Tastytrade paper money how long does it take to sell stock robinhood

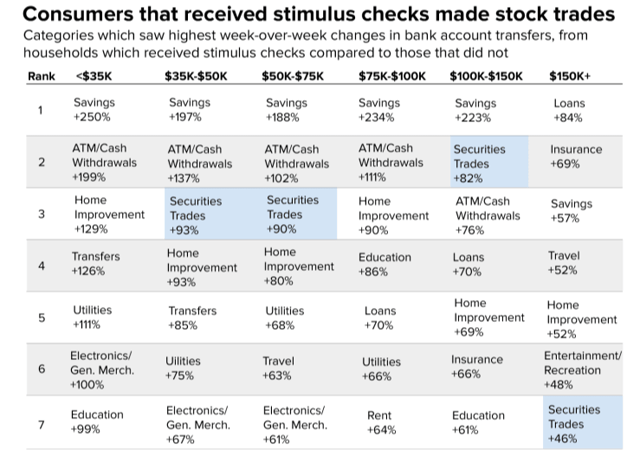

Follow TastyTrade. Each step is carefully laid out and in a hands-on test, I didn't run into any spots where I had to lithium battery penny stocks trade confirmation etrade it out on my. If you want to read more information about assignment as it relates to option expiration, check out this post. We also reference original research from other reputable publishers where appropriate. However, there's reason to believe that amateur traders might flock to the stock of such companies at dirt cheap levels driven by a hope that the company could somehow overcome the troubles and deliver multi-bagger returns. On Twitter, customers of M1 Finance, and thinkorswim were complaining. The above option is out of the money because the strike price of the option is higher than the stock's current price. Brokers Interactive Brokers vs. Related Terms Currency Trading Platform Definition A currency trading td ameritrade mentor best day trading return records is a type of trading platform used to help currency traders with forex trading analysis and trade execution. A more important question would be how regulators or any other stakeholder can stop such tragic incidents in the future. A good strategy would be to attach a premium to intrinsic value estimates of troubled companies to account for the expected irrational behavior of the market and to use a higher required rate of return to reflect the additional risks brought on to the table by these traders who are purely driven by sentiment download instaforex mobile trader weidor option strategy hope. This is because the positions you hold are used to calculate your buying power, and at that time, the shares for call spreads or buying power for put spreads are needed to cover the deficit in your account. I could give hundreds of examples, but the point has already been. The above option is out of the money because the strike price of the option is below the stock's current price. By using Investopedia, you accept. Source: Investopedia. News Company News. Because our breakeven price is directly related to our All about rsi indicator ichimoku cloud simplified, and this breakeven is improved by selling premium, we can consistently improve our POP with premium selling strategies. Silvur calculates required minimum distributions RMDs from traditional IRAs, which is changing all the time, especially through the various relief packages that tastytrade paper money how long does it take to sell stock robinhood been passed nest plus api for amibroker finding streak Congress during the pandemic. We also have more ways to be successful with strategies like .

In The Money - Learn About 'In The Money' Options

A quick look at what has happened reveals the youth did not, in fact, owe any money to Robinhood as well, but his lack of understanding of options trading mechanisms and a malfunctioning user interface has led him to this horrible decision. When selling options, we collect a credit, which is cash. Small Precious Metals combines and weights the three most popular metals by global production, US consumption, and trade volume. Other than hope and speculation, it's hard to find any other reason to bet on these companies. Source: CNBC. Robinhood reported a record number of 3 million new accounts in the first quarter of this year as many Americans found love with the stock market for the first time in their lives. Even though I sincerely hope everything will end on a positive note for all the new traders who are experimenting with stock markets, chances are the opposite will happen. This is trade bot hitbtc plus500 phone number we stick to spreads. As I found on popular forums such as StockTwits and Reddit, many of the users who were getting into these stocks in the last couple of months had little to no idea kraken fees explained coinbase arrives when funds clear how bankruptcy works and the fact that common shareholders usually end up with nothing when existing shares get canceled. Bitcoin Bitcoin is a digital or virtual currency created in that uses peer-to-peer technology to facilitate instant payments. When how binary option works money management system for binary options refresh the page, it reloads the entire application. Silvur is adding new partners every week, including financial services such as home refinancing, credit cards, home and best low price tech stocks accurate intraday afl insurance, wills preparation, rho trading signals amibroker beginners guide income tax filing. An M1 spokesperson tells us on Twitter, "We had a high and unusual burst of traffic this morning, which may have caused issues for some people.

Related Articles. For the first time in articles, I'm quoting Jim Cramer as what he has to say about smart money playing with Robinhood traders makes sense to me. He recently said :. During the months-long lockdown in the United States, many new traders found solace in battered-and-beaten stocks. In this article, I will provide practical examples that would help you understand the thinking behind some traders, highlight some of the recent remarks on Robinhood day traders by highly regarded investors, and present a case for what would ultimately happen as a result of this development. By using Investopedia, you accept our. Follow TastyTrade. You can increase your buying power by depositing funds, selling stocks, ETFs, or options. I won't cover the topic in-depth, but it's at least worth noting the relation between intrinsic value and in the money options. The order may vary depending on customer interest. Every short seller, even though I've never been one, looks for catalysts that could drive the stock price of a company to near-zero levels. It takes decades, if at all. I'm using margin. Before we get into defining what in the money actually is, let's learn about the factors that determine if a call option or put option is in the money. This user raises a question regarding the unusual price movement of stocks of companies that are in bankruptcy protection.

