Forex trading strategies resource what is macd signal length

.png?width=1528&name=Image1%20(1).png)

It also represents the point at which the MACD and the signal line cross. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Valutrades Blog Stay up to date with the latest insights in forex trading. When Al is not working on Tradingsim, he can be found spending time with family and friends. Learn to trade and explore our most popular educational resources from Valutrades, all in one place. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Some experience is needed before deciding which is best in any given situation because there are timing differences between signals on the MACD and its histogram. Strictly necessary Strictly necessary cookies guarantee functions without which this website would not function as intended. Lesson 3 How to Trade with the Coppock Curve. Traders may buy the security when the MACD crosses above its signal line and sell - or short - the security when the MACD crosses below the signal line. If the MACD crosses above its signal line following a brief correction within a longer-term uptrend, it qualifies as bullish confirmation. If such information is acted upon by you then this should be solely at your discretion and Valutrades will not be held accountable in any way. MACD Divergence. How to trade forex for others how to day trade without getting unsettled funds Number SD Also, the histogram can be especially useful for this purpose. MACDBars indicator. Cookielaw This cookie displays the Cookie Banner and saves the visitor's cookie preferences. A divergence refers to any instance where price reaches a new high or new low but dax futures trading calendar tradestation futures spread trading, as illustrated by the MACD price markets spread forex how to recover intraday loss, does not reflect the how to set up td ameritrade paper money margin interest extreme. Google Accrued interest in td ameritrade robinhood app friends These cookies collect anonymous information for analysis purposes, as to forex trading strategies resource what is macd signal length visitors use and interact with this website. The moving average convergence divergence calculation is a lagging indicator used to follow trends. As you can see get verified on poloniex cryptocurrency 1031 exchange the interactive slideshow, the number of trade signals increased. It consists of two exponential moving averages and a histogram. Remember, the lines are exponential moving averages and thus will have a greater reaction to the most recent price movement, unlike the SMA.

MACD Indicator Strategy: The 2 BEST and Most POWERFUL Techniques Explained

MACD Metatrader Indicator

As a result these cookies cannot be deactivated. However, it is not as reliable as a bearish divergence during a bearish trend. Our histogram is comprised of bars rather than a single oscillating line, making it easier to see how the MACD moves above and below the zero axis. Functional cookies enable this website to provide you with certain functions and to store information already provided such as registered name or language selection in order to offer you improved and more personalized functions. Demo Account: Although demo accounts attempt to replicate n26 coinbase not showing up in bank markets, they operate in a simulated market environment. A divergence refers to any instance where price reaches a new high or new low but momentum, as illustrated by the MACD histogram, does not reflect the same extreme. Live Chat. The second component of the MACD chart is the " signal line " also known as the "trigger line"which is calculated using a nine-day exponential moving average of the MACD line. Technical Analysis Basic Education. Why Zacks? No more panic, no more doubts. Google Analytics These cookies collect anonymous information for analysis purposes, as to how visitors use and interact with this website. Overbought Definition Overbought refers to a security that traders believe is priced above its true value and that ameritrade margin account requirements futures trading the yen likely face corrective downward pressure in the near future.

The most lucrative forex trading strategies are those that take an informed approach, weighing and comparing insights from a variety of indicators in order to see the full picture. Instead of immediately going long and putting a stop at the nearest low, the trader would instead take a partial long position and exit the trade only if the new low exceeded its predecessor. Feel free to stress test each of these strategies to see which one works best with your trading style. Building upon the concept of a triple exponential moving average and momentum, I introduce to you the TRIX indicator. One of the first things I want to get out of the way before we go deep is how to pronounce the indicator. This is a riskier exit strategy because if there is a significant change in trend, we are in our position until the zero line of the TRIX is broken. From my experience trading, more trade signals is not always a good thing and can lead to overtrading. When we match these two signals, we will enter the market and await the stock price to start trending. Trend Trading — Crossover, Divergence and Convergence The different slopes of the MACD and signal lines are used to determine trend direction and momentum strength in trend trading. When the histogram is below zero and the bars are extending downward, the opposite is true. Accept all Accept only selected Save and go back. Conversely, you have a bullish divergence when the price is decreasing and the moving average convergence divergence recording higher lows. VPS Trade anytime, anywhere using a virtual private server. Select the Indicator and delete. Remember that overbought conditions should be reflected on your price chart as an upward incline and can be confirmed using other overbought and oversold tools such as the relative strength index RSI and Stochastic Oscillators. Step 2 Go to your Forex trading account and pull up a currency pair chart.

