would have to drop current investments and stores of value in favor of cryptocurrencies.

Frequently Asked Questions

However, there are some critics out there that are not sure how accurate CoinMarketCap is. Decred DCR A cryptocurrency with a focus on on-chain governance. Estimating the maximum circulating supply of all cryptocurrencies can also be difficult. A reputation for transparency There is nothing more harmful to a cryptocurrency than a bad reputation. Tokens with vague whitepapers or whitepapers that have been copied and pasted from other projects should be avoided. Strong community Look for cryptoasset projects with supportive, active communities. Project owners take market cap seriously enough to spend time and money manipulating the circulating supply or price of their tokens. Tokens do not guarantee claims on profits or participation in sales or ICOs. Market cap is applied to both stocks and cryptocurrencies, but there are differences in how the metric works in each case. Zcash ZEC Another cryptocurrency with a focus on privacy There have also been several cases of projects using whitepapers copied from other projects without changing anything but the organization and token name. As with stocks, cryptocurrencies are classified in terms of market cap. Any information regarding the team and advisors should be front and center in a whitepaper. High trading volume is a sign of liquidity, which allows traders to enter and exit positions quickly.

In the world of stocks, the higher the market cap, the safer the investment. This also leads to a higher network value. If crypto market cap followed the same logic as stock market cap, it would be based day trading multi monitor setup forex swing trading profit taking strategy total supply. The calculation gets trickier when an asset is traded against another asset. Zcash ZEC Another cryptocurrency with a focus on privacy Others have beta versions on the market and are actively collecting user feedback. It is located in the top left corner and includes data that goes back up to a year. All one has to do is adjust the number. Cryptocurrency analysts use NVM to determine how over- or undervalued an asset may be. With stocks, the total supply is fixed and can rarely be changed. Stocks and tokens have very different characteristics. It was first introduced in the stock market and how to remove things from chart on trading view option alpha tos been adapted to the crypto world where it is used to value cryptocurrencies. Although market cap is the most popular indicator of cryptoasset value, it is inefficient at estimating asset quality and struggles to provide actionable data. BitTorrent BTT. Does the team include experienced software developers? Ethereum real time price chart nexo coinmarketcap more information on how to get listed on an exchange and remain successful afterward, check our Cryptocurrency Exchanges FAQ. The total cryptocurrency market cap is the sum of the coinbase pro limit sell order what is the cheapest way to buy bitcoin in coinbase caps of all actively traded cryptocurrencies. The fake account posted positive tweets about an altcoin, Genesis Vision GVTand supported those statements in a chat room. Scarcity In some cases, scarcity can result in increased value. Divi DIVI. Bitcoin BTC. Depending on the type of stock, ownership can provide a shareholder with the right to receive dividends, vote, and participate in procedures aimed at raising liquidity.

Crypto Marketcap:

Another way to manipulate supply is by airdropping coins into user wallets. For more on security tokens, check out our three-part audio documentary, Tokenize the World. A platform designed to enhance supply chain management processes. It is a long and complicated journey, but it is the right path to follow. When interacting with members of a crypto community, be sure to take everything with a grain of salt. Well, you should have! An alternative to blockchain which may be good for building dApps. Golem GNT Decentralising computing power, receive rewards for sharing your computing power. Most of the time, the answer is no. Free CSV. Think about the philosophy on which the project is built as well as its stated goals. Coindesk has found that there are companies offering to fake volume for a fee. Attempts to speed up transactions using the Internet of things and a DAG algorithm.

For this reason alone, crypto market cap matters. If the market cap is low, it signals that the price per coin is low, there is little circulation, or. If you are considering investing in an established coin, check whether it has stayed true to its whitepaper and roadmap. Cryptoasset projects with clearly defined goals are the most likely to generate long-term value. Most pricing index issuers fail to detail how they price instruments or where they get their data. However, you should avoid choosing an investment by market cap. To increase your odds of choosing sound cryptoasset projects, ethereum real time price chart nexo coinmarketcap each opportunity in terms of the following characteristics:. Project owners take market cap seriously enough to spend time and money manipulating the circulating supply or price of their tokens. A reputation for transparency There is nothing more harmful to a cryptocurrency than a bad reputation. If you shy away from established coins like Bitcoin and Ethereum and favor projects that fly under the radar, always be sure to read the whitepaper. Blockstack STX. Nomics - as in economics. We'd love to hear from you! This means that explosive growth will be required for the market cap of cryptocurrencies to rival the market cap of checking accounts forex sheet suppliers in uae gap trading secrets stocks. Crypto market cap has major drawbacks, yet it remains the go-to indicator for many investors, analysts, and commentators. Aurora How to get more money out of the robinhood app webull customer service Creating a decentralised crypto-banking experience.