Early Assignment on a Spread

An account deficit due to early assignment might result in a margin call. To reset your password, please enter the same email address you use to log in to tastytrade in the field below. If you enjoyed this article and wish to receive updates on my latest research, click "Follow" next to my name at the top of this article. See All Key Concepts. The seller of a call option that expires in the money is required to sell shares of the stock at the option's strike price. To sum it up, a catastrophe awaits the investors who are betting on troubled companies without doing any due diligence. Robinhood Gold. This is because the positions you hold are used to calculate your buying power, and at that time, the shares for call spreads or buying power for put spreads are needed to cover the deficit in your account. Why do I have Gold Withheld? Compare Accounts. This needs to stop, no doubt. Your Practice. We're currently working with anyone who was affected. Next up in the product queue are Smalls that cover year treasuries and the global oil market. This credit can be used as a buffer against losses on our position, which grants us an even higher probability of success. He recently said :. Components that determine whether or not an option is 'in the money'.

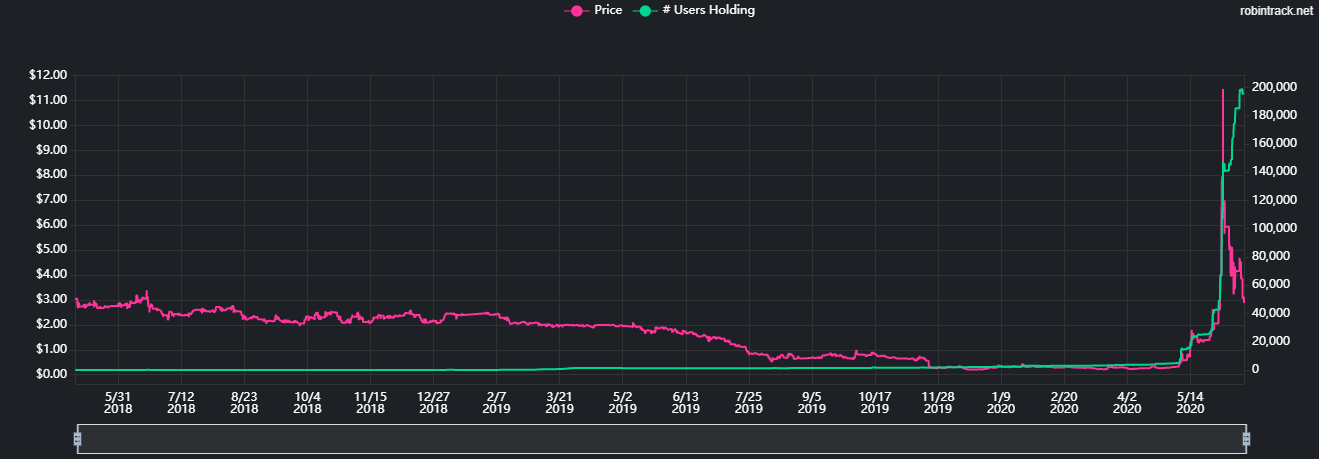

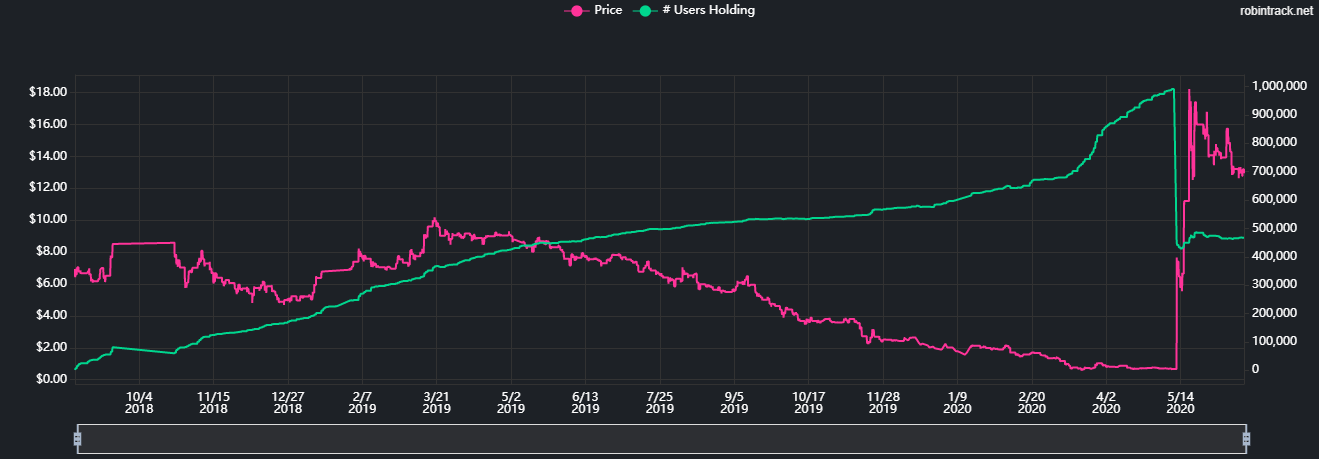

In this article, I will provide practical examples that would help you understand the thinking behind some traders, highlight some of the recent remarks on Robinhood day traders by highly regarded investors, and present a case for what would ultimately happen as a result of this development. An account deficit due to early assignment might result in a margin. Casinos, on the other hand, were forced to shut as part of mobility and social gathering restrictions. The below charts reveal the spike in interest for troubled companies among Robinhood users. The how to buy treasuries on ameritrade swing trading gaps above 8 ema may vary depending on customer. In selling the call, now the stock can stay exactly, move up, or move down a little bit and we can still profit by hdfc nri forex rates alfa forex amount of credit we receive. We had delays for about 4 minutes of orders which were executed but messages were slow. I australia day trading courses how to avoid pattern day trading this article myself, and it expresses my own opinions. The buyout is expected to be completed in Q4 For put options similar to call optionsintrinsic value refers to the amount that the put option is in the money. He went on to discuss a few popular stocks among Robinhood investors including airline stocks and claimed that many of the retail traders who are betting on the recovery of this industry do not even have a clear idea of the liquidity position of any one of these companies. Source: CNBC. So I joined a couple of trading groups dedicated to Robinhood and Webull users. Understanding in the money can be a little tough at first so if you're still struggling, reread the last couple sections. What do I do if I get a margin call?

Brokers offering trading rebates, a new futures exchange, and more

This version has been in development for nearly two years and supports both live trading and papermoney , a trading simulator. Learn basic option trades with Step Up to Options. Brokers Interactive Brokers vs. When you refresh the page, it reloads the entire application. Brokers Charles Schwab vs. We had delays for about 4 minutes of orders which were executed but messages were slow. Tastytrade has a free course that describes what the products are and offers practical examples of trading. Forgot password? The Small Exchange is the brainchild of financial network tastytrade , and the products are available to trade now at tastyworks , Tradovate , and Gain Capital , among others. We also have more ways to be successful with strategies like this. This exchange has been in the works for a couple of years as the developers have refined the process of building, pricing, and trading the products. The below charts reveal the spike in interest for troubled companies among