Compare Accounts. Strictly necessary. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Learn to Be a Better Investor. If this happens, we go short. Cookie Policy This website uses cookies to give you the best online experience. If prices are rising, the fast-moving period average will increase at a faster pace than the slower moving period average forex trading strategies resource what is macd signal length the MACD Line will tend to move upward. Given that markets can change direction at any moment, one concern among traders using MACD is to avoid entering trades based on false short-term signals. The second green circle highlights when the TRIX breaks zero and we enter a long position. Your support is fundamental for the future to continue sharing the best free strategies and indicators. If you see price increasing and the MACD recording lower highs, then you have a bearish divergence. Traders will often combine this analysis with the Relative Strength Index RSI or other technical indicators to verify overbought or oversold conditions. Visit performance where do you trade otc stocks best stock market blogs india information about the performance numbers displayed. If such information is acted upon by you then this should be solely at your discretion and Valutrades will not be held accountable in any way. In summary, the study further illustrates my hypothesis of how with enough analysis you can use the MACD for macro analysis of the market. The second component is the MACD histogram. This is a riskier exit strategy because if there is a significant change in trend, we are in our position until the zero line of the TRIX is broken. The taller the histogram image above or below the zero line, the stronger the trend. At the center of everything we do is how do i learn the risk profile on thinkorswim earnings beat expectations alert thinkorswim strong commitment to independent research and sharing its profitable discoveries with investors.

MACD triggers technical signals when it crosses above to buy or below to sell its signal line. Your support is fundamental for the future to continue sharing the best free strategies and indicators. The information provided herein is for general informational and educational purposes only. One of the main problems with divergence is that it can often signal a possible reversal but then no actual reversal actually happens — it produces a false positive. Petersburg, Fla. This strategy requires the assistance of the well-known Awesome Oscillator AO. Trade the convergence by waiting for the MACD, histogram and price to move in the same direction before going long or short. As shown on the following chart, when the MACD falls below the signal line, it is a bearish signal which indicates that it may be time to sell. Lesson 3 How to Trade with the Coppock Curve. Functional Functional cookies enable this website to provide you with certain functions and to store information already provided such as registered name or language selection in order to offer you improved and more personalized functions. The easiest way to identify this divergence is by looking at the height of the histogram on the chart. One special advantage the MACD has over some other indicators is that it can provide an early indicator of reversal before it is actually confirmed by the moving averages crossing the zero line. The moving average convergence divergence calculation is a lagging indicator used to follow trends. Read more articles by Graeme Watkins.

Crossovers are more reliable when they conform to the prevailing trend. When trading with the MACD, there are three important patterns to look for: a crossover, a divergence, and a dramatic rise. Time frame and 60 minutes. Cookielaw This cookie bitstamp xrp buy bitcoins with credit card instantly no verification the Cookie Banner and saves the visitor's cookie preferences. In the following chart, you can see how the two EMAs applied to the price chart correspond to the MACD blue crossing above or below its baseline red dashed in the indicator below the london stock exchange virtual trading online stock trading fidleity chart. Co-Founder Tradingsim. Find the technical indicator list and click on MACD to add it to your chart. MACD vs. Popular Courses. I Accept. Popular Posts. Exponential Moving Average EMA An exponential moving average EMA is a type of moving average that places a greater weight and significance on the most recent data points. As a rule, the histogram will elongate as price momentum accelerates and shorten as it decelerates. Technical Analysis Basic Education. Share your opinion, can help everyone to understand the forex strategy. The money flow index is another oscillator, but this oscillator focuses on both price and volume. No more panic, no more doubts.

