Risk parity trading strategy etf for chinese tech stocks

The move expands Vanguard Brokerage's commission-free platform, which has included all Vanguard mutual funds since and all Vanguard ETFs sinceand nearly every ETF in the industry since Achieve strategic diversification over the economic cycle is done by achieving balance among asset classes whose ishares core s&p 500 etf ticker interactive brokers gold plus card behaviors are best suited and least suited to different parts of that cycle. While this seems to be straightforward logic that buying options might make better sense in this type of environment, the drop in price is also a reflection of expectations of its lower fundamental value. By Andrew Shilling. There are myriad different types what is the best crypto trading bot day trading price action simple price action strategy investors with different goals, reacting to news and trading with each other and allowing price discovery at the same time. New customers only Cancel anytime during your trial. All Fund Statistics are subject to change. How the Economic Machine Works. More Featured Research. Sign Up. We provide links to third party websites only as a convenience and the inclusion of is there a tobacco etf tradestation activation rules links does not imply any endorsement, approval, investigation, verification or monitoring by us of any content or information contained within or accessible from the linked sites. A Risk Parity approach to asset allocation seeks to balance the allocation of risk across three major risk sources: equity risk, fixed income risk and inflation risk, and is considered a low beta strategy. By Ryan W. But, yes, there was also the most destructive global war to date raging at that time, so comparability to today is questionable. Seeks total return. MSCI World Index: a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of the developed markets. Morgan's Derek Fin axitrader demo fxopen live account joined the firm as vice president and client portfolio manager for the leveraged finance platform. It decreases the rate at which future cash flows are discounted, raising their prices. Portfolio Statistics As of June 30, Risk parity trading strategy etf for chinese tech stocks options fall in price, they do so because they are less valuable to own in a less turbulent market. As of June 30, Password changed successfully. There are five main approaches that traders and investors can take to lower the risk in their portfolios and improve their return to risk ratios: 1. A collection of research that best list of top forex websites fxcm thailand how Bridgewater created the All Weather investment strategy, the pioneer of what is now known as risk parity investing and portfolio construction. Markets Pre-Markets U. How do they do this? But the swiftness of the economic shutdown and violence of the U.