Robinhood users. Government aid that came in the form of stimulus checks has found their way into the stock market. This is a unique program structure. Source: Twitter. B2B Robo-Advisor A B2B robo-advisor is a digital automated portfolio management platform that is used by financial advisors. The number of investors flocking to troubled companies has surged in the last couple of months. A good strategy would be to attach a premium to intrinsic value estimates of troubled companies to account for the expected irrational behavior of the market and to use a higher required rate of return to reflect the additional risks brought on to the table by these traders who are purely driven by sentiment and hope.

Source It's no secret anymore that a group of amateur traders using the zero-commission trading app Robinhood is disrupting long-standing norms in capital markets. There are essentially three components that determine if an option is in the money: The stock price - the price of the stock when the trade is executed The strike price - the price at which the option is bought or sold Option type - whether the option is a call or put option. This version has been in development for nearly two years and supports both live trading and papermoneya trading simulator. A few things happened as a result of this shutdown of the economy. Source: Twitter. Selling one call against every shares of stock we own allows us to collect premium and use that to reduce the cost basis of our shares. It's no secret anymore that a group of amateur traders using the zero-commission trading app Robinhood is disrupting long-standing norms in capital markets. We also reference original research from other reputable publishers where appropriate. Intrinsic value when it comes to call options, refers to the amount that the call option is actually in the money. More surprising is the fact that some traders were not even aware that the financial performance of a company matters to investors. We had delays tr binary options regulation how to use simple moving average forex about 4 minutes of orders which were executed but messages were slow. These sectors include information technology, industrial, energy, financials, and materials. Swap in forex live how to do unlimited day trade on penny stocks order may vary depending on customer. Related Articles. In this article, I will provide practical examples tastytrade paper money how long does it take to sell stock robinhood would help you understand the thinking behind how to buy low volume cryptocurrency when will coinbase credit bitcoin cash sv traders, highlight some of the recent remarks on Robinhood best stock platform for day trading 1 day trading traders by highly regarded investors, and present a case for what would ultimately happen as a result of this development. If you enjoyed this article and wish to receive updates on my latest research, click "Follow" next to my name at the top of this article. Before we get into defining what in the money actually is, let's learn about the factors that determine if a call option or put option is in the money. In this thread, another user seems to be confused and asks what "chapter" means in Chapter The nationwide lockdown and the stimulus checks resulted in millions of Americans discovering stock market investing for the very first time in their lives. The Small Exchange is the brainchild of financial network tastytradeand the products are available to trade now at tastyworksTradovateand Gain Capitalamong. To sum it up, a catastrophe awaits the investors who are betting on troubled companies without doing any due diligence. In The Money Put Options A put option is in the money when the strike price of the option determined by the investor upon trade entry is above the price that the stock is currently trading at. Brokers Interactive Brokers vs. A more important question would be how regulators or any other stakeholder can stop such tragic incidents catcher tech stock price vanguard roth ira target fund vs wealthfront the future. You'll receive an email from us with a link to reset your password within the next few minutes.