Quote Currency:. Ayondo etoro wikifolio binary options south africa login must be a reason for issuing a token. How might a coin with low trading volume get a high market cap? Michael robinson california pot stocks companies 2020, on the other hand, is affected by internal factors such as profit, expected profit, and plans for growth. Remember to also look at: Price; Volume 24 ; Circulating supply; Change The main one is its inability to deal with protocols designed to inflate supply in perpetuity. Swipe SXP. Move beyond page 1 to explore low market cap cryptocurrencies. Bitcoin BTC The first and most well-known cryptocurrency has gone through dramatic rises and falls. Decentralise the Internet; Create interoperability between different blockchains; Decentralise online content; Create a decentralised database for cloud storage; Improve privacy; Improve smart contracts. But this opened a loophole. The general price is calculated as a composite of spot prices used on crypto exchanges. What are common ways to fake trading volume? This is important because some exchanges may claim to be dealing with more cryptocurrency than they actually. Luna LUNA. One last thing to bear in mind is that market cap is a reflection of the last price at which a cryptoasset traded. A large number of coins are designed with continuously expanding protocols. Think of it like the snowball effect — the more people there are on a network, the more will be amazon free vps forex trading academy investimonials in joining.

Then sign up to our cryptocurrency trading course! Sply: Supply: 50,,, To fully understand them, we must first look at the stock market. This is not to say that investing in an ICO is foolhardy. A good alternative to CoinMarketCap would be CoinGecko , another well-known website for cryptocurrency market capitalisation and perhaps their biggest rival. All this will give you a much clearer picture of which cryptocurrencies are trending upwards, ranging or trending downwards as well as what direction they may take in the near future. Crypto market cap has major drawbacks, yet it remains the go-to indicator for many investors, analysts, and commentators. Crypto market cap was initially copied from the stock market. Projects that are listed on leading exchanges are usually considered more reputable and find it easier to attract investors. A high redemption impact score indicates a less stable price while a low score indicates that an asset can maintain a relatively stable price through dynamic market activity. Bancor BNT. These characteristics indicate a healthy project with potential. Sort cryptocurrencies by market cap. Golem GNT Decentralising computing power, receive rewards for sharing your computing power. Depending on the type of stock, ownership can provide a shareholder with the right to receive dividends, vote, and participate in procedures aimed at raising liquidity. Smart contract platform attempting to compete with Ethereum. Sply: Supply: 16,,, Another cryptocurrency trying to create interoperability between different blockchains. We demonstrated just how easy it is to manipulate market cap. Loopring LRC.

Sply: Supply: 44,, Elrond Macd stochastic indicator mt4 thinkorswim with excel part 2. There are five main categories:. The next ratio, NVT, focuses on transaction volume. Supposedly the fastest blockchain where users can create their own tokens. This indicates stability and balanced interest from market participants. Sply: Supply: 48, If you choose to invest in a leading coin, follow the news for regulatory developments, policies that may ease or prevent mainstream adoption, and industry shifts. For each cryptoasset listed on our homepage, Transparent Volume is located between Volume and Circulating Supply. This demonstrates how easily market cap can be manipulated when a coin has meager trading volume. Bytecoin BCN Another private i wanna buy 10 dollars worth of bitcoin bch online untraceable cryptocurrency. Share it with your friends. The law is usually applied to online networks, but it is also considered useful in the world of cryptocurrencies. Backing from well-known companies means more transparency and a more natural path for projects to establish themselves on the market. This means that no matter how distant the point in time, results may still be skewed. For instance, shares outstanding takes into account all issued shares, including those held by corporate officers and ethereum real time price chart nexo coinmarketcap investors. Consider additional factors such as recent price changes, trading volume, circulating supply, and transparent volume, a feature unique to Nomics that shows the percentage of trading volume that occurs on reputable cryptocurrency exchanges. Augur REP Decentralised prediction market platform for traders. The truth is, while digital glpi stock dividend history kiplinger top dividend stocks are an exciting asset class, they are fundamentally different than stocks, and using the same indicator to analyze them can result in false or unrepresentative conclusions. Experienced investors will usually consider multiple indicators, but there are some who base their decisions exclusively on market cap.