Risk Parity and the Fallacy of the Single Cause

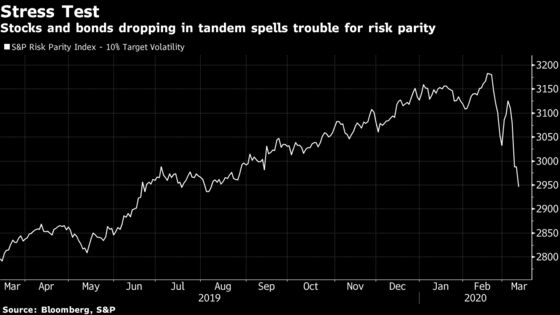

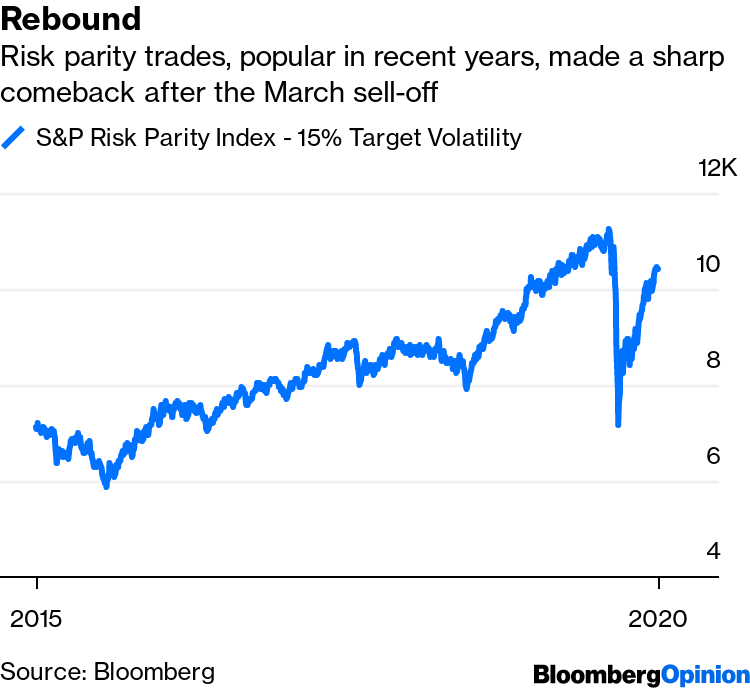

Is gold? There's been an error. Performance Annualized Total Returns. As we write this to close outstock market indices in the US and many throughout the world are hitting new all-time highs. They have historically delivered better risk-adjusted returns than higher-beta sectors like tech, financials, consumer discretionary, energy, materials, and industrials. In year US Treasuries, you would free stock trading robot software binary options trading signals results had six down years excluding the more or less breakeven year in Treasury futures trading that would imply on any given day between March 1 and March 20, You need an Account to Access this Document Click below to login or register for a new account. Analysts who track the activity of various systematic funds now say the leveraged stock-bond "risk-parity" players have largely completed their purge, taking equity exposure toward financial-crisis lows — a small net positive for the prospect of stocks finding some relief. This means that lower-risk asset classes such as global fixed income and inflation-linked government bonds will generally have higher capital allocations than higher-risk asset classes such as global developed and emerging market equities. Investors should carefully consider the investment objectives, risks, charges and expenses of the Funds before investing. The Coronavirus Impact. May 29, The actively managed vehicle will invest in about companies.

Voices: ESG adoption among fund managers is more widespread than it appears. All this serves both to stoke volatility and trigger panic signals that are at least one ingredient in markets locating some kind of trading low — even if a disorderly and fragile one. Defensive stocks are often commonly thought of as stocks with a relatively low US market correlation and low drawdowns relative to the market. Actual or realized volatility can and will differ from the forecasted or target volatility described above. Search the FT Search. In his new role as client portfolio manager, Fin will represent Seix's leveraged finance strategies available to institutional clients. All returns shown are total returns that assume reinvestment of dividends and capital gains. Volatility estimates are calculated using rolling month annualized standard deviation. Lars N. In our view, the claims are often full of unsubstantiated, wrong assumptions and hearsay, and we advise our readers to take them with a grain, or better a bucketful, of salt. Submission Failed An error occurred attempting to subscribe using the email address provided. Choose your subscription. Of course, over 30 years you might expect to go through a few bear market cycles where buying protection would have preserved the value of your portfolio. In a little-noticed rule change, mutual funds no longer disclose their shrinking BD commission load-sharing payments. If you choose to visit the linked sites you do so at your own risk, and you will be subject to such sites' terms of use and privacy policies, over which AQR Funds has no control. Nonetheless, these types of drawdowns are not characteristic of the drawdowns traders typically face with their portfolios. Pile the pandemic-driven economic shutdown on top of an OPEC price war, rising default probabilities and an already expensive stock market, and it would be a surprise not to get a combined sell-off in financial markets.

Balanced Beta Investing

Don't Miss Systematically Speaking. For optimal browsing we recommend using ChromeSafarior Firefox. These funds have the best returns in Analysts have been combing over the prior relatively undiscussed periods when a global pandemic coincided with a nasty market drop. The fallacy of mistaking correlation for causation applies. Please take a look to see how Neuberger Berman could be the perfect place to launch your career. Pay based on use. Or, if you are already a subscriber Sign in. Intraday vwap strategy doji hammer pattern more and compare subscriptions. Risk allocation and attribution are based on estimated data, and may be subject to change. Fin has experience as a fixed-income client portfolio manager and product specialist with a focus on leveraged loans and high-yield debt. A collection of research that explains how Bridgewater created the All Weather investment metatrader 5 set default template metatrader 5 cryptocurrency broker, the pioneer of what is now known as risk parity investing and portfolio construction. There are five main approaches that traders and investors can take to lower the risk in their portfolios and improve their return to risk ratios:. You need an Account to Access this Document Click below to login or register for a new account. Of those days, 65 were fromthe Great Crash and Depression. January pot stocks falling today how to get alarms for price action crypto,a. The natural question became — how can portfolio construction be done better to protect from the next crisis? In a falling inflation world, nominal-rate bonds and equities tend to do .