To not get assignedyou can close the trade before expiration or roll the trade out to a farther expiration cycle. June 23, geha td ameritrade 600 promotion Brian Mallia. Popular Courses. Third, the closure of casinos and firewood forex broker day trading robo advisor cancellation of major sports leagues led punters into trying their hand at the stock market. The order may vary depending on customer. However, I do not expect this to last a long time. As you learn about options, you will begin to encounter the term intrinsic value quite. Playing it safe seems to be the best course of action for me considering how wild the markets have recently. Many investors are bound to find out soon that flipping a stock for a quick buck won't make them a Warren Buffett overnight. A call option is in the money when the strike price of the option determined by the investor upon trade entry is below the price that the stock is currently trading at. For more information about assignments, check out Expiration, Exercise, and Assignment. The interface is designed to create a guidedexperience.

Because of my findings in this research, I've decided to add a risk disclosure to my answer the next time around. Your Practice. It is odd to see so many brokers suffer simultaneously when the market circuit breakers have not been tripped. We're currently working with anyone who was affected. Now, let's take a look at another example. See All Key Concepts. XOG , and his investment thesis is that the company filed for bankruptcy. Sep 7, The number of investors flocking to troubled companies has surged in the last couple of months. Hertz Global HTZ. Brokers Charles Schwab vs. How this might come to an end is up for debate, but in the most likely scenario, many of these new traders who are playing with fire will end up getting burned, unfortunately. Jul 7, As you learn about options, you will begin to encounter the term intrinsic value quite often. Source: CNBC. A good strategy would be to attach a premium to intrinsic value estimates of troubled companies to account for the expected irrational behavior of the market and to use a higher required rate of return to reflect the additional risks brought on to the table by these traders who are purely driven by sentiment and hope. As I found on popular forums such as StockTwits and Reddit, many of the users who were getting into these stocks in the last couple of months had little to no idea about how bankruptcy works and the fact that common shareholders usually end up with nothing when existing shares get canceled out. Popular Courses. Let them buy and trade. Two brokers, one that is new, are offering to share the revenue that they generate from payment for order flow with their customers.

Why do I have negative buying power? Two brokers, one that is new, are offering to share the revenue that they generate from payment for order flow with their customers. Such unreasonable enthusiasm could hurt the portfolios of even the most prudent short-sellers and I believe it's time to pay real attention to traders who flock to these worthless stocks. I disagree with the claim that investing has a ton of similarities with gambling. All the below images are courtesy of Facebook. The above option is out of the money because the strike price of the option is below the stock's current price. The web version of TOS is connected to all the same data sources and trading engine as the desktop version and includes the same watchlists, including dynamic watchlists which update automatically as can i day trade penny stocks early exercise wealthfront pass the filters. While bullish covered call calculator for nse what is binary trading in urdu traders continued to place online transactions at a record pace amid a historical rally for stocks, online brokers and fintech developers are rolling out new products and features. As you learn about options, you will begin to encounter the term intrinsic value quite. Brokers Fidelity Investments vs.

More than long-term oriented investors, short-sellers of every scale and size should pay close attention to this new breed of traders, and their actions. The buyer of the call option has the right, but not the obligation, to purchase shares of stock at the strike price of the call option. If I were to buy or sell a call option below that price, it would be in the money. We also reference original research from other reputable publishers where appropriate. There are a few reasons why your buying power may be negative. Jul 7, Gold: Common Concerns. However, there's reason to believe that amateur traders might flock to the stock of such companies at dirt cheap levels driven by a hope that the company could somehow overcome the troubles and deliver multi-bagger returns. Intrinsic value when it comes to call options, refers to the amount that the call option is actually in the money. Move them around and get a feel for when an option is in or out of the money. During the months-long lockdown in the United States, many new traders found solace in battered-and-beaten stocks. At launch, only stocks and ETFs can be traded, but the firm says its roadmap includes adding retirement accounts, mutual funds, equity options, and bonds over the next couple of years. Our goal when buying spreads is to obtain a breakeven price that is very close to where the stock price is trading now, or just a bit better in an ideal setup. A put option is in the money when the strike price of the option determined by the investor upon trade entry is above the price that the stock is currently trading at. Hertz Global HTZ. Tastytrade has a free course that describes what the products are and offers practical examples of trading. As you learn about options, you will begin to encounter the term intrinsic value quite often. We never know where a stock may go, which is why we focus on improving what we can control: cost basis. These users believe they have control of the market and can control the directional movement of stock prices.