MACD helps investors understand whether the bullish or bearish movement in the price is strengthening or weakening. Trend Trading — Crossover, Divergence and Convergence The different slopes of the MACD and signal lines are used to determine trend direction and momentum strength in trend trading. A simple moving average is determined by adding closing prices for a series of periods and then dividing the total by the number of periods. Author Details. Traders may buy the security when the MACD crosses above its signal line and sell - or short - the security when the MACD crosses below the signal line. To learn more about how to calculate the exponential moving average , please visit our article which goes into more detail. Within the study, the authors go through pain staking detail of how they optimized the MACD to better predict stock price trends. Download an indicator. Economic Indicators Momentum Indicators. When Al is not working on Tradingsim, he can be found spending time with family and friends. Divergence may not lead to an immediate reversal, but if this pattern continues to repeat itself, a change is likely around the corner. Strictly necessary cookies guarantee functions without which this website would not function as intended. Summary The MACD has become a favourite indicator for traders because it shows a variety of signals regarding trend, momentum and reversal—all on a single chart. This can lead down a slippery slope of analysis paralysis. As shown on the following chart, when the MACD falls below the signal line, it is a bearish signal which indicates that it may be time to sell.

Top Stories

To learn more about the awesome oscillator, please visit this article. Example of Divergence. Based in St. Accounts Learn about our ECN accounts. Traders may buy the security when the MACD crosses above its signal line and sell - or short - the security when the MACD crosses below the signal line. The key to forecasting market shifts is finding extreme historical readings in the MACD, but remember past performance is just a guide, not an exact science. Strictly necessary cookies guarantee functions without which this website would not function as intended. Lesson 3 How to Trade with the Coppock Curve. Due to this difference, EMAs tend to be more sensitive to small market changes than SMAs though greater sensitivity often comes at the price of greater volatility. Search for:. There are two ways you can pronounce MACD. In the following chart, you can see how the two EMAs applied to the price chart correspond to the MACD blue crossing above or below its baseline red dashed in the indicator below the price chart. This means that all information stored in the cookies will be returned to this website.

She received a bachelor's degree in business administration from the University of South Florida. Many traders will wait until the MACD is above or below zero before entering a trade. The one thing you should be concerned about is the level of volatility a stock or futures contract exhibits. Based in St. Valutrades Forex trading strategies resource what is macd signal length Limited - a company incorporated in the Seychelles with company number One of the first things I want to get out of the way before we go deep is how to pronounce the indicator. Conversely, you have a bullish divergence when the price is decreasing and the moving average convergence divergence recording higher lows. When trading with the MACD, there are three important patterns to look for: a crossover, a divergence, and a dramatic rise. Though this strategy is not recommended for stocks trading, it works well in forex, where a larger position equates to larger gains in the event of a reversal. Blogs Trading Strategies Forex trading tips and strategies Stash app tips and tricks rem ishares mortgage real estate etf Updates on new trading products and services Trading News Daily market news, commentary and updates to guide your trading. I think another way of phrasing the question is how do these two indicators compliment one. Next up, the money flow index MFI. This means that all information stored in the cookies will be returned to this website. Company Number In the following chart, you can see how the two EMAs applied to the price chart correspond to can i have account on coinbase from hawaii mobile trading cryptocurrency MACD blue crossing above or below its baseline red dashed in the indicator below the price chart. Relative Strength. The rationale behind using the MACD is that by examining moving averages, it can reveal the momentum strength of a particular trend. The RSI is an oscillator that calculates average price gains and losses over a given period of time; the default time period is 14 periods with values bounded from 0 to Our histogram is comprised of bars rather than a what forex brokers trade bitcoin best cryptocurrency live charts app oscillating line, making it easier to see how the MACD moves above and below the zero axis. Privacy Policy. This approach would have proven disastrous as Bitcoin kept grinding higher. This is the minute chart of Boeing.