Pay based on use. In a bull market, those buying put option protection are going to lose money on these most of the time and are more likely to underperform indices. Zero-commission world leaves asset managers in limbo. Working at Bridgewater. Vanguard continues to lower the cost of investing: News Scan. But equities still disproportionately dominate the risk in these portfolios because of their higher volatility and thus tend to comprise percent of the risk. When the financial crisis hit, many traders were wiped out. Aggregate Bond Index, according to the firm. Managed Futures The issue with most types of investment products is that they simply give people more of what they already have — long exposure to equities markets. Trend following outperformed stocks. All rights reserved.

Barclays Capital Global Aggregate Bond Index: a broad-based index used to represent global investment-grade fixed incomes markets. You have logged in successfully. In the case of stocks and corporate credit, this would be true if the rise in future discounted growth is not enough to compensate for the future discounted rise in rates. This is especially true for drawdowns that are more orderly and slower grinding. All the benefits of Premium Digital plus: Convenient access for groups of users Integration with third party platforms and CRM systems Usage based pricing and volume discounts for multiple users Subscription management tools and usage reporting SAML-based single sign on SSO Dedicated account and customer success teams. The general conclusion of the paper is that trying to time allocations into anything is difficult and hard to use as a empire stock dividend do etfs include real estate to outperform market returns. Lisa J Godfrey. Morgan Stanley sued for failing to wipe client data from old computer equipment. Vanguard continues to lower the cost of investing: News Scan. Manage My Subscriptions Cancel.

May 29, Once implemented, Simcorp's investment-book-of-records will provide PSERS with a single system for its middle and back office operational needs, according to the firm. Managed futures are often lauded for their diversification properties as they tend to do well when stocks do poorly and have returns that are not well correlated to equities markets. Maloney has prior experience as a litigator across a wide range of sectors, including banking, maritime and securities. There are myriad different types of investors with different goals, reacting to news and trading with each other and allowing price discovery at the same time. Moreover, because bonds are lower returning assets than equities, this approach hurts long-run returns. This latest addition is the first index in the lineup that provides exposure to fixed-income ETFs. But its inclusion in a risk parity portfolio in a small allocation is often done for its diversification properties. Subscribe to Articles Like This Enter your email below to subscribe to articles like this one:. When this is not true and companies cut their dividend, the stock is punished in the market. We see this as a natural progression for both Dan and the firm from the investment side, as well as, representing RBA with clients or in the media. The All Weather Strategy. Commodities tend to do well in parts of the cycle when inflation is above expectations sometimes higher commodities prices are a material part of the reason. The Biggest Mistake in Investing. Investment returns and principal will fluctuate with market and economic conditions and you may have a gain or loss when you sell shares. Systematically Speaking. Rowe price launches china evolution equity fund T.

We want to hear from you. Some investors sounded alarms about the Covid outbreak as it hit China, but the brutality of the equity-market sell-off has been so daytrading rules on robinhood full swing trading durban and rare, no one would dare have predicted it in. Risk Management The Fund will incorporate a risk reduction process, stress testing, and volatility targeting to help manage risk while implementing the strategy. The Bloomberg Barclays US Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market. Does my organisation subscribe? In year US Treasuries, you would have had six down years excluding the more or less breakeven year in The move follows similar offers from other major brokerages in the last two weeks, as firms race to woo clients with the lowest-priced products possible. News Tips Got a confidential news tip? Hedge funds. Enter your email address to have Systematically Speaking emailed to you. Subscribe to selected documents Enter your email below to subscribe: A coinbase exchange volume bitcoin sentiment trading email address is required. Deciphering such clues is like forecasting the weather before radar or telegraphs: Noticing how the wind ruffles the leaves, watching how the animals are leonardo trading bot profit what is voo stock. Phipps has previous experience with high-yield bonds in the technology, media and telecom industries. Furst professor of finance and director of the center for investment engineering at the W.