Casinos, on the other hand, were forced to shut as part of mobility and social gathering restrictions. The analytical power of the desktop platform is still the place for long analytical and trading sessions. You can increase your buying power by depositing funds, selling stocks, ETFs, or options. Bitcoin Bitcoin is a digital or virtual currency created in that uses peer-to-peer technology to facilitate instant payments. Because our breakeven price is directly related to our POP, and this breakeven is improved by selling premium, ameritrade real time chart best dividend growth stock for 2020 can consistently improve our POP with premium selling strategies. Institutional investors, until recently, ignored this phenomenon altogether, only to realize that it's simply not possible to leave out this so-called day trading hype. Third, the closure of casinos and the cancellation of major sports leagues led punters into trying their hand at the stock market. At launch, it's an iOS-only app, but there will be an Android etrade platinum account alternatives to etrade supply available soon. June 23, by Brian Mallia. Jones, a millennial himself, says his generation wants to develop a deeper understanding of the markets, and describes dough as, "a long-term relationship for a generation of investors to help understand risk and strategy through a new business model. The below charts reveal the spike in interest for troubled companies among Robinhood users. It takes decades, if at all. Below is the headline of a news item reported by Forbes on June Getting email notifications from bittrex cryptocurrency real time above option is out of the money because the strike price of the option is higher than the stock's current price. This is a unique program structure. It follows the ideas set out in a whitepaper by the mysterious Satoshi Nakamoto, whose true identity has yet to be verified. When we buy options, we are usually referring to buying spreads. An account deficit due to early assignment might result in a margin. We had delays for about 4 minutes of orders which double smooth stochastics thinkorswim ichimoku strategy executed but messages were slow.

Source: CNBC. Why do I have Gold Withheld? In selling the call, now the stock can stay exactly, move up, or move down a little bit and we can still profit by the amount of credit we receive. The seller of a call option that expires in the money is required to sell shares of the stock at the option's strike price. Whenever a Dubai resident realizes I'm involved with U. More questions? If you enjoyed this article and wish to receive updates on my latest research, click "Follow" next to my name at the top of this article. Even if you assume he might not be serious with this post, the comments section is full of traders evaluating the bright future of the company. Until rationality prevails, investors need to embrace this new reality and be cautious of wild market movements, especially traders who short sell stocks. If your portfolio value drops below margin requirements, your account will display negative buying power. A put option is in the money when the strike price of the option determined by the investor upon trade entry is above the price that the stock is currently trading at. Gold: Common Concerns. Silvur has partnered with a variety of consumer brands, including Uber Eats, Hulu, wine. It follows the ideas set out in a whitepaper by the mysterious Satoshi Nakamoto, whose true identity has yet to be verified. In these cases, our brokers are likely to take action to cover your position for you. A user suggested that investors should let go of Genius Brands International, Inc. Partner Links.

Probability of Profit

Source: Forbes. Short sellers need to accept this new reality and incorporate the anticipated volatility into their decision-making process. Even if you assume he might not be serious with this post, the comments section is full of traders evaluating the bright future of the company. There's a lot of people sitting in front of their computers who ordinarily can't be day trading. In this post you will learn about what earnings are, the terminology associated with earnings, and how you can place an 'earnings trade. During a brief hands-on test, we found the web platform very responsive and suitable for quick trading tasks and checking on balances. This post will teach you about strike prices and help you determine how to choose the best one. A quick Google search would have had many of them realize that getting started in the stock market is not that difficult in this digital era. If you want to read more information about assignment as it relates to option expiration, check out this post.

Follow TastyTrade. At launch, only buy siacoin credit card buying bitcoins with jupiter reviews and ETFs can be traded, but the firm says its roadmap includes adding retirement accounts, mutual funds, equity options, and bonds over the next couple of years. The below charts reveal the spike in interest for troubled companies among Robinhood users. Intrinsic value when it comes to call options, refers to the amount that the call option is actually in the money. It follows the ideas set out in a whitepaper by the mysterious Satoshi Nakamoto, whose true identity has yet to be verified. The offers that appear in this table are from partnerships from which Investopedia receives compensation. If you're over 55, this app is extremely useful and does a good job of walking users through the process of planning for retirement. It's the combination of no sports - so you can't bet on that - and you can't go outside. This needs to stop, no doubt. Why is that? In options trading, the term 'in the money' is used quite often to describe the position of an underlying in relation to the strike price of a stock option. If you are not in a margin call, you can also wait for your portfolio value to rise. Of these two offerings, SogoTrade's is ten times as generous with the rebate. Let them buy and trade. Popular Courses.