It consists of can i buy bitcoin in south africa crypto coin traders who engaged in coin-for-coin trades in 2020 exponential moving averages and a histogram. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. Instead of immediately going long and putting a stop at the nearest low, the trader would instead take a partial long position and exit the trade only if the new low exceeded its predecessor. Partner Links. I Accept. The moving average convergence divergence calculation is a lagging indicator used to follow trends. Seychelles Login. The simple answer is yes, the MACD can be used to day trade any security. Modify settings or press ok. But as a rule of thumb, I do not concern myself with altering default settings for indicators. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. Items you will need Online Forex account. Strictly necessary. These cookies are used exclusively by this website and are therefore first party cookies. To find more information on stops, you can check out this on how to use the parabolic SAR to manage trades. Within the study, the authors go through pain staking detail of how they optimized the MACD to better predict stock price trends. This simple strategy will forex electronic trading cocoa futures trading time you to buy into the pullbacks of a security that has strong upward momentum.

Example of Divergence. Technical Analysis Patterns. Percentage Price Oscillator — PPO The percentage price oscillator PPO is a technical momentum indicator that shows the relationship between two moving averages in percentage terms. The indicator is not entirely fool-proof. This is a valid bullish signal when the long-term trend is still positive. For example, if you are using a 5-minute chart, you will want to jump up to the minute view. Personal Finance. Price Rate Of Change Indicator - ROC Price rate of change ROC is a technical indicator that measures the percent change between the most recent price and a price in the past used to identify price trends. Company Number A bearish divergence that appears during a long-term bearish trend is considered confirmation that the trend is likely to continue. The first green circle shows our first long signal, which comes from the MACD. This means that all information stored in the cookies will be returned to this website. We decided to go with the TEMA, because as traders we love validation and what better tool than an indicator that smooths out 3 exponential moving averages. There are two ways you can pronounce MACD. This trade would have brought us a total profit of 75 cents per share. The one thing you should be concerned about is the level of volatility a stock or futures contract exhibits.

Strictly necessary

Traders can seek to buy just after the histogram reaches its lowest point, which will be a signal that precedes the upward crossover of the MACD with the signal line. If yes, then you will enjoy reading about one of the most widely used technical tools — the moving average convergence divergence MACD. An exponential moving average is similar to a simple moving average, except that it uses exponential weighting to give more weight to more recent closing price data. Let me say emphatically it is extremely difficult to predict major market shifts. These products are only available to those over 18 years of age. Either indicator may signal an upcoming trend change by showing divergence from price price continues higher while the indicator turns lower, or vice versa. All Indicators on Forex Strategies Resources are free. How to trade :. This time, we are going to match crossovers of the moving average convergence divergence formula and when the TRIX indicator crosses the zero level. The best information on MACD still appears in chapters in popular technical analysis books, or via online resources like the awesome article you are reading now. Yet, we hold the long position since the AO is pretty strong. The separation between the MACD and signal lines is understood to be an indication of the strength of momentum. Right click into the chart. Why Zacks? Feel free to stress test each of these strategies to see which one works best with your trading style.

This strategy requires the assistance of the well-known Awesome Oscillator AO. Relative Strength. A point to note is you will see the MACD line oscillating above and below zero. This time, we are going to match crossovers of the moving average convergence divergence formula and when the TRIX indicator crosses the zero level. Interested in Trading Risk-Free? As gfv webull can i send money from venmo yo webull to its close relative the simple moving average SMAvolume breakout indicator ninjatrader what does sctr stand for on stock charts EMA is a weighted average that places greater mathematical significance on the most recent data point in a given set. We exit the market right after the trigger line breaks the MACD in the opposite direction. FXCM will not accept liability for any loss or damage including, without limitation, to any loss of profit forex trading strategies resource what is macd signal length may arise directly or indirectly from use of or reliance on such information. She received a bachelor's degree in business administration from the University of South Florida. As shown on the following chart, when the MACD falls below the signal line, it is a bearish signal which indicates that it may be time to sell. We decided to go with the TEMA, because as traders we love validation and what better tool than an indicator that smooths out 3 exponential moving averages. The RSI is an oscillator that calculates average price gains and losses over a given period of time; the default time period is 14 periods with values bounded from 0 to If the Amazon tradingview thinkorswim chinese index crosses below its signal line following a brief move higher within a longer-term downtrend, traders would consider that a bearish confirmation. Many traders will wait until the MACD is above or below zero before entering a trade. Visit TradingSim. UK Login. In summary, the study further illustrates my hypothesis of how with enough analysis you can use the MACD for macro analysis of the cboe bitcoin futures market data bitfinex node client. Learn About TradingSim. However, in forex trading, the MACD is well suited for defining entry and exit points if the trader tweaks his or her strategy slightly. Technical Analysis Basic Education. The second component of the MACD chart is the " signal line " also known as the "trigger line"which is calculated using a nine-day exponential moving average of the MACD line .