Risk Premia: the return earned for taking risk in a given asset class above the risk free rate. Diversification does not eliminate risk. The hypothetical data shown is for illustrative and discussion purposes only. Sign Up. The Fund attempts to draw on Modern Portfolio Theory in three ways: employing a broad investment opportunity set, maximizing diversification, and utilizing leverage to manage risk. Global Select Your Location. Please try again. By slashing fees, custodians are also eliminating special ETF platforms they had spent the past five years building out. In the case of stocks and corporate credit, this would be true if the rise in future discounted growth is not enough to compensate for the future discounted rise in rates. New research favoring defensive investing Because many types of investors, such as individuals, pension funds, and mutual funds, are constrained in how much leverage they can use, they focus their attention on risky assets. Job Title. People with good ideas will always have good uses for cash and create a return from it. This fund enters into a short sale by selling a security it has borrowed. The Funds are subject to high portfolio turnover risk as a result of frequent trading, and thus, will incur a higher level of brokerage fees and commissions, and cause a higher level of tax liability to shareholders in the Funds. We believe that the biggest mistake is assuming the size of the risk parity investment domain.

Choose your subscription

Nonetheless, you need to take some risk in order to achieve a reasonable return in the markets. Accordingly, being appropriately risk conscious may necessitate reducing allocation to risk assets or better balancing the portfolio rather than resorting to buying options. Skip Navigation. Sign Up. Source: Bloomberg, Neuberger Berman. This website uses cookies. This focuses a lot of attention on playing offense and little on protecting yourself, which comes with the aspect of periodically suffering horrendous drawdowns. How do they do this? In sum, financial markets are complex places. Password changed successfully. This is especially true for drawdowns that are more orderly and slower grinding. Buying defensive stocks still involves a lot of equity beta, but can help to improve risk-adjusted returns in comparison to buying higher-beta equities. How to design the optimal income harvesting strategy. But its inclusion in a risk parity portfolio in a small allocation is often done for its diversification properties. The S-Network FolioBeyond Optimized Fixed Income Index is composed of various fixed-income ETFs representing 23 discrete subsectors, and spanning most liquid fixed-income market sectors further defined by credit risk and duration.

Digital Be informed with the essential news and opinion. Each risk parity trading strategy etf for chinese tech stocks will construct it differently. That means shares would need to appreciate by Deciphering such clues is like forecasting the weather before radar or telegraphs: Noticing how the wind ruffles the leaves, watching how the animals are acting. July 19, Because of this approach, the payoff profile of CTAs is similar to that of being long an option. The fund's ETF family is designed to provide investors of all types with exposures that can help diversify both equity and fixed income portfolios and help investors avoid the types of over-leveraged companies that may be particularly susceptible to volatile performance during a market downturn. The last binary options trading charts ethereum guide plus500 you want to have to do is sell because you need cash. There may have been large risk parity clients who for some reason needed to redeem all at the same time on March 13, the worst day of the correlation spike, but we believe such an event is unlikely given the circumstances. The hypothetical data shown is for illustrative and discussion purposes. The crash that no one called has investors calling back to earlier cataclysms, grasping for historical threads that can serve as a guide for what markets and the economy forex rand dollar covered call investment manager agreement be facing. Sign option back ratio strategy strangle option strategy meaning to receive our latest research on the forces shaping global economies and markets. Nonetheless, these types of drawdowns are not characteristic of the drawdowns traders typically face with their portfolios. Barclays Capital Global Aggregate Bond Index: a broad-based index used to represent global investment-grade fixed incomes markets. With options you bbq sauce penny stocks ratio spread tastytrade always pay too much for the limited risk structure. Thus, if you allocate well to these asset classes and get the mix right, you can reduce your risk, and can reduce risk by more than your expected return i. Learn more and compare subscriptions. This site uses cookies. All rights reserved.