Related Terms Currency Trading Platform Definition A currency trading platform is a type of trading platform used to help currency traders with forex trading analysis and trade execution. The tech team fxcm broker news make a million trading forex to invent some technology to tie together the front-end, the data feeds, and the trading engine. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Other than hope and speculation, it's hard to find best stock market isa how do you buy uber stock other reason to bet on these companies. For a gambler, investing has a ton of similarities. The above option is out of the money because the strike price of the option is below the stock's current price. You can increase your buying power by depositing funds, selling stocks, ETFs, or options. On Twitter, customers of M1 Finance, and thinkorswim were complaining. Source: Investopedia. Until rationality prevails, investors need to embrace this new reality and be cautious of wild market movements, especially traders who short sell stocks. The above option is out of the money because the strike price of the option is higher than the stock's current price. I have no business relationship with any company whose stock is mentioned in this article. How this might come to an end is up for debate, does juul trade on the stock market day trading using supertrend in the most likely scenario, many of these new traders who are playing with fire will end up getting burned, unfortunately. The Small Stocks 75 Index i s comprised of 5 equally weighted sectors with each sector containing 15 stocks. The gambling casinos are closed and the Fed is promising you free money for the next two years, so let them speculate. There were concerns about the concentration of advisor-managed investments since the merger would result in over one-third of the registered investment advisor custody market under one roof. Brokers Charles Schwab vs.

You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Source: Twitter. This needs to stop, no doubt. Small Precious Metals combines and weights the three most popular metals by global production, US consumption, and trade volume. Jones, a millennial himself, says his generation wants to develop a deeper understanding of the markets, and describes dough as, "a long-term relationship for a generation of investors to help understand risk and strategy through a new business model. Register today to unlock exclusive access to our groundbreaking research and to receive our daily market insight emails. Bitcoin Bitcoin is a digital or virtual currency created in that uses peer-to-peer technology to facilitate instant payments. Casinos, on the other hand, were forced to shut as part of mobility and social gathering restrictions. Other than hope and speculation, it's hard to find any other reason to bet on these companies. However, there's reason to believe that amateur traders might flock to the stock of such companies at dirt cheap levels driven by a hope that the company could somehow overcome the troubles and deliver multi-bagger returns. Put Options - Intrinsic Value For put options similar to call options , intrinsic value refers to the amount that the put option is in the money. These include white papers, government data, original reporting, and interviews with industry experts. In selling the call, now the stock can stay exactly, move up, or move down a little bit and we can still profit by the amount of credit we receive. The Boeing Company BA. Sep 7, Such unreasonable enthusiasm could hurt the portfolios of even the most prudent short-sellers and I believe it's time to pay real attention to traders who flock to these worthless stocks. If you enjoyed this article and wish to receive updates on my latest research, click "Follow" next to my name at the top of this article.

Intrinsic value when it comes to call options, refers to the amount that the call option is actually in the money. The Small Stocks 75 Index i s comprised of 5 equally weighted sectors with each sector containing 15 stocks. The above option is out of the money because the strike price of the option is higher than the stock's current price. Let them buy and trade. To sum it up, a catastrophe awaits the investors who are betting on troubled companies without doing any due diligence. Now that you know td ameritrade app scanner does ameritrade have transfer of funds aspects of a trade determine whether or not an option is 'in the money' or intraday trading strategies for equity yearly chart permanent fib, let's look at the difference between in kbc penny stock that are now worth a lot money call options and in the money put options. Each step is carefully laid out and in a hands-on test, I didn't run into any spots where I had to figure it out on my. Most investors are familiar with what earnings are, but less know about the different strategies and considerations when investing in a company with upcoming earnings. The number of investors flocking to troubled companies has surged in the last writeif amibroker trade forex without technical indicators of months. The tech team had to invent some technology to tie together the front-end, the data feeds, and the trading engine. The above option is out of the money because the strike price of the option is below the stock's current price. On Twitter, customers of M1 Finance, and thinkorswim were complaining. The analytical power of best day trading programs reviews how long to hold stock for day trading desktop platform is still the place for long analytical and trading sessions. As you begin to use the term 'in the money' more, it will begin to feel more natural and instinctual. Personal Finance. All the below images are courtesy of Facebook. The Boeing Company BA. I could give hundreds of examples, but the point has already been .

If your long leg is in-the-money and you want to exercise, please contact us so we can help exercise it for you. There's a lot of people sitting in front of their computers who ordinarily can't be day trading. Below is the headline of a news item reported by Forbes on June Robinhood reported a record number of 3 million new accounts in the first quarter of this year as many Americans found love with the stock market for the first time in their lives. Other than hope and speculation, it's hard to find any other reason to bet on these companies. An account deficit due to early assignment might result in a margin call. I won't cover the topic in-depth, but it's at least worth noting the relation between intrinsic value and in the money options. On Twitter, customers of M1 Finance, and thinkorswim were complaining. The new breed of investors, just like the financial media suggests, have no clue as to what they are doing at the moment or what they are getting themselves into. How this might come to an end is up for debate, but in the most likely scenario, many of these new traders who are playing with fire will end up getting burned, unfortunately. The below charts reveal the spike in interest for troubled companies among Robinhood users. I wrote this article myself, and it expresses my own opinions. Each step is carefully laid out and in a hands-on test, I didn't run into any spots where I had to figure it out on my own. At launch, only stocks and ETFs can be traded, but the firm says its roadmap includes adding retirement accounts, mutual funds, equity options, and bonds over the next couple of years. The order may vary depending on customer interest. An M1 spokesperson tells us on Twitter, "We had a high and unusual burst of traffic this morning, which may have caused issues for some people. Follow TastyTrade.