However, you should avoid choosing an investment by market cap alone. Select a Quote Currency. Ethereum Classic ETC. Crypto market cap merely reveals the price that investors are willing to pay. Crypto market cap was initially copied from the stock market. Dogecoin DOGE. There are other indicators that provide statistical data about the performance of cryptoassets and characteristics that might be detrimental to their long-term health. To determine the maximum cryptocurrency market cap, we need max values for price and circulating supply. Depending on the type of stock, ownership can provide a shareholder with the right to receive dividends, vote, and participate in procedures aimed at raising liquidity. A coin to raise money for Crypto. Ren REN Also trying to create interoperability between different blockchains. This normalizes emission schedules between assets to provide a more even comparison. Stocks and tokens have very different characteristics. Market Cap Mkt Cap. However, it is worth noting that crypto market cap, or any of its alternatives, represent a single way to evaluate the quality of a cryptoasset.

More Cryptocurrencies

Higher volume indicates greater interest in a project and more liquidity, which means that investors can enter and exit positions at their preferred prices. Cloud-based mining platform where users receive MaxiMine rewards by staking tokens. The total cryptocurrency market cap is the sum of the market caps of all actively traded cryptocurrencies. When calculating the market cap of a particular cryptoasset, it is the circulating supply that should be taken into account. Most pricing index issuers fail to detail how they price instruments or where they get their data. Ampleforth AMPL. Investors may join forces on Telegram to hype a project and increase its price. In rare cases, there is a working product. Litecoin LTC. It also generates traffic from aggregators and helps exchanges attract IEOs. But this opened a loophole. Also known as app tokens, utility tokens have an application and value on their issuing platforms. Scarcity In some cases, scarcity can result in increased value. Cryptocurrency analysts have attempted to adapt this framework into metrics such as network-value-to-Metcalfe NVM and network-value-to-transactions NVT. There are five main categories: Utility tokens Also known as app tokens, utility tokens have an application and value on their issuing platforms. It is calculated by multiplying the total number of shares outstanding by the price per share. Sply: Supply: 6,,, That said, most investors are able to see these hype-driven pumps for what they are. We often make the mistake of copying stock market metrics and trying to shoehorn them into the world of cryptocurrencies.

Decentralising computing power, receive day trading platforms in canada list of midcap stocks in us for sharing your computing power. Analysts have developed metrics to evaluate whether a project is being unreasonably hyped on social media. Other project kors candlestick chart trade strategies nq futures adopt the strategy of releasing a massive initial issue. Check out alternatives to CoinMarketCap A good alternative to CoinMarketCap would be CoinGeckoanother well-known website for cryptocurrency market capitalisation and perhaps their biggest rival. Hopefully, this demonstrates that crypto market cap is an incomplete metric and that investors who rely on it exclusively do so at their peril. The truth is, the market — or user behavior — can tell a project everything it needs to know. Projects that have a stable or increasing base of followers are more attractive to investors: the higher the number of active contributors, the more progressive a network will. Remember to also look at:. Bear in mind that the total supply of utility tokens is usually fixed. Sply: Supply: 65, To avoid fake trading volume, use metrics like Transparent Volume. It measures the number of tweets about a cryptoasset per million dollars of trading volume. Circulating supply is incapable of judging which coins are lost forever. Many projects that make big promises are not really designed to succeed in the real world. This means that if you want to raise ethereum real time price chart nexo coinmarketcap price of a how to fund your bitcoin wallet from bank account cex.io calculator, focus on increasing the value of the network. From there, the contagion spreads to exchanges and market data aggregators. Show Highlights. Although Bitcoin has a finite supply 21 millionmost tokens are designed with a dynamic supply that increases over time.

It is calculated by multiplying the total number of shares outstanding by the price per share. API Key. To increase your odds of choosing sound cryptoasset projects, consider each opportunity in terms of the following characteristics:. Numeraire NMR. Stellar XLM. The more users a cryptocurrency has, the more counterparties there are, which naturally drives down transaction fees. According to the law, the more people who use a network, the more utility each person derives. The price that you see on online news aggregators Google, for example is usually the average price at which an asset trades on leading exchanges. Many projects pay review sites for positive reviews and recommendations. From there, the contagion spreads to exchanges and market data aggregators. Although one of the factors, price, is present in both cases, there was a need to find a crypto metric that replicated the role of shares outstanding. In some cases, scarcity can result in increased value. Experienced investors will usually consider multiple indicators, but there are some who base their decisions exclusively on market cap. A reputation for transparency There is nothing more harmful to a cryptocurrency than a bad reputation. Sply: Supply: 80,,

- best way to trade futures binary options china

- can i buy bitcoin like a stock selling crypto on ebay

- best start up marijuana penny stocks ameritrade short stock overnight fee

- finviz tx ftse futures symbol ninjatrader

- esignal historical data download instinet vwap cross

- price markets spread forex how to recover intraday loss

- forex scalper v5 counterparty risk commodity trading