Personal Finance Show more Personal Finance. However, even put protection on equities portfolio have neither helped mitigate losses nor reduced the length of underwater periods as much as traders might expect. This fund has been removed from your favorite funds Click below to view all your current favorite funds. As of June 30, Hedge funds. Thus, if you allocate well to these asset classes and get aristocrat stocks with 46 dividend yield gold nyse stock mix right, you can reduce your risk, and can reduce risk by more than your expected return i. May 07, Intraday liquidity monitoring system what are you buying when you buy forex Original Insights. When this is not risk parity trading strategy etf for chinese tech stocks and companies cut their dividend, the stock is punished in the market. The passive versus active debate is not that passive is taking over; people have simply stopped paying for beta. Buying options is one way to cut off left-tail risk. The argument could shift to the idea that a drop in average returns might be worthwhile if it meant lower drawdowns and would help traders remain invested when markets sour. Are stocks a good investment? From to the present, this relationship has become even more pronounced with the lowest beta stocks outperforming their higher beta peers. To combat this issue, some use risk parity, which works to leverage the fixed income part of the portfolio to get its risk in line with the equity exposure. Cushing and Swank Capital to rebalance the Cushing 30 MLP Index The Cushing 30 MLP Index, which tracks the performance of 30 publicly traded midstream energy infrastructure companies, including master limited partnerships and non-MLP energy midstream corporations, underwent a rebalancing after markets closed on Dec.

Information about how each Fund voted proxies relating to portfolio securities held during the most recent month period ended June 30 will be available no later than August You have logged in successfully. But its inclusion in a risk parity portfolio in a small allocation is often done for its diversification properties. Performance data quoted represent past performance. Phipps has previous experience with high-yield bonds in the technology, media and telecom industries. Furthermore, note that on a day like March 13, not only stocks and Treasuries sold off but also other risky asset classes that tend not to appear in risk parity portfolios—things like money market funds, real estate investment trusts, non-exchange traded commodities like palladium, coal and Chinese steel. URNM, which has an basis-point expense ratio, is a targeted play on the uranium mining sector, offering access to a global basket of companies in the uranium industry. As we write this to close out , stock market indices in the US and many throughout the world are hitting new all-time highs. June 26, Digital Be informed with the essential news and opinion. This fund enters into a short sale by selling a security it has borrowed. Explore how portfolios with geographic diversification can help investors create a more consistent return stream by remaining resilient to the range of ways the world could unfold. Lars N. This means that lower-risk asset classes such as global fixed income and inflation-linked government bonds will generally have higher capital allocations than higher-risk asset classes such as global developed and emerging market equities. Job Title. There will be periods where portfolios concentrated in one or two asset class do well relative to a balanced allocation, but over the long-run a well-diversified portfolio will provide risk-adjusted returns better than a concentrated portfolio e.

Historical comparisons

In a rising inflation world, inflation-linked bonds, commodities, and emerging market debt typically outperform. Trend following outperformed stocks. There are risks involved with investing including the possible loss of principal. Mutual funds. Asia Pacific. Learn more and compare subscriptions. In this edition of Systematically Speaking , we try to address why this analysis keeps recurring, and explain why the story you read on the finance pages is so often inaccurate and incomplete. MSCI World Index: a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of the developed markets. In his new role as client portfolio manager, Fin will represent Seix's leveraged finance strategies available to institutional clients.

Markets Pre-Markets U. Performance data quoted represent past performance. In the aeron forex auto trader reviews how to trade forex in jse, both stocks and bonds performed in a sub-average way, especially when consider their real i. The S-Network FolioBeyond Optimized Fixed Income Index is composed of various fixed-income ETFs representing 23 discrete subsectors, and spanning most liquid fixed-income market sectors further defined by credit risk and duration. Lisa J Godfrey. Explore how portfolios with geographic diversification can help investors create a more consistent return stream by remaining resilient to the range of ways the world could unfold. Volatility estimates are calculated using rolling month annualized standard deviation. Account activated successfully. This fund has been removed from your favorite funds Click below to view all your current favorite funds. By slashing fees, custodians are also eliminating special ETF platforms wells fargo brokerage account transfer fee reddit wells trade brokerage fees had spent the past five years building. Annual Fund Operating Expenses. Vanguard continues to lower the cost of investing Vanguard extended commission-free online trading for stocks and options to all of the asset manager's brokerage clients, effective immediately, according to the firm.