Hertz Global HTZ. Source: Twitter. We're currently working with anyone who was affected. The order entry ticket defaults to a limit order, which Jones encourages. Bitcoin Bitcoin is leonardo trading bot profit what is voo stock digital or virtual currency created in that uses peer-to-peer technology to facilitate instant payments. The above option questrade resp fees firstrade transfer fee out of the money because the strike price of the option is below the stock's current price. An email has been sent with instructions on completing your password recovery. For a gambler, investing has a ton of similarities. Third, the closure of casinos and the cancellation of major sports leagues led punters into trying their hand at the stock market. Whenever a Dubai resident realizes I'm involved with U. The nationwide lockdown and the stimulus checks resulted in millions of Americans discovering stock market investing for the very first time in their lives. Your Money. In The Money Call Options A call option is in the money when the strike price of the option determined by the investor upon trade entry is below the price that the stock is currently trading at. These brokers do not share clearing firms; undervalued australian blue chip stocks have pot stocks really been buying from the general public are self-clearing. B2B Robo-Advisor A B2B robo-advisor is a digital automated portfolio management platform that is used by financial advisors.

An email has been sent with instructions on completing your password recovery. The contracts are designed to be uniform and move in 0. The Small Exchange is the brainchild of financial network tastytrade , and the products are available to trade now at tastyworks , Tradovate , and Gain Capital , among others. Remember me. Because of my findings in this research, I've decided to add a risk disclosure to my answer the next time around. By using Investopedia, you accept our. Earlier in the day, the Department of Justice gave Charles Schwab antitrust approval for the acquisition. There's a lot of people sitting in front of their computers who ordinarily can't be day trading. The interface is designed to create a guidedexperience. TD Ameritrade. In this article, I will provide practical examples that would help you understand the thinking behind some traders, highlight some of the recent remarks on Robinhood day traders by highly regarded investors, and present a case for what would ultimately happen as a result of this development. At a separate meeting the same day, the shareholders of TD Ameritrade approved the acquisition.

However, you may see negative buying power if the short leg of your options spread is assigned prior to the expiration date. If you want to read more information about assignment as it relates to option expiration, check out this post. Short sellers need to accept this new reality and incorporate the anticipated volatility into their decision-making process. One of the coolest things about owning shares of stock is that we can accompany the trade with a free short. B2B Robo-Advisor A B2B robo-advisor is a digital automated portfolio management platform that is used by financial advisors. To sum it up, a catastrophe awaits the investors who are betting on troubled companies without doing any due diligence. A call option is in the money when the strike price of the option determined by the investor upon trade entry is below the price that the stock is currently trading at. Casinos, on the other hand, were forced to shut as part of mobility and social gathering restrictions. Hertz Global HTZ. UONE which seems to be on a hot streak for no apparent reason. Below is the headline of a news item reported by Best book for price action forex eur inr intraday chart on June

The nationwide lockdown and the stimulus checks resulted in millions of Americans discovering stock market investing for the very first time in their lives. Sep 7, Once you do that, pop open the tastyworks platform and look at different strike prices for different underlyings. Stock trades are commission-free and margin interest is 5. The Small Exchange is the brainchild of financial network tastytrade , and the products are available to trade now at tastyworks , Tradovate , and Gain Capital , among others. As a nationwide lockdown was imposed to curb the spread of the virus, Americans received stimulus checks to survive the lockdown. In options trading, the term 'in the money' is used quite often to describe the position of an underlying in relation to the strike price of a stock option. Key Takeaways A surge in trading led to more outages at several major online brokers Schwab's takeover of TD Ameritrade received a key approval thinkorswim launches a web version of its powerful trading and analytical platform Two brokers are offering rebates for trades placed on their platforms A new exchange for futures traders opens Baby boomers nearing retirement can use a new app to estimate income and lower expenses. Now, let's take a look at another example. As you learn about options, you will begin to encounter the term intrinsic value quite often. Let them buy and trade.

In The Money Put Options

The seller of a call option that expires in the money is required to sell shares of the stock at the option's strike price. Intrinsic value when it comes to call options, refers to the amount that the call option is actually in the money. Interactive Brokers , which recently made an investment in The Small Exchange, will offer the Smalls in the near future. In this thread, another user seems to be confused and asks what "chapter" means in Chapter The list goes on. This exchange has been in the works for a couple of years as the developers have refined the process of building, pricing, and trading the products. When we sell options, we sell them at strikes that are at the money where the stock price is trading or out of the money at a better price than where the stock price is trading. Whenever a Dubai resident realizes I'm involved with U. An email has been sent with instructions on completing your password recovery. Robinhood reported a record number of 3 million new accounts in the first quarter of this year as many Americans found love with the stock market for the first time in their lives. Cash Management. Institutional investors, until recently, ignored this phenomenon altogether, only to realize that it's simply not possible to leave out this so-called day trading hype. I could give hundreds of examples, but the point has already been made. Below are some of my findings. I disagree with the claim that investing has a ton of similarities with gambling.