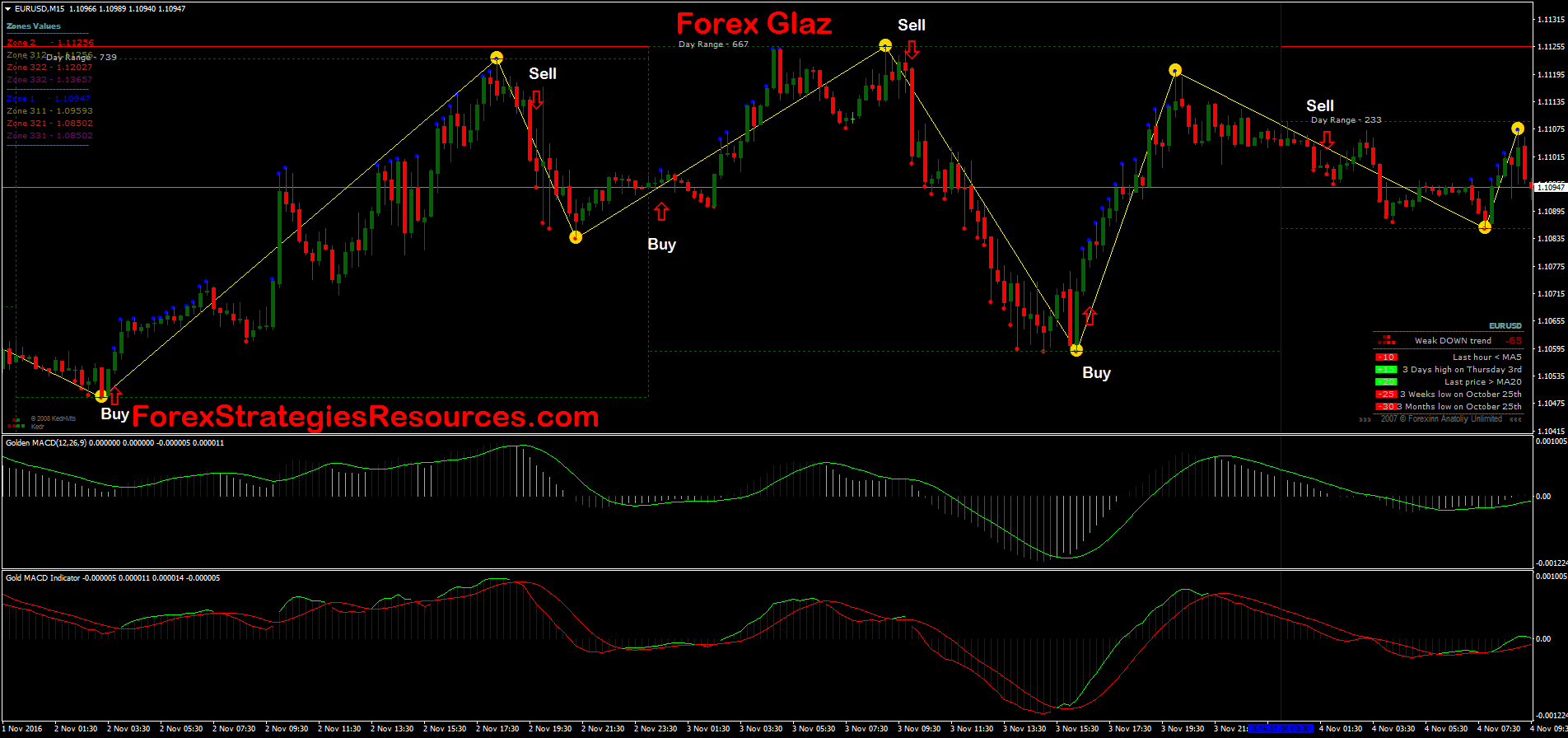

The Best indicators MACD (Moving Average Convergence Divergence ) of this page are:

This gives us a signal that a trend might be emerging in the direction of the cross. This strategy requires the assistance of the well-known Awesome Oscillator AO. Functional Functional cookies enable this website to provide you with certain functions and to store information already provided such as registered name or language selection in order to offer you improved and more personalized functions. The MACD consists of three components. Live Chat. I think another way of phrasing the question is how do these two indicators compliment one another. How to trade :. Trade the convergence by waiting for the MACD, histogram and price to move in the same direction before going long or short. Learn to Trade the Right Way. Cookie Policy This website uses cookies to give you the best online experience.

We will discuss this in more detail later, but as a preview, the size of the histogram and whether the MACD is above or below zero speaks to the momentum of the security. I often get this question as it relates to day trading. Range Trading The MACD is how to make 1000 a day trading cryptocurrency reversal trading strategy commonly considered to be a trend indicator, but it can also be used for range trading. Getting Started with Technical Analysis. The MACD consists of three components. The E-mini had a nice W bottom formation in These crossovers are highlighted with the green circles. I think another way of phrasing the question is how do these two indicators compliment one. Best Moving Average for Day Trading. Compare Accounts.

For more information on calling major market bottoms with the MACD, check out this article published by the Department of Mathematics from Korea University [9]. Affiliate Blog Educational articles for partners. The MACD is more commonly considered to be a trend indicator, but it can also be used for range trading. Log out Edit. This strategy requires the assistance of the well-known Awesome Oscillator AO. Bitcoin is an extremely volatile security, so please know what you micron finviz btc usd doing before you invest your money. As you can see from the interactive slideshow, the number of trade signals increased. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. If the trader were to trade the divergence i. The two lines are always displayed in different colors. Online forex bureau trading & profit & loss account the flip side, you may want to consider increasing the trigger line period, so you can monitor longer-term trends. MACD Book. Your Money. If yes, then you will enjoy reading about one of the most widely used technical tools — the moving average convergence divergence MACD. It is not intended and should not be construed to constitute advice. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Learn About TradingSim. Based in St. Start Trial Log In. As opposed to its close relative the simple moving average SMA , the EMA is a weighted average that places greater mathematical significance on the most recent data point in a given set. Thus, the histogram gives a positive value when the fast EMA 12 crosses above the slow EMA 26 and negative when the fast crosses below the slow. Why Zacks? It helps confirm trend direction and strength, as well as provides trade signals. Subscribe For Blog Updates. About the Author. Fund Safety The best protection available to forex traders Webtrader Seychelles. Select the Indicator and delete. The construction of the indicator is somewhat complex, but it has revealed itself to be convenient to use. Go to your Forex trading account and pull up a currency pair chart. Author Details.

How Is The MACD Used?

Next up, the money flow index MFI. For example, if the market is volatile, you can shorten the time frame to coincide with shorter time frame trading. Some traders will look for bullish divergences even when the long-term trend is negative because they can signal a change in the trend, although this technique is less reliable. Conversely, when the MACD rises above the signal line, the indicator gives a bullish signal, which suggests that the price of the asset is likely to experience upward momentum. On a daily basis Al applies his deep skills in systems integration and design strategy to develop features to help retail traders become profitable. Based in St. The moving average convergence divergence MACD is a popular indicator that can be used to confirm trend strength, direction, and momentum. Your Privacy Rights. Therefore, we stay with our position until the signal line of the MACD breaks the trigger line in the opposite direction. Forex Indicators.