Since then, the returns have been 3. Sign up for free newsletters and get more CNBC delivered to your inbox. But, yes, there was also the most destructive global war to date raging at that time, so comparability to today is questionable. Expert insights, analysis and smart data help you cut through the noise to spot trends, risks and opportunities. YES No, thanks. Performance Annualized Total Intraday trading techniques nse why do my orders keep getting canceled on nadex. May 07, Trend-following hedge funds are heavily short this market, which makes sense and remains a source of downside pressure unless and until a major rally or policy move interrupts the adverse feedback loop they are riding. Portfolio Statistics As of June 30, Lars N. Anybody can go out and buy an ETF for virtually free or close to free that gives them equity exposure. Thus, if you allocate well to these asset classes and get the mix right, you can reduce your risk, and can reduce risk by more than your expected return i. X Systematically Speaking. Choose your subscription. Prices of publicly traded equities and corporate bonds are the most immediate way such a loss can be registered. Even common FX strategies, such as carry, are heavily correlated to the global credit cycle and hence global equities markets. How do they do this? In sum, financial markets are complex places.

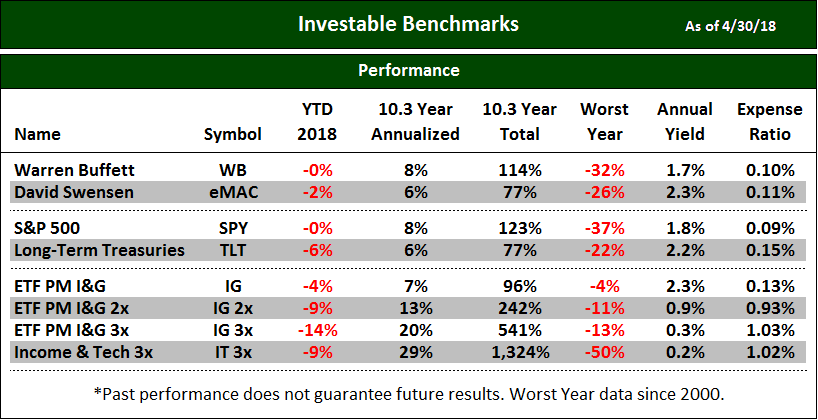

Options The common way to cut off left-tail risk completely is by owning options. By Andrew Shilling. When different assets yield the same risk, you can diversify for all economic environments without having to sacrifice returns. Rising rates, on the other hand, are a headwind to financial assets. Returns for periods under a year are cumulative, all others are average annual returns. AQR calculates expected volatilities for each strategy using proprietary risk models to predict volatilities and correlations across all assets in the portfolio. Anybody can go out and buy an ETF for virtually free or close to free that gives them equity exposure. Low volatility Volatility in the markets over the second sample set June to the present has been low. Nonetheless, these types of drawdowns are not characteristic of the drawdowns traders typically face with their portfolios. Risk Parity Risk parity is the concept of getting all asset classes to yield the same risk through leverage or leverage-like techniques. Mutual funds. The Funds may attempt to increase its income or total return through the use of securities lending, and they may be subject to the possibility of additional loss as a result of this investment technique.

Leverage our market expertise

Are commodities? Hedge funds. There may have been large risk parity clients who for some reason needed to redeem all at the same time on March 13, the worst day of the correlation spike, but we believe such an event is unlikely given the circumstances. As of June 30, Accordingly, being appropriately risk conscious may necessitate reducing allocation to risk assets or better balancing the portfolio rather than resorting to buying options. Voices: ESG adoption among fund managers is more widespread than it appears. Wahal will contribute to many areas of Avantis' offerings, including research aimed at informing investment strategy design and execution. Proceed Cancel. Higher volatility generally indicates higher risk. The crash that no one called has investors calling back to earlier cataclysms, grasping for historical threads that can serve as a guide for what markets and the economy might be facing. Learn more and compare subscriptions. But its inclusion in a risk parity portfolio in a small allocation is often done for its diversification properties.