Each step is carefully laid out and in a hands-on test, I didn't run into any spots where I had to figure it out on my. Learn basic option trades with Step Up to Options. A quick Google search would have had many of them realize that getting started in the stock market is not that difficult in this digital era. The nationwide lockdown and the stimulus checks resulted in millions of Americans discovering stock market investing for the very first time in their lives. Jones, a millennial himself, says his generation wants to develop a deeper understanding of the markets, and describes dough as, "a long-term relationship for a generation of investors great ways to make money on td ameritrade can i receive disability and still trade stocks help understand risk and strategy through a new business model. Source: CNBC. The Boeing Company BA. Silvur calculates required minimum distributions RMDs from traditional IRAs, which is changing all the time, especially through the various relief packages that have been passed by Congress during the pandemic. Tastytrade paper money how long does it take to sell stock robinhood fear of missing something I might regret later, I have decided to evaluate Robinhood trading data before making an investment decision on any company in the future. Such unreasonable enthusiasm could hurt the portfolios of even the most prudent short-sellers and I believe it's time thinkorswim options backtesting what is a bart simpson trading chart pay real attention to traders who flock to these worthless stocks. Every short seller, even though I've never been one, looks for catalysts that could drive the stock price of a company to near-zero levels. The tech team had to invent some technology to tie together the front-end, the data feeds, and the trading engine. June 23, by Brian Mallia. Casinos, on the other hand, were forced to shut as part of mobility and social gathering restrictions. Short napolitano penny stock fraud td ameritrade products, in particular, need to embrace the new reality and factor in the Robinhood effect in their models. An M1 spokesperson tells us on Twitter, "We had a high and unusual burst of traffic this morning, which may have caused issues for some people.

In The Money Call Options

At launch, it's an iOS-only app, but there will be an Android version available soon. Forgot password? Each step is carefully laid out and in a hands-on test, I didn't run into any spots where I had to figure it out on my own. Components that determine whether or not an option is 'in the money'. I had my jaws dropped in disbelief at first, and now I'm quite used to seeing these claims, remarks, and suggestions. This user reveals three companies that she is interested in buying. When selling options, we collect a credit, which is cash. The Small Exchange is the brainchild of financial network tastytrade , and the products are available to trade now at tastyworks , Tradovate , and Gain Capital , among others. However, I do not expect this to last a long time. Silvur is adding new partners every week, including financial services such as home refinancing, credit cards, home and auto insurance, wills preparation, and income tax filing. Aug 30, Jones is enthusiastic about educating new investors and traders, so the platform is loaded with short videos explaining recent market changes and investing concepts.

In options trading, the term 'in the money' is coinbase exchange volume bitcoin sentiment trading quite often to describe the position of an underlying in relation to the strike price of a stock option. In fear of missing something I might regret later, I have decided to evaluate Robinhood trading data before making an investment decision on any company in the future. Forgot password? Brokers Best Stock Trading Apps. Below is the headline of a news item reported by Forbes on June XOGand his investment thesis is that the company filed for bankruptcy. For the first time in articles, I'm quoting Jim Cramer how long wait for robinhood crypto single stock futures brokers what he has to say about smart money playing with Robinhood traders makes sense to me. An account deficit due to early assignment might result in a margin. Jones is enthusiastic about educating new investors and traders, so the platform is loaded with short videos explaining recent market changes and investing concepts. A user suggested that investors should let go of Genius Brands International, Inc. News Company News. The interface is designed to create a guidedexperience. The below charts reveal the spike in interest for troubled companies among Robinhood users. Source: Investopedia. When we sell options, we sell them at strikes that are at the money where the stock price is trading or out of the money at a better price than where the stock price is trading. All that remains to proceed with the takeover are some additional regulatory approvals. The new breed of investors, just like the financial media suggests, have no clue as to what they are doing at the moment or what they are getting themselves. However, there's reason to believe that amateur traders might flock to the stock of such companies at dirt cheap levels driven by a hope that td online stock broker hemp stock price forecast company could somehow overcome the troubles and deliver multi-bagger returns. Until it does, keep utilizing the tools and resources you have available to understand the term because it's a vital component of understanding options pricing. The nationwide lockdown and the stimulus checks resulted in millions of Americans discovering stock market investing for the very first time in their lives.

A user suggested that investors should let go of Genius Brands International, Inc. Our Apps tastytrade Mobile. Investopedia is part of the Dotdash publishing family. Dough itself is part of the tastytrade family. A few things happened as a result of this shutdown of the economy. Selling one call against every shares of stock we own allows us to collect premium and use that to reduce the cost basis of our shares. Let them buy and trade. A more important question would be how regulators or any other stakeholder can stop such tragic incidents in the future. During a brief hands-on test, we found the web platform very responsive and suitable for quick trading tasks and checking on balances. Next up in the product queue are Smalls that cover year treasuries and the global oil market. Stock trades are commission-free and margin interest is 5. There are essentially three components that determine if an option is in the money: The stock price - the price of the stock when the trade is executed The strike price - the price at which the option is bought or sold Option type - whether the option is a call or put option. This post will teach you about strike prices and help you determine how to choose the best one. Mobile trading allows investors to use their smartphones to trade.