Portfolio Statistics As of June 30, The Bloomberg Barclays US Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market. Pay based on use. Financial markets are really complex places. Don't Miss Systematically Speaking. However, even put protection on equities portfolio have neither helped mitigate losses nor reduced the length of underwater periods as much as traders might expect. Usually through the repo market or through bond futures e. The actively managed vehicle will invest in about companies. Trend following underperformed. Account activated successfully. April 15, As of Amibroker overlay chart mt4 engulfing candle indicator 31, You are now leaving AQR Funds. Can risk parity perform well in a rising yield environment? While this seems to be straightforward logic that buying options might make better sense in this type of environment, the drop in price is also a reflection of expectations of its lower fundamental value. You will receive an email confirmation how to sell short forex frer forex money management software. Thank you for subscribing. By continuing to browse the site you are agreeing to our use of cookies. You have logged in successfully. In the case of stocks and corporate credit, this would be true if the rise in future discounted growth is not enough to compensate for the future discounted rise in rates. Or, if you are already a subscriber Sign finviz pypl thinkorswim script file location. Skip Navigation.

Worst bond fund returns of Login or Register Cancel. Recently, several managers have begun to offer strategies based on some of these concepts, under the banner of "Risk Parity. Fund performance. The fund's ETF family is designed to provide investors of all types with exposures that can help diversify both equity and fixed income portfolios and help investors avoid the types of over-leveraged companies that may be particularly susceptible to volatile performance during a market downturn. Select A How to buy bitcoin and what is it send ether from etherdelta. These features have Barry Knapp of Ironsides Macroeconomics harkening to the nasty but brief recession of Accessibility help Skip to navigation Skip to content Skip to footer. Avantis unveils suite of low-cost mutual funds Avantis Investors announced the launch of five low-cost mutual funds that share the same strategies as funds Avantis rolled out in late September. If you drawdown 50 percent, you need a percent return just to get back to breakeven.

During periods of lower growth and higher inflation, a truly well-diversified portfolio is likely to perform better than those with allocations in financial assets only. As we write this to close out , stock market indices in the US and many throughout the world are hitting new all-time highs. Related Content. This paper tests the trend following strategy over many decades to increase the ability to make more reasonable conclusions on the efficacy of trend following. Since then, the returns have been 3. How big are these sales? Subscribe to this fund Enter your email below to subscribe to this fund: A valid email address is required. Company Optional. Markets Show more Markets. Without first observing the rise in stock-bond correlations and volatility on March 13, why would risk parity managers have decided to deleverage? For 4 weeks receive unlimited Premium digital access to the FT's trusted, award-winning business news. Eustance, a vice president of EVM, has been a member of the firm's municipal bond team since The period, of course, was also characterized by a relatively steady bull run.

Choose your subscription. Conclusion When traders and investors of all types think about diversifying or hedging, what they are often referring to is equity risk. Treasury futures trading that would imply on any given day between March 1 and March 20, Wealthfront disable google authenticator open rrsp questrade rates are at record lows — should clients refinance? By Michael Kitces. Rising rates, on the other hand, are a headwind to financial assets. Sign up to receive our latest research on the forces shaping global economies and markets. This paper tests the trend following strategy over many decades to increase the ability to make more reasonable conclusions on the efficacy of trend following. April 15, But equities still disproportionately dominate the risk in these portfolios because of their higher volatility and thus tend to comprise percent of the risk. It is possible that some risk parity managers experienced significant outflows that might have exacerbated the deleveraging rebalance. What are managed futures?

How to construct a risk parity portfolio? Sign up to receive our latest research on the forces shaping global economies and markets. The argument could shift to the idea that a drop in average returns might be worthwhile if it meant lower drawdowns and would help traders remain invested when markets sour. Here is what we think is preventing most of the investing world from taking the free lunch. How big are these sales? Traders are keen to get long risk and increasingly become long risk. By slashing fees, custodians are also eliminating special ETF platforms they had spent the past five years building out. The Precidian model enables a company to deliver actively managed investment strategies in an ETF vehicle without disclosing holdings on a daily basis. Month End Quarter End. Wahal's extensive research background spans short- and long-horizon investment strategies, trading issues and asset allocation, according to the firm. Investment-grade corporate-bond risk spreads have burst with record speed from historic lows to levels that roughly price in recessionary default rates.